Key Insights

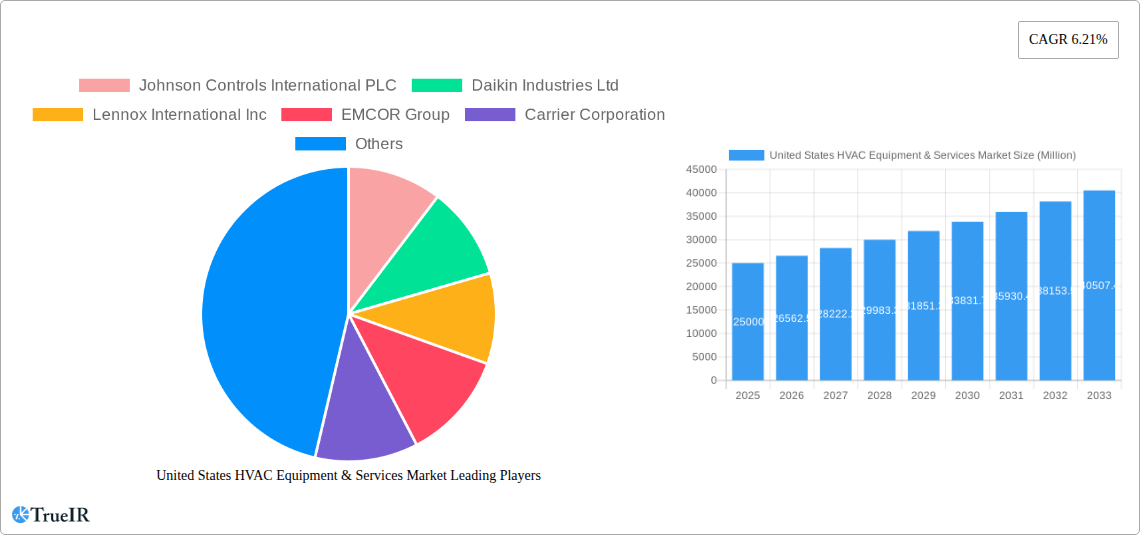

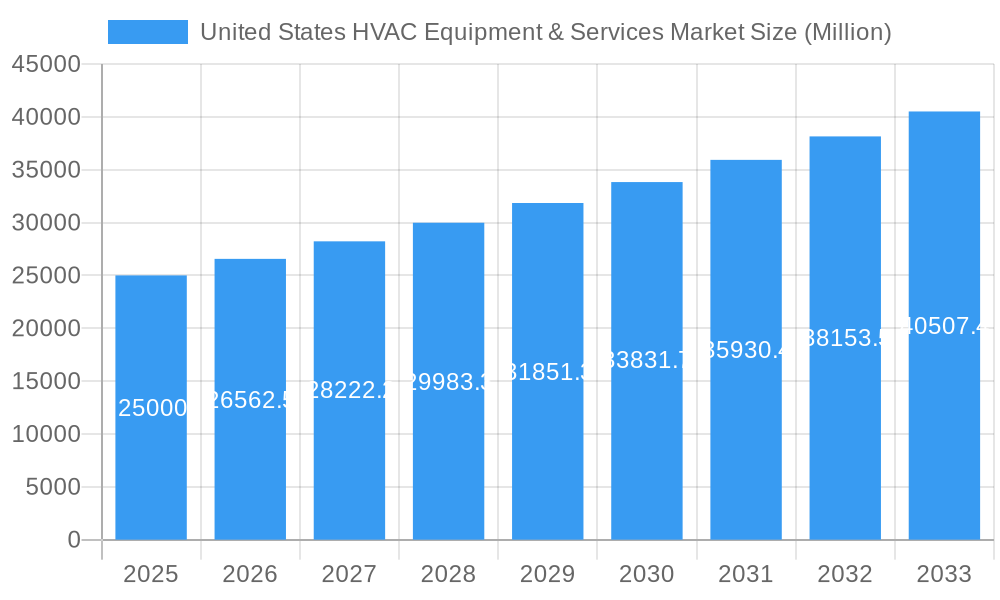

The United States HVAC Equipment & Services Market is poised for significant growth, projected to reach an estimated $XX million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 6.21% through 2033. This expansion is fueled by a confluence of factors, including an increasing demand for energy-efficient and smart HVAC solutions, driven by stringent government regulations and a growing consumer awareness of environmental sustainability. Modernization efforts across both residential and commercial sectors, spurred by aging infrastructure and the desire for improved indoor air quality, are a primary driver. Furthermore, the ongoing integration of advanced technologies like IoT-enabled controls, variable speed drives, and smart thermostats is enhancing system performance and contributing to market expansion. The demand for retrofitting existing systems to meet new energy standards and the consistent need for new installations in a growing economy are key contributors to this positive trajectory.

United States HVAC Equipment & Services Market Market Size (In Billion)

The market is segmented across a diverse range of equipment, from essential split systems (ducted and ductless) and high-efficiency chillers to specialized boilers and heat pumps, catering to varied end-user needs in the residential, industrial, and commercial sectors. Key players such as Johnson Controls International PLC, Daikin Industries Ltd, and Carrier Corporation are at the forefront of innovation, introducing cutting-edge technologies and expanding their service offerings. While the market demonstrates strong growth potential, certain restraints, such as the high initial cost of advanced HVAC systems and fluctuations in raw material prices, need to be navigated by industry stakeholders. Despite these challenges, the overarching trend towards greater comfort, improved energy management, and enhanced occupant well-being will continue to propel the United States HVAC Equipment & Services Market forward.

United States HVAC Equipment & Services Market Company Market Share

Here's a dynamic, SEO-optimized report description for the United States HVAC Equipment & Services Market, designed for immediate use:

Unlock critical insights into the booming United States HVAC Equipment & Services Market. This comprehensive report provides an exhaustive analysis of market dynamics, key trends, competitive strategies, and future growth trajectories from 2019 to 2033, with a base and estimated year of 2025 and a detailed forecast period of 2025–2033.

This report is your definitive guide to understanding the intricate landscape of the US HVAC market, covering everything from advanced equipment innovations and critical service demands to the latest industry developments and strategic player moves. Leveraging high-volume keywords like "HVAC equipment," "HVAC services," "residential HVAC," "commercial HVAC," "heating and cooling systems," "air conditioning market," and "HVAC market trends," this analysis is optimized to enhance search rankings and captivate industry professionals, investors, and decision-makers.

United States HVAC Equipment & Services Market Market Structure & Competitive Landscape

The United States HVAC Equipment & Services Market exhibits a moderately concentrated structure, characterized by a mix of large, established global players and a growing number of specialized regional and local service providers. Innovation remains a primary driver, fueled by increasing demand for energy-efficient and smart HVAC solutions, particularly in the residential and commercial sectors. Regulatory impacts, such as stricter energy efficiency standards and refrigerant phase-outs, are compelling manufacturers to invest in research and development for eco-friendly and high-performance products. Product substitutes, while present in some basic cooling and heating applications, are increasingly challenged by the integrated functionality and advanced features of modern HVAC systems.

Mergers and Acquisitions (M&A) have played a significant role in market consolidation and expansion. For instance, the acquisition of DiversiTech by Partners Group in November 2021 underscores the attractiveness of the HVAC supply chain to private equity. Similarly, Audax Private Equity's sale of Reedy Industries to Partners Group in July 2021 highlights the ongoing consolidation within the HVAC services segment. These strategic moves aim to leverage economies of scale, expand service portfolios, and strengthen market positions. End-user segmentation is crucial, with distinct needs in the residential market (focused on comfort, affordability, and efficiency) and the industrial & commercial sectors (prioritizing reliability, capacity, and compliance).

United States HVAC Equipment & Services Market Market Trends & Opportunities

The United States HVAC Equipment & Services Market is poised for substantial growth, driven by a confluence of factors including rising energy efficiency mandates, increasing disposable incomes, and the growing adoption of smart home technology. The market is experiencing a significant shift towards new installations driven by new construction projects and replacement cycles for aging infrastructure, while retrofits of existing buildings present a considerable opportunity for upgrades to more efficient systems. The residential segment, accounting for a substantial portion of market revenue, is seeing heightened demand for energy-efficient heat pumps, furnaces, and split systems, influenced by government incentives and consumer awareness of environmental impact. The industrial & commercial sector, vital for its large-scale applications, is witnessing increased investment in advanced chillers, air handling units, and rooftop units designed for optimized performance and reduced operational costs.

Technological advancements are at the forefront of market evolution. The integration of Internet of Things (IoT) capabilities, leading to the development of smart thermostats and connected HVAC systems, is transforming user experience and operational efficiency. This trend facilitates remote monitoring, predictive maintenance, and personalized climate control, directly addressing consumer preferences for convenience and cost savings. The ongoing push for sustainability is another major trend, with a growing preference for refrigerants with lower global warming potential (GWP) and a surge in demand for renewable energy-integrated HVAC solutions, such as geothermal heat pumps.

Opportunities abound for companies that can offer integrated solutions, combining equipment sales with comprehensive maintenance, repair, and installation services. The forecast period (2025–2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.5%, as the market expands to an estimated value of over $100 Billion by 2030. This growth is further fueled by increasing investments in building retrofits aimed at improving energy efficiency in older structures, as well as the construction of new, energy-conscious residential and commercial properties. The increasing adoption of Variable Refrigerant Flow (VRF) systems in commercial buildings and the growing demand for indoor air quality (IAQ) solutions post-pandemic represent significant untapped market potential.

Dominant Markets & Segments in United States HVAC Equipment & Services Market

The residential end-user segment holds significant dominance within the United States HVAC Equipment & Services Market, driven by the sheer volume of households and the continuous need for comfortable and healthy living environments. Within this segment, split systems (ducted and ductless), including highly popular mini-splits, represent the largest and fastest-growing equipment category. Their versatility, energy efficiency, and ease of installation make them ideal for both new constructions and retrofits in a wide array of residential applications. The industrial & commercial segment also contributes substantially, with a strong demand for indoor packaged & roof tops, chillers, and air handling units due to their capacity for large-scale climate control in offices, retail spaces, manufacturing facilities, and data centers.

The market segmentation by Type reveals that New Installations are a primary growth driver, particularly in regions experiencing robust construction activity and urban development. However, Retrofits are increasingly gaining traction as building owners seek to upgrade older, inefficient systems to meet modern energy standards and reduce operational expenditures. This presents a substantial aftermarket opportunity for service providers and equipment manufacturers.

Key growth drivers within these dominant segments include:

- Infrastructure Development: Expansion of new residential communities and commercial complexes necessitates the installation of new HVAC systems.

- Government Policies & Incentives: Federal, state, and local initiatives promoting energy efficiency and the adoption of renewable energy sources for HVAC systems, such as tax credits for heat pump installations, significantly boost demand.

- Technological Advancements: The integration of smart technology, improved energy efficiency ratings (e.g., SEER, EER), and the availability of eco-friendly refrigerants enhance the appeal and adoption of specific equipment types.

- Consumer Awareness: Growing consciousness about indoor air quality (IAQ), energy savings, and environmental impact influences purchasing decisions, favoring advanced and sustainable HVAC solutions.

The heat pump category, across both residential and commercial applications, is experiencing exceptional growth due to its dual functionality of heating and cooling and its increasing efficiency, making it a preferred alternative to traditional furnaces and air conditioners, especially in regions with milder winters. The humidifiers and dehumidifiers segment is also gaining prominence as consumers and businesses prioritize complete indoor climate control and improved IAQ.

United States HVAC Equipment & Services Market Product Analysis

Product innovations in the United States HVAC Equipment & Services Market are heavily focused on enhancing energy efficiency, connectivity, and user comfort. Advanced heat pumps with improved cold-climate performance, variable-speed compressors, and smart controls are redefining heating and cooling solutions. The integration of IoT technology into split systems and air handling units allows for remote diagnostics, predictive maintenance, and personalized temperature settings, offering a distinct competitive advantage. Furthermore, the development of next-generation refrigerants with lower GWP and the incorporation of sustainable materials in equipment manufacturing are critical market differentiators, aligning with both regulatory mandates and growing consumer demand for environmentally responsible products.

Key Drivers, Barriers & Challenges in United States HVAC Equipment & Services Market

Key Drivers:

- Increasing Demand for Energy Efficiency: Stringent government regulations and rising energy costs are compelling consumers and businesses to opt for energy-efficient HVAC systems.

- Technological Advancements: Innovations in smart technology, IoT integration, and improved equipment performance are driving adoption of advanced HVAC solutions.

- New Construction and Infrastructure Growth: A steady pipeline of new residential and commercial construction projects fuels demand for new HVAC installations.

- Government Incentives and Rebates: Tax credits and rebates for energy-efficient equipment, particularly heat pumps, significantly boost market sales.

- Growing Awareness of Indoor Air Quality (IAQ): Post-pandemic focus on health and well-being is increasing demand for sophisticated air purification and filtration systems integrated with HVAC.

Barriers & Challenges:

- High Initial Investment Costs: Advanced and energy-efficient HVAC systems can have a higher upfront cost, potentially deterring some consumers.

- Supply Chain Disruptions: Global supply chain volatility can lead to material shortages and increased component costs, impacting production and delivery timelines.

- Skilled Labor Shortage: A lack of trained technicians for installation, maintenance, and repair of complex HVAC systems can limit market growth and service quality.

- Regulatory Complexities: Navigating varying state and local building codes and environmental regulations can add complexity for manufacturers and installers.

- Competition from Substitutes: While less advanced, traditional heating and cooling methods can still present a cost-competitive alternative in certain budget-sensitive scenarios.

Growth Drivers in the United States HVAC Equipment & Services Market Market

Growth in the United States HVAC Equipment & Services Market is primarily propelled by an intensifying focus on energy efficiency, spurred by government mandates and rising utility costs. Technological innovations, such as the widespread integration of smart home capabilities and the development of highly efficient heat pumps, are creating new market segments and driving upgrade cycles. Economic factors, including robust housing starts and increasing commercial construction, directly translate to higher demand for new HVAC installations. Furthermore, favorable government incentives and tax credits for energy-efficient equipment are playing a crucial role in accelerating the adoption of advanced climate control solutions, particularly for residential consumers.

Challenges Impacting United States HVAC Equipment & Services Market Growth

The United States HVAC Equipment & Services Market faces several significant challenges. Supply chain disruptions, a persistent issue in recent years, continue to impact the availability and cost of critical components, potentially delaying production and installations. Regulatory complexities, including evolving energy codes and refrigerant phase-out schedules, require constant adaptation from manufacturers and installers. Competitive pressures from both established players and emerging companies, coupled with the increasing demand for skilled labor, can strain profit margins and service delivery capabilities. Moreover, the high initial cost of cutting-edge, energy-efficient systems can act as a barrier for some consumer segments, necessitating robust financing options and clear communication of long-term savings.

Key Players Shaping the United States HVAC Equipment & Services Market Market

- Johnson Controls International PLC

- Daikin Industries Ltd

- Lennox International Inc

- EMCOR Group

- Carrier Corporation

- Goodman Manufacturing Company

- Uponor Corp

- Trane Technologies

- Raheem Manufacturing Company Ltd

- Emerson Electric Company

Significant United States HVAC Equipment & Services Market Industry Milestones

- November 2021: Partners Group agrees to acquire DiversiTech, a key manufacturer and supplier of HVAC parts and accessories, signaling consolidation and investment in the supply chain.

- July 2021: Audax Private Equity agrees to sell Reedy Industries, a commercial HVAC provider, to Partners Group, highlighting the strategic importance and growth potential of the HVAC services sector.

Future Outlook for United States HVAC Equipment & Services Market Market

The future outlook for the United States HVAC Equipment & Services Market remains exceptionally positive, driven by ongoing demand for energy-efficient and smart climate control solutions. The continuous push for sustainability, coupled with government initiatives promoting renewable energy integration and improved IAQ, will fuel innovation and market expansion. The increasing adoption of IoT-enabled devices and the growing need for retrofitting existing buildings with advanced systems are anticipated to be significant growth catalysts. Strategic opportunities lie in developing integrated service offerings, expanding into emerging technologies like geothermal and advanced VRF systems, and addressing the growing demand for resilient and healthy indoor environments, ensuring a sustained upward trajectory for the market throughout the forecast period.

United States HVAC Equipment & Services Market Segmentation

-

1. Equipment

- 1.1. Split Systems (Ducted & Ductless)

- 1.2. Indoor Packaged & Roof Tops

- 1.3. Chillers

- 1.4. Air Handling Units

- 1.5. Furnaces

- 1.6. Fain Coils

- 1.7. Window/through the Wall, Moveable & PTAC

- 1.8. Boilers

- 1.9. Heat Pumps

- 1.10. Humidifiers and Dehumidifiers

- 1.11. Other Equipment Types

-

2. End-User

- 2.1. Residential

- 2.2. Industrial & Commercial

- 3. Market Overvies

-

4. Market Segmentation

-

4.1. By Type

- 4.1.1. New Installations

- 4.1.2. Retrofits

-

4.2. By End-User

- 4.2.1. Residential

- 4.2.2. Industrial & Commercial

-

4.1. By Type

-

5. Type

- 5.1. New Installations

- 5.2. Retrofits

-

6. End-User

- 6.1. Residential

- 6.2. Industrial & Commercial

United States HVAC Equipment & Services Market Segmentation By Geography

- 1. United States

United States HVAC Equipment & Services Market Regional Market Share

Geographic Coverage of United States HVAC Equipment & Services Market

United States HVAC Equipment & Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Residential and Non-residential Users

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to IoT and Smart Devices; Higher Costs of Refurbishment of Old Buildings

- 3.4. Market Trends

- 3.4.1. New Installations to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Split Systems (Ducted & Ductless)

- 5.1.2. Indoor Packaged & Roof Tops

- 5.1.3. Chillers

- 5.1.4. Air Handling Units

- 5.1.5. Furnaces

- 5.1.6. Fain Coils

- 5.1.7. Window/through the Wall, Moveable & PTAC

- 5.1.8. Boilers

- 5.1.9. Heat Pumps

- 5.1.10. Humidifiers and Dehumidifiers

- 5.1.11. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Industrial & Commercial

- 5.3. Market Analysis, Insights and Forecast - by Market Overvies

- 5.4. Market Analysis, Insights and Forecast - by Market Segmentation

- 5.4.1. By Type

- 5.4.1.1. New Installations

- 5.4.1.2. Retrofits

- 5.4.2. By End-User

- 5.4.2.1. Residential

- 5.4.2.2. Industrial & Commercial

- 5.4.1. By Type

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. New Installations

- 5.5.2. Retrofits

- 5.6. Market Analysis, Insights and Forecast - by End-User

- 5.6.1. Residential

- 5.6.2. Industrial & Commercial

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Johnson Controls International PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daikin Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lennox International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EMCOR Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carrier Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Goodman Manufacturing Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uponor Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trane Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Raheem Manufacturing Company Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emerson Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United States HVAC Equipment & Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States HVAC Equipment & Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States HVAC Equipment & Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States HVAC Equipment & Services Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Overvies 2020 & 2033

- Table 5: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Segmentation 2020 & 2033

- Table 6: United States HVAC Equipment & Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: United States HVAC Equipment & Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 9: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United States HVAC Equipment & Services Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 20: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 21: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Overvies 2020 & 2033

- Table 22: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Segmentation 2020 & 2033

- Table 23: United States HVAC Equipment & Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States HVAC Equipment & Services Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the United States HVAC Equipment & Services Market?

Key companies in the market include Johnson Controls International PLC, Daikin Industries Ltd, Lennox International Inc, EMCOR Group, Carrier Corporation, Goodman Manufacturing Company, Uponor Corp, Trane Technologies, Raheem Manufacturing Company Ltd *List Not Exhaustive, Emerson Electric Company.

3. What are the main segments of the United States HVAC Equipment & Services Market?

The market segments include Equipment, End-User, Market Overvies, Market Segmentation, Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Residential and Non-residential Users.

6. What are the notable trends driving market growth?

New Installations to Drive the Growth.

7. Are there any restraints impacting market growth?

Security Concerns Related to IoT and Smart Devices; Higher Costs of Refurbishment of Old Buildings.

8. Can you provide examples of recent developments in the market?

November 2021 - Partners Group, a leading global private markets firm, agreed to acquire DiversiTech, a manufacturer and supplier of parts and accessories for heating, ventilation, and air conditioning ("HVAC") equipment in the US, from funds advised by global private equity firm Permira.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States HVAC Equipment & Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States HVAC Equipment & Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States HVAC Equipment & Services Market?

To stay informed about further developments, trends, and reports in the United States HVAC Equipment & Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence