Key Insights

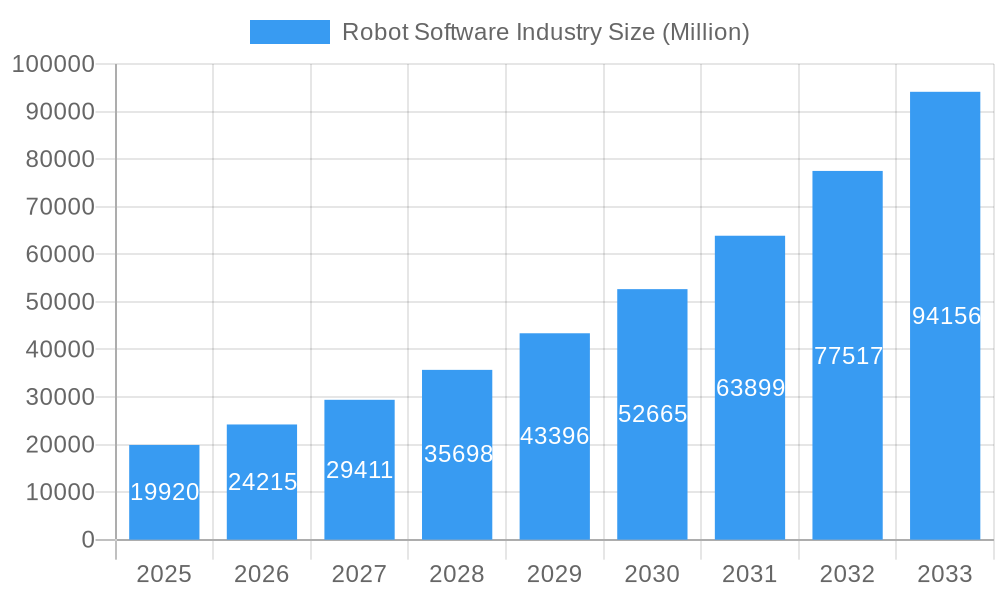

The global Robot Software market is poised for explosive growth, with an estimated market size of USD 19.92 billion in the base year 2025, projected to surge at a remarkable Compound Annual Growth Rate (CAGR) of 21.62%. This robust expansion is primarily driven by the accelerating adoption of automation across diverse industries, fueled by advancements in artificial intelligence and machine learning, enabling more sophisticated robot capabilities. The increasing demand for enhanced operational efficiency, precision, and safety in sectors like manufacturing, logistics, and healthcare are significant catalysts. Furthermore, the rise of service robots in retail, hospitality, and elder care, alongside the continued dominance of industrial robots in production lines, underscores the broad applicability of robot software solutions. The market is segmented by software type, with Recognition Software and Predictive Maintenance Software expected to witness particularly strong adoption due to their direct impact on robot performance and operational longevity. The growing prevalence of cloud-based deployment models, offering scalability and accessibility, will also be a key trend shaping market dynamics.

Robot Software Industry Market Size (In Billion)

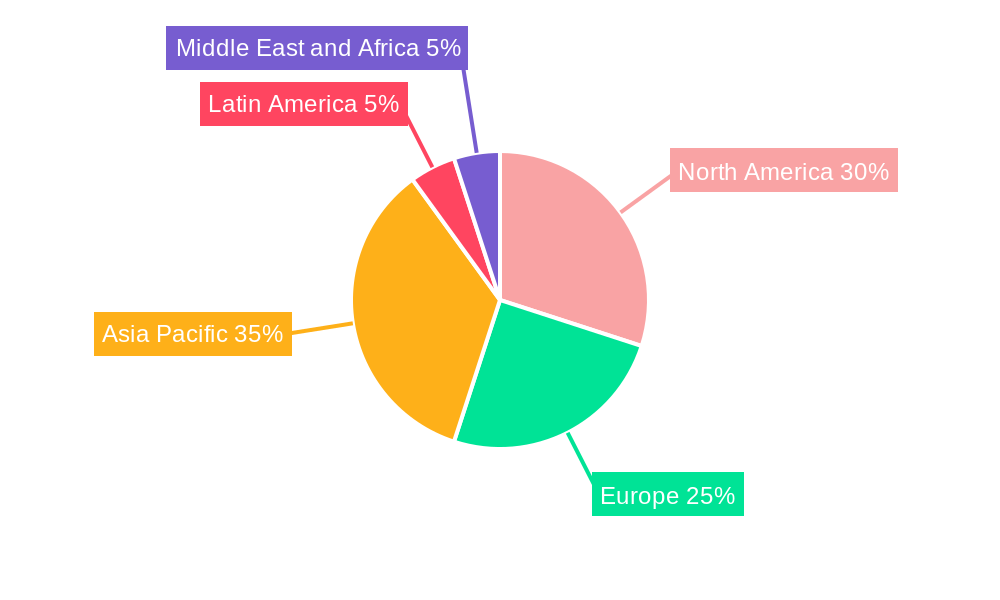

The forecast period from 2025 to 2033 anticipates a transformative era for the robot software landscape. While robust growth is evident, the market faces certain restraints, including the high initial investment costs associated with advanced robotic systems and the ongoing need for skilled personnel to manage and maintain them. However, these challenges are likely to be mitigated by increasing technological affordability and the development of user-friendly interfaces. The enterprise size segmentation indicates that both Small and Medium Enterprises (SMEs) and Large Enterprises are significant contributors, with SMEs increasingly leveraging robotic solutions for competitive advantage. Geographically, North America and Asia Pacific are expected to lead market growth due to strong technological infrastructure and rapid industrialization. Emerging applications in autonomous vehicles, smart cities, and advanced healthcare further highlight the vast and evolving potential of robot software, solidifying its position as a critical component of future technological advancements.

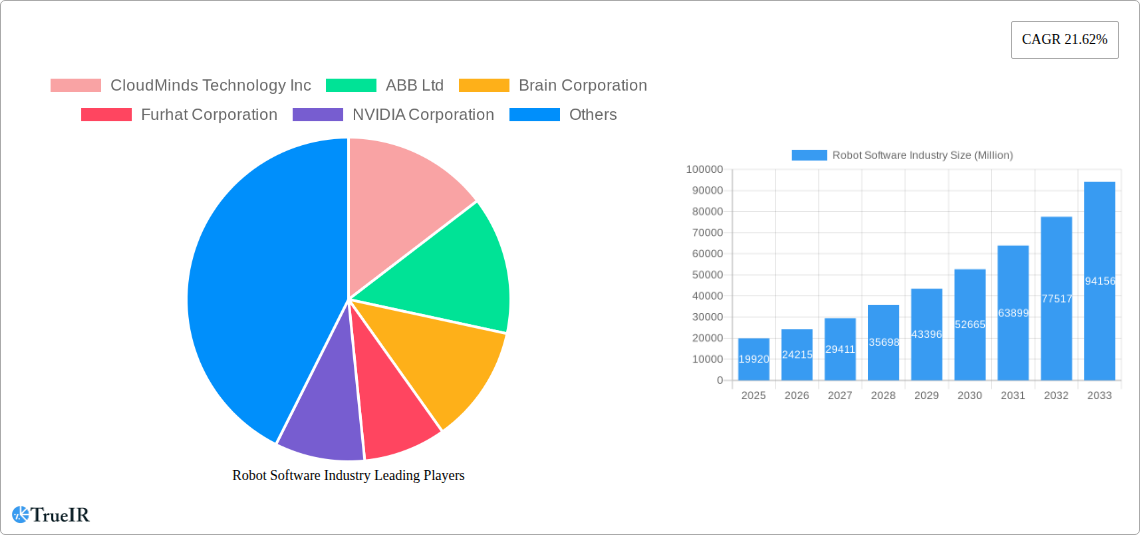

Robot Software Industry Company Market Share

Robot Software Industry: Market Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Robot Software Industry, providing critical insights for stakeholders, investors, and industry professionals. Leveraging a robust study period from 2019 to 2033, with a base year of 2025, the report meticulously examines market dynamics, emerging trends, key players, and future growth trajectories. We delve into the intricacies of various software types, robot classifications, deployment models, enterprise sizes, and end-user verticals, painting a clear picture of the current landscape and future potential. The report utilizes high-volume SEO keywords to ensure maximum visibility and engagement within the industry.

Robot Software Industry Market Structure & Competitive Landscape

The Robot Software Industry is characterized by a moderately concentrated market structure, with a blend of large established technology giants and agile, specialized software providers. Innovation is a primary driver, fueled by rapid advancements in AI, machine learning, and sensor technologies. Regulatory impacts are nascent but growing, particularly concerning data privacy and safety protocols for autonomous systems. Product substitution is a growing concern, as integrated hardware-software solutions and open-source platforms offer alternative pathways for robotic implementation. End-user segmentation is diverse, with industrial automation, logistics, and healthcare emerging as significant demand centers. Mergers and acquisitions (M&A) are a key M&A trend, reflecting the industry's consolidation and the strategic imperative for companies to acquire advanced software capabilities and market share. For instance, Rockwell's acquisition of Clearpath Robotics in September 2023 signifies a major consolidation, valuing the acquired entity at an estimated xx Million. This trend is expected to continue, with an anticipated xx Million in M&A activities over the forecast period, driving market concentration and fostering innovation. The competitive landscape is dynamic, with companies continually investing in R&D to maintain a competitive edge and capture emerging market opportunities.

Robot Software Industry Market Trends & Opportunities

The global Robot Software Industry is poised for substantial growth, driven by an accelerating rate of technological innovation and increasing adoption across a wide spectrum of end-user verticals. The market size is projected to reach an estimated $xxx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from the base year of 2025. This expansion is underpinned by significant technological shifts, including the widespread integration of AI and machine learning algorithms into robot control systems, enabling more sophisticated decision-making, enhanced perception, and adaptive behaviors. Consumer preferences are increasingly leaning towards more autonomous, collaborative, and intelligent robotic solutions that can seamlessly integrate into existing workflows and improve operational efficiency. Competitive dynamics are intensifying, with established players like NVIDIA Corporation and ABB Ltd. investing heavily in R&D and strategic partnerships, while emerging companies such as Brain Corporation and Furhat Corporation are carving out niches with specialized software offerings. Market penetration rates for advanced robot software are expected to rise, particularly in manufacturing and logistics, where automation is crucial for maintaining competitiveness. The ongoing evolution of 5G technology will further enable real-time communication and control, unlocking new possibilities for remote operation and distributed robotic systems. The growing demand for predictive maintenance software, aimed at minimizing downtime and optimizing robot performance, represents a significant opportunity. Furthermore, the burgeoning service robot sector, encompassing applications in healthcare, hospitality, and personal assistance, is creating new avenues for software innovation. The proliferation of cloud-based robotics platforms and Software-as-a-Service (SaaS) models is also democratizing access to advanced robotics, enabling small and medium-sized enterprises (SMEs) to leverage robotic automation without significant upfront capital investment. The market is ripe with opportunities for companies offering robust data management and analysis software, essential for extracting actionable insights from the vast amounts of data generated by robotic systems.

Dominant Markets & Segments in Robot Software Industry

The global Robot Software Industry demonstrates varied dominance across its constituent segments, with North America currently leading in market share, largely driven by its advanced manufacturing sector and significant investments in robotics research and development, particularly in the United States. Within North America, the United States stands out as the dominant country due to its robust technological infrastructure and the presence of key industry players.

Key Growth Drivers in Leading Segments:

Software Type:

- Recognition Software: Driven by the increasing need for robots to perceive and interpret their environment, especially in complex and dynamic settings like autonomous navigation and human-robot interaction.

- Data Management and Analysis Software: Experiencing significant growth due to the exponential increase in data generated by robots, necessitating efficient storage, processing, and actionable insights extraction for optimization and decision-making.

- Predictive Maintenance Software: Fueled by the industry's focus on minimizing downtime and maximizing operational efficiency, reducing costs associated with unexpected failures.

Robot Type:

- Industrial Robots: Continue to dominate due to their established role in manufacturing automation, but are increasingly being augmented with advanced software for greater flexibility and intelligence.

- Service Robots: Showing the most rapid growth, encompassing a wide range of applications from healthcare and logistics to customer service and personal assistance, requiring sophisticated software for interaction and task execution.

Deployment:

- On-Premise: Remains a significant segment, especially for large enterprises with strict data security and control requirements.

- On-Demand: Gaining traction, offering scalability and flexibility, particularly for SMEs and companies with fluctuating operational needs.

Enterprise Size:

- Large Enterprises: Continue to be major adopters, investing in comprehensive robotic solutions for large-scale operations.

- Small and Medium Enterprises (SMEs): Represent a rapidly growing segment, as the increasing affordability and accessibility of robot software solutions, particularly cloud-based offerings, enable them to automate and enhance productivity.

End-user Vertical:

- Manufacturing: Remains the largest and most established vertical, with ongoing demand for advanced automation solutions.

- Transportation and Logistics: Experiencing rapid growth due to the increasing adoption of autonomous mobile robots (AMRs) for warehousing, delivery, and supply chain optimization.

- Healthcare: A high-growth vertical, with increasing deployment of robots for surgery, patient care, diagnostics, and logistics within medical facilities.

- Retail and E-commerce: Growing demand for robots in inventory management, last-mile delivery, and customer engagement.

The dominance in these segments is driven by factors such as the increasing demand for automation, government initiatives supporting technological adoption, substantial R&D investments, and the continuous drive for operational efficiency and cost reduction across industries.

Robot Software Industry Product Analysis

The robot software industry is witnessing a surge in product innovation, with a strong emphasis on enhancing autonomy, intelligence, and interoperability. Key advancements include sophisticated AI-powered perception systems, enabling robots to understand and interact with complex environments, and advanced simulation software for virtual testing and development, significantly reducing real-world deployment risks and costs. Predictive maintenance software is evolving to offer more accurate failure prediction and proactive intervention, minimizing downtime and operational expenses. Data management and analysis tools are becoming more integrated, providing users with actionable insights from robot-generated data for performance optimization. Furthermore, communication management software is critical for enabling seamless multi-robot coordination and human-robot collaboration, paving the way for more efficient and flexible automated systems. These innovations provide a significant competitive advantage by enabling robots to perform tasks with greater precision, adaptability, and safety, meeting the diverse and evolving needs of various end-user verticals.

Key Drivers, Barriers & Challenges in Robot Software Industry

Key Drivers: The robot software industry is propelled by several key drivers. Technological advancements in artificial intelligence, machine learning, computer vision, and sensor fusion are continuously expanding the capabilities of robots, enabling them to perform more complex tasks. Increasing demand for automation across various sectors, driven by labor shortages, the need for improved efficiency, and enhanced safety, is a primary economic factor. Government initiatives and funding supporting R&D and adoption of robotics and AI technologies, coupled with favorable regulatory frameworks in some regions, also play a crucial role. The growing adoption of Industry 4.0 principles, emphasizing connectivity, data analytics, and intelligent automation, further fuels the market.

Barriers & Challenges: Despite robust growth, the industry faces significant barriers and challenges. High initial investment costs for advanced robotic systems and associated software can be a restraint for smaller businesses. Complex integration with existing infrastructure and legacy systems poses a technical challenge. Stringent regulatory hurdles and ethical considerations, particularly concerning safety, data privacy, and job displacement, can slow down adoption. Cybersecurity threats are a growing concern, as connected robotic systems can be vulnerable to attacks, impacting operations and data integrity. Supply chain disruptions, as seen in recent years, can affect the availability of both hardware components and specialized software, impacting project timelines and costs. Competitive pressures are intense, demanding continuous innovation and cost-effectiveness.

Growth Drivers in the Robot Software Industry Market

The robot software industry's growth is significantly driven by the relentless pace of technological innovation, particularly in areas like Artificial Intelligence and Machine Learning, which are empowering robots with enhanced cognitive abilities and decision-making. The economic imperative for increased productivity and operational efficiency across diverse sectors, from manufacturing to healthcare, is a major catalyst. Furthermore, growing labor shortages in many regions are pushing companies towards automation solutions. Government support through R&D grants and favorable policies for technology adoption in sectors like defense and logistics also plays a vital role in market expansion. The increasing demand for customized and specialized robotic solutions tailored to specific industry needs is also creating significant growth opportunities.

Challenges Impacting Robot Software Industry Growth

Several challenges can impact the growth of the robot software industry. Regulatory complexities, especially concerning safety standards, ethical implications of autonomous systems, and data privacy concerns, can create hurdles for widespread adoption. Supply chain issues, including the availability of critical hardware components and the potential for delays, can hinder timely project execution and increase costs. Intense competitive pressures necessitate continuous innovation and aggressive pricing strategies, which can strain smaller players. The high cost of initial implementation and the need for specialized skilled labor for operation and maintenance can also be significant restraints for some enterprises. Addressing cybersecurity vulnerabilities within increasingly connected robotic systems is paramount to building trust and ensuring uninterrupted operations.

Key Players Shaping the Robot Software Industry Market

- CloudMinds Technology Inc

- ABB Ltd

- Brain Corporation

- Furhat Corporation

- NVIDIA Corporation

- AIBrain Inc

- Liquid Robotics Inc

- Neurala Inc

- Clearpath Robotics

Significant Robot Software Industry Industry Milestones

- September 2023: Rockwell announces Acquisition of Clearpath Robotics, demonstrating the growth of mobile robots. This strategic move is expected to expand Rockwell's automation solutions, aiming for more connected and productive manufacturing operations by integrating Clearpath's expertise in AMRs, fleet management, and navigation software.

- May 2023: Clearpath Robotics announces Husky Observer, an all-terrain, rugged robot with an integrated payload for inspection. This new robotic system combines the versatile Husky robot with OutdoorNav Autonomy Software, enabling autonomous navigation for unmanned ground vehicles and showcasing advancements in outdoor robotic applications.

Future Outlook for Robot Software Industry Market

The future outlook for the Robot Software Industry is exceptionally bright, characterized by sustained high growth and transformative innovation. Key growth catalysts include the continued integration of advanced AI and machine learning, leading to more intelligent and adaptable robotic systems. The expanding applications in emerging sectors such as autonomous logistics, advanced healthcare robotics, and sophisticated service robots will drive significant market penetration. The increasing adoption of cloud-based robotics platforms and Software-as-a-Service (SaaS) models will further democratize access and foster innovation among a broader range of businesses, particularly SMEs. Strategic opportunities lie in developing robust cybersecurity solutions, ensuring ethical AI deployment, and fostering seamless human-robot collaboration. The market potential is immense, promising increased efficiency, enhanced safety, and novel applications across the global economy.

Robot Software Industry Segmentation

-

1. Software Type

- 1.1. Recognition Software

- 1.2. Simulation Software

- 1.3. Predictive Maintenance Software

- 1.4. Data Management and Analysis Software

- 1.5. Communication Management Software

-

2. Robot Type

- 2.1. Industrial Robots

- 2.2. Service Robots

-

3. Deployment

- 3.1. On-Premise

- 3.2. On-Demand

-

4. Enterprise Size

- 4.1. Small and Medium Enterprises

- 4.2. Large Enterprises

-

5. End-user Vertical

- 5.1. Automotive

- 5.2. Retail and E-commerce

- 5.3. Government and Defense

- 5.4. Healthcare

- 5.5. Transportation and Logistics

- 5.6. Manufacturing

- 5.7. IT and Telecommunications

- 5.8. Other End-user Verticals

Robot Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Robot Software Industry Regional Market Share

Geographic Coverage of Robot Software Industry

Robot Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in need for automation and safety in organizations; Rapid adoption of robot software by SMEs to reduce labor and energy costs

- 3.3. Market Restrains

- 3.3.1. Vulnerabilities Associated with Cloud Technologies

- 3.4. Market Trends

- 3.4.1. Industrial Robots to Have the Majority Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Software Type

- 5.1.1. Recognition Software

- 5.1.2. Simulation Software

- 5.1.3. Predictive Maintenance Software

- 5.1.4. Data Management and Analysis Software

- 5.1.5. Communication Management Software

- 5.2. Market Analysis, Insights and Forecast - by Robot Type

- 5.2.1. Industrial Robots

- 5.2.2. Service Robots

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-Premise

- 5.3.2. On-Demand

- 5.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.4.1. Small and Medium Enterprises

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.5.1. Automotive

- 5.5.2. Retail and E-commerce

- 5.5.3. Government and Defense

- 5.5.4. Healthcare

- 5.5.5. Transportation and Logistics

- 5.5.6. Manufacturing

- 5.5.7. IT and Telecommunications

- 5.5.8. Other End-user Verticals

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Software Type

- 6. North America Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Software Type

- 6.1.1. Recognition Software

- 6.1.2. Simulation Software

- 6.1.3. Predictive Maintenance Software

- 6.1.4. Data Management and Analysis Software

- 6.1.5. Communication Management Software

- 6.2. Market Analysis, Insights and Forecast - by Robot Type

- 6.2.1. Industrial Robots

- 6.2.2. Service Robots

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-Premise

- 6.3.2. On-Demand

- 6.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.4.1. Small and Medium Enterprises

- 6.4.2. Large Enterprises

- 6.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.5.1. Automotive

- 6.5.2. Retail and E-commerce

- 6.5.3. Government and Defense

- 6.5.4. Healthcare

- 6.5.5. Transportation and Logistics

- 6.5.6. Manufacturing

- 6.5.7. IT and Telecommunications

- 6.5.8. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Software Type

- 7. Europe Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Software Type

- 7.1.1. Recognition Software

- 7.1.2. Simulation Software

- 7.1.3. Predictive Maintenance Software

- 7.1.4. Data Management and Analysis Software

- 7.1.5. Communication Management Software

- 7.2. Market Analysis, Insights and Forecast - by Robot Type

- 7.2.1. Industrial Robots

- 7.2.2. Service Robots

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-Premise

- 7.3.2. On-Demand

- 7.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.4.1. Small and Medium Enterprises

- 7.4.2. Large Enterprises

- 7.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.5.1. Automotive

- 7.5.2. Retail and E-commerce

- 7.5.3. Government and Defense

- 7.5.4. Healthcare

- 7.5.5. Transportation and Logistics

- 7.5.6. Manufacturing

- 7.5.7. IT and Telecommunications

- 7.5.8. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Software Type

- 8. Asia Pacific Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Software Type

- 8.1.1. Recognition Software

- 8.1.2. Simulation Software

- 8.1.3. Predictive Maintenance Software

- 8.1.4. Data Management and Analysis Software

- 8.1.5. Communication Management Software

- 8.2. Market Analysis, Insights and Forecast - by Robot Type

- 8.2.1. Industrial Robots

- 8.2.2. Service Robots

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-Premise

- 8.3.2. On-Demand

- 8.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.4.1. Small and Medium Enterprises

- 8.4.2. Large Enterprises

- 8.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.5.1. Automotive

- 8.5.2. Retail and E-commerce

- 8.5.3. Government and Defense

- 8.5.4. Healthcare

- 8.5.5. Transportation and Logistics

- 8.5.6. Manufacturing

- 8.5.7. IT and Telecommunications

- 8.5.8. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Software Type

- 9. Latin America Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Software Type

- 9.1.1. Recognition Software

- 9.1.2. Simulation Software

- 9.1.3. Predictive Maintenance Software

- 9.1.4. Data Management and Analysis Software

- 9.1.5. Communication Management Software

- 9.2. Market Analysis, Insights and Forecast - by Robot Type

- 9.2.1. Industrial Robots

- 9.2.2. Service Robots

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-Premise

- 9.3.2. On-Demand

- 9.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.4.1. Small and Medium Enterprises

- 9.4.2. Large Enterprises

- 9.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.5.1. Automotive

- 9.5.2. Retail and E-commerce

- 9.5.3. Government and Defense

- 9.5.4. Healthcare

- 9.5.5. Transportation and Logistics

- 9.5.6. Manufacturing

- 9.5.7. IT and Telecommunications

- 9.5.8. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Software Type

- 10. Middle East and Africa Robot Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Software Type

- 10.1.1. Recognition Software

- 10.1.2. Simulation Software

- 10.1.3. Predictive Maintenance Software

- 10.1.4. Data Management and Analysis Software

- 10.1.5. Communication Management Software

- 10.2. Market Analysis, Insights and Forecast - by Robot Type

- 10.2.1. Industrial Robots

- 10.2.2. Service Robots

- 10.3. Market Analysis, Insights and Forecast - by Deployment

- 10.3.1. On-Premise

- 10.3.2. On-Demand

- 10.4. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.4.1. Small and Medium Enterprises

- 10.4.2. Large Enterprises

- 10.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.5.1. Automotive

- 10.5.2. Retail and E-commerce

- 10.5.3. Government and Defense

- 10.5.4. Healthcare

- 10.5.5. Transportation and Logistics

- 10.5.6. Manufacturing

- 10.5.7. IT and Telecommunications

- 10.5.8. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Software Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CloudMinds Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brain Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Furhat Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NVIDIA Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AIBrain Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Liquid Robotics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Neurala Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Clearpath Robotics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CloudMinds Technology Inc

List of Figures

- Figure 1: Global Robot Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Robot Software Industry Revenue (Million), by Software Type 2025 & 2033

- Figure 3: North America Robot Software Industry Revenue Share (%), by Software Type 2025 & 2033

- Figure 4: North America Robot Software Industry Revenue (Million), by Robot Type 2025 & 2033

- Figure 5: North America Robot Software Industry Revenue Share (%), by Robot Type 2025 & 2033

- Figure 6: North America Robot Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 7: North America Robot Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 8: North America Robot Software Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 9: North America Robot Software Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 10: North America Robot Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: North America Robot Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: North America Robot Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Robot Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Robot Software Industry Revenue (Million), by Software Type 2025 & 2033

- Figure 15: Europe Robot Software Industry Revenue Share (%), by Software Type 2025 & 2033

- Figure 16: Europe Robot Software Industry Revenue (Million), by Robot Type 2025 & 2033

- Figure 17: Europe Robot Software Industry Revenue Share (%), by Robot Type 2025 & 2033

- Figure 18: Europe Robot Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Europe Robot Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Europe Robot Software Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 21: Europe Robot Software Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 22: Europe Robot Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Europe Robot Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Europe Robot Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Robot Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Robot Software Industry Revenue (Million), by Software Type 2025 & 2033

- Figure 27: Asia Pacific Robot Software Industry Revenue Share (%), by Software Type 2025 & 2033

- Figure 28: Asia Pacific Robot Software Industry Revenue (Million), by Robot Type 2025 & 2033

- Figure 29: Asia Pacific Robot Software Industry Revenue Share (%), by Robot Type 2025 & 2033

- Figure 30: Asia Pacific Robot Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 31: Asia Pacific Robot Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 32: Asia Pacific Robot Software Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 33: Asia Pacific Robot Software Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 34: Asia Pacific Robot Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 35: Asia Pacific Robot Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 36: Asia Pacific Robot Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Robot Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Robot Software Industry Revenue (Million), by Software Type 2025 & 2033

- Figure 39: Latin America Robot Software Industry Revenue Share (%), by Software Type 2025 & 2033

- Figure 40: Latin America Robot Software Industry Revenue (Million), by Robot Type 2025 & 2033

- Figure 41: Latin America Robot Software Industry Revenue Share (%), by Robot Type 2025 & 2033

- Figure 42: Latin America Robot Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 43: Latin America Robot Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Latin America Robot Software Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 45: Latin America Robot Software Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 46: Latin America Robot Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 47: Latin America Robot Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 48: Latin America Robot Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Latin America Robot Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Robot Software Industry Revenue (Million), by Software Type 2025 & 2033

- Figure 51: Middle East and Africa Robot Software Industry Revenue Share (%), by Software Type 2025 & 2033

- Figure 52: Middle East and Africa Robot Software Industry Revenue (Million), by Robot Type 2025 & 2033

- Figure 53: Middle East and Africa Robot Software Industry Revenue Share (%), by Robot Type 2025 & 2033

- Figure 54: Middle East and Africa Robot Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 55: Middle East and Africa Robot Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 56: Middle East and Africa Robot Software Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 57: Middle East and Africa Robot Software Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 58: Middle East and Africa Robot Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 59: Middle East and Africa Robot Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 60: Middle East and Africa Robot Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Robot Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 2: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 3: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 5: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Robot Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 8: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 9: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 11: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Robot Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 14: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 15: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 16: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 17: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Robot Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 20: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 21: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 23: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Robot Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 26: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 27: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 29: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 30: Global Robot Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Robot Software Industry Revenue Million Forecast, by Software Type 2020 & 2033

- Table 32: Global Robot Software Industry Revenue Million Forecast, by Robot Type 2020 & 2033

- Table 33: Global Robot Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 34: Global Robot Software Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 35: Global Robot Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 36: Global Robot Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robot Software Industry?

The projected CAGR is approximately 21.62%.

2. Which companies are prominent players in the Robot Software Industry?

Key companies in the market include CloudMinds Technology Inc, ABB Ltd, Brain Corporation, Furhat Corporation, NVIDIA Corporation, AIBrain Inc, Liquid Robotics Inc, Neurala Inc *List Not Exhaustive, Clearpath Robotics.

3. What are the main segments of the Robot Software Industry?

The market segments include Software Type, Robot Type, Deployment, Enterprise Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in need for automation and safety in organizations; Rapid adoption of robot software by SMEs to reduce labor and energy costs.

6. What are the notable trends driving market growth?

Industrial Robots to Have the Majority Application.

7. Are there any restraints impacting market growth?

Vulnerabilities Associated with Cloud Technologies.

8. Can you provide examples of recent developments in the market?

September 2023 - Rockwell has announced Acquisition of Clearpath Robotics Demonstrates Growth of Mobile Robots, While Rockwell's acquisition of Clearpath Robotics, including its OTTO Motors Division which develops AMRs as well as fleet management and navigation software, is expected to help expand Rockwell's range of automation solutions aimed at creating more connected and thus productive manufacturing operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robot Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robot Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robot Software Industry?

To stay informed about further developments, trends, and reports in the Robot Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence