Key Insights

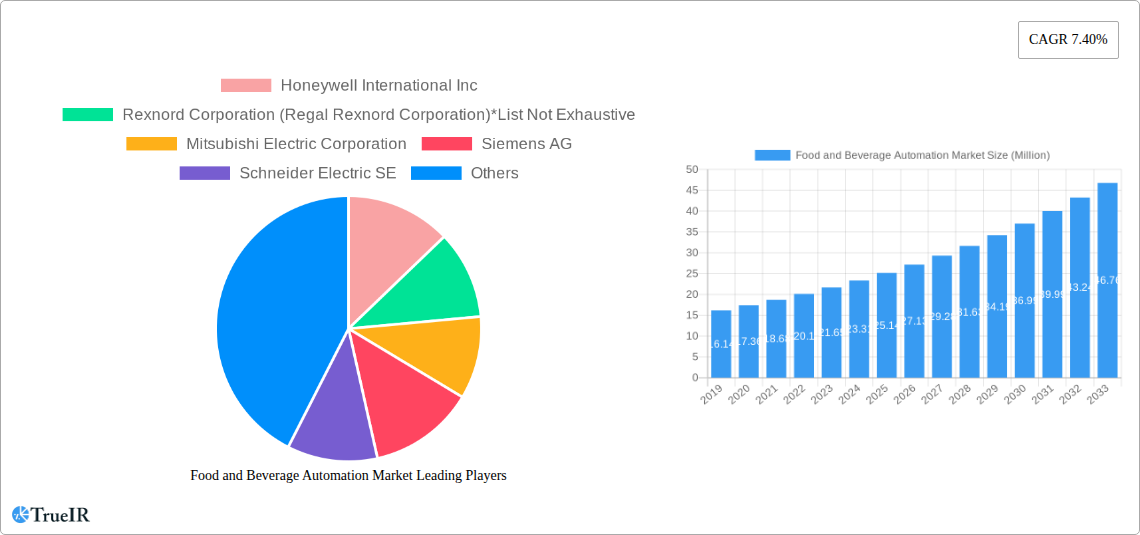

The global Food and Beverage Automation Market is poised for significant expansion, projected to reach an estimated $25.14 million in value, driven by a robust Compound Annual Growth Rate (CAGR) of 7.40% from 2019 to 2033. This substantial growth is fueled by an increasing demand for enhanced food safety, improved product quality, and greater operational efficiency across the entire food and beverage processing chain. Key drivers include the relentless pursuit of cost reduction through optimized production processes, the need to meet stringent regulatory compliance standards, and the growing consumer preference for consistently high-quality products. The adoption of advanced technologies like Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning (ML) is revolutionizing how food and beverage products are manufactured, from ingredient sourcing to final packaging.

Food and Beverage Automation Market Market Size (In Million)

The market's dynamic landscape is further shaped by evolving consumer trends and technological advancements. Automation is no longer a luxury but a necessity for businesses aiming to maintain competitiveness, address labor shortages, and minimize waste. Segmented by technology, the market encompasses a wide array of solutions including Distributed Control Systems (DCS), Manufacturing Execution Systems (MES), Variable-Frequency Drives (VFD), valves and actuators, electric motors, sensors, industrial robotics, and other specialized technologies. These are critical for optimizing processes in diverse end-user industries such as dairy processing, bakery and confectionary, meat, poultry, and seafood, fruits and vegetables, and beverages. Applications span packaging, palletizing, sorting and grading, and complex processing operations, all contributing to a more streamlined and responsive food supply chain. Leading companies like Honeywell, Siemens, Rockwell Automation, and ABB are at the forefront, investing heavily in research and development to deliver innovative automation solutions that cater to the evolving needs of this vital industry.

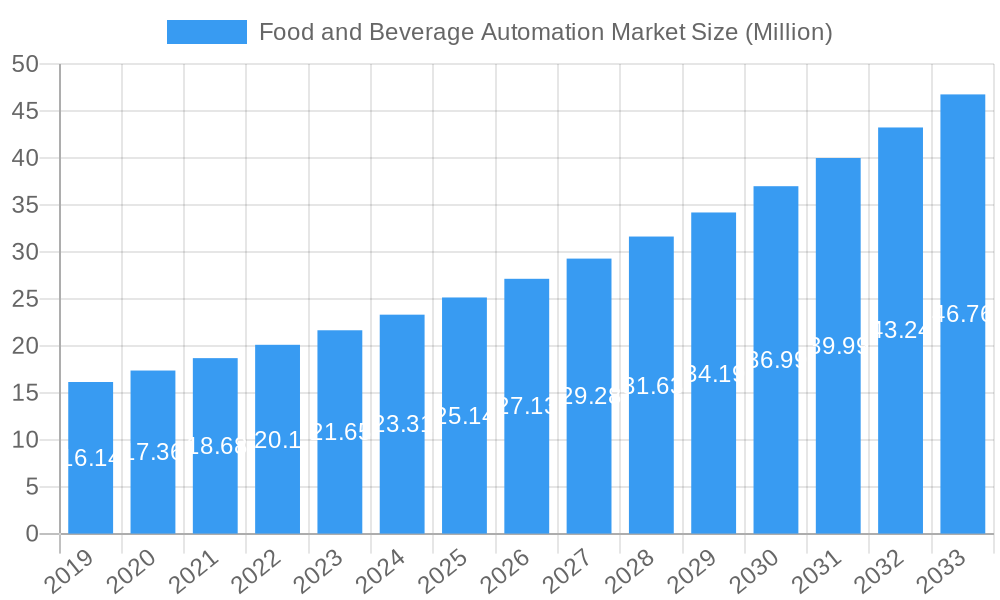

Food and Beverage Automation Market Company Market Share

This comprehensive report delivers a detailed analysis of the global Food and Beverage Automation Market, providing in-depth insights into its structure, trends, opportunities, and competitive landscape. Leveraging extensive data from the historical period 2019–2024 and projecting forward through the forecast period 2025–2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this critical industry. Explore market segmentation by Operational Technology and Software, End User, and Application, alongside a thorough product analysis and a deep dive into the key players driving innovation. Understand the significant industry milestones and gain a clear future outlook for the Food and Beverage Automation Market.

Food and Beverage Automation Market Market Structure & Competitive Landscape

The global Food and Beverage Automation Market exhibits a moderately consolidated structure, with a few key players holding significant market share. Innovation remains a primary driver, fueled by the constant need for enhanced efficiency, reduced operational costs, and improved product quality in the food and beverage sector. Regulatory impacts, particularly concerning food safety and traceability, are increasingly influencing automation adoption. Product substitutes, while present in certain manual processes, are largely being displaced by advanced automation solutions. End-user segmentation reveals distinct needs across dairy processing, bakery and confectionery, meat, poultry, and seafood, fruits and vegetables, and beverage production. Mergers and acquisitions (M&A) activity is a notable trend, with strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, recent M&A activities have focused on acquiring specialized automation technology providers and companies with strong customer bases in key food and beverage sub-sectors. The overall market concentration is estimated to be around 40-50% held by the top five players.

Food and Beverage Automation Market Market Trends & Opportunities

The Food and Beverage Automation Market is poised for significant expansion, driven by a confluence of factors including escalating global food demand, increasing labor shortages, and the imperative for enhanced food safety and traceability. Market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market value of over $XX Million by 2033. Technological shifts are at the forefront, with the integration of Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and advanced robotics transforming processing, packaging, and logistics. Consumer preferences for consistently high-quality, safely produced, and sustainably sourced food products are further accelerating the adoption of automated solutions that ensure precision and minimize human error. Competitive dynamics are intensifying, with companies focusing on developing intelligent automation systems, cloud-based software solutions for data analytics and predictive maintenance, and end-to-end automation platforms. The demand for customizable and flexible automation solutions that can adapt to varying production lines and product types presents a significant opportunity. The increasing focus on Industry 4.0 principles is driving the development of smart factories within the food and beverage industry, enabling real-time data monitoring, optimized resource utilization, and predictive quality control. The market penetration rate for advanced automation technologies in large-scale food processing facilities is expected to reach over 70% by 2033, while adoption in smaller and medium-sized enterprises is also steadily increasing. The rise of e-commerce and the subsequent demand for efficient and rapid order fulfillment in the food and beverage sector also necessitate greater automation in warehousing and distribution.

Dominant Markets & Segments in Food and Beverage Automation Market

The Operational Technology and Software segment is expected to witness robust growth, with Distributed Control Systems (DCS) and Manufacturing Execution Systems (MES) leading the charge. DCS provides centralized control and monitoring of complex industrial processes, ensuring efficiency and safety in food production. MES solutions enhance production visibility, manage workflows, and optimize resource allocation, crucial for meeting stringent quality standards. The End User segment of Beverages and Dairy Processing are anticipated to dominate the market due to their high production volumes and the critical need for hygienic and precise automation. In the Application segment, Packaging and Repackaging will continue to be a primary growth driver, as efficient and automated packaging solutions are essential for product preservation, branding, and distribution.

Operational Technology and Software Dominance:

- Distributed Control System (DCS): Essential for complex process control in large-scale food and beverage plants, ensuring consistency and safety.

- Manufacturing Execution Systems (MES): Vital for real-time production tracking, quality control, and operational efficiency improvements.

- Variable-frequency Drive (VFD): Crucial for energy efficiency and precise control of motor speeds in various processing and conveying systems.

- Sensors and Transmitters: Indispensable for real-time monitoring of critical parameters like temperature, pressure, and flow, ensuring product quality and safety.

- Industrial Robotics: Increasingly adopted for repetitive, hazardous, or high-precision tasks in packaging, palletizing, and assembly.

End User Leadership:

- Beverages: High-volume production, diverse product lines, and stringent hygiene requirements drive automation adoption.

- Dairy Processing: Demands high levels of precision, hygiene, and temperature control, making automation indispensable.

- Meat, Poultry, and Seafood: Automation addresses labor-intensive tasks, improves safety, and enhances traceability in a highly regulated sector.

- Bakery and Confectionery: Automation is key for consistent product quality, high-speed production, and intricate processing steps.

Application Dominance:

- Packaging and Repackaging: A core area for automation, encompassing filling, sealing, labeling, and boxing to meet market demands for efficiency and product integrity.

- Processing: Automation of critical steps like mixing, heating, cooling, and ingredient dispensing ensures uniformity and optimal product characteristics.

- Palletizing: Robotic and automated palletizing solutions streamline logistics and reduce manual handling injuries.

Food and Beverage Automation Market Product Analysis

Product innovations in the Food and Beverage Automation Market are characterized by the integration of advanced technologies such as AI-powered vision systems for quality inspection, collaborative robots for enhanced flexibility in production lines, and IoT-enabled sensors for real-time data analytics and predictive maintenance. These advancements offer significant competitive advantages by enabling higher throughput, improved product consistency, reduced waste, and enhanced food safety compliance. For instance, smart sensors and advanced analytics are optimizing energy consumption and resource utilization, while robotic solutions are addressing labor shortages and improving ergonomics for human workers. The market fit for these products is evident in their ability to address the industry's pressing needs for efficiency, sustainability, and safety.

Key Drivers, Barriers & Challenges in Food and Beverage Automation Market

Key Drivers:

- Increasing demand for processed and packaged food: Global population growth and changing lifestyles necessitate efficient food production.

- Labor shortages and rising labor costs: Automation offers a sustainable solution to these persistent challenges.

- Growing emphasis on food safety and traceability: Stringent regulations and consumer expectations drive the need for precise and automated processes.

- Technological advancements: Integration of AI, IoT, and robotics enhances efficiency and opens new possibilities.

- Quest for operational efficiency and cost reduction: Automation streamlines operations, reduces waste, and optimizes resource utilization.

Barriers & Challenges:

- High initial investment costs: The capital expenditure for implementing advanced automation systems can be substantial, particularly for small and medium-sized enterprises.

- Complexity of integration: Integrating new automation systems with existing legacy infrastructure can be challenging.

- Need for skilled workforce: Operating and maintaining sophisticated automation systems requires a skilled workforce, leading to training challenges.

- Regulatory hurdles and compliance: Navigating diverse food safety and operational regulations across different regions can be complex.

- Cybersecurity concerns: Increased connectivity in automated systems raises concerns about data security and potential cyber threats.

Growth Drivers in the Food and Beverage Automation Market Market

The Food and Beverage Automation Market is propelled by several key growth drivers. Technologically, the continuous evolution of AI, ML, and IoT is enabling smarter, more efficient, and predictive automation solutions. Economically, the persistent global demand for food products, coupled with increasing labor costs and shortages, makes automation an attractive proposition for manufacturers seeking to maintain competitiveness and profitability. Regulatory factors, such as heightened food safety standards and traceability requirements, are further compelling companies to invest in automated systems that ensure compliance and minimize risks. The drive towards Industry 4.0 adoption and the establishment of smart factories are also significant catalysts.

Challenges Impacting Food and Beverage Automation Market Growth

Several challenges are impacting the growth of the Food and Beverage Automation Market. The high initial capital investment required for advanced automation solutions can be a significant barrier, particularly for smaller enterprises with limited financial resources. The complexity of integrating new automation technologies with existing legacy systems poses technical challenges. Furthermore, a shortage of skilled personnel to operate and maintain sophisticated automated equipment can hinder adoption. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of automation components. Competitive pressures among automation providers may lead to price wars, impacting profitability, while stringent and evolving regulatory landscapes can create compliance complexities.

Key Players Shaping the Food and Beverage Automation Market Market

- Honeywell International Inc

- Rexnord Corporation (Regal Rexnord Corporation)

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- GEA Group AG

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- ABB Limited

- Yaskawa Electric Corporation

- Emerson Electric Company

Significant Food and Beverage Automation Market Industry Milestones

- Mar 2023: ForgeOS integrated with Rockwell's Logix controllers and design and simulation software by Rockwell and READY Robotics. This integration aims to simplify robot integration and reduce industrial automation deployment time to market.

- Jan 2023: Teway Food installed ABB's automated solution, comprising 10 IRB 6700 robots, 65 IRB 360 delta robots, three IRB 660 robots, and a 3D vision system. This upgrade to their production line addresses increasing demand for compound seasoning and positions TewayFood as the first in the industry to utilize 3D vision-assisted robot positioning for feeding production lines.

Future Outlook for Food and Beverage Automation Market Market

The future outlook for the Food and Beverage Automation Market remains exceptionally positive, driven by sustained demand for efficiency, safety, and quality in food production. Strategic opportunities lie in the development of more intelligent, adaptable, and sustainable automation solutions that can cater to evolving consumer preferences and regulatory landscapes. The increasing adoption of cloud-based platforms for data analytics and remote monitoring will empower manufacturers with greater insights and control over their operations. The continued integration of AI and robotics will unlock new levels of productivity and precision, further solidifying automation's role as a critical enabler of growth and innovation within the global food and beverage industry. The market is expected to continue its upward trajectory, with significant potential for expansion into emerging economies and specialized food processing niches.

Food and Beverage Automation Market Segmentation

-

1. Operational Technology and Software

- 1.1. Distributed Control System (DCS)

- 1.2. Manufacturing Execution Systems (MES)

- 1.3. Variable-frequency Drive (VFD)

- 1.4. Valves and Actuators

- 1.5. Electric Motors

- 1.6. Sensors and Transmitters

- 1.7. Industrial Robotics

- 1.8. Other Technologies

-

2. End User

- 2.1. Dairy Processing

- 2.2. Bakery and Confectionary

- 2.3. Meat, Poultry, and Seafood

- 2.4. Fruits and Vegetables

- 2.5. Beverages

- 2.6. Other End Users

-

3. Application

- 3.1. Packaging and Repackaging

- 3.2. Palletizing

- 3.3. Sorting and Grading

- 3.4. Processing

- 3.5. Other Applications

Food and Beverage Automation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

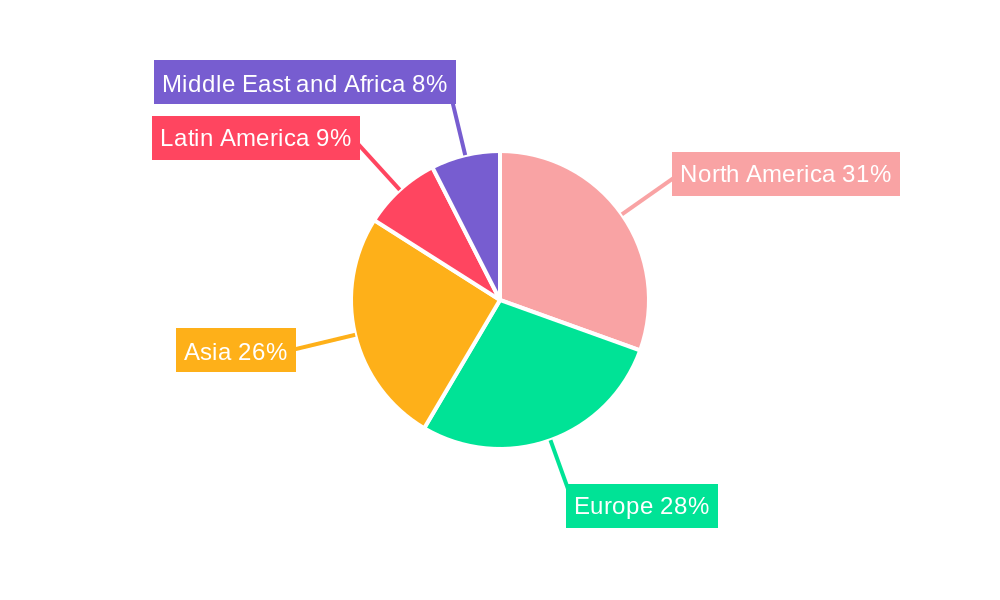

Food and Beverage Automation Market Regional Market Share

Geographic Coverage of Food and Beverage Automation Market

Food and Beverage Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Food Safety and Rising Demand for Processed Food

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors

- 3.4. Market Trends

- 3.4.1. Beverages End-user Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 5.1.1. Distributed Control System (DCS)

- 5.1.2. Manufacturing Execution Systems (MES)

- 5.1.3. Variable-frequency Drive (VFD)

- 5.1.4. Valves and Actuators

- 5.1.5. Electric Motors

- 5.1.6. Sensors and Transmitters

- 5.1.7. Industrial Robotics

- 5.1.8. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Dairy Processing

- 5.2.2. Bakery and Confectionary

- 5.2.3. Meat, Poultry, and Seafood

- 5.2.4. Fruits and Vegetables

- 5.2.5. Beverages

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Packaging and Repackaging

- 5.3.2. Palletizing

- 5.3.3. Sorting and Grading

- 5.3.4. Processing

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6. North America Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6.1.1. Distributed Control System (DCS)

- 6.1.2. Manufacturing Execution Systems (MES)

- 6.1.3. Variable-frequency Drive (VFD)

- 6.1.4. Valves and Actuators

- 6.1.5. Electric Motors

- 6.1.6. Sensors and Transmitters

- 6.1.7. Industrial Robotics

- 6.1.8. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Dairy Processing

- 6.2.2. Bakery and Confectionary

- 6.2.3. Meat, Poultry, and Seafood

- 6.2.4. Fruits and Vegetables

- 6.2.5. Beverages

- 6.2.6. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Packaging and Repackaging

- 6.3.2. Palletizing

- 6.3.3. Sorting and Grading

- 6.3.4. Processing

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7. Europe Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7.1.1. Distributed Control System (DCS)

- 7.1.2. Manufacturing Execution Systems (MES)

- 7.1.3. Variable-frequency Drive (VFD)

- 7.1.4. Valves and Actuators

- 7.1.5. Electric Motors

- 7.1.6. Sensors and Transmitters

- 7.1.7. Industrial Robotics

- 7.1.8. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Dairy Processing

- 7.2.2. Bakery and Confectionary

- 7.2.3. Meat, Poultry, and Seafood

- 7.2.4. Fruits and Vegetables

- 7.2.5. Beverages

- 7.2.6. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Packaging and Repackaging

- 7.3.2. Palletizing

- 7.3.3. Sorting and Grading

- 7.3.4. Processing

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8. Asia Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8.1.1. Distributed Control System (DCS)

- 8.1.2. Manufacturing Execution Systems (MES)

- 8.1.3. Variable-frequency Drive (VFD)

- 8.1.4. Valves and Actuators

- 8.1.5. Electric Motors

- 8.1.6. Sensors and Transmitters

- 8.1.7. Industrial Robotics

- 8.1.8. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Dairy Processing

- 8.2.2. Bakery and Confectionary

- 8.2.3. Meat, Poultry, and Seafood

- 8.2.4. Fruits and Vegetables

- 8.2.5. Beverages

- 8.2.6. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Packaging and Repackaging

- 8.3.2. Palletizing

- 8.3.3. Sorting and Grading

- 8.3.4. Processing

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9. Latin America Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9.1.1. Distributed Control System (DCS)

- 9.1.2. Manufacturing Execution Systems (MES)

- 9.1.3. Variable-frequency Drive (VFD)

- 9.1.4. Valves and Actuators

- 9.1.5. Electric Motors

- 9.1.6. Sensors and Transmitters

- 9.1.7. Industrial Robotics

- 9.1.8. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Dairy Processing

- 9.2.2. Bakery and Confectionary

- 9.2.3. Meat, Poultry, and Seafood

- 9.2.4. Fruits and Vegetables

- 9.2.5. Beverages

- 9.2.6. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Packaging and Repackaging

- 9.3.2. Palletizing

- 9.3.3. Sorting and Grading

- 9.3.4. Processing

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10. Middle East and Africa Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10.1.1. Distributed Control System (DCS)

- 10.1.2. Manufacturing Execution Systems (MES)

- 10.1.3. Variable-frequency Drive (VFD)

- 10.1.4. Valves and Actuators

- 10.1.5. Electric Motors

- 10.1.6. Sensors and Transmitters

- 10.1.7. Industrial Robotics

- 10.1.8. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Dairy Processing

- 10.2.2. Bakery and Confectionary

- 10.2.3. Meat, Poultry, and Seafood

- 10.2.4. Fruits and Vegetables

- 10.2.5. Beverages

- 10.2.6. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Packaging and Repackaging

- 10.3.2. Palletizing

- 10.3.3. Sorting and Grading

- 10.3.4. Processing

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schneider Electric SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GEA Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Automation Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yokogawa Electric Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yaskawa Electric Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Emerson Electric Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Food and Beverage Automation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 3: North America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 4: North America Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 11: Europe Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 12: Europe Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 19: Asia Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 20: Asia Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 27: Latin America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 28: Latin America Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 35: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 36: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 2: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Food and Beverage Automation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 6: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 12: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 19: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia and New Zealand Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 27: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 31: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food and Beverage Automation Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Food and Beverage Automation Market?

Key companies in the market include Honeywell International Inc, Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, GEA Group AG, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Yaskawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Food and Beverage Automation Market?

The market segments include Operational Technology and Software, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Food Safety and Rising Demand for Processed Food.

6. What are the notable trends driving market growth?

Beverages End-user Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors.

8. Can you provide examples of recent developments in the market?

Mar 2023: ForgeOS integrated with Rockwell's Logix controllers and design and simulation software by Rockwell and READY Robotics. The combination will make robot integration easier and reduce industrial automation deployment time to market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food and Beverage Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food and Beverage Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food and Beverage Automation Market?

To stay informed about further developments, trends, and reports in the Food and Beverage Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence