Key Insights

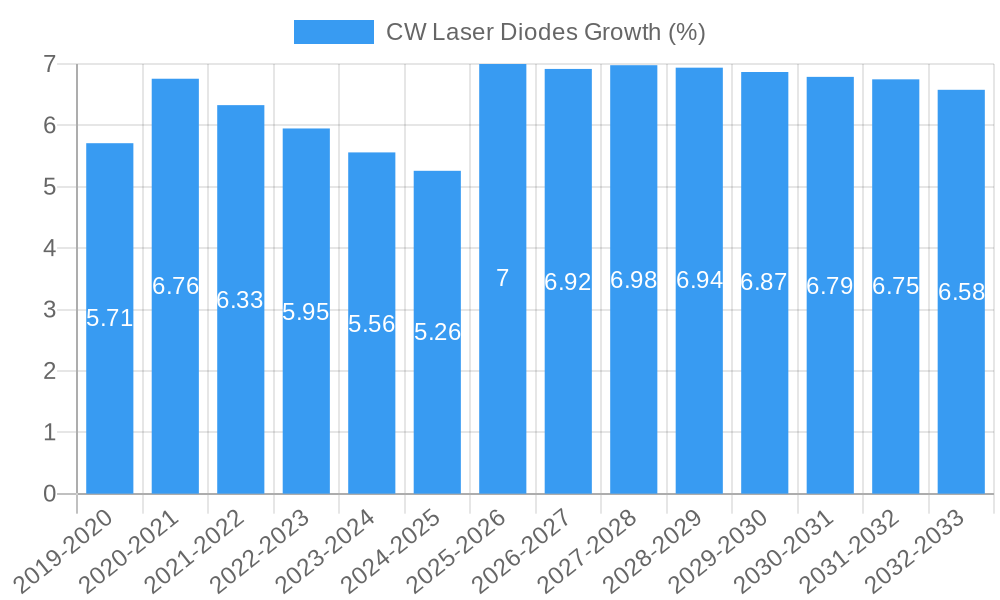

The global Continuous Wave (CW) Laser Diode market is poised for significant expansion, projected to reach an estimated market size of approximately $5,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8% anticipated from 2025 to 2033. This growth is underpinned by the increasing demand for high-precision laser applications across diverse sectors. Key drivers fueling this expansion include the escalating adoption of laser range finders in military, surveying, and automotive industries, alongside the growing use of laser designators in defense and industrial alignment systems. Furthermore, advancements in semiconductor technology are leading to more efficient, compact, and powerful CW laser diodes, expanding their applicability into emerging fields such as advanced materials processing and medical diagnostics. The market's trajectory is also influenced by the continuous innovation in laser diode types, with a notable focus on wavelengths like 450 nm and 520 nm, catering to specific application requirements for enhanced performance and specialized functions.

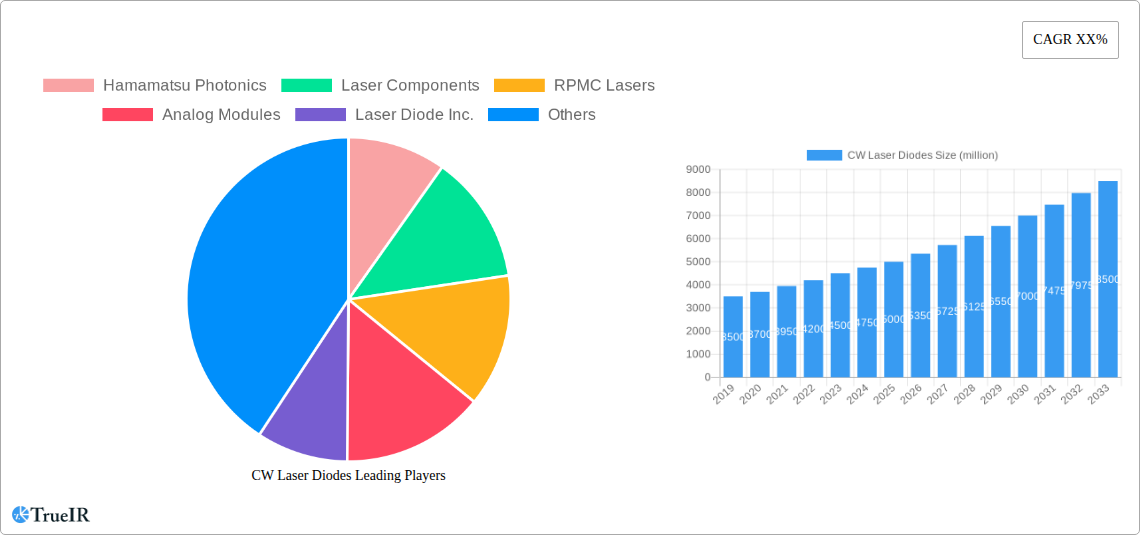

However, the market faces certain restraints that could temper its growth. The high initial cost of advanced CW laser diode systems and the stringent regulatory landscape surrounding laser safety and manufacturing can pose significant barriers to entry for smaller players and slower adoption in certain regions. Nevertheless, the overarching trend towards miniaturization and integration of laser components, coupled with ongoing research and development into novel materials and fabrication techniques, suggests a sustained upward trend. Companies like Hamamatsu Photonics and Laser Components are at the forefront of this innovation, actively investing in R&D to overcome these challenges and capitalize on the burgeoning opportunities. The Asia Pacific region, particularly China and Japan, is expected to lead market growth due to a strong manufacturing base and increasing investments in high-technology sectors.

CW Laser Diodes Market Research Report 2024-2033

This comprehensive market research report provides an in-depth analysis of the global CW Laser Diodes Market. With a focus on the period from 2019 to 2033, encompassing historical data, base year insights, and a detailed forecast, this report offers invaluable intelligence for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate challenges in the continuous wave laser diode industry. The study leverages high-volume keywords to ensure SEO optimization and maximum discoverability within the industry.

CW Laser Diodes Market Structure & Competitive Landscape

The CW laser diodes market is characterized by a moderately consolidated structure, with a few key players holding significant market share, estimated at over 50 million units in terms of volume. Innovation serves as a primary driver, fueled by continuous research and development in areas like improved efficiency, higher power output, and extended wavelength ranges. Regulatory impacts, particularly concerning safety standards and material sourcing, are increasingly influencing market entry and product development. The threat of product substitutes, while present from other laser technologies, remains moderate due to the unique advantages offered by CW laser diodes. End-user segmentation is diverse, with significant contributions from defense, industrial, and scientific sectors. Mergers and acquisitions (M&A) activity is expected to remain a significant trend, with an estimated XX million in M&A volumes anticipated over the forecast period, consolidating market leadership and expanding product portfolios. The competitive landscape is dynamic, demanding constant adaptation to technological advancements and evolving customer needs.

CW Laser Diodes Market Trends & Opportunities

The global CW laser diodes market is projected to witness substantial growth, with a projected market size exceeding $100 million by the base year of 2025 and a Compound Annual Growth Rate (CAGR) of approximately 6.5% expected during the forecast period of 2025-2033. This robust expansion is underpinned by a confluence of technological shifts, evolving consumer preferences, and intensifying competitive dynamics. Technologically, advancements in material science, epitaxy techniques, and packaging solutions are enabling the development of CW laser diodes with enhanced power, efficiency, and wavelength stability. This translates to higher performance in demanding applications. Consumer preferences are increasingly leaning towards miniaturized, energy-efficient, and cost-effective laser diode solutions. This trend is driving innovation in compact laser modules and integrated systems. Competitive dynamics are characterized by a race for technological superiority, with companies investing heavily in R&D to secure intellectual property and introduce differentiated products. Strategic partnerships and collaborations are also on the rise, fostering innovation and expanding market reach. The penetration rate of CW laser diodes in emerging applications, such as advanced medical diagnostics and high-precision industrial automation, is steadily increasing, presenting significant untapped opportunities. Furthermore, the growing demand for high-power laser diodes in material processing, including cutting, welding, and marking, is a major growth catalyst. The expanding use of laser range finders in automotive, surveying, and defense sectors is also contributing to market expansion. The development of novel wavelengths, such as those in the deep blue and UV spectrum, is opening up new application frontiers in areas like photolithography and sterilization. The increasing adoption of laser-based systems in smart manufacturing and Industry 4.0 initiatives is further bolstering the demand for reliable and high-performance CW laser diodes. The market is also seeing a trend towards customized solutions, where manufacturers are working closely with end-users to develop laser diodes tailored to specific application requirements. This personalized approach is fostering stronger customer relationships and driving incremental revenue growth. The increasing focus on sustainability and energy efficiency in various industries is also creating opportunities for laser diode manufacturers who can offer solutions that reduce energy consumption. The growth of the e-commerce sector, leading to increased demand for automated warehousing and logistics, is indirectly boosting the demand for laser-based scanning and positioning systems, thereby benefiting the CW laser diode market. The continued miniaturization of electronic devices is also driving the demand for smaller and more integrated laser diode components.

Dominant Markets & Segments in CW Laser Diodes

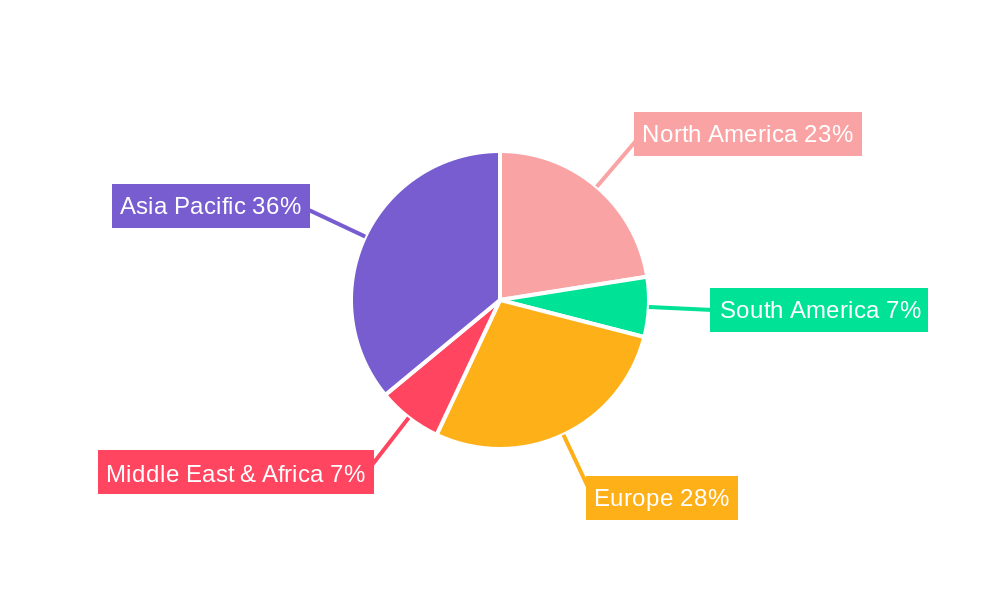

The CW laser diodes market is experiencing significant growth across various applications and wavelength types, with a particular dominance observed in regions characterized by robust industrial and technological infrastructure. North America and Europe currently hold substantial market shares, driven by strong investments in defense, advanced manufacturing, and scientific research. Asia-Pacific, however, is emerging as the fastest-growing region, fueled by the burgeoning electronics manufacturing sector and increasing government support for technological innovation.

Within the Application segment, Laser Range Finders are exhibiting strong growth, driven by their widespread adoption in automotive (LiDAR systems), surveying, defense (target acquisition), and consumer electronics. The estimated market size for laser range finders is projected to exceed $50 million by 2025. The Designators segment also represents a significant market, particularly within defense applications, where high-reliability and precise targeting are paramount. The “Other” application segment, encompassing industrial marking, medical diagnostics, and scientific instrumentation, is also demonstrating consistent expansion.

Regarding Types, the 405 nm Type laser diodes are experiencing robust demand due to their applications in Blu-ray drives, 3D printing, and certain medical procedures. The 450 nm Type and 520 nm Type laser diodes are also witnessing increasing traction, particularly in display technologies, medical imaging, and industrial illumination. The 375 nm Type laser diodes, while representing a smaller segment, are crucial for specialized applications like photolithography and fluorescence microscopy. The “Other” types, encompassing a broad spectrum of wavelengths, cater to niche yet critical industrial and scientific requirements.

Key growth drivers for market dominance include:

- Technological Advancements: Continuous improvements in diode efficiency, output power, and wavelength stability are enabling new and enhanced applications.

- Infrastructure Development: Investments in smart cities, automated manufacturing, and advanced transportation systems are directly increasing the demand for laser-based technologies.

- Government Policies & Funding: Supportive policies for R&D, defense procurement, and industrial modernization are crucial for market expansion.

- Cost Reduction: Economies of scale and manufacturing efficiencies are making CW laser diodes more accessible across a wider range of industries.

- Miniaturization Trends: The growing demand for compact and portable devices is driving the development of smaller, more integrated laser diode solutions.

CW Laser Diodes Product Analysis

The CW laser diodes market is witnessing continuous product innovation centered on enhancing performance metrics such as power output, efficiency, wavelength stability, and device longevity. Key advancements include the development of higher-power CW diodes capable of sustained operation, crucial for industrial processing and advanced sensing. Innovations in epitaxial growth techniques and chip design are enabling greater power conversion efficiency, leading to reduced heat generation and lower operational costs. Furthermore, the miniaturization of laser diode packages is facilitating integration into increasingly compact and portable systems. Competitive advantages are being gained through superior beam quality, precise wavelength control, and robust thermal management solutions, catering to the stringent requirements of applications like laser range finders and designators.

Key Drivers, Barriers & Challenges in CW Laser Diodes

Key Drivers: The CW laser diodes market is propelled by several key drivers. Technological advancements in material science and semiconductor fabrication are enabling higher power, greater efficiency, and extended wavelength ranges, directly fueling demand for improved performance in applications like laser range finders and designators. Economic factors, such as the growing demand for automation in manufacturing and logistics, create a significant pull for laser-based systems. Policy-driven initiatives focusing on defense modernization, smart city development, and advanced medical technologies further stimulate market growth by increasing procurement of laser diode components. The increasing integration of laser technology into consumer electronics, such as projectors and advanced displays, also contributes significantly.

Barriers & Challenges: Despite robust growth, the market faces supply chain issues, particularly concerning the availability of raw materials and specialized components, which can lead to price volatility and production delays. Regulatory hurdles, related to laser safety standards and international trade compliance, can impact market entry and product adoption. Competitive pressures are intense, with numerous players vying for market share, often leading to price erosion for standard products. The high cost of research and development for novel laser diode technologies can also be a significant barrier to entry for smaller companies. Furthermore, the need for specialized expertise in handling and integrating laser diodes presents a challenge for some end-users.

Growth Drivers in the CW Laser Diodes Market

Several key factors are driving the CW laser diodes market forward. Technological innovation remains paramount, with continuous improvements in power output, efficiency, and wavelength precision unlocking new applications. The increasing demand for automation and precision across industries, from manufacturing to healthcare, directly boosts the need for reliable laser diode solutions in systems like laser range finders and designators. Furthermore, government initiatives supporting defense modernization and advanced research are providing significant impetus. The ongoing development of energy-efficient laser diodes aligns with global sustainability goals, further enhancing their appeal.

Challenges Impacting CW Laser Diodes Growth

The growth of the CW laser diodes market is not without its obstacles. Complex regulatory frameworks surrounding laser safety and international trade can create barriers to market entry and product distribution. Supply chain disruptions, particularly for critical raw materials and specialized semiconductor components, can lead to production delays and increased costs, impacting the estimated market volume. Intense competitive pressures among manufacturers often result in price wars for standard components, squeezing profit margins. Additionally, the need for specialized knowledge and infrastructure for the effective integration and application of advanced laser diodes can limit adoption in certain sectors.

Key Players Shaping the CW Laser Diodes Market

- Hamamatsu Photonics

- Laser Components

- RPMC Lasers

- Analog Modules

- Laser Diode Inc.

- Semi Conductor Devices

- Astrum Lasers

Significant CW Laser Diodes Industry Milestones

- 2019/08: Launch of novel high-power CW laser diode modules for industrial marking applications, significantly enhancing processing speeds.

- 2020/03: Hamamatsu Photonics introduces a new series of ultra-stable CW laser diodes for scientific instrumentation, improving measurement accuracy by over 10%.

- 2021/01: Laser Components announces a strategic partnership to expand its distribution network for CW laser diodes in the Asia-Pacific region, aiming to capture an additional $20 million in market share.

- 2022/05: RPMC Lasers showcases advanced blue CW laser diodes (e.g., 450 nm type) with improved beam quality for medical imaging, projected to increase their market penetration by 5%.

- 2023/07: Semi Conductor Devices patents a new thermal management technology for CW laser diodes, extending product lifespan by an estimated 30% and reducing maintenance costs for end-users.

- 2024/02: Analog Modules releases a compact, integrated CW laser diode driver with enhanced safety features, targeting the growing market for portable laser range finders.

Future Outlook for CW Laser Diodes Market

The future outlook for the CW laser diodes market remains exceptionally promising, driven by continuous technological advancements and expanding application frontiers. Strategic opportunities lie in developing higher-power, more energy-efficient diodes for industrial processing and addressing the growing demand for miniaturized solutions in consumer electronics and portable sensing devices. The increasing integration of laser technology into autonomous systems, advanced medical diagnostics, and next-generation defense platforms will further fuel market expansion. The market is poised for substantial growth, with projected sales exceeding $150 million by 2033, representing a significant untapped market potential for innovative and reliable CW laser diode manufacturers.

CW Laser Diodes Segmentation

-

1. Application

- 1.1. Laser Range Finders

- 1.2. Designators

- 1.3. Other

-

2. Types

- 2.1. 375 nm Type

- 2.2. 405 nm Type

- 2.3. 450 nm Type

- 2.4. 520 nm Type

- 2.5. Other

CW Laser Diodes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

CW Laser Diodes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Laser Range Finders

- 5.1.2. Designators

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 375 nm Type

- 5.2.2. 405 nm Type

- 5.2.3. 450 nm Type

- 5.2.4. 520 nm Type

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Laser Range Finders

- 6.1.2. Designators

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 375 nm Type

- 6.2.2. 405 nm Type

- 6.2.3. 450 nm Type

- 6.2.4. 520 nm Type

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Laser Range Finders

- 7.1.2. Designators

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 375 nm Type

- 7.2.2. 405 nm Type

- 7.2.3. 450 nm Type

- 7.2.4. 520 nm Type

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Laser Range Finders

- 8.1.2. Designators

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 375 nm Type

- 8.2.2. 405 nm Type

- 8.2.3. 450 nm Type

- 8.2.4. 520 nm Type

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Laser Range Finders

- 9.1.2. Designators

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 375 nm Type

- 9.2.2. 405 nm Type

- 9.2.3. 450 nm Type

- 9.2.4. 520 nm Type

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific CW Laser Diodes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Laser Range Finders

- 10.1.2. Designators

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 375 nm Type

- 10.2.2. 405 nm Type

- 10.2.3. 450 nm Type

- 10.2.4. 520 nm Type

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hamamatsu Photonics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Laser Components

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RPMC Lasers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Analog Modules

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Laser Diode Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Semi Conductor Devices

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Astrum Lasers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Hamamatsu Photonics

List of Figures

- Figure 1: Global CW Laser Diodes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America CW Laser Diodes Revenue (million), by Application 2024 & 2032

- Figure 3: North America CW Laser Diodes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America CW Laser Diodes Revenue (million), by Types 2024 & 2032

- Figure 5: North America CW Laser Diodes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America CW Laser Diodes Revenue (million), by Country 2024 & 2032

- Figure 7: North America CW Laser Diodes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America CW Laser Diodes Revenue (million), by Application 2024 & 2032

- Figure 9: South America CW Laser Diodes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America CW Laser Diodes Revenue (million), by Types 2024 & 2032

- Figure 11: South America CW Laser Diodes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America CW Laser Diodes Revenue (million), by Country 2024 & 2032

- Figure 13: South America CW Laser Diodes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe CW Laser Diodes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe CW Laser Diodes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe CW Laser Diodes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe CW Laser Diodes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe CW Laser Diodes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe CW Laser Diodes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa CW Laser Diodes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa CW Laser Diodes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa CW Laser Diodes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa CW Laser Diodes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa CW Laser Diodes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa CW Laser Diodes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific CW Laser Diodes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific CW Laser Diodes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific CW Laser Diodes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific CW Laser Diodes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific CW Laser Diodes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific CW Laser Diodes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CW Laser Diodes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global CW Laser Diodes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global CW Laser Diodes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global CW Laser Diodes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global CW Laser Diodes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global CW Laser Diodes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global CW Laser Diodes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global CW Laser Diodes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global CW Laser Diodes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific CW Laser Diodes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CW Laser Diodes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the CW Laser Diodes?

Key companies in the market include Hamamatsu Photonics, Laser Components, RPMC Lasers, Analog Modules, Laser Diode Inc., Semi Conductor Devices, Astrum Lasers.

3. What are the main segments of the CW Laser Diodes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CW Laser Diodes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CW Laser Diodes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CW Laser Diodes?

To stay informed about further developments, trends, and reports in the CW Laser Diodes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence