Key Insights

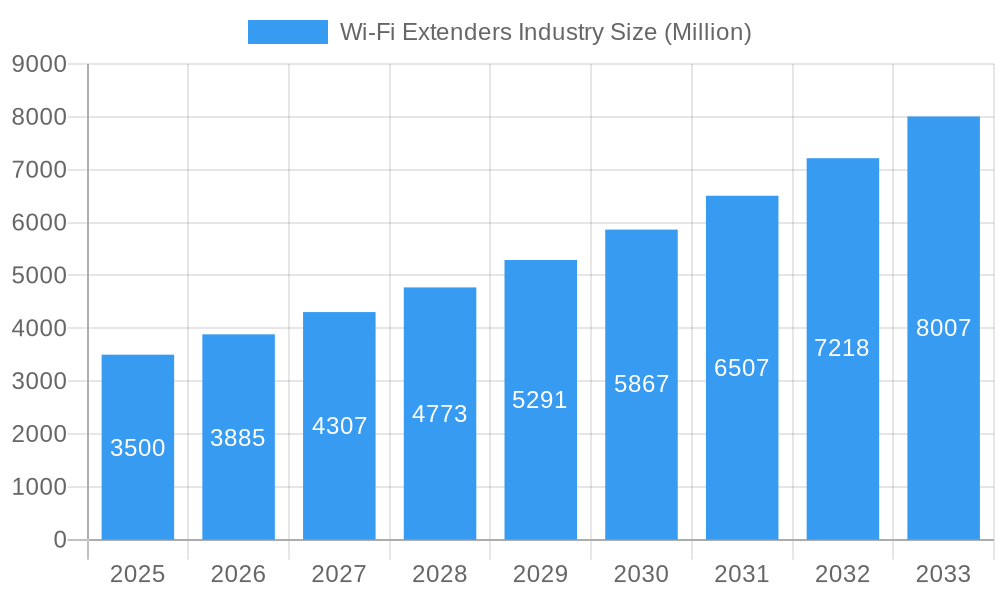

The Wi-Fi Extenders Market is projected for substantial growth, anticipating a market size of $2.1 billion by 2025, driven by a strong Compound Annual Growth Rate (CAGR) of 10% through 2033. This expansion is fueled by the increasing demand for seamless wireless connectivity in homes and businesses. Key drivers include the rise of smart home devices, the necessity for high-speed internet for remote work and online learning, and wider Wi-Fi adoption in public spaces. Technological advancements in Wi-Fi extenders and access points are also enhancing performance and user experience, addressing connectivity dead zones.

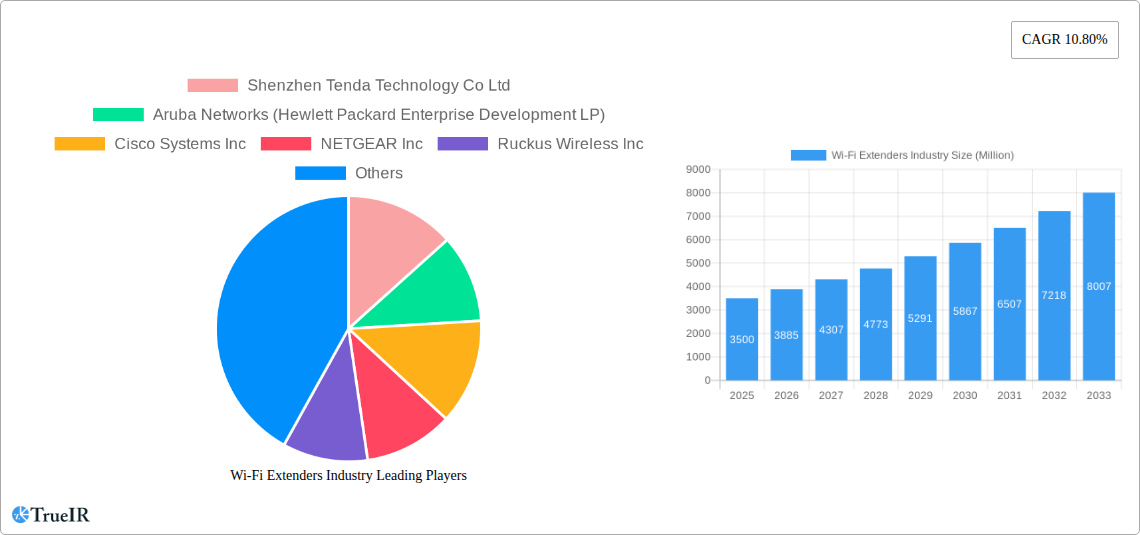

Wi-Fi Extenders Industry Market Size (In Billion)

The competitive landscape features major players like Shenzhen Tenda Technology, Aruba Networks (HPE), and Cisco Systems, investing in R&D for faster, more secure, and user-friendly products. The adoption of Wi-Fi 6 and Wi-Fi 6E presents opportunities, though potential interference and setup complexity are challenges. Nonetheless, global digital transformation and the pervasive nature of wireless networks are expected to overcome these hurdles, ensuring a dynamic market future. The market is segmented by type (Indoor, Outdoor) and product (Extenders/Repeaters, Access Points, Antennas), serving residential, commercial, and public end-users.

Wi-Fi Extenders Industry Company Market Share

This comprehensive report delivers in-depth analysis of the Wi-Fi Extenders Market, including market dynamics, competitive strategies, technological trends, and future growth forecasts. Covering the historical period 2019-2024, with 2025 as the base year and a forecast extending to 2033, this study is vital for stakeholders aiming to leverage the expanding need for enhanced wireless solutions.

Wi-Fi Extenders Industry Market Structure & Competitive Landscape

The Wi-Fi Extenders Industry is characterized by a moderately concentrated market structure, with a blend of established global players and emerging regional manufacturers. Innovation serves as a primary driver, fueled by the relentless pursuit of faster, more stable, and secure Wi-Fi solutions. Regulatory impacts, while present, are generally focused on spectrum allocation and safety standards, fostering a competitive yet fair market environment. Product substitutes, primarily advanced router technologies and mesh networking systems, are increasingly prevalent, pushing Wi-Fi extender manufacturers to differentiate through features, performance, and affordability. End-user segmentation reveals significant growth opportunities across residential, commercial, and public sectors, with niche applications in "Other End-user Verticals" also emerging. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies acquiring smaller innovators to expand their product portfolios and market reach. The top companies are actively engaged in strategic partnerships and product development to maintain their competitive edge. Concentration ratios in the top 5 companies are estimated to be around 55% in 2025, with M&A activities seeing approximately 5-7 significant deals annually between 2021-2024.

Wi-Fi Extenders Industry Market Trends & Opportunities

The Wi-Fi Extenders Industry is poised for substantial growth, driven by the ever-increasing demand for seamless and ubiquitous wireless connectivity across all facets of life. The market size is projected to reach an impressive USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. Technological shifts are at the forefront of this expansion, with the widespread adoption of Wi-Fi 6 and the emerging Wi-Fi 6E standards significantly boosting performance, reducing latency, and enhancing capacity. This evolution is creating a strong demand for Wi-Fi extenders that can fully leverage these advanced protocols, enabling higher data transfer speeds and supporting a greater number of connected devices simultaneously. Consumer preferences are increasingly leaning towards user-friendly, plug-and-play solutions that offer extended Wi-Fi coverage without complex setup procedures. The proliferation of smart home devices, the rise of remote work and hybrid work models, and the growing popularity of high-definition content streaming and online gaming are all contributing to a heightened need for robust Wi-Fi networks that can reliably cover larger areas.

Competitive dynamics are intensifying, with manufacturers focusing on developing intelligent, adaptive Wi-Fi extenders that can optimize network performance and seamlessly integrate into existing mesh systems. Opportunities abound for companies that can offer innovative solutions addressing specific pain points, such as dead zones in large homes, connectivity issues in older buildings, or reliable outdoor Wi-Fi coverage for businesses and public spaces. The increasing affordability of advanced Wi-Fi extender technologies is also broadening market penetration rates, making high-performance wireless networking accessible to a wider consumer base. The integration of advanced features like artificial intelligence (AI) for network optimization, enhanced security protocols, and simplified management interfaces are becoming key differentiators. Furthermore, the growing adoption of Wi-Fi in industrial IoT (Internet of Things) applications and smart city initiatives presents new avenues for market expansion. The market penetration rate for Wi-Fi extenders is expected to grow from XX% in 2025 to XX% by 2033.

Dominant Markets & Segments in Wi-Fi Extenders Industry

The Indoor Wi-Fi segment is currently the dominant market within the Wi-Fi Extenders Industry, driven by the pervasive need for enhanced wireless coverage in residential and commercial spaces. Within this segment, the Residential End User category represents the largest share, fueled by the increasing number of connected devices per household and the growing adoption of smart home technologies. The Commercial End User segment is also exhibiting robust growth, as businesses of all sizes invest in reliable Wi-Fi to support their operations, enhance customer experiences, and enable flexible work arrangements. The Extenders and Repeaters product category holds a significant market share due to their widespread availability, affordability, and ease of use, providing a cost-effective solution for extending existing Wi-Fi networks.

Key growth drivers in the dominant Indoor Wi-Fi segment include the increasing density of connected devices, the growing adoption of bandwidth-intensive applications like 4K streaming and online gaming, and the ongoing trend towards remote and hybrid work models that necessitate strong home network performance. Government initiatives promoting digital infrastructure and the expansion of broadband services also contribute to this growth. The Commercial end-user segment is propelled by the demand for reliable Wi-Fi in offices, retail spaces, hospitality venues, and educational institutions, where seamless connectivity is crucial for productivity and customer satisfaction. The Extenders and Repeaters product category benefits from its established market presence and its ability to offer incremental network expansion. As Wi-Fi technology evolves, there is a growing opportunity for more sophisticated Access Points that offer greater control and performance, particularly in enterprise environments. The Public End User segment, encompassing Wi-Fi in public transportation, parks, and community centers, is also experiencing growth driven by smart city initiatives and the desire for free public internet access. The Other End-user Verticals, such as industrial settings and healthcare facilities, are emerging as key growth areas with specialized connectivity requirements.

Wi-Fi Extenders Industry Product Analysis

Product innovation in the Wi-Fi Extenders Industry is primarily focused on enhancing speed, range, and reliability. Wi-Fi 6 and Wi-Fi 6E compatibility is becoming standard, enabling devices to tap into higher frequencies and achieve multi-gigabit speeds. Manufacturers are also developing intelligent extenders with features like seamless roaming, beamforming technology, and adaptive channel selection to optimize network performance and user experience. Applications span from eliminating Wi-Fi dead zones in homes and offices to providing robust connectivity in large commercial venues and public spaces. Competitive advantages are derived from superior performance metrics, ease of setup and management, advanced security features, and attractive price points. The integration of mesh networking capabilities into extenders further enhances their appeal by creating a unified and more robust wireless network.

Key Drivers, Barriers & Challenges in Wi-Fi Extenders Industry

Key Drivers, Barriers & Challenges in Wi-Fi Extenders Industry

The Wi-Fi Extenders Industry is propelled by several key drivers. The escalating demand for seamless wireless connectivity in homes and businesses, driven by the proliferation of smart devices and the growth of bandwidth-intensive applications, is a primary growth catalyst. The ongoing technological advancements in Wi-Fi standards, such as Wi-Fi 6 and Wi-Fi 6E, are creating a need for compatible extender solutions to maximize network performance. The increasing adoption of remote and hybrid work models also necessitates reliable Wi-Fi coverage throughout larger living and working spaces. Furthermore, government initiatives to expand digital infrastructure and promote internet accessibility are contributing to market expansion.

Conversely, the industry faces several barriers and challenges. Intense competition from integrated router solutions and mesh Wi-Fi systems, which offer more comprehensive network management, can limit the market share of standalone extenders. Supply chain disruptions, as experienced in recent years, can impact manufacturing and lead to increased costs and extended delivery times. Regulatory hurdles related to spectrum usage and device certification can also pose challenges. Moreover, ensuring robust security protocols across a distributed network of extenders is a continuous concern, requiring ongoing development and user education. The potential for performance degradation or interference when using multiple extenders can also be a deterrent for some users. The estimated impact of supply chain issues on production costs is approximately a 5-10% increase.

Growth Drivers in the Wi-Fi Extenders Industry Market

The Wi-Fi Extenders Industry market is experiencing significant growth driven by several compelling factors. Technologically, the widespread adoption of Wi-Fi 6 and the emergence of Wi-Fi 6E standards are creating a strong demand for extenders that can deliver enhanced speed, reduced latency, and improved capacity, supporting a growing number of connected devices. Economically, the increasing affordability of these advanced technologies is making them accessible to a broader consumer base. The persistent trend of remote and hybrid work models necessitates robust and extended Wi-Fi coverage within homes, making extenders a crucial component of home networking infrastructure. Policy-wise, government initiatives aimed at expanding broadband access and promoting digital inclusion are indirectly boosting the demand for devices that ensure reliable connectivity across all areas.

Challenges Impacting Wi-Fi Extenders Industry Growth

Several challenges are impacting the growth of the Wi-Fi Extenders Industry. The competitive landscape is increasingly dominated by integrated mesh Wi-Fi systems, which offer a more seamless and centralized network management experience, posing a direct challenge to standalone extenders. Supply chain vulnerabilities, including component shortages and logistical issues, can lead to increased manufacturing costs and delayed product availability, affecting market momentum. Regulatory complexities surrounding Wi-Fi spectrum allocation and device certification in different regions can also slow down product deployment and market entry. Furthermore, ensuring robust cybersecurity across a distributed network of extenders remains a critical concern, requiring continuous innovation in security protocols and user education to mitigate risks from unauthorized access and cyber threats.

Key Players Shaping the Wi-Fi Extenders Industry Market

- Shenzhen Tenda Technology Co Ltd

- Aruba Networks (Hewlett Packard Enterprise Development LP)

- Cisco Systems Inc

- NETGEAR Inc

- Ruckus Wireless Inc

- Juniper Networks Inc

- Linksys Group Inc

- Huawei Technologies Co Ltd

- TRENDnet Inc

- TP-Link Technologies Co Ltd

- D-Link Corporation

- Motorola Solutions Inc

Significant Wi-Fi Extenders Industry Industry Milestones

- January 2023: TRENDnet, a pioneer in networking solutions, announced the opening of new offices in Mexico City's financial center, aiming to enhance service for partners in Mexico and Latin America.

- May 2022: Linksys released two new Wi-Fi 6 mesh systems, the Hydra 6 and Atlas 6, designed for home users, especially remote workers and avid gamers, offering cost-effective dual-band performance.

Future Outlook for Wi-Fi Extenders Industry Market

The future outlook for the Wi-Fi Extenders Industry remains highly positive, driven by ongoing technological innovation and evolving consumer demands. The continued evolution towards Wi-Fi 7 and beyond will create opportunities for next-generation extenders that offer even greater speeds and lower latency, catering to the increasing bandwidth requirements of immersive technologies like augmented reality (AR) and virtual reality (VR). The integration of artificial intelligence (AI) and machine learning (ML) into Wi-Fi extenders will enable smarter network management, self-optimization, and predictive maintenance, enhancing user experience and simplifying network administration. Strategic opportunities lie in developing solutions tailored for specific niche markets, such as industrial IoT deployments, smart cities, and the burgeoning metaverse. As the digital transformation continues to accelerate across all sectors, the demand for reliable and pervasive Wi-Fi connectivity will only intensify, cementing the indispensable role of Wi-Fi extenders in the modern digital ecosystem. The market is projected to witness a steady increase in value, reaching approximately USD XXX Million by 2033.

Wi-Fi Extenders Industry Segmentation

-

1. Type

- 1.1. Indoor Wi-Fi

- 1.2. Outdoor Wi-Fi

-

2. Product

- 2.1. Extenders and Repeaters

- 2.2. Access Points

- 2.3. Antennas

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Public

- 3.4. Other End-user Verticals

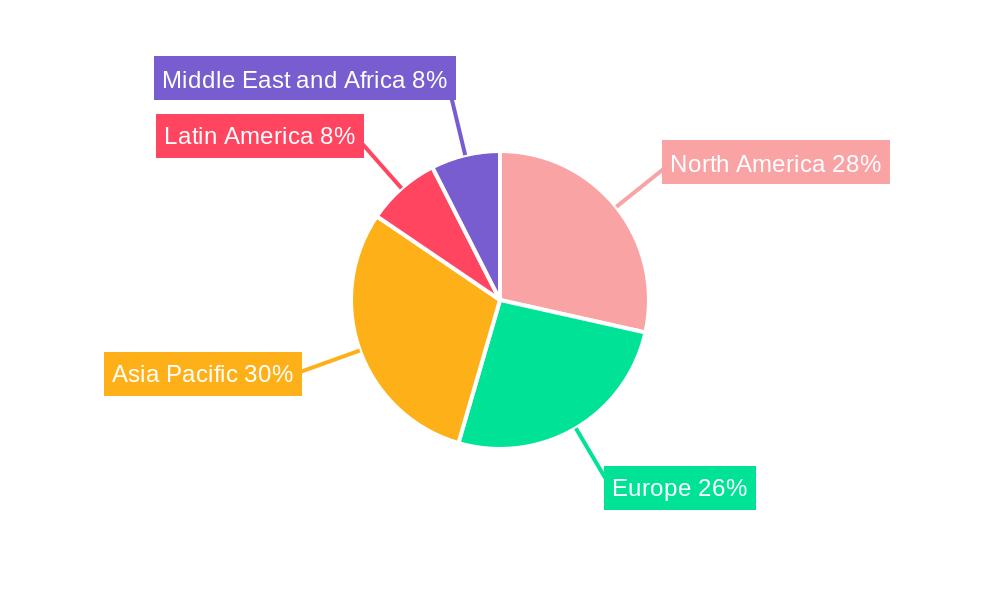

Wi-Fi Extenders Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wi-Fi Extenders Industry Regional Market Share

Geographic Coverage of Wi-Fi Extenders Industry

Wi-Fi Extenders Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Smart Cities and Smart Homes; Adoption of Bring-Your-Own-Device (BYOD)

- 3.3. Market Restrains

- 3.3.1. Network Security and Complexities Related to Network Management; Susceptibility to Macro-economic Changes; Usage of Mobile Broadband

- 3.4. Market Trends

- 3.4.1. Proliferation of Smart Cities and Smart Homes Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Indoor Wi-Fi

- 5.1.2. Outdoor Wi-Fi

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Extenders and Repeaters

- 5.2.2. Access Points

- 5.2.3. Antennas

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Public

- 5.3.4. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Indoor Wi-Fi

- 6.1.2. Outdoor Wi-Fi

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Extenders and Repeaters

- 6.2.2. Access Points

- 6.2.3. Antennas

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Public

- 6.3.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Indoor Wi-Fi

- 7.1.2. Outdoor Wi-Fi

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Extenders and Repeaters

- 7.2.2. Access Points

- 7.2.3. Antennas

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Public

- 7.3.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Indoor Wi-Fi

- 8.1.2. Outdoor Wi-Fi

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Extenders and Repeaters

- 8.2.2. Access Points

- 8.2.3. Antennas

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Public

- 8.3.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Indoor Wi-Fi

- 9.1.2. Outdoor Wi-Fi

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Extenders and Repeaters

- 9.2.2. Access Points

- 9.2.3. Antennas

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Public

- 9.3.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Wi-Fi Extenders Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Indoor Wi-Fi

- 10.1.2. Outdoor Wi-Fi

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Extenders and Repeaters

- 10.2.2. Access Points

- 10.2.3. Antennas

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.3.3. Public

- 10.3.4. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shenzhen Tenda Technology Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cisco Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NETGEAR Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ruckus Wireless Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Juniper Networks Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Linksys Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Huawei Technologies Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TRENDnet Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TP-Link Technologies Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 D-Link Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Motorola Solutions Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Shenzhen Tenda Technology Co Ltd

List of Figures

- Figure 1: Global Wi-Fi Extenders Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Wi-Fi Extenders Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Wi-Fi Extenders Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wi-Fi Extenders Industry Revenue (billion), by Product 2025 & 2033

- Figure 5: North America Wi-Fi Extenders Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Wi-Fi Extenders Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Wi-Fi Extenders Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Wi-Fi Extenders Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Wi-Fi Extenders Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wi-Fi Extenders Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Wi-Fi Extenders Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Wi-Fi Extenders Industry Revenue (billion), by Product 2025 & 2033

- Figure 13: Europe Wi-Fi Extenders Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Wi-Fi Extenders Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Wi-Fi Extenders Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Wi-Fi Extenders Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Wi-Fi Extenders Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wi-Fi Extenders Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Wi-Fi Extenders Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Wi-Fi Extenders Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Asia Pacific Wi-Fi Extenders Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific Wi-Fi Extenders Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Wi-Fi Extenders Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Wi-Fi Extenders Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Wi-Fi Extenders Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Wi-Fi Extenders Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin America Wi-Fi Extenders Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Wi-Fi Extenders Industry Revenue (billion), by Product 2025 & 2033

- Figure 29: Latin America Wi-Fi Extenders Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Latin America Wi-Fi Extenders Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Latin America Wi-Fi Extenders Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Wi-Fi Extenders Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Wi-Fi Extenders Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Wi-Fi Extenders Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East and Africa Wi-Fi Extenders Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Wi-Fi Extenders Industry Revenue (billion), by Product 2025 & 2033

- Figure 37: Middle East and Africa Wi-Fi Extenders Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Middle East and Africa Wi-Fi Extenders Industry Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East and Africa Wi-Fi Extenders Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Wi-Fi Extenders Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Wi-Fi Extenders Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 19: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global Wi-Fi Extenders Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Global Wi-Fi Extenders Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wi-Fi Extenders Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Wi-Fi Extenders Industry?

Key companies in the market include Shenzhen Tenda Technology Co Ltd, Aruba Networks (Hewlett Packard Enterprise Development LP), Cisco Systems Inc, NETGEAR Inc, Ruckus Wireless Inc, Juniper Networks Inc, Linksys Group Inc, Huawei Technologies Co Ltd, TRENDnet Inc, TP-Link Technologies Co Ltd, D-Link Corporation, Motorola Solutions Inc .

3. What are the main segments of the Wi-Fi Extenders Industry?

The market segments include Type, Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Smart Cities and Smart Homes; Adoption of Bring-Your-Own-Device (BYOD).

6. What are the notable trends driving market growth?

Proliferation of Smart Cities and Smart Homes Drives the Market Growth.

7. Are there any restraints impacting market growth?

Network Security and Complexities Related to Network Management; Susceptibility to Macro-economic Changes; Usage of Mobile Broadband.

8. Can you provide examples of recent developments in the market?

January 2023: TRENDnet, one of the global pioneers in reliable SMB and consumer networking and surveillance solutions, is announced the opening of new offices in Mexico City's financial center. TRENDnet's new consolidated headquarters helps it better service partners in Mexico and other regions of Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wi-Fi Extenders Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wi-Fi Extenders Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wi-Fi Extenders Industry?

To stay informed about further developments, trends, and reports in the Wi-Fi Extenders Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence