Key Insights

The ASEAN two-wheeler rental market, valued at approximately $2.27 billion in the base year 2024, is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 8% from 2024 to 2033. This growth is propelled by increasing urbanization and traffic congestion in key cities, driving demand for cost-effective two-wheeler rentals for daily commutes. The burgeoning tourism sector further stimulates the market as travelers seek independent exploration via scooters and motorcycles. The inherent convenience and affordability of short-term rentals, compared to car alternatives, are key market drivers. The scooter/moped segment is expected to dominate due to ease of operation in urban settings. Both short-term and long-term rental durations show promising growth. Leading manufacturers such as Honda, Yamaha, Kawasaki, and Piaggio are strategically investing in fleet expansion and technological advancements. Indonesia is anticipated to be the largest market within the ASEAN region, owing to its substantial population and developing infrastructure.

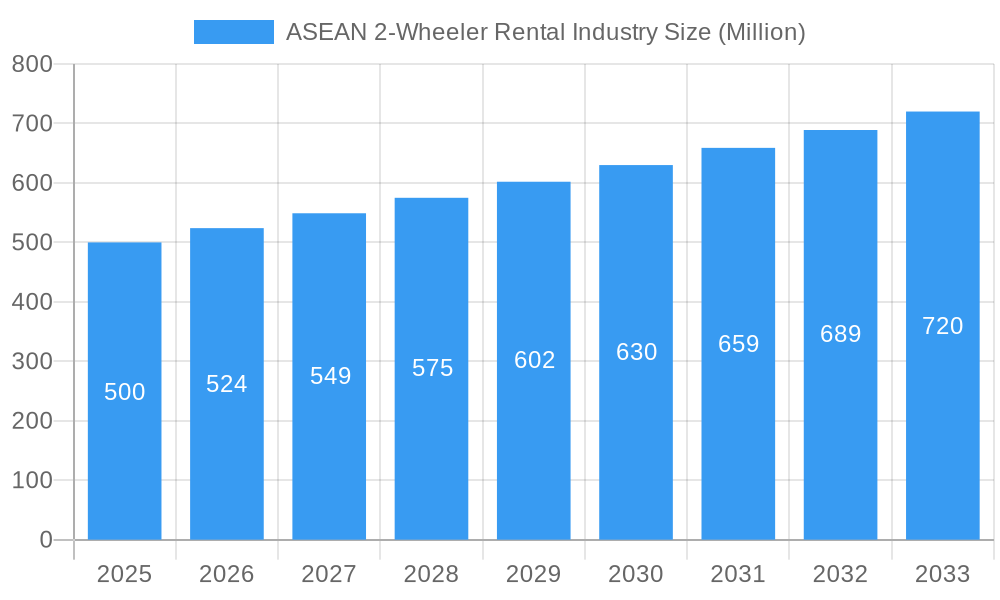

ASEAN 2-Wheeler Rental Industry Market Size (In Billion)

Despite the positive outlook, regulatory variations across ASEAN nations present operational challenges for rental companies. Safety concerns and insurance coverage limitations also impact broader adoption. Standardization of regulations and enhanced insurance solutions could unlock further market potential. Competition from ride-hailing services and accessible public transportation in select areas may moderately temper growth. Nonetheless, the ASEAN two-wheeler rental market demonstrates a robust trajectory, with considerable opportunities in technological integration, including mobile applications for seamless booking and management, and the adoption of sustainable practices, such as the integration of electric vehicles.

ASEAN 2-Wheeler Rental Industry Company Market Share

ASEAN 2-Wheeler Rental Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning ASEAN 2-wheeler rental market, offering invaluable insights for investors, industry players, and strategic decision-makers. With a focus on the period 2019-2033, the report leverages extensive data analysis to forecast market trends and identify key growth opportunities. The study covers a market valued at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a robust CAGR of XX%.

ASEAN 2-Wheeler Rental Industry Market Structure & Competitive Landscape

The ASEAN 2-wheeler rental market is characterized by a moderately fragmented structure, with several key players vying for market share. Concentration ratios are currently estimated at XX%, indicating a competitive landscape. Major players include Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, and BMW, but the market also incorporates numerous smaller, regional operators.

- Innovation Drivers: Technological advancements such as GPS tracking, mobile booking apps, and electric vehicle integration are driving innovation and efficiency within the industry.

- Regulatory Impacts: Varying regulations across ASEAN nations concerning licensing, insurance, and safety standards significantly impact market dynamics.

- Product Substitutes: Ride-hailing services and public transportation pose a competitive threat, especially for short-term rentals.

- End-User Segmentation: The market caters to diverse segments, including tourists, daily commuters, and business travelers, each with distinct rental preferences and needs.

- M&A Trends: The historical period (2019-2024) witnessed XX M&A transactions, primarily focused on consolidation and expansion into new markets. The forecast period is expected to see a further XX transactions.

ASEAN 2-Wheeler Rental Industry Market Trends & Opportunities

The ASEAN 2-wheeler rental market is experiencing robust growth, driven by several factors. Rising urbanization, increasing disposable incomes, and the popularity of tourism are fueling demand for convenient and affordable transportation options. Technological advancements are streamlining operations, improving customer experience, and enhancing efficiency. The market is witnessing a shift towards online booking platforms and mobile applications, signifying a move towards a more digitalized rental experience. The increasing popularity of scooters and mopeds, particularly in urban areas, represents a key segment growth driver. Consumer preferences are trending toward eco-friendly options, opening opportunities for electric 2-wheeler rental services. Competitive dynamics are marked by increasing price competition, strategic partnerships, and a focus on service differentiation.

Dominant Markets & Segments in ASEAN 2-Wheeler Rental Industry

Thailand and Vietnam currently represent the dominant markets within the ASEAN region, exhibiting the highest growth rates due to strong tourism sectors and burgeoning urban populations. The scooter/moped segment dominates the vehicle type market, accounting for approximately XX% of total rentals. Short-term rentals are the most prevalent rental duration type, driven by tourist demand. Tourism is currently the primary application type, though daily commuting is showing significant growth potential.

- Key Growth Drivers in Thailand: Robust tourism infrastructure, favorable government policies supporting the tourism sector, and high tourist arrivals.

- Key Growth Drivers in Vietnam: Rapid urbanization, increasing disposable incomes, and the expansion of motorcycle-based ride-hailing services.

- Key Growth Drivers in the Scooter/Moped segment: Affordability, ease of maneuverability in congested urban areas, and fuel efficiency.

- Key Growth Drivers in Short-Term Rentals: Tourist demand, flexibility, and convenience.

- Key Growth Drivers in Tourism Application: Growth of the tourism sector and increasing popularity of independent travel.

ASEAN 2-Wheeler Rental Industry Product Analysis

Product innovation in the ASEAN 2-wheeler rental market is primarily focused on enhancing convenience, safety, and sustainability. This includes the integration of GPS tracking systems, mobile booking applications, and the introduction of electric vehicles into rental fleets. The market is increasingly witnessing the adoption of smart helmets equipped with communication and safety features. Companies are focusing on offering various insurance and maintenance packages to enhance customer satisfaction.

Key Drivers, Barriers & Challenges in ASEAN 2-Wheeler Rental Industry

Key Drivers: The rising popularity of tourism, increasing urbanization leading to traffic congestion, improving infrastructure, and favorable government policies promoting tourism and transportation are key drivers.

Key Challenges: Regulatory hurdles regarding licensing and insurance requirements across different ASEAN nations, supply chain disruptions impacting vehicle availability, and intense competition from established players and ride-hailing services. These challenges translate into approximately XX% of total market losses each year.

Growth Drivers in the ASEAN 2-Wheeler Rental Industry Market

The ASEAN 2-wheeler rental market is fueled by several key growth drivers, namely the burgeoning tourism sector, rapid urbanization leading to increased demand for convenient transportation options, and technological advancements that enhance the rental experience. Economic growth within the region, coupled with supportive government policies promoting sustainable transportation, also contribute to market expansion.

Challenges Impacting ASEAN 2-Wheeler Rental Industry Growth

Challenges facing the ASEAN 2-wheeler rental industry include inconsistent regulatory frameworks across different ASEAN countries, impacting licensing and operational costs. Supply chain disruptions, particularly regarding vehicle parts and maintenance, present significant operational hurdles. Furthermore, the rise of ride-hailing services and increasing competition from established players intensify the pressure on market profitability.

Significant ASEAN 2-Wheeler Rental Industry Industry Milestones

- 2020: Introduction of several mobile booking apps by major rental companies.

- 2021: Government initiatives in several ASEAN countries to promote electric two-wheeler rentals.

- 2022: Significant investments in fleet expansion by key players.

- 2023: Launch of several rental services integrated with ride-hailing platforms.

Future Outlook for ASEAN 2-Wheeler Rental Industry Market

The future of the ASEAN 2-wheeler rental market appears bright, driven by sustained economic growth, increasing urbanization, and the rising popularity of tourism. The strategic adoption of technology, focus on sustainability through electric vehicle integration, and expansion into underserved markets will shape the industry’s trajectory. The market presents significant opportunities for expansion, particularly in areas with limited public transportation options.

ASEAN 2-Wheeler Rental Industry Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter/Moped

-

2. Rental Duration Type

- 2.1. Short term

- 2.2. Long Term

-

3. Application Type

- 3.1. Tourism

- 3.2. Daily Commuting

-

4. Geography

-

4.1. ASEAN

- 4.1.1. Indonesia

- 4.1.2. Malaysia

- 4.1.3. Singapore

- 4.1.4. Philippines

- 4.1.5. Rest of ASEAN

-

4.1. ASEAN

ASEAN 2-Wheeler Rental Industry Segmentation By Geography

-

1. ASEAN

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Philippines

- 1.5. Rest of ASEAN

ASEAN 2-Wheeler Rental Industry Regional Market Share

Geographic Coverage of ASEAN 2-Wheeler Rental Industry

ASEAN 2-Wheeler Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter/Moped

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 5.2.1. Short term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Daily Commuting

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. ASEAN

- 5.4.1.1. Indonesia

- 5.4.1.2. Malaysia

- 5.4.1.3. Singapore

- 5.4.1.4. Philippines

- 5.4.1.5. Rest of ASEAN

- 5.4.1. ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Indonesia ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 7. Malaysia ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 8. Singapore ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 9. Philippines ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 10. Rest of ASEAN ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kawasaki

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Piaggio

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Suzuki

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yamaha

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Honda

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Triumph

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BMW*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Kawasaki

List of Figures

- Figure 1: Global ASEAN 2-Wheeler Rental Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 3: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 7: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 8: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 9: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Geography 2025 & 2033

- Figure 11: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 4: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 5: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Indonesia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Malaysia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Singapore ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Philippines ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 15: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 16: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 17: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Indonesia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Malaysia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Singapore ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Philippines ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN 2-Wheeler Rental Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the ASEAN 2-Wheeler Rental Industry?

Key companies in the market include Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, BMW*List Not Exhaustive.

3. What are the main segments of the ASEAN 2-Wheeler Rental Industry?

The market segments include Vehicle Type, Rental Duration Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN 2-Wheeler Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN 2-Wheeler Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN 2-Wheeler Rental Industry?

To stay informed about further developments, trends, and reports in the ASEAN 2-Wheeler Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence