Key Insights

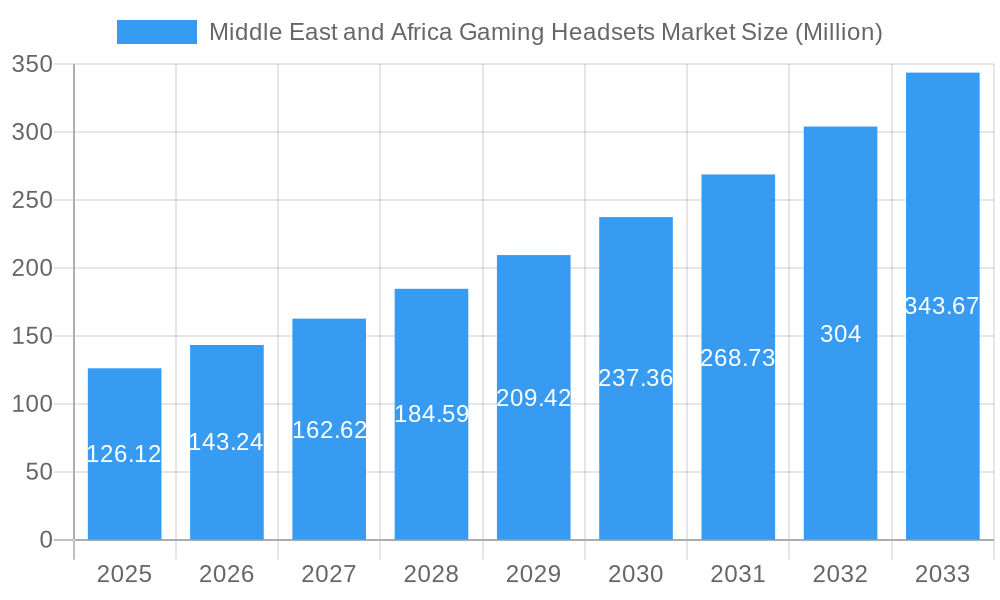

The Middle East and Africa (MEA) gaming headsets market is poised for significant expansion, projected to reach an estimated \$126.12 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 13.64% through 2033. This surge is largely driven by the rapidly increasing penetration of gaming across the region, fueled by a young, tech-savvy population and a growing number of esports tournaments and gaming communities. The increasing availability of affordable, high-quality gaming hardware, coupled with the widespread adoption of smartphones and accessible internet, is further democratizing gaming and consequently boosting the demand for immersive audio solutions like gaming headsets. Key trends shaping this market include a strong preference for wireless connectivity, offering greater freedom and convenience, and a rising demand for PC headsets, as PC gaming continues to gain traction. The increasing focus on enhanced audio quality, features like active noise cancellation, and ergonomic designs are also becoming critical purchase decision factors for consumers seeking a superior gaming experience.

Middle East and Africa Gaming Headsets Market Market Size (In Million)

The MEA region, with countries like Saudi Arabia and the United Arab Emirates at the forefront, presents a fertile ground for growth in the gaming headset market. While the market is experiencing strong growth, certain restraints, such as varying levels of disposable income across different segments of the population and potential import duties or taxes on electronic goods in some countries, could slightly temper the pace of adoption. However, the overwhelming enthusiasm for gaming and the continuous innovation by leading companies like Razer, SteelSeries, and Logitech are expected to largely overcome these challenges. The retail and online sales channels will both play crucial roles, with e-commerce platforms becoming increasingly important for reaching a wider audience, especially in more geographically dispersed areas. The increasing investment in local esports infrastructure and the growing number of professional gamers also act as significant catalysts, driving the demand for high-performance gaming headsets.

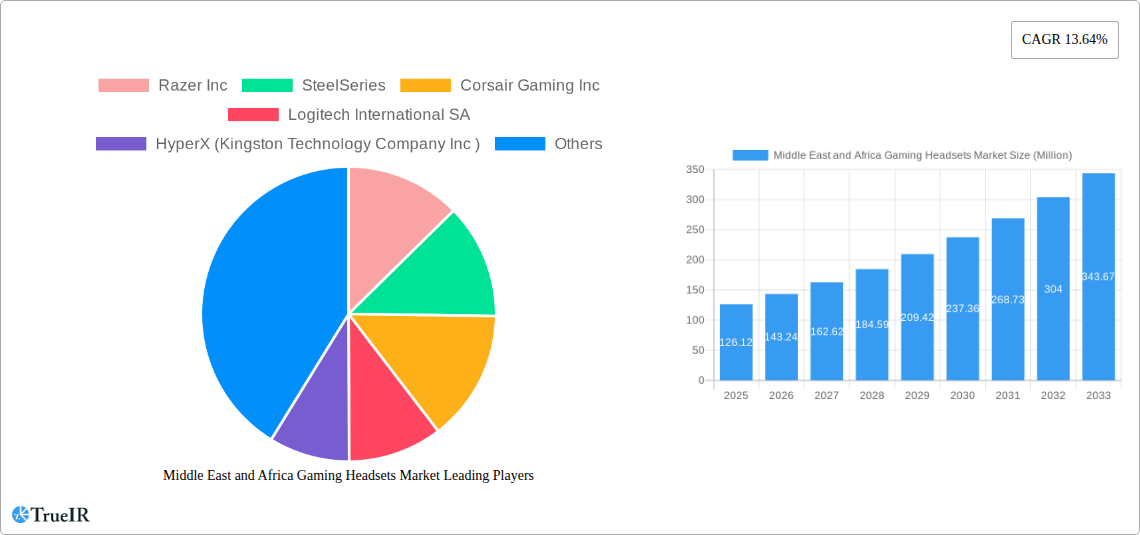

Middle East and Africa Gaming Headsets Market Company Market Share

This in-depth report provides a detailed analysis of the Middle East and Africa Gaming Headsets Market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this report delves into market dynamics, key players, emerging trends, and future opportunities. Leveraging high-volume SEO keywords, this report is designed to enhance search rankings and engage a broad spectrum of industry audiences.

Middle East and Africa Gaming Headsets Market Market Structure & Competitive Landscape

The Middle East and Africa (MEA) Gaming Headsets Market exhibits a dynamic competitive landscape characterized by a moderate to high degree of concentration. Leading global players such as Razer Inc., SteelSeries, Corsair Gaming Inc., Logitech International SA, and HyperX (Kingston Technology Company Inc) dominate market share, leveraging their established brand recognition and extensive product portfolios. However, the region also fosters a growing ecosystem of local and regional manufacturers, contributing to market fragmentation and intense competition. Innovation serves as a primary driver, with companies continuously investing in research and development to introduce advanced features like spatial audio, active noise cancellation, and enhanced microphone quality. Regulatory impacts are generally favorable, with governments increasingly recognizing the economic potential of the gaming industry and supporting its growth through initiatives and reduced import duties on gaming peripherals.

Key aspects of the market structure and competitive landscape include:

- Market Concentration: Dominated by a few key global players, with increasing influence from emerging regional brands. The top 5 players are estimated to hold approximately 60-70% of the market share.

- Innovation Drivers: Focus on advanced audio technologies, wireless connectivity improvements, ergonomic designs for comfort, and integration with emerging gaming platforms.

- Regulatory Impacts: Supportive government policies promoting digital economies and esports, with a need for continued focus on consumer protection and intellectual property rights.

- Product Substitutes: While direct substitutes are limited, the overall gaming experience can be impacted by high-quality audio systems and professional microphones, posing indirect competitive pressure.

- End-User Segmentation: Primarily driven by the growing e-sports scene, professional gamers, and the expanding casual gaming population across various age groups.

- M&A Trends: While overt M&A activity is currently limited, strategic partnerships and collaborations are on the rise as companies seek to expand their reach and product offerings. The volume of strategic alliances is projected to grow by 15-20% over the forecast period.

Middle East and Africa Gaming Headsets Market Market Trends & Opportunities

The Middle East and Africa Gaming Headsets Market is poised for significant growth, fueled by a confluence of burgeoning gaming cultures, increasing disposable incomes, and rapid digital infrastructure development. The market size is projected to expand from an estimated USD 1,500 Million in 2025 to over USD 3,200 Million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. Technological shifts are a paramount trend, with consumers increasingly demanding wireless gaming headsets that offer superior audio fidelity, low latency, and enhanced comfort for extended gaming sessions. The proliferation of high-speed internet, particularly 5G networks, is a critical enabler for wireless adoption and the seamless streaming of competitive esports events, further boosting demand for high-performance gaming audio solutions.

Consumer preferences are evolving rapidly, with a pronounced shift towards premium gaming headsets that offer immersive audio experiences, sophisticated design aesthetics, and advanced features such as customizable RGB lighting and integrated virtual surround sound. The rise of mobile gaming has also created a substantial demand for versatile gaming headsets that are compatible with a wide range of devices, including smartphones, tablets, and consoles. Esports, in particular, is a major growth catalyst, with the MEA region witnessing a surge in tournaments, professional teams, and a passionate fan base, all of which require specialized gaming audio equipment. This trend creates significant opportunities for headset manufacturers to tailor their offerings to the specific needs of competitive gamers, focusing on features that enhance in-game communication and situational awareness.

Furthermore, the increasing penetration of online sales channels offers a significant opportunity for market expansion. E-commerce platforms provide wider reach and accessibility, allowing manufacturers to connect with a broader consumer base across diverse geographical locations within the MEA region. This trend is complemented by the growing popularity of social media and online influencer marketing, which are effectively shaping consumer purchasing decisions and driving product awareness. The economic development across several MEA nations, coupled with a youthful demographic that is highly engaged with digital entertainment, further solidifies the long-term growth prospects for the gaming headsets market. Strategic collaborations with gaming event organizers, esports teams, and technology providers will be crucial for brands to capitalize on these evolving market dynamics and secure a dominant position. The market penetration rate for gaming headsets is expected to climb from approximately 25% in 2025 to over 45% by 2033.

Dominant Markets & Segments in Middle East and Africa Gaming Headsets Market

The Middle East and Africa Gaming Headsets Market presents a diversified landscape with distinct regional and segment-driven growth patterns. Among the compatibility types, PC Headsets are expected to maintain a dominant position, accounting for an estimated 45% of the market revenue in 2025. This dominance is attributed to the established PC gaming culture, the prevalence of esports tournaments on PC platforms, and the higher adoption of high-fidelity audio solutions by dedicated PC gamers. Console Headsets, however, are rapidly gaining traction, driven by the increasing popularity of gaming consoles like PlayStation and Xbox, and the expansion of console gaming into more mainstream households. The console headset segment is projected to witness a CAGR of over 10% during the forecast period.

In terms of connectivity, Wireless Gaming Headsets are emerging as the clear frontrunner, projected to capture over 55% of the market share by 2025 and continue their upward trajectory. The demand for wireless solutions is propelled by the desire for freedom of movement, reduced cable clutter, and advancements in wireless audio technology that offer near-lossless audio quality and ultra-low latency. Wired gaming headsets will continue to hold a significant share, particularly among budget-conscious consumers and professional esports players who prioritize absolute reliability and minimal latency.

The Online Sales Channel is set to become the most dominant distribution avenue for gaming headsets in the MEA region, expected to account for approximately 60% of sales by 2025. This surge is fueled by the convenience, wider product selection, competitive pricing, and ease of access offered by e-commerce platforms across countries like the UAE, Saudi Arabia, and Egypt. Retail channels, including specialized electronics stores and hypermarkets, will continue to play a crucial role, particularly for consumers who prefer hands-on product evaluation before purchase. The retail segment will likely see a steady growth of around 7% annually, driven by in-store promotions and experiential marketing.

- Leading Region: The United Arab Emirates (UAE) and Saudi Arabia are anticipated to lead the MEA Gaming Headsets Market, driven by their strong economic growth, high disposable incomes, significant expatriate populations, and government initiatives to foster digital economies and esports.

- Key Growth Drivers (Regional):

- Infrastructure: Widespread availability of high-speed internet and growing smartphone penetration.

- Policies: Government support for esports and gaming events, tax incentives for technology adoption.

- Demographics: A young and tech-savvy population with a high propensity for digital entertainment.

- Key Growth Drivers (Segmental):

- PC Headsets: Proliferation of PC cafes, growth of PC-based esports leagues, and demand for high-fidelity audio.

- Wireless Connectivity: Consumer preference for convenience, advancements in Bluetooth and proprietary wireless technologies.

- Online Sales Channel: Ease of purchase, wider product availability, competitive pricing, and targeted digital marketing.

Middle East and Africa Gaming Headsets Market Product Analysis

Product innovation in the MEA Gaming Headsets Market is predominantly centered on enhancing the immersive gaming experience and improving communication capabilities. Manufacturers are focusing on developing headsets with advanced audio drivers for superior sound fidelity, including support for virtual surround sound technologies like Dolby Atmos and DTS Headphone:X. Active Noise Cancellation (ANC) is becoming a sought-after feature, allowing gamers to block out ambient distractions for a more focused gameplay. Furthermore, the integration of high-quality, detachable, or boom microphones with noise-filtering technology is crucial for clear in-game communication, a vital aspect for competitive play. Competitive advantages are being carved out through lightweight, ergonomic designs for extended comfort, durable build materials, and customizable RGB lighting to appeal to the aesthetic preferences of gamers. The market is also witnessing an increasing emphasis on cross-platform compatibility, allowing a single headset to seamlessly function across PCs, consoles, and mobile devices.

Key Drivers, Barriers & Challenges in Middle East and Africa Gaming Headsets Market

Key Drivers:

- Surge in Esports and Online Gaming: The burgeoning esports scene and the increasing popularity of online multiplayer games across the MEA region are the primary catalysts.

- Growing Disposable Income and Young Demographics: A youthful population with increasing purchasing power fuels demand for gaming peripherals.

- Technological Advancements: Innovations in audio technology, wireless connectivity, and comfort design enhance the user experience.

- Government Initiatives and Investment: Supportive policies promoting digital economies and gaming infrastructure create a favorable environment.

- Penetration of Smartphones and Gaming Consoles: Increased accessibility to gaming devices drives the need for accompanying audio solutions.

Barriers & Challenges:

- Economic Volatility and Currency Fluctuations: Some MEA countries experience economic instability, impacting consumer spending power and import costs.

- Counterfeit Products and Gray Market: The prevalence of counterfeit gaming headsets erodes market trust and revenue for legitimate brands.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the timely availability of components and finished products.

- Digital Divide and Internet Accessibility: In certain rural areas, limited access to stable internet connectivity can hinder the adoption of online gaming and related peripherals.

- Price Sensitivity: A segment of the market remains price-sensitive, making it challenging for premium-priced products to gain widespread adoption.

Growth Drivers in the Middle East and Africa Gaming Headsets Market Market

The Middle East and Africa Gaming Headsets Market is experiencing robust growth driven by several key factors. The exponential rise of esports tournaments and professional gaming leagues across the region, particularly in countries like the UAE and Saudi Arabia, necessitates high-performance gaming audio solutions. This surge is supported by significant government investment in digital infrastructure and the promotion of the gaming industry as a key economic sector. Furthermore, a rapidly expanding youth population with increasing disposable incomes and a strong affinity for digital entertainment acts as a consistent demand driver. Technological advancements, such as improved wireless connectivity (e.g., 5G integration for low-latency gaming), superior audio engineering for immersive soundscapes, and ergonomic design innovations for enhanced comfort, are also significantly propelling market growth. The increasing affordability of gaming consoles and PCs further broadens the potential consumer base for gaming headsets.

Challenges Impacting Middle East and Africa Gaming Headsets Market Growth

Despite the promising growth trajectory, the Middle East and Africa Gaming Headsets Market faces several challenges. Regulatory complexities and varying import duties across different MEA countries can create logistical hurdles and impact pricing strategies for manufacturers. Supply chain disruptions, exacerbated by global events, can lead to product shortages and increased lead times, affecting market availability. Intense competition from established global brands and the emergence of local manufacturers also puts pressure on profit margins. Moreover, the prevalence of counterfeit and pirated gaming headsets poses a significant threat to brand reputation and revenue streams. The digital divide, with varying levels of internet accessibility and affordability across diverse populations within the region, can also limit the reach and adoption of online gaming and its associated peripherals in certain markets.

Key Players Shaping the Middle East and Africa Gaming Headsets Market Market

- Razer Inc.

- SteelSeries

- Corsair Gaming Inc.

- Logitech International SA

- HyperX (Kingston Technology Company Inc.)

- Turtle Beach Corporation

- ASTRO Gaming (Logitech)

- Sony Interactive Entertainment Inc.

- Cooler Master Technology Inc.

- EKSA Technology Co., Ltd.

Significant Middle East and Africa Gaming Headsets Market Industry Milestones

- August 2024: In UAE, Sony introduced a partnership with the National Football League, naming Sony as an official technology partner of the NFL and its official headphones. This collaboration aims to develop new headsets for coach-to-coach communication on the field, powered by Verizon Business’ Managed Private Wireless Solution on Verizon’s 5G network.

- October 2023: EKSA, a prominent gaming headphones and accessories manufacturer, announced its participation in GITEX 2023 in Dubai. EKSA has rapidly gained prominence by focusing on high-quality products that enhance the gaming experience through performance, design, comfort, and packaging.

Future Outlook for Middle East and Africa Gaming Headsets Market Market

The future outlook for the Middle East and Africa Gaming Headsets Market is exceptionally bright, driven by sustained growth catalysts and expanding market opportunities. The continued expansion of esports infrastructure, coupled with increasing government support for the gaming industry across key nations like the UAE, Saudi Arabia, and Egypt, will fuel demand for high-performance audio peripherals. The growing adoption of advanced wireless technologies and the increasing consumer preference for immersive audio experiences will ensure a strong market position for innovative headset designs. Strategic partnerships with gaming platforms, esports organizations, and telecommunication companies will be crucial for market players to enhance brand visibility and reach. Furthermore, the ongoing digital transformation and the rising disposable incomes within the region's young demographic present a substantial long-term growth potential, solidifying the MEA region as a key emerging market for gaming headsets globally. The market is expected to witness sustained double-digit growth in the coming years.

Middle East and Africa Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Middle East and Africa Gaming Headsets Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

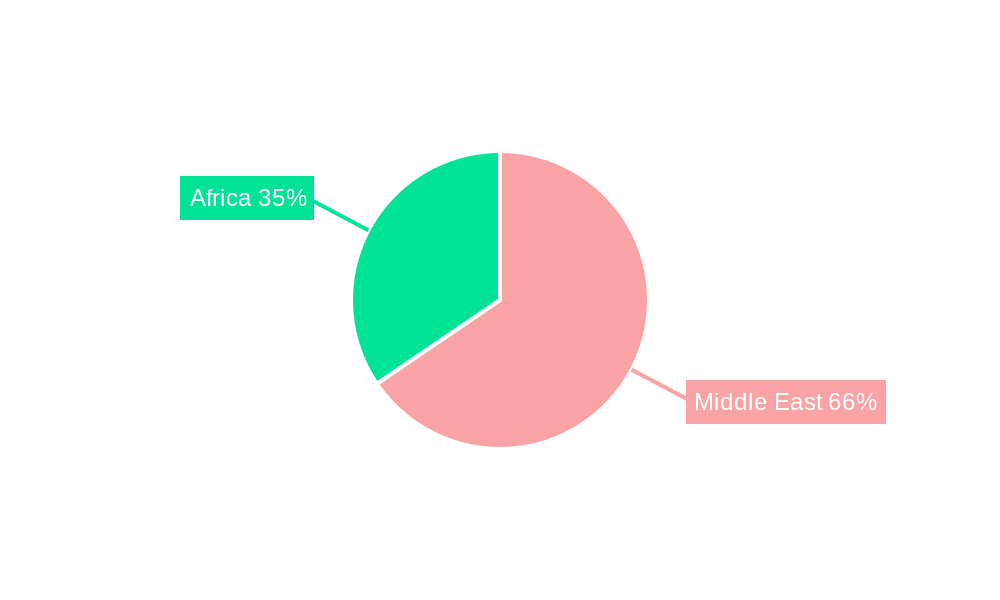

Middle East and Africa Gaming Headsets Market Regional Market Share

Geographic Coverage of Middle East and Africa Gaming Headsets Market

Middle East and Africa Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.3.2 such as E-sports Betting and Fantasy Sites

- 3.4. Market Trends

- 3.4.1. Retail Sales Channel Augment the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Razer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SteelSeries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Logitech International SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (Kingston Technology Company Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Turtle Beach Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ASTRO Gaming (Logitech)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Interactive Entertainment Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cooler Master Technology Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Razer Inc

List of Figures

- Figure 1: Middle East and Africa Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Gaming Headsets Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2020 & 2033

- Table 3: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 4: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 5: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 6: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2020 & 2033

- Table 7: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 8: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 9: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 12: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 13: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 14: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2020 & 2033

- Table 15: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 17: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Country 2020 & 2033

- Table 19: Saudi Arabia Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Saudi Arabia Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: United Arab Emirates Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Arab Emirates Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Israel Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Israel Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Qatar Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Qatar Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Kuwait Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Kuwait Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Oman Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Oman Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Bahrain Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Bahrain Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Jordan Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Jordan Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Lebanon Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Lebanon Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gaming Headsets Market?

The projected CAGR is approximately 13.64%.

2. Which companies are prominent players in the Middle East and Africa Gaming Headsets Market?

Key companies in the market include Razer Inc, SteelSeries, Corsair Gaming Inc, Logitech International SA, HyperX (Kingston Technology Company Inc ), Turtle Beach Corporation, ASTRO Gaming (Logitech), Sony Interactive Entertainment Inc, Cooler Master Technology Inc.

3. What are the main segments of the Middle East and Africa Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Retail Sales Channel Augment the Market's Growth.

7. Are there any restraints impacting market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

8. Can you provide examples of recent developments in the market?

August 2024 - In UAE, Sony introduced a partnership with the National Football League, which names Sony as an official technology partner of the NFL, along with the new official headphones of the NFL. The NFL and Sony will work closely to create this new headset supporting coach-to-coach communication on the field. These will be powered by Verizon Business’ Managed Private Wireless Solution running on Verizon’s reliable 5G network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence