Key Insights

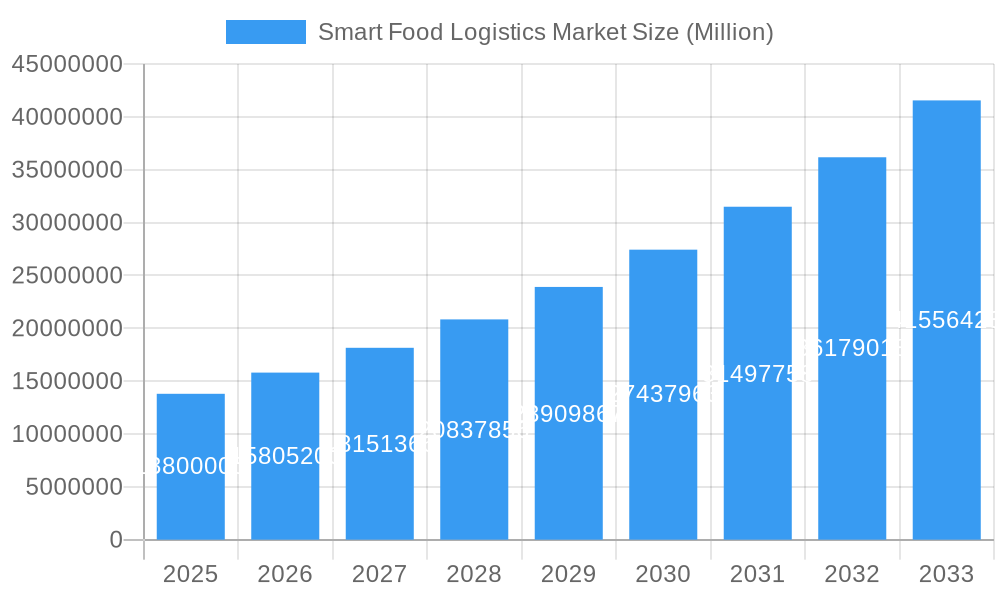

The global Smart Food Logistics Market is poised for significant expansion, projected to reach a substantial market size of $13.80 million in the base year 2025. This robust growth trajectory is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 14.61%, indicating strong and sustained market momentum throughout the forecast period of 2025-2033. The market's expansion is primarily driven by the escalating demand for enhanced food safety and quality assurance, coupled with the increasing adoption of advanced technologies for efficient supply chain management. Key technological advancements such as the Internet of Things (IoT) for real-time monitoring, Artificial Intelligence (AI) for predictive analytics, and blockchain for transparent traceability are instrumental in revolutionizing food logistics. Furthermore, stringent government regulations concerning food safety and a growing consumer awareness regarding the origin and handling of their food products are compelling businesses to invest in smart solutions. The integration of these technologies ensures reduced spoilage, optimized inventory management, and improved overall supply chain resilience, directly contributing to the market's upward trend.

Smart Food Logistics Market Market Size (In Million)

The Smart Food Logistics Market is segmented into distinct categories, reflecting the diverse technological and operational needs of the industry. The "Component" segment is broadly categorized into Hardware, Software, and Services. Within the "Technology" segment, key areas of focus include Fleet Management, Asset Tracking, and Cold Chain Monitoring. Fleet management solutions are critical for optimizing delivery routes and fuel efficiency, while asset tracking ensures the secure and timely movement of goods. Cold chain monitoring, in particular, is vital for perishable food items, ensuring they are transported and stored within precise temperature ranges to maintain freshness and prevent contamination. The market is also characterized by the presence of influential players such as Geotab Inc., Samsara Inc., Verizon Connect, and Controlant, among others. These companies are actively developing and deploying innovative solutions to address the evolving challenges within the food supply chain. The market's growth is anticipated to be geographically diverse, with significant opportunities expected across regions, driven by increasing investments in smart infrastructure and a growing emphasis on food security and sustainability.

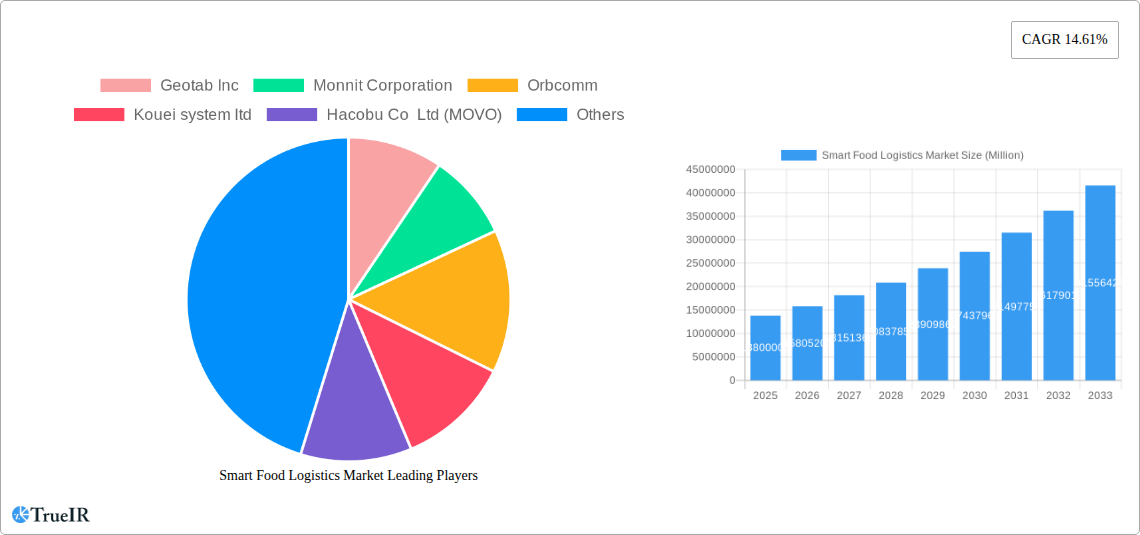

Smart Food Logistics Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Smart Food Logistics Market, a rapidly evolving sector critical for ensuring the safety, quality, and timely delivery of food products. Leveraging high-volume keywords such as "food logistics technology," "cold chain management," "IoT in food supply chain," "fleet management food," and "asset tracking logistics," this report is optimized for search engines and designed to engage industry professionals. The study covers the historical period from 2019 to 2024, with a base year of 2025, and projects market growth through 2033. We analyze key segments, dominant regions, industry trends, and the competitive landscape, offering actionable insights for stakeholders aiming to capitalize on market opportunities.

Smart Food Logistics Market Market Structure & Competitive Landscape

The Smart Food Logistics Market exhibits a moderately concentrated structure, driven by the increasing adoption of advanced technologies and a growing emphasis on supply chain visibility and regulatory compliance. Key innovation drivers include the demand for reduced food waste, enhanced food safety, and greater operational efficiency. Regulatory impacts, particularly concerning food traceability and temperature control, are significant, pushing companies to invest in smart solutions. Product substitutes, such as manual tracking and traditional logistics methods, are gradually being phased out by more sophisticated digital alternatives. End-user segmentation reveals a strong focus on the grocery retail, food processing, and food service sectors, all seeking to optimize their complex distribution networks. Mergers and acquisitions (M&A) trends are on the rise as larger players aim to consolidate market share and acquire innovative technologies. For instance, the period from 2019-2024 has seen approximately 15-20 significant M&A activities valued at over xx Million, indicating a drive towards consolidation. Concentration ratios are estimated to be around xx% for the top 5 players, suggesting a competitive yet consolidating market.

Smart Food Logistics Market Market Trends & Opportunities

The Smart Food Logistics Market is poised for substantial growth, driven by an escalating global demand for efficient, transparent, and safe food supply chains. The market size is projected to reach xx Million by 2033, expanding at a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Technological shifts are central to this expansion, with the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and advanced telematics becoming indispensable tools. These technologies enable real-time monitoring of temperature, humidity, location, and product integrity throughout the entire journey from farm to fork. Consumer preferences are increasingly leaning towards sustainably sourced and safely delivered food, creating a strong market pull for smart logistics solutions that can guarantee product quality and reduce spoilage. Competitive dynamics are intensifying, with established logistics providers, technology firms, and specialized food tech companies vying for market dominance. The increasing adoption of digital platforms for order management, route optimization, and inventory control is creating new revenue streams and opportunities for service providers. For example, the penetration of IoT devices in cold chain monitoring has increased from approximately xx% in 2019 to an estimated xx% in 2024, indicating rapid market adoption. The potential for predictive analytics to prevent stockouts and minimize waste presents a significant opportunity for companies to offer value-added services. Furthermore, the growing focus on compliance with international food safety standards is a powerful catalyst, driving investments in technologies that provide immutable audit trails and ensure adherence to strict temperature and handling protocols. The expansion of e-commerce for groceries further amplifies the need for sophisticated last-mile delivery solutions and efficient inventory management, presenting a fertile ground for smart food logistics.

Dominant Markets & Segments in Smart Food Logistics Market

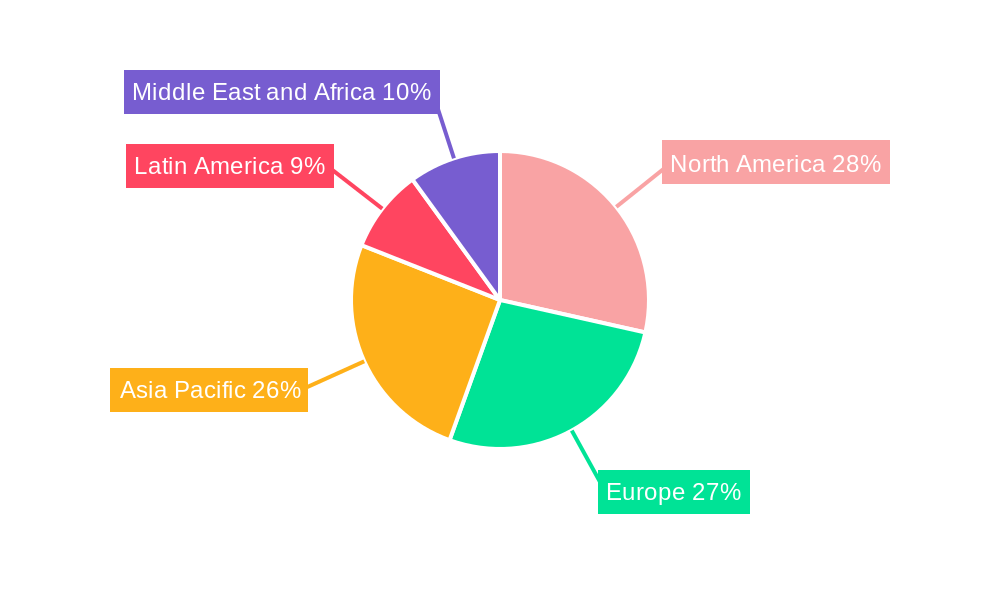

The Smart Food Logistics Market is dominated by regions and segments that prioritize technological adoption, robust infrastructure, and stringent food safety regulations.

- Leading Region: North America and Europe currently lead the smart food logistics market due to their advanced technological infrastructure, high disposable incomes, and strong regulatory frameworks emphasizing food safety and traceability. The Asia Pacific region is emerging as a significant growth area, driven by rapid industrialization, increasing urbanization, and a burgeoning middle class with higher demand for quality food products.

- Dominant Component:

- Hardware: The hardware segment, including IoT sensors, GPS trackers, RFID tags, and smart refrigeration units, is crucial for real-time data collection. The demand for reliable and cost-effective sensors capable of withstanding harsh environments is a key growth driver.

- Software: Software solutions, encompassing fleet management systems, warehouse management systems (WMS), transportation management systems (TMS), and cold chain monitoring platforms, are vital for processing and analyzing the vast amounts of data generated. Cloud-based solutions and AI-powered analytics are gaining traction for their scalability and predictive capabilities.

- Services: Logistics and supply chain management services, including implementation, integration, maintenance, and consulting, are essential for optimizing smart food logistics operations. Value-added services like data analytics and compliance reporting contribute significantly to market growth.

- Dominant Technology:

- Cold Chain Monitoring: This technology is paramount in the food industry, ensuring that perishable goods are maintained within specific temperature ranges throughout their journey. Advancements in real-time temperature tracking, alerts, and historical data logging are critical.

- Fleet Management: Optimizing delivery routes, monitoring driver behavior, ensuring vehicle maintenance, and managing fuel efficiency are key aspects of fleet management in food logistics. Technologies like GPS tracking and telematics systems are integral.

- Asset Tracking: Real-time visibility of food products, containers, and vehicles is essential for preventing loss, theft, and damage. RFID, GPS, and other tracking technologies provide this crucial visibility.

The growth in these segments is propelled by government policies promoting food safety and traceability, the increasing need to reduce food spoilage and waste (estimated at xx% annually), and the demand for efficient last-mile delivery solutions driven by the growth of online grocery shopping, which is expected to reach xx% market penetration by 2033.

Smart Food Logistics Market Product Analysis

Product innovations in the Smart Food Logistics Market are centered around enhancing real-time visibility, predictive capabilities, and automation. Key advancements include the development of highly sensitive and durable IoT sensors capable of monitoring a wider range of parameters like humidity, ethylene levels, and shock impacts. Integrated software platforms are offering sophisticated analytics for demand forecasting, route optimization, and proactive identification of potential spoilage risks. Smart refrigeration units with advanced temperature control and remote diagnostics are becoming more prevalent. Competitive advantages lie in the ability of these products to provide end-to-end traceability, ensure regulatory compliance, reduce operational costs, and minimize food waste, thereby improving overall supply chain resilience and customer satisfaction.

Key Drivers, Barriers & Challenges in Smart Food Logistics Market

Key Drivers: The Smart Food Logistics Market is propelled by several critical drivers. Technologically, the proliferation of IoT devices, advanced sensors, and AI-powered analytics enables unprecedented visibility and control over the food supply chain. Economically, the growing consumer demand for safe, fresh, and traceable food products, coupled with the need to reduce food waste and associated financial losses (estimated at over xx Billion annually), incentivizes investment in smart solutions. Policy-driven factors, such as stricter food safety regulations and governmental initiatives promoting supply chain transparency, also play a significant role.

Barriers & Challenges: Despite the strong growth potential, the market faces several challenges. Supply chain complexities, particularly in diverse geographical and climatic conditions, can hinder the seamless integration of smart technologies. Regulatory hurdles, including varying standards across regions and the cost of compliance, can be substantial. Competitive pressures from established logistics providers and the need for significant upfront investment in technology can act as barriers for smaller players. Cybersecurity threats to connected systems also pose a risk, requiring robust security measures. The cost of implementation and the need for skilled labor to manage and interpret data are also significant considerations.

Growth Drivers in the Smart Food Logistics Market Market

Key drivers propelling the Smart Food Logistics Market are multifaceted. The technological imperative to enhance food safety and traceability, driven by increasing consumer awareness and stringent regulations, is a primary catalyst. The economic benefit of reducing food spoilage, which accounts for an estimated xx% of total food produced globally, presents a compelling business case for adopting smart logistics. Furthermore, the expansion of e-commerce for groceries necessitates more efficient and responsive last-mile delivery systems, powered by smart technologies. Government initiatives promoting sustainability and food security are also contributing significantly to market growth.

Challenges Impacting Smart Food Logistics Market Growth

Several challenges are impacting the growth of the Smart Food Logistics Market. The integration of disparate IT systems and the interoperability of different technologies remain significant hurdles. The high initial investment costs associated with implementing advanced smart logistics solutions can be a barrier, especially for small and medium-sized enterprises. Navigating complex and evolving regulatory landscapes across different jurisdictions adds another layer of difficulty. Furthermore, ensuring robust cybersecurity to protect sensitive supply chain data from potential breaches is a constant concern, demanding continuous investment in security protocols and infrastructure.

Key Players Shaping the Smart Food Logistics Market Market

- Geotab Inc

- Monnit Corporation

- Orbcomm

- Kouei system ltd

- Hacobu Co Ltd (MOVO)

- Seaos

- Berlinger & Co AG

- Samsara Inc

- Kii Corporation

- Teletrac Navman

- Nippon Express co Ltd

- Controlant

- LYNA LOGICS Inc

- Sensitech (Carrier Global Corporation)

- YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- Verizon Connect

Significant Smart Food Logistics Market Industry Milestones

- April 2022: CoolKit, a leading UK manufacturer of temperature-controlled vans, selected ORBCOMM Inc. for its temperature monitoring and compliance solutions. This partnership aims to ensure a continuous cold chain for pharmaceutical, healthcare, food, beverage, and agricultural clients, improve eco-friendly driving practices, and enhance administrative efficiency.

- March 2022: ORBCOMM Inc. launched its CT 3500 IoT telematics device, enabling comprehensive remote management of containerized assets across land, rail, and sea. This data-driven solution enhances functionality, analytics, and interoperability for global shippers and carriers, improving reefer container logistics.

Future Outlook for Smart Food Logistics Market Market

The future outlook for the Smart Food Logistics Market is exceptionally positive, driven by ongoing technological advancements and an increasing global demand for food safety and efficiency. Strategic opportunities lie in the further integration of AI and blockchain for enhanced transparency and fraud prevention, as well as the expansion of smart solutions into emerging markets. The growing emphasis on sustainability and the reduction of food waste will continue to be a major growth catalyst. Market players that can offer integrated, end-to-end solutions, coupled with robust data analytics and predictive capabilities, are best positioned to capitalize on the expanding market potential and secure a competitive advantage in the years to come. The market is expected to witness continued innovation, with a focus on creating more resilient and responsive food supply chains.

Smart Food Logistics Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software and Services

-

2. Technology

- 2.1. Fleet Management

- 2.2. Asset Tracking

- 2.3. Cold Chain Monitoring

Smart Food Logistics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Smart Food Logistics Market Regional Market Share

Geographic Coverage of Smart Food Logistics Market

Smart Food Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Efficient Monitoring and Tracking for Better Control of Assets

- 3.3. Market Restrains

- 3.3.1. Installation Complexities

- 3.4. Market Trends

- 3.4.1. Cold Chain Monitoring to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fleet Management

- 5.2.2. Asset Tracking

- 5.2.3. Cold Chain Monitoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Fleet Management

- 6.2.2. Asset Tracking

- 6.2.3. Cold Chain Monitoring

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Fleet Management

- 7.2.2. Asset Tracking

- 7.2.3. Cold Chain Monitoring

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Fleet Management

- 8.2.2. Asset Tracking

- 8.2.3. Cold Chain Monitoring

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Fleet Management

- 9.2.2. Asset Tracking

- 9.2.3. Cold Chain Monitoring

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Smart Food Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software and Services

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Fleet Management

- 10.2.2. Asset Tracking

- 10.2.3. Cold Chain Monitoring

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Geotab Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Monnit Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Orbcomm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kouei system ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hacobu Co Ltd (MOVO)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seaos

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Berlinger & Co AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Samsara Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kii Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teletrac Navman

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Express co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Controlant

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LYNA LOGICS Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sensitech (Carrier Global Corporation)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Verizon Connect

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Geotab Inc

List of Figures

- Figure 1: Global Smart Food Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Latin America Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Latin America Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Smart Food Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Food Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Smart Food Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Smart Food Logistics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Smart Food Logistics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Smart Food Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Food Logistics Market?

The projected CAGR is approximately 14.61%.

2. Which companies are prominent players in the Smart Food Logistics Market?

Key companies in the market include Geotab Inc, Monnit Corporation, Orbcomm, Kouei system ltd, Hacobu Co Ltd (MOVO), Seaos, Berlinger & Co AG, Samsara Inc, Kii Corporation, Teletrac Navman, Nippon Express co Ltd, Controlant, LYNA LOGICS Inc *List Not Exhaustive, Sensitech (Carrier Global Corporation), YUSEN LOGISTICS CO LTD (Nippon Yusen Kabushiki Kaisha(NYK), Verizon Connect.

3. What are the main segments of the Smart Food Logistics Market?

The market segments include Component, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Efficient Monitoring and Tracking for Better Control of Assets.

6. What are the notable trends driving market growth?

Cold Chain Monitoring to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Installation Complexities.

8. Can you provide examples of recent developments in the market?

April 2022: CoolKit, the largest manufacturer of temperature-controlled vans in the UK, has chosen ORBCOMM Inc. to supply temperature monitoring, management, and compliance for the refrigerated vehicles it offers to customers primarily in the pharmaceutical, healthcare, food, beverage, and agricultural industries. With ORBCOMM's strong temperature recorder solution, CoolKit can prove a continuous cold chain, reduce its carbon footprint by encouraging eco-friendly driving, and improve the efficiency of its administrative operations and workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Food Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Food Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Food Logistics Market?

To stay informed about further developments, trends, and reports in the Smart Food Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence