Key Insights

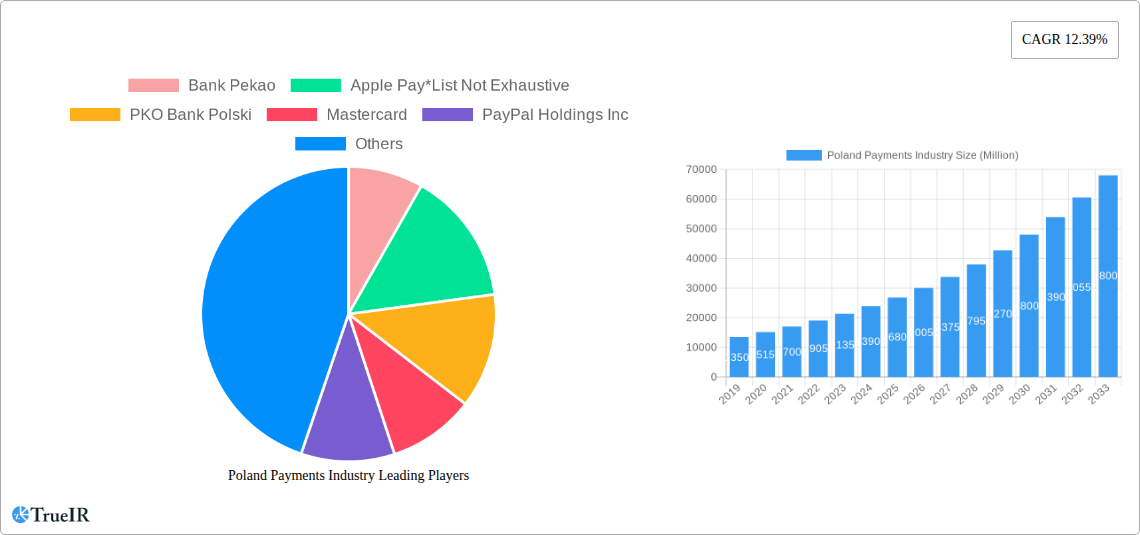

The Polish payments industry is poised for substantial growth, projected to reach a market size of approximately $30,000 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 12.39%. This expansion is fueled by a confluence of factors, most notably the accelerating adoption of digital payment methods. Consumers and businesses alike are increasingly embracing card payments and digital wallets, including mobile payment solutions, over traditional cash transactions. This shift is further propelled by government initiatives promoting financial inclusion and digital transformation, alongside a growing e-commerce landscape. Key drivers include the increasing per capita income, a young and tech-savvy population readily adopting new technologies, and the expanding reach of financial services into previously underserved segments of the population. The retail and entertainment sectors are at the forefront of this digital payment revolution, with healthcare and hospitality sectors also showing significant adoption.

Poland Payments Industry Market Size (In Billion)

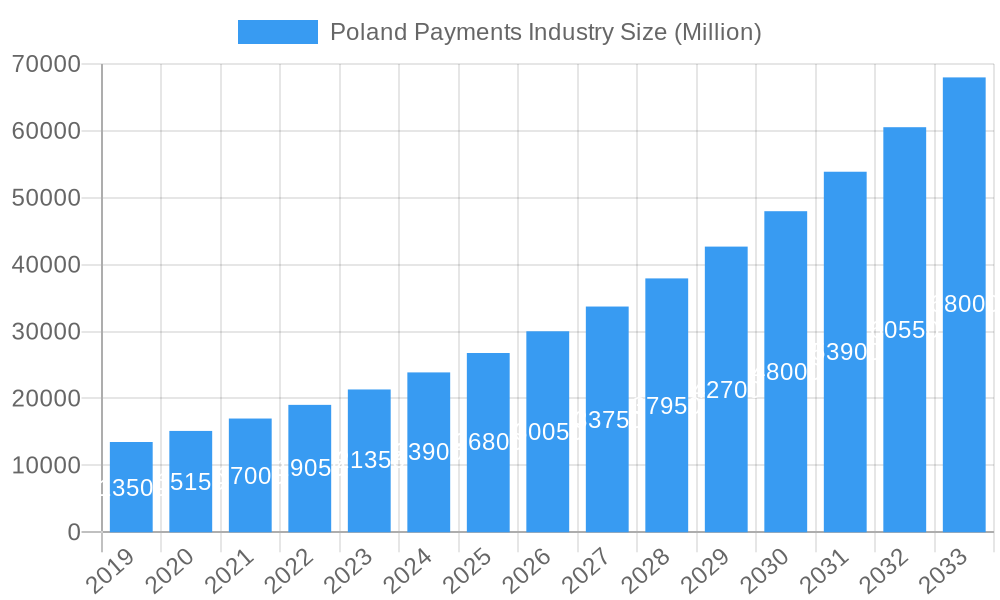

However, this dynamic market also faces certain restraints. While digital adoption is high, a segment of the population, particularly older demographics or those in rural areas, may still prefer cash or face challenges with digital literacy, posing a barrier to complete digital penetration. The ongoing development of cybersecurity measures and the need for constant vigilance against evolving fraud tactics also present a continuous challenge for payment providers. Furthermore, the competitive landscape, while fostering innovation, can also lead to margin pressures. Nevertheless, the overwhelming trend is towards greater digital payment integration, with continuous innovation in areas like contactless payments, buy now pay later (BNPL) options, and instant payment systems expected to further invigorate the market. Key players like Mastercard, PayPal Holdings Inc., and local institutions such as Bank Pekao and PKO Bank Polski are actively shaping this landscape through strategic partnerships and service enhancements, ensuring a dynamic and evolving future for the Polish payments industry.

Poland Payments Industry Company Market Share

Poland Payments Industry: Market Analysis & Forecast 2019-2033

This comprehensive report delves into the dynamic Poland Payments Industry, offering in-depth analysis of market structure, competitive landscape, trends, and future outlook. Leveraging high-volume keywords such as Poland digital payments, online payment solutions Poland, fintech Poland, and mobile payment growth, this report is optimized for search engines and designed to engage industry professionals. With a robust study period from 2019 to 2033, including a base year of 2025, and a forecast period spanning 2025–2033, this report provides unparalleled insights for strategic decision-making. The analysis covers key segments like Point of Sale (Card Pay, Digital Wallet, Cash) and Online Sale across vital end-user industries including Retail, Entertainment, Healthcare, and Hospitality.

Poland Payments Industry Market Structure & Competitive Landscape

The Poland Payments Industry exhibits a dynamic market structure characterized by a healthy degree of competition, with major banking institutions, international payment networks, and emerging fintech players vying for market share. Innovation drivers are primarily centered around the increasing adoption of digital payment methods, enhanced security features, and the demand for seamless, user-friendly transaction experiences. Regulatory impacts, while present, generally foster a more secure and transparent environment for digital transactions, encouraging growth. Product substitutes are evolving rapidly, with advancements in mobile payment solutions and Buy Now, Pay Later (BNPL) services offering compelling alternatives to traditional payment methods.

End-user segmentation reveals a strong preference for convenient and secure payment options across various industries. The market concentration ratio is influenced by the presence of large financial institutions, but the growing fintech landscape ensures a vibrant and competitive ecosystem. Mergers and Acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, as companies seek to broaden their service offerings and customer base. For instance, the increasing integration of digital wallets and contactless payment solutions signifies a significant shift in consumer behavior and merchant adoption. The industry's capacity to adapt to technological advancements and evolving consumer expectations will be critical for sustained growth.

Poland Payments Industry Market Trends & Opportunities

The Poland Payments Industry is experiencing robust growth, driven by an escalating digital transformation and a burgeoning e-commerce sector. The market size for payment processing in Poland is projected to reach XX Billion PLN by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is significantly fueled by the increasing penetration of smartphones and widespread internet access, enabling a larger segment of the population to engage in online transactions. Technological shifts are paramount, with contactless payments, mobile wallets, and QR code-based payment systems gaining substantial traction. These innovations are not merely facilitating transactions but are also enhancing the overall customer experience, leading to higher adoption rates across various retail and service sectors.

Consumer preferences are evolving rapidly, with a clear tilt towards convenience, speed, and security. Polish consumers are increasingly opting for digital payment methods that offer immediate transaction confirmations and reduced reliance on physical cash. This shift is creating significant opportunities for payment service providers to introduce innovative solutions that cater to these evolving demands. For example, the surge in popularity of Buy Now, Pay Later (BNPL) services, as highlighted by the PKO BP initiative, signifies a growing appetite for flexible payment options. The competitive dynamics within the industry are intensifying, pushing existing players to innovate and new entrants to identify niche markets or underserved segments. The ongoing digital evolution presents a fertile ground for strategic partnerships and the development of integrated payment ecosystems, further solidifying the growth trajectory of the Poland payments market.

Dominant Markets & Segments in Poland Payments Industry

The Poland Payments Industry is characterized by the dominance of specific segments and end-user industries, driven by infrastructure, policy, and consumer behavior.

Mode of Payment:

Point of Sale:

- Card Pay: Remains a cornerstone of in-person transactions, driven by widespread card issuance and merchant acceptance. The convenience and security offered by chip-and-PIN and contactless card payments continue to bolster its position.

- Digital Wallet (includes Mobile Wallets): This segment is experiencing exponential growth, propelled by the increasing adoption of smartphones and the convenience of mobile payment solutions. The integration of popular digital wallets into loyalty programs and daily transactions further amplifies their appeal.

- Cash: While its dominance is gradually diminishing, cash still holds a significant share, particularly for smaller transactions and among certain demographics. However, the trend is clearly leaning towards digital alternatives.

- Others: This category encompasses emerging payment methods and niche solutions that are gaining traction.

Online Sale:

- Others: This broad category is dominated by a variety of online payment gateways, e-wallets, and innovative solutions that facilitate seamless e-commerce transactions. The increasing sophistication of online marketplaces and the demand for diverse payment options fuel the growth in this segment.

End-user Industry:

- Retail: This is a primary driver of payment volume, encompassing everything from supermarkets and fashion outlets to online e-commerce platforms. The push towards omnichannel retail experiences necessitates integrated and diverse payment solutions.

- Entertainment: Ticketing for events, online streaming services, and gaming platforms represent a significant and growing segment for payment processing. The demand for instant access and digital delivery fuels the adoption of digital payment methods.

- Healthcare: While traditionally slower to adopt digital payments, the healthcare sector is increasingly integrating online payment options for appointments, consultations, and prescription services, driven by convenience and efficiency.

- Hospitality: Hotels, restaurants, and travel services are actively adopting digital and contactless payment solutions to enhance customer experience and streamline operations, especially with the resurgence of tourism.

- Other End-user Industries: This encompasses a wide array of sectors, including utilities, education, and government services, all of which are progressively migrating towards digital payment infrastructure.

Key growth drivers include robust digital infrastructure, supportive government policies promoting cashless transactions, and a young, tech-savvy population eager to adopt innovative payment technologies. The expansion of e-commerce and the increasing adoption of smartphones across all demographics further solidify the dominance of digital payment methods within these key segments.

Poland Payments Industry Product Analysis

The Poland Payments Industry is witnessing a surge in product innovation, with a focus on enhancing user experience and security. Innovations in digital wallets are enabling seamless in-app and online purchases, while advancements in contactless payment technology for Point of Sale (POS) terminals are accelerating transaction speeds. Buy Now, Pay Later (BNPL) solutions are emerging as a significant product category, offering consumers flexible repayment options and boosting sales for merchants. Furthermore, the integration of AI and machine learning is improving fraud detection and personalization within payment platforms. These technological advancements are not only driving market adoption but also creating distinct competitive advantages for companies that can offer integrated, secure, and user-friendly payment ecosystems.

Key Drivers, Barriers & Challenges in Poland Payments Industry

Key Drivers:

- Digital Transformation: Widespread internet and smartphone penetration are driving the adoption of digital payment solutions.

- E-commerce Growth: The booming online retail sector necessitates efficient and diverse online payment options.

- Consumer Preference for Convenience: Polish consumers increasingly favor fast, secure, and contactless payment methods.

- Fintech Innovation: Emerging fintech companies are introducing innovative payment technologies and services.

- Government Initiatives: Support for cashless economies and digital infrastructure development.

Barriers & Challenges:

- Digital Divide: Ensuring accessibility for segments of the population with limited digital literacy or access.

- Cybersecurity Concerns: Addressing evolving cyber threats and maintaining consumer trust in digital transactions.

- Regulatory Compliance: Navigating complex and evolving payment regulations.

- Cash Dependence: Residual reliance on cash for certain transaction types and demographics.

- Competition: Intense competition from established financial institutions and agile fintech startups.

Growth Drivers in the Poland Payments Industry Market

The Poland Payments Industry market is propelled by several key growth drivers. Technologically, the widespread adoption of smartphones and increasing internet penetration are foundational. The growth of e-commerce and the increasing consumer preference for convenient and contactless payment methods are significant economic drivers. Government initiatives promoting digital payments and the development of robust payment infrastructure further accelerate this growth. For instance, the increasing acceptance of mobile wallets and QR code payments signifies a clear shift towards digital-first solutions. The expansion of online retail, coupled with a growing demand for Buy Now, Pay Later (BNPL) services, represents a substantial market opportunity.

Challenges Impacting Poland Payments Industry Growth

Despite the positive growth trajectory, the Poland Payments Industry faces several challenges. Regulatory complexities, while aimed at ensuring security, can sometimes create hurdles for new entrants and innovation. Supply chain issues are less of a direct concern for payment processing itself but can impact the availability of hardware like POS terminals. Competitive pressures are intense, with both established banks and agile fintech companies vying for market share, leading to price sensitivity and the need for continuous innovation. Addressing the digital divide and ensuring inclusivity for all demographics remains a crucial challenge. Furthermore, evolving cybersecurity threats require constant vigilance and investment to maintain consumer trust. The shift away from cash also presents challenges in ensuring all segments of society are adequately served.

Key Players Shaping the Poland Payments Industry Market

- Bank Pekao

- Apple Pay

- PKO Bank Polski

- Mastercard

- PayPal Holdings Inc

- PayU

- Santander Bank Polska

- DotPay

- American Express

- Tap2Pay me

Significant Poland Payments Industry Industry Milestones

- May 2022: Allegro announced a new service implemented in one of the platform's delivery methods - One Kurier. Customers using this method and paying for cash-on-delivery purchases can pay by card or smartphone using the contactless method on the courier's device used to manage shipments.

- May 2022: PKO BP announced today that it is completing work on a deferred payment solution (the so-called BNPL - buy now, pay later). One of the essential features of the new service will be that after its introduction by PKO BP, it will become one of the payment options available in virtually all online shops in Poland.

Future Outlook for Poland Payments Industry Market

The Future Outlook for Poland Payments Industry Market is exceptionally bright, driven by continued technological advancements and evolving consumer behavior. Strategic opportunities lie in the expansion of innovative payment solutions like BNPL, further integration of digital wallets, and the development of seamless omnichannel payment experiences. The increasing digitization of businesses and services across all end-user industries will create a sustained demand for efficient and secure payment processing. Investment in robust cybersecurity measures and user-friendly interfaces will be crucial for capturing market share and fostering consumer confidence. The market's potential for growth is significant, especially as Poland continues to embrace a cashless economy and digital-first payment methodologies.

Poland Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Poland Payments Industry Segmentation By Geography

- 1. Poland

Poland Payments Industry Regional Market Share

Geographic Coverage of Poland Payments Industry

Poland Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in the Polish Payments Market; Initiatives by the Government to improve cashless payment methods

- 3.3. Market Restrains

- 3.3.1. Lack of a standard legislative policy remains especially in the case of cross-border transactions

- 3.4. Market Trends

- 3.4.1. Advancements in the Polish Payments Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank Pekao

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apple Pay*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PKO Bank Polski

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mastercard

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PayPal Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PayU

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Santander Bank Polska

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DotPay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 American Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tap2Pay me

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Pekao

List of Figures

- Figure 1: Poland Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Poland Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Poland Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Poland Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 5: Poland Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Poland Payments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Payments Industry?

The projected CAGR is approximately 12.39%.

2. Which companies are prominent players in the Poland Payments Industry?

Key companies in the market include Bank Pekao, Apple Pay*List Not Exhaustive, PKO Bank Polski, Mastercard, PayPal Holdings Inc, PayU, Santander Bank Polska, DotPay, American Express, Tap2Pay me.

3. What are the main segments of the Poland Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in the Polish Payments Market; Initiatives by the Government to improve cashless payment methods.

6. What are the notable trends driving market growth?

Advancements in the Polish Payments Market.

7. Are there any restraints impacting market growth?

Lack of a standard legislative policy remains especially in the case of cross-border transactions.

8. Can you provide examples of recent developments in the market?

May 2022 - Allegro announced a new service implemented in one of the platform's delivery methods - One Kurier. Customers using this method and paying for cash-on-delivery purchases can pay by card or smartphone using the contactless method on the courier's device used to manage shipments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Payments Industry?

To stay informed about further developments, trends, and reports in the Poland Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence