Key Insights

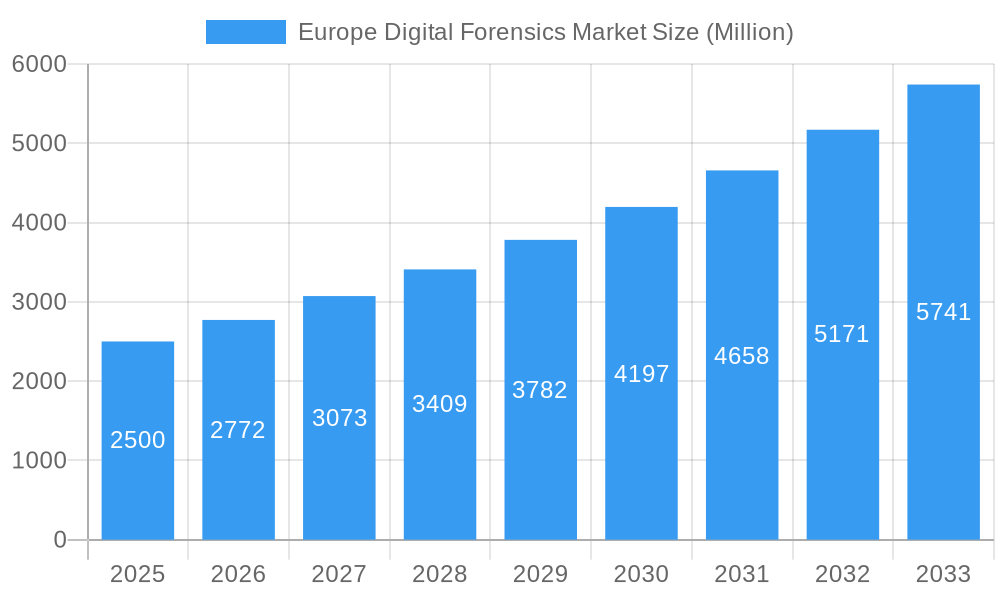

The Europe Digital Forensics Market is projected for substantial expansion, anticipated to reach $2.19 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.25% through 2033. This growth is propelled by increasing digital data volumes, evolving cyber threats, and a growing emphasis on digital forensics in investigations and security. Demand is strong across key segments, with "Hardware" and "Software" leading due to the need for advanced analytical tools. Specialized "Services," including expert analysis and incident response, further contribute to market expansion.

Europe Digital Forensics Market Market Size (In Billion)

The "Government and Law Enforcement Agencies" segment is a primary growth driver, investing heavily to combat cybercrime and fraud. The "IT and Telecom" sector is another significant end-user, addressing data breaches and intellectual property theft. Key market restraints include a shortage of skilled professionals and the dynamic nature of forensic technologies. However, widespread digitalization and the increasing reliance on digital evidence in legal proceedings ensure sustained growth for the Europe Digital Forensics Market.

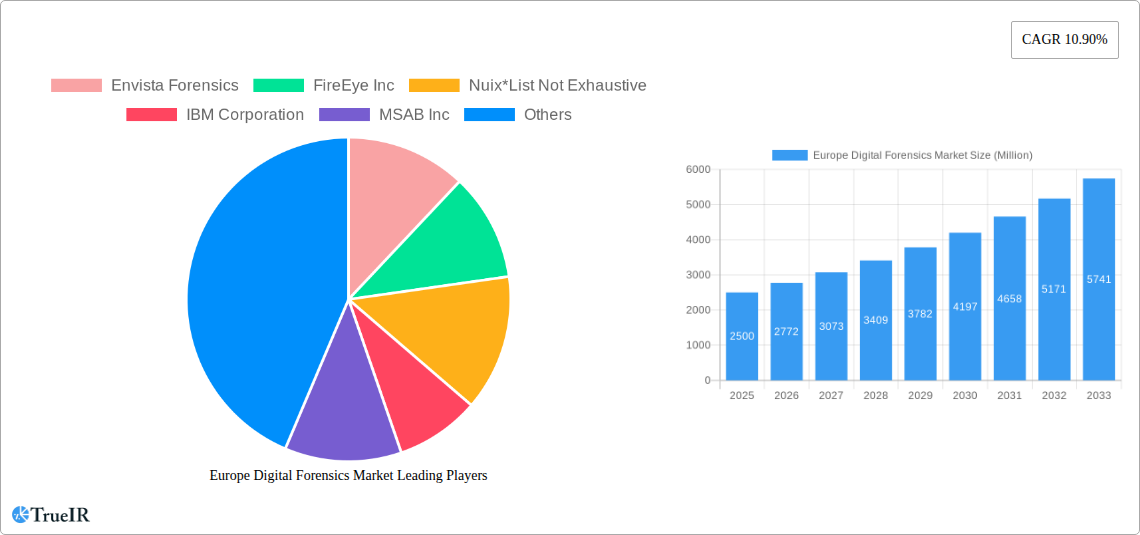

Europe Digital Forensics Market Company Market Share

This report offers comprehensive insights into the Europe digital forensics market, driven by escalating cyber threats, increasing data volumes, and regulatory compliance. The forecast spans 2025-2033, with 2025 as the base year. We analyze market size, key trends, dominant segments, competitive landscape, and future opportunities. The Europe digital forensics market is experiencing significant growth, fueled by advancements in digital forensics software, mobile forensics solutions, and computer forensics tools. This report details the dynamics of cybersecurity investigation tools, eDiscovery solutions, and the rising demand for digital forensics services.

Europe Digital Forensics Market Market Structure & Competitive Landscape

The Europe digital forensics market exhibits a moderately concentrated structure, with a blend of established global players and emerging specialized firms. Innovation is a key driver, spurred by the relentless evolution of cybercriminal tactics and the increasing complexity of digital evidence. Regulatory frameworks across Europe, such as GDPR, significantly influence market dynamics, mandating robust data protection and investigation capabilities. Product substitutes are limited due to the specialized nature of digital forensics, but advancements in AI and machine learning are beginning to automate certain aspects of analysis. End-user segmentation reveals a strong reliance on government and law enforcement agencies, with substantial growth anticipated in the BFSI and IT and Telecom sectors. Mergers and acquisitions (M&A) are strategic tools for market expansion and technology integration. For instance, the acquisition of Eurofins Forensics Services' digital forensics division by Eurofins Cyber Security UK in March 2022 exemplifies this trend, enhancing service portfolios. The concentration ratio in specific sub-segments can be as high as 40% among the top 5 players. M&A activity has seen a steady increase, with an estimated volume of 15-20 transactions annually over the historical period, aimed at consolidating market share and acquiring niche technologies.

Europe Digital Forensics Market Market Trends & Opportunities

The Europe digital forensics market is poised for substantial expansion, projected to reach a valuation of EUR 15,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period (2025-2033). This robust growth is underpinned by several converging trends. The escalating sophistication and frequency of cyberattacks across the continent necessitate advanced digital forensics capabilities for incident response and evidence recovery. Increasing regulatory scrutiny and data privacy laws, including GDPR, are compelling organizations to invest heavily in digital evidence management and forensic investigation tools. The proliferation of connected devices and the exponential growth of data generated across various industries create a rich, albeit complex, landscape for forensic analysis.

Technological advancements are revolutionizing the digital forensics market in Europe. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing the speed and accuracy of digital evidence analysis, enabling the detection of subtle patterns and anomalies. Cloud forensics is emerging as a critical area, with organizations seeking solutions to investigate data residing in cloud environments. The demand for mobile forensics solutions continues its upward trajectory, driven by the pervasive use of smartphones and tablets in criminal activities and corporate misconduct.

Consumer preferences within the market are shifting towards integrated platforms that offer comprehensive solutions, from data acquisition and preservation to analysis and reporting. This demand for end-to-end digital forensic investigation services is creating opportunities for service providers to expand their offerings and develop more holistic approaches. The competitive dynamics are characterized by intense innovation, with companies striving to differentiate through specialized technologies, enhanced efficiency, and robust support services. Opportunities abound for players who can address the evolving needs of the BFSI sector, with its complex regulatory landscape and high-value data, and the rapidly digitizing IT and Telecom industry. Furthermore, the growing need for cross-border digital investigations presents a significant growth avenue. The market penetration rate for advanced digital forensics software is expected to rise from 25% in 2024 to 45% by 2033. The market size for digital forensics services alone is projected to reach EUR 7,000 Million by 2033.

Dominant Markets & Segments in Europe Digital Forensics Market

The Government and Law Enforcement Agencies segment is the undisputed leader in the Europe digital forensics market, driven by their critical role in national security, criminal investigations, and anti-terrorism efforts. This segment is projected to account for over 40% of the total market share by 2033, valued at approximately EUR 6,000 Million. The increasing complexity of cybercrime and the need for swift, accurate digital evidence collection and analysis are primary growth drivers. Government investments in advanced digital investigation tools and training programs are substantial.

Within the Type segment, Mobile Forensics is experiencing the fastest growth, with an estimated CAGR of 13.5% during the forecast period. The pervasive use of smartphones for communication, data storage, and increasingly, criminal activities, makes mobile device analysis indispensable. This segment is expected to reach EUR 4,000 Million by 2033. Computer Forensics remains a robust segment, essential for investigating data breaches, intellectual property theft, and financial fraud within organizational networks. Network Forensics is also gaining prominence as cyberattacks increasingly target network infrastructure.

The Component segment is dominated by Software, which constitutes approximately 45% of the market share. This is attributed to the continuous development of sophisticated analytical tools, AI-powered solutions, and cloud-based forensic platforms. The Services segment, encompassing incident response, data recovery, and expert testimony, is also experiencing significant growth, projected to reach EUR 7,000 Million by 2033, reflecting the increasing outsourcing of forensic capabilities. The Hardware segment, including specialized forensic workstations and storage solutions, plays a crucial supporting role.

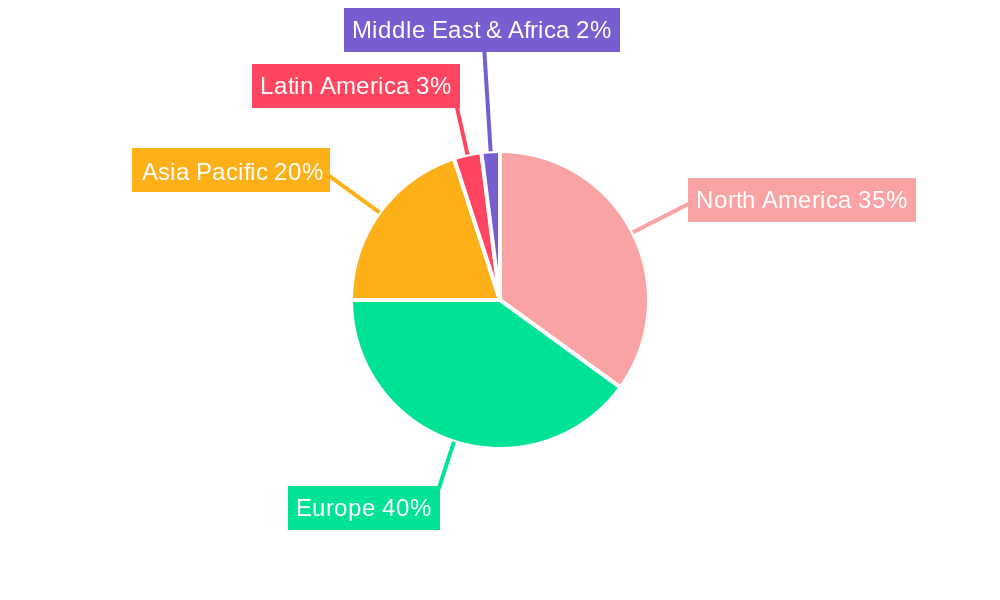

Geographically, Western Europe, particularly countries like the UK, Germany, and France, represents the largest regional market due to their advanced economies, robust cybersecurity infrastructure, and proactive regulatory environments. The BFSI sector, driven by the need to combat financial fraud, money laundering, and insider threats, is emerging as a significant growth area within the end-user industry. Similarly, the IT and Telecom sector, a prime target for cyberattacks, is significantly increasing its adoption of digital forensics solutions. The market dominance of Software is further solidified by the recurring revenue models of SaaS-based digital forensics platforms.

Europe Digital Forensics Market Product Analysis

The Europe digital forensics market is characterized by continuous product innovation, focusing on enhancing the speed, accuracy, and comprehensiveness of digital evidence analysis. Key advancements include the integration of AI and machine learning algorithms for automated data triage and pattern recognition, significantly reducing manual effort. Cloud-native forensic tools are emerging to address the complexities of investigating data stored in distributed cloud environments. Mobile forensic solutions are becoming more sophisticated, capable of extracting data from the latest operating systems and encrypted devices. eDiscovery solutions are also evolving, offering seamless integration with forensic workflows for legal proceedings. Competitive advantages are derived from user-friendly interfaces, advanced analytical capabilities, and robust reporting functionalities, enabling organizations to efficiently conduct investigations and meet compliance requirements.

Key Drivers, Barriers & Challenges in Europe Digital Forensics Market

The Europe digital forensics market is propelled by several key drivers. The escalating sophistication and volume of cyber threats, including ransomware attacks and data breaches, necessitate advanced investigative capabilities. Stringent data privacy regulations like GDPR compel organizations to implement robust incident response and data recovery mechanisms. The exponential growth of digital data across industries, from IoT devices to cloud platforms, creates a constant demand for forensic analysis. Technological advancements in AI, ML, and cloud computing are enabling more efficient and effective forensic investigations. The increasing awareness among businesses and governments about the importance of digital evidence in legal proceedings and security investigations further fuels market growth.

Key challenges impacting the Europe digital forensics market growth include the constant need for skilled professionals, as the demand for experienced digital forensic analysts often outstrips supply. The rapid evolution of technology, particularly new operating systems and encryption methods, requires continuous updates and adaptation of forensic tools. Maintaining compliance with a fragmented regulatory landscape across different European countries can be complex for global service providers. Supply chain issues for specialized hardware components can also pose a temporary restraint. Furthermore, the cost of sophisticated digital forensics software and training can be a barrier for smaller organizations.

Growth Drivers in the Europe Digital Forensics Market Market

The Europe digital forensics market is experiencing significant growth driven by the relentless surge in cybercrime, forcing organizations to bolster their cybersecurity defenses and invest in advanced investigative tools. Regulatory mandates, particularly stringent data privacy laws across the EU, are compelling businesses to adopt comprehensive digital forensic solutions for compliance and risk management. The rapid expansion of cloud computing and the Internet of Things (IoT) generates vast amounts of data, creating new frontiers and complexities for forensic analysis. The increasing volume of digital evidence required for legal proceedings, both civil and criminal, further underscores the importance of reliable digital forensics services.

Challenges Impacting Europe Digital Forensics Market Growth

Several challenges impact the growth of the Europe digital forensics market. A persistent shortage of highly skilled digital forensic professionals creates a talent gap, hindering operational capacity. The ever-evolving technological landscape, with new devices, operating systems, and encryption techniques emerging constantly, necessitates continuous adaptation and investment in updated forensic tools. Navigating the complex and sometimes disparate regulatory requirements across various European nations adds to operational complexity for service providers. Furthermore, the substantial upfront investment required for acquiring and maintaining cutting-edge digital forensics software and hardware can be a significant barrier, especially for smaller enterprises and organizations. Competitive pressures also drive down pricing in certain segments, impacting profitability.

Key Players Shaping the Europe Digital Forensics Market Market

- Envista Forensics

- FireEye Inc

- Nuix

- IBM Corporation

- MSAB Inc

- LogRhythm Inc

- Guidance Software Inc (Opentext)

- PricewaterhouseCoopers

Significant Europe Digital Forensics Market Industry Milestones

- December 2022: An agreement was reached between the European Commission and the Office of the Prosecutor of the International Criminal Court (ICC), significantly improving the court's capacity to handle digital evidence. This initiative, with the EU providing EUR 7.25 million, will expedite the processing of new evidence types, particularly beneficial for investigations related to Russia's aggression against Ukraine.

- March 2022: Eurofins Cyber Security UK expanded its digital forensics offerings through the acquisition of Eurofins Forensics Services' digital forensics division. This strategic move allows Eurofins Cyber Security UK, part of Eurofins Digital Testing, to provide a comprehensive suite of testing services encompassing systems, security, gadgets, and digital forensics.

Future Outlook for Europe Digital Forensics Market Market

The future outlook for the Europe digital forensics market is exceptionally bright, characterized by sustained growth and expanding opportunities. The increasing interconnectedness of digital systems and the persistent threat of sophisticated cyberattacks will continue to drive demand for advanced forensic solutions. Strategic opportunities lie in the development of AI-driven automated forensic platforms, cloud forensics solutions, and specialized services for emerging industries like the metaverse and blockchain. The market will witness further consolidation through strategic mergers and acquisitions as companies seek to expand their technological capabilities and market reach. Investments in training and development of skilled professionals will be crucial for sustaining this growth trajectory. The growing emphasis on proactive threat hunting and incident response will also shape future market trends.

Europe Digital Forensics Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type

- 2.1. Mobile Forensics

- 2.2. Computer Forensics

- 2.3. Network Forensics

- 2.4. Other Types

-

3. End-user Industry

- 3.1. Government and Law Enforcement Agencies

- 3.2. BFSI

- 3.3. IT and Telecom

- 3.4. Other End-user Industries

Europe Digital Forensics Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Digital Forensics Market Regional Market Share

Geographic Coverage of Europe Digital Forensics Market

Europe Digital Forensics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of IoT Devices Driving the Demand for Digital Forensic Solutions and Services; Growing Cybercrimes and Security Concerns across Industries

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Growing Adoption of IoT Devices is Driving the Demand for Digital Forensic Solutions and Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mobile Forensics

- 5.2.2. Computer Forensics

- 5.2.3. Network Forensics

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government and Law Enforcement Agencies

- 5.3.2. BFSI

- 5.3.3. IT and Telecom

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United Kingdom Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mobile Forensics

- 6.2.2. Computer Forensics

- 6.2.3. Network Forensics

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Government and Law Enforcement Agencies

- 6.3.2. BFSI

- 6.3.3. IT and Telecom

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Germany Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mobile Forensics

- 7.2.2. Computer Forensics

- 7.2.3. Network Forensics

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Government and Law Enforcement Agencies

- 7.3.2. BFSI

- 7.3.3. IT and Telecom

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. France Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mobile Forensics

- 8.2.2. Computer Forensics

- 8.2.3. Network Forensics

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Government and Law Enforcement Agencies

- 8.3.2. BFSI

- 8.3.3. IT and Telecom

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Italy Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mobile Forensics

- 9.2.2. Computer Forensics

- 9.2.3. Network Forensics

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Government and Law Enforcement Agencies

- 9.3.2. BFSI

- 9.3.3. IT and Telecom

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Rest of Europe Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mobile Forensics

- 10.2.2. Computer Forensics

- 10.2.3. Network Forensics

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Government and Law Enforcement Agencies

- 10.3.2. BFSI

- 10.3.3. IT and Telecom

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Envista Forensics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FireEye Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nuix*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MSAB Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LogRhythm Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Guidance Software Inc (Opentext)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PricewaterhouseCoopers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Envista Forensics

List of Figures

- Figure 1: Europe Digital Forensics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Digital Forensics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Digital Forensics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 10: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 14: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 18: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 22: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Digital Forensics Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the Europe Digital Forensics Market?

Key companies in the market include Envista Forensics, FireEye Inc, Nuix*List Not Exhaustive, IBM Corporation, MSAB Inc, LogRhythm Inc, Guidance Software Inc (Opentext), PricewaterhouseCoopers.

3. What are the main segments of the Europe Digital Forensics Market?

The market segments include Component, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of IoT Devices Driving the Demand for Digital Forensic Solutions and Services; Growing Cybercrimes and Security Concerns across Industries.

6. What are the notable trends driving market growth?

Growing Adoption of IoT Devices is Driving the Demand for Digital Forensic Solutions and Services.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

December 2022 - An agreement was reached between the European Commission and the Office of the Prosecutor of the International Criminal Court (ICC), which improves the court's capacity to handle digital evidence. Investigations into Russia's aggressiveness against Ukraine will also benefit from this. By the agreement, the EU would provide EUR 7.25 million to assist the ICC in more quickly processing new types of evidence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Digital Forensics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Digital Forensics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Digital Forensics Market?

To stay informed about further developments, trends, and reports in the Europe Digital Forensics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence