Key Insights

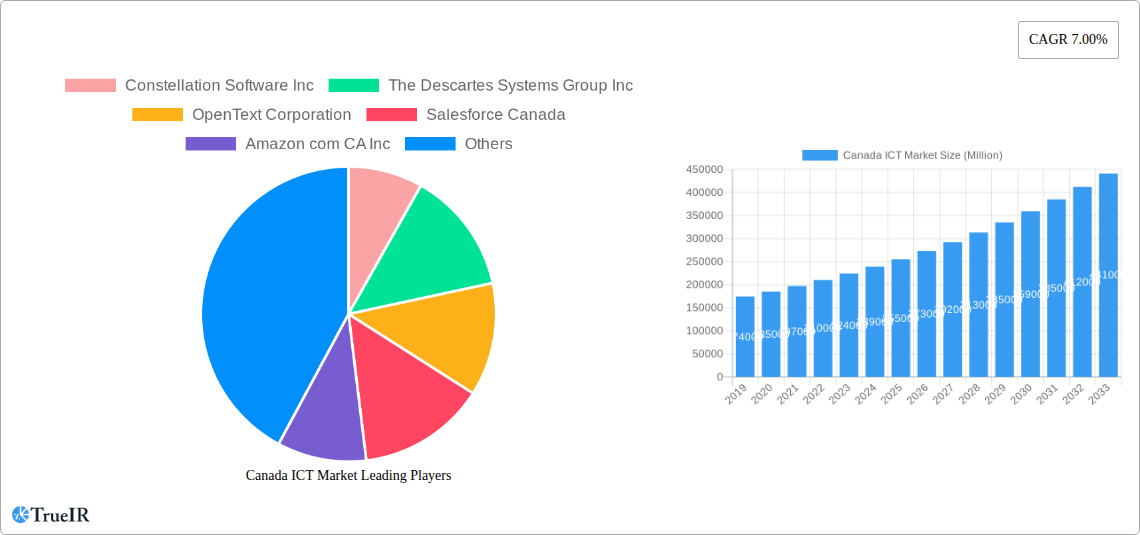

The Canadian Information and Communication Technology (ICT) market is projected for substantial growth, expected to reach USD 133.93 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.9% from 2025 to 2033. Key growth drivers include significant digital transformation investments across BFSI, IT & Telecom, Government, and Retail sectors. The rising adoption of cloud computing, AI, and IoT fuels demand for advanced hardware, software, and IT services. 5G deployment and enhanced connectivity further accelerate market expansion. Both SMEs and large enterprises are embracing digital technologies, fostering innovation and tailored ICT solutions.

Canada ICT Market Market Size (In Billion)

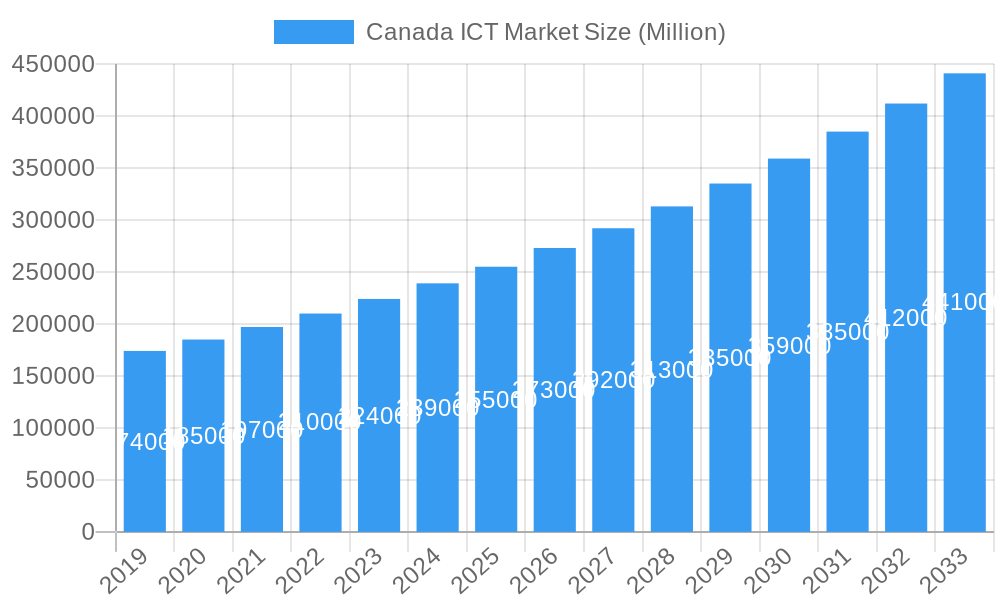

While the market exhibits strong growth, challenges such as cybersecurity threats, high implementation costs, and a potential shortage of skilled professionals exist. However, these are being mitigated through increased investment in cybersecurity, workforce development, and strategic partnerships. Key trends include the growing adoption of managed IT services and SaaS models for increased flexibility and cost-efficiency. Leading players like Constellation Software Inc., OpenText Corporation, Salesforce Canada, Rogers Communications Inc., and Telus Communications Inc. are actively influencing the market through acquisitions, innovation, and service expansion, contributing to the dynamic and promising outlook of the Canadian ICT sector.

Canada ICT Market Company Market Share

This comprehensive report provides in-depth analysis of the Canadian ICT market, covering the historical period 2019-2024, a detailed base year analysis for 2025, and a forecast through 2033. It offers crucial insights into market dynamics, competitive landscapes, and future trends. Our research utilizes high-volume keywords such as "Canada IT market," "Canadian software market," "ICT services Canada," and "telecom Canada growth" for optimal search engine visibility and to engage key industry stakeholders.

Canada ICT Market Market Structure & Competitive Landscape

The Canadian ICT market is characterized by a dynamic structure with significant innovation drivers. The market exhibits moderate to high concentration, with a few large players dominating certain segments while a vibrant ecosystem of smaller, agile companies fosters competition and innovation. Regulatory frameworks, particularly concerning data privacy and telecommunications, play a crucial role in shaping market entry and operational strategies. Product substitutes are abundant, especially in the software and cloud services sectors, intensifying competition and driving continuous product development. End-user segmentation reveals a strong demand from both Small and Medium Enterprises (SMEs) and Large Enterprises, each with distinct technology adoption patterns and service requirements. Mergers and Acquisitions (M&A) activity is a consistent feature, driven by the pursuit of market consolidation, technological advancement, and expanded service offerings. Key players like Constellation Software Inc., OpenText Corporation, and BCE Inc. are actively involved in strategic M&A to enhance their market position. The concentration ratio in the IT services segment is estimated to be around 45%, indicating a significant influence of top players. Over the historical period (2019-2024), approximately $5 Billion in M&A deals have been recorded, highlighting active market consolidation.

Canada ICT Market Market Trends & Opportunities

The Canadian ICT market is poised for significant growth, driven by robust digital transformation initiatives across all industry verticals. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033), reaching an estimated value exceeding $150 Billion by 2033. This growth is fueled by an increasing adoption of cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), fundamentally reshaping how businesses operate and consumers interact with technology. The rise of remote work and hybrid models has accelerated demand for advanced collaboration tools and secure network infrastructure, creating substantial opportunities for IT services and telecommunication providers. E-commerce expansion, particularly in the Retail and E-commerce sector, is also a major catalyst, driving investment in digital platforms, data analytics, and cybersecurity solutions. Furthermore, government investments in digital infrastructure and smart city initiatives are creating a fertile ground for innovation and market penetration. Consumer preferences are increasingly leaning towards personalized digital experiences and seamless connectivity, pushing companies to invest in customer-centric technologies. The competitive landscape is evolving with the emergence of niche solution providers and the aggressive expansion of global tech giants into the Canadian market. Opportunities abound in areas such as cybersecurity, data analytics, cloud migration services, and the development of specialized AI-driven applications for sectors like BFSI and Manufacturing. The market penetration rate for cloud services is expected to exceed 70% by 2030, underscoring the shift towards digital-first strategies.

Dominant Markets & Segments in Canada ICT Market

The IT Services segment is the dominant force within the Canadian ICT market, commanding an estimated 35% market share. This dominance is propelled by the increasing reliance of businesses across all sizes and verticals on outsourced IT support, cloud migration, digital transformation consulting, and managed services. The Software segment follows closely, holding approximately 28% of the market, driven by the burgeoning demand for specialized applications, enterprise resource planning (ERP) systems, customer relationship management (CRM) solutions, and data analytics platforms. Telecommunication Services represent a substantial 25% of the market, underpinned by the continuous need for high-speed internet, mobile connectivity, and advanced network infrastructure, essential for supporting the digital economy. The Hardware segment, though smaller at around 12%, remains critical, encompassing the provision of servers, networking equipment, and end-user devices.

Dominant Segments by Size of Enterprise:

- Large Enterprises: These organizations are significant consumers of complex, integrated ICT solutions, driving demand for enterprise-grade software, extensive IT services, and robust telecommunication networks. Their substantial IT budgets and strategic focus on digital transformation make them key growth drivers.

- Small and Medium Enterprises (SMEs): SMEs are increasingly adopting cloud-based solutions, SaaS models, and managed IT services to enhance efficiency and competitiveness without significant upfront capital investment. Government initiatives supporting SME digitalization are further boosting this segment.

Dominant Segments by Industry Vertical:

- IT and Telecom: This sector is a primary consumer and driver of ICT advancements, constantly investing in cutting-edge technologies and services.

- BFSI (Banking, Financial Services, and Insurance): This vertical is a major adopter of digital solutions for enhanced customer experience, fraud detection, regulatory compliance, and efficient operations.

- Government: Federal, provincial, and municipal governments are heavily investing in digitalizing public services, improving citizen engagement, and strengthening national cybersecurity infrastructure.

- Retail and E-commerce: The rapid growth of online retail necessitates sophisticated e-commerce platforms, data analytics for customer insights, and secure payment gateways.

- Manufacturing: Industry 4.0 adoption, including IoT, automation, and data analytics for predictive maintenance, is driving significant ICT investment in this sector.

- Energy and Utilities: Digitalization is crucial for grid modernization, smart metering, remote asset management, and optimizing energy distribution.

Key growth drivers across these segments include continuous technological innovation, supportive government policies for digital adoption, and the increasing need for cybersecurity solutions.

Canada ICT Market Product Analysis

The Canadian ICT market is characterized by a relentless pace of product innovation focused on enhancing efficiency, security, and user experience. Software solutions are increasingly leveraging AI and machine learning for advanced analytics, automation, and personalized user engagement, as exemplified by Salesforce Canada's CRM offerings. Hardware innovation focuses on more powerful, energy-efficient devices and sophisticated networking equipment from Cisco Systems Canada Co. IT services are evolving to encompass sophisticated cloud management, cybersecurity consulting, and end-to-end digital transformation enablement, with companies like Cognizant Technology Solutions Canada Inc. at the forefront. Telecommunication services are rapidly expanding with the rollout of 5G technology and advancements in fiber optic networks, enhancing connectivity speeds and reliability. Competitive advantages are being gained through specialized solutions, superior customer support, and the ability to integrate diverse technological components into cohesive business solutions. The market fit for these products is driven by the urgent need for businesses to adapt to evolving digital landscapes and meet the dynamic demands of consumers and industries.

Key Drivers, Barriers & Challenges in Canada ICT Market

Key Drivers:

- Digital Transformation Imperative: Across all sectors, businesses are compelled to adopt digital technologies for efficiency, competitiveness, and customer engagement.

- Government Support & Investment: Initiatives promoting digital adoption, innovation, and infrastructure development provide a conducive environment.

- Technological Advancements: The continuous evolution of AI, cloud computing, IoT, and 5G fuels demand for new solutions and services.

- Growing Cybersecurity Threats: The increasing sophistication of cyber threats drives significant investment in robust security solutions.

- E-commerce Expansion: The booming online retail sector necessitates advanced digital platforms and robust IT infrastructure.

Key Barriers & Challenges:

- Talent Shortage: A significant gap exists in skilled ICT professionals, hindering the adoption and implementation of new technologies.

- Cybersecurity Risks: Despite investments, the evolving threat landscape presents a persistent challenge for businesses and consumers.

- High Implementation Costs: For some smaller businesses, the initial investment in advanced ICT solutions can be a barrier.

- Regulatory Complexity: Navigating various data privacy and compliance regulations can be challenging for businesses.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of hardware components.

Growth Drivers in the Canada ICT Market Market

The Canadian ICT market's growth is propelled by several key factors. Technological advancements in areas like AI, machine learning, and cloud computing are creating new avenues for innovation and adoption. The Canadian government's commitment to digital infrastructure and innovation, including funding for R&D and digital skills development, significantly boosts the market. Economically, the increasing demand for digital solutions from a diverse range of industries, from BFSI to manufacturing, is a primary catalyst. Furthermore, the growing adoption of remote work necessitates enhanced connectivity and collaborative tools, driving demand for telecommunication and IT services. The robust growth of e-commerce is also a significant contributor.

Challenges Impacting Canada ICT Market Growth

Several challenges temper the growth trajectory of the Canadian ICT market. Regulatory complexities, particularly concerning data privacy and cross-border data flows, can create hurdles for businesses. Supply chain issues, stemming from global manufacturing and logistics disruptions, continue to impact the availability and cost of essential hardware components. Intense competitive pressures from both established global players and agile domestic startups demand continuous innovation and strategic agility from market participants. The persistent shortage of skilled ICT talent poses a significant restraint, limiting the capacity for organizations to fully implement and leverage advanced technologies. Furthermore, cybersecurity threats are an ongoing concern, requiring constant vigilance and investment.

Key Players Shaping the Canada ICT Market Market

- Constellation Software Inc.

- The Descartes Systems Group Inc.

- OpenText Corporation

- Salesforce Canada

- Amazon com CA Inc

- Saskatchewan Telecommunications Holding Corporation

- MeloTel Inc

- Rogers Communications Inc

- Cognizant Technology Solutions Canada Inc

- Telus Communications Inc

- Shaw Communications Inc

- CGI Inc

- Videotron

- Cisco Systems Canada Co

- BCE Inc

- Quebecor Inc

Significant Canada ICT Market Industry Milestones

- October 2023: CyberCatch Holdings, Inc. launched the Digital Standards Manager, a compliance assessment solution designed to assist organizations in managing and implementing digital technology governance standards, enhancing partnership with Canada's Digital Governance Council.

- July 2023: Alletec, a Microsoft Business Applications and Azure partner, strengthened its Canadian operations by partnering with Frux Technologies. This synergy aims to provide comprehensive digital transformation solutions leveraging Microsoft Dynamics 365, Power Platform, Microsoft 365, and Azure Cloud services.

Future Outlook for Canada ICT Market Market

The future outlook for the Canada ICT market is exceptionally bright, driven by continued digital transformation and innovation. Strategic opportunities lie in the expansion of cloud-native solutions, the pervasive adoption of AI and machine learning across industries, and the continuous build-out of 5G infrastructure. The increasing focus on cybersecurity, data analytics, and IoT solutions will create sustained demand. Government initiatives supporting innovation and digital skills development are expected to foster a dynamic and growth-oriented market. We anticipate substantial growth in IT services, software development, and advanced telecommunication services, catering to the evolving needs of businesses and consumers alike. The market is projected to witness increased investment in areas like quantum computing and edge computing, further solidifying Canada's position as a key player in the global digital economy.

Canada ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Canada ICT Market Segmentation By Geography

- 1. Canada

Canada ICT Market Regional Market Share

Geographic Coverage of Canada ICT Market

Canada ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Spending on Hardware and Software Services

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. 5G Application at the Peak

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Eastern Canada Canada ICT Market Analysis, Insights and Forecast, 2020-2032

- 7. Western Canada Canada ICT Market Analysis, Insights and Forecast, 2020-2032

- 8. Central Canada Canada ICT Market Analysis, Insights and Forecast, 2020-2032

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Constellation Software Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 The Descartes Systems Group Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 OpenText Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Salesforce Canada

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Amazon com CA Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Saskatchewan Telecommunications Holding Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 MeloTel Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Rogers Communications Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cognizant Technology Solutions Canada Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Telus Communications Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Shaw Communications Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 CGI Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Videotron

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Cisco Systems Canada Co

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 BCE Inc

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Quebecor Inc

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.1 Constellation Software Inc

List of Figures

- Figure 1: Canada ICT Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada ICT Market Share (%) by Company 2025

List of Tables

- Table 1: Canada ICT Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Canada ICT Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Canada ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Canada ICT Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Canada ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 6: Canada ICT Market Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 7: Canada ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Canada ICT Market Volume K Unit Forecast, by Industry Vertical 2020 & 2033

- Table 9: Canada ICT Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Canada ICT Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Canada ICT Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Canada ICT Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Eastern Canada Canada ICT Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Eastern Canada Canada ICT Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Western Canada Canada ICT Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Western Canada Canada ICT Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Central Canada Canada ICT Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Central Canada Canada ICT Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Canada ICT Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Canada ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 22: Canada ICT Market Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 23: Canada ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 24: Canada ICT Market Volume K Unit Forecast, by Industry Vertical 2020 & 2033

- Table 25: Canada ICT Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Canada ICT Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada ICT Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Canada ICT Market?

Key companies in the market include Constellation Software Inc, The Descartes Systems Group Inc, OpenText Corporation, Salesforce Canada, Amazon com CA Inc, Saskatchewan Telecommunications Holding Corporation, MeloTel Inc, Rogers Communications Inc, Cognizant Technology Solutions Canada Inc, Telus Communications Inc, Shaw Communications Inc, CGI Inc, Videotron, Cisco Systems Canada Co, BCE Inc, Quebecor Inc .

3. What are the main segments of the Canada ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 133.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Spending on Hardware and Software Services.

6. What are the notable trends driving market growth?

5G Application at the Peak.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

In October 2023, CyberCatch Holdings, Inc. launched a cutting-edge compliance assessment solution, the Digital Standards Manager, designed to help organizations effectively manage and implement digital technology governance standards. This latest product launch expands on the partnership with Canada's Digital Governance Council. It provides organizations with a comprehensive online tool for evaluating, monitoring and ensuring compliance with standards published by the Council's Digital Governance Standards Institute.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada ICT Market?

To stay informed about further developments, trends, and reports in the Canada ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence