Key Insights

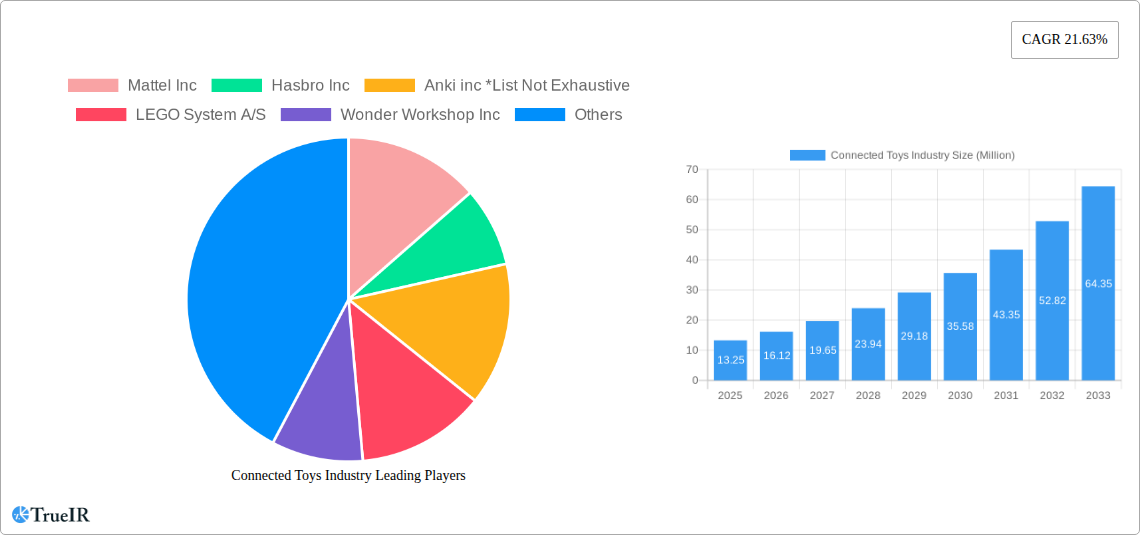

The Connected Toys industry is poised for remarkable expansion, with a current market size estimated at a substantial USD 13.25 million. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 21.63% over the forecast period of 2025-2033, signaling a dynamic and rapidly evolving market. This accelerated growth is primarily driven by the increasing integration of technology in children's play, fueled by advancements in the Internet of Things (IoT), artificial intelligence (AI), and enhanced connectivity options. The escalating demand for educational and interactive toys that foster cognitive development and digital literacy among children is a significant catalyst. Parents are increasingly recognizing the value of toys that offer a blend of entertainment and learning, leading to a greater willingness to invest in these sophisticated products. Furthermore, the proliferation of smartphones, tablets, and gaming consoles as primary digital interfaces for entertainment among younger demographics directly supports the growth of associated connected toy segments, including smartphone-connected toys, console-connected toys, and tablet-connected toys.

Connected Toys Industry Market Size (In Million)

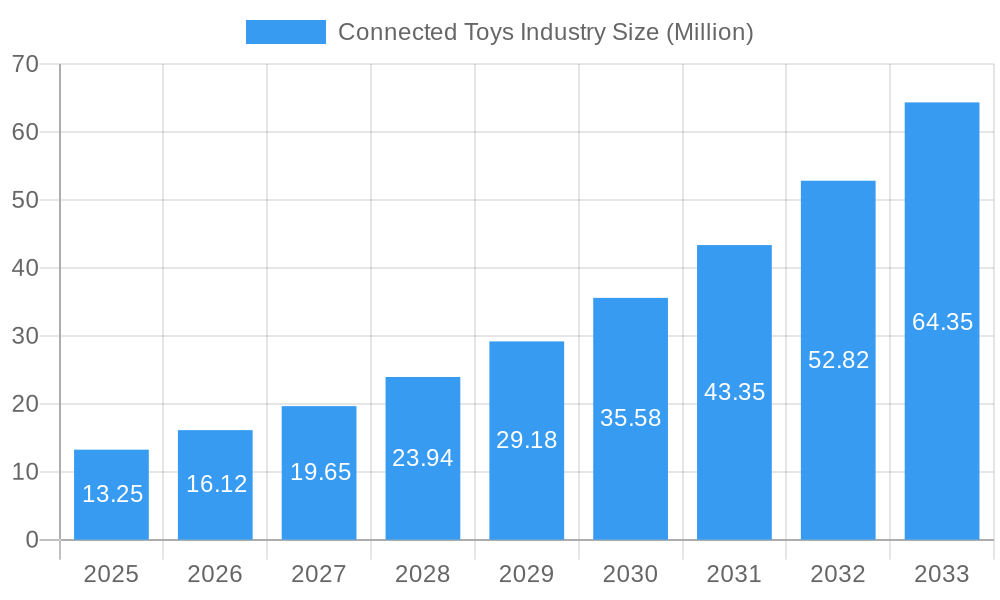

The market landscape is characterized by a diverse range of players, from established toy giants like Mattel Inc. and Hasbro Inc. to innovative tech-focused companies such as Sphero and Wonder Workshop Inc. These companies are actively investing in research and development to introduce novel products that offer immersive experiences, personalized content, and secure digital environments. Emerging trends include the rise of augmented reality (AR) and virtual reality (VR) integrated toys, the development of AI-powered companions that adapt to a child's learning pace, and a growing emphasis on data privacy and child safety within connected ecosystems. While the market presents significant opportunities, potential restraints include concerns around screen time, the cost of advanced connected toys, and the need for robust parental controls to ensure responsible usage. Nonetheless, the overarching trend points towards a future where toys are not merely physical objects but intelligent, interactive companions that enrich a child's developmental journey.

Connected Toys Industry Company Market Share

Here's the SEO-optimized report description for the Connected Toys Industry:

Connected Toys Industry Market Structure & Competitive Landscape

The global Connected Toys market is characterized by a dynamic and evolving structure, marked by significant innovation and increasing market concentration. As of our analysis, key players like Mattel Inc., Hasbro Inc., and The LEGO Group collectively hold a substantial market share, indicating a moderate to high concentration ratio. Innovation is the primary driver, fueled by advancements in Artificial Intelligence (AI), Augmented Reality (AR), and the Internet of Things (IoT), enabling more interactive and educational play experiences. Regulatory impacts are growing, particularly concerning data privacy and child safety online, prompting companies to invest heavily in secure platforms and transparent data handling practices. Product substitutes are emerging, not just from traditional toy manufacturers but also from educational technology firms, blurring the lines between play and learning. End-user segmentation reveals a strong preference for smartphone-connected toys, followed by tablet-connected and console-connected variants, reflecting broader digital adoption trends among children and families. Mergers and Acquisitions (M&A) activity, while not at peak levels, are strategically focused on acquiring innovative startups and expanding technological capabilities. For instance, the acquisition of Anki Inc. by a consortium of investors in 2020 underscored the sector's potential for advanced robotics integration. Market concentration is expected to slightly increase in the forecast period (2025–2033) as larger players leverage their resources for R&D and market penetration.

Connected Toys Industry Market Trends & Opportunities

The Connected Toys industry is poised for robust growth, with an estimated market size projected to reach $XX Billion by 2033, expanding from approximately $XX Billion in 2025. This impressive trajectory is fueled by a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Technological advancements are at the forefront of this expansion, with the seamless integration of AI, machine learning, and AR/VR capabilities transforming traditional play into immersive and personalized experiences. For example, smart dolls that respond to voice commands and educational robots that adapt to a child's learning pace are setting new industry benchmarks. The increasing penetration of smartphones and tablets among children, coupled with rising disposable incomes in emerging economies, significantly broadens the consumer base for these digital-enhanced playthings.

Consumer preferences are shifting towards toys that offer educational value alongside entertainment, leading to a surge in demand for STEM-focused connected toys. Parents are increasingly recognizing the developmental benefits of interactive learning tools that foster problem-solving, critical thinking, and coding skills. This trend opens up significant opportunities for companies that can effectively blend engaging gameplay with pedagogical principles. The competitive landscape is intensifying, with established toy giants like Mattel Inc. and Hasbro Inc. investing heavily in digital innovation and strategic partnerships. Simultaneously, agile startups such as Sphero and Wonder Workshop Inc. are carving out niche markets with their unique technological offerings. The market penetration rate for connected toys is expected to climb steadily, driven by greater affordability and increased consumer awareness of their benefits. Furthermore, the rise of subscription-based models and online gaming platforms is creating new revenue streams and enhancing customer engagement. The ongoing evolution of connectivity, including 5G technology, promises even richer interactive experiences, enabling real-time multiplayer gaming and more sophisticated AI interactions, further propelling market growth and innovation in the coming years.

Dominant Markets & Segments in Connected Toys Industry

The Smartphone Connected Toys segment is currently the dominant force within the Connected Toys industry, driven by unparalleled market penetration and accessibility. As of the base year 2025, this segment is estimated to contribute over XX% to the overall market revenue. The widespread availability of smartphones across various age demographics, coupled with their inherent multifunctionality and compatibility with a vast array of apps, makes them the primary platform for connected toy interaction. Key growth drivers for this segment include:

- Ubiquitous Smartphone Adoption: A significant percentage of households globally possess at least one smartphone, making it the most accessible gateway to connected play for a broad consumer base.

- App Ecosystem Development: The robust app stores offer a continuous stream of innovative applications, games, and interactive content that complements and enhances the functionality of smartphone-connected toys.

- Parental Comfort with Digital Devices: Parents are increasingly comfortable with their children engaging with smartphones for educational and entertainment purposes, provided appropriate controls and content are in place.

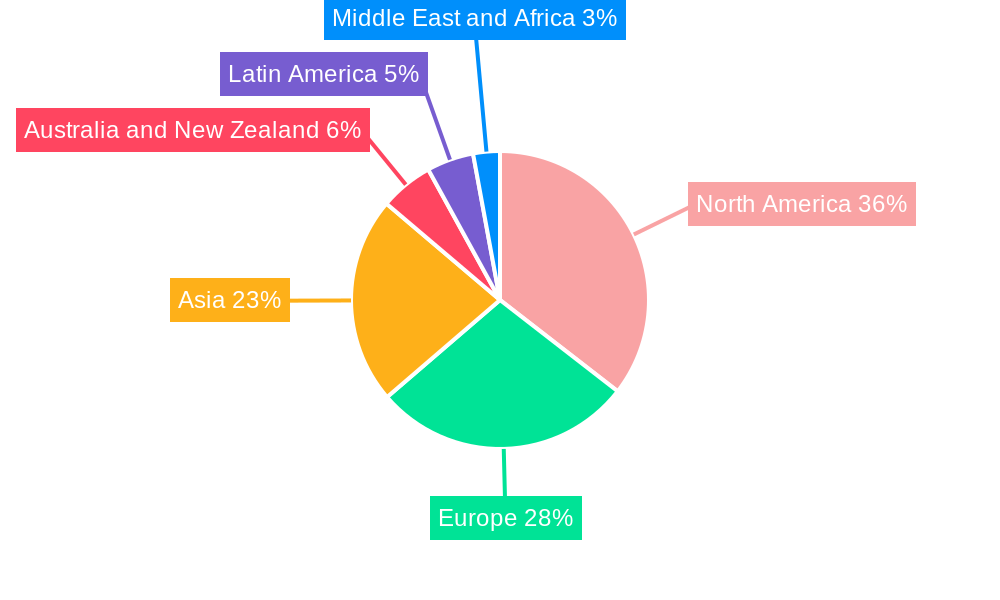

In terms of regional dominance, North America is projected to maintain its leading position throughout the forecast period (2025–2033), driven by high disposable incomes, early adoption of new technologies, and a strong parental inclination towards educational and innovative play products. The United States, in particular, represents a substantial market for connected toys, with a high rate of internet penetration and a culture that values technological integration in education and entertainment. Government initiatives promoting STEM education and technological literacy further bolster the market in this region.

While Console Connected Toys and Tablet Connected Toys hold significant market share, their growth is more intrinsically linked to the lifecycle and adoption rates of their respective hardware. Smartphone Connected Toys, however, benefit from the ongoing evolution and widespread adoption of mobile devices, ensuring their sustained dominance and offering extensive opportunities for innovation and market expansion. The strategic focus on developing engaging and educational content for smartphone platforms will be crucial for continued market leadership.

Connected Toys Industry Product Analysis

The Connected Toys industry is defined by its constant stream of innovative products that merge physical play with digital interaction. Key product innovations include AI-powered dolls and robots that offer personalized learning experiences, AR-enhanced board games that bring characters to life, and programmable building sets that teach coding fundamentals. These products leverage advancements in sensors, connectivity, and artificial intelligence to provide immersive, educational, and entertaining experiences. Their competitive advantage lies in their ability to offer a richer, more engaging, and often educational alternative to traditional toys, fostering critical thinking, creativity, and digital literacy.

Key Drivers, Barriers & Challenges in Connected Toys Industry

Key Drivers: The Connected Toys industry is propelled by several powerful drivers. Technologically, the rapid advancements in Artificial Intelligence (AI), Augmented Reality (AR), and the Internet of Things (IoT) are enabling more sophisticated and interactive play experiences. Economically, rising disposable incomes in emerging markets and a growing parental willingness to invest in educational toys fuel demand. Policy-driven factors, such as government initiatives promoting STEM education, also create a favorable environment. For instance, the widespread adoption of smartphones and tablets serves as a foundational driver, providing the necessary infrastructure for these toys to function.

Key Challenges: Despite significant growth potential, the industry faces notable challenges. Supply chain issues, as seen with global disruptions impacting electronics manufacturing, can lead to production delays and increased costs. Regulatory hurdles, particularly concerning data privacy and child online safety (e.g., COPPA in the US, GDPR in Europe), necessitate substantial investment in compliance and security measures, impacting development timelines and budgets. Competitive pressures are intense, with both established players and emerging startups vying for market share, often leading to price sensitivity and the need for continuous innovation.

Growth Drivers in the Connected Toys Industry Market

The Connected Toys market is experiencing substantial growth driven by key factors. Technological advancements, including the pervasive integration of AI, machine learning, and enhanced connectivity, are creating more intelligent and engaging play experiences. The increasing adoption of smartphones and tablets by children worldwide provides a readily accessible platform for these interactive toys. Furthermore, a growing parental emphasis on educational play and STEM learning is a significant market driver, as parents recognize the developmental benefits of connected toys. Economic factors, such as rising disposable incomes in developing nations, are also expanding the consumer base.

Challenges Impacting Connected Toys Industry Growth

Several barriers and restraints are impacting the growth of the Connected Toys industry. Regulatory complexities surrounding data privacy and child online safety, including legislation like COPPA and GDPR, require significant compliance efforts and can limit data collection and personalization features. Supply chain disruptions for electronic components can lead to production delays and increased manufacturing costs, impacting product availability and pricing. Intense competitive pressures from both established toy manufacturers and new tech entrants necessitate continuous innovation and significant R&D investment, potentially leading to price wars.

Key Players Shaping the Connected Toys Industry Market

- Mattel Inc.

- Hasbro Inc.

- Anki inc

- LEGO System A/S

- Wonder Workshop Inc

- Sphero

- WowWee Group Limited

- Leka SAS

- Sony Corporation

- Bandai Namco Entertainment Inc

Significant Connected Toys Industry Industry Milestones

- March 2023: The Lego Group announced a significant increase in profit after three years, driven by a surge in demand. To meet this, the company made substantial investments in production capabilities and expanded its reach by opening 155 new branded stores in the previous year. Additionally, they ramped up production at three of its five factories.

- January 2022: LEGO announced the cancellation of VIDIYO products, including a line of music-making toys controlled by a smartphone or tablet, effective from January 31st. This decision reflects a strategic recalibration within their digital play initiatives.

Future Outlook for Connected Toys Industry Market

The future outlook for the Connected Toys industry is exceptionally bright, characterized by sustained growth and innovation. Key catalysts include the ongoing integration of advanced AI and AR technologies, promising even more personalized and immersive play. The increasing penetration of 5G networks will enable richer, real-time interactive experiences, driving demand for sophisticated connected toys. Strategic opportunities lie in the continued focus on educational content and the expansion into emerging markets with growing middle classes. The market potential is significant as consumers increasingly seek toys that offer both entertainment and developmental benefits, positioning the industry for continued expansion and technological evolution.

Connected Toys Industry Segmentation

-

1. Type

- 1.1. Smartphone Connected Toys

- 1.2. Console Connected Toys

- 1.3. Tablet Connected Toys

Connected Toys Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Connected Toys Industry Regional Market Share

Geographic Coverage of Connected Toys Industry

Connected Toys Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Easy Availability of Connected Platforms

- 3.3. Market Restrains

- 3.3.1. Fragmented Market with Several Local Vendors

- 3.4. Market Trends

- 3.4.1. Smartphone Connected Toys are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Smartphone Connected Toys

- 5.1.2. Console Connected Toys

- 5.1.3. Tablet Connected Toys

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Smartphone Connected Toys

- 6.1.2. Console Connected Toys

- 6.1.3. Tablet Connected Toys

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Smartphone Connected Toys

- 7.1.2. Console Connected Toys

- 7.1.3. Tablet Connected Toys

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Smartphone Connected Toys

- 8.1.2. Console Connected Toys

- 8.1.3. Tablet Connected Toys

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Smartphone Connected Toys

- 9.1.2. Console Connected Toys

- 9.1.3. Tablet Connected Toys

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Smartphone Connected Toys

- 10.1.2. Console Connected Toys

- 10.1.3. Tablet Connected Toys

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Connected Toys Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Smartphone Connected Toys

- 11.1.2. Console Connected Toys

- 11.1.3. Tablet Connected Toys

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mattel Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hasbro Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Anki inc *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LEGO System A/S

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wonder Workshop Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sphero

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 WowWee Group Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leka SAS

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sony Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bandai Namco Entertainment Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Mattel Inc

List of Figures

- Figure 1: Global Connected Toys Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Australia and New Zealand Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Australia and New Zealand Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Latin America Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Connected Toys Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East and Africa Connected Toys Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East and Africa Connected Toys Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Connected Toys Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Connected Toys Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Connected Toys Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Connected Toys Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Toys Industry?

The projected CAGR is approximately 21.63%.

2. Which companies are prominent players in the Connected Toys Industry?

Key companies in the market include Mattel Inc, Hasbro Inc, Anki inc *List Not Exhaustive, LEGO System A/S, Wonder Workshop Inc, Sphero, WowWee Group Limited, Leka SAS, Sony Corporation, Bandai Namco Entertainment Inc.

3. What are the main segments of the Connected Toys Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Easy Availability of Connected Platforms.

6. What are the notable trends driving market growth?

Smartphone Connected Toys are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fragmented Market with Several Local Vendors.

8. Can you provide examples of recent developments in the market?

March 2023: The Lego Group recently announced a significant increase in profit after three years, despite experiencing a surge in demand. To meet the growing demand, the company made substantial investments in production capabilities and expanded its reach by opening 155 new branded stores in the previous year. Additionally, the company ramped up production at three of its five factories to ensure an adequate supply of Lego products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Toys Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Toys Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Toys Industry?

To stay informed about further developments, trends, and reports in the Connected Toys Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence