Key Insights

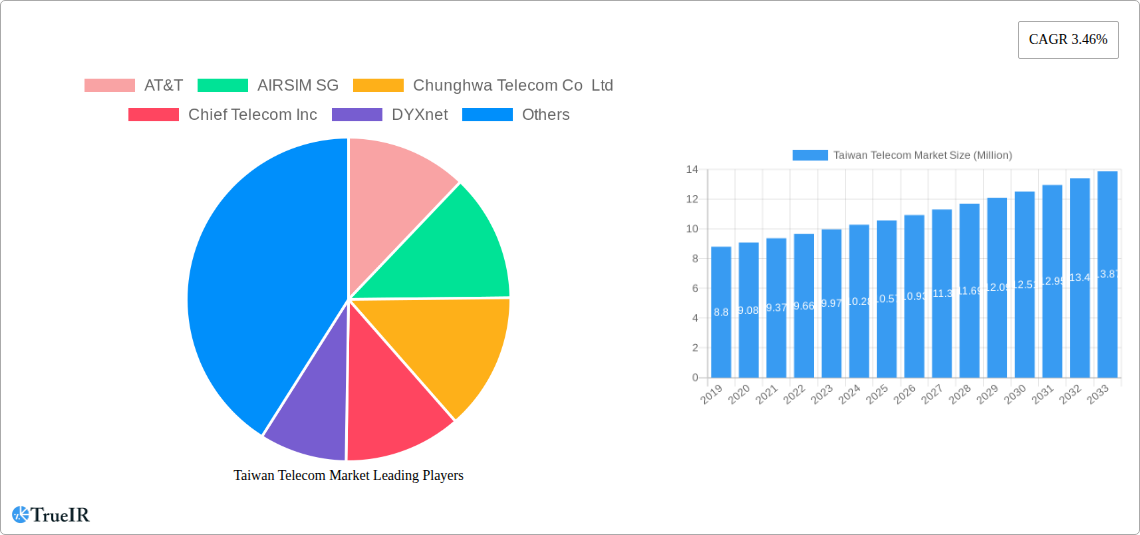

The Taiwan telecommunications market is poised for steady growth, projected to reach approximately USD 10.57 billion by 2025. This expansion is underpinned by a compound annual growth rate (CAGR) of 3.46% throughout the forecast period of 2025-2033. A primary driver for this sustained growth is the increasing demand for robust data services, fueled by the widespread adoption of smartphones and the burgeoning popularity of over-the-top (OTT) streaming platforms and pay-TV services. As consumers continue to rely on high-speed internet for entertainment, communication, and productivity, the telecommunications infrastructure in Taiwan will be critical in meeting these evolving needs. Furthermore, the integration of advanced technologies such as 5G deployment and the expansion of fiber optic networks are expected to create new revenue streams and enhance the overall service offerings available to both residential and business users. The dynamic interplay between technological innovation and consumer behavior will undoubtedly shape the future trajectory of this market.

Taiwan Telecom Market Market Size (In Million)

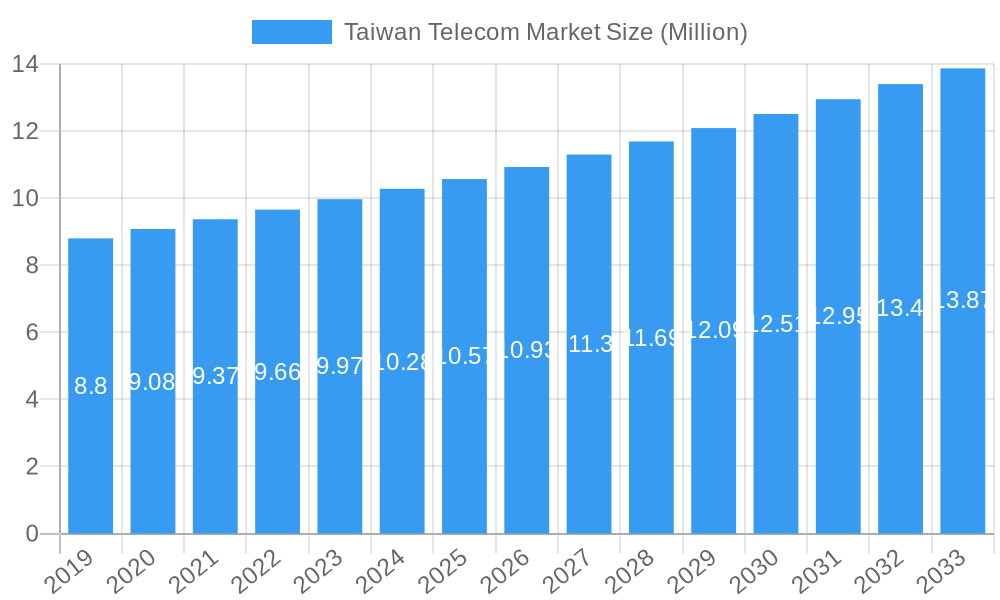

While the market is experiencing significant growth, certain restraints may influence its pace. These include the substantial capital expenditure required for network upgrades, particularly in the rollout of next-generation technologies like 5G, and the increasing competition among established players and new entrants offering innovative services. The evolving regulatory landscape and the need for continuous investment in infrastructure to maintain service quality and expand coverage are also key considerations. Despite these challenges, the market's segmentation reveals a strong emphasis on data and OTT/Pay-TV services, indicating a consumer preference for immersive digital experiences. Key companies like AT&T, AIRSIM SG, Chunghwa Telecom, and Far EasTone Telecommunications are actively investing in these areas, aiming to capture a larger market share. The focus on services like wired and wireless voice services remains significant, but the growth trajectory is increasingly dictated by the demand for higher bandwidth and richer digital content consumption.

Taiwan Telecom Market Company Market Share

Taiwan Telecom Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report offers an in-depth analysis of the dynamic Taiwan telecom market, providing critical insights into its structure, trends, opportunities, and competitive landscape. Spanning the historical period of 2019–2024 and projecting forward to 2033, with a base and estimated year of 2025, this study leverages high-volume keywords to enhance SEO visibility and deliver actionable intelligence for industry stakeholders. Explore the evolution of voice, data, and OTT services, and understand the strategic moves of key players like Chunghwa Telecom, AT&T, and Far EasTone.

Taiwan Telecom Market Market Structure & Competitive Landscape

The Taiwan telecom market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for the core mobile and broadband segments is estimated to be in the xx to xx range, indicating a competitive yet consolidated environment. Innovation drivers are primarily fueled by the relentless pursuit of 5G deployment, fiber optic network expansion, and the integration of artificial intelligence (AI) within service delivery. Regulatory impacts, while aiming to foster competition, can also introduce complexities regarding spectrum allocation and infrastructure access. Product substitutes are increasingly prevalent, with over-the-top (OTT) services posing a significant challenge to traditional PayTV and voice offerings. End-user segmentation reveals a growing demand for high-speed data and personalized entertainment experiences across consumer and enterprise sectors. Mergers and acquisitions (M&A) trends are characterized by strategic consolidation within specific service areas and occasional cross-sector collaborations to leverage new technologies. The volume of M&A deals in the historical period (2019-2024) is estimated at xx, signifying ongoing market restructuring.

Taiwan Telecom Market Market Trends & Opportunities

The Taiwan telecom market is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and strategic industry developments. The Compound Annual Growth Rate (CAGR) for the overall market is projected to be in the range of xx% to xx% during the forecast period of 2025–2033. This expansion is significantly influenced by the widespread adoption of high-speed internet services, with broadband penetration rates already exceeding xx%. The increasing demand for bandwidth-intensive applications, such as cloud computing, IoT, and immersive entertainment, is a key market trend.

Technological shifts are predominantly centered around the continued rollout and optimization of 5G networks, enabling lower latency and higher speeds crucial for new use cases in gaming, augmented reality (AR), and virtual reality (VR). Furthermore, the strategic investment in cloud infrastructure, exemplified by Amazon Web Services' (AWS) commitment to establishing a region in Taiwan, signifies a pivotal moment. This development will not only boost the local digital economy but also empower businesses with enhanced data processing capabilities, reduced latency for cloud-based applications, and improved cybersecurity.

Consumer preferences are increasingly shifting towards on-demand content and integrated digital experiences. This is evident in the growing popularity of OTT and PayTV services, which offer a wider array of content and greater flexibility compared to traditional broadcasting. Companies are responding by developing more personalized service bundles and innovative content delivery platforms. The convergence of telecommunications and digital services presents a significant opportunity for telcos to expand their revenue streams beyond traditional voice and data.

Competitive dynamics are intensifying, with established players like Chunghwa Telecom, Far EasTone, and Taiwan Mobile investing heavily in network upgrades and service diversification. The market is witnessing a growing emphasis on edge computing and specialized enterprise solutions, catering to the evolving needs of industries such as manufacturing, healthcare, and finance. The expansion of cloud services within Taiwan will further catalyze this trend, enabling local businesses to access global cloud platforms with improved performance and security.

The increasing demand for digital transformation across all sectors of the Taiwanese economy presents a substantial market opportunity. Companies are looking for reliable, high-performance connectivity and integrated digital solutions to enhance their operational efficiency and competitiveness. This includes a growing need for advanced data analytics, cybersecurity services, and the integration of AI into business processes. The telecom market is strategically positioned to capitalize on these demands, offering comprehensive solutions that go beyond basic connectivity.

Dominant Markets & Segments in Taiwan Telecom Market

The Taiwan telecom market is experiencing significant dominance and growth within its core service segments, with Data Services emerging as the primary revenue generator and growth engine. This dominance is underpinned by robust infrastructure development and supportive government policies. The market's leading region is undoubtedly Taiwan itself, given the focused nature of the analysis.

Data and: This segment, encompassing mobile data, broadband internet, and enterprise data solutions, holds the largest market share and is projected to witness the highest growth rate.

- Key Growth Drivers:

- Ubiquitous 5G Deployment: The ongoing expansion and densification of 5G networks are providing consumers and businesses with unprecedented speeds and lower latency, driving demand for data-intensive applications and services.

- Fiber Optic Network Expansion: Continued investment in high-speed fiber optic broadband infrastructure is crucial for supporting the increasing bandwidth requirements of households and enterprises.

- Cloud Computing Adoption: The growing adoption of cloud services by businesses necessitates high-capacity, reliable data connectivity, further boosting the data services segment. The impending AWS region in Taiwan will significantly accelerate this trend.

- IoT Growth: The proliferation of Internet of Things (IoT) devices across various sectors, from smart homes to industrial automation, requires constant and robust data transmission.

- Digital Transformation Initiatives: Government and corporate initiatives promoting digital transformation are driving demand for advanced data solutions and services.

- Key Growth Drivers:

OTT and PayTV Services: This segment is experiencing substantial growth, directly correlating with evolving consumer entertainment preferences and the increasing availability of high-speed internet.

- Key Growth Drivers:

- On-Demand Content Consumption: Consumers are increasingly favoring on-demand viewing over traditional linear television, leading to a surge in the adoption of streaming services.

- Content Diversification: A wide array of local and international content available through OTT platforms caters to diverse consumer tastes.

- Bundled Offerings: Telecommunication providers are increasingly bundling OTT services with their connectivity packages, enhancing customer value and driving adoption.

- Technological Innovations in Broadcasting: As demonstrated by Chunghwa Telecom's initiatives for the Paris Olympics, innovations like AR and ultra-slow-motion replays are enhancing the viewing experience and attracting subscribers.

- Key Growth Drivers:

Voice Services (Wired, Wireless): While still a foundational service, the growth in voice services is more mature compared to data and OTT. Wireless voice services continue to see stable demand, while wired voice services are experiencing a gradual decline or transition towards bundled VoIP solutions.

- Key Growth Drivers (for Wireless Voice):

- Continued Mobile Penetration: High mobile phone penetration rates ensure a steady base for wireless voice communication.

- Bundled Packages: Voice services are often included as part of comprehensive mobile plans, maintaining their relevance.

- Market Dynamics: The focus is shifting from pure voice revenue to integrated communication solutions where voice is a component of a larger digital service offering.

- Key Growth Drivers (for Wireless Voice):

The dominance of the Data segment, propelled by the infrastructure investments and the increasing need for digital connectivity, sets the stage for further innovation and growth across all segments of the Taiwan telecom market.

Taiwan Telecom Market Product Analysis

Product innovation in the Taiwan telecom market is characterized by a relentless drive towards enhanced connectivity and integrated digital experiences. The 5G network rollout remains a cornerstone, enabling faster speeds, lower latency, and greater capacity for a plethora of new applications. Beyond core connectivity, advancements in cloud integration are crucial, with companies like Chunghwa Telecom leveraging AWS infrastructure to offer low-latency cloud solutions, improved bandwidth, and robust security. This focus extends to enhanced media consumption, as seen with Chunghwa Telecom's introduction of AR and ultra-slow-motion capabilities for live event broadcasting, alongside 4K content and on-demand features. The competitive advantage lies in offering seamless, high-performance digital ecosystems that cater to both consumer entertainment and enterprise digital transformation needs.

Key Drivers, Barriers & Challenges in Taiwan Telecom Market

The Taiwan telecom market is propelled by several key drivers. Technological advancements, particularly the pervasive 5G network deployment and the expansion of fiber optics, are fundamental. Economic growth and digitalization initiatives within the country foster a strong demand for advanced connectivity and digital services. Government support for digital infrastructure development and innovation further fuels market expansion.

However, significant barriers and challenges exist. Intense competitive pressures among major operators lead to price wars and pressure on margins. Regulatory complexities related to spectrum allocation, infrastructure sharing, and data privacy can create hurdles. Supply chain issues, particularly for sophisticated network equipment, can impact deployment timelines. The substantial capital expenditure required for network upgrades (e.g., 5G and fiber) also presents a financial challenge.

Growth Drivers in the Taiwan Telecom Market Market

Key drivers shaping the Taiwan telecom market include the accelerated deployment of 5G networks, which is unlocking new use cases and demanding higher bandwidth. The strategic expansion of fiber optic infrastructure continues to enhance fixed broadband capabilities. Increased enterprise adoption of cloud computing and digital transformation initiatives is a significant economic driver, requiring robust and reliable telecommunications services. Furthermore, supportive government policies aimed at fostering a digital economy and promoting innovation play a crucial role. The impending launch of the AWS Asia Pacific (Taipei) Region is a transformative development, poised to significantly boost cloud-based services and related demand for advanced telecom infrastructure.

Challenges Impacting Taiwan Telecom Market Growth

Several challenges impact the growth of the Taiwan telecom market. Intense competition among established players, including Chunghwa Telecom, Far EasTone, and Taiwan Mobil, often leads to price erosion and necessitates continuous investment in network upgrades and service innovation. Regulatory complexities, while aiming to ensure fair competition, can sometimes slow down market evolution and deployment of new technologies. Supply chain vulnerabilities, particularly for specialized telecommunications equipment, pose a risk to timely network expansion and maintenance. The significant capital expenditure required for 5G network build-out and ongoing infrastructure upgrades represents a substantial financial hurdle for operators. Additionally, evolving cybersecurity threats necessitate continuous investment in protective measures.

Key Players Shaping the Taiwan Telecom Market Market

- AT&T

- AIRSIM SG

- Chunghwa Telecom Co Ltd

- Chief Telecom Inc

- DYXnet

- eASPNet Inc

- Far EasTone Telecommunications Co Ltd

- GigaMedia Limited

- So-net Entertainment Taiwan Limited

- Taiwan Mobil

Significant Taiwan Telecom Market Industry Milestones

- June 2024: Amazon Web Services (AWS) announced plans to launch an AWS infrastructure Region in Taiwan, slated for an early 2025 debut. This new AWS Asia Pacific (Taipei) Region aims to offer a broader spectrum of options to developers, startups, entrepreneurs, enterprises, and various sectors, including education, entertainment, financial services, and nonprofits. These entities can now host their applications and cater to end-users directly from data centers within Taiwan. AWS has committed to a multi-billion-dollar investment in Taiwan over the next 15 years. Additionally, Chunghwa Telecom is set to capitalize on AWS's cloud technologies and infrastructure, enhancing its service offerings with a focus on reduced latency, increased bandwidth, and bolstered security.

- May 2024: Chunghwa Telecom hosted the "Catch the 2024 Paris Olympics Live on Chunghwa Telecom" event, where its subsidiaries, MOD and Hami Video, unveiled plans to revolutionize Olympic broadcasting. The Taiwanese telecommunications giant is set to debut features, including pioneering Augmented Reality and ultra-slow motion angles. Alongside these innovations, Chunghwa Telecom will roll out a comprehensive suite of services, ranging from 4K quality broadcasts to event reminders, replays, and VOD offerings, all conveniently accessible through its one-stop Olympic zone.

Future Outlook for Taiwan Telecom Market Market

The future outlook for the Taiwan telecom market is exceptionally promising, driven by strategic investments in cutting-edge infrastructure and the burgeoning demand for digital services. The imminent launch of the AWS Asia Pacific (Taipei) Region will significantly bolster the cloud computing ecosystem, creating substantial opportunities for enhanced data services, AI-driven applications, and robust enterprise solutions. Coupled with the ongoing expansion of 5G and fiber optic networks, this will enable telcos to offer highly sophisticated, low-latency services. The market is poised for continued growth in OTT and PayTV, fueled by innovative content delivery and bundled offerings. Strategic partnerships and a focus on delivering integrated digital experiences will be key to capitalizing on the digital transformation wave across various industries.

Taiwan Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Taiwan Telecom Market Segmentation By Geography

- 1. Taiwan

Taiwan Telecom Market Regional Market Share

Geographic Coverage of Taiwan Telecom Market

Taiwan Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Voice Services are Witnessing a Strong Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AT&T

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIRSIM SG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chunghwa Telecom Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chief Telecom Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DYXnet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 eASPNet Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Far EasTone Telecommunications Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GigaMedia Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 So-net Entertainment Taiwan Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Taiwan Mobil

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AT&T

List of Figures

- Figure 1: Taiwan Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Taiwan Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 3: Taiwan Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Taiwan Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 5: Taiwan Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Taiwan Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Taiwan Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Taiwan Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 9: Taiwan Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Taiwan Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Telecom Market?

The projected CAGR is approximately 3.46%.

2. Which companies are prominent players in the Taiwan Telecom Market?

Key companies in the market include AT&T, AIRSIM SG, Chunghwa Telecom Co Ltd, Chief Telecom Inc, DYXnet, eASPNet Inc, Far EasTone Telecommunications Co Ltd, GigaMedia Limited, So-net Entertainment Taiwan Limited, Taiwan Mobil.

3. What are the main segments of the Taiwan Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Voice Services are Witnessing a Strong Growth Rate.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

June 2024: Amazon Web Services (AWS) announced plans to launch an AWS infrastructure Region in Taiwan, slated for an early 2025 debut. This new AWS Asia Pacific (Taipei) Region aims to offer a broader spectrum of options to developers, startups, entrepreneurs, enterprises, and various sectors, including education, entertainment, financial services, and nonprofits. These entities can now host their applications and cater to end-users directly from data centers within Taiwan. AWS has committed to a multi-billion-dollar investment in Taiwan over the next 15 years. Additionally, Chunghwa Telecom is set to capitalize on AWS's cloud technologies and infrastructure, enhancing its service offerings with a focus on reduced latency, increased bandwidth, and bolstered security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Telecom Market?

To stay informed about further developments, trends, and reports in the Taiwan Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence