Key Insights

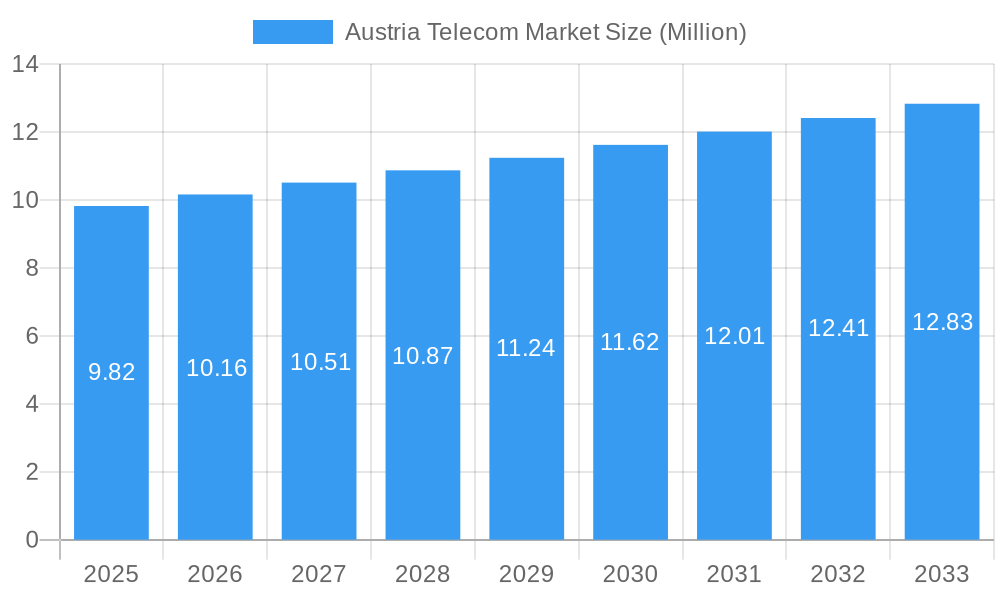

The Austrian telecommunications market is poised for steady growth, projected to reach a substantial value of USD 9.82 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.42% anticipated through 2033. This expansion is fueled by a confluence of evolving consumer demands and technological advancements. A primary driver is the escalating adoption of high-speed data and messaging services, necessitated by the increasing reliance on digital platforms for work, education, and entertainment. The proliferation of smartphones and connected devices further propels this segment, creating a robust demand for reliable and fast mobile connectivity. Furthermore, the burgeoning Over-The-Top (OTT) and Pay-TV services market is transforming traditional broadcast consumption, with consumers increasingly opting for flexible, on-demand content delivery models. This shift necessitates substantial investments in broadband infrastructure and content delivery networks by telecom operators, thereby contributing to market expansion.

Austria Telecom Market Market Size (In Million)

While the market demonstrates strong growth potential, certain factors may influence its trajectory. The ongoing competitive landscape, characterized by the presence of established players like Telekom Austria (A1), Magenta Telekom, and 3 Austria, alongside emerging virtual network operators such as Lycamobile and Hofer Telekom, necessitates continuous innovation and strategic pricing to retain and attract subscribers. Investments in 5G deployment and fiber optic infrastructure are critical for meeting future data demands and maintaining a competitive edge. However, the significant capital expenditure required for these upgrades, coupled with evolving regulatory frameworks and potential price pressures, could act as moderating forces on the market's pace of growth. Nonetheless, the fundamental demand for seamless connectivity and enhanced digital experiences remains a powerful engine for the Austrian telecom sector's sustained development.

Austria Telecom Market Company Market Share

Austria Telecom Market Analysis: Trends, Innovations, and Future Outlook (2019-2033)

Report Description:

Unlock deep insights into the dynamic Austria telecom market. This comprehensive report, covering 2019-2033, analyzes market structure, competitive landscape, evolving trends, and future growth prospects for Austria's telecommunications industry. Leveraging high-volume SEO keywords such as Austrian broadband expansion, FTTH Austria, mobile data services Austria, telecom investment Austria, and digital infrastructure Austria, this report is essential for stakeholders seeking to understand Austria's digital transformation. Explore dominant market segments, product innovations, key drivers, and challenges shaping the Austrian connectivity landscape. Discover strategic opportunities and the competitive edge of leading players like A1 Telekom Austria, Magenta Telekom, and 3 Austria.

Austria Telecom Market Market Structure & Competitive Landscape

The Austria telecom market exhibits a moderately concentrated structure, with established players like Telekom Austria (A1), Magenta Telekom, and 3 Austria dominating market share. Innovation is a key driver, fueled by ongoing investments in next-generation networks, particularly fiber optic broadband and 5G deployment. Regulatory frameworks, overseen by the Austrian regulatory authority, play a crucial role in shaping competition and investment, promoting fair access and consumer protection. While traditional voice services are mature, the market is witnessing a significant shift towards data and messaging services and the burgeoning OTT and PayTV services sector. The availability of viable product substitutes, such as alternative communication platforms, necessitates continuous innovation and service differentiation. End-user segmentation spans residential, business, and government sectors, each with distinct connectivity demands. Mergers and acquisitions (M&A) are sporadic but significant, reflecting the industry's consolidation trends. For instance, the consolidation leading to Magenta Telekom's formation has reshaped the competitive environment. We project a concentration ratio of approximately 70% held by the top three operators in the Austrian mobile market. M&A volumes are estimated to be in the range of several hundred million Euros over the historical period.

Austria Telecom Market Market Trends & Opportunities

The Austria telecom market is poised for substantial growth, driven by a robust CAGR of approximately 5% between 2025 and 2033. The market size is projected to exceed several tens of billions of Euros by the forecast period's end. A primary trend is the accelerated broadband expansion in Austria, with a significant push towards fiber-to-the-home (FTTH) connectivity across both urban and rural areas. This aligns with the EU's digital agenda and national recovery plans, fostering widespread digital infrastructure development. Technological shifts are characterized by the increasing adoption of 5G technology, enabling faster mobile data speeds and unlocking new applications in areas like IoT and enhanced mobile broadband. Consumer preferences are rapidly evolving, with a growing demand for high-speed, reliable internet access for streaming, online gaming, remote work, and advanced digital services. This is directly impacting the growth of OTT and PayTV services and driving increased consumption of mobile data. Competitive dynamics are intensifying as operators vie for market share through aggressive pricing, bundled service offerings, and strategic partnerships. The "2nd Broadband Billion" initiative, as highlighted by Open Fiber Austria (OFAA), is a prime example of how government funding is catalyzing infrastructure investments, creating significant opportunities for network operators and technology providers. Market penetration for broadband services is already high, exceeding 95% for fixed broadband, while mobile penetration stands at over 120%, indicating a strong demand for multiple SIMs and advanced mobile services. The increasing reliance on digital platforms for education, healthcare, and commerce further solidifies the importance of robust telecommunications infrastructure.

Dominant Markets & Segments in Austria Telecom Market

The data and messaging services segment is emerging as the dominant force within the Austria telecom market, projected to command a significant market share, potentially exceeding 50% of total service revenues by 2033. This dominance is propelled by the insatiable demand for high-speed internet access, fueled by the proliferation of smartphones, the increasing adoption of cloud-based services, and the rise of digital content consumption, including video streaming and online gaming. Wireless data services, in particular, are experiencing rapid growth due to the widespread availability of 4G and the ongoing rollout of 5G networks. Infrastructure development is a critical growth driver, with ongoing investments in FTTH deployments and 5G network expansion directly supporting the expansion of data services. Policies promoting digital connectivity and innovation, such as the EU's digital decade targets and national broadband strategies, are creating a conducive environment for this segment's growth. While voice services, both wired and wireless, remain foundational, their growth rate is comparatively slower due to the increasing use of Over-The-Top (OTT) communication applications. However, the high penetration of mobile subscriptions ensures a stable revenue stream. The OTT and PayTV services segment is also exhibiting strong growth, benefiting from evolving consumer entertainment preferences and the convenience of on-demand content access. The competitive landscape within data services is fierce, with operators differentiating through speed, data allowances, pricing, and bundled offerings that often include entertainment and other digital services. The expanding IoT ecosystem also represents a significant opportunity for data service providers, as a growing number of devices require constant connectivity.

Austria Telecom Market Product Analysis

Product innovation in the Austria telecom market is heavily focused on enhancing connectivity and delivering richer digital experiences. The leading edge is characterized by advancements in fiber-to-the-home (FTTH) technology, offering symmetrical high-speed internet access that surpasses traditional copper-based solutions. Furthermore, the ongoing deployment of 5G networks is revolutionizing mobile communication, enabling ultra-low latency, massive device connectivity, and significantly higher data speeds. These advancements are powering new applications in areas such as augmented reality (AR), virtual reality (VR), smart cities, and enhanced mobile gaming. Competitive advantages are being forged through the development of bundled service packages that integrate high-speed broadband, mobile plans, and attractive OTT and PayTV content, catering to the evolving consumer demand for seamless digital entertainment and communication.

Key Drivers, Barriers & Challenges in Austria Telecom Market

Key Drivers:

- Infrastructure Expansion: Significant investments in FTTH deployment and 5G network rollout are foundational, driving market growth by increasing coverage and capacity.

- Technological Advancements: The adoption of advanced technologies like 5G and fiber optics fuels demand for higher-speed data services and enables new applications.

- Government Initiatives: EU and national funding programs, such as the "2nd Broadband Billion," actively support Austrian broadband expansion, accelerating infrastructure deployment.

- Growing Demand for Data: Increasing consumption of digital content, online services, and remote work necessitates robust and high-capacity connectivity.

Barriers & Challenges:

- High Infrastructure Costs: The extensive capital expenditure required for deploying fiber optic and 5G networks presents a significant financial hurdle.

- Regulatory Complexities: Navigating regulatory frameworks, including spectrum allocation and market access rules, can be challenging and time-consuming.

- Competitive Pressures: Intense competition among established operators and the emergence of new players exert downward pressure on pricing and profit margins.

- Rural Deployment Challenges: Extending high-speed connectivity to sparsely populated rural areas involves higher per-household costs and logistical complexities, estimated to increase deployment costs by 20-30%.

Growth Drivers in the Austria Telecom Market Market

Key growth drivers in the Austria telecom market are multifaceted. Technological advancements, particularly the widespread adoption of 5G technology and the accelerated rollout of fiber-to-the-home (FTTH), are paramount, enabling faster speeds and new service possibilities. Government initiatives, like the EU's National Recovery and Resilience Plan and national broadband strategies, provide crucial funding and policy support for Austrian broadband expansion, fostering a favorable investment climate. The escalating demand for high-speed data services, driven by increasing video streaming, online gaming, remote work, and the burgeoning Internet of Things (IoT) ecosystem, directly fuels market expansion. Economic factors, including rising disposable incomes and a growing reliance on digital services across all sectors, also contribute significantly to the robust growth trajectory.

Challenges Impacting Austria Telecom Market Growth

Several challenges impact the Austria telecom market growth. The substantial capital expenditure required for deploying advanced infrastructure, such as fiber optic networks and 5G base stations, presents a significant financial barrier, with estimated deployment costs for rural areas being up to 40% higher than in urban centers. Regulatory complexities, including spectrum allocation processes and ongoing compliance requirements, can create uncertainties and delays. Intense competition among established operators, such as A1 Telekom Austria and Magenta Telekom, and the potential for new market entrants, exert downward pressure on pricing and profitability. Supply chain disruptions for essential network components can also lead to project delays and increased costs, impacting the pace of network expansion and upgrades.

Key Players Shaping the Austria Telecom Market Market

- Telekom Austria (A1)

- Tele

- tele ring

- Magenta Telekom

- 3 Austria

- Orange Austria

- Mundio

- Lycamobile

- M:Tel Austria

- Hofer Telekom

Significant Austria Telecom Market Industry Milestones

- May 2024: A1, an Austrian operator, is investing EUR 15 million (USD 16.34 million) into its broadband expansion initiative, aiming to deploy FTTH connections for 5,500 households and businesses in Strasshof an der Nordbahn, Lower Austria. The EU National Recovery and Resilience Plan contributes EUR 1.7 million (USD 1.85 Million) to this project.

- September 2023: Open Fiber Austria (OFAA), representing open fiber optic networks, embraced the 2nd Broadband Billion's funding initiative, focusing on advancing fiber optic expansion in both urban and rural areas of Austria.

Future Outlook for Austria Telecom Market Market

The future outlook for the Austria telecom market is exceptionally promising, driven by sustained investment in digital infrastructure and evolving consumer and business demands. Continued expansion of FTTH networks and the comprehensive rollout of 5G services will be key growth catalysts, enabling a new wave of digital services and applications. Strategic opportunities lie in leveraging enhanced connectivity for industries like manufacturing (Industry 4.0), automotive (connected vehicles), and smart city initiatives, contributing to Austria's digital transformation. The increasing reliance on cloud services, big data analytics, and AI will further solidify the demand for high-capacity, low-latency telecommunications. Market potential is also enhanced by the growing adoption of OTT and PayTV services, creating diversified revenue streams for operators. By focusing on innovation, customer experience, and efficient network deployment, stakeholders can capitalize on the robust growth trajectory of the Austrian telecommunications sector.

Austria Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Austria Telecom Market Segmentation By Geography

- 1. Austria

Austria Telecom Market Regional Market Share

Geographic Coverage of Austria Telecom Market

Austria Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telekom Austria (A1)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tele

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 tele ring

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Magenta Telekom

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3 Austria

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orange Austria

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mundio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lycamobile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Telekom Austria (A1)

List of Figures

- Figure 1: Austria Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Austria Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Austria Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Austria Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 3: Austria Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Austria Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Austria Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Austria Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 7: Austria Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Austria Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Telecom Market?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the Austria Telecom Market?

Key companies in the market include Telekom Austria (A1), Tele, tele ring, Magenta Telekom, 3 Austria, Orange Austria, Mundio, Lycamobile, M:Tel Austria, Hofer Telekom*List Not Exhaustive.

3. What are the main segments of the Austria Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

May 2024: A1, an Austrian operator, is investing EUR 15 million (USD 16.34 million) into its broadband expansion initiative. The project aims to deploy FTTH connections for 5,500 households and businesses in Strasshof an der Nordbahn, Lower Austria. Notably, the EU National Recovery and Resilience Plan, a part of Austria's broader construction strategy, is contributing EUR 1.7 million (USD 1.85 Million) toward the total investment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Telecom Market?

To stay informed about further developments, trends, and reports in the Austria Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence