Key Insights

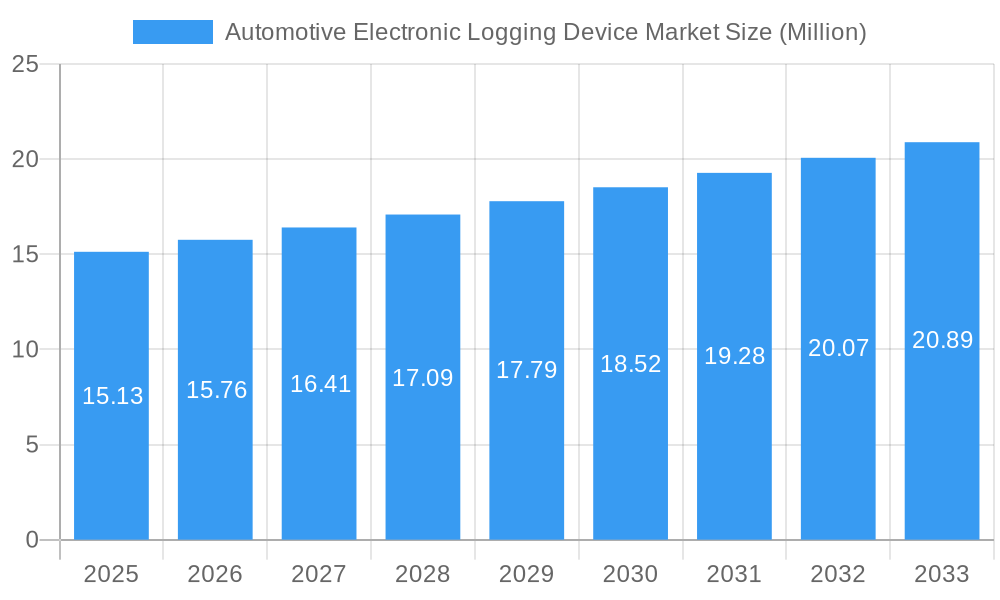

The global Automotive Electronic Logging Device (ELD) market is poised for robust expansion, projected to reach an impressive $15.13 million in value by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.32% anticipated to continue through 2033. This sustained growth is primarily fueled by the increasing adoption of stringent government regulations mandating the use of ELDs to enhance driver safety, improve fleet efficiency, and ensure compliance with Hours of Service (HOS) rules. The rising complexity of logistics and supply chains, coupled with a growing emphasis on real-time tracking and data analytics for optimized operations, further propels market demand. The evolution of telematics technology, offering advanced features beyond basic logging, is also a significant growth driver, enabling fleet managers to gain deeper insights into vehicle performance, driver behavior, and fuel consumption.

Automotive Electronic Logging Device Market Market Size (In Million)

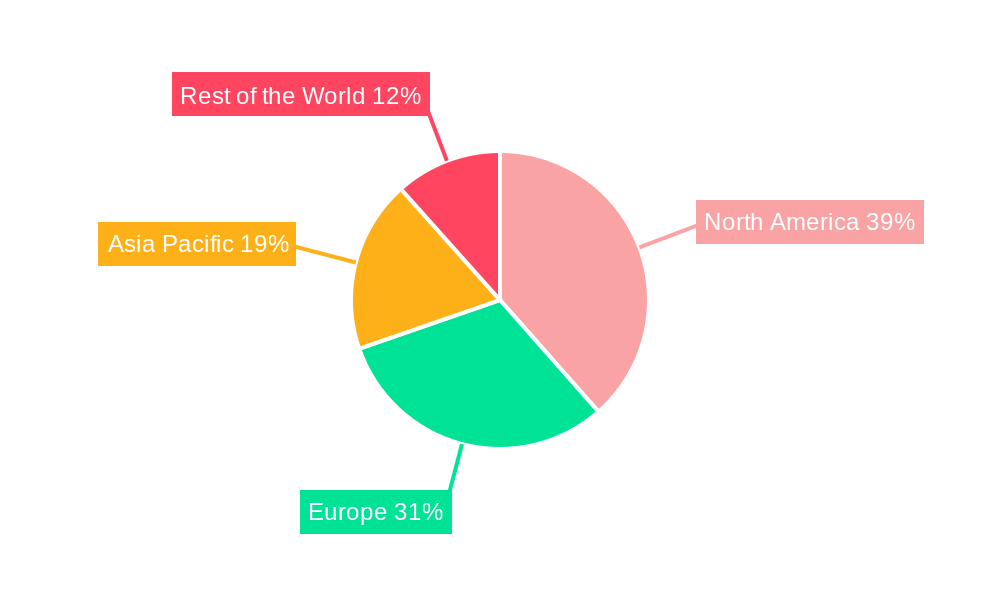

The ELD market's segmentation reveals a dynamic landscape. Within Component Type, the Telematics Unit segment is expected to dominate, driven by its integral role in data collection and transmission. The Service Type segment is experiencing a strong shift towards Intermediate and High-End Services, as businesses seek more comprehensive fleet management solutions rather than basic compliance tools. Embedded and Integrated Form Factor Types are gaining traction due to their seamless integration into vehicle architectures, offering enhanced reliability and user experience. Trucks and Buses, owing to their commercial nature and regulatory oversight, are leading the adoption of ELDs, with Light Commercial Vehicles (LCVs) also presenting a significant growth opportunity as regulations expand. Geographically, North America and Europe are currently the largest markets, driven by early regulatory mandates, but the Asia Pacific region, with its rapidly expanding logistics sector and burgeoning adoption of technology, is set to witness the fastest growth.

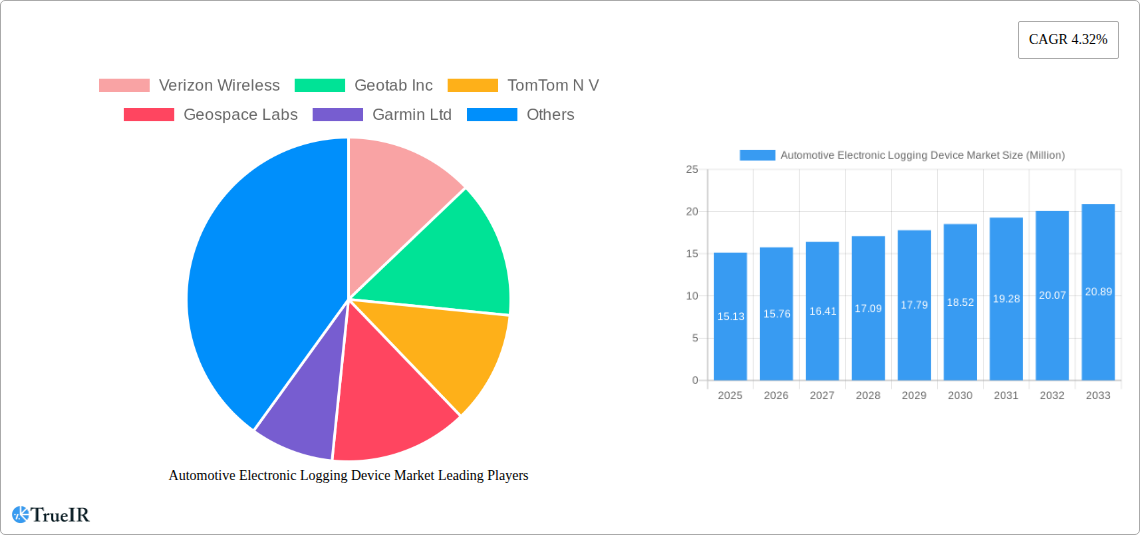

Automotive Electronic Logging Device Market Company Market Share

Unlocking the Automotive Electronic Logging Device (ELD) Market: A Comprehensive Forecast (2019-2033)

This in-depth report delves into the dynamic Automotive Electronic Logging Device (ELD) Market, providing critical insights for stakeholders navigating this rapidly evolving landscape. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this analysis offers a granular view of market growth, technological advancements, and regulatory impacts. We meticulously examine key segments including Component Type (Display, Telematics unit), Service Type (Entry-Level Services, Intermediate Services, High-End Services), Form Factor Type (Embedded, Integrated), and Vehicle Type (Truck, Bus, Light Commercial Vehicles). Leveraging high-volume keywords such as "ELD market," "automotive telematics," "fleet management solutions," "driver fatigue reduction," "Canadian ELD mandate," and "DOT compliance," this report is meticulously crafted for optimal SEO performance and to deliver actionable intelligence to industry leaders, fleet managers, technology providers, and regulatory bodies.

Automotive Electronic Logging Device Market Market Structure & Competitive Landscape

The Automotive Electronic Logging Device (ELD) Market is characterized by a moderately consolidated structure, driven by increasing regulatory mandates and the growing adoption of fleet management technologies. Innovation is a key differentiator, with companies continuously investing in advanced telematics units and integrated display solutions to offer enhanced functionalities beyond basic Hours of Service (HOS) tracking, such as real-time diagnostics, GPS tracking, and driver behavior monitoring. The regulatory landscape plays a pivotal role, with mandates like the ELD rule in the United States and similar initiatives in Canada and other regions acting as significant market drivers. Product substitutes include paper logs, which are rapidly becoming obsolete, and more complex fleet management systems that incorporate ELD functionalities. End-user segmentation is crucial, with trucks, buses, and light commercial vehicles all representing distinct adoption patterns and requirements. Mergers and acquisitions (M&A) are a growing trend as larger players seek to expand their market share and technological capabilities, with an estimated XX M&A deals recorded in the historical period. Concentration ratios are influenced by the presence of established telematics providers and specialized ELD manufacturers.

- Innovation Drivers: Advanced telematics, AI-powered analytics, driver coaching modules, predictive maintenance.

- Regulatory Impacts: Mandates for HOS recording, safety compliance, cross-border trucking regulations.

- Product Substitutes: Manual logging, standalone GPS trackers (limited compliance).

- End-User Segmentation: Heavy-duty trucks, vocational vehicles, public transit buses, last-mile delivery vans.

- M&A Trends: Consolidation for market reach, acquisition of innovative technologies, expansion into new geographic markets.

- Market Concentration: Moderately consolidated, with key players holding significant market share, but space for niche providers.

Automotive Electronic Logging Device Market Market Trends & Opportunities

The global Automotive Electronic Logging Device (ELD) Market is poised for significant expansion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This impressive growth trajectory is fueled by a confluence of factors including stringent regulatory frameworks aimed at enhancing road safety and driver well-being, coupled with the increasing demand for efficient fleet management solutions. The shift from paper-based logging to electronic systems, driven by the need for accuracy, reduced administrative burden, and real-time data visibility, represents a fundamental market trend. Technological advancements are continuously reshaping the ELD landscape. The integration of telematics units with sophisticated software platforms enables a broader spectrum of services, moving beyond basic compliance to encompass advanced fleet analytics, predictive maintenance, fuel management, and driver performance monitoring. Consumer preferences are evolving towards integrated solutions that offer a comprehensive view of fleet operations, rather than standalone devices. This has led to a surge in demand for ELD systems that can seamlessly integrate with existing fleet management software and enterprise resource planning (ERP) systems. Opportunities abound for providers offering scalable, user-friendly, and feature-rich ELD solutions that cater to the diverse needs of different vehicle types and fleet sizes. The growing adoption of embedded ELD systems, which are factory-installed, further signifies the market's maturation and the increasing sophistication of vehicle manufacturing. Furthermore, the expanding reach of digital connectivity and the Internet of Things (IoT) in the automotive sector presents fertile ground for innovative ELD applications, such as real-time accident detection and automated incident reporting. The increasing emphasis on sustainability and eco-friendly transportation is also driving demand for ELD features that can monitor fuel efficiency and optimize routes, contributing to reduced emissions. The market penetration rate of ELDs is expected to climb steadily, reaching xx% of the commercial vehicle fleet by 2033, underscoring the indispensable nature of these devices in modern logistics and transportation. As global trade continues to grow, the need for efficient, safe, and compliant cross-border transportation will further propel the demand for advanced ELD solutions.

Dominant Markets & Segments in Automotive Electronic Logging Device Market

The Automotive Electronic Logging Device (ELD) Market exhibits strong dominance in regions and segments driven by stringent regulatory enforcement and a high concentration of commercial vehicle fleets. North America, particularly the United States and Canada, stands as the leading region due to the early and comprehensive implementation of ELD mandates by regulatory bodies like the Federal Motor Carrier Safety Administration (FMCSA). This has spurred significant market penetration and fostered a competitive environment among key players.

Within vehicle types, Trucks represent the largest and most dominant segment. The sheer volume of freight transportation conducted by trucks, coupled with the critical need for driver safety and regulatory compliance for long-haul operations, makes them the primary adopters of ELD technology. Mandates specifically targeting heavy-duty vehicles have further solidified this segment's leadership.

In terms of component type, the Telematics unit is the core component driving the ELD market. Its ability to collect, process, and transmit critical data related to vehicle operation, driver hours, and location is paramount. The sophistication and reliability of these units directly influence the overall effectiveness of ELD solutions.

For service types, High-End Services are witnessing substantial growth, moving beyond basic HOS compliance. These services often include advanced fleet analytics, real-time diagnostics, predictive maintenance, driver coaching, and integration with other enterprise systems. This reflects a trend towards leveraging ELDs as a comprehensive fleet management tool rather than just a compliance device.

Considering form factor, the Embedded ELD systems are gaining significant traction. Factory-installed ELDs offer a more seamless integration with vehicle electronics, enhance data security, and can provide a more streamlined user experience compared to aftermarket solutions.

- Leading Region: North America (USA & Canada) - driven by strong ELD mandates and a large commercial vehicle fleet.

- Dominant Vehicle Type: Trucks - essential for freight movement, subject to strict Hours of Service regulations.

- Key Growth Drivers: Mandated compliance for safety, increased freight volumes, need for operational efficiency.

- Dominant Component Type: Telematics Unit - the central data collection and transmission hub for ELD functionality.

- Key Growth Drivers: Technological advancements in data processing, miniaturization, enhanced connectivity.

- Dominant Service Type: High-End Services - offering value beyond basic compliance through analytics and fleet management integration.

- Key Growth Drivers: Demand for operational optimization, driver performance improvement, cost reduction.

- Dominant Form Factor Type: Embedded - factory-installed units offering superior integration and user experience.

- Key Growth Drivers: OEM partnerships, increasing vehicle connectivity, demand for integrated solutions.

Automotive Electronic Logging Device Market Product Analysis

The Automotive Electronic Logging Device (ELD) market is characterized by a steady stream of product innovations focused on enhancing functionality, compliance, and user experience. Key advancements include the development of more robust and accurate telematics units capable of capturing a wider array of vehicle data, such as engine diagnostics, fuel consumption, and driving behavior. Display technologies are evolving towards more intuitive and user-friendly interfaces, often incorporating touchscreen capabilities for easier driver interaction. The competitive advantage for ELD providers lies in their ability to offer integrated solutions that go beyond basic Hours of Service (HOS) tracking, providing valuable fleet management insights, driver performance analytics, and real-time communication capabilities. Applications range from ensuring DOT compliance and reducing driver fatigue to optimizing routes and improving overall fleet efficiency.

Key Drivers, Barriers & Challenges in Automotive Electronic Logging Device Market

The Automotive Electronic Logging Device (ELD) Market is propelled by several key drivers. Foremost among these is the global push for enhanced road safety, with regulatory mandates worldwide requiring ELDs to reduce driver fatigue and ensure compliance with work and rest hours. Technological advancements in telematics and IoT are enabling more sophisticated and integrated ELD solutions, offering significant operational efficiencies for fleets. The economic benefits of ELDs, such as reduced administrative costs associated with paper logs and improved fuel efficiency through better route planning and driver behavior monitoring, also act as significant growth catalysts.

However, the market faces substantial barriers and challenges. The initial cost of acquiring and installing ELD systems can be a deterrent for smaller fleet operators. Regulatory complexities and varying compliance standards across different jurisdictions can create implementation hurdles. Supply chain disruptions, particularly concerning electronic components, can impact the availability and cost of ELD devices. Furthermore, cybersecurity threats and concerns regarding data privacy present ongoing challenges that manufacturers and fleet operators must address proactively to maintain trust and ensure the integrity of sensitive operational data.

Growth Drivers in the Automotive Electronic Logging Device Market Market

The Automotive Electronic Logging Device (ELD) Market is experiencing robust growth driven by a potent mix of technological advancements, economic imperatives, and regulatory mandates. The increasing global emphasis on road safety and the reduction of driver fatigue is a primary catalyst, with governments worldwide implementing stricter regulations for tracking driver hours. Technological innovations in telematics and IoT are enabling the development of more sophisticated and feature-rich ELD solutions, offering advanced fleet management capabilities beyond basic compliance. Economically, the drive for operational efficiency, cost reduction through optimized routing and fuel management, and improved driver productivity are compelling fleet operators to adopt these advanced systems. The growing complexity of supply chains and the demand for real-time visibility into logistics operations further fuel the adoption of ELDs.

Challenges Impacting Automotive Electronic Logging Device Market Growth

Despite the strong growth trajectory, the Automotive Electronic Logging Device (ELD) Market faces several significant challenges. Regulatory hurdles, including the need for continuous adaptation to evolving mandates and ensuring compliance across diverse international frameworks, present a constant challenge. The upfront investment required for ELD hardware, software, and installation can be a substantial barrier, particularly for small and medium-sized enterprises (SMEs) with limited capital. Cybersecurity concerns and the potential for data breaches remain a critical issue, necessitating robust security measures to protect sensitive operational data. Furthermore, the market experiences competitive pressures from established players and emerging technology providers, leading to price sensitivity and the need for continuous innovation. Supply chain volatility for critical electronic components can also impact production and delivery timelines, affecting market growth.

Key Players Shaping the Automotive Electronic Logging Device Market Market

- Verizon Wireless

- Geotab Inc

- TomTom N V

- Geospace Labs

- Garmin Ltd

- Donlen Corporation

- Teletrac Navman

- Omnitracs LLC

- Trimble Inc

- WorkWave LLC

Significant Automotive Electronic Logging Device Market Industry Milestones

- January 2023: Quebec's Transport and Sustainable Mobility Minister, Geneviève Guilbault, mandated electronic logging devices (ELDs) for heavy vehicles in the province. The implementation requires the devices to record work and rest hours, aiming to enhance road safety by reducing driver fatigue.

- February 2022: Omnitracs LLC, a Solera company, announced that its intelligent vehicle gateway electronic logging device (ELD) achieved mandatory third-party certification in Canada. FP Innovations certified the ELD, confirming its compliance with the Canadian Electronic Logging Device (ELD) Mandate.

Future Outlook for Automotive Electronic Logging Device Market Market

The future outlook for the Automotive Electronic Logging Device (ELD) Market is exceptionally bright, driven by continued regulatory expansion, technological innovation, and a growing recognition of ELDs as indispensable tools for modern fleet management. We anticipate a sustained period of growth as more countries adopt similar mandates to those seen in North America. The integration of advanced AI and machine learning capabilities will unlock new levels of predictive analytics, enabling proactive maintenance, optimized route planning, and enhanced driver safety coaching. The market will witness further consolidation as larger players acquire innovative startups to bolster their portfolios. Opportunities will emerge in developing solutions tailored for niche vehicle segments and specialized industries, as well as in enhancing the interoperability of ELDs with broader smart transportation ecosystems. The increasing focus on sustainability will also drive demand for ELD features that contribute to fuel efficiency and reduced emissions, making ELDs a cornerstone of responsible and efficient logistics operations in the years to come.

Automotive Electronic Logging Device Market Segmentation

-

1. Component Type

- 1.1. Display

- 1.2. Telematics unit

-

2. Service Type

- 2.1. Entry-Level Services

- 2.2. Intermediate Services

- 2.3. High-End Services

-

3. Form Factor Type

- 3.1. Embedded

- 3.2. Integrated

-

4. Vehicle Type

- 4.1. Truck

- 4.2. Bus

- 4.3. Light Commercial Vehicles

Automotive Electronic Logging Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Electronic Logging Device Market Regional Market Share

Geographic Coverage of Automotive Electronic Logging Device Market

Automotive Electronic Logging Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration With Telematics And Fleet Management Systems; Others

- 3.3. Market Restrains

- 3.3.1. The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others

- 3.4. Market Trends

- 3.4.1. Government Regulations is Driving the Telematics Units Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Electronic Logging Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Display

- 5.1.2. Telematics unit

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Entry-Level Services

- 5.2.2. Intermediate Services

- 5.2.3. High-End Services

- 5.3. Market Analysis, Insights and Forecast - by Form Factor Type

- 5.3.1. Embedded

- 5.3.2. Integrated

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Truck

- 5.4.2. Bus

- 5.4.3. Light Commercial Vehicles

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Automotive Electronic Logging Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Display

- 6.1.2. Telematics unit

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Entry-Level Services

- 6.2.2. Intermediate Services

- 6.2.3. High-End Services

- 6.3. Market Analysis, Insights and Forecast - by Form Factor Type

- 6.3.1. Embedded

- 6.3.2. Integrated

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. Truck

- 6.4.2. Bus

- 6.4.3. Light Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Automotive Electronic Logging Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Display

- 7.1.2. Telematics unit

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Entry-Level Services

- 7.2.2. Intermediate Services

- 7.2.3. High-End Services

- 7.3. Market Analysis, Insights and Forecast - by Form Factor Type

- 7.3.1. Embedded

- 7.3.2. Integrated

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. Truck

- 7.4.2. Bus

- 7.4.3. Light Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Automotive Electronic Logging Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Display

- 8.1.2. Telematics unit

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Entry-Level Services

- 8.2.2. Intermediate Services

- 8.2.3. High-End Services

- 8.3. Market Analysis, Insights and Forecast - by Form Factor Type

- 8.3.1. Embedded

- 8.3.2. Integrated

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. Truck

- 8.4.2. Bus

- 8.4.3. Light Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Automotive Electronic Logging Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Display

- 9.1.2. Telematics unit

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Entry-Level Services

- 9.2.2. Intermediate Services

- 9.2.3. High-End Services

- 9.3. Market Analysis, Insights and Forecast - by Form Factor Type

- 9.3.1. Embedded

- 9.3.2. Integrated

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. Truck

- 9.4.2. Bus

- 9.4.3. Light Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Verizon Wireless

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Geotab Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TomTom N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Geospace Labs

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Garmin Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Donlen Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Teletrac Navman

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Omnitracs LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trimble Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 WorkWave LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Verizon Wireless

List of Figures

- Figure 1: Global Automotive Electronic Logging Device Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Electronic Logging Device Market Revenue (Million), by Component Type 2025 & 2033

- Figure 3: North America Automotive Electronic Logging Device Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Automotive Electronic Logging Device Market Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America Automotive Electronic Logging Device Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Automotive Electronic Logging Device Market Revenue (Million), by Form Factor Type 2025 & 2033

- Figure 7: North America Automotive Electronic Logging Device Market Revenue Share (%), by Form Factor Type 2025 & 2033

- Figure 8: North America Automotive Electronic Logging Device Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: North America Automotive Electronic Logging Device Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America Automotive Electronic Logging Device Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Automotive Electronic Logging Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Electronic Logging Device Market Revenue (Million), by Component Type 2025 & 2033

- Figure 13: Europe Automotive Electronic Logging Device Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 14: Europe Automotive Electronic Logging Device Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe Automotive Electronic Logging Device Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe Automotive Electronic Logging Device Market Revenue (Million), by Form Factor Type 2025 & 2033

- Figure 17: Europe Automotive Electronic Logging Device Market Revenue Share (%), by Form Factor Type 2025 & 2033

- Figure 18: Europe Automotive Electronic Logging Device Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Automotive Electronic Logging Device Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Automotive Electronic Logging Device Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Automotive Electronic Logging Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Electronic Logging Device Market Revenue (Million), by Component Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Electronic Logging Device Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Electronic Logging Device Market Revenue (Million), by Service Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Electronic Logging Device Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Electronic Logging Device Market Revenue (Million), by Form Factor Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Electronic Logging Device Market Revenue Share (%), by Form Factor Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Electronic Logging Device Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Asia Pacific Automotive Electronic Logging Device Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Asia Pacific Automotive Electronic Logging Device Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Electronic Logging Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Electronic Logging Device Market Revenue (Million), by Component Type 2025 & 2033

- Figure 33: Rest of the World Automotive Electronic Logging Device Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 34: Rest of the World Automotive Electronic Logging Device Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Rest of the World Automotive Electronic Logging Device Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Rest of the World Automotive Electronic Logging Device Market Revenue (Million), by Form Factor Type 2025 & 2033

- Figure 37: Rest of the World Automotive Electronic Logging Device Market Revenue Share (%), by Form Factor Type 2025 & 2033

- Figure 38: Rest of the World Automotive Electronic Logging Device Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 39: Rest of the World Automotive Electronic Logging Device Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Rest of the World Automotive Electronic Logging Device Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Automotive Electronic Logging Device Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Form Factor Type 2020 & 2033

- Table 4: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 7: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Form Factor Type 2020 & 2033

- Table 9: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 15: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Form Factor Type 2020 & 2033

- Table 17: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 24: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Form Factor Type 2020 & 2033

- Table 26: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: India Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: China Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 34: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 35: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Form Factor Type 2020 & 2033

- Table 36: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Automotive Electronic Logging Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Brazil Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Mexico Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Other Countries Automotive Electronic Logging Device Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Electronic Logging Device Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Automotive Electronic Logging Device Market?

Key companies in the market include Verizon Wireless, Geotab Inc, TomTom N V, Geospace Labs, Garmin Ltd, Donlen Corporation, Teletrac Navman, Omnitracs LLC, Trimble Inc, WorkWave LLC.

3. What are the main segments of the Automotive Electronic Logging Device Market?

The market segments include Component Type, Service Type, Form Factor Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Integration With Telematics And Fleet Management Systems; Others.

6. What are the notable trends driving market growth?

Government Regulations is Driving the Telematics Units Growth.

7. Are there any restraints impacting market growth?

The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others.

8. Can you provide examples of recent developments in the market?

January 2023: Quebec's Transport and Sustainable Mobility Minister, Geneviève Guilbault, mandated electronic logging devices (ELDs) for heavy vehicles in the province. The implementation requires the devices to record work and rest hours, aiming to enhance road safety by reducing driver fatigue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Electronic Logging Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Electronic Logging Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Electronic Logging Device Market?

To stay informed about further developments, trends, and reports in the Automotive Electronic Logging Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence