Key Insights

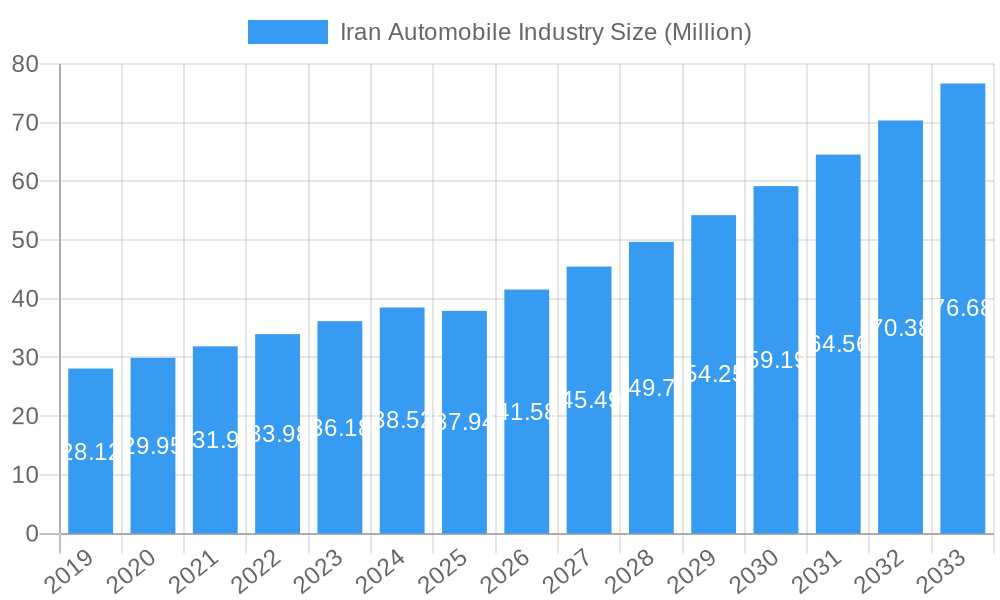

The Iran Automobile Industry is poised for significant expansion, with a current market size estimated at USD 37.94 million in 2025. The sector is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.57% throughout the forecast period from 2025 to 2033. This impressive growth is propelled by several key drivers, including the increasing demand for personal mobility, a growing middle class, and government initiatives aimed at boosting domestic production and stimulating the economy. Furthermore, the ongoing development of more fuel-efficient and potentially electric vehicle (EV) technologies, alongside a large and relatively young population, creates a fertile ground for sustained market advancement. The industry is also benefiting from a gradual easing of international sanctions, which could facilitate greater access to advanced automotive technologies and foreign investment.

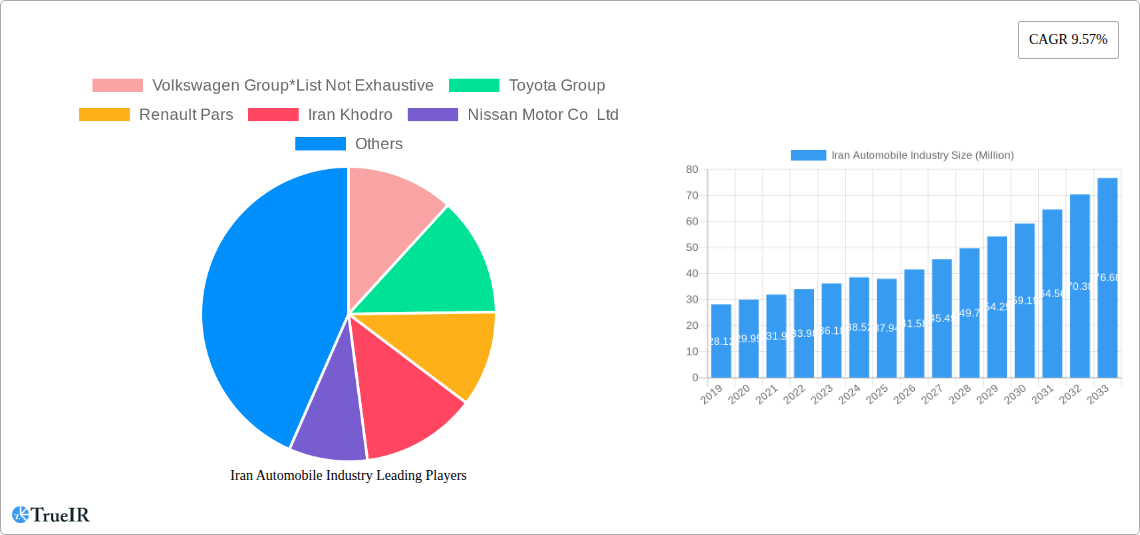

Iran Automobile Industry Market Size (In Million)

Despite the promising outlook, the Iran Automobile Industry faces certain restraints that could temper its growth trajectory. These include persistent economic volatility, currency fluctuations, and the ongoing impact of international trade restrictions, which can affect the import of critical components and raw materials. The aging vehicle parc also presents both an opportunity for new vehicle sales and a challenge in terms of affordability and the adoption of newer, cleaner technologies. Nevertheless, the industry is actively segmenting to cater to diverse consumer needs, with significant focus on both passenger and commercial vehicles. Within these segments, a notable shift towards exploring and integrating electric powertrains is also becoming evident, reflecting a global trend towards sustainable transportation. Key players like Volkswagen Group, Toyota Group, and domestic giants such as Iran Khodro and SAIPA Group are strategically positioned to capitalize on these evolving market dynamics and competition.

Iran Automobile Industry Company Market Share

This comprehensive report delves into the intricate landscape of the Iran Automobile Industry, offering in-depth analysis and actionable insights for stakeholders. Spanning the Study Period: 2019–2033, with a Base Year and Estimated Year of 2025, and a robust Forecast Period: 2025–2033, this research meticulously examines the Historical Period: 2019–2024. We leverage high-volume keywords such as "Iran automotive market," "Iranian car industry," "vehicle manufacturing Iran," and "automotive sector Iran" to ensure optimal search visibility and reach industry professionals.

Iran Automobile Industry Market Structure & Competitive Landscape

The Iran Automobile Industry exhibits a moderately concentrated market structure, with a few dominant players like Iran Khodro and SAIPA Group controlling a significant share of production. Innovation drivers are largely dictated by the need for localization of technology and component manufacturing, spurred by international sanctions. Regulatory impacts are substantial, influencing import/export policies, local manufacturing incentives, and safety standards. Product substitutes primarily include used vehicles and, to a lesser extent, imported vehicles when permissible. End-user segmentation is broad, encompassing individual consumers for passenger vehicles and businesses for commercial vehicles. Mergers and acquisitions (M&A) trends are less pronounced due to economic conditions and geopolitical factors, but strategic partnerships and joint ventures aimed at technology transfer and expanding production capacity are observed. The Industry Concentration Ratio for the top three players is estimated to be over 70%. The volume of M&A activities in the historical period was minimal, likely below XX Million.

Iran Automobile Industry Market Trends & Opportunities

The Iran Automobile Industry is poised for significant evolution, driven by a complex interplay of economic recovery, technological advancements, and evolving consumer preferences. Market size growth is projected to accelerate, fueled by pent-up demand and government initiatives aimed at revitalizing the sector. Technological shifts are increasingly leaning towards enhancing fuel efficiency and exploring nascent segments like electric vehicles, though the adoption rate for the latter is still in its early stages. Consumer preferences are gradually shifting towards more fuel-efficient, technologically advanced, and safer vehicles, influenced by global trends and local economic realities. Competitive dynamics are characterized by a strong domestic manufacturing base, with ongoing efforts to attract foreign investment and expertise. The Compound Annual Growth Rate (CAGR) for the overall automotive market is estimated at XX% during the forecast period. Market penetration rates for new vehicles are expected to increase from XX% in the historical period to over XX% by 2033. Opportunities lie in the development of a robust EV charging infrastructure, fostering local production of EV components, and enhancing the export potential of Iranian-made vehicles to regional markets. The increasing disposable income of a growing middle class will also be a key driver for sales of passenger vehicles.

Dominant Markets & Segments in Iran Automobile Industry

The Passenger Vehicles segment overwhelmingly dominates the Iran Automobile Industry, driven by the needs of a large and growing population. Within this segment, vehicles powered by IC Engines continue to hold the dominant share due to established infrastructure and cost-effectiveness. However, the Electric vehicle segment, though nascent, presents a significant long-term growth opportunity, propelled by global environmental concerns and potential government incentives.

Key Growth Drivers for Passenger Vehicles:

- Population Growth and Urbanization: A large and young demographic with increasing urbanization fuels the demand for personal mobility.

- Economic Recovery and Rising Disposable Income: As the economy stabilizes, consumer spending on durable goods like cars is expected to rise.

- Government Support for Local Manufacturing: Policies aimed at boosting domestic production and creating jobs indirectly support the passenger vehicle segment.

- Fleet Renewal Programs: Initiatives to replace aging vehicle fleets in public and private sectors contribute to demand.

Detailed Analysis of Market Dominance: The dominance of passenger vehicles is evident in production volumes, which consistently outweigh commercial vehicle output. Companies like Iran Khodro and SAIPA Group primarily focus on producing sedans and hatchbacks that cater to the mass market. The continued reliance on IC engines is due to the established refueling infrastructure and lower upfront costs compared to EVs. However, the potential for electric vehicles to gain traction is tied to government policy, battery technology advancements, and the development of a supportive ecosystem. The commercial vehicle segment, while smaller, plays a crucial role in logistics and transportation, with demand linked to industrial activity and infrastructure development.

Iran Automobile Industry Product Analysis

Product innovation in the Iran Automobile Industry is increasingly focused on enhancing fuel efficiency, safety features, and adapting existing models to meet evolving consumer expectations. Localized production of components and the integration of smart technologies are key competitive advantages. Applications range from daily commuting and family transportation in passenger vehicles to critical logistics and cargo movement in commercial vehicles. The emphasis remains on developing cost-effective and reliable vehicles suited to local conditions and consumer affordability.

Key Drivers, Barriers & Challenges in Iran Automobile Industry

Key Drivers: The Iran Automobile Industry is propelled by a combination of factors including robust domestic demand stemming from a large population, government initiatives to support local manufacturing, and the ongoing development of automotive supply chains. Technological advancements in localization of production and the potential for export growth also serve as significant drivers.

Key Barriers & Challenges: Significant challenges include the impact of international sanctions on access to advanced technologies and global supply chains, leading to potential disruptions and increased costs. Regulatory complexities, currency fluctuations, and the need for substantial investment in research and development for future technologies like electric vehicles present further hurdles. Competitive pressures from both domestic and potentially international players, coupled with evolving environmental regulations, add to the complexity. The estimated impact of supply chain disruptions on production costs could be as high as XX%.

Growth Drivers in the Iran Automobile Industry Market

Key growth drivers for the Iran Automobile Industry include a burgeoning domestic market with strong demand for personal transportation, supported by government policies promoting local production and job creation. Economic recovery and the gradual increase in disposable income will further stimulate vehicle purchases. Technological advancements in local manufacturing capabilities and a focus on developing more fuel-efficient and compliant vehicles are also critical growth catalysts. The potential for regional export market penetration, leveraging competitive pricing and localized production, presents a significant opportunity.

Challenges Impacting Iran Automobile Industry Growth

Challenges impacting Iran Automobile Industry growth are primarily shaped by the lingering effects of international sanctions, which can restrict access to critical components and advanced technologies, thereby increasing production costs and lead times. Regulatory complexities, currency volatility, and the substantial investment required for research and development, particularly in the nascent electric vehicle segment, pose significant barriers. Furthermore, intense competition within the domestic market and the need to adapt to evolving global emission standards add to the operational pressures. Supply chain disruptions have historically led to production delays estimated at XX% in some periods.

Key Players Shaping the Iran Automobile Industry Market

- Renault Pars

- Iran Khodro

- SAIPA Group

- Toyota Group

- Volkswagen Group

- Hyundai Kia Automotive Group

- Nissan Motor Co Ltd

- Brilliance Automobile Group

Significant Iran Automobile Industry Industry Milestones

- 2019: Increased focus on localization of component manufacturing to mitigate sanction impacts.

- 2020: Introduction of new emission standards aligned with regional requirements.

- 2021: Growth in the used car market due to affordability concerns for new vehicles.

- 2022: Exploration of partnerships for EV technology and infrastructure development.

- 2023: Government announcement of incentives for domestic automotive production and R&D.

- 2024: Launch of new passenger vehicle models with enhanced fuel efficiency and safety features.

Future Outlook for Iran Automobile Industry Market

The future outlook for the Iran Automobile Industry is characterized by a strategic emphasis on self-sufficiency, technological advancement, and the gradual integration of sustainable mobility solutions. Growth catalysts include the continued expansion of the domestic market, driven by demographic trends and economic recovery, coupled with government support for local manufacturing and export initiatives. Opportunities lie in developing competitive electric vehicle offerings, enhancing supply chain resilience, and fostering innovation in automotive technologies. Strategic focus on regional market penetration and the development of a robust after-sales service network will be crucial for long-term success.

Iran Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. IC Engines

- 2.2. Electric

Iran Automobile Industry Segmentation By Geography

- 1. Iran

Iran Automobile Industry Regional Market Share

Geographic Coverage of Iran Automobile Industry

Iran Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. IC Engines

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Volkswagen Group*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toyota Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Renault Pars

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iran Khodro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nissan Motor Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brilliance Automobile Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Kia Automotive Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIPA Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Volkswagen Group*List Not Exhaustive

List of Figures

- Figure 1: Iran Automobile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Automobile Industry Share (%) by Company 2025

List of Tables

- Table 1: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 3: Iran Automobile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 6: Iran Automobile Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Automobile Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Automobile Industry?

Key companies in the market include Volkswagen Group*List Not Exhaustive, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, SAIPA Group.

3. What are the main segments of the Iran Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Highest Growth.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Automobile Industry?

To stay informed about further developments, trends, and reports in the Iran Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence