Key Insights

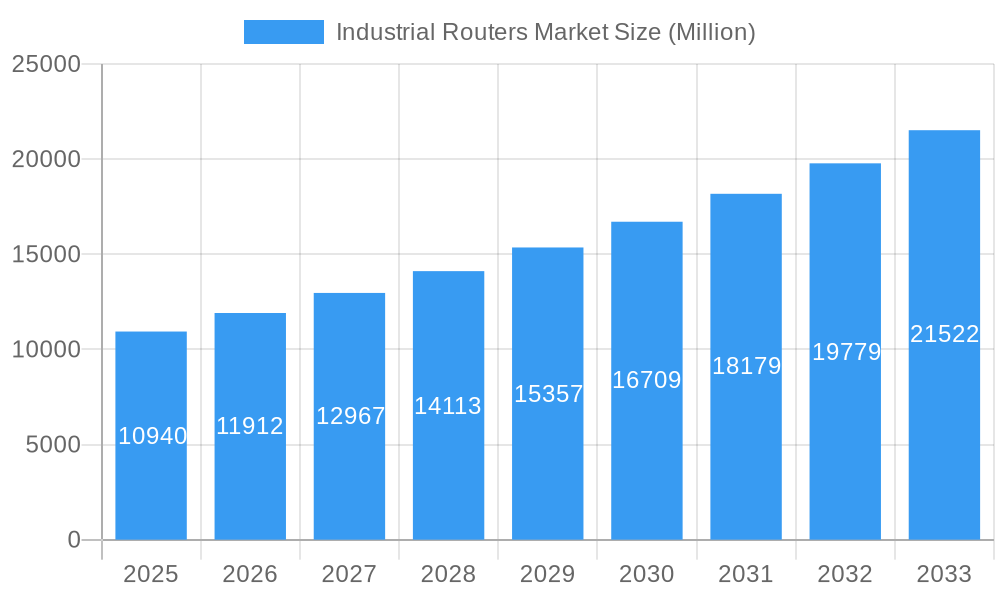

The global Industrial Routers Market is poised for substantial expansion, projected to reach a significant valuation of $10.94 billion. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.90% throughout the study period of 2019-2033, with a particular focus on the forecast years of 2025-2033. The market's dynamism is driven by escalating investments in industrial automation and the increasing adoption of Industry 4.0 technologies across various sectors. The burgeoning demand for enhanced network connectivity and data management in harsh industrial environments, coupled with the critical need for reliable and secure communication for operational efficiency, are primary catalysts for this market surge. Furthermore, the continuous evolution of wireless communication technologies, such as 5G, is opening new avenues for advanced industrial networking solutions, driving innovation and adoption of wireless industrial routers. This trend is expected to accelerate market penetration and create significant opportunities for market players.

Industrial Routers Market Market Size (In Billion)

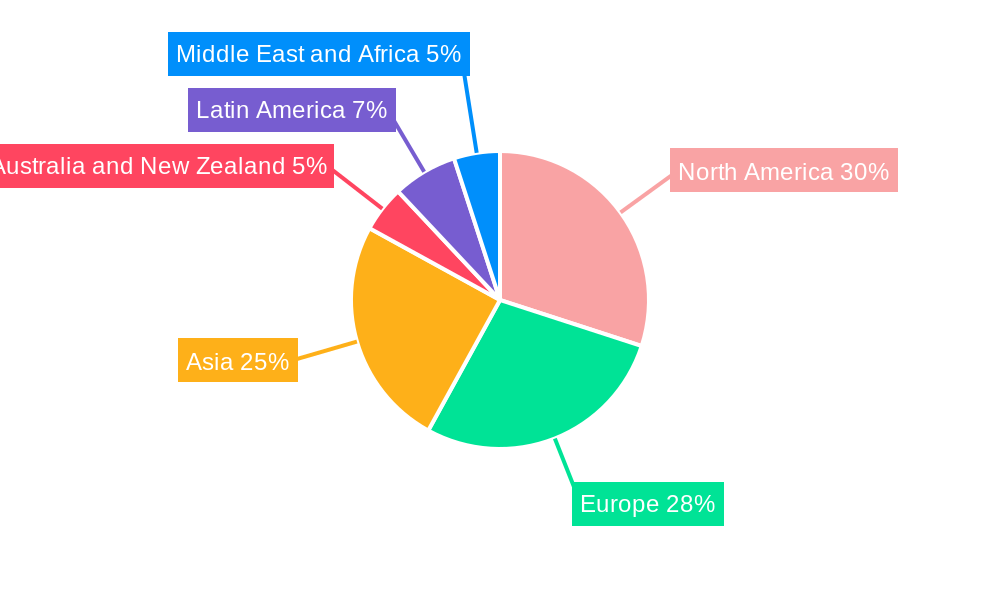

The Industrial Routers Market is segmented into two primary product types: Wired and Wireless, with a notable inclination towards wireless solutions due to their flexibility and ease of deployment in complex industrial settings. In terms of end-user industries, the Process Industry and Discrete Industry are the dominant segments, both showcasing strong adoption rates driven by their respective needs for robust and efficient network infrastructure. Geographically, North America is anticipated to lead the market, followed closely by Europe, owing to their advanced industrial landscapes and early adoption of smart manufacturing practices. Asia is emerging as a key growth region, fueled by rapid industrialization and increasing digital transformation initiatives. While the market benefits from these strong growth drivers, potential challenges such as cybersecurity concerns and the initial high cost of sophisticated industrial router deployments could present some restraints. However, the overarching trend towards digital transformation and the indispensable role of reliable networking in modern industrial operations are expected to outweigh these challenges, ensuring sustained market expansion.

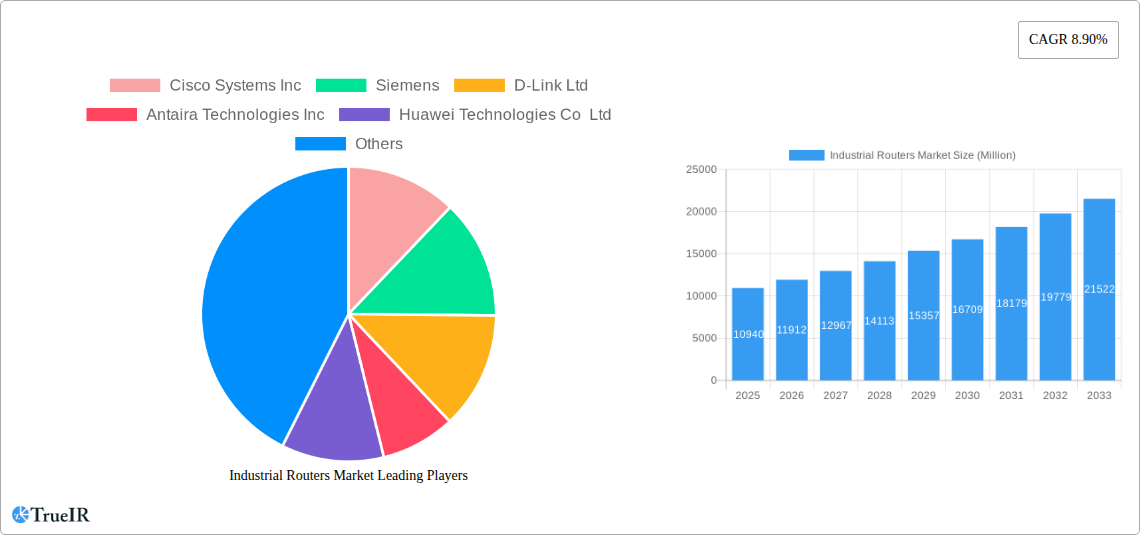

Industrial Routers Market Company Market Share

This report provides an in-depth analysis of the global Industrial Routers Market, offering critical insights into market dynamics, growth drivers, competitive landscape, and future outlook. Leveraging high-volume SEO keywords such as "industrial routers," "IoT connectivity," "5G industrial routers," "IIoT devices," and "factory automation," this report is optimized for maximum visibility and engagement among industry professionals, researchers, and investors. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, covering historical data from 2019 to 2024.

Industrial Routers Market Market Structure & Competitive Landscape

The Industrial Routers Market exhibits a moderately consolidated structure, characterized by the presence of both established global players and emerging regional manufacturers. Innovation drivers are primarily fueled by the burgeoning adoption of Industrial Internet of Things (IIoT) solutions, the increasing demand for reliable and secure connectivity in harsh environments, and the transformative impact of 5G technology. Regulatory impacts are becoming more pronounced, with data security and industry-specific compliance standards influencing product development and market entry strategies. Product substitutes are limited, given the specialized nature of industrial routers designed for resilience and specific operational demands. End-user segmentation reveals a strong reliance on the Process Industry and Discrete Industry, both of which are undergoing significant digital transformation. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, over the historical period (2019-2024), approximately 20-30 M&A deals were observed, indicating active industry consolidation. Concentration ratios are estimated to be in the range of 40-50% for the top five players.

Industrial Routers Market Market Trends & Opportunities

The Industrial Routers Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period (2025-2033). This growth is driven by the escalating adoption of Industry 4.0 technologies, including automation, AI, and the IIoT. The increasing deployment of smart factories, intelligent transportation systems, and the growing need for robust connectivity in remote and challenging environments are key market trends. Consumer preferences are shifting towards routers offering enhanced security features, higher bandwidth capabilities, and seamless integration with cloud platforms. The proliferation of 5G networks is a significant catalyst, enabling ultra-reliable low-latency communication (URLLC) essential for real-time industrial applications. Opportunities abound in the development of specialized routers for critical infrastructure, energy management, and advanced manufacturing processes. Market penetration rates for advanced industrial routers are expected to increase significantly as businesses prioritize operational efficiency and data-driven decision-making. The market size is estimated to reach over $8,000 Million by 2033, up from an estimated $4,000 Million in 2025. Technological shifts, such as the integration of edge computing capabilities within industrial routers, present further avenues for innovation and market expansion. The competitive dynamics are evolving, with companies focusing on developing feature-rich, ruggedized, and software-defined networking (SDN) enabled industrial routers to meet the diverse and demanding needs of various industrial sectors.

Dominant Markets & Segments in Industrial Routers Market

The Wireless segment is anticipated to dominate the Industrial Routers Market, driven by the increasing demand for flexible and scalable connectivity solutions in dynamic industrial environments. Within the Wireless segment, Wi-Fi 6/6E and 5G-enabled industrial routers are expected to witness the highest growth rates due to their superior speed, capacity, and low latency capabilities. The Process Industry, encompassing sectors like oil and gas, chemicals, and utilities, represents a leading end-user segment due to the critical nature of their operations and the continuous need for reliable data transmission from remote and hazardous locations. The Discrete Industry, including automotive, electronics, and machinery manufacturing, is also a significant contributor to market growth, propelled by the adoption of smart manufacturing practices and the automation of production lines.

- Leading Region: North America is expected to maintain its leadership in the Industrial Routers Market, owing to strong government initiatives supporting digital transformation, a high concentration of advanced manufacturing facilities, and significant investments in IIoT infrastructure.

- Key Growth Drivers in Discrete Industry:

- Increased adoption of robotics and automation in manufacturing.

- Demand for real-time data analytics for process optimization.

- Implementation of predictive maintenance solutions.

- Key Growth Drivers in Process Industry:

- Need for secure and reliable connectivity in remote and hazardous environments.

- Expansion of smart grid initiatives in the energy sector.

- Compliance with stringent safety and operational regulations.

- Market Dominance of Wireless Segment: The inherent flexibility, ease of deployment, and ability to support mobile assets make wireless industrial routers indispensable for modern industrial operations. The ongoing rollout of 5G networks further bolsters this dominance.

Industrial Routers Market Product Analysis

Product innovations in the Industrial Routers Market are largely centered on enhancing ruggedization, security, and connectivity options. Manufacturers are developing routers capable of withstanding extreme temperatures, humidity, vibrations, and electromagnetic interference, making them suitable for the most demanding industrial environments. Advancements in cybersecurity features, including VPN support, firewalls, and intrusion detection systems, are paramount to protect critical industrial networks from cyber threats. The integration of 5G technology, edge computing capabilities, and support for multiple communication protocols (e.g., Modbus, Profinet) are key competitive advantages. Applications span across factory automation, smart grids, intelligent transportation systems, remote monitoring, and critical infrastructure management.

Key Drivers, Barriers & Challenges in Industrial Routers Market

Key Drivers:

- Digital Transformation and Industry 4.0: The widespread adoption of smart manufacturing, automation, and IIoT technologies is a primary growth engine.

- Advancements in 5G Technology: The deployment of 5G networks enables ultra-reliable, low-latency communication essential for real-time industrial applications.

- Increasing Demand for Edge Computing: Industrial routers are increasingly incorporating edge computing capabilities for localized data processing and reduced latency.

- Need for Enhanced Security: Growing cybersecurity threats necessitate robust and secure network connectivity solutions.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of advanced industrial routers can be a deterrent for some small and medium-sized enterprises.

- Interoperability and Standardization Issues: Ensuring seamless integration with diverse legacy systems and protocols can be challenging.

- Skilled Workforce Shortage: A lack of skilled professionals to manage and maintain complex industrial network infrastructure poses a constraint.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of components, affecting production timelines.

Growth Drivers in the Industrial Routers Market Market

The growth of the Industrial Routers Market is propelled by several interconnected factors. The accelerating pace of digital transformation across industries, fueled by the adoption of Industry 4.0 principles, necessitates robust and secure connectivity solutions like industrial routers. The ongoing global rollout of 5G infrastructure is a significant growth driver, enabling applications requiring ultra-high bandwidth, low latency, and massive device connectivity, crucial for industrial automation and control. Furthermore, the increasing focus on operational efficiency, predictive maintenance, and remote monitoring across sectors like manufacturing, energy, and transportation directly translates into higher demand for reliable industrial networking devices. Policy-driven initiatives promoting smart city development and critical infrastructure upgrades also contribute to market expansion.

Challenges Impacting Industrial Routers Market Growth

Despite the positive growth trajectory, the Industrial Routers Market faces several challenges that can impact its expansion. Regulatory complexities and varying data privacy laws across different regions can pose hurdles for global manufacturers and necessitate localized compliance strategies. Supply chain issues, exacerbated by geopolitical factors and component shortages, can lead to production delays and increased costs, affecting market availability and pricing. Intense competitive pressures from both established players and new entrants drive down profit margins and necessitate continuous innovation. Additionally, the cybersecurity landscape is constantly evolving, demanding ongoing investment in advanced security features to protect industrial networks from sophisticated threats, which can be a significant financial and technical challenge for some organizations.

Key Players Shaping the Industrial Routers Market Market

- Cisco Systems Inc

- Siemens

- D-Link Ltd

- Antaira Technologies Inc

- Huawei Technologies Co Ltd

- ZTE Corporation

- Dell Technologies Inc

- Inseego Corporation

- ASUSTeK Computer Inc

- Advantech Co Ltd

Significant Industrial Routers Market Industry Milestones

- September 2024: Siemens Limited launched private industrial 5G user equipment, marking a pivotal step for the manufacturing industry's digital transformation. Siemens introduced its inaugural industrial 5G routers, Scalance MUM856-1 and MUM853-1, designed to bolster mobile broadband transmission, facilitate massive machine-type communication, and ensure ultra-reliable low latencies.

- February 2024: Robustel expanded its 5G router lineup with the R5010 High Speed 5G Router. This router supports both 5G NSA (non-standalone) and 5G SA (standalone) networks, and is compatible with 3GPP Release 16. Measuring just 10cm, the R5010 boasts a compact design, offers multiple power supply options (PoE & USB), and features an Ethernet/USB Modem Mode, making it ideal for enterprises seeking high bandwidth Fixed Wireless Access or mobile internet.

Future Outlook for Industrial Routers Market Market

The future outlook for the Industrial Routers Market is exceptionally promising, driven by relentless technological advancements and the increasing digitization of global industries. The continued expansion of 5G networks, coupled with the growing demand for IIoT solutions and edge computing, will fuel innovation and market growth. Strategic opportunities lie in developing highly secure, AI-enabled, and software-defined industrial routers that can seamlessly integrate into complex operational technology (OT) environments. The market is expected to witness a surge in demand for solutions that offer enhanced network resilience, improved data analytics capabilities, and support for diverse industrial protocols. The trend towards automation, smart manufacturing, and the development of smart cities will continue to be major growth catalysts, ensuring sustained expansion and innovation in the industrial routers landscape. The market is projected to witness a CAGR of approximately 12-15% during the forecast period.

Industrial Routers Market Segmentation

-

1. Product Type

- 1.1. Wired

- 1.2. Wireless

-

2. End User Industry

- 2.1. Process Industry

- 2.2. Discrete Industry

Industrial Routers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Industrial Routers Market Regional Market Share

Geographic Coverage of Industrial Routers Market

Industrial Routers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development

- 3.3. Market Restrains

- 3.3.1. Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development

- 3.4. Market Trends

- 3.4.1. Processing Industry Expected to Observe Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Process Industry

- 5.2.2. Discrete Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Process Industry

- 6.2.2. Discrete Industry

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Process Industry

- 7.2.2. Discrete Industry

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Process Industry

- 8.2.2. Discrete Industry

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Process Industry

- 9.2.2. Discrete Industry

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Process Industry

- 10.2.2. Discrete Industry

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Industrial Routers Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Wired

- 11.1.2. Wireless

- 11.2. Market Analysis, Insights and Forecast - by End User Industry

- 11.2.1. Process Industry

- 11.2.2. Discrete Industry

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cisco Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 D-Link Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Antaira Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Huawei Technologies Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ZTE Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dell Technologies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Inseego Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ASUSTeK Computer Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Advantech Co Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Global Industrial Routers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Routers Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 8: North America Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 9: North America Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: North America Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 11: North America Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Routers Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 17: Europe Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 20: Europe Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 21: Europe Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Europe Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 23: Europe Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Routers Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Asia Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 32: Asia Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 33: Asia Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 34: Asia Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 35: Asia Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Industrial Routers Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Australia and New Zealand Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 41: Australia and New Zealand Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Australia and New Zealand Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Australia and New Zealand Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 44: Australia and New Zealand Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 45: Australia and New Zealand Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 46: Australia and New Zealand Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 47: Australia and New Zealand Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Industrial Routers Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Latin America Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Latin America Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Latin America Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Latin America Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 56: Latin America Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 57: Latin America Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 58: Latin America Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 59: Latin America Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Industrial Routers Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Industrial Routers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 64: Middle East and Africa Industrial Routers Market Volume (Billion), by Product Type 2025 & 2033

- Figure 65: Middle East and Africa Industrial Routers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Middle East and Africa Industrial Routers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Middle East and Africa Industrial Routers Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 68: Middle East and Africa Industrial Routers Market Volume (Billion), by End User Industry 2025 & 2033

- Figure 69: Middle East and Africa Industrial Routers Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 70: Middle East and Africa Industrial Routers Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 71: Middle East and Africa Industrial Routers Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Industrial Routers Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Industrial Routers Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Industrial Routers Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global Industrial Routers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Routers Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 10: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 16: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 22: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 23: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 28: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 34: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 35: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 40: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 41: Global Industrial Routers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Industrial Routers Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Routers Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Industrial Routers Market?

Key companies in the market include Cisco Systems Inc, Siemens, D-Link Ltd, Antaira Technologies Inc, Huawei Technologies Co Ltd, ZTE Corporation, Dell Technologies Inc, Inseego Corporation, ASUSTeK Computer Inc, Advantech Co Ltd*List Not Exhaustive.

3. What are the main segments of the Industrial Routers Market?

The market segments include Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development.

6. What are the notable trends driving market growth?

Processing Industry Expected to Observe Significant Growth.

7. Are there any restraints impacting market growth?

Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development.

8. Can you provide examples of recent developments in the market?

September 2024: Siemens Limited launched private industrial 5G user equipment, marking a pivotal step for the manufacturing industry's digital transformation. Siemens introduced its inaugural industrial 5G routers, Scalance MUM856-1 and MUM853-1, designed to bolster mobile broadband transmission, facilitate massive machine-type communication, and ensure ultra-reliable low latencies.February 2024: Robustel expanded its 5G router lineup with the R5010 High Speed 5G Router. This router supports both 5G NSA (non-standalone) and 5G SA (standalone) networks, and is compatible with 3GPP Release 16. Measuring just 10cm, the R5010 boasts a compact design, offers multiple power supply options (PoE & USB), and features an Ethernet/USB Modem Mode, making it ideal for enterprises seeking high bandwidth Fixed Wireless Access or mobile internet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Routers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Routers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Routers Market?

To stay informed about further developments, trends, and reports in the Industrial Routers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence