Key Insights

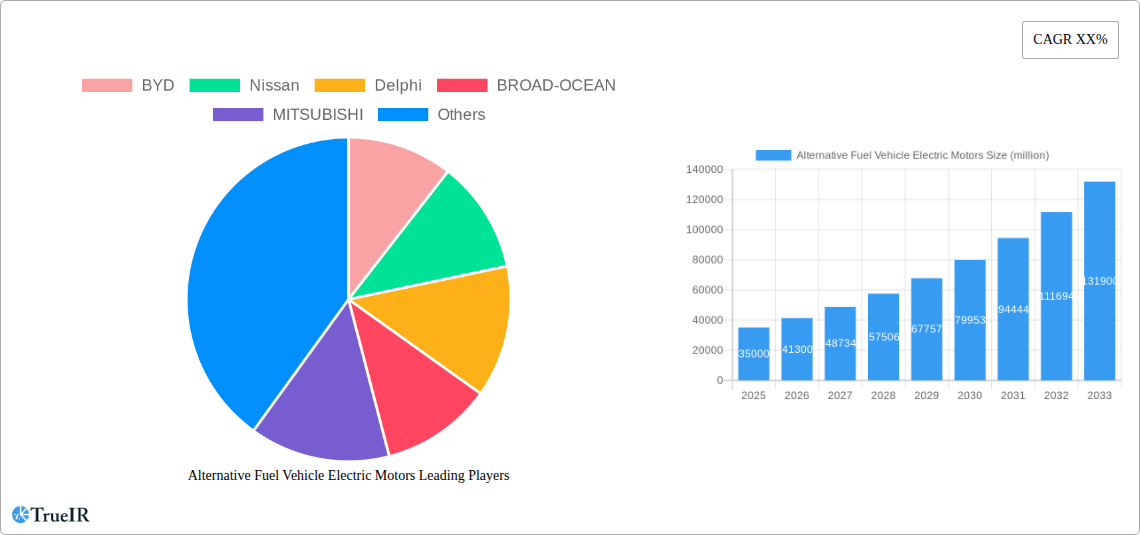

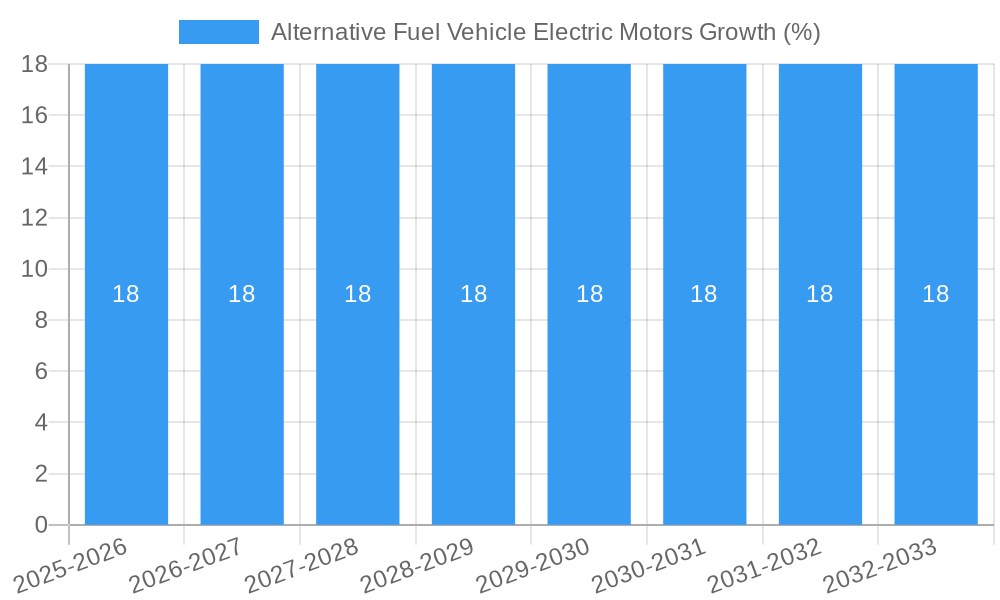

The global Alternative Fuel Vehicle Electric Motors market is poised for substantial growth, projected to reach approximately $35,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 18% anticipated through 2033. This expansion is primarily driven by the escalating global demand for electric vehicles (EVs) across both passenger and commercial segments. Governments worldwide are implementing stringent emission regulations and offering lucrative incentives to promote EV adoption, creating a favorable environment for electric motor manufacturers. The continuous technological advancements in motor efficiency, power density, and cost reduction are further accelerating market penetration. Key applications in passenger cars are leading the charge, fueled by increasing consumer awareness of environmental issues and the desire for sustainable transportation solutions. Commercial vehicles are also witnessing significant adoption, driven by operational cost savings and corporate sustainability goals.

The market is characterized by a dynamic competitive landscape, with major automotive manufacturers and specialized component suppliers actively investing in research and development. Companies like BYD, Nissan, Toyota, Ford, and Bosch are at the forefront, innovating to enhance performance and reduce the cost of electric powertrains. The shift towards Permanent Magnet Synchronous Motors (PMSM) is a significant trend, owing to their superior efficiency and power density compared to traditional DC motors and induction motors. However, the market faces certain restraints, including the high initial cost of EVs, limitations in charging infrastructure, and the ongoing supply chain challenges for critical raw materials. Despite these hurdles, the long-term outlook remains exceptionally strong, as the industry continues to prioritize electrification and sustainable mobility solutions, paving the way for widespread adoption of alternative fuel vehicles and their essential electric motor components.

This in-depth report provides a dynamic, SEO-optimized analysis of the global Alternative Fuel Vehicle (AFV) electric motors market. Leveraging high-volume keywords such as "electric vehicle motors," "AFV powertrain," "e-mobility solutions," and "automotive electric drives," this study caters to industry professionals, investors, and strategists seeking critical insights into this rapidly evolving sector. We dissect market structures, competitive landscapes, emerging trends, dominant segments, and future outlook, offering actionable intelligence for strategic decision-making. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025 to 2033.

Alternative Fuel Vehicle Electric Motors Market Structure & Competitive Landscape

The global Alternative Fuel Vehicle Electric Motors market exhibits a moderately concentrated structure, driven by a blend of established automotive suppliers and specialized electric motor manufacturers. Key innovation drivers include advancements in power density, efficiency, thermal management, and cost reduction for electric motor technologies like Permanent Magnet Synchronous Motors (PMSM). Regulatory impacts, particularly stringent emission standards and government incentives for EV adoption, are profoundly shaping market dynamics. Product substitutes, while limited in the direct EV motor space, can emerge from evolving battery technologies and alternative propulsion systems in the broader AFV ecosystem. End-user segmentation is dominated by the Passenger Car segment, followed by the Commercial Vehicle sector, each with distinct performance and cost requirements. Merger and Acquisition (M&A) trends are indicative of consolidation efforts and strategic partnerships aimed at securing intellectual property, expanding manufacturing capabilities, and gaining market share. Approximately 15% of major market players have engaged in strategic acquisitions or joint ventures in the past two years to enhance their technology portfolios and global reach. Concentration ratios, while varying by segment, suggest that the top 5 players hold a significant portion of the market share.

Alternative Fuel Vehicle Electric Motors Market Trends & Opportunities

The Alternative Fuel Vehicle Electric Motors market is poised for substantial growth, driven by an accelerating global transition towards sustainable mobility. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 18 million units, reaching an estimated xx million units by 2033. This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and robust governmental support. Technological shifts are characterized by the increasing dominance of high-efficiency Permanent Magnet Synchronous Motors (PMSM) due to their superior power-to-weight ratio and energy efficiency, which are crucial for extending EV range. However, ongoing research into advanced DC motors and induction motors continues to offer competitive alternatives, particularly for specific commercial vehicle applications and cost-sensitive segments. Consumer preferences are increasingly leaning towards electric vehicles, driven by growing environmental consciousness, lower running costs, and improving charging infrastructure. This demand surge directly translates into a higher market penetration rate for electric motors within the AFV segment. Competitive dynamics are intensifying, with key players like BYD, Nissan, Delphi, BROAD-OCEAN, MITSUBISHI, Toyota, FUKUTA, Ford, Bosch, GM, and DENSO vying for market leadership. Opportunities abound for companies that can offer innovative, cost-effective, and high-performance electric motor solutions, particularly those capable of seamless integration with advanced battery management systems and sophisticated vehicle control software. The development of modular motor designs, enhanced thermal management systems to cope with increasing power outputs, and the adoption of novel materials to reduce weight and cost are critical areas of focus. Furthermore, the growing demand for electric powertrains in emerging markets and the electrification of niche automotive sectors like last-mile delivery vehicles present significant growth avenues. The continuous innovation in motor control algorithms and the integration of AI for predictive maintenance and performance optimization are also shaping the competitive landscape, offering differentiation for leading manufacturers.

Dominant Markets & Segments in Alternative Fuel Vehicle Electric Motors

The Passenger Car segment stands as the undisputed leader in the Alternative Fuel Vehicle Electric Motors market, accounting for an estimated 70% of the total market volume. This dominance is driven by mass-market adoption of electric sedans, SUVs, and hatchbacks, propelled by government incentives, expanding charging infrastructure, and increasing consumer acceptance. Within the Passenger Car segment, Permanent Magnet Synchronous Motors (PMSM) are the most prevalent type, constituting approximately 65% of the motor installations. Their high efficiency, compact size, and excellent torque characteristics make them ideal for maximizing range and performance in passenger EVs.

Key growth drivers in this dominant segment include:

- Government Policies and Incentives: Subsidies, tax credits, and emissions regulations pushing for EV adoption.

- Improving Charging Infrastructure: Wider availability and faster charging speeds are alleviating range anxiety.

- Falling Battery Costs: Making EVs more accessible and affordable for a broader consumer base.

- Technological Advancements: Enhanced motor efficiency and power density directly contribute to better vehicle performance.

The Commercial Vehicle segment is a rapidly growing secondary market, projected to grow at a CAGR of 20 million units. Electric buses, delivery vans, and trucks are gaining traction due to their lower operating costs, reduced emissions in urban areas, and the increasing focus on corporate sustainability goals. In this segment, while PMSMs are also gaining ground, Induction Motors and specialized DC Motors still hold significant market share, particularly for heavy-duty applications where robustness and specific torque characteristics are paramount.

Within the types of motors, Permanent Magnet Synchronous Motors are expected to maintain their leading position across both segments due to their inherent efficiency advantages. However, advancements in materials and manufacturing processes for Induction Motors are making them increasingly competitive, especially in applications requiring high torque at low speeds. The DC Motor segment, while historically significant, is primarily being adopted in specialized hybrid applications or for certain auxiliary systems within AFVs.

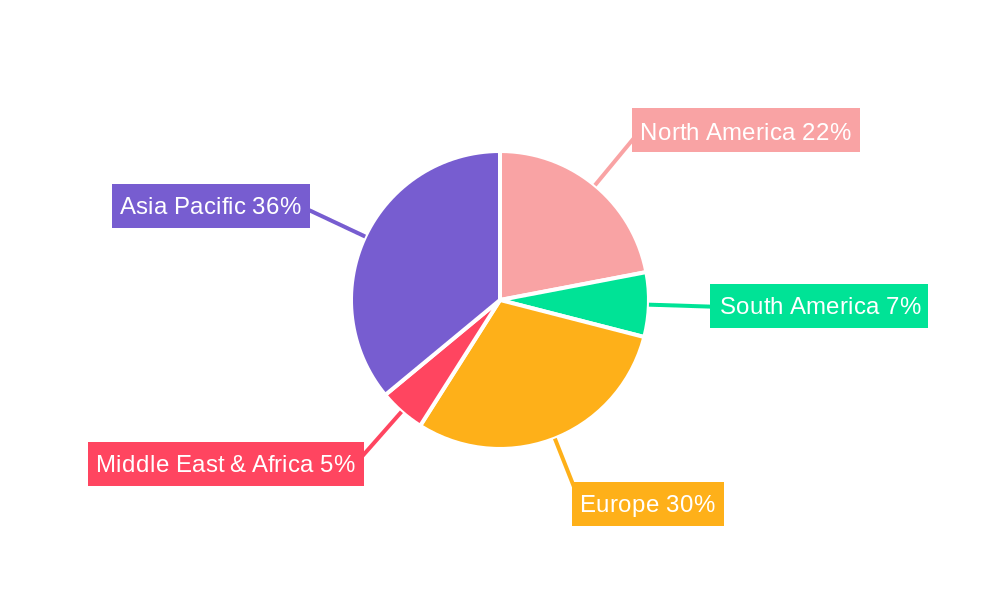

Geographically, Asia-Pacific, particularly China, leads the global market due to its aggressive EV manufacturing policies and massive domestic demand, followed by Europe with its stringent environmental regulations and strong consumer interest in EVs. North America is also witnessing significant growth, driven by increasing investments in EV production and expanding charging networks.

Alternative Fuel Vehicle Electric Motors Product Analysis

Product innovation in AFV electric motors centers on enhancing power density, improving thermal management for sustained performance, and reducing manufacturing costs through novel materials and design. PMSMs are at the forefront, benefiting from advancements in rare-earth magnet technology and winding techniques to achieve higher efficiency and torque. Applications span from compact city cars to high-performance sports EVs, with manufacturers like BYD and MITSUBISHI showcasing cutting-edge integrated powertrain solutions. Competitive advantages are derived from superior energy efficiency, reduced weight, and enhanced reliability, enabling longer EV ranges and more dynamic driving experiences.

Key Drivers, Barriers & Challenges in Alternative Fuel Vehicle Electric Motors

Key Drivers: The primary forces propelling the AFV electric motors market include stringent government regulations mandating reduced emissions (e.g., Euro 7, CAFE standards), substantial government incentives for EV purchases and infrastructure development, and a growing consumer awareness of environmental sustainability. Technological advancements in motor efficiency, battery energy density, and charging speeds further catalyze market expansion. The decreasing cost of electric vehicle components, especially batteries, is making AFVs more economically viable.

Barriers & Challenges: Significant challenges include the upfront cost of electric vehicles compared to their internal combustion engine counterparts, the adequacy and speed of charging infrastructure rollout, and supply chain vulnerabilities, particularly concerning rare-earth materials for permanent magnets. Regulatory complexities across different regions and evolving safety standards also pose hurdles. Intense competitive pressures among established automakers and emerging EV manufacturers drive down margins, while the need for continuous R&D investment to stay ahead of technological curves requires substantial capital. Supply chain disruptions, as seen in recent global events, can significantly impact production volumes and lead times.

Growth Drivers in the Alternative Fuel Vehicle Electric Motors Market

Growth in the AFV electric motors market is primarily propelled by technological advancements, with ongoing improvements in motor efficiency and power density leading to extended vehicle range and enhanced performance. Economic factors, such as the declining cost of batteries and government subsidies, are making electric vehicles more accessible to a wider consumer base. Regulatory tailwinds, including increasingly strict emissions standards and ambitious EV sales mandates in key markets like China and Europe, are compelling automakers to accelerate their electrification strategies. The continuous expansion of charging infrastructure and the growing consumer preference for sustainable transportation solutions further solidify these growth drivers.

Challenges Impacting Alternative Fuel Vehicle Electric Motors Growth

Several challenges impede the rapid growth of the AFV electric motors market. Regulatory complexities in navigating differing standards and incentive programs across global markets create fragmentation and increase compliance costs. Supply chain issues, particularly the reliance on specific raw materials for magnets and the limited capacity for semiconductor production, can lead to production bottlenecks and price volatility. Competitive pressures are intense, with numerous players vying for market share, leading to price wars and requiring substantial R&D investment to maintain differentiation. Furthermore, consumer concerns regarding charging infrastructure availability, charging times, and the residual value of EVs continue to pose barriers to widespread adoption.

Key Players Shaping the Alternative Fuel Vehicle Electric Motors Market

- BYD

- Nissan

- Delphi

- BROAD-OCEAN

- MITSUBISHI

- Toyota

- FUKUTA

- Ford

- Bosch

- GM

- DENSO

Significant Alternative Fuel Vehicle Electric Motors Industry Milestones

- 2019: Increased adoption of advanced PMSM technology in mass-market EVs.

- 2020: Significant investments in R&D for next-generation electric motor efficiency and power density.

- 2021: Supply chain disruptions highlight the need for diversified sourcing of critical materials.

- 2022: Major automakers announce accelerated EV production targets, boosting demand for electric motors.

- 2023: Development of more compact and integrated e-axle solutions for improved vehicle packaging.

- 2024: Focus on thermal management solutions to optimize motor performance in demanding conditions.

Future Outlook for Alternative Fuel Vehicle Electric Motors Market

- 2019: Increased adoption of advanced PMSM technology in mass-market EVs.

- 2020: Significant investments in R&D for next-generation electric motor efficiency and power density.

- 2021: Supply chain disruptions highlight the need for diversified sourcing of critical materials.

- 2022: Major automakers announce accelerated EV production targets, boosting demand for electric motors.

- 2023: Development of more compact and integrated e-axle solutions for improved vehicle packaging.

- 2024: Focus on thermal management solutions to optimize motor performance in demanding conditions.

Future Outlook for Alternative Fuel Vehicle Electric Motors Market

The future outlook for the Alternative Fuel Vehicle Electric Motors market is exceptionally bright, characterized by sustained high growth and continuous innovation. Key growth catalysts include escalating government support for electrification, a widening array of EV models across all vehicle segments, and ongoing technological breakthroughs in motor design and materials science. Strategic opportunities lie in developing modular and scalable motor platforms, enhancing power electronics integration, and focusing on sustainable manufacturing practices to meet increasing environmental scrutiny. The market is expected to witness a greater emphasis on customized motor solutions for specific vehicle applications and a drive towards higher levels of electrification, including advanced hybrid systems.

Alternative Fuel Vehicle Electric Motors Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Permanent Magnet Synchronous Motor

- 2.2. DC Motor

- 2.3. Induction Motor

Alternative Fuel Vehicle Electric Motors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Alternative Fuel Vehicle Electric Motors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Permanent Magnet Synchronous Motor

- 5.2.2. DC Motor

- 5.2.3. Induction Motor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Permanent Magnet Synchronous Motor

- 6.2.2. DC Motor

- 6.2.3. Induction Motor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Permanent Magnet Synchronous Motor

- 7.2.2. DC Motor

- 7.2.3. Induction Motor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Permanent Magnet Synchronous Motor

- 8.2.2. DC Motor

- 8.2.3. Induction Motor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Permanent Magnet Synchronous Motor

- 9.2.2. DC Motor

- 9.2.3. Induction Motor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Alternative Fuel Vehicle Electric Motors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Permanent Magnet Synchronous Motor

- 10.2.2. DC Motor

- 10.2.3. Induction Motor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BYD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nissan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delphi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BROAD-OCEAN

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MITSUBISHI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toyota

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FUKUTA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ford

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bosch

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GM

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DENSO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 BYD

List of Figures

- Figure 1: Global Alternative Fuel Vehicle Electric Motors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Alternative Fuel Vehicle Electric Motors Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Alternative Fuel Vehicle Electric Motors Revenue (million), by Application 2024 & 2032

- Figure 4: North America Alternative Fuel Vehicle Electric Motors Volume (K), by Application 2024 & 2032

- Figure 5: North America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Alternative Fuel Vehicle Electric Motors Revenue (million), by Types 2024 & 2032

- Figure 8: North America Alternative Fuel Vehicle Electric Motors Volume (K), by Types 2024 & 2032

- Figure 9: North America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Alternative Fuel Vehicle Electric Motors Revenue (million), by Country 2024 & 2032

- Figure 12: North America Alternative Fuel Vehicle Electric Motors Volume (K), by Country 2024 & 2032

- Figure 13: North America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Alternative Fuel Vehicle Electric Motors Revenue (million), by Application 2024 & 2032

- Figure 16: South America Alternative Fuel Vehicle Electric Motors Volume (K), by Application 2024 & 2032

- Figure 17: South America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Alternative Fuel Vehicle Electric Motors Revenue (million), by Types 2024 & 2032

- Figure 20: South America Alternative Fuel Vehicle Electric Motors Volume (K), by Types 2024 & 2032

- Figure 21: South America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Alternative Fuel Vehicle Electric Motors Revenue (million), by Country 2024 & 2032

- Figure 24: South America Alternative Fuel Vehicle Electric Motors Volume (K), by Country 2024 & 2032

- Figure 25: South America Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Alternative Fuel Vehicle Electric Motors Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Alternative Fuel Vehicle Electric Motors Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Alternative Fuel Vehicle Electric Motors Volume (K), by Application 2024 & 2032

- Figure 29: Europe Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Alternative Fuel Vehicle Electric Motors Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Alternative Fuel Vehicle Electric Motors Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Alternative Fuel Vehicle Electric Motors Volume (K), by Types 2024 & 2032

- Figure 33: Europe Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Alternative Fuel Vehicle Electric Motors Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Alternative Fuel Vehicle Electric Motors Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Alternative Fuel Vehicle Electric Motors Volume (K), by Country 2024 & 2032

- Figure 37: Europe Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Alternative Fuel Vehicle Electric Motors Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Alternative Fuel Vehicle Electric Motors Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Alternative Fuel Vehicle Electric Motors Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Alternative Fuel Vehicle Electric Motors Volume K Forecast, by Country 2019 & 2032

- Table 81: China Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Alternative Fuel Vehicle Electric Motors Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Alternative Fuel Vehicle Electric Motors Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alternative Fuel Vehicle Electric Motors?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Alternative Fuel Vehicle Electric Motors?

Key companies in the market include BYD, Nissan, Delphi, BROAD-OCEAN, MITSUBISHI, Toyota, FUKUTA, Ford, Bosch, GM, DENSO.

3. What are the main segments of the Alternative Fuel Vehicle Electric Motors?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alternative Fuel Vehicle Electric Motors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alternative Fuel Vehicle Electric Motors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alternative Fuel Vehicle Electric Motors?

To stay informed about further developments, trends, and reports in the Alternative Fuel Vehicle Electric Motors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence