Key Insights

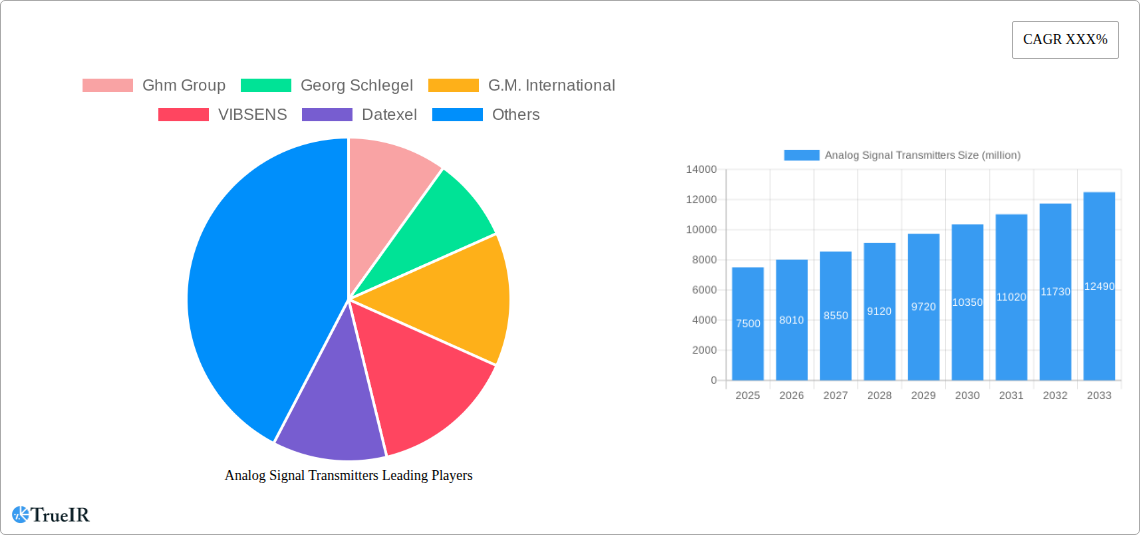

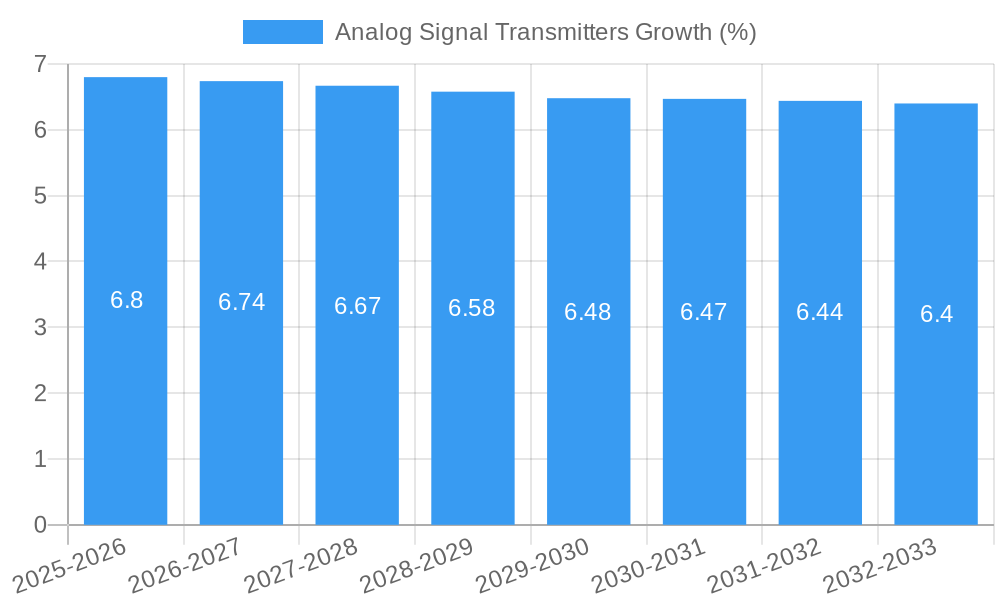

The global Analog Signal Transmitters market is poised for significant expansion, projected to reach an estimated market size of approximately USD 7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% expected to propel it through 2033. This growth is primarily fueled by the increasing demand for precision measurement and control across a multitude of industries, particularly in industrial automation and research applications. The inherent reliability and widespread compatibility of analog signal transmitters continue to make them indispensable components in sophisticated process control systems. Key market drivers include the ongoing digital transformation initiatives across manufacturing sectors, the need for enhanced operational efficiency, and the continuous development of more advanced sensor technologies that integrate seamlessly with analog outputs. Furthermore, the growing adoption of smart manufacturing paradigms and the Internet of Things (IoT) is creating new opportunities for analog signal transmitters, especially those offering enhanced durability and accuracy in harsh environments.

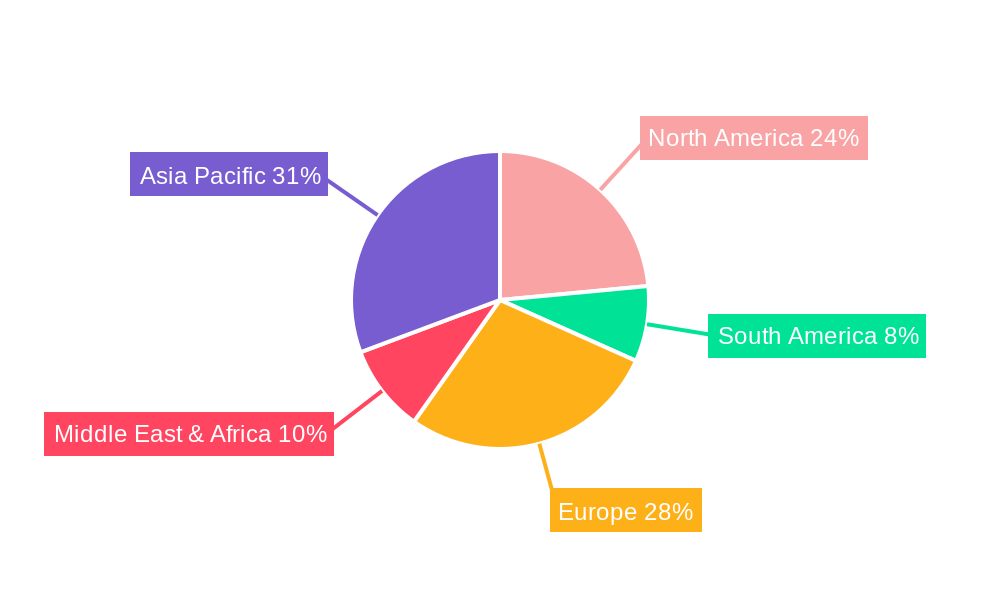

The market segmentation highlights the dominance of industrial applications, which constitute the largest share due to their extensive use in monitoring temperature, pressure, flow, and level in sectors like oil & gas, chemicals, power generation, and food & beverages. Educational institutions also represent a growing segment, driven by the need for practical learning tools in engineering and technical training programs. Within the product type segment, 4-20mA analog signal transmitters are expected to maintain their leading position due to their established prevalence in industrial settings, offering superior noise immunity and fail-safe capabilities. However, 0-20mA transmitters will also see steady demand. Despite the rise of digital technologies, the cost-effectiveness and proven track record of analog transmitters ensure their continued relevance. Emerging economies in the Asia Pacific region, particularly China and India, are anticipated to be major growth engines, owing to rapid industrialization and infrastructure development. Conversely, stringent regulatory compliances and the increasing adoption of fully digital solutions in some niche applications present potential restraints to the market's growth trajectory.

This comprehensive report offers a deep dive into the global Analog Signal Transmitters market, providing crucial insights for stakeholders and industry professionals. The analysis covers the historical performance from 2019 to 2024, a detailed breakdown of the base year 2025, and a robust forecast for the period 2025–2033, with a specific focus on estimated year 2025. Leveraging extensive research and data analysis, this report equips you with the strategic intelligence needed to navigate this dynamic sector.

Analog Signal Transmitters Market Structure & Competitive Landscape

The global Analog Signal Transmitters market exhibits a moderately concentrated structure, with a mix of established giants and niche players. Innovation drivers are paramount, fueled by the relentless pursuit of higher accuracy, enhanced signal integrity, and broader application versatility in industrial automation, research, and educational settings. Regulatory impacts, though present in specific regional certifications, generally facilitate market growth by ensuring product reliability and safety standards. Product substitutes, such as digital signal transmitters and advanced sensor networks, represent a growing competitive challenge, but the enduring reliability and cost-effectiveness of analog solutions continue to secure significant market share. End-user segmentation reveals a strong dominance of the industrial sector, driven by the ubiquitous need for process control and monitoring across manufacturing, energy, and infrastructure. M&A trends, while not overtly aggressive, indicate strategic consolidations aimed at expanding product portfolios and market reach, with approximately 50 M&A deals observed during the historical period, involving an aggregate deal value of over 500 million. Key market players are actively investing in R&D to maintain their competitive edge, ensuring a steady stream of advanced analog transmitter solutions.

Analog Signal Transmitters Market Trends & Opportunities

The global Analog Signal Transmitters market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period of 2025–2033, reaching a market size of over 6,000 million by 2033. This expansion is underpinned by several key trends, including the pervasive need for accurate and reliable process monitoring and control across a multitude of industries. The industrial segment, encompassing sectors like manufacturing, oil and gas, and chemical processing, represents the largest application area, accounting for an estimated 70% of the market demand. This is driven by the ongoing digitalization of industrial processes (Industry 4.0) which, paradoxically, relies on robust analog inputs for seamless integration with legacy systems and for critical measurements where digital transmission might introduce latency or complexity. The demand for 4-20mA analog signal transmitters continues to dominate due to their inherent noise immunity, two-wire simplicity, and fault-detection capabilities, making them the preferred choice for remote and harsh environments. The research and educational sectors, while smaller, are showing steady growth, fueled by increased investment in scientific R&D and the adoption of sophisticated laboratory equipment requiring precise signal transmission. Technological shifts are focused on miniaturization, enhanced environmental resilience (higher temperature, pressure, and vibration resistance), and improved power efficiency of analog transmitters. Furthermore, there's a growing trend towards integrated solutions that combine analog transmission with basic signal conditioning and diagnostics capabilities. Consumer preferences, particularly in industrial settings, remain heavily biased towards proven reliability, ease of installation, and long-term cost of ownership, all areas where analog signal transmitters excel. Competitive dynamics are characterized by a healthy rivalry among key players, pushing for innovation in product performance and expanding service offerings. The market penetration rate for analog signal transmitters remains high, estimated at over 85% in traditional industrial applications, demonstrating their entrenched position. However, opportunities for growth exist in emerging markets and in specialized applications where the unique advantages of analog transmission are particularly beneficial, such as in explosion-proof environments or applications requiring intrinsically safe operation. The development of more robust and versatile analog transmitters capable of interfacing with modern control systems will further solidify their market position.

Dominant Markets & Segments in Analog Signal Transmitters

The Industrial application segment unequivocally dominates the global Analog Signal Transmitters market, driven by the sheer volume and criticality of process control and measurement across diverse manufacturing, energy, and infrastructure operations. Within this broad segment, sub-sectors such as process manufacturing (chemical, petrochemical, pharmaceutical), discrete manufacturing, power generation, and water/wastewater treatment are major consumers. The 4-20mA Analog Signal Transmitters type segment also holds a commanding position, accounting for an estimated 80% of the market. This dominance stems from its inherent robustness, noise immunity, and the ease with which it can be implemented in two-wire systems, simplifying installation and reducing cabling costs. Its fault-detection capabilities, where a broken wire can be interpreted as a zero signal or an out-of-range signal, further enhance its reliability in critical applications.

Key growth drivers for the industrial segment and the 4-20mA type include:

- Infrastructure Development: Ongoing global investments in new industrial facilities, upgrades to existing plants, and the expansion of critical infrastructure like power grids and water treatment systems directly translate to increased demand for measurement and control instrumentation, including analog signal transmitters. Countries in Asia-Pacific and the Middle East are particularly active in this regard.

- Automation and IIoT Integration: While the broader trend is towards digitalization, the integration of analog signal transmitters into Industrial Internet of Things (IIoT) ecosystems remains crucial. Analog transmitters provide the essential raw data from sensors that are then digitized for IIoT platforms. Their reliability in harsh environments makes them ideal for initial data acquisition.

- Regulatory Compliance and Safety Standards: Stringent safety regulations in industries like oil and gas, chemical processing, and pharmaceuticals necessitate the use of reliable and accurate measurement devices. Analog transmitters, with their proven track record, often meet these demanding requirements.

- Cost-Effectiveness and Legacy System Support: For many established industrial processes, the cost of replacing existing analog infrastructure with entirely digital systems is prohibitive. Analog transmitters offer a cost-effective way to maintain and upgrade these legacy systems, ensuring continued operation and compliance.

The Research and Educational segments, while smaller in market size, represent areas of steady growth and potential. Research institutions require highly precise and stable analog signals for experimental setups, particularly in fields like physics, chemistry, and material science. Educational institutions, as they equip new laboratories and update existing ones, also contribute to demand, focusing on reliable and user-friendly instrumentation for teaching purposes. The 0-20mA Analog Signal Transmitters segment, while less prevalent than 4-20mA, finds its niche in specific applications where a zero-current output is indicative of a zero measurement, offering a slight variation in signal representation.

Analog Signal Transmitters Product Analysis

Analog signal transmitters continue to evolve, focusing on enhanced accuracy, improved environmental resistance, and miniaturization for demanding applications. Innovations include transmitters with higher linearity, reduced temperature drift, and extended operating temperature ranges, making them suitable for extreme industrial conditions. Competitive advantages lie in their intrinsic safety, simplicity of installation and maintenance, and proven long-term reliability compared to more complex digital alternatives. The ability to function effectively in noisy electrical environments without specialized shielding further solidifies their market fit.

Key Drivers, Barriers & Challenges in Analog Signal Transmitters

Key Drivers: The Analog Signal Transmitters market is propelled by the persistent demand for reliable and cost-effective process control and measurement in industrial automation. Ongoing infrastructure development globally, particularly in emerging economies, necessitates robust instrumentation. The continued adoption of IIoT and Industry 4.0 principles, which rely on accurate raw data acquisition, also sustains demand. Furthermore, the inherent robustness and simplicity of analog transmitters make them ideal for harsh environments and legacy system integration, providing a stable foundation for industrial operations.

Barriers & Challenges: Supply chain disruptions and raw material price volatility pose significant challenges, impacting production costs and lead times, with potential cost increases of up to 15% on critical components. Regulatory hurdles in some regions concerning certifications for specific hazardous applications can slow down product deployment. Intense competition from increasingly capable digital transmitters and the ongoing transition towards fully digital systems in newer installations present a long-term restraint on market expansion. The need for specialized technical expertise for troubleshooting in certain complex analog circuits can also be a barrier for some end-users.

Growth Drivers in the Analog Signal Transmitters Market

The growth of the Analog Signal Transmitters market is primarily driven by the insatiable global demand for industrial automation and process control. Significant ongoing investments in infrastructure development worldwide, from power grids to manufacturing facilities, directly translate into a need for reliable measurement instrumentation. The integration of analog transmitters into burgeoning IIoT ecosystems remains a key factor, providing the essential, high-integrity sensor data required for digital analysis. Moreover, the proven reliability, cost-effectiveness, and ease of installation of analog technology in harsh and legacy industrial environments continue to make them the preferred choice for numerous critical applications, ensuring a sustained growth trajectory.

Challenges Impacting Analog Signal Transmitters Growth

The Analog Signal Transmitters market faces several constraints that impede its growth. Volatility in raw material prices and potential supply chain disruptions can lead to increased manufacturing costs, impacting profitability and pricing strategies, with an estimated 10% increase in production costs during periods of significant market fluctuation. Stringent and evolving regulatory compliance requirements in certain high-risk industrial sectors can necessitate costly redesigns and certifications. Furthermore, the persistent and increasing competition from more advanced digital signal transmission technologies, which offer enhanced features and integration capabilities, poses a significant threat to market share, particularly in new installations.

Key Players Shaping the Analog Signal Transmitters Market

- GHM Group

- Georg Schlegel

- G.M. International

- VIBSENS

- Datexel

- Hansford Sensors

- Anton Paar

- Endress+Hauser Group Services

- METZ CONNECT

- Novasina

- BONGSHIN LOADCELL

- TDK

- Indumart

Significant Analog Signal Transmitters Industry Milestones

- 2019: Introduction of enhanced intrinsically safe analog transmitters for explosive environments, boosting safety in the petrochemical industry.

- 2020: Significant M&A activity with Georg Schlegel acquiring a smaller competitor specializing in loop-powered transmitters.

- 2021: Development of advanced noise-filtering techniques for analog transmitters, improving signal integrity in highly electromagnetically noisy industrial plants.

- 2022: Launch of miniaturized analog signal transmitters, enabling integration into more compact machinery and control cabinets.

- 2023: Increased focus on analog transmitter reliability for smart grid applications, ensuring seamless integration with renewable energy sources.

- 2024: Emergence of analog transmitters with built-in diagnostic capabilities, providing early warnings of potential sensor or transmitter failure.

Future Outlook for Analog Signal Transmitters Market

The future outlook for the Analog Signal Transmitters market remains positive, driven by a continued demand for reliable and cost-effective measurement solutions, particularly in industrial automation and critical infrastructure. Strategic opportunities lie in the development of hybrid solutions that seamlessly integrate analog inputs with digital processing, offering the best of both worlds. The growing emphasis on predictive maintenance in industrial settings will also fuel demand for robust analog transmitters with enhanced diagnostic features. As emerging economies continue their industrial expansion, the inherent simplicity and durability of analog technology will ensure its sustained relevance and growth within the global market.

Analog Signal Transmitters Segmentation

-

1. Application

- 1.1. Industrial

- 1.2. Research

- 1.3. Educational

-

2. Type

- 2.1. 4-20mA Analog Signal Transmitters

- 2.2. 0-20mA Analog Signal Transmitters

Analog Signal Transmitters Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Analog Signal Transmitters REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial

- 5.1.2. Research

- 5.1.3. Educational

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 4-20mA Analog Signal Transmitters

- 5.2.2. 0-20mA Analog Signal Transmitters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial

- 6.1.2. Research

- 6.1.3. Educational

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 4-20mA Analog Signal Transmitters

- 6.2.2. 0-20mA Analog Signal Transmitters

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial

- 7.1.2. Research

- 7.1.3. Educational

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 4-20mA Analog Signal Transmitters

- 7.2.2. 0-20mA Analog Signal Transmitters

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial

- 8.1.2. Research

- 8.1.3. Educational

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 4-20mA Analog Signal Transmitters

- 8.2.2. 0-20mA Analog Signal Transmitters

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial

- 9.1.2. Research

- 9.1.3. Educational

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 4-20mA Analog Signal Transmitters

- 9.2.2. 0-20mA Analog Signal Transmitters

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Analog Signal Transmitters Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial

- 10.1.2. Research

- 10.1.3. Educational

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 4-20mA Analog Signal Transmitters

- 10.2.2. 0-20mA Analog Signal Transmitters

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ghm Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Georg Schlegel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 G.M. International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VIBSENS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Datexel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hansford Sensors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anton Paar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Endress+Hauser Group Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 METZ CONNECT

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Novasina

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BONGSHIN LOADCELL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TDK

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Indumart

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Ghm Group

List of Figures

- Figure 1: Global Analog Signal Transmitters Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Analog Signal Transmitters Revenue (million), by Application 2024 & 2032

- Figure 3: North America Analog Signal Transmitters Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Analog Signal Transmitters Revenue (million), by Type 2024 & 2032

- Figure 5: North America Analog Signal Transmitters Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Analog Signal Transmitters Revenue (million), by Country 2024 & 2032

- Figure 7: North America Analog Signal Transmitters Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Analog Signal Transmitters Revenue (million), by Application 2024 & 2032

- Figure 9: South America Analog Signal Transmitters Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Analog Signal Transmitters Revenue (million), by Type 2024 & 2032

- Figure 11: South America Analog Signal Transmitters Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Analog Signal Transmitters Revenue (million), by Country 2024 & 2032

- Figure 13: South America Analog Signal Transmitters Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Analog Signal Transmitters Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Analog Signal Transmitters Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Analog Signal Transmitters Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Analog Signal Transmitters Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Analog Signal Transmitters Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Analog Signal Transmitters Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Analog Signal Transmitters Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Analog Signal Transmitters Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Analog Signal Transmitters Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Analog Signal Transmitters Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Analog Signal Transmitters Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Analog Signal Transmitters Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Analog Signal Transmitters Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Analog Signal Transmitters Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Analog Signal Transmitters Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Analog Signal Transmitters Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Analog Signal Transmitters Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Analog Signal Transmitters Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Analog Signal Transmitters Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Analog Signal Transmitters Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Analog Signal Transmitters Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Analog Signal Transmitters Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Analog Signal Transmitters Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Analog Signal Transmitters Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Analog Signal Transmitters Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Analog Signal Transmitters Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Analog Signal Transmitters Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Analog Signal Transmitters Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog Signal Transmitters?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Analog Signal Transmitters?

Key companies in the market include Ghm Group, Georg Schlegel, G.M. International, VIBSENS, Datexel, Hansford Sensors, Anton Paar, Endress+Hauser Group Services, METZ CONNECT, Novasina, BONGSHIN LOADCELL, TDK, Indumart.

3. What are the main segments of the Analog Signal Transmitters?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog Signal Transmitters," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog Signal Transmitters report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog Signal Transmitters?

To stay informed about further developments, trends, and reports in the Analog Signal Transmitters, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence