Key Insights

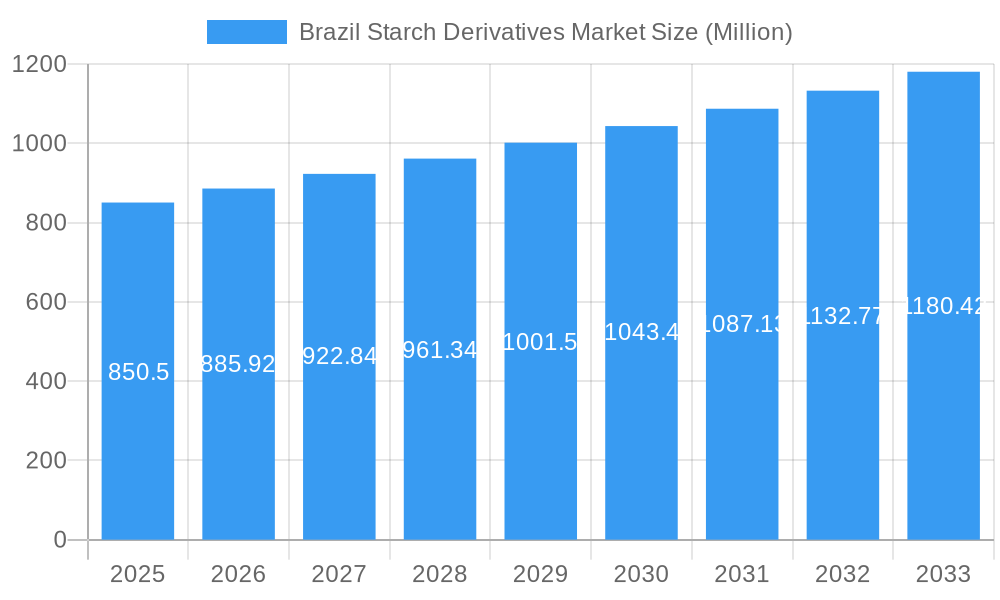

The Brazil Starch Derivatives Market is poised for significant growth, projected to reach a substantial market size by 2033, driven by a Compound Annual Growth Rate (CAGR) of 4.10%. This expansion is fueled by the increasing demand for starch derivatives across a multitude of applications, particularly within the food and beverage sector, where they are essential for enhancing texture, stability, and shelf-life. The burgeoning pharmaceutical industry also represents a key growth driver, leveraging starch derivatives as excipients and binders. Furthermore, the expanding animal feed industry's need for cost-effective and functional ingredients will contribute to market momentum. Emerging trends such as the development of novel, high-performance starch derivatives and a growing consumer preference for naturally sourced ingredients are shaping the market landscape. This dynamic environment presents considerable opportunities for innovation and market penetration.

Brazil Starch Derivatives Market Market Size (In Million)

Despite the positive outlook, certain restraints may influence the pace of growth. Fluctuations in raw material prices, particularly for corn and tapioca, the primary feedstocks for starch derivatives in Brazil, can impact profitability. Moreover, stringent regulatory frameworks surrounding food additives and pharmaceutical ingredients, while ensuring safety, can sometimes pose challenges for new product development and market entry. However, the inherent versatility of starch derivatives, coupled with ongoing research and development efforts to create specialized products for diverse needs, is expected to mitigate these challenges. The market is characterized by the presence of major global players, fostering a competitive environment that encourages continuous product innovation and operational efficiency. Brazil's rich agricultural base provides a strong foundation for the production and supply of starch derivatives, further bolstering its position in the regional and global markets.

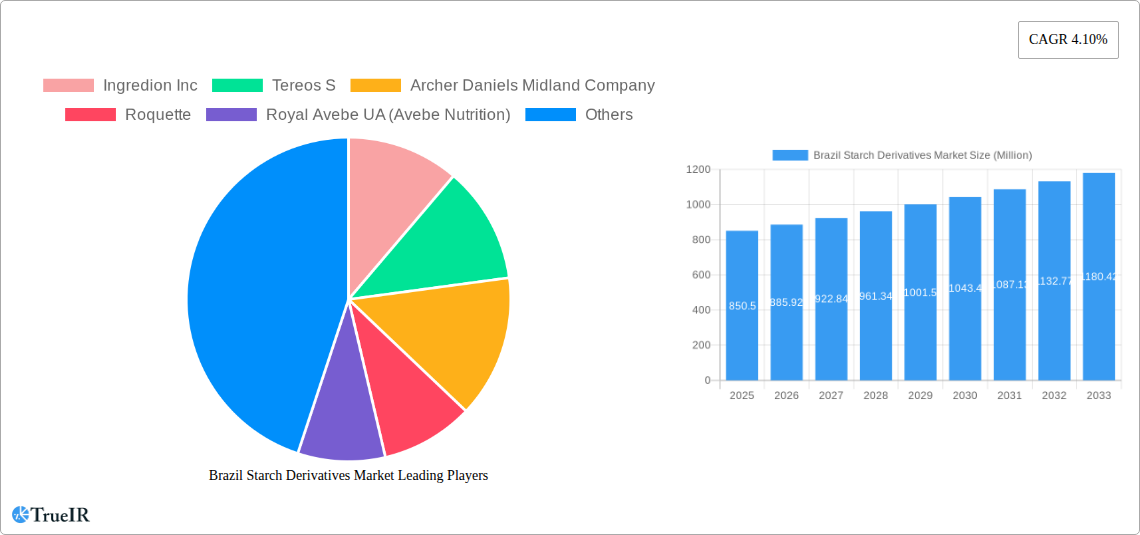

Brazil Starch Derivatives Market Company Market Share

Here's the dynamic, SEO-optimized report description for the Brazil Starch Derivatives Market, structured as requested:

This in-depth report provides a thorough analysis of the Brazil Starch Derivatives Market, offering critical insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. With a base year of 2025 and an estimated value of XX Million for the same year, the report forecasts a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Leveraging high-volume keywords such as "Brazil starch derivatives," "modified starch Brazil," "maltodextrin market," "glucose syrup applications," and "food ingredients Brazil," this report is designed to enhance search rankings and engage a broad spectrum of industry professionals, including manufacturers, suppliers, formulators, investors, and researchers.

Brazil Starch Derivatives Market Market Structure & Competitive Landscape

The Brazil Starch Derivatives Market is characterized by a moderately concentrated structure, with key players like Ingredion Inc, Tereos S, Archer Daniels Midland Company, Roquette, Royal Avebe UA (Avebe Nutrition), Agrana Group, Cargill Inc, and Tate & Lyle holding significant market share. Innovation drivers are primarily centered around developing novel starch derivatives with enhanced functionalities, sustainability, and cost-effectiveness to meet evolving consumer and industrial demands. Regulatory impacts, including food safety standards and import/export policies, play a crucial role in shaping market entry and operational strategies. The availability of raw materials, particularly corn and cassava, influences production costs and competitive advantages. Product substitutes, such as synthetic thickeners and alternative sweeteners, present a continuous challenge, necessitating ongoing product differentiation and value addition. End-user segmentation is diverse, spanning the food and beverage, feed, pharmaceutical, and cosmetic industries, each with unique requirements and growth potential. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding market reach, acquiring advanced technologies, and diversifying product portfolios. For instance, the market has witnessed XX M&A deals between 2019 and 2024, with an estimated transaction volume of XX Million. Understanding these structural elements is vital for navigating the competitive terrain and capitalizing on emerging opportunities within the Brazilian starch derivatives sector.

Brazil Starch Derivatives Market Market Trends & Opportunities

The Brazil Starch Derivatives Market is poised for substantial growth, driven by a confluence of escalating consumer demand for processed foods and beverages, coupled with advancements in processing technologies. The market size is projected to reach XX Million by 2033, expanding at a robust CAGR of XX% from its estimated base year value of XX Million in 2025. A significant trend is the increasing preference for natural and clean-label ingredients, prompting manufacturers to invest in research and development of starch derivatives derived from sustainable sources. This shift aligns with a growing awareness of health and wellness, leading to a higher demand for functional ingredients that offer nutritional benefits, such as prebiotic effects from certain modified starches. Technological shifts are evident in the adoption of enzymatic hydrolysis and fermentation processes, which enable the production of specialized starch derivatives with tailored properties like specific viscosity, solubility, and stability. These advancements are critical for meeting the stringent requirements of diverse applications, from confectionery and dairy products to pharmaceuticals and animal feed.

The competitive dynamics are intensifying, with companies focusing on product innovation, strategic partnerships, and expanding their distribution networks to capture a larger market share. The penetration rate of starch derivatives in key application segments, particularly food and beverage, is steadily increasing, reflecting their versatility and cost-effectiveness as functional ingredients. For example, maltodextrin's widespread use as a bulking agent, carrier, and texturizer in the food industry continues to drive its market penetration. Similarly, glucose syrups are indispensable in bakery, confectionery, and beverage formulations, their demand mirroring the growth of these sectors. The pharmaceutical industry's reliance on starch derivatives as excipients, binders, and disintegrants also presents a significant growth avenue, especially with the increasing production of generic drugs and novel drug delivery systems. Opportunities also lie in the development of biodegradable and compostable starch-based materials, aligning with global sustainability initiatives and addressing the growing concern over plastic waste. The expanding middle class in Brazil, with its increased disposable income and evolving dietary habits, further fuels the demand for a wide array of processed food and beverage products, thereby stimulating the growth of the starch derivatives market. Strategic investments in R&D to create value-added starch derivatives and explore niche applications will be crucial for sustained market leadership.

Dominant Markets & Segments in Brazil Starch Derivatives Market

The Food and Beverage application segment stands as the dominant force within the Brazil Starch Derivatives Market, consistently driving demand and innovation. This dominance is underpinned by Brazil's vast agricultural output, particularly of corn and cassava, which serve as primary raw materials for starch production. The ever-growing processed food industry, fueled by evolving consumer lifestyles and a burgeoning middle class, relies heavily on starch derivatives for a myriad of functions.

- Maltodextrin: This type of starch derivative is a powerhouse in the Food and Beverage sector, serving as a bulking agent, thickener, carrier for flavors and colors, and a texture modifier in products ranging from infant formula and sports nutrition drinks to baked goods and snack foods. Its versatility and cost-effectiveness make it a go-to ingredient.

- Glucose Syrups: Essential for confectionery, bakery, and beverage production, glucose syrups provide sweetness, viscosity, and prevent crystallization. Their widespread use in candies, jams, ice cream, and soft drinks solidifies their position as a key market driver.

- Modified Starch: This broad category encompasses a range of starches engineered for specific functionalities. In the Food and Beverage industry, modified starches are crucial for improving texture, stability, and shelf-life in sauces, dairy products, desserts, and convenience foods. Their ability to withstand processing conditions like high temperatures and acidic environments further enhances their appeal.

Beyond Food and Beverage, the Feed application segment is also a significant contributor, driven by Brazil's large and expanding livestock industry. Starch derivatives are utilized as energy sources and binders in animal feed formulations, supporting animal growth and health. The Pharmaceutical Industry represents a high-value segment, where starch derivatives serve as excipients in tablets, capsules, and drug formulations, acting as binders, disintegrants, and fillers. The Cosmetics industry also utilizes starch derivatives for their absorbent and texturizing properties in powders, lotions, and creams.

Geographically, while the entire Brazilian market is substantial, the Southeastern region, with its high population density and established industrial infrastructure, typically leads in consumption and manufacturing of starch derivatives. Policies supporting agricultural development and food processing industries, coupled with infrastructure improvements in logistics and supply chains, are key growth drivers for these dominant segments and regions.

Brazil Starch Derivatives Market Product Analysis

The Brazil Starch Derivatives Market is witnessing continuous innovation focused on enhancing functional properties and sustainability. Maltodextrins are being developed with specific dextrose equivalent (DE) values to tailor sweetness and viscosity for diverse food applications. Cyclodextrins are gaining traction for their encapsulation capabilities, enabling controlled release of flavors, fragrances, and active pharmaceutical ingredients. Glucose Syrups are being optimized for reduced caloric content and improved digestive properties. Hydrolysates are being engineered for specialized nutritional applications. Modified Starches are at the forefront of innovation, with advancements in native starch modification techniques leading to superior emulsification, stabilization, and gelling properties for demanding food, pharmaceutical, and industrial applications. These product advancements are driven by a need for ingredients that offer improved performance, cost-effectiveness, and align with consumer demands for healthier and more sustainable products.

Key Drivers, Barriers & Challenges in Brazil Starch Derivatives Market

Key Drivers: The Brazil Starch Derivatives Market is propelled by the robust growth of the food and beverage industry, fueled by increasing disposable incomes and evolving consumer preferences for convenience foods. The feed sector's expansion in Brazil, a global agricultural powerhouse, significantly boosts demand for energy-rich starch derivatives. Technological advancements in starch processing and modification enable the creation of specialized ingredients with enhanced functionalities. Furthermore, supportive government policies aimed at promoting agricultural value addition and export growth play a crucial role.

Barriers & Challenges: Supply chain volatility, particularly concerning raw material availability and pricing influenced by climate conditions and global demand, presents a significant challenge. Regulatory hurdles related to food safety, labeling, and import/export procedures can impact market entry and product adoption. Intense competitive pressure from both domestic and international players, along with the threat of product substitutes like synthetic ingredients and alternative sweeteners, necessitates continuous innovation and cost optimization. Fluctuations in the Brazilian Real can also impact export competitiveness and import costs, posing economic challenges.

Growth Drivers in the Brazil Starch Derivatives Market Market

The Brazil Starch Derivatives Market is experiencing substantial growth driven by several key factors. The expanding food and beverage sector, a cornerstone of the Brazilian economy, continuously demands a wide array of starch derivatives for texture, sweetness, and stability. Furthermore, the burgeoning animal feed industry, critical for Brazil's status as an agricultural exporter, relies on starch derivatives for energy and as binders. Technological advancements in starch modification and processing techniques are enabling the development of high-performance ingredients tailored for specific applications, from pharmaceuticals to cosmetics. Favorable government initiatives supporting agricultural processing and innovation also provide a conducive environment for market expansion. The increasing consumer focus on health and wellness is also driving demand for functional starch derivatives with prebiotic properties or reduced caloric content, opening new avenues for product development.

Challenges Impacting Brazil Starch Derivatives Market Growth

Despite robust growth prospects, the Brazil Starch Derivatives Market faces several significant challenges. Supply chain disruptions, influenced by climatic variations affecting crop yields and global commodity price fluctuations, can lead to raw material scarcity and price volatility for corn and cassava. Stringent and evolving regulatory landscapes, particularly concerning food safety standards and product certifications, can create compliance burdens and delays for market entrants. Intense competitive pressures from established global players and emerging local manufacturers necessitate continuous innovation and cost management strategies. The availability of cost-effective substitutes, such as synthetic thickeners and sweeteners, also poses a threat, requiring starch derivative producers to highlight their natural origins and functional benefits. Economic instability and currency fluctuations can also impact import costs for machinery and export competitiveness.

Key Players Shaping the Brazil Starch Derivatives Market Market

- Ingredion Inc

- Tereos S

- Archer Daniels Midland Company

- Roquette

- Royal Avebe UA (Avebe Nutrition)

- Agrana Group

- Cargill Inc

- Tate & Lyle

Significant Brazil Starch Derivatives Market Industry Milestones

- 2023: Launch of novel prebiotic-enhanced maltodextrins by a leading player, catering to the growing functional food market.

- 2022: Increased investment in sustainable cassava sourcing for starch production, reflecting a growing emphasis on eco-friendly practices.

- 2021: Acquisition of a specialized modified starch producer by a major starch derivative company to expand its product portfolio in the food ingredients segment.

- 2020: Introduction of advanced enzymatic hydrolysis techniques to produce glucose syrups with improved digestibility for specialized dietary applications.

- 2019: Significant capacity expansion in corn wet milling facilities to meet rising demand for starch and starch derivatives in the Latin American region.

Future Outlook for Brazil Starch Derivatives Market Market

The future outlook for the Brazil Starch Derivatives Market remains exceptionally positive, driven by sustained demand from core sectors and emerging opportunities. Continued innovation in functional and clean-label starch derivatives will cater to health-conscious consumers and stringent regulatory demands. The expanding pharmaceutical and cosmetic industries will offer lucrative avenues for specialized starch applications. Furthermore, the global drive towards sustainability and bio-based materials presents a significant growth catalyst for starch derivatives as they offer biodegradable and renewable alternatives. Strategic investments in R&D, coupled with a focus on supply chain resilience and operational efficiency, will be paramount for market participants to capitalize on the projected growth and solidify their competitive positions in this dynamic market. The market is anticipated to witness further consolidation and strategic collaborations as companies aim to expand their technological capabilities and geographical reach.

Brazil Starch Derivatives Market Segmentation

-

1. Type

- 1.1. Maltodextrin

- 1.2. Cyclodextrin

- 1.3. Glucose Syrups

- 1.4. Hydrolysates

- 1.5. Modified Starch

- 1.6. Other Types

-

2. Application

- 2.1. Food and Beverage

- 2.2. Feed

- 2.3. Pharmaceutical Industry

- 2.4. Cosmetics

- 2.5. Other Applications

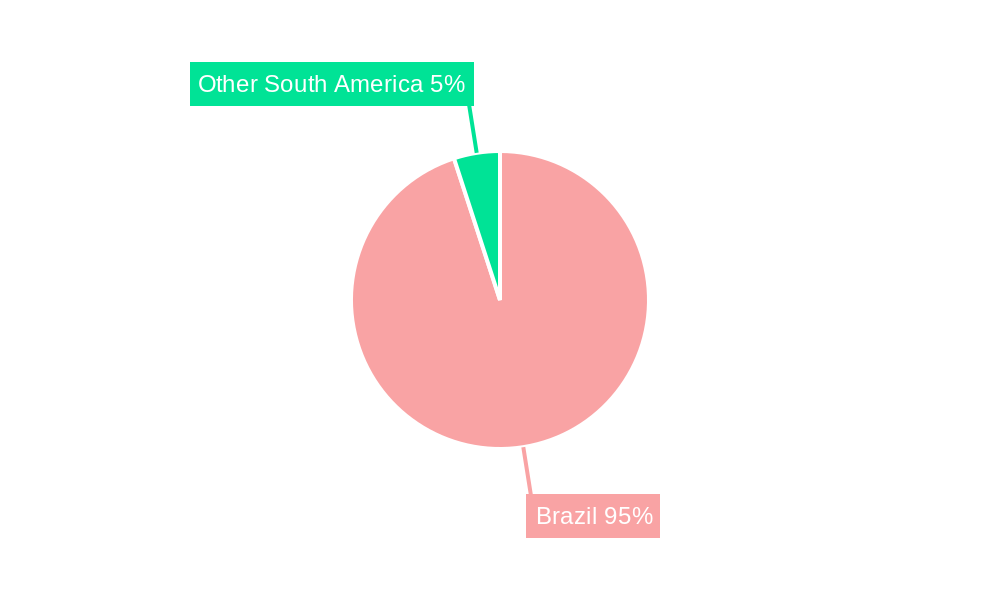

Brazil Starch Derivatives Market Segmentation By Geography

- 1. Brazil

Brazil Starch Derivatives Market Regional Market Share

Geographic Coverage of Brazil Starch Derivatives Market

Brazil Starch Derivatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Glucose Syrups witnessed a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Starch Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Maltodextrin

- 5.1.2. Cyclodextrin

- 5.1.3. Glucose Syrups

- 5.1.4. Hydrolysates

- 5.1.5. Modified Starch

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Feed

- 5.2.3. Pharmaceutical Industry

- 5.2.4. Cosmetics

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingredion Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tereos S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Roquette

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Avebe UA (Avebe Nutrition)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrana Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Ingredion Inc

List of Figures

- Figure 1: Brazil Starch Derivatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Starch Derivatives Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Starch Derivatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Brazil Starch Derivatives Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Brazil Starch Derivatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Brazil Starch Derivatives Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Brazil Starch Derivatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Brazil Starch Derivatives Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Brazil Starch Derivatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Brazil Starch Derivatives Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Brazil Starch Derivatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Brazil Starch Derivatives Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Brazil Starch Derivatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Brazil Starch Derivatives Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Starch Derivatives Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Brazil Starch Derivatives Market?

Key companies in the market include Ingredion Inc, Tereos S, Archer Daniels Midland Company, Roquette, Royal Avebe UA (Avebe Nutrition), Agrana Group, Cargill Inc, Tate & Lyle.

3. What are the main segments of the Brazil Starch Derivatives Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Glucose Syrups witnessed a Significant Growth.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Starch Derivatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Starch Derivatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Starch Derivatives Market?

To stay informed about further developments, trends, and reports in the Brazil Starch Derivatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence