Key Insights

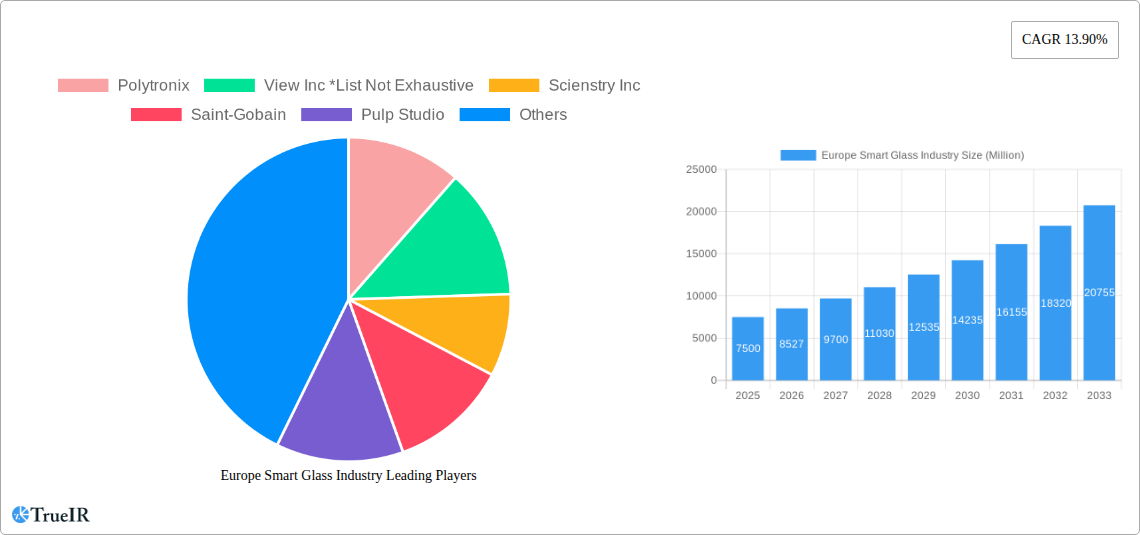

The European Smart Glass Market is poised for substantial expansion, projected to reach a market size of approximately $7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 13.90% expected to drive it through 2033. This remarkable growth is primarily fueled by increasing demand for energy-efficient building solutions and advancements in smart home technology across the region. The construction sector, encompassing both residential and commercial buildings, stands as a dominant application segment, driven by stringent building regulations promoting sustainability and innovative architectural designs. Furthermore, the automotive industry's adoption of smart glass for enhanced passenger comfort, privacy, and safety, alongside its growing use in aerospace and rail applications, contributes significantly to market momentum. Technological advancements, particularly in Suspended Particle Devices (SPDs) and Electro-chromic Glass, are offering superior performance and versatility, further stimulating market penetration.

Europe Smart Glass Industry Market Size (In Billion)

The European market's growth is strategically supported by key players like Saint-Gobain, View Inc., and Gentex Corporation, actively investing in research and development to introduce next-generation smart glass solutions. Countries such as the United Kingdom, Germany, and France are leading the adoption due to a strong emphasis on green building initiatives, high disposable incomes, and a receptive consumer base for advanced technologies. While the market benefits from a clear upward trajectory, certain restraints, such as the initial high cost of installation for some smart glass technologies and a lack of widespread consumer awareness in specific segments, could pose challenges. However, ongoing innovation, economies of scale, and increasing government support for energy-efficient solutions are expected to mitigate these limitations, paving the way for sustained and dynamic market growth in Europe.

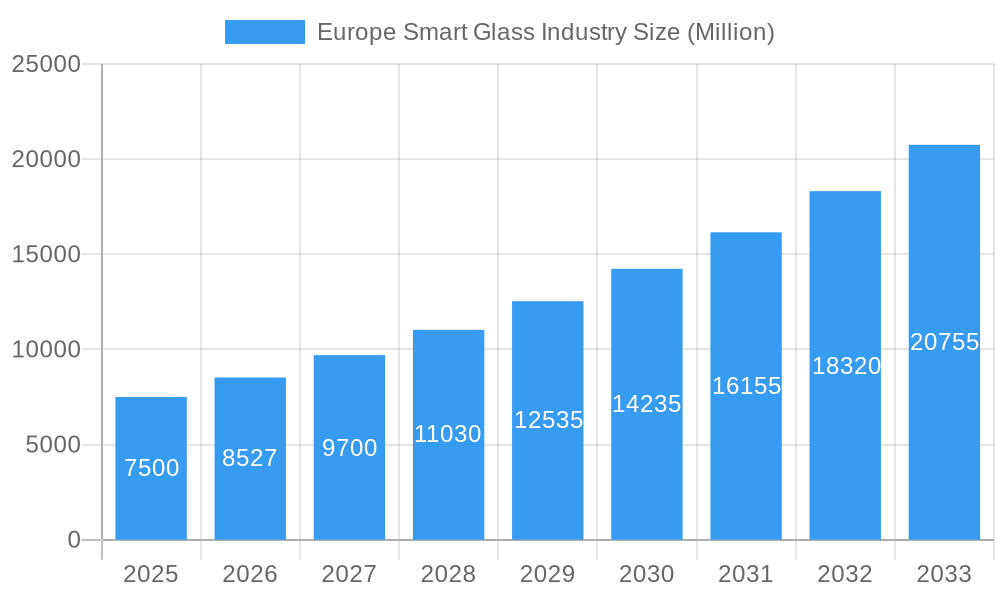

Europe Smart Glass Industry Company Market Share

Europe Smart Glass Industry: Market Dynamics, Trends, and Forecasts 2019-2033

This comprehensive report delves into the dynamic Europe Smart Glass Industry, providing an in-depth analysis of market structure, trends, opportunities, and key players. Covering the historical period from 2019-2024 and projecting growth through 2033, this report leverages high-volume SEO keywords to engage industry professionals and enhance search visibility. Discover the intricate landscape of smart glass technologies, diverse applications, and the evolving competitive environment across Europe.

Europe Smart Glass Industry Market Structure & Competitive Landscape

The Europe Smart Glass Industry is characterized by a moderately concentrated market structure, with a significant presence of both established chemical and glass manufacturers, alongside innovative technology-driven companies. Key innovation drivers include advancements in material science, energy efficiency mandates, and increasing demand for dynamic architectural solutions and enhanced user experiences in transportation and consumer electronics. Regulatory impacts, particularly those related to building codes for energy conservation and sustainability, are significantly shaping market adoption. Product substitutes, while present in traditional window treatments, are increasingly being challenged by the superior functionality and aesthetic appeal of smart glass. End-user segmentation reveals a strong focus on the construction sector, followed by transportation and emerging opportunities in consumer electronics. Mergers and Acquisitions (M&A) trends are indicative of consolidation and strategic partnerships aimed at expanding technological capabilities and market reach. For instance, the historical period witnessed XX M&A deals totaling an estimated value of XX Million Euros, reflecting a robust appetite for strategic integration and market consolidation. Concentration ratios are estimated to be around XX% for the top five players, highlighting a dynamic yet competitive landscape.

Europe Smart Glass Industry Market Trends & Opportunities

The Europe Smart Glass Industry is poised for substantial growth, driven by escalating demand for energy-efficient building solutions and innovative integration in the automotive and aerospace sectors. The market size is projected to expand from an estimated XX Million Euros in the base year of 2025 to an impressive XX Million Euros by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Technological shifts are a dominant trend, with a notable move towards more sophisticated electro-chromic and liquid crystal technologies offering superior control over light and heat transmission, thereby reducing energy consumption in buildings. Consumer preferences are increasingly leaning towards smart functionalities that enhance comfort, privacy, and aesthetic appeal. This includes a growing desire for self-tinting windows in residential and commercial spaces, as well as dynamic displays integrated into automotive interiors and aircraft cabins. Competitive dynamics are intensifying, with companies focusing on product differentiation through advanced features, cost optimization, and strategic partnerships. The market penetration rate for smart glass in new construction is still relatively nascent, presenting significant untapped potential for growth and innovation. Opportunities abound in the development of integrated smart window systems that can communicate with building management systems, optimize natural light utilization, and contribute to overall energy savings, further bolstering the market's upward trajectory. The increasing adoption of smart devices and the growing awareness of environmental sustainability are creating a fertile ground for smart glass solutions across various applications.

Dominant Markets & Segments in Europe Smart Glass Industry

The Construction segment is a dominant force within the Europe Smart Glass Industry, driven by stringent energy efficiency regulations and a growing emphasis on sustainable building practices across the continent. Within construction, Commercial Buildings represent a significant market share due to the high demand for advanced facade solutions that offer dynamic shading, glare reduction, and improved occupant comfort, thereby reducing HVAC operational costs. Germany, the UK, and France are leading countries in adopting smart glass technologies in this sector, fueled by substantial government incentives and a strong pipeline of green building projects.

In terms of technology, Electro-chromic Glass is gaining substantial traction due to its ability to offer precise control over light transmission and its compatibility with architectural designs. Its ability to transition between clear and tinted states seamlessly makes it ideal for dynamic facades.

The Transportation sector, particularly Automotive, is emerging as a significant growth driver. The integration of smart glass in vehicle windows and sunroofs offers enhanced passenger comfort, reduced glare, and improved privacy, aligning with the premium features demanded in modern vehicles. Countries like Germany, with its strong automotive industry, are at the forefront of this adoption.

Other key growth drivers in the construction sector include:

- Infrastructure Development: Ongoing urban regeneration projects and the construction of new commercial complexes.

- Government Policies: Favorable building codes and incentives for energy-efficient and sustainable construction.

- Technological Advancements: Improvements in durability, cost-effectiveness, and ease of installation of smart glass systems.

In the transportation sector, key growth drivers include:

- Automotive Electrification: The trend towards electric vehicles often incorporates advanced features, including smart glass.

- Demand for Premium Features: Consumers increasingly expect enhanced comfort and advanced functionalities in their vehicles.

- Aerospace Applications: Growing demand for lightweight, durable smart glass solutions in aircraft cabins for passenger comfort and cabin control.

The Energy sector also presents emerging opportunities, particularly in the development of smart windows for solar energy integration and optimized building energy management.

Europe Smart Glass Industry Product Analysis

Product innovations in the Europe Smart Glass Industry are primarily focused on enhancing functionality, energy efficiency, and user experience. Advancements in liquid crystal and electro-chromic technologies are leading to faster switching times, improved durability, and a wider range of tinting capabilities. Smart glass is increasingly being integrated into building facades to dynamically control natural light and reduce solar heat gain, offering significant energy savings. In the transportation sector, applications range from self-tinting windows in high-end vehicles to integrated display functionalities in aircraft cabins. The competitive advantage lies in offering tailored solutions that meet specific application requirements, such as privacy, glare control, and thermal insulation, while also catering to aesthetic demands in modern architectural and automotive designs.

Key Drivers, Barriers & Challenges in Europe Smart Glass Industry

The Europe Smart Glass Industry is propelled by several key drivers. Technological advancements in material science and control systems are making smart glass more accessible and performing. Government regulations and sustainability mandates, such as those promoting energy efficiency in buildings, are significant catalysts. The growing consumer demand for enhanced comfort, privacy, and aesthetic appeal in both residential and commercial spaces, coupled with the increasing adoption of smart technologies in daily life, further fuels market growth. For instance, the increasing focus on Net-Zero targets across Europe is a major driver for energy-saving building materials.

However, the industry faces several barriers and challenges. High upfront costs compared to traditional glass remain a significant restraint for widespread adoption, particularly in price-sensitive markets. Complex installation procedures and integration with existing building management systems can also pose challenges. Regulatory hurdles and the need for standardization across different European countries can slow down market penetration. Supply chain issues, particularly for specialized components, and the availability of skilled labor for installation and maintenance also present ongoing challenges. Furthermore, the competitive pressure from alternative energy-saving solutions necessitates continuous innovation and cost reduction.

Growth Drivers in the Europe Smart Glass Industry Market

Key growth drivers in the Europe Smart Glass Industry are multifaceted. Technologically, continuous advancements in electro-chromic and liquid crystal materials are leading to improved performance and cost-effectiveness. Economically, the growing imperative for energy efficiency and sustainability across all sectors, driven by climate change concerns and government mandates, is a primary impetus. Regulatory factors, such as stringent building codes and incentives for green buildings, actively promote the adoption of smart glass. The increasing demand for enhanced occupant comfort, privacy, and sophisticated aesthetic integration in residential and commercial construction, alongside the growing integration of smart features in the automotive and aerospace industries, further accelerates market expansion.

Challenges Impacting Europe Smart Glass Industry Growth

Several challenges are impacting the growth of the Europe Smart Glass Industry. The high initial investment cost remains a significant barrier to widespread adoption, particularly for smaller projects and in budget-conscious segments. Complex installation processes and the need for specialized expertise can also hinder market penetration. Regulatory complexities and the lack of unified standards across different European nations can create market fragmentation and slow down growth. Supply chain vulnerabilities, especially for raw materials and advanced components, can lead to production delays and cost fluctuations. Moreover, intense competitive pressure from established building material providers and emerging alternative energy-saving technologies requires constant innovation and strategic differentiation.

Key Players Shaping the Europe Smart Glass Industry Market

- Polytronix

- View Inc

- Scienstry Inc

- Saint-Gobain

- Pulp Studio

- Smartglass International

- Citala

- Pro Display

- Asahi Glass Corporation

- Gentex Corporation

- Nippon

- Ravenbrick

- Hitachi Chemical

- LTI Smart Glass

- PPG Industries

Significant Europe Smart Glass Industry Industry Milestones

- September 2021: Xiaomi launched its own smart glasses, which are capable of taking photos, displaying messages and notifications, making calls, providing navigation, and translating text right in real-time in front of eyes. The glasses also have an indicator light that shows when the 5-megapixel camera is in use.

- September 2021: Facebook Inc, in partnership with Ray-Ban, launched its first smart glasses named 'Ray-Ban Stories' that allow wearers to listen to music, take calls, or capture photos and short videos and share them across Facebook's services using a companion app.

Future Outlook for Europe Smart Glass Industry Market

The future outlook for the Europe Smart Glass Industry is exceptionally promising, driven by an increasing global focus on sustainability, energy efficiency, and advanced technological integration. Strategic opportunities lie in the continued development of cost-effective and user-friendly smart glass solutions that seamlessly integrate into smart home and building management systems. The expanding applications in the automotive sector, particularly with the rise of autonomous and electric vehicles, will unlock significant market potential. Furthermore, the growing demand for personalized and dynamic environments in both commercial and residential spaces will spur innovation in product customization and advanced functionalities. The industry is expected to witness further consolidation and strategic collaborations as key players aim to leverage technological synergies and expand their market reach across diverse European economies. The forecast indicates sustained growth and innovation, positioning smart glass as a pivotal component in the future of architecture, transportation, and consumer electronics.

Europe Smart Glass Industry Segmentation

-

1. Technology

- 1.1. Suspended Particle Devices

- 1.2. Liquid Crystals

- 1.3. Electro-chromic Glass

- 1.4. Passive Smart glass

- 1.5. Active Smart glass

- 1.6. Others

-

2. Applications

-

2.1. Construction

- 2.1.1. Residential Buildings

- 2.1.2. Commercial Buildings

-

2.2. Transportation

- 2.2.1. Aerospace

- 2.2.2. Rail

- 2.2.3. Automotive

- 2.2.4. Others

- 2.3. Energy

- 2.4. Consumer Electronics

-

2.1. Construction

Europe Smart Glass Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

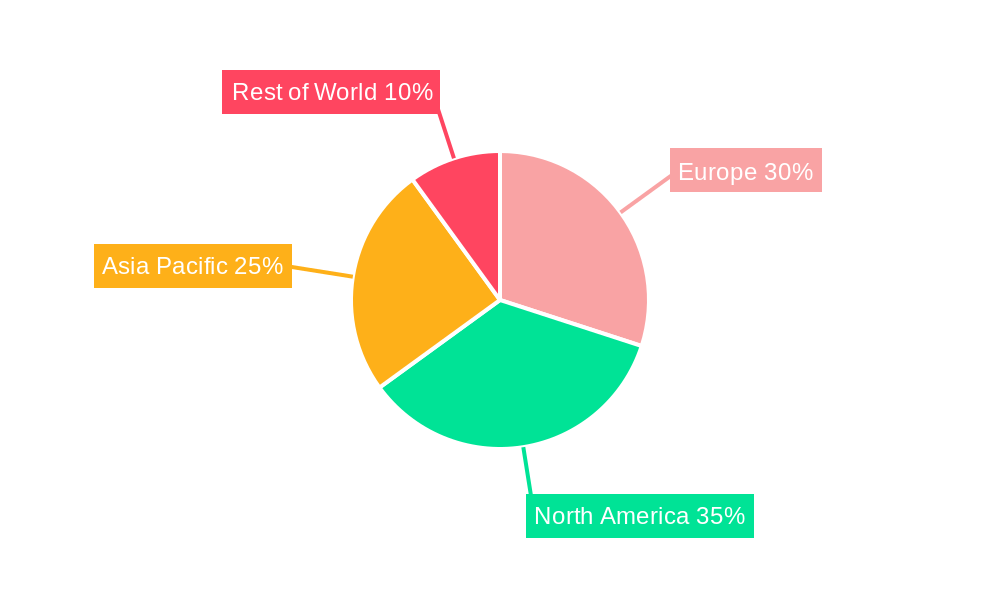

Europe Smart Glass Industry Regional Market Share

Geographic Coverage of Europe Smart Glass Industry

Europe Smart Glass Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing focus on Energy Conservation and Environment Friendly Technologies; Government Regulations; Increasing demand for energy savings techniques

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass

- 3.4. Market Trends

- 3.4.1. Transportation industry is expected to have further growth opportunities in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Glass Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Suspended Particle Devices

- 5.1.2. Liquid Crystals

- 5.1.3. Electro-chromic Glass

- 5.1.4. Passive Smart glass

- 5.1.5. Active Smart glass

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Construction

- 5.2.1.1. Residential Buildings

- 5.2.1.2. Commercial Buildings

- 5.2.2. Transportation

- 5.2.2.1. Aerospace

- 5.2.2.2. Rail

- 5.2.2.3. Automotive

- 5.2.2.4. Others

- 5.2.3. Energy

- 5.2.4. Consumer Electronics

- 5.2.1. Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polytronix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 View Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Scienstry Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saint-Gobain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pulp Studio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smartglass International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Citala

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pro Display

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asahi Glass Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gentex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ravenbrick

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hitachi Chemical

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 LTI Smart Glass

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PPG Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Polytronix

List of Figures

- Figure 1: Europe Smart Glass Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Smart Glass Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Glass Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Europe Smart Glass Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 3: Europe Smart Glass Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Smart Glass Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Europe Smart Glass Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 6: Europe Smart Glass Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Smart Glass Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Glass Industry?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Europe Smart Glass Industry?

Key companies in the market include Polytronix, View Inc *List Not Exhaustive, Scienstry Inc, Saint-Gobain, Pulp Studio, Smartglass International, Citala, Pro Display, Asahi Glass Corporation, Gentex Corporation, Nippon, Ravenbrick, Hitachi Chemical, LTI Smart Glass, PPG Industries.

3. What are the main segments of the Europe Smart Glass Industry?

The market segments include Technology, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing focus on Energy Conservation and Environment Friendly Technologies; Government Regulations; Increasing demand for energy savings techniques.

6. What are the notable trends driving market growth?

Transportation industry is expected to have further growth opportunities in the market.

7. Are there any restraints impacting market growth?

Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass.

8. Can you provide examples of recent developments in the market?

September 2021: Xiaomi launched its own smart glasses, which are capable of taking photos, displaying messages and notifications, making calls, providing navigation, and translating text right in real-time in front of eyes. The glasses also have an indicator light that shows when the 5-megapixel camera is in use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Glass Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Glass Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Glass Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Glass Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence