Key Insights

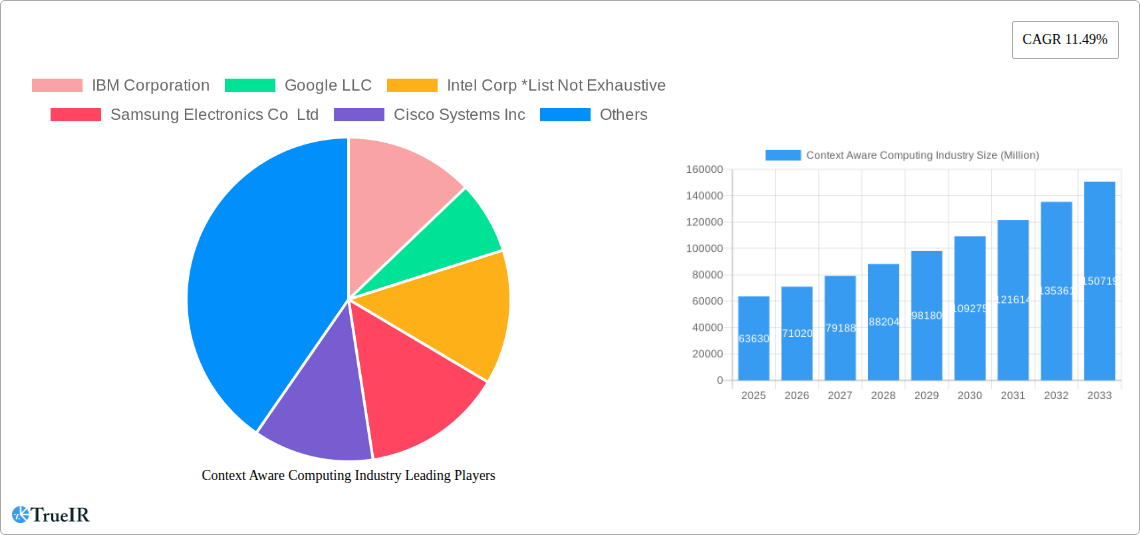

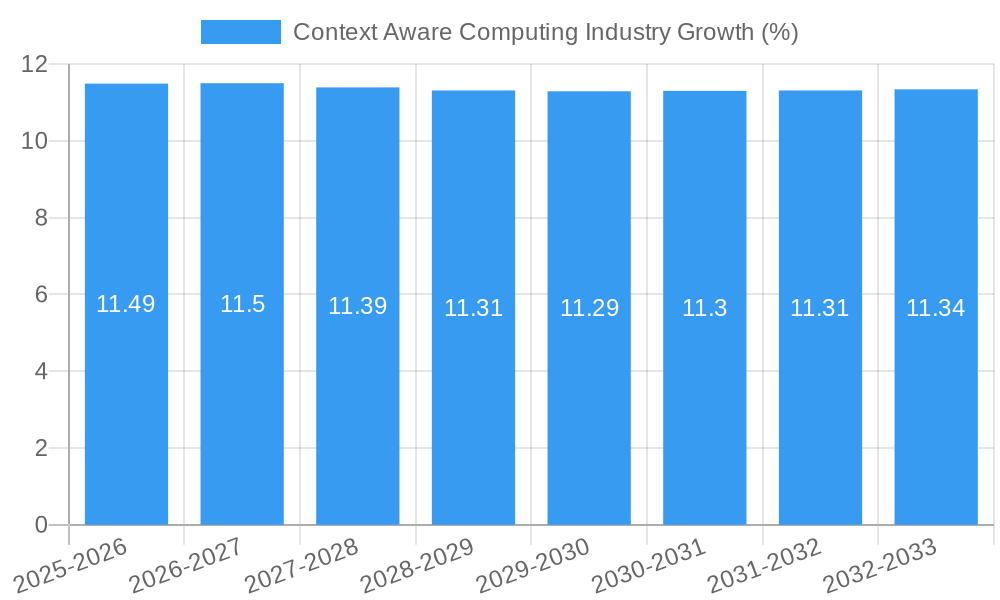

The Context Aware Computing Industry is poised for significant expansion, projected to reach a market size of USD 63.63 billion by 2025. This robust growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 11.49%, indicating a dynamic and rapidly evolving market landscape. The industry's expansion is primarily driven by the increasing demand for personalized user experiences, enhanced operational efficiencies, and advanced data analytics across a multitude of sectors. Key growth enablers include the proliferation of IoT devices, the widespread adoption of AI and machine learning algorithms, and the growing need for real-time, location-aware, and situation-aware information processing. These technological advancements are creating new opportunities for businesses to leverage contextual data for more intelligent decision-making, improved customer engagement, and streamlined workflows.

The market is segmented across hardware, software, and services, with each playing a crucial role in the development and deployment of context-aware solutions. End-user industries such as BFSI, Consumer Electronics, Media and Entertainment, Automotive, Healthcare, Telecommunication, and Logistics and Transportation are actively investing in these technologies to gain a competitive edge. Emerging trends point towards a greater integration of edge computing for localized data processing, the rise of sophisticated predictive analytics, and the development of more intuitive human-computer interactions. However, challenges such as data privacy concerns, the need for robust security measures, and the complexity of integrating disparate data sources need to be addressed to ensure sustained and widespread adoption. Leading companies like IBM Corporation, Google LLC, Intel Corp, Samsung Electronics Co Ltd, Cisco Systems Inc, Verizon Communications Inc, Microsoft Corporation, Amazon Web Services Inc, and Oracle Corporation are at the forefront, driving innovation and shaping the future of context-aware computing.

Here's a dynamic, SEO-optimized report description for the Context Aware Computing Industry, designed for maximum clarity and engagement, without requiring further modification.

Context Aware Computing Industry Market Structure & Competitive Landscape

The Context Aware Computing Industry is characterized by a highly dynamic and evolving market structure, driven by continuous innovation and strategic partnerships. Market concentration is moderate, with a few dominant players investing heavily in research and development, alongside a vibrant ecosystem of specialized vendors. Innovation drivers are primarily the escalating demand for personalized user experiences, enhanced operational efficiency, and advanced data analytics capabilities across various sectors. Regulatory impacts, while nascent, are beginning to shape data privacy and security standards, influencing development trajectories. Product substitutes are emerging, primarily from advancements in AI-driven analytics and IoT platforms that can infer context without explicit sensor integration.

The end-user segmentation is broad and rapidly expanding, encompassing sectors that leverage contextual data for improved decision-making and service delivery. Mergers and acquisitions (M&A) trends are observed as larger players seek to consolidate market share, acquire specialized technologies, and broaden their service portfolios. For instance, approximately 10-15% of companies in the market have been involved in M&A activities over the past two years, indicating a strong consolidation drive. Concentration ratios, particularly in specific niche segments like edge computing for context awareness, may reach up to 60-70% among the top five players, while the broader market remains more fragmented. Qualitative insights suggest that interoperability and standardization are becoming critical for sustained growth, prompting collaborations and alliances.

- Key Innovation Drivers:

- Demand for personalized user experiences and proactive services.

- Need for real-time data processing and decision-making at the edge.

- Advancements in AI, machine learning, and sensor technologies.

- Growth of the Internet of Things (IoT) and connected devices.

- Market Concentration Dynamics:

- Dominated by a few large technology conglomerates with broad portfolios.

- Significant presence of specialized software and service providers.

- Emergence of startups focusing on niche contextual applications.

- M&A Trends:

- Acquisitions aimed at gaining access to proprietary algorithms and data sets.

- Consolidation of edge computing infrastructure providers.

- Strategic partnerships to expand into new end-user industries.

Context Aware Computing Industry Market Trends & Opportunities

The Context Aware Computing Industry is poised for substantial market size growth, projected to reach an estimated USD 150 Million by the end of 2025, with a compelling Compound Annual Growth Rate (CAGR) of 18-22% expected throughout the forecast period of 2025–2033. This robust expansion is fueled by a confluence of transformative technological shifts and evolving consumer preferences that are increasingly prioritizing intelligent, personalized, and proactive digital experiences. The proliferation of connected devices, from smartphones and wearables to smart home appliances and industrial sensors, continues to generate vast amounts of real-time data. This data, when analyzed within its specific context, unlocks unprecedented opportunities for businesses to understand user behavior, predict needs, and deliver highly relevant services.

Technological advancements in Artificial Intelligence (AI), Machine Learning (ML), and Edge Computing are foundational to this growth. AI and ML algorithms are becoming increasingly sophisticated in interpreting complex contextual signals, enabling systems to learn, adapt, and respond intelligently. Edge computing, by processing data closer to its source, significantly reduces latency and enhances privacy, making context-aware applications more feasible and responsive, especially in mission-critical scenarios such as autonomous driving or industrial automation. Consumer preferences are shifting towards seamless, intuitive interactions that anticipate their needs. This is evident in the growing adoption of personalized recommendations in e-commerce, adaptive user interfaces in mobile applications, and smart home systems that automatically adjust settings based on occupancy and environmental conditions.

The competitive landscape is intensifying, with established technology giants like Google LLC, Microsoft Corporation, and Amazon Web Services Inc. competing alongside hardware innovators such as Intel Corp and Samsung Electronics Co Ltd. Mobile network operators like Verizon Communications Inc. are also playing a crucial role, leveraging their network infrastructure to enable low-latency, high-bandwidth context-aware services. The market penetration rate for context-aware features in consumer electronics is already exceeding 40% and is expected to climb higher as user awareness and demand increase. Opportunities abound in developing novel applications for sectors like healthcare (e.g., remote patient monitoring with contextual alerts), automotive (e.g., predictive maintenance and personalized driving experiences), and smart cities (e.g., optimizing traffic flow and public safety). The ability to offer predictive analytics and automated decision-making based on real-time contextual understanding will be a key differentiator for market leaders.

Dominant Markets & Segments in Context Aware Computing Industry

The Context Aware Computing Industry is witnessing significant growth and dominance across various segments, driven by strategic investments and the increasing adoption of contextual intelligence in diverse end-user industries. Among the Type segments, Software is emerging as a dominant force, accounting for an estimated 45-50% of the market share by 2025. This is attributed to the development of sophisticated AI and ML algorithms, data analytics platforms, and middleware solutions that enable devices and systems to understand and act upon contextual information. Hardware, encompassing sensors, processors, and specialized edge devices, represents a substantial 35-40% share, forming the foundational infrastructure for context-aware applications. Services, including integration, consulting, and maintenance, capture the remaining 15-20%, facilitating the deployment and optimization of these solutions.

In terms of Vendor (Qualitative Analysis), Device Manufacturers hold a significant position, embedding context-aware capabilities into their products, from smartphones and wearables to smart home devices and industrial equipment. Mobile Network Operators are increasingly pivotal, leveraging their advanced 5G networks to support low-latency, high-throughput context-aware services and enabling new business models. Online, Web, and Social Networking Vendors are also key players, utilizing contextual data to personalize user experiences, optimize advertising, and enhance content delivery.

The End-user Industry landscape reveals broad adoption, with Telecommunication leading the charge, closely followed by Consumer Electronics. The telecommunication sector benefits immensely from enhanced network management, personalized customer services, and the rollout of advanced 5G applications. Consumer electronics are rapidly integrating context-aware features for smart homes, entertainment, and personal assistance. The BFSI sector is exploring context-aware solutions for fraud detection, personalized financial advice, and risk assessment. Automotive is a rapidly growing area, with context-aware systems enhancing driver assistance, in-car infotainment, and predictive maintenance. Healthcare is witnessing transformative potential in remote patient monitoring, personalized treatment plans, and efficient hospital management. Media and Entertainment leverages context for highly tailored content recommendations and immersive experiences. Logistics and Transportation are optimizing routes, enhancing supply chain visibility, and improving fleet management through contextual data.

- Dominant Segments by Type:

- Software: Accounting for approximately 45-50% market share, driven by AI/ML platforms and analytics.

- Hardware: Constituting 35-40%, with growth in edge computing devices and advanced sensors.

- Services: Holding 15-20%, focused on integration, deployment, and optimization.

- Key End-User Industry Growth Drivers:

- Telecommunication: Essential for 5G-enabled context-aware services and network optimization.

- Consumer Electronics: Driving demand for smart homes, wearables, and personalized user interfaces.

- Automotive: Rapid adoption for advanced driver-assistance systems (ADAS) and connected car features.

- Healthcare: Significant potential for remote monitoring, diagnostics, and personalized medicine.

- Market Dominance Factors:

- Advanced AI/ML algorithm development.

- Robust 5G network infrastructure deployment.

- Integration of sensors and data processing at the edge.

- Strategic partnerships across the value chain.

Context Aware Computing Industry Product Analysis

Context-aware computing products are characterized by their ability to perceive and react to their surrounding environment and user context. Innovations are focused on enhancing the accuracy and responsiveness of these systems. Key applications include personalized user interfaces that adapt to individual preferences and usage patterns, predictive analytics that anticipate user needs, and intelligent automation that streamlines tasks. Competitive advantages lie in the seamless integration of hardware and software, the efficiency of data processing (especially at the edge), and the ability to provide actionable insights derived from complex contextual data. For example, advancements in edge AI chips are enabling real-time analysis of sensor data directly on devices, reducing latency and enhancing privacy for applications like smart surveillance and autonomous systems.

Key Drivers, Barriers & Challenges in Context Aware Computing Industry

The Context Aware Computing Industry is propelled by several key drivers. Technologically, the exponential growth of the Internet of Things (IoT), coupled with advancements in Artificial Intelligence (AI) and Machine Learning (ML), provides the foundational elements for context awareness. The increasing availability of vast datasets from connected devices fuels the development of more sophisticated contextual understanding. Economically, the demand for enhanced operational efficiency and personalized user experiences across industries creates a strong market pull. Policy-driven factors, such as government initiatives supporting smart city development and digital transformation, further stimulate adoption. For instance, the widespread deployment of 5G networks, facilitated by supportive regulatory frameworks, is crucial for enabling low-latency, high-bandwidth context-aware applications.

However, several barriers and challenges impede market growth. Supply chain issues, particularly for specialized semiconductors and sensors, can lead to production delays and increased costs. Regulatory hurdles, especially concerning data privacy and security (e.g., GDPR, CCPA), require careful navigation and robust compliance measures, impacting development timelines and operational models. Competitive pressures from established tech giants and nimble startups alike necessitate continuous innovation and strategic differentiation. The complexity of integrating disparate data sources and ensuring interoperability across various platforms also presents a significant challenge. The estimated cost of regulatory compliance can add 5-10% to development budgets for context-aware solutions.

Growth Drivers in the Context Aware Computing Industry Market

Key growth drivers for the Context Aware Computing Industry are multifaceted, encompassing technological, economic, and regulatory factors. Technologically, the continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamental, enabling more sophisticated interpretation of contextual data. The proliferation of Internet of Things (IoT) devices provides an ever-expanding source of real-time information, crucial for building comprehensive contextual understanding. Economically, businesses are increasingly seeking operational efficiencies and enhanced customer engagement through personalized experiences, driving demand for context-aware solutions. Regulatory landscapes supporting digital transformation and smart infrastructure development, such as the push for smart cities and industrial IoT, also act as significant catalysts. The widespread availability of high-speed connectivity, like 5G networks, is crucial for enabling the low-latency, high-bandwidth requirements of many context-aware applications.

Challenges Impacting Context Aware Computing Industry Growth

Despite its promising growth, the Context Aware Computing Industry faces several significant challenges. Regulatory complexities surrounding data privacy and security are a primary concern, as the collection and analysis of personal contextual data must adhere to stringent guidelines like GDPR and CCPA, impacting product design and market entry strategies. Supply chain issues, particularly for specialized hardware components like advanced sensors and edge computing chips, can lead to production bottlenecks and increased costs, affecting the timely delivery of solutions. Competitive pressures are intense, with established technology giants and emerging startups vying for market share, requiring continuous innovation and differentiation. The interoperability between diverse devices and platforms remains a technical hurdle, making seamless integration a complex undertaking. Quantifiable impacts include potential delays in product launches and increased R&D expenditures to ensure compliance and interoperability, potentially adding 10-15% to overall project costs.

Key Players Shaping the Context Aware Computing Industry Market

- IBM Corporation

- Google LLC

- Intel Corp

- Samsung Electronics Co Ltd

- Cisco Systems Inc

- Verizon Communications Inc

- Microsoft Corporation

- Amazon Web Services Inc

- Oracle Corporation

Significant Context Aware Computing Industry Industry Milestones

- December 2022: T-Mobile announced a collaboration with Cisco to launch the world's largest highly scalable and distributed nationwide cloud native converged core gateway, taking the Un-carrier's 5G standalone core to the next level. The Un-carrier has moved all of its 5G and 4G traffic to the new cloud-native core gateway, immediately improving customer performance by more than 10% in speed and latency. Furthermore, the new converged core gateway simplifies operations for T-Mobile, allowing the Un-carrier to shift resources with greater agility and roll out services such as 5G Home Internet. It will also shorten the time to market for new 5G and IoT services such as network slicing and Voice over 5G (VoNR) by allowing T-Mobile to test and quickly deploy new capabilities at scale.

- November 2022: Tata Consultancy Services (TCS) and Amazon Web Services (AWS) collaborated to launch a quantum computing lab on the Amazon platform. Accordingly, TCS invested in quantum computing research for over four years, which has resulted in two patent filings and progress toward advancing artificial intelligence (AI), optimization, cryptography, and digital security. The company assists customers in exploring and co-creating new use cases for quantum computing to address business challenges beyond traditional technologies' capabilities.

Future Outlook for Context Aware Computing Industry Market

The future outlook for the Context Aware Computing Industry is exceptionally bright, characterized by sustained growth driven by increasingly sophisticated AI, pervasive IoT adoption, and the continued rollout of advanced network infrastructures like 5G and beyond. Strategic opportunities lie in deeper integration across all end-user industries, leading to more personalized consumer experiences and hyper-efficient business operations. The market will witness a surge in predictive analytics and proactive service delivery, transforming how individuals and organizations interact with technology. Emerging areas like the metaverse and augmented reality will heavily rely on context-aware computing to deliver immersive and responsive environments. Investments in edge AI and federated learning will further enhance privacy and real-time processing capabilities, solidifying context-aware computing's position as a foundational technology for the next era of digital innovation. The market potential is projected to expand significantly, reaching an estimated USD 200-250 Million by 2028.

Context Aware Computing Industry Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Vendor (Qualitative Analysis)

- 2.1. Device Manufacturers

- 2.2. Mobile Network Operators

- 2.3. Online, Web, and Social Networking Vendors

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Consumer Electronics

- 3.3. Media and Entertainment

- 3.4. Automotive

- 3.5. Healthcare

- 3.6. Telecommunication

- 3.7. Logistics and Transportation

- 3.8. Other End-user Industries

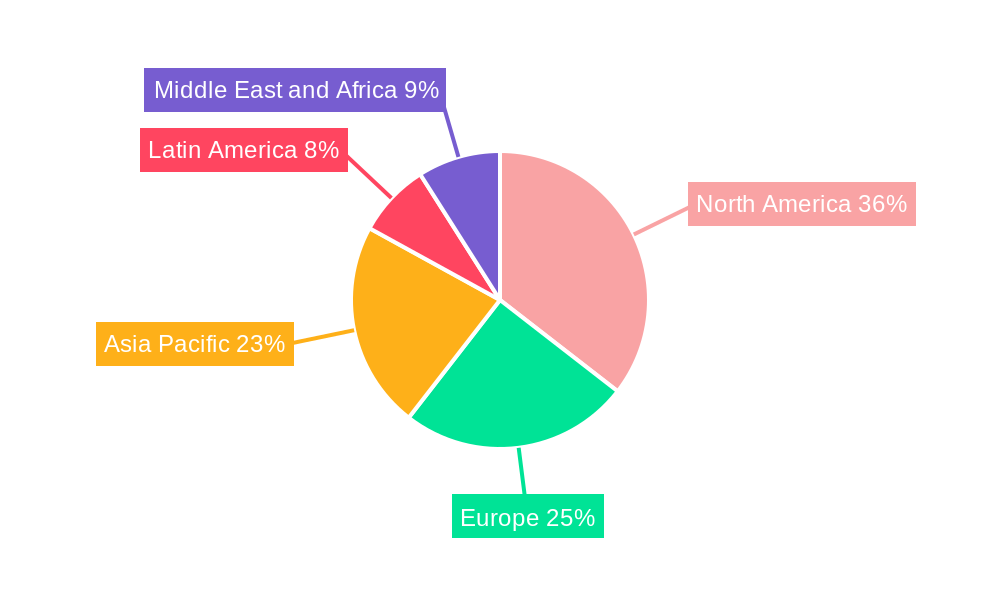

Context Aware Computing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Context Aware Computing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration of Artificial Intelligence into Mobile Apps; Rise in Integrated IoT Offerings

- 3.3. Market Restrains

- 3.3.1. Computational Complexities

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 5.2.1. Device Manufacturers

- 5.2.2. Mobile Network Operators

- 5.2.3. Online, Web, and Social Networking Vendors

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Consumer Electronics

- 5.3.3. Media and Entertainment

- 5.3.4. Automotive

- 5.3.5. Healthcare

- 5.3.6. Telecommunication

- 5.3.7. Logistics and Transportation

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 6.2.1. Device Manufacturers

- 6.2.2. Mobile Network Operators

- 6.2.3. Online, Web, and Social Networking Vendors

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Consumer Electronics

- 6.3.3. Media and Entertainment

- 6.3.4. Automotive

- 6.3.5. Healthcare

- 6.3.6. Telecommunication

- 6.3.7. Logistics and Transportation

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 7.2.1. Device Manufacturers

- 7.2.2. Mobile Network Operators

- 7.2.3. Online, Web, and Social Networking Vendors

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Consumer Electronics

- 7.3.3. Media and Entertainment

- 7.3.4. Automotive

- 7.3.5. Healthcare

- 7.3.6. Telecommunication

- 7.3.7. Logistics and Transportation

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 8.2.1. Device Manufacturers

- 8.2.2. Mobile Network Operators

- 8.2.3. Online, Web, and Social Networking Vendors

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Consumer Electronics

- 8.3.3. Media and Entertainment

- 8.3.4. Automotive

- 8.3.5. Healthcare

- 8.3.6. Telecommunication

- 8.3.7. Logistics and Transportation

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 9.2.1. Device Manufacturers

- 9.2.2. Mobile Network Operators

- 9.2.3. Online, Web, and Social Networking Vendors

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Consumer Electronics

- 9.3.3. Media and Entertainment

- 9.3.4. Automotive

- 9.3.5. Healthcare

- 9.3.6. Telecommunication

- 9.3.7. Logistics and Transportation

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Vendor (Qualitative Analysis)

- 10.2.1. Device Manufacturers

- 10.2.2. Mobile Network Operators

- 10.2.3. Online, Web, and Social Networking Vendors

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Consumer Electronics

- 10.3.3. Media and Entertainment

- 10.3.4. Automotive

- 10.3.5. Healthcare

- 10.3.6. Telecommunication

- 10.3.7. Logistics and Transportation

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Context Aware Computing Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 IBM Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Google LLC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Intel Corp *List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Samsung Electronics Co Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Cisco Systems Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Verizon Communications Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Microsoft Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Amazon Web Services Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Oracle Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 IBM Corporation

List of Figures

- Figure 1: Global Context Aware Computing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Context Aware Computing Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Context Aware Computing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Context Aware Computing Industry Revenue (Million), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 17: North America Context Aware Computing Industry Revenue Share (%), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 18: North America Context Aware Computing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: North America Context Aware Computing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: North America Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Context Aware Computing Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Context Aware Computing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Context Aware Computing Industry Revenue (Million), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 25: Europe Context Aware Computing Industry Revenue Share (%), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 26: Europe Context Aware Computing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Context Aware Computing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Context Aware Computing Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Context Aware Computing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Context Aware Computing Industry Revenue (Million), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 33: Asia Pacific Context Aware Computing Industry Revenue Share (%), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 34: Asia Pacific Context Aware Computing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Asia Pacific Context Aware Computing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Asia Pacific Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Context Aware Computing Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Context Aware Computing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Context Aware Computing Industry Revenue (Million), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 41: Latin America Context Aware Computing Industry Revenue Share (%), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 42: Latin America Context Aware Computing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 43: Latin America Context Aware Computing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 44: Latin America Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Context Aware Computing Industry Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Context Aware Computing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Context Aware Computing Industry Revenue (Million), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 49: Middle East and Africa Context Aware Computing Industry Revenue Share (%), by Vendor (Qualitative Analysis) 2024 & 2032

- Figure 50: Middle East and Africa Context Aware Computing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 51: Middle East and Africa Context Aware Computing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 52: Middle East and Africa Context Aware Computing Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Context Aware Computing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Context Aware Computing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 4: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Context Aware Computing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Context Aware Computing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 53: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 54: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 57: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 58: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 61: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 62: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 65: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 66: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global Context Aware Computing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 68: Global Context Aware Computing Industry Revenue Million Forecast, by Vendor (Qualitative Analysis) 2019 & 2032

- Table 69: Global Context Aware Computing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 70: Global Context Aware Computing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Context Aware Computing Industry?

The projected CAGR is approximately 11.49%.

2. Which companies are prominent players in the Context Aware Computing Industry?

Key companies in the market include IBM Corporation, Google LLC, Intel Corp *List Not Exhaustive, Samsung Electronics Co Ltd, Cisco Systems Inc, Verizon Communications Inc, Microsoft Corporation, Amazon Web Services Inc, Oracle Corporation.

3. What are the main segments of the Context Aware Computing Industry?

The market segments include Type, Vendor (Qualitative Analysis), End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Integration of Artificial Intelligence into Mobile Apps; Rise in Integrated IoT Offerings.

6. What are the notable trends driving market growth?

Consumer Electronics Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Computational Complexities.

8. Can you provide examples of recent developments in the market?

December 2022: T-Mobile announced a collaboration with Cisco to launch the world's largest highly scalable and distributed nationwide cloud native converged core gateway, taking the Un-carrier's 5G standalone core to the next level. The Un-carrier has moved all of its 5G and 4G traffic to the new cloud-native core gateway, immediately improving customer performance by more than 10% in speed and latency. Furthermore, the new converged core gateway simplifies operations for T-Mobile, allowing the Un-carrier to shift resources with greater agility and roll out services such as 5G Home Internet. It will also shorten the time to market for new 5G and IoT services such as network slicing and Voice over 5G (VoNR) by allowing T-Mobile to test and quickly deploy new capabilities at scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Context Aware Computing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Context Aware Computing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Context Aware Computing Industry?

To stay informed about further developments, trends, and reports in the Context Aware Computing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence