Key Insights

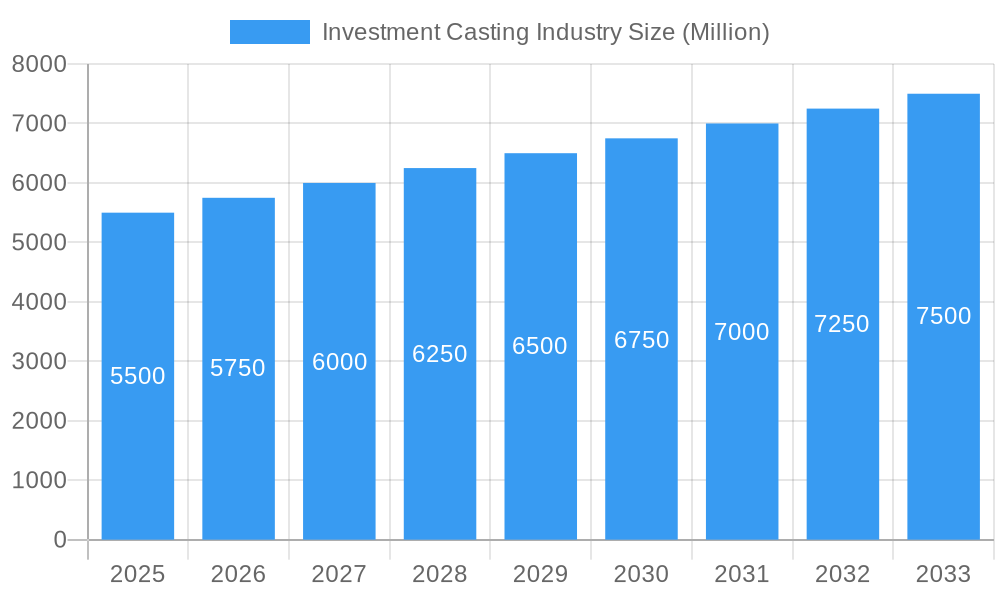

The global investment casting market is poised for robust growth, projected to reach a substantial market size of approximately $XX million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.58% expected to continue through 2033. This sustained expansion is primarily driven by the increasing demand for high-precision components across critical industries. The automotive sector, a significant end-user, is experiencing a surge in demand for lightweight and complex parts for both internal combustion engine vehicles and the burgeoning electric vehicle (EV) segment, necessitating advanced casting solutions for engine components, transmissions, and battery enclosures. Similarly, the aerospace and military industries are key contributors, leveraging investment casting for intricate turbine blades, structural components, and missile parts where material integrity and complex geometries are paramount. Furthermore, the medical industry's growing reliance on biocompatible implants and surgical instruments, along with the general industrial machinery sector's need for durable and precisely engineered parts, are fueling market expansion. The prevalent Sodium Silicate Process, known for its versatility and cost-effectiveness for a wide range of alloys, is likely to maintain its dominance, while the Tetraethyl Orthosilicate/Silica Sol Process will cater to specialized applications requiring higher precision and finer finishes.

Investment Casting Industry Market Size (In Billion)

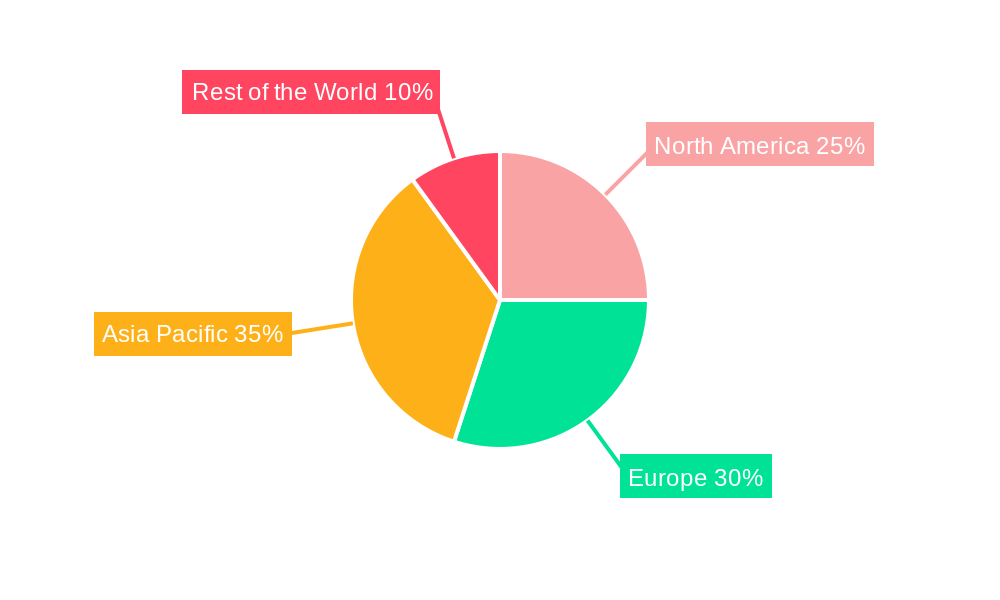

The market dynamics are further shaped by several evolving trends. The increasing adoption of advanced manufacturing technologies, including automation and additive manufacturing integration, is enhancing efficiency and product quality within investment casting foundries. A strong emphasis on material innovation, particularly the development and use of high-performance alloys, is enabling investment casting to meet the stringent requirements of demanding applications. Geographically, Asia Pacific, led by China and India, is anticipated to be the fastest-growing region due to its expanding industrial base and manufacturing capabilities. North America and Europe, with their established automotive, aerospace, and medical industries, will continue to be significant markets. However, the industry faces certain restraints. Fluctuations in raw material prices, particularly for critical metals used in casting alloys, can impact profitability. Stringent environmental regulations concerning industrial emissions and waste disposal also pose challenges, necessitating investment in sustainable practices and technologies. The labor-intensive nature of some aspects of investment casting and the need for skilled personnel also represent a potential bottleneck for rapid expansion.

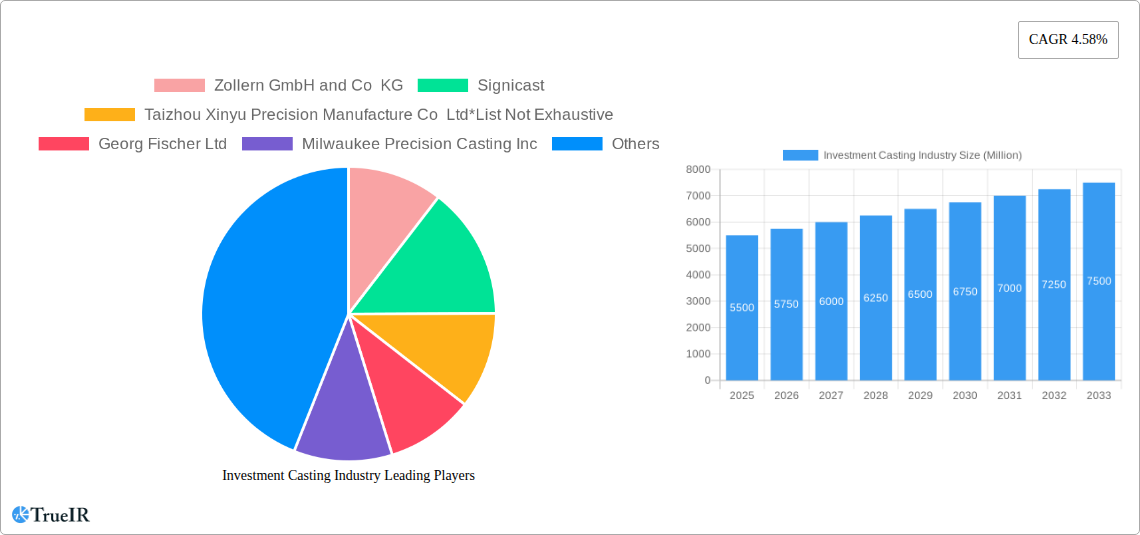

Investment Casting Industry Company Market Share

Investment Casting Industry Market Structure & Competitive Landscape

The global Investment Casting Industry exhibits a moderately concentrated market structure, with key players like Precision Castparts Corp (Berkshire Hathaway), Georg Fischer Ltd, and MetalTek International holding significant market share. The estimated market concentration ratio for the top 5 players stands at approximately 45% in 2025, projected to evolve with ongoing M&A activities and new entrant strategies. Innovation remains a primary driver, fueled by advancements in metallurgy, digital manufacturing technologies (such as 3D printing for tooling), and material science, enabling the production of intricate and high-performance components. Regulatory impacts, particularly those concerning environmental sustainability and material sourcing, are increasingly influencing manufacturing processes and product development. Product substitutes, while present in some lower-end applications, are largely outcompeted by the superior precision, complex geometries, and material integrity offered by investment casting for critical applications in aerospace and medical devices. End-user segmentation reveals a strong reliance on the Automotive and Aerospace and Military sectors, which collectively accounted for an estimated 60% of the market demand in 2025. Mergers and Acquisitions (M&A) trends are indicative of consolidation and strategic vertical integration, with an estimated 10 significant M&A deals in the historical period (2019-2024) valued at over 500 Million, aimed at expanding geographical reach and technological capabilities.

Investment Casting Industry Market Trends & Opportunities

The global Investment Casting Industry is poised for substantial growth, projected to expand from an estimated market size of 12,000 Million in 2025 to 18,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period (2025–2033). This robust expansion is underpinned by several interwoven trends and emerging opportunities. The increasing demand for lightweight yet durable components across key end-user industries, particularly Automotive (driven by electric vehicle production and stringent fuel efficiency standards) and Aerospace (fueled by a resurgence in air travel and the development of next-generation aircraft), is a primary growth catalyst. Technological shifts are paramount, with the integration of advanced simulation software for mold design, robotic automation for wax pattern and shell creation, and sophisticated inspection techniques enhancing efficiency, reducing lead times, and improving product quality. The adoption of Industry 4.0 principles, including data analytics and artificial intelligence, is enabling predictive maintenance and process optimization, further driving down costs and increasing output. Consumer preferences are increasingly leaning towards customized and high-precision parts, a niche where investment casting excels. This necessitates a focus on agile manufacturing and rapid prototyping capabilities. Competitive dynamics are intensifying, characterized by a push for higher material utilization, reduced waste, and the development of superalloys capable of withstanding extreme temperatures and pressures, particularly for aerospace and energy sector applications. Opportunities also lie in the diversification of end-user markets, such as the burgeoning medical device industry’s need for complex, biocompatible implants and surgical instruments, and the expansion of General Industrial Machinery applications requiring specialized, high-strength components. The continuous pursuit of energy efficiency and reduced environmental impact throughout the casting process presents another avenue for innovation and market differentiation, with opportunities for companies investing in sustainable practices and materials.

Dominant Markets & Segments in Investment Casting Industry

The Automotive sector emerges as the dominant end-user segment within the global Investment Casting Industry, accounting for an estimated 35% of the total market value in 2025. This dominance is driven by the relentless pursuit of lightweighting strategies to improve fuel efficiency and meet evolving emissions regulations, particularly for internal combustion engines and the burgeoning electric vehicle market, which demands intricate battery housings, motor components, and structural elements. The Aerospace and Military sector follows closely, representing approximately 25% of the market share, characterized by its stringent quality requirements and demand for high-performance, corrosion-resistant alloys for critical engine parts, airframes, and defense systems. General Industrial Machinery constitutes another significant segment, estimated at 20%, where investment casting is crucial for producing complex components for pumps, valves, turbines, and heavy equipment requiring exceptional durability and precision. The Medical segment, while currently smaller at around 10%, is a high-growth area, propelled by the demand for biocompatible, custom-designed implants, surgical instruments, and prosthetics, where the precision and material integrity of investment casting are indispensable.

Key Growth Drivers for Dominant Segments:

- Automotive:

- Increasing production of electric vehicles (EVs) requiring specialized components.

- Stringent fuel efficiency and emissions standards driving lightweighting initiatives.

- Demand for high-performance engine components and exhaust systems.

- Growth in the aftermarket for specialized automotive parts.

- Aerospace and Military:

- Development of new aircraft models and defense systems.

- Replacement of aging aircraft fleets, increasing demand for spare parts.

- Advancements in engine technology requiring advanced materials.

- Government defense spending and modernization programs.

- General Industrial Machinery:

- Infrastructure development projects globally.

- Industrial automation and the need for precision machinery components.

- Demand for pumps, valves, and turbines in various industrial applications.

- Replacement and upgrade cycles for existing industrial equipment.

- Medical:

- Growing aging global population and increasing incidence of chronic diseases.

- Advancements in minimally invasive surgical techniques.

- Rising demand for custom-fit implants and prosthetics.

- Technological innovations in medical device manufacturing.

The leading geographical market for investment casting remains North America and Europe, driven by the presence of major automotive and aerospace manufacturers and a mature industrial base. However, Asia Pacific, particularly China, is experiencing the fastest growth due to its expanding manufacturing capabilities and increasing adoption of advanced casting technologies.

Investment Casting Industry Product Analysis

Investment casting, also known as the lost-wax process, is revered for its ability to produce highly intricate and complex metal components with exceptional dimensional accuracy and surface finish. This makes it ideal for applications demanding tight tolerances and minimal post-casting machining. Key product innovations focus on the development of advanced alloys capable of withstanding extreme environments, such as nickel-based superalloys for aerospace turbine blades and stainless steels for corrosive industrial applications. The technology is increasingly being applied to produce critical parts for medical implants, prosthetics, and sophisticated surgical instruments where biocompatibility and precision are paramount. The competitive advantage lies in its capacity to cast complex geometries that are difficult or impossible to achieve with other metal forming processes, offering designers greater freedom and engineers superior performance.

Key Drivers, Barriers & Challenges in Investment Casting Industry

Key Drivers:

- Technological Advancements: Innovations in metallurgy, automation, and digital manufacturing (e.g., 3D printed tooling) are enhancing precision, reducing costs, and enabling the production of more complex parts.

- Growing Demand from End-Use Industries: The automotive sector's transition to EVs and the aerospace industry's expansion are significant growth catalysts.

- Demand for High-Performance Materials: The need for components that can withstand extreme temperatures, pressures, and corrosive environments in aerospace, energy, and defense.

- Increased Outsourcing: Global manufacturing trends lead to increased outsourcing of complex component production.

Barriers & Challenges:

- High Initial Investment: Setting up an investment casting facility requires substantial capital investment in specialized equipment and tooling.

- Material Costs Volatility: Fluctuations in the prices of raw metals can impact profitability.

- Skilled Labor Shortage: A lack of skilled technicians and engineers proficient in advanced casting processes poses a challenge.

- Environmental Regulations: Increasingly stringent environmental regulations concerning waste disposal, emissions, and energy consumption can increase operational costs.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and lead times, affecting production schedules. The estimated impact of supply chain disruptions on lead times has increased by approximately 20% in the historical period.

- Competition from Alternative Processes: For simpler components, alternative manufacturing methods may offer cost advantages.

Growth Drivers in the Investment Casting Industry Market

The growth of the Investment Casting Industry is propelled by several interconnected factors. Technologically, the integration of advanced simulation software for mold design and the increasing use of 3D printing for rapid prototyping of wax patterns and even direct metal tooling are significantly reducing development cycles and costs. Economically, the global demand for lightweight, high-strength components, particularly from the booming electric vehicle market and the resurgent aerospace sector, provides a substantial tailwind. Government initiatives promoting advanced manufacturing and infrastructure development in emerging economies also contribute to market expansion. Regulatory-wise, while environmental regulations can present challenges, they also drive innovation towards more sustainable casting practices, creating a competitive edge for early adopters. The increasing complexity of modern machinery and devices necessitates precision components, a forte of investment casting.

Challenges Impacting Investment Casting Industry Growth

Several challenges continue to impact the growth trajectory of the Investment Casting Industry. Regulatory complexities, particularly around environmental compliance and material traceability, can increase operational expenses and necessitate significant investment in pollution control technologies. Supply chain issues, including the volatility of raw material prices and the potential for disruptions from geopolitical events, pose a constant threat to production schedules and cost management. Competitive pressures from alternative manufacturing processes, especially for less complex parts, and from low-cost producers in emerging economies, necessitate continuous innovation and efficiency improvements. The skilled labor shortage remains a critical constraint, with a growing need for experienced technicians and engineers to operate and maintain sophisticated casting equipment. The estimated impact of raw material price volatility on profit margins has been in the range of 5-10% annually in the historical period.

Key Players Shaping the Investment Casting Industry Market

- Zollern GmbH and Co KG

- Signicast

- Taizhou Xinyu Precision Manufacture Co Ltd

- Georg Fischer Ltd

- Milwaukee Precision Casting Inc

- Precision Castparts Corp (Berkshire Hathaway)

- MetalTek International

- Impro Precision Industries Limited

- Dongying Giayoung Precision Metal

- Alcoa Corporation

Significant Investment Casting Industry Industry Milestones

- 2019: Increased adoption of AI and machine learning for process optimization, leading to an estimated 5% reduction in scrap rates for major manufacturers.

- 2020: Significant advancements in the development of high-entropy alloys suitable for investment casting, expanding application possibilities in extreme environments.

- 2021: Growing emphasis on sustainability, with several leading companies investing in energy-efficient melting furnaces and waste recycling programs, contributing to an estimated 10% reduction in energy consumption per ton of casting.

- 2022: Widespread integration of digital twin technology for real-time monitoring and predictive maintenance of casting equipment, enhancing operational efficiency by an estimated 8%.

- 2023: Emergence of additive manufacturing (3D printing) for creating complex wax patterns and even direct metal tooling, significantly reducing lead times for highly intricate designs by up to 30%.

- 2024: Increased focus on strategic partnerships and mergers to consolidate market share and acquire advanced technological capabilities, with an estimated 5 major M&A deals.

Future Outlook for Investment Casting Industry Market

The future outlook for the Investment Casting Industry is exceptionally positive, driven by ongoing technological innovation and sustained demand from critical sectors. The continued evolution of advanced alloys, coupled with the integration of Industry 4.0 technologies like AI and IoT, will enable greater precision, reduced costs, and faster production cycles. The burgeoning electric vehicle market and the sustained growth in aerospace will provide consistent demand for high-performance components. Furthermore, the expanding applications in the medical and renewable energy sectors present significant growth avenues. Strategic investments in R&D, workforce development, and sustainable manufacturing practices will be crucial for companies aiming to maintain a competitive edge and capitalize on the expanding market potential, projected to reach over 18,000 Million by 2033.

Investment Casting Industry Segmentation

-

1. Type

- 1.1. Sodium Silicate Process

- 1.2. Tetraethyl Orthosilicate/Silica Sol Process

-

2. End-user Type

- 2.1. Automotive

- 2.2. Aerospace and Military

- 2.3. General Industrial Machinery

- 2.4. Medical

- 2.5. Other End-user Types

Investment Casting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

- 4.4. United Arab Emirates

- 4.5. Other Countries

Investment Casting Industry Regional Market Share

Geographic Coverage of Investment Casting Industry

Investment Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investments in Refueling Infrastructure Is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Sodium Silicate Process To Exhibit The Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sodium Silicate Process

- 5.1.2. Tetraethyl Orthosilicate/Silica Sol Process

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Automotive

- 5.2.2. Aerospace and Military

- 5.2.3. General Industrial Machinery

- 5.2.4. Medical

- 5.2.5. Other End-user Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Investment Casting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sodium Silicate Process

- 6.1.2. Tetraethyl Orthosilicate/Silica Sol Process

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Automotive

- 6.2.2. Aerospace and Military

- 6.2.3. General Industrial Machinery

- 6.2.4. Medical

- 6.2.5. Other End-user Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Investment Casting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sodium Silicate Process

- 7.1.2. Tetraethyl Orthosilicate/Silica Sol Process

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Automotive

- 7.2.2. Aerospace and Military

- 7.2.3. General Industrial Machinery

- 7.2.4. Medical

- 7.2.5. Other End-user Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Investment Casting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sodium Silicate Process

- 8.1.2. Tetraethyl Orthosilicate/Silica Sol Process

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Automotive

- 8.2.2. Aerospace and Military

- 8.2.3. General Industrial Machinery

- 8.2.4. Medical

- 8.2.5. Other End-user Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Investment Casting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sodium Silicate Process

- 9.1.2. Tetraethyl Orthosilicate/Silica Sol Process

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Automotive

- 9.2.2. Aerospace and Military

- 9.2.3. General Industrial Machinery

- 9.2.4. Medical

- 9.2.5. Other End-user Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Zollern GmbH and Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Signicast

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taizhou Xinyu Precision Manufacture Co Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Georg Fischer Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Milwaukee Precision Casting Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Precision Castparts Corp (Berkshire Hathaway)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MetalTek International

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Impro Precision Industries Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Dongying Giayoung Precision Metal

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alcoa Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Zollern GmbH and Co KG

List of Figures

- Figure 1: Global Investment Casting Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Investment Casting Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Investment Casting Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Investment Casting Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 5: North America Investment Casting Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 6: North America Investment Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Investment Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Investment Casting Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Investment Casting Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Investment Casting Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 11: Europe Investment Casting Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 12: Europe Investment Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Investment Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Investment Casting Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Investment Casting Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Investment Casting Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 17: Asia Pacific Investment Casting Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 18: Asia Pacific Investment Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Investment Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Investment Casting Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Investment Casting Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Investment Casting Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Rest of the World Investment Casting Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Rest of the World Investment Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Investment Casting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Casting Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Investment Casting Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Global Investment Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Investment Casting Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Investment Casting Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Global Investment Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Investment Casting Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Investment Casting Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Investment Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Investment Casting Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Investment Casting Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 20: Global Investment Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Investment Casting Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Investment Casting Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 28: Global Investment Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Mexico Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Arab Emirates Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Other Countries Investment Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Casting Industry?

The projected CAGR is approximately 4.58%.

2. Which companies are prominent players in the Investment Casting Industry?

Key companies in the market include Zollern GmbH and Co KG, Signicast, Taizhou Xinyu Precision Manufacture Co Ltd*List Not Exhaustive, Georg Fischer Ltd, Milwaukee Precision Casting Inc, Precision Castparts Corp (Berkshire Hathaway), MetalTek International, Impro Precision Industries Limited, Dongying Giayoung Precision Metal, Alcoa Corporation.

3. What are the main segments of the Investment Casting Industry?

The market segments include Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investments in Refueling Infrastructure Is Driving the Market Growth.

6. What are the notable trends driving market growth?

Sodium Silicate Process To Exhibit The Highest Growth Rate.

7. Are there any restraints impacting market growth?

Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Casting Industry?

To stay informed about further developments, trends, and reports in the Investment Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence