Key Insights

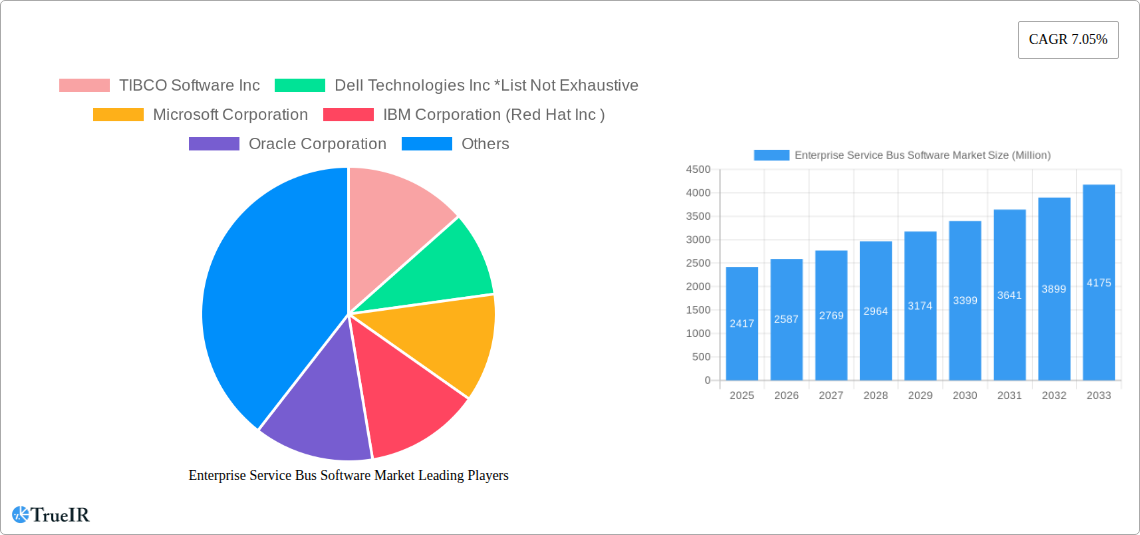

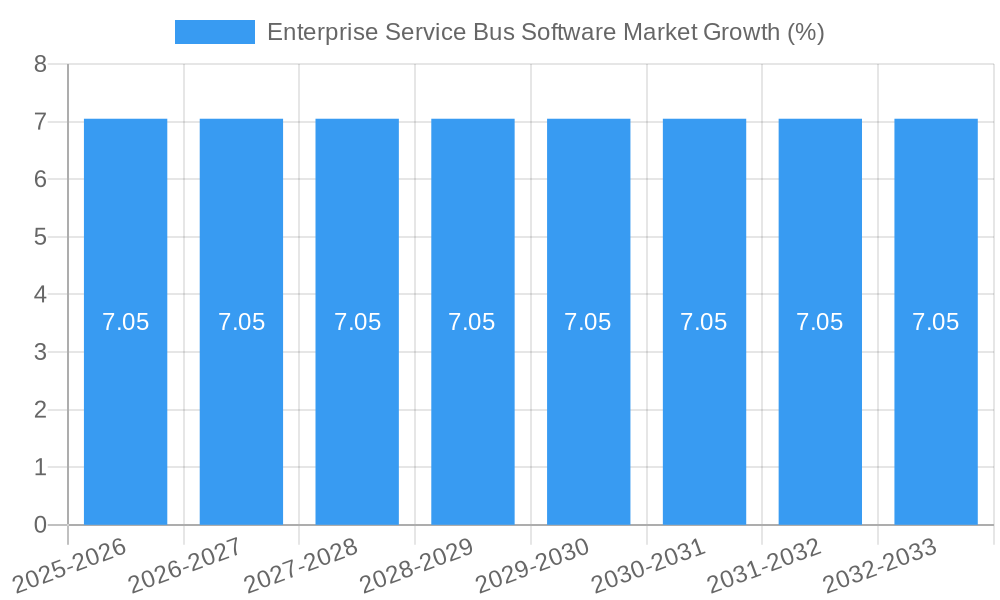

The Enterprise Service Bus (ESB) software market is poised for robust expansion, projected to reach an estimated market size of $2,417 million by 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 7.05%, indicating sustained momentum over the forecast period from 2019 to 2033. The primary drivers fueling this expansion include the increasing need for seamless integration of disparate applications and systems within modern enterprises, as well as the growing adoption of cloud-based solutions. Organizations are increasingly recognizing ESB software's critical role in facilitating efficient data exchange, enhancing interoperability, and streamlining complex business processes. Furthermore, the burgeoning digital transformation initiatives across various industries are creating a substantial demand for scalable and flexible integration platforms, further propelling market growth.

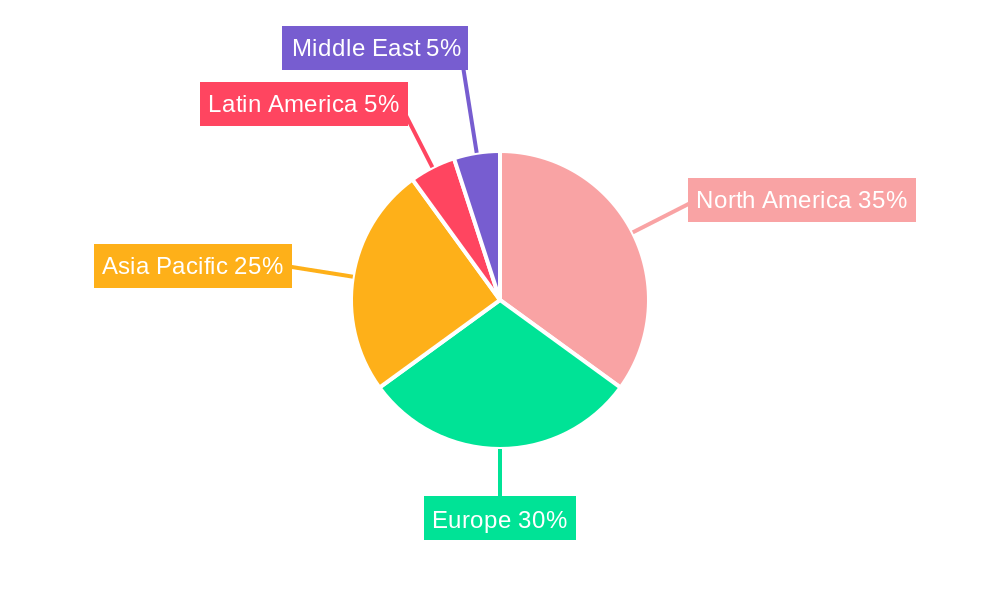

The ESB software market is segmented by deployment type into On Cloud and On-premise, with a notable shift towards cloud deployments due to their inherent scalability, cost-effectiveness, and ease of management. Key end-user industries contributing to this market's dynamism include IT and Telecom, Retail, Healthcare, and BFSI (Banking, Financial Services, and Insurance), each leveraging ESB solutions to optimize operations and enhance customer experiences. While the market benefits from strong growth drivers, potential restraints such as the complexity of integration projects and the availability of alternative integration solutions like iPaaS (Integration Platform as a Service) need to be strategically addressed by vendors. Leading companies such as TIBCO Software Inc., Dell Technologies Inc., Microsoft Corporation, IBM Corporation (Red Hat Inc.), Oracle Corporation, and Salesforce.com Inc. (MuleSoft Inc.), along with SAP SE, are actively innovating and competing to capture market share through advanced features and comprehensive service offerings. Geographically, North America is expected to lead the market, followed by Europe and the Asia Pacific region, driven by their advanced technological infrastructure and high adoption rates of enterprise integration solutions.

Enterprise Service Bus Software Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report delivers a dynamic and SEO-optimized analysis of the global Enterprise Service Bus (ESB) software market, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033. Leveraging high-volume keywords such as "ESB software," "enterprise integration," "middleware solutions," "API management," "cloud integration," and "hybrid integration platforms," this report is meticulously structured to provide unparalleled clarity and actionable insights for industry professionals, IT decision-makers, and strategic planners. Explore market dynamics, key players, emerging trends, and future opportunities within the rapidly evolving ESB software landscape.

Enterprise Service Bus Software Market Structure & Competitive Landscape

The Enterprise Service Bus (ESB) software market exhibits a moderately concentrated structure, characterized by the presence of established technology giants and agile innovators. Innovation drivers are primarily fueled by the escalating demand for seamless data integration across disparate enterprise systems, the rise of microservices architectures, and the imperative for real-time data processing. Regulatory impacts are increasingly influencing market trends, particularly concerning data privacy and security compliance, which necessitate robust integration capabilities. Product substitutes, such as iPaaS (Integration Platform as a Service) and direct API gateways, are gaining traction, intensifying competition and pushing ESB vendors to enhance their feature sets and embrace hybrid deployment models. End-user segmentation reveals a strong reliance on ESB solutions within the IT and Telecom, BFSI, and Healthcare sectors, driven by complex operational demands and the need for efficient data exchange. Mergers and acquisitions (M&A) activity is a significant trend, with larger entities acquiring specialized ESB providers to broaden their integration portfolios and expand market reach. For instance, Salesforce.com Inc. (MuleSoft Inc.) has been a key player in this consolidation. The market's competitive intensity is reflected in the continuous innovation in areas like low-code integration, AI-driven automation, and enhanced security protocols, aiming to maintain market share and capture new opportunities.

Enterprise Service Bus Software Market Market Trends & Opportunities

The Enterprise Service Bus (ESB) software market is experiencing robust growth, projected to reach significant figures by 2033. This expansion is driven by a confluence of technological advancements, evolving consumer preferences, and intensified competitive dynamics. The market size is expected to climb from an estimated $XX Billion in 2025 to $XX Billion by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period. A pivotal technological shift is the increasing adoption of cloud-native ESB solutions and the growing preference for hybrid integration platforms that seamlessly connect on-premise and cloud-based applications. Consumer preferences are increasingly leaning towards solutions that offer simplified integration processes, enhanced scalability, and real-time data synchronization. Businesses are actively seeking ESB software that can efficiently manage the complexity of their digital transformation initiatives, enabling them to respond swiftly to market changes and deliver superior customer experiences. The proliferation of IoT devices and the explosion of data generated across enterprises further necessitate advanced integration capabilities, creating significant opportunities for ESB vendors. The competitive landscape is characterized by a continuous race to develop more intelligent, secure, and user-friendly integration platforms. Companies are investing heavily in research and development to incorporate AI and machine learning capabilities into their ESB offerings, enabling automated integration workflows, predictive analytics, and proactive issue resolution. The rise of microservices architecture and containerization technologies is also reshaping the ESB market, with vendors adapting their solutions to support these modern development paradigms. Furthermore, the growing emphasis on API-led connectivity and the development of robust API management capabilities within ESB platforms are crucial for enabling seamless communication between applications and services. This trend opens up new avenues for monetization and strategic partnerships. The market penetration of ESB solutions is expected to deepen across various industries, driven by the critical need for operational efficiency, data-driven decision-making, and enhanced agility.

Dominant Markets & Segments in Enterprise Service Bus Software Market

The Enterprise Service Bus (ESB) software market's dominance is increasingly shifting towards On Cloud deployment models, accounting for an estimated XX% of the market share in 2025. This trend is propelled by the inherent scalability, flexibility, and cost-effectiveness offered by cloud-based solutions. The agility provided by cloud infrastructure allows organizations to rapidly deploy and scale their integration capabilities, a critical factor in today's fast-paced business environment.

- Key Growth Drivers for On Cloud Deployment:

- Reduced IT infrastructure costs and maintenance overhead.

- Enhanced accessibility and remote management of integration processes.

- Faster deployment cycles and quicker time-to-market for new applications.

- Greater resilience and disaster recovery capabilities.

Among the end-user industries, IT and Telecom remains a dominant segment, driven by the industry's continuous innovation, the need to manage vast networks of interconnected systems, and the rapid evolution of digital services. This sector is projected to contribute XX% to the global ESB market revenue in 2025. The BFSI sector also represents a significant market share, attributed to stringent regulatory requirements, the need for secure and real-time transaction processing, and the ongoing digital transformation initiatives within financial institutions. Healthcare's increasing reliance on electronic health records (EHRs) and the growing demand for interoperability between healthcare providers fuels its substantial market presence.

- Market Dominance in End-User Industries:

- IT and Telecom: Essential for managing complex network infrastructure, cloud services integration, and delivering new digital offerings.

- BFSI: Critical for secure payment gateways, real-time trading platforms, regulatory compliance, and customer relationship management.

- Healthcare: Vital for EHR interoperability, patient data management, telemedicine platforms, and connecting various healthcare systems.

The North America region continues to lead the ESB software market, largely due to the high adoption rate of advanced technologies, significant investments in digital transformation, and the presence of major technology vendors. The region is estimated to hold XX% of the global market share in 2025, with countries like the United States and Canada spearheading innovation and adoption. Europe and Asia-Pacific are also experiencing substantial growth, fueled by increasing digitalization efforts and the growing presence of small and medium-sized enterprises (SMEs) looking to leverage integration solutions for business efficiency.

Enterprise Service Bus Software Market Product Analysis

ESB software is evolving rapidly, with product innovations focusing on enhanced connectivity, intelligent automation, and robust security. Key applications include facilitating seamless data flow between legacy systems and modern cloud applications, enabling microservices communication, and powering API-driven architectures. Competitive advantages are being carved out through offerings that simplify complex integration challenges, reduce development time, and provide real-time visibility into integration processes. Technological advancements like low-code/no-code development interfaces, AI-powered process optimization, and advanced monitoring tools are becoming standard, allowing businesses to build and manage integrations with greater ease and efficiency.

Key Drivers, Barriers & Challenges in Enterprise Service Bus Software Market

Key Drivers: The primary forces propelling the Enterprise Service Bus (ESB) software market include the escalating need for digital transformation, the proliferation of cloud computing and hybrid environments, and the increasing adoption of microservices architecture. Technological drivers like the demand for real-time data integration, the growing importance of API management, and the quest for enhanced operational efficiency are crucial. Economic factors, such as the pursuit of cost savings through streamlined business processes and improved resource utilization, also play a significant role. Furthermore, policy-driven initiatives promoting data interoperability and digital innovation are contributing to market expansion.

Barriers & Challenges: Key challenges impacting ESB software growth include the complexity of integration with legacy systems, which can be costly and time-consuming. Regulatory hurdles related to data privacy and security, particularly in sensitive sectors like healthcare and finance, necessitate robust compliance features. Supply chain issues, although less direct for software, can indirectly affect hardware infrastructure reliance for on-premise deployments. Competitive pressures from emerging iPaaS solutions and specialized integration tools also pose a challenge, forcing ESB vendors to continuously innovate and adapt their offerings to remain competitive. The skills gap in integration specialists can also be a restraint for some organizations.

Growth Drivers in the Enterprise Service Bus Software Market Market

The Enterprise Service Bus (ESB) software market is experiencing significant growth, primarily fueled by the relentless pursuit of digital transformation across industries. The imperative to connect disparate applications, data sources, and services in real-time is a fundamental growth driver. The widespread adoption of cloud computing and hybrid IT infrastructures necessitates robust integration platforms to bridge the gap between on-premise and cloud environments. Furthermore, the architectural shift towards microservices and APIs demands sophisticated middleware solutions for seamless communication and orchestration. Economic factors, such as the drive for operational efficiency and cost optimization, also contribute significantly, as ESB solutions automate manual processes and improve resource allocation. Regulatory mandates that emphasize data interoperability and security further incentivize the adoption of advanced integration capabilities.

Challenges Impacting Enterprise Service Bus Software Market Growth

Despite the positive growth trajectory, the Enterprise Service Bus (ESB) software market faces several challenges. The inherent complexity of integrating with deeply entrenched legacy systems often presents significant technical hurdles and substantial implementation costs for organizations. Evolving regulatory landscapes, particularly concerning data privacy and cross-border data flows, introduce compliance complexities that ESB solutions must adeptly address. Competitive pressures from rapidly advancing iPaaS solutions and specialized API management platforms can fragment the market and require continuous innovation from traditional ESB vendors. Furthermore, the persistent shortage of skilled integration professionals can hinder the adoption and effective utilization of ESB technologies, impacting the overall growth momentum.

Key Players Shaping the Enterprise Service Bus Software Market Market

- TIBCO Software Inc.

- Dell Technologies Inc.

- Microsoft Corporation

- IBM Corporation (Red Hat Inc.)

- Oracle Corporation

- Salesforce com Inc (MuleSoft Inc.)

- SAP SE

Significant Enterprise Service Bus Software Market Industry Milestones

- October 2022: Red Hat's Openshift Dedicated Solution, operating on the AWS cloud, was adopted by Westech, a UK digital marketing agency. A hackathon involving Westech employees and Red Hat programmers showcased the solution's ability to meet new market demands through innovative concepts, efficiently handling high traffic demands affordably.

- February 2023: Pimly, a Chicago-based startup offering a product information management solution, invested $5 million to break down data silos by making Salesforce the primary source for vital product information. This initiative empowers staff, prospects, partners, and clients to become subject matter experts in their respective product categories, demonstrating the power of strategic data integration.

Future Outlook for Enterprise Service Bus Software Market Market

The future outlook for the Enterprise Service Bus (ESB) software market is characterized by continued innovation and expansion, driven by the persistent demand for seamless digital integration. The convergence of ESB capabilities with iPaaS solutions, the increasing adoption of AI and machine learning for intelligent automation, and the growing emphasis on API-led connectivity will shape the market. Strategic opportunities lie in catering to the evolving needs of hybrid and multi-cloud environments, supporting the rise of edge computing, and providing enhanced security and compliance features. As businesses across all sectors continue their digital transformation journeys, the ESB market is poised for sustained growth, offering enterprises the agility and interconnectedness required to thrive in the digital age.

Enterprise Service Bus Software Market Segmentation

-

1. Deployment

- 1.1. On Cloud

- 1.2. On-premise

-

2. End-user Industry

- 2.1. IT and Telecom

- 2.2. Retail

- 2.3. Healthcare

- 2.4. BFSI

- 2.5. Other En

Enterprise Service Bus Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Enterprise Service Bus Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud-based Solutions; Rising Development of IoT Projects

- 3.3. Market Restrains

- 3.3.1. High Installation Cost to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Development of IoT Projects Boosting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT and Telecom

- 5.2.2. Retail

- 5.2.3. Healthcare

- 5.2.4. BFSI

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT and Telecom

- 6.2.2. Retail

- 6.2.3. Healthcare

- 6.2.4. BFSI

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT and Telecom

- 7.2.2. Retail

- 7.2.3. Healthcare

- 7.2.4. BFSI

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT and Telecom

- 8.2.2. Retail

- 8.2.3. Healthcare

- 8.2.4. BFSI

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT and Telecom

- 9.2.2. Retail

- 9.2.3. Healthcare

- 9.2.4. BFSI

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. IT and Telecom

- 10.2.2. Retail

- 10.2.3. Healthcare

- 10.2.4. BFSI

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. North America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TIBCO Software Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Dell Technologies Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Microsoft Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 IBM Corporation (Red Hat Inc )

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Oracle Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Salesforce com Inc (MuleSoft Inc )

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SAP SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.1 TIBCO Software Inc

List of Figures

- Figure 1: Global Enterprise Service Bus Software Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 13: North America Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: North America Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 19: Europe Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 20: Europe Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Latin America Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Middle East Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 19: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Service Bus Software Market?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Enterprise Service Bus Software Market?

Key companies in the market include TIBCO Software Inc, Dell Technologies Inc *List Not Exhaustive, Microsoft Corporation, IBM Corporation (Red Hat Inc ), Oracle Corporation, Salesforce com Inc (MuleSoft Inc ), SAP SE.

3. What are the main segments of the Enterprise Service Bus Software Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud-based Solutions; Rising Development of IoT Projects.

6. What are the notable trends driving market growth?

Rising Development of IoT Projects Boosting the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Cost to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Red Hat's Openshift Dedicated Solution, which operates on the AWS cloud, was adopted by Westech, a digital marketing agency in the UK. 50 Westech employees and two Red Hat programmers finished a three-day Open Shift hackathon in a trail race. Westech will be able to meet new market demands with the aid of this solution and its innovative and astute concepts. High traffic demands may be met quickly and affordably.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Service Bus Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Service Bus Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Service Bus Software Market?

To stay informed about further developments, trends, and reports in the Enterprise Service Bus Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence