Key Insights

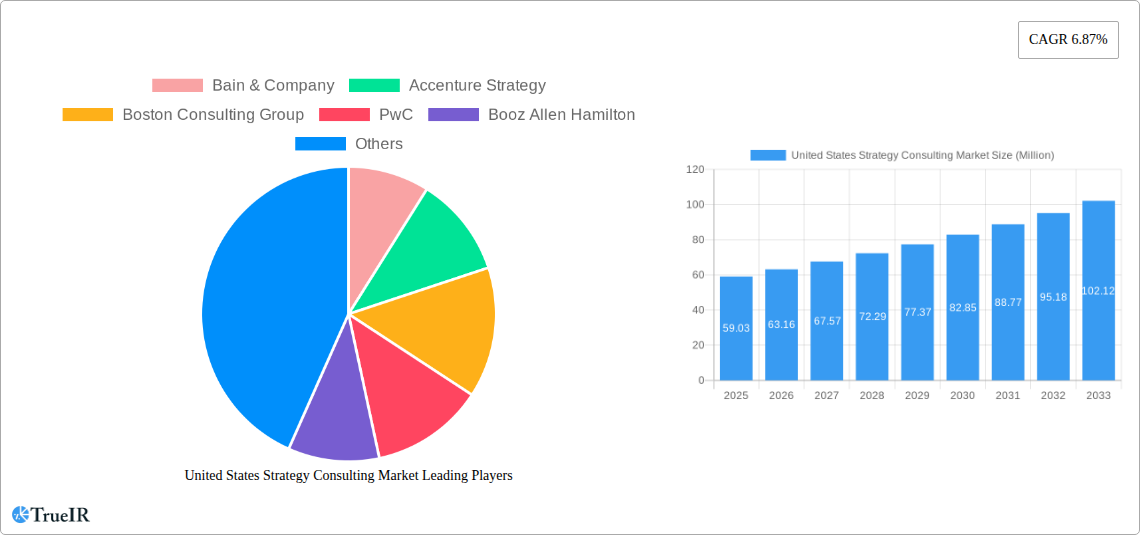

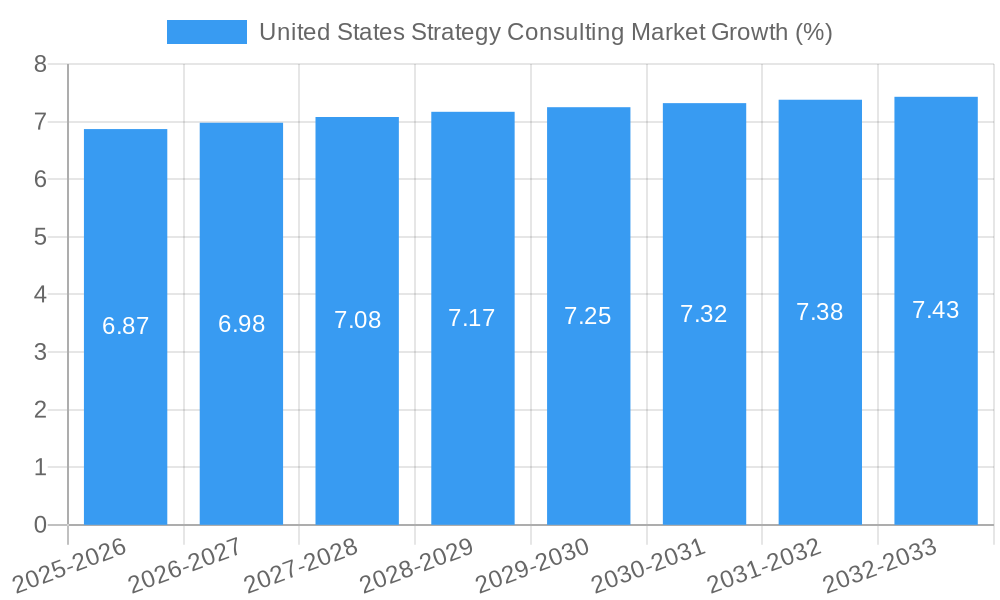

The United States strategy consulting market is poised for robust expansion, projected to reach a valuation of $59.03 million with a compound annual growth rate (CAGR) of 6.87% between 2025 and 2033. This significant growth is fueled by a confluence of factors, including the increasing complexity of business landscapes, the imperative for digital transformation, and the ongoing need for businesses to adapt to evolving economic and regulatory environments. Industries such as IT & Telecommunication, Manufacturing, and Healthcare are at the forefront of demanding sophisticated strategic guidance to navigate disruption and seize new opportunities. The demand for specialized consulting services across HR, operations, and overall business strategy is intensifying as companies seek to optimize performance, enhance competitive advantage, and achieve sustainable growth.

Key drivers for this market expansion include the persistent need for businesses to re-evaluate and refine their long-term strategic objectives in the face of rapid technological advancements and shifting consumer behaviors. Major consulting firms like McKinsey, Accenture Strategy, and Boston Consulting Group are instrumental in shaping this market, offering expertise in areas such as market entry strategies, organizational restructuring, and digital innovation. The market is characterized by a strong emphasis on data-driven insights and the development of actionable roadmaps that enable clients to achieve measurable outcomes. While the market exhibits strong growth potential, potential restraints could emerge from economic downturns or significant geopolitical uncertainties that might lead to reduced corporate spending on consulting services. However, the inherent need for strategic agility in today's dynamic business world is expected to largely counteract these limitations.

This comprehensive report provides an in-depth analysis of the United States Strategy Consulting Market, offering insights into market structure, competitive landscape, key trends, opportunities, and future outlook. Leveraging high-volume keywords, this report is optimized for search engines and designed to engage industry professionals seeking critical market intelligence. The study period covers 2019–2033, with 2025 as the base and estimated year, and a forecast period from 2025–2033, including historical data from 2019–2024.

United States Strategy Consulting Market Market Structure & Competitive Landscape

The United States strategy consulting market exhibits a highly concentrated structure, dominated by a few major players, with a concentration ratio estimated at over 75% for the top five firms. Innovation is a key driver, fueled by continuous investment in R&D and the adoption of advanced analytics, AI, and digital transformation methodologies. Regulatory impacts, while present, are generally supportive of market growth, focusing on data privacy and ethical consulting practices. Product substitutes are limited in the high-end strategic advisory space, though technological advancements in automated analytics platforms are beginning to influence certain sub-segments. End-user segmentation reveals a dynamic interplay across various industries, with IT & Telecommunication and Healthcare showing particularly strong demand. Merger and acquisition (M&A) trends are robust, with an estimated 150+ M&A deals annually in the broader consulting landscape, signaling consolidation and strategic expansion efforts by leading firms.

- Key Market Characteristics:

- High concentration among top-tier strategy consulting firms.

- Significant investment in digital transformation and AI integration.

- Favorable regulatory environment with increasing focus on data governance.

- Limited direct substitutes for complex strategic advisory services.

- Dynamic end-user industry engagement with a focus on technology-driven sectors.

- Active M&A landscape for talent acquisition and market expansion.

United States Strategy Consulting Market Market Trends & Opportunities

The United States strategy consulting market is projected for substantial growth, with an estimated CAGR of approximately 8.5% from 2025–2033. The market size is expected to reach over $200 Billion by 2033, a significant increase from an estimated $120 Billion in 2025. This expansion is driven by several interconnected trends. Technological shifts, particularly the pervasive adoption of Artificial Intelligence (AI), machine learning, and advanced data analytics, are transforming how businesses approach strategy. Consulting firms are leveraging these technologies to offer more sophisticated insights, predictive modeling, and automated solutions, enhancing client decision-making and operational efficiency. Consumer preferences are evolving, with clients increasingly demanding outcome-based consulting, agile methodologies, and specialized expertise in areas like sustainability and digital transformation.

The competitive dynamics are characterized by intense competition, not only among traditional strategy consulting firms but also from technology companies and specialized niche consultancies. This has led to a focus on differentiation through specialized service offerings and deep industry knowledge. Opportunities abound in areas such as digital strategy enablement, supply chain optimization, cybersecurity strategy, and ESG (Environmental, Social, and Governance) consulting. The increasing complexity of global markets, regulatory landscapes, and technological disruption creates a persistent need for expert strategic guidance. Firms that can demonstrate tangible ROI, adapt to evolving client needs, and integrate cutting-edge technologies are best positioned to capitalize on these emerging opportunities. Furthermore, the ongoing digital transformation across all industries, from Manufacturing to Retail, necessitates strategic planning and execution, creating a continuous demand for consulting services.

Dominant Markets & Segments in United States Strategy Consulting Market

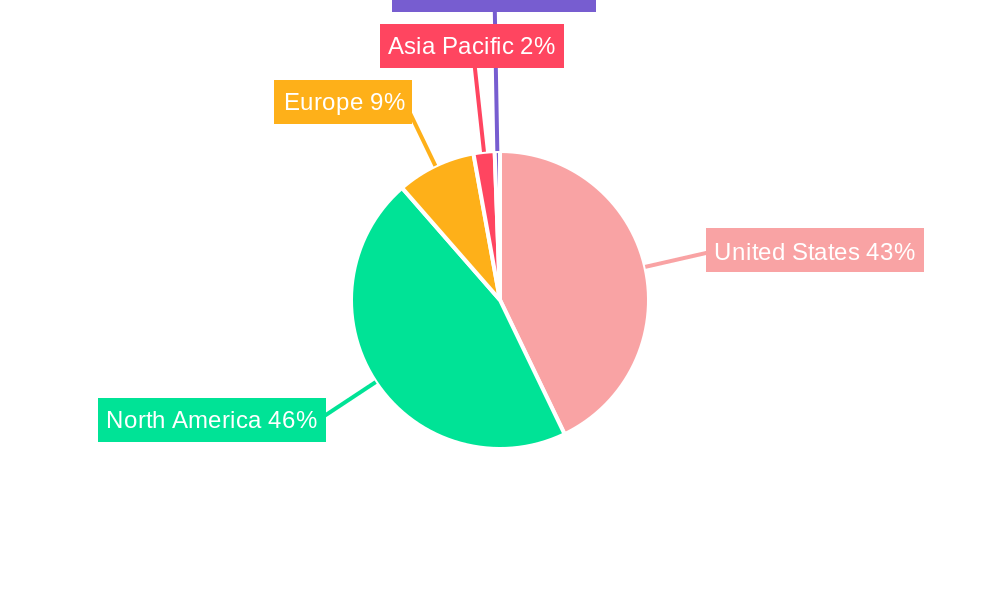

The United States strategy consulting market showcases dominance across specific regions and industry segments. Within the country, the Northeast corridor, encompassing major business hubs like New York City, Boston, and Washington D.C., represents the most dominant market due to its high concentration of corporate headquarters, financial institutions, and government agencies. This region consistently drives significant demand for strategic advisory services.

In terms of service Type, Strategy Consulting itself remains the largest and most influential segment, accounting for an estimated 55% of the total market revenue. This is closely followed by Operations Consulting (around 30%), which focuses on improving efficiency and effectiveness, and HR Consulting (around 15%), which addresses organizational design, talent management, and change management.

Across End-User Industries, the IT & Telecommunication sector is a powerhouse, representing approximately 25% of the market demand. This is driven by the rapid pace of technological innovation, digital transformation initiatives, and the constant need for strategic adaptation in a highly competitive landscape. The Healthcare sector is another significant contributor, with an estimated 18% market share, fueled by regulatory changes, advancements in medical technology, and the increasing focus on patient care and operational efficiency. The Manufacturing sector (around 15%) is experiencing a resurgence due to Industry 4.0 adoption and supply chain reshoring initiatives. The Public Sector (around 12%) is increasingly seeking strategic guidance for modernization and efficiency improvements, while Energy (around 10%) and Retail (around 10%) are adapting to sustainability trends and evolving consumer behaviors.

- Key Growth Drivers for Dominant Segments:

- IT & Telecommunication: Rapid technological advancements, digital transformation mandates, and intense market competition.

- Healthcare: Evolving regulatory frameworks, healthcare reform, technological integration in patient care, and operational optimization needs.

- Manufacturing: Industry 4.0 implementation, automation, supply chain resilience, and reshoring initiatives.

- Public Sector: Government modernization efforts, digital service delivery, and efficiency mandates.

- Strategy Consulting (Type): Increasing business complexity, global market volatility, and the need for long-term strategic planning.

United States Strategy Consulting Market Product Analysis

The "products" in the strategy consulting market are predominantly knowledge-based services and proprietary methodologies. Innovations revolve around the development of advanced analytical frameworks, AI-powered diagnostic tools, and digital transformation roadmapping software. These offerings are designed to provide clients with actionable insights, optimize decision-making, and drive tangible business outcomes. Competitive advantages are derived from deep industry expertise, a proven track record of success, a strong understanding of emerging technologies, and the ability to tailor solutions to unique client challenges. The market fit is strong for solutions that address complex strategic imperatives such as market entry, organizational restructuring, digital innovation, and sustainability integration.

Key Drivers, Barriers & Challenges in United States Strategy Consulting Market

The United States strategy consulting market is propelled by several key drivers, including the accelerating pace of digital transformation, the increasing complexity of global business environments, and the growing demand for specialized expertise in areas like ESG and cybersecurity. Economic growth, corporate restructuring, and the need for competitive advantage further fuel market expansion. Technological advancements, such as AI and advanced analytics, are not only drivers but also tools that consulting firms leverage to deliver enhanced value.

However, the market faces significant challenges. Intense competition from a broad spectrum of players, including Big Four accounting firms, technology giants, and boutique consultancies, puts pressure on pricing and margins. Regulatory hurdles, particularly concerning data privacy and compliance, require careful navigation. Economic downturns or increased uncertainty can lead to reduced corporate spending on consulting services. Supply chain disruptions can indirectly impact client businesses, leading to project reprioritization or postponement, thereby affecting demand for strategic interventions. The perception of high consulting fees can also act as a barrier for some organizations.

Growth Drivers in the United States Strategy Consulting Market Market

The United States strategy consulting market is experiencing robust growth fueled by several critical factors. The ongoing digital transformation imperative across all industries compels businesses to seek expert guidance in adopting new technologies, redesigning business models, and enhancing customer experiences. Furthermore, increasing economic volatility and geopolitical shifts necessitate agile strategic planning and risk mitigation, creating sustained demand for consulting services. Advancements in AI and data analytics are enabling consultants to offer more sophisticated, data-driven insights, driving innovation and competitive advantage for their clients. Government initiatives supporting technological adoption and infrastructure development also contribute to market expansion.

Challenges Impacting United States Strategy Consulting Market Growth

Despite strong growth prospects, the United States strategy consulting market confronts several challenges. Intense competition from a widening array of service providers, including management consultancies, IT firms, and niche specialists, exerts downward pressure on pricing and necessitates constant differentiation. Evolving regulatory landscapes, particularly around data privacy (e.g., CCPA) and industry-specific compliance, demand significant expertise and can create complexities in project execution. Moreover, economic uncertainties or recessions can lead to budget cuts in non-essential services, impacting the demand for strategic consulting. Client expectations are also rising, demanding demonstrable ROI and tangible outcomes, which places a higher burden on consulting firms to deliver measurable value.

Key Players Shaping the United States Strategy Consulting Market Market

- Bain & Company

- Accenture Strategy

- Boston Consulting Group

- PwC

- Booz Allen Hamilton

- McKinsey

- KPMG

- A.T. Kearney

- EY

- Deloitte

Significant United States Strategy Consulting Market Industry Milestones

- September 2023: XIX International, a trade management consulting firm based in Dubai, announced its expansion into the US market to assist clients in managing overseas trade contracts, aiming to support US-based trading corporations in improving assurance and supply chain management for imported goods.

- April 2023: Credera, a US-based commercial and technology consulting firm, entered the German market, marking its expansion into mainland Europe. This venture is a joint effort with Smart Digital, a German tech consulting company, and is headquartered in Berlin with a team of 100 professionals, operating under Credera's parent company, Omnicom Group.

Future Outlook for United States Strategy Consulting Market Market

The future outlook for the United States strategy consulting market remains exceptionally positive, driven by persistent demand for strategic guidance in navigating complex business landscapes. Key growth catalysts include the continued acceleration of digital transformation, the increasing emphasis on sustainability and ESG initiatives, and the ongoing need for operational efficiency and resilience in supply chains. The integration of advanced technologies like AI and machine learning will further enhance the value proposition of consulting services, enabling more predictive and personalized strategies. Strategic opportunities lie in areas such as cybersecurity strategy, cloud adoption, and the transformation of traditional industries through digital innovation, promising sustained market expansion and evolving service offerings.

United States Strategy Consulting Market Segmentation

-

1. Type

- 1.1. HR Consulting

- 1.2. Strategy Consulting

- 1.3. Operations Consulting

-

2. End-User Industry

- 2.1. IT & Telecommunication

- 2.2. Manufacturing

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Public Sector

- 2.6. Retail

- 2.7. Other End-User Industries

United States Strategy Consulting Market Segmentation By Geography

- 1. United States

United States Strategy Consulting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth

- 3.3. Market Restrains

- 3.3.1. Project Complexities and Shift In Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Strategy Consulting Segment is Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. HR Consulting

- 5.1.2. Strategy Consulting

- 5.1.3. Operations Consulting

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. IT & Telecommunication

- 5.2.2. Manufacturing

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Public Sector

- 5.2.6. Retail

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. DACH Region United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. United Kingdom and Ireland United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. France United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Benelux United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Eastern Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Scandinavia United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Rest of Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bain & Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Accenture Strategy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Boston Consulting Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PwC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Booz Allen Hamilton

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 McKinsey

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KPMG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 A T Kearney

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 EY

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Deloitte

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Bain & Company

List of Figures

- Figure 1: United States Strategy Consulting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Strategy Consulting Market Share (%) by Company 2024

List of Tables

- Table 1: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 21: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Strategy Consulting Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the United States Strategy Consulting Market?

Key companies in the market include Bain & Company, Accenture Strategy, Boston Consulting Group, PwC, Booz Allen Hamilton, McKinsey, KPMG, A T Kearney, EY, Deloitte.

3. What are the main segments of the United States Strategy Consulting Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth.

6. What are the notable trends driving market growth?

Strategy Consulting Segment is Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

Project Complexities and Shift In Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

In September 2023, XIX International, a consulting firm dealing with trade management, located in Dubai, announced its plans to provide services to its clients in the US for assisting customers in managing overseas trade contracts. XIX International's purpose is is to aid US-based trading corporations that import foreign goods into the US to progress excellent assurance and supply chain management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Strategy Consulting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Strategy Consulting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Strategy Consulting Market?

To stay informed about further developments, trends, and reports in the United States Strategy Consulting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence