Key Insights

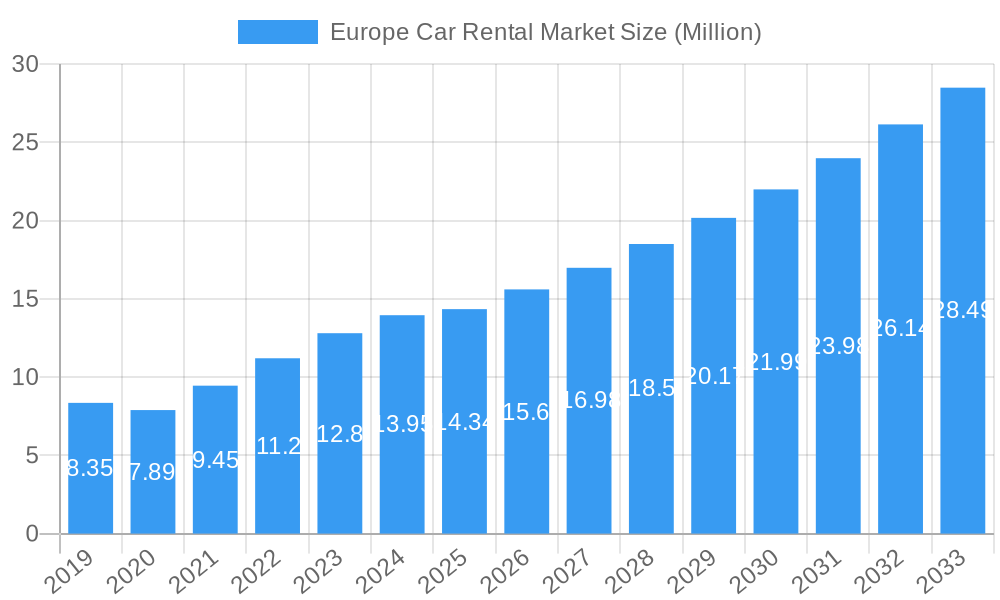

The Europe Car Rental Market is poised for robust expansion, projected to reach a substantial $14.34 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.96% during the forecast period of 2025-2033. This dynamic growth is fueled by several key drivers. The increasing demand for flexible and convenient travel solutions, particularly for leisure and tourism, is a primary catalyst. Travelers are opting for car rentals to explore diverse European destinations at their own pace, especially post-pandemic, with a surge in road trips and intercity travel. Business travel, while recovering, also contributes significantly, as companies utilize rental services for corporate mobility needs and employee transportation. The growing adoption of online booking platforms and mobile applications has streamlined the rental process, enhancing customer accessibility and convenience, thus driving the online booking segment. Furthermore, the proliferation of diverse vehicle options, ranging from economical budget cars to premium luxury vehicles, caters to a wide spectrum of consumer preferences and budgets, further stimulating market growth.

Europe Car Rental Market Market Size (In Million)

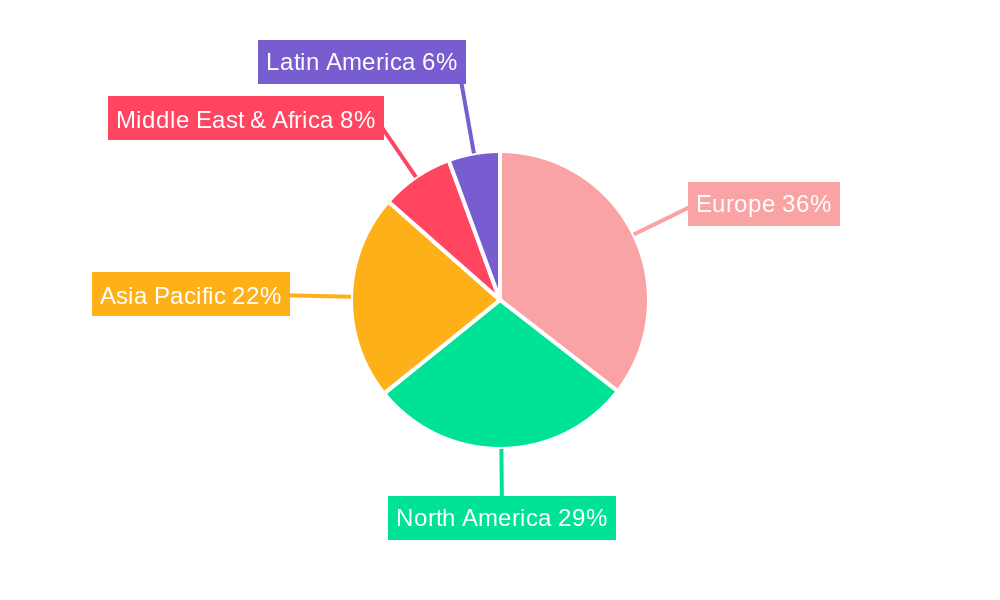

The market is experiencing significant trends that are shaping its trajectory. The short-term rental segment is outperforming long-term rentals, driven by the rise of spontaneous travel and short breaks. Within vehicle types, a balanced demand exists for both economy/budget cars and premium/luxury cars, reflecting the diverse economic strata of travelers. Geographically, Europe, with its established tourism infrastructure and extensive road networks, represents a dominant and lucrative market. Key countries like the United Kingdom, Germany, France, Italy, and Spain are major contributors due to high tourist footfall and strong business activity. While the market enjoys strong growth, certain restraints need consideration. The increasing competition from ride-sharing services and car-sharing platforms presents a challenge, offering alternative mobility solutions. Fluctuations in fuel prices and growing environmental concerns can also impact consumer choices, potentially favoring electric or hybrid rental options. Regulatory changes and insurance costs can also introduce complexities for rental providers.

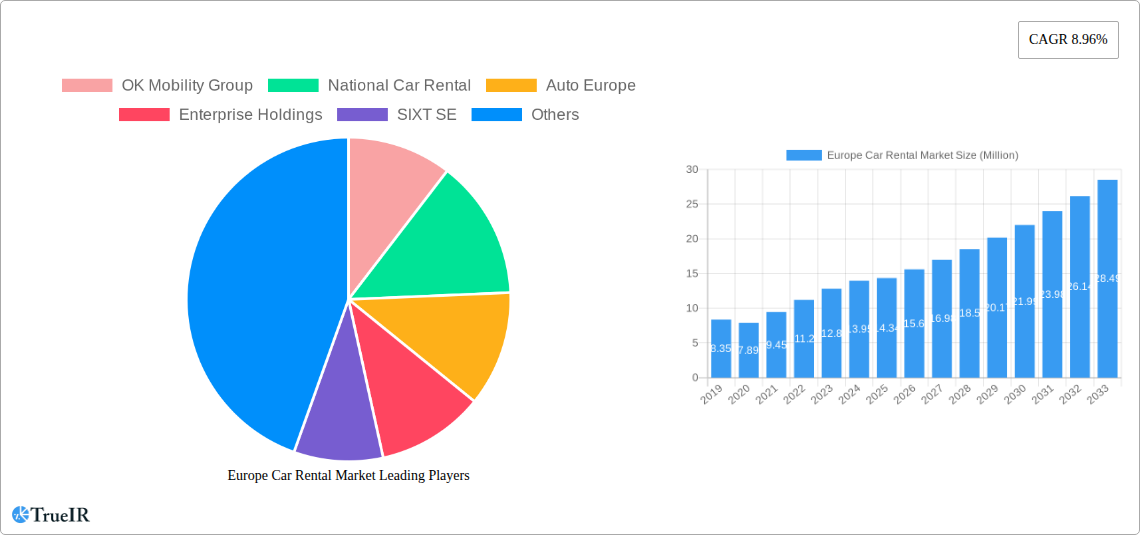

Europe Car Rental Market Company Market Share

Europe Car Rental Market: Comprehensive Analysis & Future Projections (2019-2033)

Gain deep insights into the dynamic Europe car rental market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides a complete understanding of market structure, trends, dominant segments, and future outlook. Leverage high-volume keywords like "Europe car rental," "car hire Europe," "European mobility solutions," and "rental car market growth" to understand key drivers, competitive landscapes, and emerging opportunities. This report is essential for industry stakeholders, investors, and strategic planners seeking to navigate the evolving European car rental ecosystem, particularly focusing on key trends like the shift in EV fleets and the growing demand for seamless digital booking experiences.

Europe Car Rental Market Market Structure & Competitive Landscape

The Europe car rental market is characterized by a moderate to high level of concentration, with a few major global players dominating a significant portion of the market share. Key players like Enterprise Holdings, Avis Budget Group Inc., and Europcar Mobility Group command substantial influence, supported by extensive fleet sizes and widespread network coverage. Innovation drivers are primarily focused on enhancing customer experience through digital platforms, offering flexible rental options, and adapting to evolving vehicle technologies. Regulatory impacts, while present, are generally aimed at standardizing safety protocols and consumer protection, with limited direct constraints on market entry for established entities. Product substitutes, such as ride-sharing services and expanding public transportation networks, present ongoing challenges, necessitating continuous innovation in service offerings and pricing strategies. End-user segmentation is increasingly refined, with dedicated offerings for leisure and business travelers, as well as niche markets like adventure tourism. Mergers and acquisitions (M&A) have played a crucial role in market consolidation, with approximately 3-5 significant M&A deals observed annually in recent years, primarily aimed at expanding geographic reach, acquiring new technologies, or strengthening fleet diversification. The competitive landscape is further shaped by the growing presence of online travel agencies (OTAs) and aggregators, intensifying price competition and driving the need for efficient online booking capabilities. Concentration ratios are estimated to be in the range of 60-70% for the top 5 players.

Europe Car Rental Market Market Trends & Opportunities

The Europe car rental market is poised for robust growth, driven by a confluence of factors including a rebound in travel and tourism, evolving mobility preferences, and technological advancements. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2033. Technological shifts are a prominent trend, with a notable acceleration in the adoption of online booking platforms, mobile applications, and digital keyless entry systems. This digital transformation is enhancing customer convenience and operational efficiency, leading to increased market penetration for online booking channels, which are expected to capture over 70% of total bookings by 2033. Consumer preferences are increasingly leaning towards flexible rental durations and a wider variety of vehicle types, from economy and budget cars for cost-conscious travelers to premium and luxury cars for discerning customers. The demand for electric vehicles (EVs) continues to grow, although recent industry developments, such as SIXT SE's decision to phase out Tesla rentals due to resale cost concerns, highlight the complexities and evolving dynamics within this segment. Opportunities lie in catering to the burgeoning leisure and tourism sector, which is expected to constitute approximately 65% of the total market revenue, and in developing tailored solutions for business travelers. Competitive dynamics are intensifying, with companies focusing on fleet modernization, sustainable mobility options, and strategic partnerships to differentiate themselves. The growing emphasis on mobility-as-a-service (MaaS) solutions also presents a significant opportunity for car rental companies to integrate their offerings into broader transportation ecosystems. The overall market penetration for car rentals within the broader European mobility landscape is projected to reach 15% by 2033, indicating substantial room for expansion.

Dominant Markets & Segments in Europe Car Rental Market

Within the Europe car rental market, several key regions and segments are exhibiting particularly strong growth and dominance. Online booking channels have emerged as the leading segment within Booking Type, driven by unparalleled convenience, real-time price comparisons, and seamless user experiences. The projected market share for online bookings is expected to exceed 70% by 2033. Short Term rentals remain the dominant category under Rental Duration, catering to the immediate needs of leisure travelers and business professionals on short trips. However, the long-term rental segment is witnessing steady growth, fueled by increased remote work trends and the desire for flexible, extended mobility solutions. For Application Type, the Leisure/Tourism segment is the primary revenue generator, accounting for approximately 65% of the market. The resurgence of international travel post-pandemic and the growing popularity of European destinations are key growth drivers. The Business segment, while smaller, remains significant and is characterized by a demand for premium vehicles and efficient service. In terms of Vehicle Type, Economy/Budget Cars constitute the largest segment due to their affordability and suitability for a broad range of travelers. However, there is a discernible upward trend in demand for Premium/Luxury Cars, reflecting a growing segment of travelers seeking enhanced comfort and status during their journeys. Key growth drivers across these segments include robust tourism infrastructure, favorable government policies supporting travel and mobility, and increasing disposable incomes among target demographics. The digitalization of booking processes has significantly boosted the dominance of online channels, while the evolving preferences of travelers, seeking both cost-effectiveness and enhanced experiences, are shaping the dynamics of vehicle types and rental durations.

Europe Car Rental Market Product Analysis

The Europe car rental market is characterized by continuous product innovation aimed at enhancing customer experience and operational efficiency. Companies are investing heavily in digital platforms, offering intuitive mobile apps for booking, vehicle selection, and keyless entry. The integration of telematics and IoT devices is enabling real-time vehicle tracking, predictive maintenance, and personalized customer services. A significant area of product development revolves around fleet diversification, with a growing emphasis on electric and hybrid vehicles to meet sustainability demands, despite recent challenges in EV resale markets. Competitive advantages are being built around flexible rental packages, loyalty programs, and the provision of ancillary services such as GPS, child seats, and insurance options. The market fit for these innovations is evident in the increasing customer adoption rates and the demand for integrated mobility solutions that extend beyond traditional car rentals.

Key Drivers, Barriers & Challenges in Europe Car Rental Market

Key Drivers: The Europe car rental market is propelled by several key drivers. The strong rebound in international and domestic tourism post-pandemic is a significant factor, leading to increased demand for rental vehicles. Economic recovery across European nations fuels business travel and corporate rental needs. Technological advancements in digital booking platforms and fleet management systems enhance customer convenience and operational efficiency. Growing environmental consciousness is driving demand for electric and hybrid vehicle rentals, presenting a substantial opportunity for eco-friendly fleets.

Barriers & Challenges: Despite the positive outlook, several barriers and challenges impact market growth. Regulatory complexities across different European countries, including varying taxation policies and licensing requirements, can create operational hurdles. Supply chain disruptions, as seen with the global semiconductor shortage, can affect fleet availability and vehicle acquisition costs. Intense competitive pressure from established players, new entrants, and alternative mobility solutions like ride-sharing services can lead to price wars and reduced profit margins. Fluctuations in fuel prices and the ongoing uncertainty surrounding the total cost of ownership for electric vehicles in rental fleets also pose significant challenges.

Growth Drivers in the Europe Car Rental Market Market

The Europe car rental market is experiencing robust growth driven by several critical factors. The resurgence of international tourism post-pandemic has led to a surge in demand for rental cars as travelers seek convenient and flexible transportation options. Economic recovery across the continent is boosting both leisure and business travel, further fueling rental needs. Technological advancements, particularly in digital booking platforms and mobile applications, are enhancing customer convenience and driving online penetration. The increasing focus on sustainability is also a significant growth driver, with a growing number of consumers opting for electric and hybrid vehicles. Furthermore, governments in many European countries are promoting multimodal transportation and smart mobility solutions, creating a favorable ecosystem for car rental services.

Challenges Impacting Europe Car Rental Market Growth

Several challenges are impacting the growth trajectory of the Europe car rental market. The ongoing geopolitical instability and economic uncertainties in certain regions can deter travel and reduce rental demand. Regulatory complexities and variations in local laws across different European nations can create operational hurdles and increase compliance costs for car rental companies. Supply chain issues, including the availability and cost of new vehicles, continue to pose a significant challenge, impacting fleet expansion and renewal efforts. Intense competition from ride-sharing platforms, car-sharing services, and an expanding public transportation network exerts constant pressure on pricing and market share. Furthermore, the transition to electric vehicle fleets presents challenges related to charging infrastructure, battery lifespan, and fluctuating resale values, as highlighted by recent industry developments.

Key Players Shaping the Europe Car Rental Market Market

- OK Mobility Group

- National Car Rental

- Auto Europe

- Enterprise Holdings

- SIXT SE

- Budget Rent a Car System Inc

- Alamo Rent a Car

- ACE Rent A Car

- Hertz Global Holdings

- Europcar Mobility Group

- Avis Budget Group Inc

Significant Europe Car Rental Market Industry Milestones

- December 2023: SIXT SE announced the phasing out of Tesla electric rental cars from its fleets due to reduced resale costs, marking a notable shift in EV fleet strategy.

- October 2023: Enterprise Holdings rebranded to Enterprise Mobility to reflect its expanded global mobility solutions, launching a new logo and tagline, though its existing brands remain unchanged.

- June 2023: Europcar partnered with the BringOz logistics platform to digitize internal processes, automate vehicle movement, and optimize resource efficiency through consolidation.

Future Outlook for Europe Car Rental Market Market

The future outlook for the Europe car rental market is optimistic, driven by sustained recovery in travel and a growing embrace of diversified mobility solutions. The continued digitalization of services, including seamless online booking and keyless entry, will enhance customer satisfaction and operational efficiency. A key growth catalyst will be the increasing demand for sustainable mobility, pushing companies to expand their fleets of electric and hybrid vehicles, despite current challenges. Strategic partnerships and collaborations with technology providers and other mobility service operators will be crucial for integrating car rentals into broader MaaS ecosystems. The market is expected to see further consolidation and innovation aimed at offering more flexible, personalized, and integrated transportation experiences, catering to both leisure and business segments. The overall market potential remains substantial as economies rebound and travel patterns normalize.

Europe Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Rental Duration

- 2.1. Short Term

- 2.2. Long Term

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Economy/Budget Cars

- 4.2. Premium/Luxury Cars

Europe Car Rental Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Car Rental Market Regional Market Share

Geographic Coverage of Europe Car Rental Market

Europe Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inbound Tourism to Fuel Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Online Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short Term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Economy/Budget Cars

- 5.4.2. Premium/Luxury Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OK Mobility Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Car Rental

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Auto Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enterprise Holdings

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIXT SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budget Rent a Car System Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alamo Rent a Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACE Rent A Ca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hertz Global Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Europcar Mobility Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Avis Budget Group Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 OK Mobility Group

List of Figures

- Figure 1: Europe Car Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 3: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Europe Car Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 9: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Europe Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Rental Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the Europe Car Rental Market?

Key companies in the market include OK Mobility Group, National Car Rental, Auto Europe, Enterprise Holdings, SIXT SE, Budget Rent a Car System Inc, Alamo Rent a Car, ACE Rent A Ca, Hertz Global Holdings, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Europe Car Rental Market?

The market segments include Booking Type, Rental Duration, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inbound Tourism to Fuel Market Growth.

6. What are the notable trends driving market growth?

Online Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: SIXT SE, a German-based car rental company, announced that it was phasing out Tesla electric rental cars from its fleets because of reduced resale costs. SIXT was the second company apart from Hertz to announce the replacement of its electric vehicle fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Rental Market?

To stay informed about further developments, trends, and reports in the Europe Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence