Key Insights

The Japan Multilayer Ceramic Capacitor (MLCC) market is projected for significant expansion, reaching an estimated market size of $1.95 billion by 2024, with a robust Compound Annual Growth Rate (CAGR) of 22.5%. This growth is primarily driven by escalating demand from core industries. The consumer electronics sector, a vital contributor to Japan's technological leadership, fuels MLCC adoption through the widespread use of smartphones, wearable devices, and sophisticated home appliances, all necessitating compact, high-performance capacitors. The rapidly expanding automotive industry, particularly its focus on electric vehicles (EVs) and advanced driver-assistance systems (ADAS), presents a substantial growth opportunity. EVs, requiring a higher density of MLCCs for efficient power management and control, are a key market catalyst. The telecommunications sector, with the continuous deployment of 5G infrastructure and the growing need for high-speed data transmission, also contributes to the market's dynamic growth.

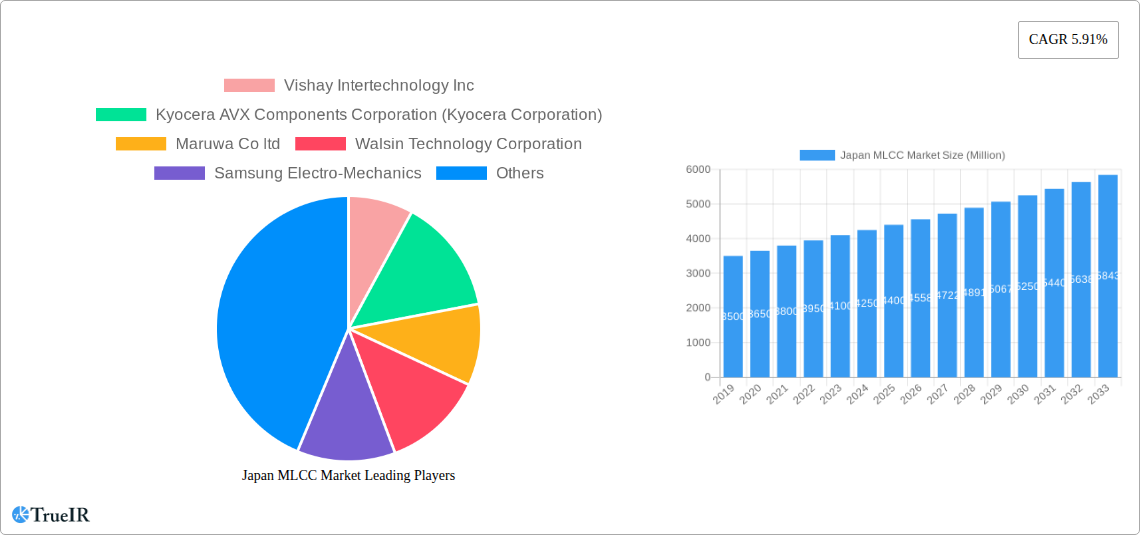

Japan MLCC Market Market Size (In Billion)

Key trends are shaping the Japan MLCC market. The ongoing pursuit of miniaturization is increasing demand for smaller case sizes (e.g., 0201, 0402), facilitating more compact and efficient electronic devices. Innovations in dielectric materials, including the development of Class 2 MLCCs with enhanced capacitance, are addressing the demand for greater energy storage within smaller footprints. Emerging applications in industrial automation, medical devices, and aerospace & defense further diversify the market, each presenting unique requirements for reliability and performance. While the market exhibits a strong growth trajectory, potential restraints include supply chain volatility, geopolitical impacts on raw material availability, and intense price competition among leading manufacturers such as Murata Manufacturing Co., Ltd., Samsung Electro-Mechanics, and TDK Corporation. Nevertheless, continuous technological innovation and robust domestic demand in Japan are expected to sustain market vitality.

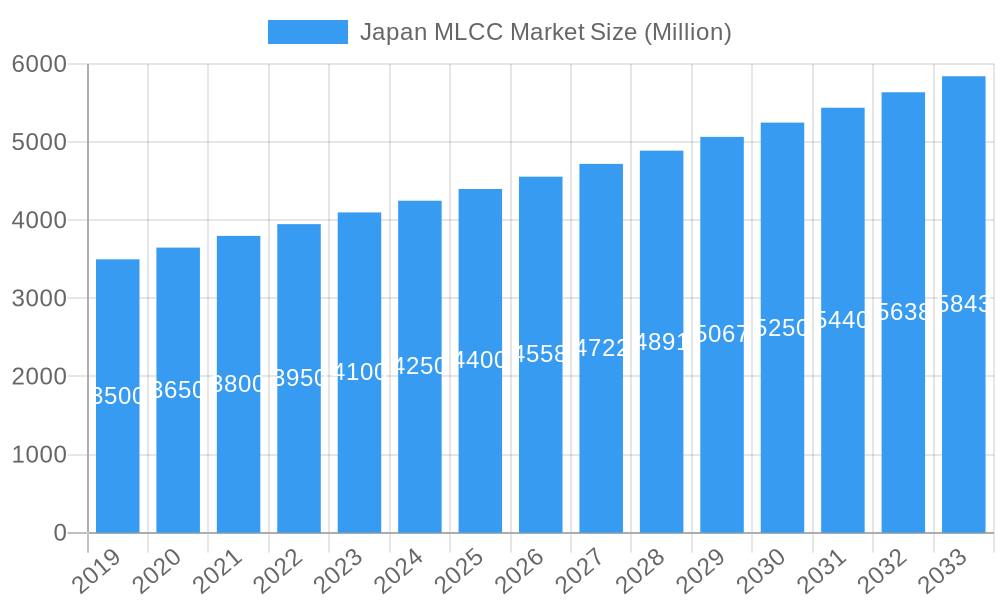

Japan MLCC Market Company Market Share

Japan MLCC Market Analysis: Future Outlook, Trends, and Competitive Landscape (2019-2033)

This comprehensive report delves into the dynamic Japan MLCC market, offering an in-depth analysis of market structure, trends, opportunities, and the competitive landscape from 2019 to 2033. With a base year of 2025, the study provides crucial insights into the market's evolution, driven by surging demand in automotive, telecommunications, and consumer electronics sectors. Explore key segments like Class 2 dielectrics, 0402 case size MLCCs, and Surface Mount MLCCs, and understand their impact on the overall market trajectory. This report is essential for stakeholders seeking to navigate the complexities of the Japanese capacitor industry, identify strategic growth avenues, and capitalize on emerging technological advancements in Multilayer Ceramic Capacitors (MLCCs).

Japan MLCC Market Market Structure & Competitive Landscape

The Japan MLCC market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Innovation remains a key driver, with companies continuously investing in R&D to develop advanced MLCCs for high-frequency, high-voltage, and miniaturized applications. Regulatory impacts, primarily concerning environmental standards and electronic waste management, are also shaping market dynamics. While direct product substitutes are limited, alternative capacitor technologies pose a competitive threat, particularly in niche applications. The segmentation by end-user industries highlights the critical role of the automotive sector, driven by the proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Mergers and acquisitions (M&A) have been a strategic tool for companies to expand their product portfolios and geographical reach. For instance, Yageo Corporation's acquisition of KEMET has significantly altered the competitive landscape. The market concentration ratio is estimated to be around 65-70% among the top five players. M&A volumes have seen a steady increase, reflecting industry consolidation efforts.

Japan MLCC Market Market Trends & Opportunities

The Japan MLCC market is experiencing robust growth, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is propelled by the relentless demand for miniaturization and higher performance in electronic devices across various sectors. The automotive industry, particularly the EV segment, is a significant growth catalyst, with an increasing number of MLCCs being integrated into battery management systems, power inverters, and on-board chargers. Technological shifts are evident in the development of MLCCs with higher capacitance values, enhanced voltage ratings, and improved temperature stability, catering to the evolving needs of next-generation electronics. Consumer preferences are leaning towards smaller, more energy-efficient, and feature-rich devices, further fueling the demand for advanced MLCCs. The telecommunications sector, with the ongoing rollout of 5G networks, also presents substantial opportunities for MLCC manufacturers due to the increased density of electronic components in base stations and user equipment. Furthermore, the industrial automation trend and the growing adoption of smart grid technologies are creating new avenues for market penetration. The trend towards higher capacitance values, such as 100µF to 1000µF, is particularly noteworthy, driven by the power management requirements of modern electronic systems. The Japan MLCC market presents a fertile ground for companies focusing on high-reliability components for mission-critical applications.

Dominant Markets & Segments in Japan MLCC Market

The Japan MLCC market is witnessing dominance across several key segments. The Automotive end-user segment is the largest and fastest-growing, driven by the accelerating adoption of EVs, autonomous driving technology, and in-car infotainment systems. The increasing complexity of automotive electronics necessitates a higher density of MLCCs, with specific requirements for high voltage and temperature resistance.

- Dielectric Type: Class 2 dielectrics are currently the dominant segment due to their higher capacitance density and cost-effectiveness, making them suitable for a wide range of general-purpose applications. However, Class 1 dielectrics are gaining traction in high-precision applications demanding greater stability.

- Case Size: The 0402 and 0603 case sizes represent the most significant volume due to their widespread use in miniaturized consumer electronics and mobile devices. The trend towards even smaller form factors like 0201 is also evident, pushing innovation in manufacturing processes. Larger case sizes like 1210 are crucial for high-power applications.

- Voltage: The Less than 500V segment holds the largest market share, serving the majority of consumer electronics and telecommunication devices. However, the 500V to 1000V segment is experiencing rapid growth, largely fueled by the automotive industry's increasing voltage requirements for EVs. The More than 1000V segment, though smaller, is critical for specialized industrial and power applications.

- Capacitance: The Less than 100µF range dominates the market, encompassing a vast array of applications. However, the demand for higher capacitance, from 100µF to 1000µF, is on an upward trajectory, driven by advanced power management circuits and energy storage solutions.

- MLCC Mounting Type: Surface Mount technology is the undisputed leader, enabling high-density board design and automated manufacturing processes essential for mass production of electronic devices.

- End User: Beyond the dominant Automotive sector, Telecommunication and Consumer Electronics are significant contributors. The burgeoning IoT market is also driving demand across all end-user segments.

Japan MLCC Market Product Analysis

Recent product innovations in the Japan MLCC market underscore a strong focus on high-performance, miniaturization, and specialized applications. Companies are developing MLCCs with enhanced dielectric materials that offer improved capacitance density and stable electrical characteristics across a wide temperature range. Key advancements include the development of MLCCs capable of handling higher voltages and currents, crucial for the electrification of the automotive sector and the expansion of 5G infrastructure. The drive towards smaller case sizes, such as the 0201 and 01005 formats, while maintaining high capacitance and reliability, is a significant area of innovation. These product advancements are directly addressing the evolving needs for more compact, power-efficient, and feature-rich electronic devices. Competitive advantages are being gained by manufacturers who can offer a comprehensive portfolio of high-quality MLCCs catering to diverse application requirements, coupled with robust supply chain management.

Key Drivers, Barriers & Challenges in Japan MLCC Market

The Japan MLCC market is primarily propelled by the escalating demand for advanced electronic devices across key sectors like automotive, telecommunications, and consumer electronics. Technological advancements in miniaturization and high-performance components are significant drivers, alongside government initiatives promoting digitalization and smart infrastructure. The growing adoption of electric vehicles (EVs) and sophisticated automotive electronics is a major catalyst.

Conversely, the market faces several barriers and challenges. Supply chain disruptions, stemming from raw material availability and geopolitical factors, can impact production and pricing. Intense price competition, especially from emerging manufacturers, puts pressure on profit margins. Stringent quality control and reliability standards, particularly for automotive and industrial applications, require significant investment in R&D and manufacturing processes. The complexity of managing diverse product portfolios and catering to niche application demands also presents challenges.

Growth Drivers in the Japan MLCC Market Market

Several critical factors are fueling the growth of the Japan MLCC market. The ongoing technological revolution in the automotive industry, with the surge in EVs and autonomous driving systems, is a primary growth driver. The expansion of 5G networks and the proliferation of IoT devices are also significantly boosting demand for high-performance MLCCs. Furthermore, government support for digitalization initiatives and smart city development in Japan is creating a favorable ecosystem for electronic component manufacturers. The increasing need for compact and power-efficient electronic devices across all consumer segments also contributes to market expansion.

Challenges Impacting Japan MLCC Market Growth

The Japan MLCC market is not without its challenges. Supply chain vulnerabilities, including the availability and price volatility of key raw materials like ceramic powders and palladium, pose a persistent threat. Intense competition, both from established global players and emerging regional manufacturers, leads to pricing pressures. Meeting the increasingly stringent quality and reliability standards demanded by sectors like automotive and medical devices requires substantial investment in research, development, and advanced manufacturing capabilities. Regulatory complexities, particularly concerning environmental compliance and product certifications, can also add to operational costs and timelines.

Key Players Shaping the Japan MLCC Market Market

- Murata Manufacturing Co Ltd

- TDK Corporation

- Taiyo Yuden Co Ltd

- Kyocera AVX Components Corporation (Kyocera Corporation)

- Samsung Electro-Mechanics

- Yageo Corporation

- Vishay Intertechnology Inc

- Würth Elektronik GmbH & Co KG

- Maruwa Co ltd

- Walsin Technology Corporation

- Nippon Chemi-Con Corporation

Significant Japan MLCC Market Industry Milestones

- July 2023: KEMET, part of the Yageo Corporation, launched its X7R automotive-grade MLCC, designed for high-voltage automotive subsystems (100pF-0.1uF, 500V-1kV) in EIA 0603-1210 cases, enhancing safety and reliability in automotive applications.

- June 2023: Driven by the growing demand for industrial equipment, an unnamed company introduced the NTS/NTF Series of SMD type MLCCs (25-500 Vdc, 0.010-47µF) for applications like on-board power supplies and DC-DC converter smoothing circuits.

- May 2023: Murata introduced its EVA series of MLCCs, offering versatility for EV manufacturers in applications such as OBC, inverters, DC/DC converters, BMS, and WPT, supporting 800V powertrains and miniaturization requirements.

Future Outlook for Japan MLCC Market Market

The future outlook for the Japan MLCC market remains exceptionally positive, driven by continued innovation and the indispensable role of MLCCs in emerging technologies. The relentless pursuit of smaller, more powerful, and energy-efficient electronic devices will sustain demand across all major end-user segments, particularly automotive and telecommunications. Strategic opportunities lie in the development of advanced MLCCs for high-frequency applications, high-power solutions for next-generation EVs, and components for the burgeoning IoT and artificial intelligence sectors. Collaboration between MLCC manufacturers and end-product developers will be crucial in aligning product roadmaps with evolving technological needs, ensuring sustained market growth and leadership in the global electronic components landscape.

Japan MLCC Market Segmentation

-

1. Dielectric Type

- 1.1. Class 1

- 1.2. Class 2

-

2. Case Size

- 2.1. 0 201

- 2.2. 0 402

- 2.3. 0 603

- 2.4. 1 005

- 2.5. 1 210

- 2.6. Others

-

3. Voltage

- 3.1. 500V to 1000V

- 3.2. Less than 500V

- 3.3. More than 1000V

-

4. Capacitance

- 4.1. 100µF to 1000µF

- 4.2. Less than 100µF

- 4.3. More than 1000µF

-

5. Mlcc Mounting Type

- 5.1. Metal Cap

- 5.2. Radial Lead

- 5.3. Surface Mount

-

6. End User

- 6.1. Aerospace and Defence

- 6.2. Automotive

- 6.3. Consumer Electronics

- 6.4. Industrial

- 6.5. Medical Devices

- 6.6. Power and Utilities

- 6.7. Telecommunication

- 6.8. Others

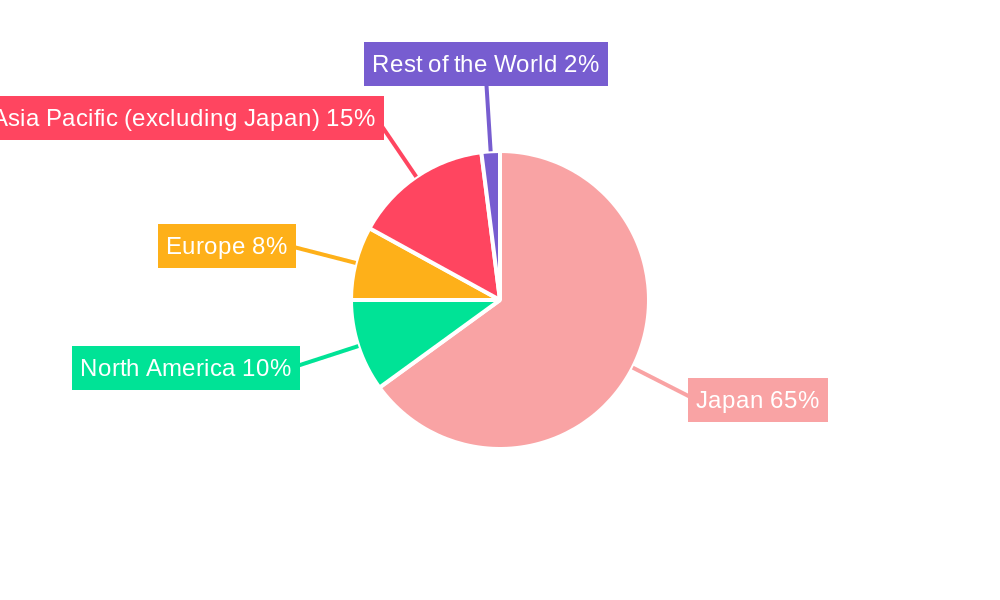

Japan MLCC Market Segmentation By Geography

- 1. Japan

Japan MLCC Market Regional Market Share

Geographic Coverage of Japan MLCC Market

Japan MLCC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan MLCC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 5.1.1. Class 1

- 5.1.2. Class 2

- 5.2. Market Analysis, Insights and Forecast - by Case Size

- 5.2.1. 0 201

- 5.2.2. 0 402

- 5.2.3. 0 603

- 5.2.4. 1 005

- 5.2.5. 1 210

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Voltage

- 5.3.1. 500V to 1000V

- 5.3.2. Less than 500V

- 5.3.3. More than 1000V

- 5.4. Market Analysis, Insights and Forecast - by Capacitance

- 5.4.1. 100µF to 1000µF

- 5.4.2. Less than 100µF

- 5.4.3. More than 1000µF

- 5.5. Market Analysis, Insights and Forecast - by Mlcc Mounting Type

- 5.5.1. Metal Cap

- 5.5.2. Radial Lead

- 5.5.3. Surface Mount

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Aerospace and Defence

- 5.6.2. Automotive

- 5.6.3. Consumer Electronics

- 5.6.4. Industrial

- 5.6.5. Medical Devices

- 5.6.6. Power and Utilities

- 5.6.7. Telecommunication

- 5.6.8. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vishay Intertechnology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Maruwa Co ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Walsin Technology Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electro-Mechanics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Würth Elektronik GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yageo Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Taiyo Yuden Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TDK Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Murata Manufacturing Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon Chemi-Con Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Japan MLCC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan MLCC Market Share (%) by Company 2025

List of Tables

- Table 1: Japan MLCC Market Revenue billion Forecast, by Dielectric Type 2020 & 2033

- Table 2: Japan MLCC Market Revenue billion Forecast, by Case Size 2020 & 2033

- Table 3: Japan MLCC Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 4: Japan MLCC Market Revenue billion Forecast, by Capacitance 2020 & 2033

- Table 5: Japan MLCC Market Revenue billion Forecast, by Mlcc Mounting Type 2020 & 2033

- Table 6: Japan MLCC Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Japan MLCC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Japan MLCC Market Revenue billion Forecast, by Dielectric Type 2020 & 2033

- Table 9: Japan MLCC Market Revenue billion Forecast, by Case Size 2020 & 2033

- Table 10: Japan MLCC Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 11: Japan MLCC Market Revenue billion Forecast, by Capacitance 2020 & 2033

- Table 12: Japan MLCC Market Revenue billion Forecast, by Mlcc Mounting Type 2020 & 2033

- Table 13: Japan MLCC Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Japan MLCC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan MLCC Market?

The projected CAGR is approximately 22.5%.

2. Which companies are prominent players in the Japan MLCC Market?

Key companies in the market include Vishay Intertechnology Inc, Kyocera AVX Components Corporation (Kyocera Corporation), Maruwa Co ltd, Walsin Technology Corporation, Samsung Electro-Mechanics, Würth Elektronik GmbH & Co KG, Yageo Corporatio, Taiyo Yuden Co Ltd, TDK Corporation, Murata Manufacturing Co Ltd, Nippon Chemi-Con Corporation.

3. What are the main segments of the Japan MLCC Market?

The market segments include Dielectric Type, Case Size, Voltage, Capacitance, Mlcc Mounting Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

July 2023: KEMET, part of the Yageo Corporation developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet the high voltage requirements of automotive subsystems, ranging from 100pF-0.1uF and with a DC voltage range of 500V-1kV. The range of cases available is EIA 0603-1210, and is suitable for both automotive under hoods and in-cabin applications. These MLCCs demonstrate the essential and reliable nature of capacitors, which are essential for the mission and safety of automotive subsystems.June 2023: The growing demand for industrial equipments has driven the company to introduce NTS/NTF NTS/NTF Series of SMD type MLCC. These capacitors are rated with 25 to 500 Vdc with a capacitance ranging from 0.010 to 47µF. These MLCCs are used in on-board power supplies,voltage regulators for computers,smoothing circuit of DC-DC converters,etc.May 2023: Murata has introduced the EVA series of MLCC, which are beneficial to EV manufacturers due to their versatility. These MLCC's can be used in a variety of applications, including OBC (On-Board Charger), inverter and DC/DC Converter, BMS (Battery Management System), and WPT (Wireless Power Transfer) implementations. As a result, they are ideal to the increased isolation that the 800V powertrain migration will require, while also meeting the miniaturization requirements of modern automotive systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan MLCC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan MLCC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan MLCC Market?

To stay informed about further developments, trends, and reports in the Japan MLCC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence