Key Insights

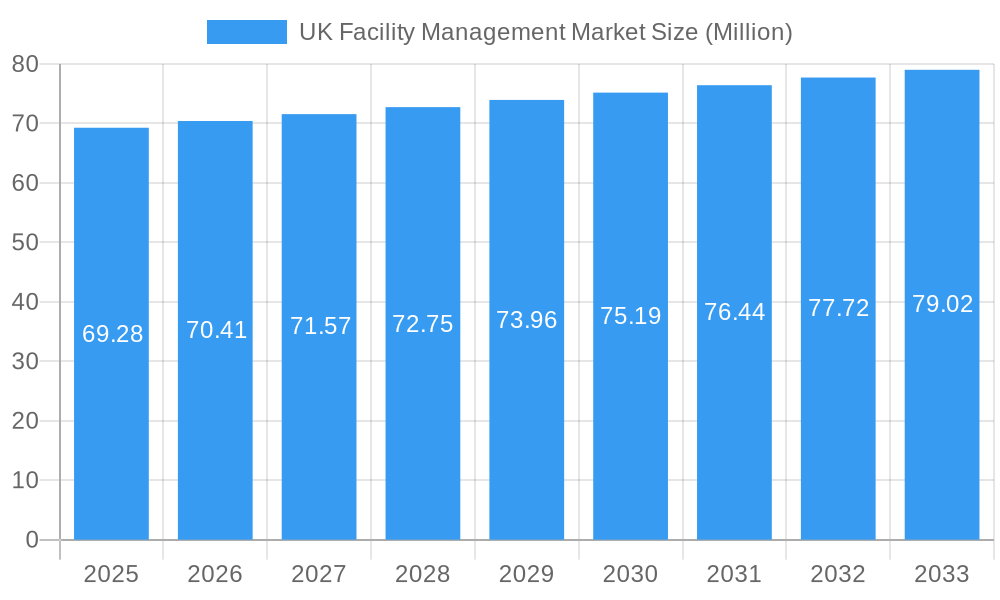

The UK facility management market is projected to reach a substantial size of approximately £69.28 million by 2025, indicating a steady but measured growth trajectory. With a Compound Annual Growth Rate (CAGR) of 1.65% forecasted over the period spanning from 2019 to 2033, the market demonstrates resilience and sustained demand for integrated and specialized facility management services. This growth is primarily propelled by the increasing complexity of commercial and institutional buildings, requiring sophisticated operational and maintenance solutions. The growing emphasis on workplace well-being, sustainability, and energy efficiency also acts as a significant driver, encouraging businesses to invest in advanced facility management to optimize their operational costs and environmental footprint. The market's expansion is further supported by the ongoing trend of outsourcing non-core business functions, allowing companies to focus on their primary competencies.

UK Facility Management Market Market Size (In Million)

The UK facility management market is characterized by a diverse range of service offerings and end-user industries. Hard FM services, encompassing building operations and maintenance, mechanical, electrical, and plumbing (MEP) services, are fundamental to the market's stability. Simultaneously, Soft FM services, including safety, security, janitorial, and catering, are gaining prominence as organizations prioritize employee comfort and a productive work environment. The commercial sector, including offices and retail spaces, represents a significant segment, followed by institutional and industrial end-users who rely heavily on FM for operational continuity and regulatory compliance. Emerging trends like smart building technology integration and the adoption of sustainable practices are shaping service demands, pushing providers to innovate and offer more integrated and technologically advanced solutions to meet evolving client needs and regulatory landscapes.

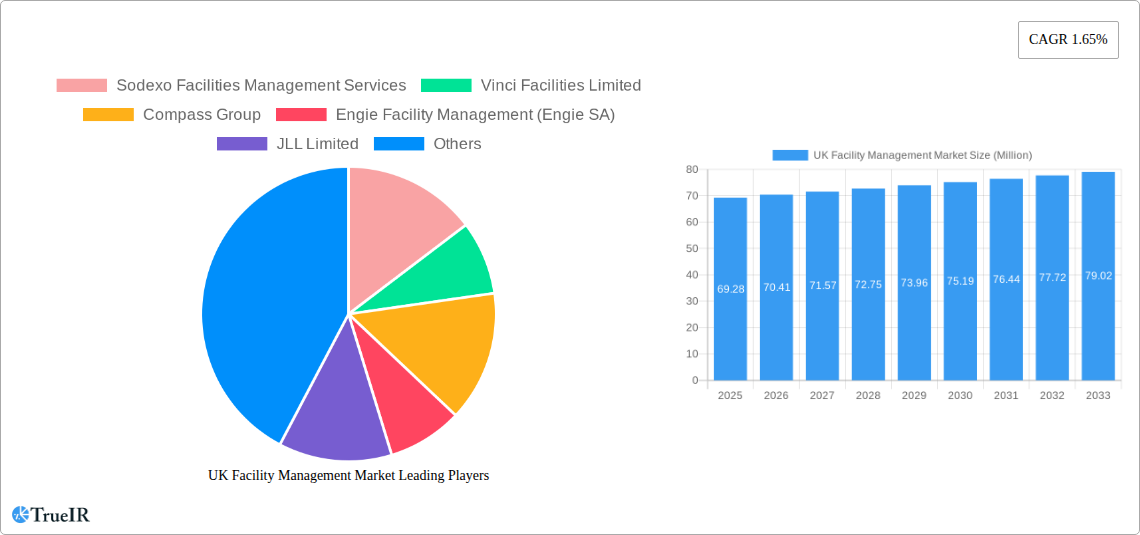

UK Facility Management Market Company Market Share

UK Facility Management Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the UK Facility Management market. Leveraging high-volume keywords and expert insights, it offers unparalleled clarity for industry stakeholders. Our comprehensive study covers the historical period from 2019 to 2024, with a base and estimated year of 2025, and a detailed forecast period extending to 2033.

UK Facility Management Market Market Structure & Competitive Landscape

The UK Facility Management market exhibits a moderately concentrated structure, with a blend of large multinational corporations and a significant number of specialized regional providers. Innovation is primarily driven by the integration of technology, particularly in areas like Building Information Modelling (BIM), smart building solutions, and AI-powered analytics for predictive maintenance and energy efficiency. Regulatory impacts are substantial, with evolving health and safety standards, environmental legislation, and procurement frameworks shaping service delivery and compliance requirements. Product substitutes are limited within core FM services, but the increasing availability of in-house solutions or point solutions for specific needs can pose indirect competition. End-user segmentation is diverse, with distinct demands from commercial, institutional, public/infrastructure, and industrial sectors. Mergers & Acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller entities to expand service portfolios and geographic reach. For instance, recent M&A activity has focused on acquiring specialized sustainability or technology-driven FM capabilities. Concentration ratios for the top five players are estimated to be around 60%, highlighting a degree of market dominance.

UK Facility Management Market Market Trends & Opportunities

The UK Facility Management market is experiencing robust growth, projected to reach an estimated market size of over £65 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 4.8% from 2019 to 2033. This expansion is fueled by increasing outsourcing trends as businesses seek to optimize operational efficiency and focus on core competencies. Technological shifts are profoundly impacting the sector, with the adoption of IoT sensors, data analytics, and AI for smart building management, energy optimization, and enhanced security systems. Consumer preferences are evolving towards sustainable, occupant-centric, and technology-enabled FM services, driving demand for integrated solutions that prioritize well-being and environmental responsibility. Competitive dynamics are characterized by a race for innovation, with companies investing heavily in digital transformation and the development of bespoke service offerings. The market penetration of outsourced FM services is steadily increasing, currently standing at approximately 70% for larger enterprises and growing significantly within the SME segment. Opportunities lie in leveraging big data for proactive facility maintenance, developing advanced cybersecurity solutions for smart buildings, and offering specialized FM services for emerging sectors like renewable energy infrastructure and the circular economy. The shift towards hybrid working models also presents new opportunities for flexible and adaptable workspace management solutions.

Dominant Markets & Segments in UK Facility Management Market

The dominance within the UK Facility Management market is multifaceted, with strong performance across various segments.

Facility Management Type:

- Outsourced Facility Management holds a commanding market share, driven by its cost-effectiveness and ability to provide specialized expertise.

- Integrated FM is experiencing the highest growth within outsourcing, as organizations seek comprehensive, single-point-of-contact solutions for managing multiple facility services. This approach offers significant efficiency gains and strategic benefits.

- Bundled FM remains a strong contender, providing a curated package of services tailored to specific client needs.

- Single FM services are typically utilized for niche requirements or by smaller organizations.

Offering Type:

- Soft FM services are currently the larger segment by volume, driven by continuous demand for safety, security, janitorial, and catering services across all industries.

- Safety and Security Services are paramount, with increasing investment in advanced surveillance, access control, and emergency response systems.

- Janitorial Services remain a foundational element, with growing emphasis on eco-friendly cleaning solutions and high-hygiene standards, particularly post-pandemic.

- Catering Services are evolving to meet diverse dietary needs and sustainability commitments.

- Hard FM services are anticipated to see accelerated growth due to increasing complexities in building maintenance, energy efficiency mandates, and the aging building stock.

- Building O&M and Property Services are crucial for asset longevity and operational continuity, with a growing demand for lifecycle management.

- Mechanical, Electrical, and Plumbing (MEP) Services are experiencing a surge due to the integration of smart technologies and the need for energy-efficient systems.

End-user Industry:

- The Commercial sector, encompassing offices, retail, and hospitality, represents the largest end-user industry due to its extensive facility management needs.

- The Public/Infrastructure sector, including healthcare, education, and government facilities, is a significant and stable market, driven by long-term contracts and a consistent demand for essential services.

- The Institutional sector (e.g., healthcare, education) is a key growth area, with a strong focus on compliance, patient/student well-being, and operational efficiency.

- The Industrial sector, while substantial, may exhibit more specialized FM requirements focusing on operational uptime and safety.

Key growth drivers include the increasing need for operational cost optimization, a growing emphasis on corporate social responsibility (CSR) and sustainability, and the government's push for energy efficiency and net-zero targets. Policies like the UK Green Building Council's initiatives and the Energy Performance Certificates (EPC) are directly influencing demand for energy-efficient Hard FM services.

UK Facility Management Market Product Analysis

Product innovations in the UK Facility Management market are increasingly centered on the integration of smart technologies, data analytics, and sustainable practices. Companies are developing intelligent building management systems that optimize energy consumption, predict maintenance needs, and enhance occupant comfort. The application of IoT sensors for real-time monitoring of building performance, air quality, and security is becoming standard. Competitive advantages are being gained through the development of AI-powered platforms for automated scheduling, resource allocation, and performance reporting. Furthermore, the focus on eco-friendly cleaning solutions and waste management technologies offers significant market appeal.

Key Drivers, Barriers & Challenges in UK Facility Management Market

Key Drivers:

- Outsourcing Trend: Businesses increasingly outsource FM to focus on core operations and achieve cost efficiencies.

- Technological Advancements: Smart building solutions, IoT, and data analytics are enhancing service delivery and efficiency.

- Sustainability Mandates: Growing pressure for environmental responsibility drives demand for green FM practices and energy efficiency.

- Infrastructure Investment: Government and private sector investment in new infrastructure projects creates demand for FM services.

- Health & Safety Regulations: Stringent regulations necessitate professional FM services for compliance.

Barriers & Challenges:

- Talent Shortage: A significant challenge is the scarcity of skilled FM professionals, impacting service quality and operational capacity.

- Cost Pressures: Clients are often seeking cost reductions, leading to intense price competition among providers.

- Regulatory Complexity: Navigating evolving health, safety, and environmental regulations can be complex and resource-intensive.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of essential materials and equipment.

- Cybersecurity Risks: The increasing reliance on technology exposes FM operations to cybersecurity threats.

- Integration Challenges: Successfully integrating disparate FM systems and technologies can be technically demanding.

Growth Drivers in the UK Facility Management Market Market

The UK Facility Management market is propelled by a confluence of powerful growth drivers. The persistent trend of outsourcing, driven by a desire for operational cost optimization and the ability for core businesses to focus on their primary activities, remains a fundamental catalyst. Technological advancements, particularly the widespread adoption of IoT, AI, and data analytics, are enabling more efficient, predictive, and sustainable facility management solutions, creating new service opportunities. A significant driver is the increasing regulatory and societal pressure towards environmental sustainability and net-zero targets, which fuels demand for energy-efficient Hard FM services and green cleaning practices. Furthermore, ongoing investment in new infrastructure projects across the public and private sectors directly translates into increased demand for comprehensive FM services to manage these assets effectively.

Challenges Impacting UK Facility Management Market Growth

Several significant challenges are impacting the growth trajectory of the UK Facility Management market. A pervasive issue is the persistent shortage of skilled labor across various FM disciplines, which can constrain service delivery capacity and impact quality. Intense competitive pressures often lead to price wars, squeezing profit margins for providers. Navigating the intricate and ever-evolving landscape of regulatory compliance, particularly concerning health, safety, and environmental standards, presents ongoing complexities. Furthermore, global supply chain disruptions can lead to delays and increased costs for essential equipment, materials, and spare parts, impacting project timelines and operational continuity. The growing digitalization of FM services also introduces significant cybersecurity risks that require robust mitigation strategies.

Key Players Shaping the UK Facility Management Market Market

- Sodexo Facilities Management Services

- Vinci Facilities Limited

- Compass Group

- Engie Facility Management (Engie SA)

- JLL Limited

- CBRE Group Inc

- Andron Facilities Management

- Aramark Facilities Services

- Atalian Servest

- Atlas FM Ltd

- Amey PLC

- EMCOR Facilities Services Inc

- Kier Group PLC

- ISS UK

- Serco Group PLC

- Mitie Group PLC

Significant UK Facility Management Market Industry Milestones

- March 2024: Sodexo Health & Care extended established partnerships for catering, retail, and soft FM services at two hospitals at Stoke-on-Trent in Staffordshire. Under a new 10-year contract worth EUR 38 million a year covering both hospitals as part of a Private Finance Initiative (PFI), Sodexo will continue to deliver catering, retail, and soft FM services throughout the PFI and the retained estate at both hospitals, demonstrating long-term commitment and significant contract values in the healthcare FM sector.

- March 2024: Mitie was awarded a place on the Crown Commercial Service’s (CCS) Healthcare Soft Facilities Management (FM) Framework agreement for three years with an option to extend for a year. As a prequalified supplier, the integrated services provider will be able to bid for contracts that support the provision of Healthcare Soft FM services to the NHS and other organizations within the healthcare industry in England, including NHS Hospital Trusts, Community Health Trusts, Mental Health Trusts, and General Practices, highlighting strategic wins in public sector healthcare and framework agreements.

Future Outlook for UK Facility Management Market Market

The future outlook for the UK Facility Management market is exceptionally positive, characterized by sustained growth and evolving service demands. Strategic opportunities lie in the continued integration of digital technologies, such as AI and IoT, to deliver smart, sustainable, and data-driven facility solutions. The increasing emphasis on Environmental, Social, and Governance (ESG) principles will further propel demand for green FM services and energy efficiency solutions. The market potential is substantial for providers adept at offering integrated service models and specialized expertise within sectors like healthcare, education, and critical infrastructure. Anticipate a continued trend of consolidation as larger players seek to enhance their capabilities through strategic acquisitions. The growing adoption of hybrid working models will also drive innovation in flexible workspace management and employee experience-focused FM services.

UK Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

-

2.1. Hard FM

- 2.1.1. Building O&M and Property Services

- 2.1.2. Mechanical, Electrical, and Plumbing Services

- 2.1.3. Other Hard FM Services (includes Energy Services)

-

2.2. Soft FM

- 2.2.1. Safety and Security Services

- 2.2.2. Office Support Services

- 2.2.3. Janitorial Services

- 2.2.4. Catering Services

- 2.2.5. Other Soft FM Services

-

2.1. Hard FM

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End-user Industries

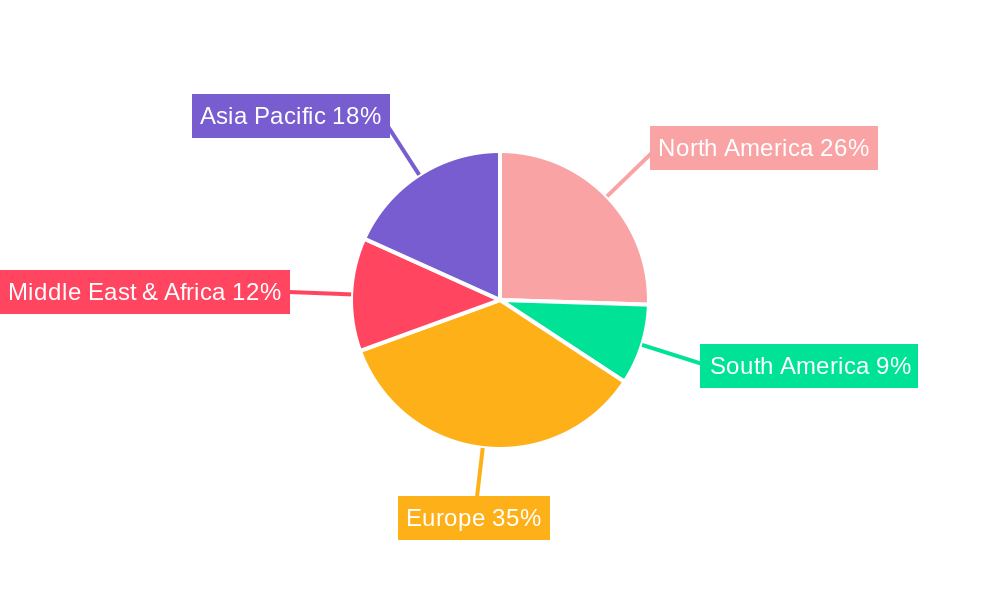

UK Facility Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Facility Management Market Regional Market Share

Geographic Coverage of UK Facility Management Market

UK Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of FM; Growing Demand for IFM and Outsourcing of Non-core Operations from Emerging Verticals; Renewed Emphasis on Workplace Optimization and Productivity

- 3.3. Market Restrains

- 3.3.1. Market Saturation in the Public Sector; Growing Competition Expected to Impact Profit Margins of Existing Vendors

- 3.4. Market Trends

- 3.4.1. Single FM Service is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.1.1. Building O&M and Property Services

- 5.2.1.2. Mechanical, Electrical, and Plumbing Services

- 5.2.1.3. Other Hard FM Services (includes Energy Services)

- 5.2.2. Soft FM

- 5.2.2.1. Safety and Security Services

- 5.2.2.2. Office Support Services

- 5.2.2.3. Janitorial Services

- 5.2.2.4. Catering Services

- 5.2.2.5. Other Soft FM Services

- 5.2.1. Hard FM

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. North America UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6.1.1. In-House Facility Management

- 6.1.2. Outsourced Facility Management

- 6.1.2.1. Single FM

- 6.1.2.2. Bundled FM

- 6.1.2.3. Integrated FM

- 6.2. Market Analysis, Insights and Forecast - by Offering Type

- 6.2.1. Hard FM

- 6.2.1.1. Building O&M and Property Services

- 6.2.1.2. Mechanical, Electrical, and Plumbing Services

- 6.2.1.3. Other Hard FM Services (includes Energy Services)

- 6.2.2. Soft FM

- 6.2.2.1. Safety and Security Services

- 6.2.2.2. Office Support Services

- 6.2.2.3. Janitorial Services

- 6.2.2.4. Catering Services

- 6.2.2.5. Other Soft FM Services

- 6.2.1. Hard FM

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Institutional

- 6.3.3. Public/Infrastructure

- 6.3.4. Industrial

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7. South America UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7.1.1. In-House Facility Management

- 7.1.2. Outsourced Facility Management

- 7.1.2.1. Single FM

- 7.1.2.2. Bundled FM

- 7.1.2.3. Integrated FM

- 7.2. Market Analysis, Insights and Forecast - by Offering Type

- 7.2.1. Hard FM

- 7.2.1.1. Building O&M and Property Services

- 7.2.1.2. Mechanical, Electrical, and Plumbing Services

- 7.2.1.3. Other Hard FM Services (includes Energy Services)

- 7.2.2. Soft FM

- 7.2.2.1. Safety and Security Services

- 7.2.2.2. Office Support Services

- 7.2.2.3. Janitorial Services

- 7.2.2.4. Catering Services

- 7.2.2.5. Other Soft FM Services

- 7.2.1. Hard FM

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Institutional

- 7.3.3. Public/Infrastructure

- 7.3.4. Industrial

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8. Europe UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8.1.1. In-House Facility Management

- 8.1.2. Outsourced Facility Management

- 8.1.2.1. Single FM

- 8.1.2.2. Bundled FM

- 8.1.2.3. Integrated FM

- 8.2. Market Analysis, Insights and Forecast - by Offering Type

- 8.2.1. Hard FM

- 8.2.1.1. Building O&M and Property Services

- 8.2.1.2. Mechanical, Electrical, and Plumbing Services

- 8.2.1.3. Other Hard FM Services (includes Energy Services)

- 8.2.2. Soft FM

- 8.2.2.1. Safety and Security Services

- 8.2.2.2. Office Support Services

- 8.2.2.3. Janitorial Services

- 8.2.2.4. Catering Services

- 8.2.2.5. Other Soft FM Services

- 8.2.1. Hard FM

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Institutional

- 8.3.3. Public/Infrastructure

- 8.3.4. Industrial

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9. Middle East & Africa UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9.1.1. In-House Facility Management

- 9.1.2. Outsourced Facility Management

- 9.1.2.1. Single FM

- 9.1.2.2. Bundled FM

- 9.1.2.3. Integrated FM

- 9.2. Market Analysis, Insights and Forecast - by Offering Type

- 9.2.1. Hard FM

- 9.2.1.1. Building O&M and Property Services

- 9.2.1.2. Mechanical, Electrical, and Plumbing Services

- 9.2.1.3. Other Hard FM Services (includes Energy Services)

- 9.2.2. Soft FM

- 9.2.2.1. Safety and Security Services

- 9.2.2.2. Office Support Services

- 9.2.2.3. Janitorial Services

- 9.2.2.4. Catering Services

- 9.2.2.5. Other Soft FM Services

- 9.2.1. Hard FM

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Institutional

- 9.3.3. Public/Infrastructure

- 9.3.4. Industrial

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 10. Asia Pacific UK Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 10.1.1. In-House Facility Management

- 10.1.2. Outsourced Facility Management

- 10.1.2.1. Single FM

- 10.1.2.2. Bundled FM

- 10.1.2.3. Integrated FM

- 10.2. Market Analysis, Insights and Forecast - by Offering Type

- 10.2.1. Hard FM

- 10.2.1.1. Building O&M and Property Services

- 10.2.1.2. Mechanical, Electrical, and Plumbing Services

- 10.2.1.3. Other Hard FM Services (includes Energy Services)

- 10.2.2. Soft FM

- 10.2.2.1. Safety and Security Services

- 10.2.2.2. Office Support Services

- 10.2.2.3. Janitorial Services

- 10.2.2.4. Catering Services

- 10.2.2.5. Other Soft FM Services

- 10.2.1. Hard FM

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Institutional

- 10.3.3. Public/Infrastructure

- 10.3.4. Industrial

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sodexo Facilities Management Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vinci Facilities Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Compass Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Engie Facility Management (Engie SA)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JLL Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CBRE Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Andron Facilities Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aramark Facilities Services7 2 Market Share Analysi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atalian Servest

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Atlas FM Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amey PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 EMCOR Facilities Services Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kier Group PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ISS UK

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Serco Group PLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Mitie Group PLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Sodexo Facilities Management Services

List of Figures

- Figure 1: Global UK Facility Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Facility Management Market Revenue (Million), by Facility Management Type 2025 & 2033

- Figure 3: North America UK Facility Management Market Revenue Share (%), by Facility Management Type 2025 & 2033

- Figure 4: North America UK Facility Management Market Revenue (Million), by Offering Type 2025 & 2033

- Figure 5: North America UK Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 6: North America UK Facility Management Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America UK Facility Management Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America UK Facility Management Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UK Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Facility Management Market Revenue (Million), by Facility Management Type 2025 & 2033

- Figure 11: South America UK Facility Management Market Revenue Share (%), by Facility Management Type 2025 & 2033

- Figure 12: South America UK Facility Management Market Revenue (Million), by Offering Type 2025 & 2033

- Figure 13: South America UK Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 14: South America UK Facility Management Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America UK Facility Management Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America UK Facility Management Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UK Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Facility Management Market Revenue (Million), by Facility Management Type 2025 & 2033

- Figure 19: Europe UK Facility Management Market Revenue Share (%), by Facility Management Type 2025 & 2033

- Figure 20: Europe UK Facility Management Market Revenue (Million), by Offering Type 2025 & 2033

- Figure 21: Europe UK Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 22: Europe UK Facility Management Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe UK Facility Management Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe UK Facility Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UK Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Facility Management Market Revenue (Million), by Facility Management Type 2025 & 2033

- Figure 27: Middle East & Africa UK Facility Management Market Revenue Share (%), by Facility Management Type 2025 & 2033

- Figure 28: Middle East & Africa UK Facility Management Market Revenue (Million), by Offering Type 2025 & 2033

- Figure 29: Middle East & Africa UK Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 30: Middle East & Africa UK Facility Management Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa UK Facility Management Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa UK Facility Management Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Facility Management Market Revenue (Million), by Facility Management Type 2025 & 2033

- Figure 35: Asia Pacific UK Facility Management Market Revenue Share (%), by Facility Management Type 2025 & 2033

- Figure 36: Asia Pacific UK Facility Management Market Revenue (Million), by Offering Type 2025 & 2033

- Figure 37: Asia Pacific UK Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 38: Asia Pacific UK Facility Management Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific UK Facility Management Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific UK Facility Management Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Facility Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 2: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 3: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global UK Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 6: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 7: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global UK Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 13: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 14: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global UK Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 20: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 21: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global UK Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 33: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 34: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global UK Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2020 & 2033

- Table 43: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 44: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global UK Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Facility Management Market?

The projected CAGR is approximately 1.65%.

2. Which companies are prominent players in the UK Facility Management Market?

Key companies in the market include Sodexo Facilities Management Services, Vinci Facilities Limited, Compass Group, Engie Facility Management (Engie SA), JLL Limited, CBRE Group Inc, Andron Facilities Management, Aramark Facilities Services7 2 Market Share Analysi, Atalian Servest, Atlas FM Ltd, Amey PLC, EMCOR Facilities Services Inc, Kier Group PLC, ISS UK, Serco Group PLC, Mitie Group PLC.

3. What are the main segments of the UK Facility Management Market?

The market segments include Facility Management Type, Offering Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of FM; Growing Demand for IFM and Outsourcing of Non-core Operations from Emerging Verticals; Renewed Emphasis on Workplace Optimization and Productivity.

6. What are the notable trends driving market growth?

Single FM Service is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Market Saturation in the Public Sector; Growing Competition Expected to Impact Profit Margins of Existing Vendors.

8. Can you provide examples of recent developments in the market?

March 2024: Sodexo Health & Care extended established partnerships for catering, retail, and soft FM services at two hospitals at Stoke-on-Trent in Staffordshire. Under a new 10-year contract worth EUR 38 million a year covering both hospitals as part of a Private Finance Initiative (PFI), Sodexo will continue to deliver catering, retail, and soft FM services throughout the PFI and the retained estate at both hospitals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Facility Management Market?

To stay informed about further developments, trends, and reports in the UK Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence