Key Insights

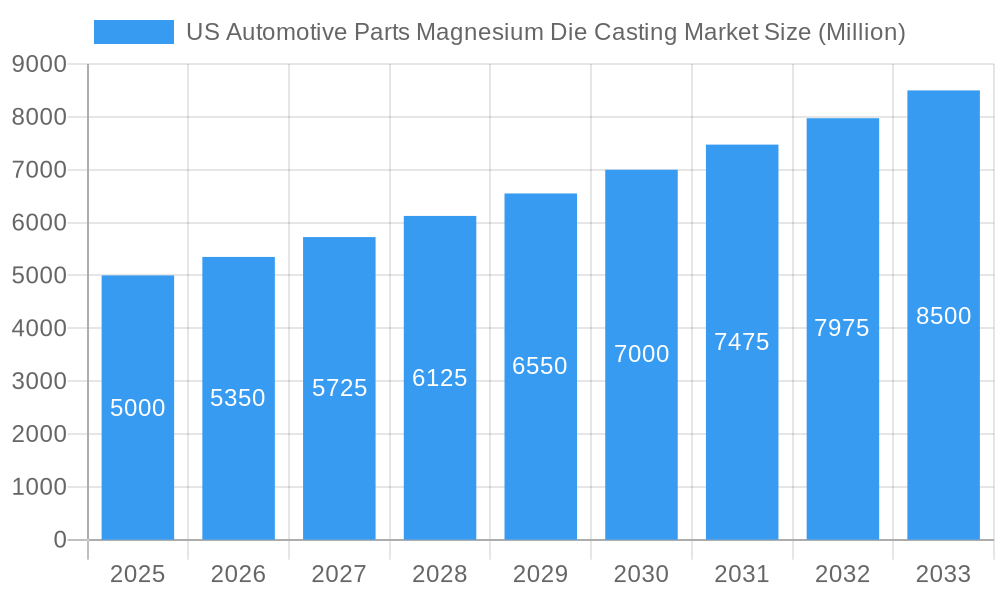

The US Automotive Parts Magnesium Die Casting Market is poised for significant expansion, driven by an insatiable demand for lightweight yet robust components within the automotive sector. With an estimated market size of USD 5,000 million in 2025, this sector is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 6.00% throughout the forecast period of 2025-2033. This robust growth is fueled by several key drivers, including stringent government regulations mandating improved fuel efficiency and reduced emissions, which directly encourages the adoption of lightweight materials like magnesium. The increasing production of electric vehicles (EVs), which prioritize weight reduction to maximize battery range, further amplifies this trend. Advancements in die casting technologies, such as enhanced pressure and vacuum die casting techniques, are also contributing to improved quality, faster production cycles, and cost-effectiveness, making magnesium die-cast parts more competitive.

US Automotive Parts Magnesium Die Casting Market Market Size (In Billion)

The market's dynamism is further shaped by evolving trends such as the growing preference for complex and integrated automotive components, where magnesium's formability and intricate design capabilities shine. The rising adoption of semi-solid die casting offers superior mechanical properties, making it ideal for critical applications like engine parts and transmission components. While the market demonstrates strong upward momentum, certain restraints need careful consideration. The volatility in raw material prices for magnesium, coupled with the energy-intensive nature of the die casting process, can impact profit margins. Additionally, the established infrastructure and expertise in other metal casting processes present a competitive challenge. However, the persistent focus on sustainability and the inherent recyclability of magnesium position it favorably for long-term market dominance, especially within key segments like engine parts and transmission components, which are expected to represent the largest share.

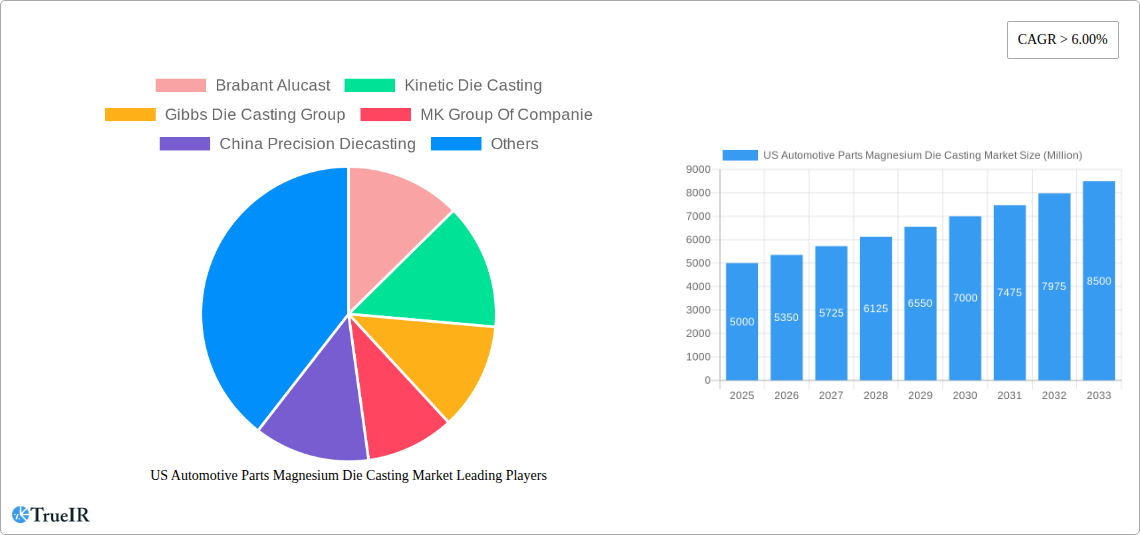

US Automotive Parts Magnesium Die Casting Market Company Market Share

US Automotive Parts Magnesium Die Casting Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report delivers a dynamic, SEO-optimized analysis of the US Automotive Parts Magnesium Die Casting Market. Leveraging high-volume keywords such as "magnesium die casting automotive," "automotive parts manufacturing," "lightweight automotive components," and "die casting solutions," this report provides invaluable insights for industry stakeholders. We cover the market from 2019 to 2033, with a deep dive into the base year 2025 and the forecast period 2025–2033, building upon historical data from 2019–2024.

US Automotive Parts Magnesium Die Casting Market Market Structure & Competitive Landscape

The US Automotive Parts Magnesium Die Casting Market exhibits a moderately concentrated structure, characterized by the presence of both large, established players and agile, specialized manufacturers. Innovation drivers are primarily fueled by the automotive industry's relentless pursuit of lightweighting, fuel efficiency, and enhanced safety features, directly impacting the demand for advanced magnesium die-cast components. Regulatory impacts, particularly those related to emissions standards and material recycling, are also shaping manufacturing processes and material choices. Product substitutes, such as aluminum die casting and plastic injection molding, pose a constant challenge, necessitating continuous improvement in magnesium's cost-effectiveness and performance attributes. End-user segmentation, encompassing engine parts, transmission components, and body parts, dictates specific application requirements and drives specialized production techniques. Mergers and acquisitions (M&A) trends, though not extensively documented with specific volume data, indicate a strategic consolidation aimed at expanding capabilities, market reach, and technological expertise. The market's competitive intensity is further amplified by global supply chain dynamics and the increasing adoption of Industry 4.0 technologies. Key players are investing heavily in R&D to develop thinner-walled components, improve casting speeds, and enhance surface finishes, ensuring magnesium's continued relevance in evolving automotive architectures.

US Automotive Parts Magnesium Die Casting Market Market Trends & Opportunities

The US Automotive Parts Magnesium Die Casting Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This robust expansion is driven by a confluence of compelling trends and emerging opportunities. The overarching trend of vehicle lightweighting, a critical strategy for meeting stringent fuel economy and emission regulations, is a primary catalyst. Magnesium's inherent lightweight properties, being significantly lighter than aluminum and steel, make it an increasingly attractive material choice for a wide array of automotive components. As manufacturers strive to reduce vehicle weight without compromising structural integrity or performance, the demand for magnesium die-cast parts like engine blocks, transmission housings, steering components, and interior structural elements is set to surge.

Technological advancements in die casting processes are further bolstering market growth. Innovations such as advanced vacuum die casting techniques, which reduce porosity and improve mechanical properties, and semi-solid die casting, enabling the production of more complex and intricate parts with enhanced strength, are expanding the application scope of magnesium. The increasing adoption of electric vehicles (EVs) presents a substantial new wave of opportunities. Magnesium die castings are ideal for battery enclosures, motor housings, and other structural components in EVs, contributing to improved range and performance. The trend towards modular vehicle architectures also favors die casting due to its ability to produce complex, integrated parts in a single operation, reducing assembly time and costs.

Consumer preferences are also subtly influencing the market. While direct consumer impact is minimal, the growing awareness of environmental sustainability and the desire for fuel-efficient vehicles indirectly drive demand for lightweight components, which magnesium die casting readily facilitates. Furthermore, the shift towards higher-performance vehicles, both internal combustion engine (ICE) and electric, necessitates components that offer a superior strength-to-weight ratio, a key advantage of magnesium.

The competitive landscape is evolving with a focus on cost optimization and supply chain resilience. Manufacturers are investing in automation and advanced simulation tools to improve efficiency and reduce production costs, thereby enhancing the competitiveness of magnesium against alternative materials. Opportunities exist for suppliers who can offer integrated solutions, from design and prototyping to high-volume production and finishing, catering to the diverse needs of automotive OEMs and Tier 1 suppliers. The increasing complexity of automotive designs and the growing demand for customized solutions create fertile ground for innovative magnesium die casting providers.

Dominant Markets & Segments in US Automotive Parts Magnesium Die Casting Market

The US Automotive Parts Magnesium Die Casting Market demonstrates significant dominance within specific production process types and application segments, driven by evolving automotive manufacturing demands and technological advancements.

Production Process Type Dominance:

Pressure Die Casting: This remains the dominant production process type in the US automotive parts magnesium die casting market. Its inherent efficiency, high production rates, and ability to create complex shapes with tight tolerances make it the go-to method for mass-produced automotive components.

- Key Growth Drivers: High volume production capabilities, established infrastructure, cost-effectiveness for large-scale manufacturing, and a wide range of available tooling solutions contribute to its continued dominance. The ability to produce parts with excellent surface finish and dimensional accuracy is crucial for automotive applications where aesthetics and precision are paramount.

- Detailed Analysis: Pressure die casting allows for the rapid solidification of molten magnesium under high pressure, resulting in dense, strong parts. This process is particularly well-suited for components such as engine cradles, intake manifolds, and steering wheel frames, where consistent quality and high throughput are essential. The continuous refinement of high-pressure die casting machines and associated technologies further solidifies its leading position.

Vacuum Die Casting: While not as prevalent as pressure die casting, vacuum die casting is experiencing growing adoption and is a significant segment due to its ability to produce parts with superior mechanical properties and reduced porosity.

- Key Growth Drivers: Enhanced material integrity, improved fatigue strength, and reduced internal defects are critical for high-stress automotive applications. The increasing demand for lighter yet stronger components in critical engine and transmission parts fuels its growth.

- Detailed Analysis: By evacuating air from the die cavity, vacuum die casting minimizes gas entrapment during filling, leading to a more homogeneous microstructure and improved mechanical performance. This makes it an attractive option for applications where reliability and long-term durability are paramount, such as in advanced powertrain components.

Squeeze Die Casting: This process is gaining traction for its ability to produce parts with mechanical properties comparable to forging, offering a compelling alternative for certain high-performance applications.

- Key Growth Drivers: The potential to achieve superior strength and ductility, enabling the replacement of heavier metal components, is a significant advantage. Its suitability for producing near-net-shape parts with minimal machining further enhances its appeal.

- Detailed Analysis: Squeeze die casting utilizes a lower filling velocity compared to conventional die casting, followed by a solidification under pressure. This controlled process results in a more refined grain structure and improved mechanical integrity, making it suitable for safety-critical components.

Semi-Solid Die Casting: This advanced process is emerging as a niche but important segment, offering unique advantages for intricate and thin-walled components.

- Key Growth Drivers: The ability to cast complex geometries with excellent fluidity and reduced shrinkage porosity opens up new design possibilities for lightweight automotive structures. Its potential to reduce cycle times for certain applications is also a significant factor.

- Detailed Analysis: Semi-solid die casting involves casting magnesium alloys that are partially solidified, behaving like a viscous slurry. This unique rheological property allows for the formation of intricate designs and thin walls that are challenging to achieve with traditional methods, finding applications in complex bracketry and interior components.

Application Type Dominance:

Engine Parts: This segment represents the largest and most dominant application area for magnesium die casting in the US automotive industry. The relentless drive for lightweighting in engines to improve fuel efficiency and reduce emissions directly translates to increased demand for magnesium components.

- Key Growth Drivers: The push for smaller, more powerful engines, along with the integration of hybrid and electric powertrains, necessitates lightweighting solutions for engine blocks, cylinder heads, oil pans, and various internal components. Magnesium's excellent thermal conductivity is also beneficial for heat dissipation in engine applications.

- Detailed Analysis: Magnesium die-cast engine parts offer a significant weight reduction compared to their cast iron or aluminum counterparts, contributing directly to improved vehicle performance and reduced environmental impact. The intricate designs achievable through die casting also allow for improved airflow and combustion efficiency.

Transmission Components: This segment is a significant and growing application for magnesium die castings, driven by the need for lighter and more compact transmission systems.

- Key Growth Drivers: The development of advanced automatic transmissions, dual-clutch transmissions, and continuously variable transmissions (CVTs) often incorporates magnesium housings and internal components to reduce overall weight and improve packaging efficiency.

- Detailed Analysis: Lightweight transmission components contribute to improved vehicle dynamics and fuel economy. Magnesium die casting's ability to produce complex internal geometries for efficient fluid flow and component integration makes it ideal for this segment.

Body Parts: While historically less prominent than engine or transmission components, the use of magnesium die castings for body parts is a rapidly expanding area, particularly for structural elements and closures.

- Key Growth Drivers: The increasing focus on crashworthiness and passive safety, coupled with the demand for lightweight exterior and interior panels, is propelling the adoption of magnesium in body-in-white applications, door modules, and tailgates.

- Detailed Analysis: Magnesium's high strength-to-weight ratio makes it an excellent candidate for reinforcing structural components, improving occupant protection without adding significant mass. Advanced casting techniques are enabling the production of larger and more complex body panels, offering opportunities for design innovation and weight reduction.

Others: This broad category encompasses a diverse range of automotive applications where magnesium die castings are utilized, including steering systems, chassis components, and thermal management systems.

- Key Growth Drivers: The continuous exploration of new applications and the inherent advantages of magnesium in terms of weight, stiffness, and damping properties drive its adoption across various vehicle systems.

- Detailed Analysis: Examples include steering column components, suspension brackets, and housings for electronic control units (ECUs), all benefiting from the weight savings and design flexibility offered by magnesium die casting.

US Automotive Parts Magnesium Die Casting Market Product Analysis

Magnesium die casting in the US automotive sector is characterized by a continuous stream of product innovations focused on enhancing performance, reducing weight, and improving manufacturability. Manufacturers are developing thinner-walled components, intricate designs with integrated features, and components with improved surface finishes and corrosion resistance. These advancements are driven by the automotive industry's relentless pursuit of fuel efficiency, reduced emissions, and enhanced vehicle performance. Competitive advantages are derived from the superior strength-to-weight ratio of magnesium, its excellent thermal conductivity, and the design flexibility offered by die casting processes. The ability to produce complex geometries in a single casting operation significantly reduces assembly time and cost, further solidifying magnesium's position.

Key Drivers, Barriers & Challenges in US Automotive Parts Magnesium Die Casting Market

Key Drivers:

The US Automotive Parts Magnesium Die Casting Market is primarily propelled by the automotive industry's imperative for lightweighting to meet stringent fuel economy and emission standards. The inherent strength-to-weight ratio of magnesium is a critical advantage. Furthermore, advancements in die casting technologies, including improved automation, process control, and material alloys, enhance efficiency and part quality. The growing demand for electric vehicles (EVs) also presents significant opportunities, as magnesium is ideal for battery enclosures and powertrain components. Government regulations promoting sustainability and fuel efficiency are indirectly driving the adoption of lightweight materials.

Barriers & Challenges:

Despite its advantages, the market faces several challenges. The higher cost of magnesium alloys compared to aluminum can be a significant barrier, especially for cost-sensitive applications. Corrosion susceptibility requires careful material selection and protective coatings. Supply chain volatility and availability of raw magnesium can impact pricing and production stability. Technical expertise required for designing and casting complex magnesium parts can also be a limitation. Finally, competition from alternative lightweight materials like advanced aluminum alloys and composites necessitates continuous innovation and cost optimization in magnesium die casting.

Growth Drivers in the US Automotive Parts Magnesium Die Casting Market Market

The US Automotive Parts Magnesium Die Casting Market is experiencing robust growth fueled by several key drivers. The paramount driver is the automotive industry's commitment to lightweighting vehicles, directly impacting the demand for magnesium due to its exceptional strength-to-weight ratio. This trend is amplified by increasingly stringent government regulations on fuel efficiency and emissions, pushing manufacturers to adopt lighter materials to reduce overall vehicle weight. Technological advancements in magnesium alloys and die casting processes are continuously improving the performance, precision, and cost-effectiveness of magnesium components, enabling their use in more critical applications. The rapid growth of the electric vehicle (EV) market represents a significant opportunity, as magnesium is an ideal material for EV battery enclosures, motor housings, and other structural components, contributing to extended range and improved performance.

Challenges Impacting US Automotive Parts Magnesium Die Casting Market Growth

Several challenges could impede the growth of the US Automotive Parts Magnesium Die Casting Market. The price volatility of magnesium, influenced by global supply dynamics and geopolitical factors, can make it a less predictable material choice compared to aluminum. Corrosion resistance remains a concern for certain applications, requiring advanced protective coatings and careful design considerations, which can add to the overall cost. While technology is advancing, the technical complexity and specialized knowledge required for designing and producing high-quality magnesium die castings can be a barrier for some manufacturers. Furthermore, the availability of skilled labor for operating and maintaining advanced die casting facilities is crucial. Finally, strong competition from alternative lightweight materials, particularly advanced aluminum alloys and composites, necessitates continuous innovation and competitive pricing strategies from the magnesium die casting industry.

Key Players Shaping the US Automotive Parts Magnesium Die Casting Market Market

- Brabant Alucast

- Kinetic Die Casting

- Gibbs Die Casting Group

- MK Group Of Companies

- China Precision Diecasting

- Chicago White Metal Casting Inc

- Meridian Lightweight Technologies

- George Fischer Ltd

- Continental Casting LLC

- Magic Precision Inc

Significant US Automotive Parts Magnesium Die Casting Market Industry Milestones

- 2019: Increased adoption of magnesium die castings in engine components for enhanced fuel efficiency.

- 2020: Introduction of advanced vacuum die casting techniques for higher-strength automotive parts.

- 2021: Growing interest in magnesium for EV battery enclosures and structural components.

- 2022: Development of novel magnesium alloys with improved corrosion resistance.

- 2023: Increased investment in automated die casting facilities to boost production efficiency.

- 2024: Significant focus on the use of magnesium for advanced driver-assistance systems (ADAS) component housings.

- 2025 (Projected): Anticipated surge in demand for magnesium die castings for electric vehicle powertrains.

- 2026 (Projected): Further integration of semi-solid die casting for complex and lightweight body parts.

- 2027 (Projected): Expansion of magnesium applications in interior structural components for enhanced safety.

- 2028 (Projected): Continued refinement of pressure die casting processes for higher precision and thinner walls.

- 2029 (Projected): Growth in the use of magnesium for thermal management systems in both ICE and EV vehicles.

- 2030 (Projected): Increased industry collaboration on developing sustainable magnesium recycling processes.

- 2031 (Projected): Greater adoption of magnesium for integrated chassis components to reduce overall vehicle weight.

- 2032 (Projected): Advancements in simulation and design software to optimize magnesium die cast part performance.

- 2033 (Projected): Magnesium die casting solidifies its position as a key material for lightweight and sustainable automotive manufacturing.

Future Outlook for US Automotive Parts Magnesium Die Casting Market Market

The future outlook for the US Automotive Parts Magnesium Die Casting Market is exceptionally positive, driven by the accelerating global demand for lightweight, fuel-efficient, and high-performance vehicles. Strategic opportunities lie in the continued expansion of applications within electric vehicles, particularly for battery enclosures and power electronics. Advancements in casting technology, including Industry 4.0 integration and artificial intelligence for process optimization, will further enhance competitiveness. Collaborative efforts between material suppliers, die casters, and automotive OEMs will be crucial for developing innovative solutions and overcoming existing material challenges like corrosion and cost. The market is projected to witness sustained growth, solidifying magnesium die casting's vital role in the future of automotive manufacturing.

US Automotive Parts Magnesium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

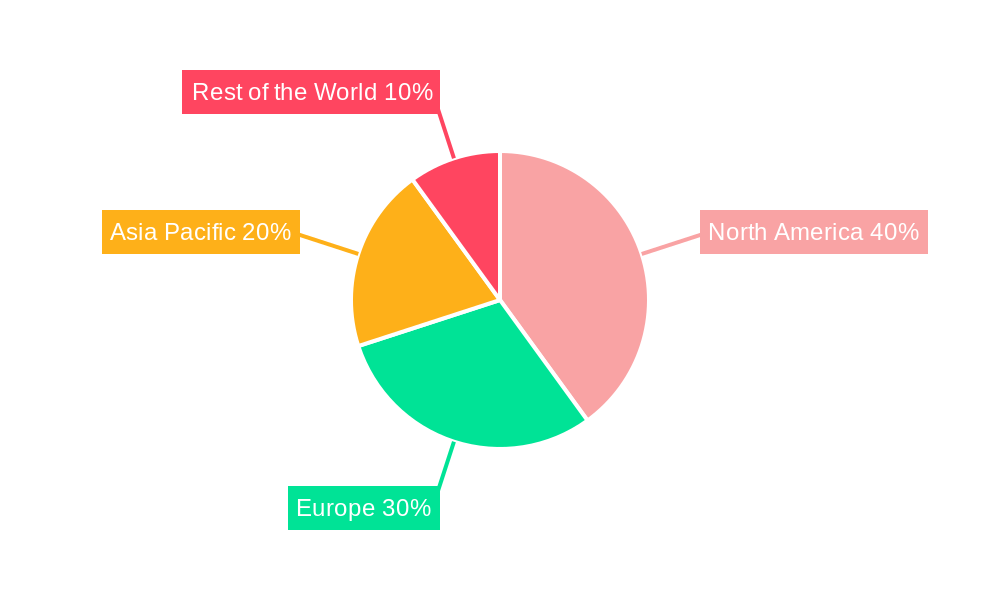

US Automotive Parts Magnesium Die Casting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Automotive Parts Magnesium Die Casting Market Regional Market Share

Geographic Coverage of US Automotive Parts Magnesium Die Casting Market

US Automotive Parts Magnesium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Increased Application in Body Assemblies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. North America US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6.1.1. Pressure Die Casting

- 6.1.2. Vacuum Die Casting

- 6.1.3. Squeeze Die Casting

- 6.1.4. Semi-Solid Die Casting

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Engine Parts

- 6.2.2. Transmission Components

- 6.2.3. Body Parts

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7. South America US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7.1.1. Pressure Die Casting

- 7.1.2. Vacuum Die Casting

- 7.1.3. Squeeze Die Casting

- 7.1.4. Semi-Solid Die Casting

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Engine Parts

- 7.2.2. Transmission Components

- 7.2.3. Body Parts

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8. Europe US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8.1.1. Pressure Die Casting

- 8.1.2. Vacuum Die Casting

- 8.1.3. Squeeze Die Casting

- 8.1.4. Semi-Solid Die Casting

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Engine Parts

- 8.2.2. Transmission Components

- 8.2.3. Body Parts

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9. Middle East & Africa US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9.1.1. Pressure Die Casting

- 9.1.2. Vacuum Die Casting

- 9.1.3. Squeeze Die Casting

- 9.1.4. Semi-Solid Die Casting

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Engine Parts

- 9.2.2. Transmission Components

- 9.2.3. Body Parts

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10. Asia Pacific US Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10.1.1. Pressure Die Casting

- 10.1.2. Vacuum Die Casting

- 10.1.3. Squeeze Die Casting

- 10.1.4. Semi-Solid Die Casting

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Engine Parts

- 10.2.2. Transmission Components

- 10.2.3. Body Parts

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Brabant Alucast

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kinetic Die Casting

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gibbs Die Casting Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MK Group Of Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Precision Diecasting

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chicago White Metal Casting Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meridian Lightweight Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 George Fischer Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Continental Casting LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Magic Precision Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Brabant Alucast

List of Figures

- Figure 1: Global US Automotive Parts Magnesium Die Casting Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 3: North America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 4: North America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 9: South America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 10: South America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 11: South America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 15: Europe US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 16: Europe US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Europe US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 21: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 22: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 27: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 28: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 11: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 17: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 29: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 38: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 39: Global US Automotive Parts Magnesium Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Automotive Parts Magnesium Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Automotive Parts Magnesium Die Casting Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the US Automotive Parts Magnesium Die Casting Market?

Key companies in the market include Brabant Alucast, Kinetic Die Casting, Gibbs Die Casting Group, MK Group Of Companie, China Precision Diecasting, Chicago White Metal Casting Inc, Meridian Lightweight Technologies, George Fischer Ltd, Continental Casting LLC, Magic Precision Inc.

3. What are the main segments of the US Automotive Parts Magnesium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Increased Application in Body Assemblies.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Automotive Parts Magnesium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Automotive Parts Magnesium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Automotive Parts Magnesium Die Casting Market?

To stay informed about further developments, trends, and reports in the US Automotive Parts Magnesium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence