Key Insights

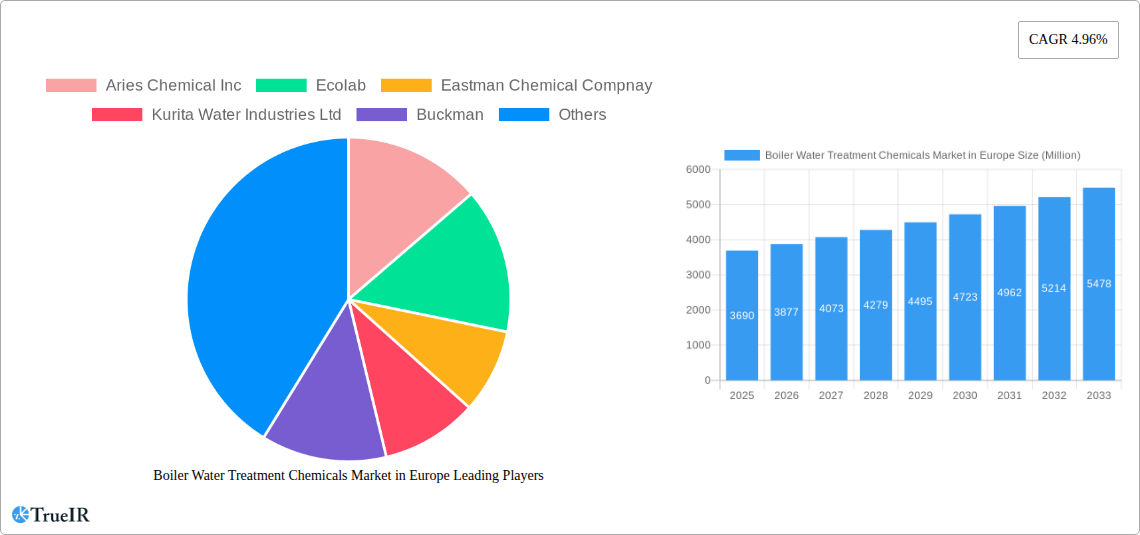

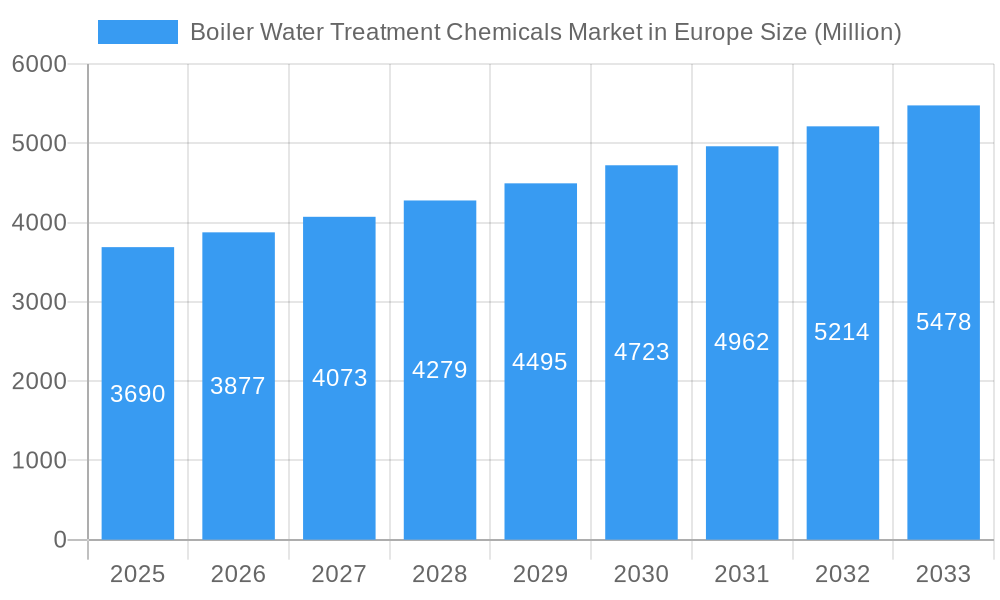

The European boiler water treatment chemicals market, valued at €3.69 billion in 2025, is projected to experience robust growth, driven by the increasing demand for efficient and reliable power generation, stringent environmental regulations, and the rising adoption of advanced water treatment technologies across various industries. The market's Compound Annual Growth Rate (CAGR) of 4.96% from 2025 to 2033 indicates a significant expansion, fueled by the growing industrialization and urbanization across the region. Key segments driving this growth include scale and corrosion inhibitors, crucial for preventing costly equipment damage and downtime. The power generation sector remains a major end-user, followed by the steel and metal, oil refinery, and chemical industries. Germany, France, and the UK are expected to be the leading national markets within Europe, reflecting their significant industrial bases and advanced infrastructure. However, the market faces challenges such as fluctuating raw material prices and the need for continuous technological innovation to meet the evolving demands for sustainable and eco-friendly water treatment solutions.

Boiler Water Treatment Chemicals Market in Europe Market Size (In Billion)

The competitive landscape is characterized by both established multinational corporations and specialized regional players. Companies such as Ecolab, BASF SE, Kemira, and Solenis are leading the market with their comprehensive product portfolios and strong distribution networks. The market is witnessing increasing focus on developing environmentally friendly and sustainable water treatment chemicals, responding to growing concerns about the impact of industrial activities on the environment. Furthermore, advancements in digitalization and data analytics are leading to improved water treatment efficiency and optimized chemical usage, contributing to the overall market growth. The forecast period will likely see increased mergers and acquisitions, further consolidating the market and accelerating innovation. While the precise market share for individual segments and countries isn't explicitly provided, logical deductions based on industrial trends point to the segments and countries mentioned above as prominent players.

Boiler Water Treatment Chemicals Market in Europe Company Market Share

Boiler Water Treatment Chemicals Market in Europe: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Boiler Water Treatment Chemicals market in Europe, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this comprehensive study unravels market trends, competitive dynamics, and future growth potential. The report leverages extensive primary and secondary research to deliver actionable intelligence, forecasting market size and growth trajectory with precision.

Boiler Water Treatment Chemicals Market in Europe Market Structure & Competitive Landscape

The European Boiler Water Treatment Chemicals market exhibits a moderately concentrated structure, with several multinational players holding significant market share. The market concentration ratio (CR4) is estimated at 35% in 2025, indicating the presence of both established giants and specialized players. Innovation is a key driver, with companies continuously developing advanced chemistries to improve efficiency, reduce environmental impact, and meet evolving regulatory standards. Stringent environmental regulations, particularly concerning water discharge and chemical usage, significantly impact market dynamics. Product substitution, primarily driven by the adoption of environmentally friendly alternatives, is another important aspect. The market is segmented by various end-user industries, with power generation and the steel and metal industries being the dominant consumers. M&A activity has been moderate in recent years, with approximately xx mergers and acquisitions recorded between 2019 and 2024, driven primarily by strategic expansion and technology acquisition.

- Market Concentration: CR4 estimated at 35% in 2025.

- Innovation Drivers: Development of eco-friendly chemicals, improved efficiency solutions.

- Regulatory Impacts: Stringent environmental regulations impacting product development and adoption.

- Product Substitutes: Growing adoption of sustainable alternatives.

- End-User Segmentation: Power generation and steel/metal industries dominate.

- M&A Trends: Moderate activity (xx deals between 2019-2024), focused on expansion and technology acquisition.

Boiler Water Treatment Chemicals Market in Europe Market Trends & Opportunities

The European Boiler Water Treatment Chemicals market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). This robust growth trajectory is propelled by a confluence of factors, including escalating industrialization across various sectors, a persistent rise in energy demand, and a heightened global emphasis on efficient water resource management and environmental sustainability. Technological advancements are a key catalyst, with particular attention being paid to the development and integration of advanced chemistries. Innovations such as nanotechnology-based inhibitors are revolutionizing performance, offering enhanced protection and operational efficiency. Concurrently, consumer preferences are evolving, leaning towards eco-friendly and economically viable solutions. This shift is compelling manufacturers to prioritize the development of sustainable products that minimize environmental impact while delivering superior results. The competitive landscape is dynamic and intensely contested. Major market players are strategically focusing on forging critical partnerships, diversifying their product portfolios to cater to a wider range of needs, and expanding their geographic reach to solidify and enhance their market leadership positions. Market penetration rates exhibit considerable variation across different end-user industries, with established sectors like power generation demonstrating high adoption rates, while emerging sectors are in the process of increasing their engagement.

Dominant Markets & Segments in Boiler Water Treatment Chemicals Market in Europe

The Power Generation sector stands as the predominant end-user segment within the European market. In 2025, this segment is estimated to contribute approximately $850 million to the market value. Countries such as Germany and France are at the forefront, largely owing to their substantial power generation capacities and the implementation of stringent environmental regulations that mandate effective water treatment solutions. Within the 'Type' category, the Scale and Corrosion Inhibitors segment commands the largest market share. This dominance is attributed to their indispensable role in safeguarding boiler systems from the detrimental effects of scaling and corrosion, thereby ensuring operational longevity and efficiency. In terms of 'Chemistry', the Blended/Specialty Chemicals segment leads, driven by an increasing demand for bespoke solutions meticulously formulated to address the unique and specific water quality challenges encountered across diverse industrial applications.

-

Key Growth Drivers (Power Generation Sector):

- Ongoing expansion and integration of renewable energy infrastructure, necessitating specialized water treatment for associated systems.

- The continuous enforcement and tightening of environmental regulations, pushing for cleaner and more efficient industrial processes.

- The aging infrastructure of existing power plants, which often requires comprehensive upgrades, maintenance, and advanced water treatment solutions to ensure continued reliable operation.

-

Market Dominance: Power Generation (End-user), Scale and Corrosion Inhibitors (Type), Blended/Specialty Chemicals (Chemistry). Germany and France are the leading countries in terms of market size and adoption.

Boiler Water Treatment Chemicals Market in Europe Product Analysis

The landscape of boiler water treatment chemistry is experiencing significant advancements, with a pronounced emphasis on the development of products that are not only environmentally benign but also offer superior performance characteristics. Innovations are at the forefront, including the emergence of nanotechnology-based inhibitors. These cutting-edge solutions provide enhanced efficiency in corrosion prevention and protection, extending the lifespan of critical equipment. Complementing these advancements, the market is witnessing an accelerated adoption of blended chemicals. These formulations are increasingly tailored to meet the precise and diverse needs of specific industrial applications, thereby minimizing environmental footprints and optimizing operational outcomes. Products demonstrating enhanced biodegradability and significantly reduced toxicity are gaining substantial traction, perfectly aligning with the industry's unwavering commitment to sustainability and responsible environmental stewardship.

Key Drivers, Barriers & Challenges in Boiler Water Treatment Chemicals Market in Europe

Key Drivers:

- Growing industrialization and energy demand.

- Stringent environmental regulations pushing for sustainable solutions.

- Technological advancements leading to improved product efficiency.

- Increasing focus on water management and conservation.

Challenges and Restraints:

- Fluctuations in raw material prices impacting manufacturing costs.

- Stringent regulatory approvals and compliance requirements.

- Intense competition from established and emerging players.

- Potential supply chain disruptions due to geopolitical factors. Estimated impact on market growth in 2025: xx Million.

Growth Drivers in the Boiler Water Treatment Chemicals Market in Europe Market

The market's growth is primarily propelled by increased industrial activity and a rising focus on sustainable practices. Stringent environmental regulations necessitate the adoption of eco-friendly solutions, creating a significant market opportunity. Simultaneously, technological advancements, particularly in nanomaterials and advanced chemistry, are driving efficiency and performance improvements. The growing emphasis on water conservation and optimized water management further boosts demand for effective boiler water treatment.

Challenges Impacting Boiler Water Treatment Chemicals Market in Europe Growth

The European Boiler Water Treatment Chemicals market faces several significant hurdles that could potentially impede its growth trajectory. Supply chain volatility remains a key concern, impacting the consistent availability and price fluctuations of essential raw materials. Furthermore, navigating the intricate landscape of complex regulatory compliance requirements adds considerable cost and extends the timelines associated with both product development and successful market launches. The market is also characterized by intense competition, not only among established global players but also from emerging new entrants. This fierce rivalry often translates into significant pricing pressures, potentially limiting profit margins for market participants.

Key Players Shaping the Boiler Water Treatment Chemicals Market in Europe Market

- Aries Chemical Inc

- Ecolab

- Eastman Chemical Company

- Kurita Water Industries Ltd

- Buckman

- BASF SE

- Kemira

- Solenis

- Suez

- Cannon Water Technology

- Lenntech B.V.

- Veolia Water Technologies

- List Not Exhaustive – This includes a representative selection of prominent companies

Significant Boiler Water Treatment Chemicals Market in Europe Industry Milestones

- 2022 (Q3): Ecolab launched a new range of sustainable boiler water treatment chemicals.

- 2021 (Q4): BASF and Kurita announced a joint venture for developing advanced water treatment technologies.

- 2020 (Q1): New EU regulations on water discharge came into effect, influencing market demand for compliant products.

- Further milestones to be added based on data collection.

Future Outlook for Boiler Water Treatment Chemicals Market in Europe Market

The European Boiler Water Treatment Chemicals market is poised for continued growth, driven by robust industrial activity and increasing environmental awareness. Strategic opportunities lie in developing sustainable and highly efficient products, leveraging technological advancements, and focusing on specific niche markets within various end-user industries. The market’s potential for growth is significant, with considerable opportunities for players who can successfully navigate the regulatory landscape and offer innovative and cost-effective solutions.

Boiler Water Treatment Chemicals Market in Europe Segmentation

-

1. Type

- 1.1. Scale and Corrosion Inhibitors

- 1.2. Coagulants and Flocculants

- 1.3. pH Boosters

- 1.4. Oxygen Scavengers

- 1.5. Others

-

2. Chemistry

- 2.1. Basic Chemicals

- 2.2. Blended/Specialty Chemicals

-

3. End-user Industry

- 3.1. Power Generation

- 3.2. Steel and Metal Industry

- 3.3. Oil Refinery

- 3.4. Chemical and Petrochemical

- 3.5. Textile and Dye Industry

- 3.6. Sugar Mill

- 3.7. Paper Mill

- 3.8. Food and Beverage

- 3.9. Institutional

- 3.10. Pharmaceutical

- 3.11. Other End-user Industries

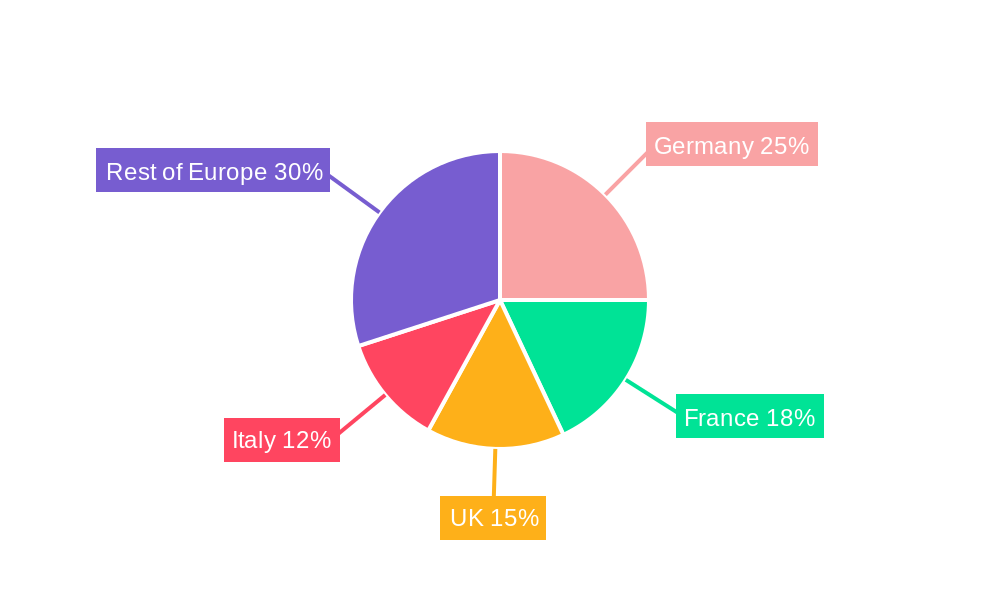

Boiler Water Treatment Chemicals Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Boiler Water Treatment Chemicals Market in Europe Regional Market Share

Geographic Coverage of Boiler Water Treatment Chemicals Market in Europe

Boiler Water Treatment Chemicals Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Power Industry; Growing Popularity of the Blowdown Liquids; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Hazardous Nature of Hydrazine; Other Restraints

- 3.4. Market Trends

- 3.4.1. Power Generation To Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Scale and Corrosion Inhibitors

- 5.1.2. Coagulants and Flocculants

- 5.1.3. pH Boosters

- 5.1.4. Oxygen Scavengers

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Chemistry

- 5.2.1. Basic Chemicals

- 5.2.2. Blended/Specialty Chemicals

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Power Generation

- 5.3.2. Steel and Metal Industry

- 5.3.3. Oil Refinery

- 5.3.4. Chemical and Petrochemical

- 5.3.5. Textile and Dye Industry

- 5.3.6. Sugar Mill

- 5.3.7. Paper Mill

- 5.3.8. Food and Beverage

- 5.3.9. Institutional

- 5.3.10. Pharmaceutical

- 5.3.11. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Scale and Corrosion Inhibitors

- 6.1.2. Coagulants and Flocculants

- 6.1.3. pH Boosters

- 6.1.4. Oxygen Scavengers

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Chemistry

- 6.2.1. Basic Chemicals

- 6.2.2. Blended/Specialty Chemicals

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Power Generation

- 6.3.2. Steel and Metal Industry

- 6.3.3. Oil Refinery

- 6.3.4. Chemical and Petrochemical

- 6.3.5. Textile and Dye Industry

- 6.3.6. Sugar Mill

- 6.3.7. Paper Mill

- 6.3.8. Food and Beverage

- 6.3.9. Institutional

- 6.3.10. Pharmaceutical

- 6.3.11. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Scale and Corrosion Inhibitors

- 7.1.2. Coagulants and Flocculants

- 7.1.3. pH Boosters

- 7.1.4. Oxygen Scavengers

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Chemistry

- 7.2.1. Basic Chemicals

- 7.2.2. Blended/Specialty Chemicals

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Power Generation

- 7.3.2. Steel and Metal Industry

- 7.3.3. Oil Refinery

- 7.3.4. Chemical and Petrochemical

- 7.3.5. Textile and Dye Industry

- 7.3.6. Sugar Mill

- 7.3.7. Paper Mill

- 7.3.8. Food and Beverage

- 7.3.9. Institutional

- 7.3.10. Pharmaceutical

- 7.3.11. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Scale and Corrosion Inhibitors

- 8.1.2. Coagulants and Flocculants

- 8.1.3. pH Boosters

- 8.1.4. Oxygen Scavengers

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Chemistry

- 8.2.1. Basic Chemicals

- 8.2.2. Blended/Specialty Chemicals

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Power Generation

- 8.3.2. Steel and Metal Industry

- 8.3.3. Oil Refinery

- 8.3.4. Chemical and Petrochemical

- 8.3.5. Textile and Dye Industry

- 8.3.6. Sugar Mill

- 8.3.7. Paper Mill

- 8.3.8. Food and Beverage

- 8.3.9. Institutional

- 8.3.10. Pharmaceutical

- 8.3.11. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Scale and Corrosion Inhibitors

- 9.1.2. Coagulants and Flocculants

- 9.1.3. pH Boosters

- 9.1.4. Oxygen Scavengers

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Chemistry

- 9.2.1. Basic Chemicals

- 9.2.2. Blended/Specialty Chemicals

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Power Generation

- 9.3.2. Steel and Metal Industry

- 9.3.3. Oil Refinery

- 9.3.4. Chemical and Petrochemical

- 9.3.5. Textile and Dye Industry

- 9.3.6. Sugar Mill

- 9.3.7. Paper Mill

- 9.3.8. Food and Beverage

- 9.3.9. Institutional

- 9.3.10. Pharmaceutical

- 9.3.11. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Scale and Corrosion Inhibitors

- 10.1.2. Coagulants and Flocculants

- 10.1.3. pH Boosters

- 10.1.4. Oxygen Scavengers

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Chemistry

- 10.2.1. Basic Chemicals

- 10.2.2. Blended/Specialty Chemicals

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Power Generation

- 10.3.2. Steel and Metal Industry

- 10.3.3. Oil Refinery

- 10.3.4. Chemical and Petrochemical

- 10.3.5. Textile and Dye Industry

- 10.3.6. Sugar Mill

- 10.3.7. Paper Mill

- 10.3.8. Food and Beverage

- 10.3.9. Institutional

- 10.3.10. Pharmaceutical

- 10.3.11. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aries Chemical Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ecolab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eastman Chemical Compnay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kurita Water Industries Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Buckman

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemira

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Solenis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suez

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cannon Water Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lenntech B V

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veolia Water Technologies*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Aries Chemical Inc

List of Figures

- Figure 1: Boiler Water Treatment Chemicals Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Boiler Water Treatment Chemicals Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 4: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 5: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 12: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 13: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 19: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 20: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 21: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 28: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 29: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 36: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 37: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 44: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 45: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Boiler Water Treatment Chemicals Market in Europe?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Boiler Water Treatment Chemicals Market in Europe?

Key companies in the market include Aries Chemical Inc, Ecolab, Eastman Chemical Compnay, Kurita Water Industries Ltd, Buckman, BASF SE, Kemira, Solenis, Suez, Cannon Water Technology, Lenntech B V, Veolia Water Technologies*List Not Exhaustive.

3. What are the main segments of the Boiler Water Treatment Chemicals Market in Europe?

The market segments include Type, Chemistry, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.69 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Power Industry; Growing Popularity of the Blowdown Liquids; Other Drivers.

6. What are the notable trends driving market growth?

Power Generation To Dominate the Market.

7. Are there any restraints impacting market growth?

; Hazardous Nature of Hydrazine; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Boiler Water Treatment Chemicals Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Boiler Water Treatment Chemicals Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Boiler Water Treatment Chemicals Market in Europe?

To stay informed about further developments, trends, and reports in the Boiler Water Treatment Chemicals Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence