Key Insights

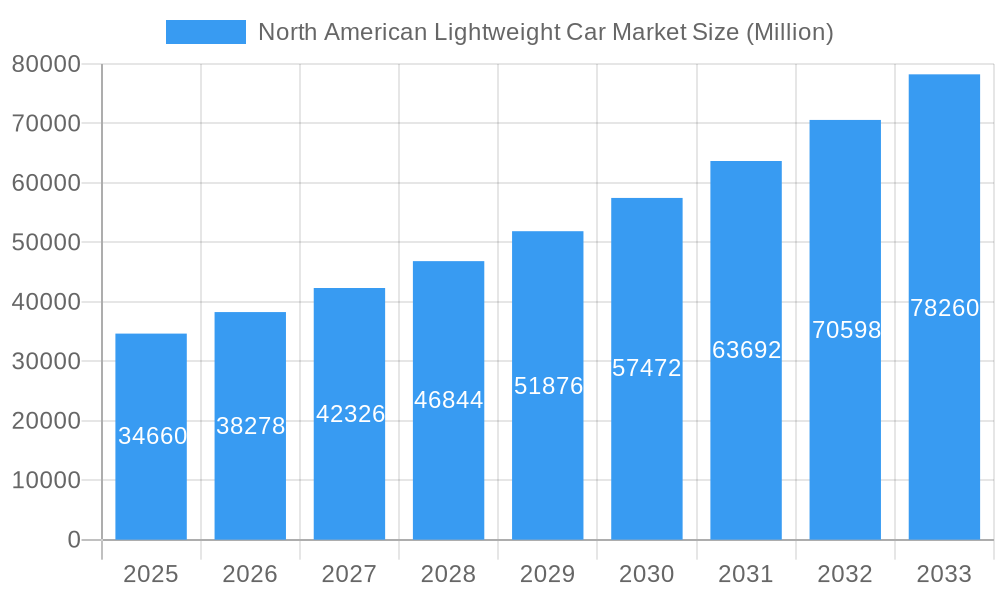

The North American lightweight car market, valued at $34.66 billion in 2025, is projected to experience robust growth, driven by increasing fuel efficiency standards, rising consumer demand for environmentally friendly vehicles, and advancements in lightweight materials technology. The market's Compound Annual Growth Rate (CAGR) of 10.27% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include the increasing adoption of aluminum, composites, and high-strength steel in vehicle manufacturing to reduce weight and improve fuel economy. Furthermore, the ongoing trend toward electric and hybrid vehicles further fuels demand for lightweighting solutions, as battery weight significantly impacts vehicle performance and range. While the rising cost of raw materials and complex manufacturing processes pose some challenges, the overall market outlook remains positive. The segmentation reveals that the metals segment currently holds a significant share, but composites are expected to witness considerable growth due to their superior strength-to-weight ratio. The powertrain application segment is anticipated to dominate, followed by exterior and interior systems. Among the major players, companies like Toyota, Ford, General Motors, and others are actively investing in research and development to integrate lightweight materials into their vehicles, driving innovation and market competition.

North American Lightweight Car Market Market Size (In Billion)

The success of lightweighting initiatives hinges on collaboration across the automotive supply chain. Manufacturers are actively exploring innovative manufacturing processes like extrusion and stamping to optimize production efficiency and cost-effectiveness. The United States remains the largest market within North America, driven by high vehicle sales and stringent emission regulations. Canada and Mexico also contribute significantly, representing considerable opportunities for growth. However, challenges exist in addressing potential supply chain disruptions and ensuring the long-term sustainability of the lightweighting materials used. Looking ahead, the North American lightweight car market is expected to witness increased adoption of advanced materials and technologies, fostering further growth and shaping the future of automotive manufacturing.

North American Lightweight Car Market Company Market Share

North American Lightweight Car Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the North American lightweight car market, offering crucial insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils key market trends, competitive dynamics, and future growth potential. Benefit from detailed segmentation by material type (metals, composites, plastics, others), manufacturing process (extrusion, stamping, forging, casting, others), application (powertrain, exterior/interior systems, frame), and country (United States, Canada, Rest of North America). The report is enriched with real-world examples, showcasing recent innovations and collaborations that are shaping the future of lightweight vehicle design. Expect data-driven analysis, valuable forecasts, and strategic recommendations to navigate this evolving market successfully. The total market size in 2025 is estimated to be xx Million.

North American Lightweight Car Market Market Structure & Competitive Landscape

The North American lightweight car market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately consolidated market. Key innovation drivers include stricter fuel efficiency regulations, the growing adoption of electric vehicles (EVs), and advancements in materials science. Regulatory impacts, particularly concerning emissions standards and safety regulations, significantly influence market dynamics. Product substitutes, such as alternative vehicle designs and materials, pose a competitive threat, although their current market penetration is relatively low (estimated at xx% in 2025).

The end-user segment is primarily comprised of automotive original equipment manufacturers (OEMs) and tier-one suppliers. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million in M&A volume in 2024. Key M&A trends include strategic partnerships to leverage technological expertise and expand market reach.

- Top 5 Players Market Share (2025): xx% (Combined).

- Major Players: Mazda Motor Corporation, Nissan Motor Co Ltd, Toyota Motors Corporation, General Motors, Volkswagen AG, Kia Motors Corporation, Chevrolet, Subaru, Honda Motor Co Ltd, Hyundai Motors, Ford Motor Company.

- Innovation Focus: Lightweight materials (carbon fiber, aluminum alloys), advanced manufacturing processes (additive manufacturing), and integrated design approaches.

North American Lightweight Car Market Market Trends & Opportunities

The North American lightweight car market is experiencing robust growth, driven by increasing demand for fuel-efficient and environmentally friendly vehicles. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, particularly in materials science and manufacturing processes, are significantly impacting market dynamics. Consumer preferences are shifting towards lighter, more fuel-efficient vehicles, further bolstering market growth. Intense competition among established automotive manufacturers and new entrants is driving innovation and price optimization. The market penetration rate for lightweight vehicles is projected to reach xx% by 2033, indicating substantial growth potential. Specific opportunities lie in the development of advanced materials, such as composites and high-strength steels, and the adoption of innovative manufacturing techniques to reduce production costs. The increasing focus on electric vehicles presents a significant opportunity for lightweight car manufacturers, as reducing weight directly improves battery range and performance.

Dominant Markets & Segments in North American Lightweight Car Market

The United States represents the dominant market within North America, accounting for xx% of the total market in 2025. This dominance is attributed to the large automotive manufacturing base and high vehicle sales volumes.

- By Material Type: Metals currently holds the largest market share (xx%), followed by composites (xx%) and plastics (xx%). The "Others" segment (Elastomers, etc.) is experiencing relatively slow growth.

- By Manufacturing Process: Stamping remains the dominant manufacturing process, capturing xx% of the market share. However, extrusion and casting processes are witnessing increased adoption due to their suitability for certain lightweight materials.

- By Application: Powertrain components (engines, transmissions) represent a significant segment, while exterior systems are witnessing relatively high growth.

Key Growth Drivers:

- Stringent Fuel Economy Regulations: Government mandates for improved fuel efficiency are driving the adoption of lightweight materials and designs.

- Rising Demand for Electric Vehicles: EVs require lightweight components to maximize range and performance.

- Technological Advancements: New materials and manufacturing processes are making lighter vehicles more feasible and cost-effective.

- Increased Consumer Awareness: Consumers are increasingly aware of the environmental and economic benefits of fuel-efficient vehicles.

North American Lightweight Car Market Product Analysis

The lightweight car market is characterized by continuous innovation in materials and manufacturing processes. Key product developments include the increasing use of advanced high-strength steels, aluminum alloys, carbon fiber composites, and innovative joining technologies. These innovations aim to reduce vehicle weight without compromising safety or performance. The market is also witnessing a shift toward more integrated and modular designs to simplify manufacturing and reduce costs. The successful integration of lightweighting solutions depends on achieving an optimal balance between weight reduction, cost, and safety requirements.

Key Drivers, Barriers & Challenges in North American Lightweight Car Market

Key Drivers:

- Stringent government regulations promoting fuel efficiency are a primary driver. The Corporate Average Fuel Economy (CAFE) standards in the US, for example, incentivize the development and adoption of lightweight vehicles.

- Growing consumer demand for fuel-efficient and environmentally conscious cars fuels the market's expansion.

- Technological innovations in materials science and manufacturing continuously reduce the cost and improve the performance of lightweight materials.

Challenges and Restraints:

- The high initial cost of some lightweight materials, such as carbon fiber, presents a significant barrier to widespread adoption. This results in a higher price point for consumers.

- Supply chain disruptions can significantly affect the availability and cost of lightweight materials, impacting production timelines and profitability.

- Meeting stringent safety and durability standards for lightweight vehicles remains a significant challenge. This necessitates rigorous testing and validation processes.

Growth Drivers in the North American Lightweight Car Market Market

Several factors are propelling the growth of the North American lightweight car market. These include stringent fuel efficiency regulations (like CAFE standards), the rising demand for electric and hybrid vehicles, and ongoing innovations in materials science (e.g., advanced high-strength steels, carbon fiber composites). Economic incentives, such as tax credits for fuel-efficient vehicles, also play a significant role.

Challenges Impacting North American Lightweight Car Market Growth

Challenges include the high cost of certain lightweight materials, supply chain complexities, and the need to meet stringent safety regulations. Fluctuations in raw material prices and potential geopolitical disruptions further complicate the market landscape. Balancing the need for weight reduction with safety and durability requirements remains an ongoing challenge.

Key Players Shaping the North American Lightweight Car Market Market

Significant North American Lightweight Car Market Industry Milestones

- August 2023: Clemson University researchers developed a 32% lighter vehicle door using carbon fiber and thermoplastic resin, meeting federal safety standards.

- March 2023: Lamborghini unveiled the LB744, its first HPEV (High-Performance Electrified Vehicle), featuring a lightweight 6.5-liter engine.

- September 2022: Atlis Motor Vehicles partnered with ArcelorMittal to develop lightweight steel solutions for its XT vehicle.

Future Outlook for North American Lightweight Car Market Market

The North American lightweight car market is poised for continued growth, driven by technological advancements, stricter environmental regulations, and evolving consumer preferences. Opportunities exist in developing innovative lightweight materials and manufacturing processes, as well as exploring new applications for lightweighting technologies. The market's future success will depend on the ability of manufacturers to balance cost, performance, and sustainability.

North American Lightweight Car Market Segmentation

-

1. Material Type

- 1.1. Metals

- 1.2. Composites

- 1.3. Plastics

- 1.4. Others (Elastomer, etc.)

-

2. Manufacturing Process

- 2.1. Extrusion

- 2.2. Stamping

- 2.3. Forging

- 2.4. Casting

- 2.5. Others (Molding, etc.)

-

3. Application

- 3.1. Powertrain

- 3.2. Exterior Systems and Components

- 3.3. Interior Systems and Components

- 3.4. Frame

North American Lightweight Car Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Lightweight Car Market Regional Market Share

Geographic Coverage of North American Lightweight Car Market

North American Lightweight Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Enhancement in Advanced High-Strength Steels (AHSS) Technology to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Raw Material Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. Composite Material Segment to gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Lightweight Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metals

- 5.1.2. Composites

- 5.1.3. Plastics

- 5.1.4. Others (Elastomer, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.2.1. Extrusion

- 5.2.2. Stamping

- 5.2.3. Forging

- 5.2.4. Casting

- 5.2.5. Others (Molding, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Powertrain

- 5.3.2. Exterior Systems and Components

- 5.3.3. Interior Systems and Components

- 5.3.4. Frame

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North American Lightweight Car Market Analysis, Insights and Forecast, 2020-2032

- 7. Canada North American Lightweight Car Market Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North American Lightweight Car Market Analysis, Insights and Forecast, 2020-2032

- 9. Rest of North America North American Lightweight Car Market Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mazda Motor Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nissan Motor Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toyota Motors Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 General Motors

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Volkswagen AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kia Motors Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chevrolet

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Subar

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honda Motor Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hyundai Motors

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ford Motor Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Mazda Motor Corporation

List of Figures

- Figure 1: North American Lightweight Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North American Lightweight Car Market Share (%) by Company 2025

List of Tables

- Table 1: North American Lightweight Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North American Lightweight Car Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: North American Lightweight Car Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 4: North American Lightweight Car Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: North American Lightweight Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North American Lightweight Car Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: North American Lightweight Car Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North American Lightweight Car Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 13: North American Lightweight Car Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North American Lightweight Car Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico North American Lightweight Car Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Lightweight Car Market?

The projected CAGR is approximately 10.27%.

2. Which companies are prominent players in the North American Lightweight Car Market?

Key companies in the market include Mazda Motor Corporation, Nissan Motor Co Ltd, Toyota Motors Corporation, General Motors, Volkswagen AG, Kia Motors Corporation, Chevrolet, Subar, Honda Motor Co Ltd, Hyundai Motors, Ford Motor Company.

3. What are the main segments of the North American Lightweight Car Market?

The market segments include Material Type, Manufacturing Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Enhancement in Advanced High-Strength Steels (AHSS) Technology to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Composite Material Segment to gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Raw Material Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

In August 2023, a team of researchers led by Clemson University created a lightweight vehicle door that increases fuel efficiency while meeting federal safety regulations using carbon fiber, thermoplastic resin, and cutting-edge computer design techniques. The research team reduced the weight of a steel door by 32% before exposing it to a battery of tests to ensure it fulfilled FMVSS and Honda's safety guidelines, another project partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Lightweight Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Lightweight Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Lightweight Car Market?

To stay informed about further developments, trends, and reports in the North American Lightweight Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence