Key Insights

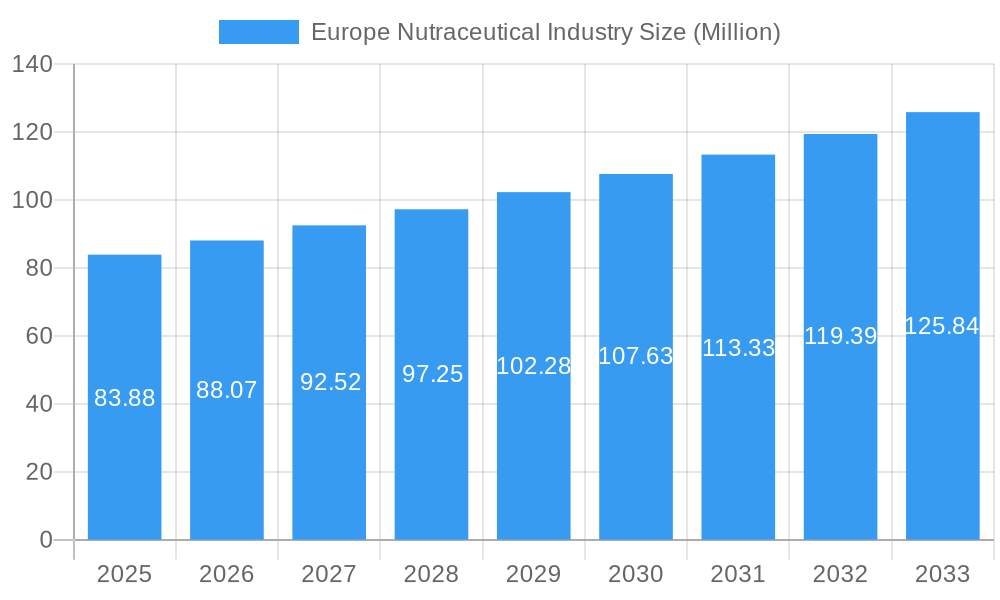

The European nutraceutical market, valued at €83.88 million in 2025, is projected to experience robust growth, driven by a rising health-conscious population increasingly seeking preventative healthcare solutions and functional foods. The market's Compound Annual Growth Rate (CAGR) of 4.91% from 2019 to 2024 indicates a consistent upward trajectory, expected to continue through 2033. Key growth drivers include the increasing prevalence of chronic diseases like cardiovascular issues and diabetes, motivating consumers to incorporate nutraceuticals into their diets for preventative health management. Furthermore, the rising popularity of functional foods and beverages, coupled with increased consumer awareness of the benefits of specific nutrients, fuels demand. This trend is particularly evident in the functional food and dietary supplement segments, representing significant market shares within the European nutraceutical landscape. Leading companies such as PepsiCo, Nestlé, and Amway are strategically capitalizing on this growth, expanding their product portfolios and distribution channels to meet growing consumer needs. Distribution channels are evolving, with online retail experiencing significant growth, alongside traditional channels like supermarkets and specialty stores. While market restraints such as stringent regulatory requirements and fluctuating raw material prices exist, the overall market outlook remains positive, particularly in key European markets like Germany, France, and the UK, which represent significant consumption hubs within the region.

Europe Nutraceutical Industry Market Size (In Million)

The European nutraceutical market segmentation reflects diverse consumer preferences and product needs. Product types such as functional foods, functional beverages, and dietary supplements cater to specific health goals and lifestyles. Similarly, distribution channels are diversified, with supermarkets, convenience stores, and online retailers providing various access points for consumers. The competitive landscape is characterized by established multinational companies and specialized nutraceutical brands, each employing distinct strategies to capture market share. The projected growth signifies significant investment opportunities for companies focusing on innovation, product diversification, and strategic partnerships within the European Union. Future market success will depend on meeting evolving consumer demands, adapting to regulatory changes, and leveraging the growth potential across different product segments and distribution channels.

Europe Nutraceutical Industry Company Market Share

Europe Nutraceutical Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European nutraceutical industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report delves into market size, growth drivers, competitive landscape, and future projections. The multi-million Euro market is poised for significant expansion, driven by evolving consumer preferences and technological advancements.

Europe Nutraceutical Industry Market Structure & Competitive Landscape

The European nutraceutical market exhibits a moderately concentrated structure, with several large multinational corporations and numerous smaller specialized players. Key players include PepsiCo Inc (Naked Juice), Amway Corporation, Sanofi, General Mills Inc, Nestlé S A (Milo Garden Gourmet), Nutraceuticals Group, The Coca-Cola Company (Aquarius), The Kraft Heinz Company, The Kellogg's Company (Morningstar), Herbalife Nutrition U S, Nature's Bounty Inc (Sundown Ester-C Solgar), and Bioiberica. However, the market is characterized by significant fragmentation at the smaller-scale level.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market with significant room for growth.

- Innovation Drivers: Technological advancements in ingredient sourcing, formulation, and delivery systems are major drivers. The increasing demand for personalized nutrition is also spurring innovation.

- Regulatory Impacts: EU regulations on food safety and labeling significantly impact market dynamics. Stricter regulations are expected in coming years, with potential consequences on market growth.

- Product Substitutes: The market faces competition from traditional food and beverage products, particularly those marketed with health claims.

- End-User Segmentation: The market caters to a broad range of consumers, segmented by age, health status, and lifestyle. Growing health consciousness across all demographics is boosting demand.

- M&A Trends: The past five years have seen xx million Euro in M&A activity, with a predicted increase in the forecast period, driven by market consolidation and expansion strategies.

Europe Nutraceutical Industry Market Trends & Opportunities

The European nutraceutical market is experiencing robust growth, projected to reach xx Million Euro by 2033, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Market Size Growth: The market experienced significant growth during the historical period (2019-2024), reaching xx Million Euro in 2024. Growth is expected to accelerate in the coming years.

- Technological Shifts: Advancements in extraction technologies, encapsulation, and delivery systems are enabling the development of more effective and convenient nutraceutical products. Personalized nutrition and precision medicine are also gaining traction.

- Consumer Preferences: Consumers are increasingly aware of the role of nutrition in maintaining health and wellbeing. The demand for products supporting gut health, immunity, cognitive function, and overall wellness is driving market expansion. Premiumization and clean-label trends are also prominent.

- Competitive Dynamics: Intense competition necessitates continuous innovation and the development of unique value propositions to maintain market share. Strategic partnerships and alliances are becoming increasingly common.

Dominant Markets & Segments in Europe Nutraceutical Industry

The largest segments within the European nutraceutical market are:

- Product Type: Dietary supplements hold the largest market share, followed by functional foods and then functional beverages. Growth is projected to be relatively equal across segments, however Dietary Supplements is the most lucrative.

- Distribution Channel: Supermarkets/hypermarkets remain the dominant distribution channel, owing to their wide reach and established infrastructure. Online retail is growing rapidly, fueled by increased e-commerce penetration and convenience.

Key Growth Drivers:

- Increasing Health Awareness: Consumers are increasingly proactive in managing their health, driving demand for nutraceuticals.

- Rising Disposable Incomes: Increased disposable incomes across Europe are enabling consumers to spend more on premium health products.

- Favorable Regulatory Environment: The EU's regulatory framework, while stringent, provides a degree of stability and predictability.

Germany, the UK, and France represent the largest national markets, due to their significant populations and high per capita consumption of nutraceuticals.

Europe Nutraceutical Industry Product Analysis

Product innovation is a key competitive differentiator within the European nutraceutical industry. Companies are focusing on developing products with enhanced efficacy, bioavailability, and convenience. This includes advancements in targeted delivery systems, novel ingredient combinations, and personalized formulations to meet evolving consumer needs. The market shows a strong preference for products with scientifically-backed claims and clean labels, boosting the appeal of natural and organic ingredients.

Key Drivers, Barriers & Challenges in Europe Nutraceutical Industry

Key Drivers:

- Growing health consciousness and preventative healthcare focus

- Rising demand for personalized nutrition

- Technological advancements

Key Challenges:

- Stringent regulations and compliance costs

- Supply chain disruptions and ingredient sourcing difficulties

- Intense competition and price pressures

Growth Drivers in the Europe Nutraceutical Industry Market

The European nutraceutical market is experiencing considerable growth due to factors such as increasing health awareness, a growing aging population, rising disposable incomes, and technological advancements. Stringent regulations in the EU create both opportunities and challenges, motivating companies to focus on quality, safety, and efficacy.

Challenges Impacting Europe Nutraceutical Industry Growth

Significant challenges facing the European nutraceutical market include evolving regulatory landscapes, potential supply chain bottlenecks, and the rising competition from both established players and new entrants. Addressing these challenges requires proactive strategies for regulatory compliance, robust supply chain management, and unique product differentiation.

Key Players Shaping the Europe Nutraceutical Industry Market

Significant Europe Nutraceutical Industry Industry Milestones

- October 2021: Nexira launched Heptura, a new ingredient for hepatoprotection and detoxification.

- January 2022: DFE Pharma expanded its nutraceutical excipient offering with the Nutrofeli starch portfolio.

- April 2022: Bioiberica partnered with Apsen to develop innovative mobility products for the Brazilian market.

Future Outlook for Europe Nutraceutical Industry Market

The future of the European nutraceutical market appears bright, driven by sustained growth in consumer demand, technological advancements, and strategic expansion by key players. Opportunities exist in personalized nutrition, functional foods with novel ingredients, and convenient delivery systems. Continued focus on regulatory compliance and maintaining transparent and ethical business practices will be critical for success in this evolving market.

Europe Nutraceutical Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Functional Beverage

- 1.3. Dietary Supplement

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Nutraceutical Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Nutraceutical Industry Regional Market Share

Geographic Coverage of Europe Nutraceutical Industry

Europe Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles

- 3.3. Market Restrains

- 3.3.1. Growing Competition from Other Convenience Foods

- 3.4. Market Trends

- 3.4.1. Germany Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Functional Beverage

- 5.1.3. Dietary Supplement

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 PepsiCo Inc (Naked Juice)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sanofi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 General Mills Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nestlé S A (Milo Garden Gourmet)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nutraceuticals Group*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Coca-Cola Company (Aquarius)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Kraft Heinz Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 The Kellogg's Company (Morningstar)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Herbalife Nutrition U S

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Nature's Bounty Inc (Sundown Ester-C Solgar)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Bioiberica

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 PepsiCo Inc (Naked Juice)

List of Figures

- Figure 1: Europe Nutraceutical Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Nutraceutical Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Nutraceutical Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Nutraceutical Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Nutraceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Germany Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Sweden Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Nutraceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Netherlands Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Norway Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Poland Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Denmark Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nutraceutical Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Europe Nutraceutical Industry?

Key companies in the market include PepsiCo Inc (Naked Juice), Amway Corporation, Sanofi, General Mills Inc, Nestlé S A (Milo Garden Gourmet), Nutraceuticals Group*List Not Exhaustive, The Coca-Cola Company (Aquarius), The Kraft Heinz Company, The Kellogg's Company (Morningstar), Herbalife Nutrition U S, Nature's Bounty Inc (Sundown Ester-C Solgar), Bioiberica.

3. What are the main segments of the Europe Nutraceutical Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles.

6. What are the notable trends driving market growth?

Germany Dominates the Market.

7. Are there any restraints impacting market growth?

Growing Competition from Other Convenience Foods.

8. Can you provide examples of recent developments in the market?

April 2022: Bioiberica, a global life science company based in Spain, partnered with multinational health and pharmaceutical expert Apsen to develop innovative mobility products for the Brazilian market. Apsen's Motilex HA combines two of Bioiberica's leading joint health ingredients, b-2 Cool native type II collagen and Mobilee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Europe Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence