Key Insights

The Middle East & Africa (MEA) Smartphones market is projected for significant expansion, with an estimated market size of $1708.7 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 12.3% from a base year of 2024. This growth is fueled by rising disposable incomes, a young and digitally engaged population, and increasing smartphone affordability. Technological advancements, including 5G deployment and AI integration, are driving demand for upgraded devices. Government-led digital initiatives and infrastructure development further bolster market expansion. While Android leads due to accessible pricing, the premium segment, influenced by iOS, is also growing, indicating evolving consumer preferences. Key manufacturers like Samsung, Xiaomi, and Huawei are actively competing with innovative products and strategic pricing, particularly in emerging economies.

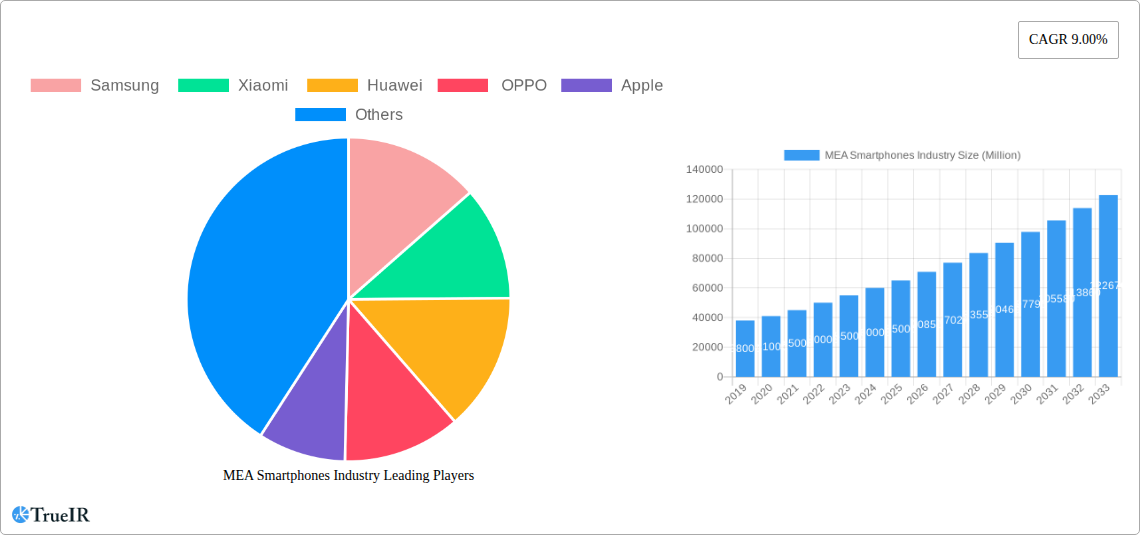

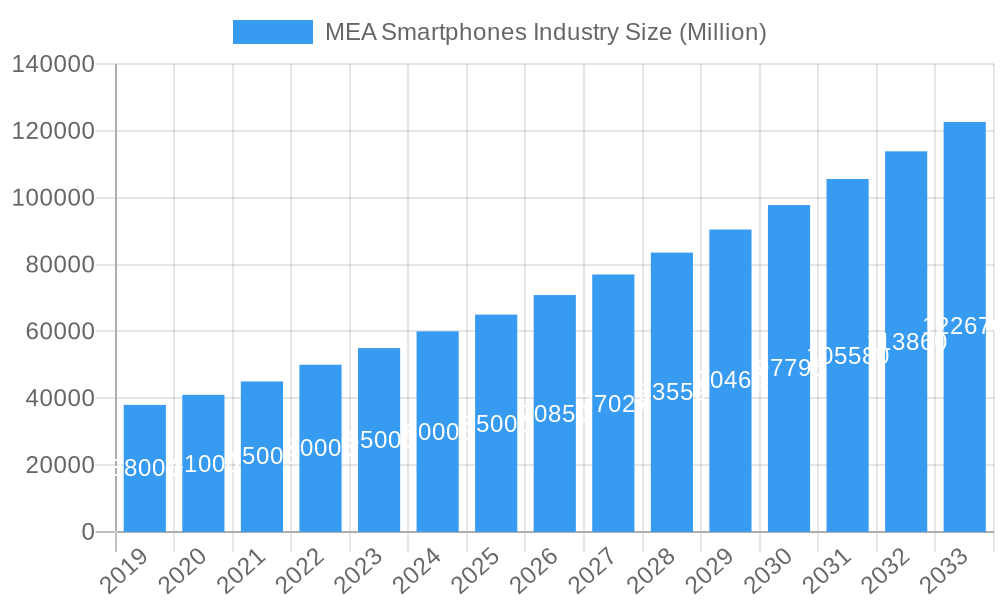

MEA Smartphones Industry Market Size (In Billion)

Despite its potential, the MEA Smartphones market faces challenges such as economic volatility, currency fluctuations impacting purchasing power, and supply chain disruptions. However, the fundamental demand for smartphones as essential tools for communication, education, and economic participation remains robust. The proliferation of mobile banking and e-commerce services reinforces the smartphone's importance, creating sustained demand for entry-level and mid-range devices, alongside a growing interest in advanced features. The Middle East is a key market, but Africa presents the most substantial growth opportunities due to lower smartphone penetration. Companies aiming to succeed in this dynamic and complex market must prioritize innovation, strategic alliances, and localized product strategies.

MEA Smartphones Industry Company Market Share

MEA Smartphones Industry: In-Depth Market Analysis and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Middle East & Africa (MEA) Smartphones Industry, providing critical insights into its market structure, trends, growth drivers, and future outlook. Covering the historical period from 2019 to 2024 and projecting growth through 2033 with a base year of 2025, this analysis utilizes high-volume keywords to ensure maximum SEO visibility and engagement for industry professionals. Gain a competitive edge with data-driven intelligence on this rapidly evolving market.

MEA Smartphones Industry Market Structure & Competitive Landscape

The MEA smartphones market is characterized by intense competition among global giants and emerging players, with a notable concentration of market share held by a few dominant companies. Innovation remains a key driver, fueled by significant R&D investments from leading brands. Regulatory impacts vary across the region, influencing market entry and product offerings. Substitute products, while present in the form of feature phones and tablets, are increasingly sidelined by the widespread adoption of smartphones. End-user segmentation is diverse, encompassing various income groups and demographic profiles. Mergers and acquisitions (M&A) are active, reflecting strategic consolidation and market expansion efforts. For instance, M&A activity volume is estimated at over $500 Million during the historical period. Concentration ratios indicate that the top 3 players command approximately 70% of the market share.

MEA Smartphones Industry Market Trends & Opportunities

The MEA Smartphones Industry is poised for substantial growth, driven by increasing disposable incomes, expanding mobile penetration, and a burgeoning young population actively seeking connected devices. The market is projected to reach a value of over $70 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8% during the forecast period (2025-2033). Technological shifts, particularly the rapid rollout of 5G networks across key MEA markets, are creating significant opportunities for the adoption of next-generation smartphones. Consumer preferences are increasingly leaning towards devices with advanced camera capabilities, larger displays, longer battery life, and robust performance for gaming and content consumption. The competitive dynamics are intensifying, with brands vying for market share through aggressive pricing strategies, innovative product launches, and localized marketing campaigns. Opportunities also lie in the growing demand for affordable, yet feature-rich, mid-range smartphones, catering to a vast segment of the population eager to upgrade. Furthermore, the expansion of e-commerce platforms is facilitating wider accessibility to smartphone devices across the region.

Dominant Markets & Segments in MEA Smartphones Industry

The Android operating system unequivocally dominates the MEA Smartphones Industry, commanding an estimated market share of over 85%. This dominance is fueled by the vast array of affordable to premium Android devices available from numerous manufacturers, catering to diverse price points and user needs. The open-source nature of Android also allows for greater customization and a wider selection of applications, aligning with the preferences of many MEA consumers.

- Key Growth Drivers for Android Dominance:

- Affordability and Accessibility: A wide spectrum of Android smartphones are available at various price points, making them accessible to a larger segment of the MEA population.

- Manufacturer Diversity: Numerous global and regional manufacturers offer Android devices, fostering intense competition that benefits consumers with more choices and competitive pricing.

- Customization and Open Ecosystem: Android's open nature allows for greater device customization and a rich app ecosystem, appealing to tech-savvy users.

- 5G Network Expansion: The increasing deployment of 5G infrastructure across MEA countries further propels the adoption of 5G-enabled Android smartphones.

- Government Initiatives: Supportive government policies promoting digital inclusion and technological adoption in many MEA nations are indirectly boosting Android smartphone sales.

While iOS holds a significant, albeit smaller, market share, primarily within the premium segment in affluent markets like the UAE and Saudi Arabia, its influence is more concentrated. Other operating systems, such as KaiOS, find a niche in the feature phone segment and some basic smartphones but have a negligible impact on the overall smartphone market. The market penetration rate for smartphones in the MEA region is expected to exceed 75% by 2033.

MEA Smartphones Industry Product Analysis

Product innovation in the MEA Smartphones Industry is characterized by a relentless pursuit of enhanced camera technologies, including higher megapixel counts and advanced AI-driven photography features. Larger, higher-resolution displays with smoother refresh rates are becoming standard, catering to multimedia consumption. Enhanced battery life and faster charging capabilities are critical competitive advantages. 5G connectivity is rapidly becoming a defining feature across all price segments. Brands are also focusing on durable designs, water resistance, and improved processing power for seamless multitasking and gaming experiences.

Key Drivers, Barriers & Challenges in MEA Smartphones Industry

Key Drivers, Barriers & Challenges in MEA Smartphones Industry

Key Drivers: The MEA Smartphones Industry is propelled by a confluence of factors. The rapidly growing youth demographic, coupled with increasing disposable incomes in several key economies, fuels demand for upgraded devices. The expanding digital infrastructure, including widespread mobile internet access and the aggressive rollout of 5G networks, creates a fertile ground for advanced smartphone adoption. Government initiatives promoting digital transformation and e-commerce further accelerate market growth.

Barriers & Challenges: Despite robust growth, the industry faces significant challenges. Economic volatility and fluctuating currency exchange rates in some MEA countries can impact affordability. Intense price competition among brands can squeeze profit margins. Supply chain disruptions, as witnessed in recent years, pose a persistent threat to production and timely delivery. Regulatory complexities and varying import duties across different nations add another layer of operational challenge. Furthermore, the increasing cost of advanced components, such as high-end processors and camera sensors, presents a barrier to maintaining aggressive pricing strategies for entry-level and mid-range devices.

Growth Drivers in the MEA Smartphones Industry Market

Key growth drivers in the MEA Smartphones Industry market include the increasing adoption of 5G technology, which necessitates smartphone upgrades. The expanding middle class in numerous MEA nations, coupled with a youthful population eager for digital connectivity and entertainment, significantly boosts demand. Government focus on digital transformation and the development of smart cities across the region also acts as a powerful catalyst for smartphone penetration and adoption. Furthermore, the proliferation of affordable and feature-rich smartphones continues to drive market expansion.

Challenges Impacting MEA Smartphones Industry Growth

Challenges impacting MEA Smartphones Industry growth include intense price competition leading to thinner profit margins for manufacturers. Supply chain vulnerabilities, from component shortages to logistical hurdles, continue to pose a threat. Fluctuating economic conditions and currency depreciation in certain key markets can impact consumer purchasing power. Additionally, evolving regulatory landscapes and varying import tariffs across different MEA countries add complexity to market operations and can create barriers to entry for some players.

Key Players Shaping the MEA Smartphones Industry Market

- Samsung

- Xiaomi

- Huawei

- OPPO

- Apple

Significant MEA Smartphones Industry Industry Milestones

- Mar 2021: Samsung announced the launch of its mid-tier smartphone, the Galaxy A32, offering both LTE and 5G options for South African consumers. This move aimed to make innovation more accessible and introduce 5G capabilities to the Galaxy A Series for the first time in the region.

- May 2021: Xiaomi expanded its mid-range smartphone lineup with the introduction of the Redmi Note 10S and Redmi Note 10 5G. These devices, featuring advanced capabilities like a 64MP camera and 5G connectivity, reinforced Xiaomi's commitment to delivering cutting-edge technology at competitive price points in the MEA market, with the Redmi Note 10 5G available from Dh 699.

Future Outlook for MEA Smartphones Industry Market

The future outlook for the MEA Smartphones Industry remains exceptionally promising. Continued 5G network expansion will be a primary growth catalyst, driving demand for compatible devices. The increasing affordability of smartphones, coupled with evolving consumer preferences for advanced features, will sustain market penetration. Opportunities lie in the development of innovative foldable devices, enhanced AI integration, and the continued expansion of mobile-first digital services across the region. Strategic partnerships and localized product development will be crucial for sustained success in this dynamic and rapidly growing market.

MEA Smartphones Industry Segmentation

-

1. Operating System

- 1.1. Android

- 1.2. iOS

- 1.3. Others

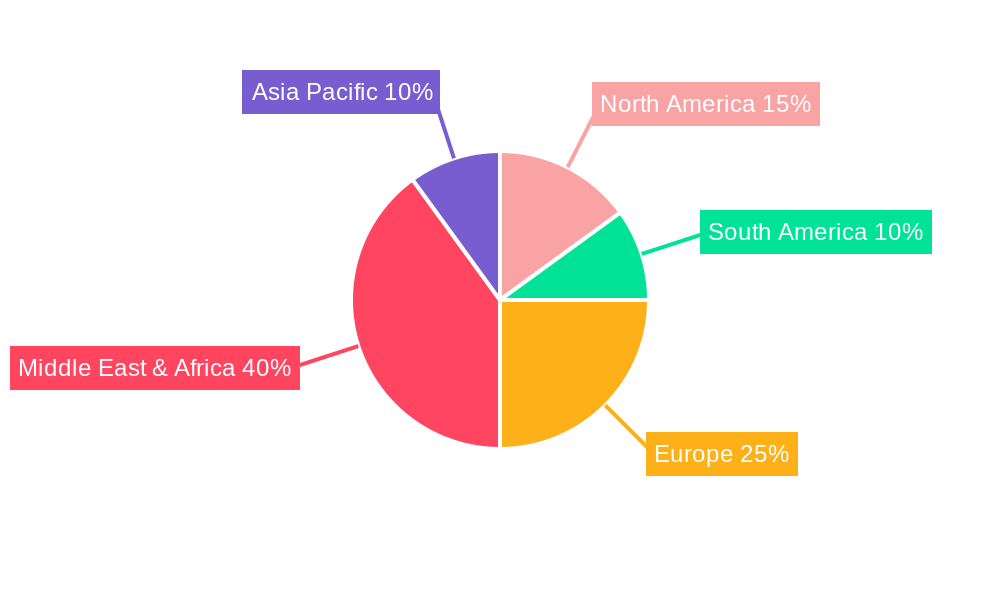

MEA Smartphones Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Smartphones Industry Regional Market Share

Geographic Coverage of MEA Smartphones Industry

MEA Smartphones Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Adoption of Energy-Efficient Devices

- 3.3. Market Restrains

- 3.3.1. Growing Production Costs and Vendor Consolidation Cited as the Key Reasons for Slow Growth Forecast; Given that the Market is on the Verge of Reaching Maturity

- 3.4. Market Trends

- 3.4.1. Android is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Android

- 5.1.2. iOS

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. North America MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 6.1.1. Android

- 6.1.2. iOS

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 7. South America MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 7.1.1. Android

- 7.1.2. iOS

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 8. Europe MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 8.1.1. Android

- 8.1.2. iOS

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 9. Middle East & Africa MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 9.1.1. Android

- 9.1.2. iOS

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 10. Asia Pacific MEA Smartphones Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 10.1.1. Android

- 10.1.2. iOS

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samsung

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Xiaomi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Huawei

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OPPO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apple

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Samsung

List of Figures

- Figure 1: Global MEA Smartphones Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America MEA Smartphones Industry Revenue (million), by Operating System 2025 & 2033

- Figure 3: North America MEA Smartphones Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 4: North America MEA Smartphones Industry Revenue (million), by Country 2025 & 2033

- Figure 5: North America MEA Smartphones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America MEA Smartphones Industry Revenue (million), by Operating System 2025 & 2033

- Figure 7: South America MEA Smartphones Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 8: South America MEA Smartphones Industry Revenue (million), by Country 2025 & 2033

- Figure 9: South America MEA Smartphones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe MEA Smartphones Industry Revenue (million), by Operating System 2025 & 2033

- Figure 11: Europe MEA Smartphones Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 12: Europe MEA Smartphones Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe MEA Smartphones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa MEA Smartphones Industry Revenue (million), by Operating System 2025 & 2033

- Figure 15: Middle East & Africa MEA Smartphones Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 16: Middle East & Africa MEA Smartphones Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa MEA Smartphones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific MEA Smartphones Industry Revenue (million), by Operating System 2025 & 2033

- Figure 19: Asia Pacific MEA Smartphones Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 20: Asia Pacific MEA Smartphones Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific MEA Smartphones Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 2: Global MEA Smartphones Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 4: Global MEA Smartphones Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 9: Global MEA Smartphones Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 14: Global MEA Smartphones Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 25: Global MEA Smartphones Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global MEA Smartphones Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 33: Global MEA Smartphones Industry Revenue million Forecast, by Country 2020 & 2033

- Table 34: China MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific MEA Smartphones Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Smartphones Industry?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the MEA Smartphones Industry?

Key companies in the market include Samsung , Xiaomi , Huawei, OPPO, Apple .

3. What are the main segments of the MEA Smartphones Industry?

The market segments include Operating System.

4. Can you provide details about the market size?

The market size is estimated to be USD 1708.7 million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Adoption of Energy-Efficient Devices.

6. What are the notable trends driving market growth?

Android is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Growing Production Costs and Vendor Consolidation Cited as the Key Reasons for Slow Growth Forecast; Given that the Market is on the Verge of Reaching Maturity.

8. Can you provide examples of recent developments in the market?

Mar 2021 - Samsung announced the launch of its Mid-Tier smartphone Galaxy A32 smartphone, which will offer both LTE and 5G options for South African consumers. The company also stated that the new Galaxy A32 being offered in both versions will not only make innovation more accessible to more South Africans but will also enable the users to experience 5G-capabilities for the first time in the Galaxy A Series smartphones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Smartphones Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Smartphones Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Smartphones Industry?

To stay informed about further developments, trends, and reports in the MEA Smartphones Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence