Key Insights

The European used car market, projected to reach $725.3 billion in 2024, is set for significant expansion. This growth is driven by a rising demand for cost-effective mobility, especially among younger demographics and budget-conscious buyers. Enhanced vehicle financing options and the proliferation of online used car platforms are improving accessibility and streamlining the purchasing journey. Advancements in vehicle diagnostics and online valuation tools are bolstering consumer trust and transparency. Within market segments, SUVs and MPVs are experiencing strong demand, aligning with evolving lifestyle and family requirements. The organized sector is anticipated to increase its market share, offering superior customer service, warranty programs, and financing solutions. While conventional gasoline and diesel vehicles remain prevalent, the electric vehicle (EV) segment, despite its current smaller size, is expected to experience substantial growth due to growing environmental awareness and supportive government policies. Market leadership is held by Germany, the UK, and France, with Eastern European nations, including Russia, projected to exhibit higher growth rates. Potential challenges include economic volatility and supply chain disruptions.

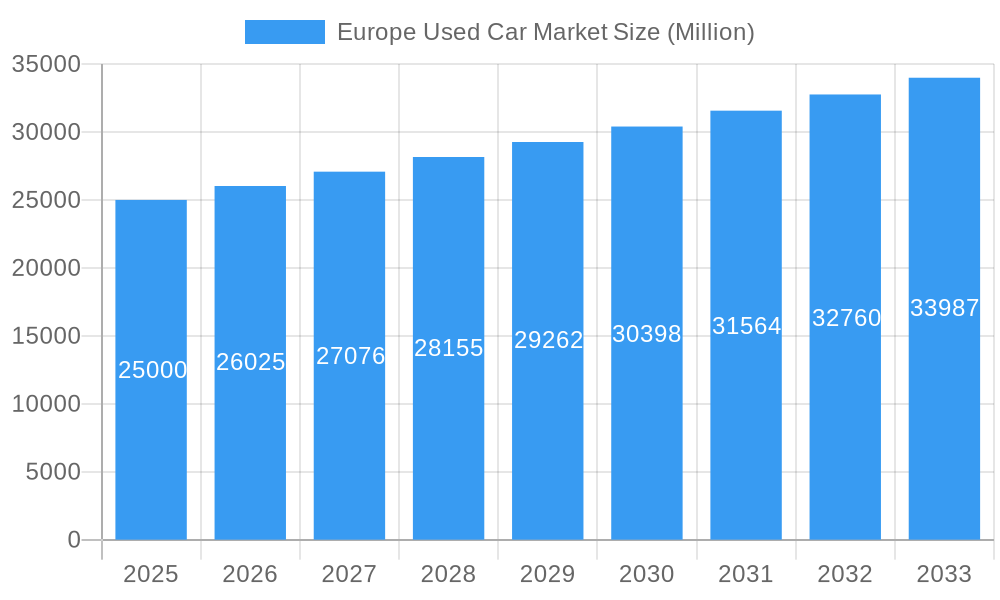

Europe Used Car Market Market Size (In Billion)

The forecast period, 2024-2033, anticipates a compound annual growth rate (CAGR) of 4.6%. This expansion is underpinned by technological innovation, increased consumer confidence in the used car sector, and the adoption of successful international business models. Digitalization is a key driver, enhancing transparency and efficiency. Market segmentation by vehicle type, vendor, and fuel type offers crucial insights into consumer preferences and emerging trends. The continued development and adoption of electric and alternative fuel vehicles will significantly influence the market's future. Intense competition among organized and unorganized vendors necessitates robust marketing strategies and customer-centric approaches to secure market share.

Europe Used Car Market Company Market Share

Europe Used Car Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the European used car market, analyzing its structure, trends, and future potential. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this evolving market. The report leverages extensive data and analysis to deliver actionable insights, offering a comprehensive overview of the market's key players, segments, and growth drivers. The market value is expected to reach xx Million by 2033.

Europe Used Car Market Market Structure & Competitive Landscape

The European used car market is characterized by a moderately fragmented landscape, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. While several large players dominate certain segments, numerous smaller dealerships and independent sellers contribute significantly to overall market volume. This report examines the market concentration, highlighting leading players like AVAG Holding, Arnold Clark Automobiles Limited, wellergruppe, Auto One Group, Lookers Plc, Auto Empire Trading GmbH, Fahrzeug-werke LUEG AG, Pendragon Plc, Autorola Group Holding, Emil Frey AG, Penske Automotive Group, and Gottfried-schultz.

- Market Concentration: The HHI suggests a moderately competitive landscape, with significant regional variations. Germany and the UK exhibit higher concentration levels than Southern European countries.

- Innovation Drivers: Technological advancements, such as online marketplaces and digital inspection tools, are driving innovation, enhancing transparency and efficiency.

- Regulatory Impacts: EU regulations on emissions and vehicle safety standards impact the market, influencing demand for specific vehicle types. Furthermore, regulations on data privacy and online sales affect how businesses operate.

- Product Substitutes: The rise of ride-sharing services and public transportation presents a mild competitive threat to the used car market.

- End-User Segmentation: The market caters to a diverse range of consumers, including individuals, businesses, and rental companies, with varying needs and preferences.

- M&A Trends: The used car market has seen a moderate level of mergers and acquisitions in recent years, with xx Million in total deal value between 2019 and 2024. This activity reflects consolidation efforts and expansion strategies among key players.

Europe Used Car Market Market Trends & Opportunities

The European used car market is experiencing significant growth, driven by a combination of factors, including rising disposable incomes, increasing urbanization, and the preference for used vehicles over new ones due to affordability. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% from 2025 to 2033. Market penetration of used car sales compared to new car sales shows xx% for 2024. Several trends are shaping market opportunities:

Technological advancements are transforming the buying and selling process, with online marketplaces and digital solutions gaining popularity. Consumer preferences are shifting towards fuel-efficient and environmentally friendly vehicles, boosting demand for electric and hybrid used cars. The competitive landscape is evolving with both established players and new entrants vying for market share. Intense price competition, particularly in densely populated areas, influences sales. The rising awareness of sustainability is creating opportunities for certified pre-owned vehicles and eco-friendly options. Increased regulations regarding emissions and vehicle safety standards, as well as the introduction of new technologies, are changing consumer behavior and driving demand. The used car market is also undergoing an evolution in the way financing is offered, with the use of fintech and digital platforms revolutionizing the consumer experience.

Dominant Markets & Segments in Europe Used Car Market

Germany remains the largest national market for used cars in Europe, followed by the United Kingdom and France. The most popular vehicle types are Hatchbacks and SUVs, driven by consumer preferences for practicality and versatility. Organized vendors represent a larger share of the market compared to unorganized sellers. Gasoline and diesel vehicles continue to dominate the fuel type segment, but electric vehicles (EVs) are growing rapidly.

- Key Growth Drivers:

- Germany: Strong economy, extensive dealer network, favorable government policies supporting the used car market.

- United Kingdom: Large population, high car ownership rates, well-developed used car infrastructure.

- France: Expanding middle class, growing demand for used vehicles as an affordable transportation option.

- SUVs and Hatchbacks: Versatility, fuel efficiency (depending on the engine type), affordability compared to new vehicles.

- Organized Vendors: Trust, reliability, warranties, and financing options often offered.

Europe Used Car Market Product Analysis

The used car market offers a diverse range of products, encompassing various vehicle types, makes, models, and conditions. Technological advancements have led to the introduction of features like advanced driver-assistance systems (ADAS), enhanced safety technologies, and improved fuel efficiency in newer used vehicles. Competitive advantages include price competitiveness, a wider range of choices, and availability of certified pre-owned vehicles backed by warranties. The growing demand for electric and hybrid vehicles is pushing innovation within this segment of the used car market.

Key Drivers, Barriers & Challenges in Europe Used Car Market

Key Drivers: Rising disposable incomes, increasing urbanization, and the preference for more affordable used vehicles over new ones are driving market growth. Technological advancements such as online platforms and digital inspection tools improve transparency and efficiency, and consumer preferences are shifting towards fuel-efficient vehicles.

Key Challenges: Supply chain disruptions caused by global events and economic uncertainty could impact market availability and pricing. Stringent emission regulations and increasing focus on vehicle safety compliance create regulatory hurdles. Intense competition among various vendors requires ongoing innovation and competitive pricing strategies. Fluctuations in the used car prices, particularly for popular models, significantly influence market dynamics.

Growth Drivers in the Europe Used Car Market Market

The growth of the European used car market is driven by several factors, including rising affordability compared to new vehicles, increasing urbanization leading to higher demand for transportation, and technological advancements that improve the efficiency and transparency of the used car market. Government policies and incentives can also stimulate the growth of this market.

Challenges Impacting Europe Used Car Market Growth

Challenges facing the European used car market include economic downturns that reduce consumer purchasing power, supply chain disruptions that affect the availability of vehicles, regulatory changes and increased compliance costs, and intense competition that puts pressure on margins.

Key Players Shaping the Europe Used Car Market Market

- AVAG Holding

- Arnold Clark Automobiles Limited

- wellergruppe

- Auto One Group

- Lookers Plc

- Auto Empire Trading GmbH

- Fahrzeug-werke LUEG AG

- Pendragon Plc

- Autorola Group Holding

- Emil Frey AG

- Penske Automotive Group

- Gottfried-schultz

Significant Europe Used Car Market Industry Milestones

- March 2022: Toyota Motors Europe (TME) partnered with INDICATA Europe to expand used car pricing data across 13 countries. This improved data transparency and streamlined pricing across the market.

- March 2022: Inchcape's withdrawal from the Russian market due to the Ukraine conflict highlighted geopolitical risks and their impact on market stability.

- March 2022: TrueCar Inc.'s launch of TrueCar+ provided consumers with a more flexible and personalized used car buying experience, increasing online market competition.

Future Outlook for Europe Used Car Market Market

The future of the European used car market appears positive, driven by consistent growth in demand, technological advancements, and increased transparency. Strategic opportunities exist for companies that can leverage technology to enhance the buying and selling experience, cater to evolving consumer preferences for fuel-efficient vehicles, and adapt to evolving regulatory landscapes. The market’s potential for further growth is considerable, particularly as consumer behavior shifts and new technologies continue to shape market trends.

Europe Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicle

- 1.4. Multi-purpose Vehicle

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

Europe Used Car Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Used Car Market Regional Market Share

Geographic Coverage of Europe Used Car Market

Europe Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Forklift; Others

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption; Others

- 3.4. Market Trends

- 3.4.1. Online Infrastructure witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle

- 5.1.4. Multi-purpose Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Used Car Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 AVAG Holding

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arnold Clark Automobiles Limite

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 wellergruppe

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Auto One Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lookers Plc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Auto Empire Trading GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fahrzeug -werke LUEG AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pendragon Plc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Autorola Group Holding

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Emil Frey AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Penske Automotive Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Gottfried-schultz

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 AVAG Holding

List of Figures

- Figure 1: Europe Used Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Used Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Europe Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Europe Used Car Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 4: Europe Used Car Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 5: Europe Used Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Used Car Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: France Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Italy Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Netherlands Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Europe Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Europe Used Car Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 16: Europe Used Car Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 17: Europe Used Car Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Belgium Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Sweden Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Denmark Europe Used Car Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Used Car Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Europe Used Car Market?

Key companies in the market include AVAG Holding, Arnold Clark Automobiles Limite, wellergruppe, Auto One Group, Lookers Plc, Auto Empire Trading GmbH, Fahrzeug -werke LUEG AG, Pendragon Plc, Autorola Group Holding, Emil Frey AG, Penske Automotive Group, Gottfried-schultz.

3. What are the main segments of the Europe Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 725.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Forklift; Others.

6. What are the notable trends driving market growth?

Online Infrastructure witnessing major growth.

7. Are there any restraints impacting market growth?

Supply Chain Disruption; Others.

8. Can you provide examples of recent developments in the market?

March 2022: Toyota Motors Europe (TME) announced a major new contract with INDICATA Europe to roll out its used car pricing data to 13 countries over the next two months. INDICATA developed a bespoke reporting suite for TME that tracks all the online used Toyota and Lexus adverts from its dealer networks across Europe and presented it into an easy-to-read dashboard for each country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Used Car Market?

To stay informed about further developments, trends, and reports in the Europe Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence