Key Insights

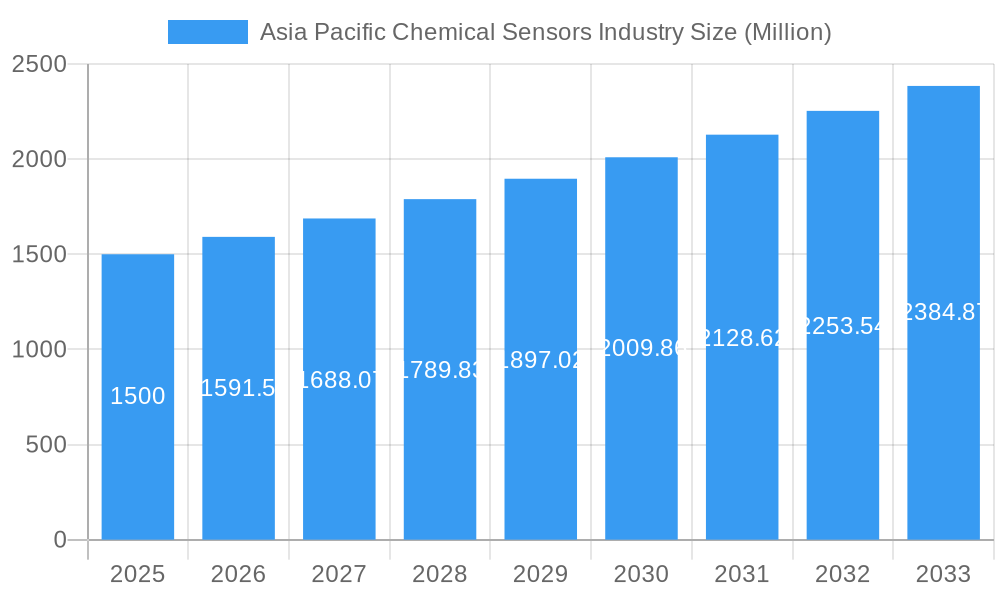

The Asia Pacific chemical sensors market is projected for significant expansion, with an estimated market size of $27.63 billion and a Compound Annual Growth Rate (CAGR) of 7.3% from the base year 2025 through 2033. This growth is propelled by increasing industrialization and the implementation of stringent environmental regulations in key economies like China, Japan, and India. Demand for advanced chemical sensors is rising due to their critical role in ensuring worker safety, optimizing industrial processes, and monitoring pollution levels. Key sectors such as industrial manufacturing, environmental monitoring, and defense are experiencing substantial adoption driven by the necessity for precise and reliable detection of various chemical compounds. Technological advancements, including the development of more sensitive electrochemical and optical sensors, alongside miniaturization and enhanced connectivity, are further stimulating market penetration and creating new application opportunities.

Asia Pacific Chemical Sensors Industry Market Size (In Billion)

Evolving technological trends and strategic initiatives by leading companies are shaping market dynamics. The increasing integration of IoT and AI in industrial environments demands sophisticated sensor solutions for real-time data acquisition and analysis, thus amplifying the need for chemical sensors that offer seamless integration. While market growth is primarily driven by these advancements and heightened awareness of safety and environmental compliance, potential restraints such as high initial investment costs for advanced sensor technologies and the requirement for specialized expertise in deployment and maintenance may present challenges. Nevertheless, the extensive range of applications across diverse industries, from energy and petrochemicals to healthcare and smart cities, ensures sustained demand and continuous innovation within the Asia Pacific chemical sensors sector.

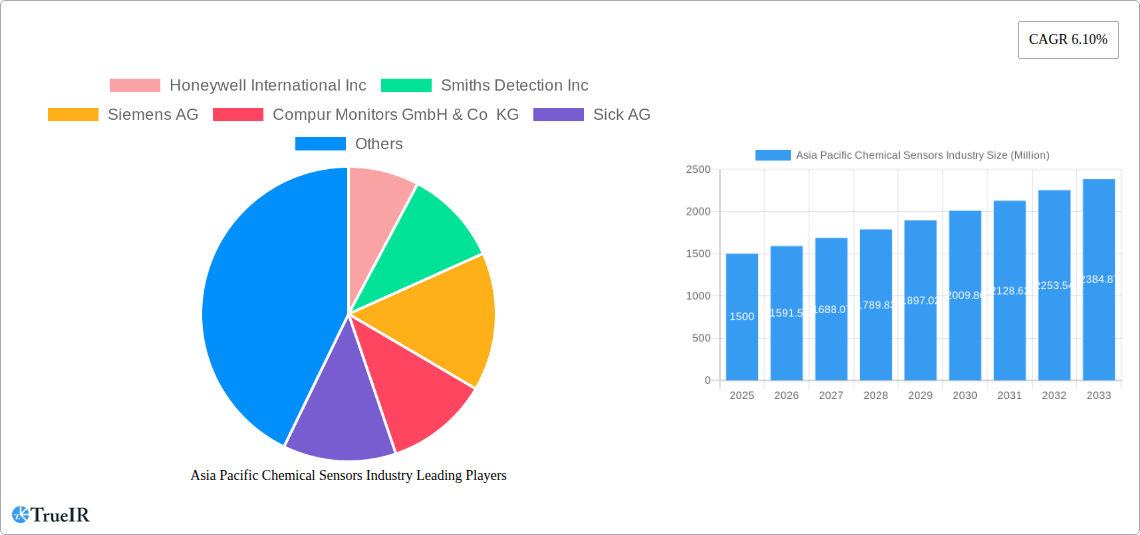

Asia Pacific Chemical Sensors Industry Company Market Share

Access comprehensive insights into the dynamic Asia Pacific chemical sensors market. This detailed report, covering the historical period 2019-2024, the base year 2025, and the forecast period 2025-2033, provides strategic intelligence for industry stakeholders. Optimized for search visibility and engagement with industry professionals, this report incorporates high-volume keywords such as "chemical sensors," "Asia Pacific market," "industrial sensors," "environmental monitoring," and "medical diagnostics."

Asia Pacific Chemical Sensors Industry Market Structure & Competitive Landscape

The Asia Pacific chemical sensors market exhibits a moderately fragmented structure, characterized by the presence of both established multinational corporations and agile regional players. Innovation drivers are primarily fueled by escalating demand for enhanced safety, stringent environmental regulations, and the pervasive adoption of IoT and AI technologies across industries. Regulatory impacts, particularly concerning emissions, industrial hygiene, and food safety, are shaping product development and market entry strategies. Product substitutes, while present, are often characterized by performance limitations or higher costs compared to advanced chemical sensor solutions. End-user segmentation reveals a strong reliance on the industrial sector, followed by environmental monitoring and healthcare. Mergers and acquisitions (M&A) activity is a notable trend, with approximately 15-20% of market participants involved in consolidation efforts over the past five years, aimed at expanding product portfolios, gaining market share, and acquiring proprietary technologies. Key players like Honeywell International Inc. and Siemens AG are actively pursuing strategic partnerships and acquisitions to solidify their positions.

Asia Pacific Chemical Sensors Industry Market Trends & Opportunities

The Asia Pacific chemical sensors market is poised for robust expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This significant market size growth is propelled by a confluence of transformative trends and emerging opportunities. Technological shifts are at the forefront, with a pronounced move towards miniaturization, increased sensitivity, improved selectivity, and lower power consumption in sensor devices. The integration of advanced materials, such as nanomaterials and flexible electronics, is enabling the development of next-generation sensors capable of detecting a wider range of analytes with unprecedented accuracy. Consumer preferences are increasingly leaning towards smart and connected devices, driving the demand for chemical sensors in applications ranging from personal health monitoring to smart home environmental control. This creates a burgeoning opportunity for companies offering integrated sensor solutions.

The competitive dynamics are intensifying, with companies focusing on research and development to differentiate their offerings. Investments in AI-driven data analysis and machine learning algorithms are enabling predictive maintenance and early warning systems, adding significant value for end-users. Market penetration rates for sophisticated chemical sensors are steadily increasing across diverse sectors, driven by the tangible benefits they offer in terms of operational efficiency, risk mitigation, and regulatory compliance. For instance, the industrial sector is witnessing a surge in demand for sensors in process control, quality assurance, and worker safety, especially in countries with rapidly industrializing economies like China and India.

Environmental monitoring applications are also a key growth engine, with governments and industries prioritizing the tracking of air and water quality. This is leading to increased deployment of sensors for real-time pollution detection and climate change research. The healthcare sector is another fertile ground, with the growing adoption of biosensors and diagnostic sensors for disease detection, drug monitoring, and personalized medicine. The defense and homeland security sector's continuous need for advanced threat detection and reconnaissance systems further fuels innovation and market demand. The Asia Pacific region, with its vast geographical spread and diverse economic landscapes, presents a unique blend of established and nascent opportunities for chemical sensor manufacturers and solution providers. The increasing awareness of health and safety, coupled with supportive government initiatives promoting technological adoption, paints a promising picture for sustained market growth and innovation in the coming years.

Dominant Markets & Segments in Asia Pacific Chemical Sensors Industry

The Industrial application segment stands as the undisputed leader in the Asia Pacific chemical sensors market, driven by the region's status as a global manufacturing hub. Within this segment, sectors such as automotive, electronics manufacturing, chemicals, and petrochemicals are major consumers. The need for precise process control, quality assurance, and stringent worker safety protocols necessitates the widespread deployment of a variety of chemical sensors. For example, countries like China, Japan, and South Korea, with their advanced industrial infrastructure, represent significant demand centers.

Among product types, Electrochemical sensors dominate due to their versatility, accuracy, and cost-effectiveness across a broad spectrum of applications, including gas detection and electrochemical analysis. Optical sensors are experiencing rapid growth, particularly in applications requiring non-contact measurement, high sensitivity, and the detection of complex molecules. The demand for optical sensors is surging in environmental monitoring for trace gas detection and in medical diagnostics for advanced imaging and analysis.

The Environmental Monitoring application segment is another significant growth driver. Increasing concerns about air and water pollution, coupled with stricter environmental regulations across countries like Australia, Singapore, and many Southeast Asian nations, are compelling industries and governments to invest heavily in sensor technologies for real-time data acquisition and analysis. This includes sensors for monitoring greenhouse gases, particulate matter, and industrial effluents.

The Medical segment, while currently smaller than industrial or environmental monitoring, is a high-growth area. The rising prevalence of chronic diseases, an aging population, and advancements in personalized medicine are fueling the demand for sophisticated biosensors and diagnostic sensors used in point-of-care testing, continuous glucose monitoring, and respiratory therapy.

The Defense and Homeland Security segment, though niche, is characterized by a consistent demand for high-performance, robust chemical sensors for threat detection, border security, and chemical warfare agent monitoring.

The dominance of these segments is underpinned by key growth drivers:

- Infrastructure Development: Rapid urbanization and industrial expansion in emerging economies create a continuous need for advanced sensor solutions for safety and efficiency.

- Policy and Regulations: Stricter environmental protection laws and workplace safety standards are mandating the use of chemical sensors across various industries.

- Technological Advancements: The development of more accurate, sensitive, and miniaturized sensors is expanding their applicability and driving adoption.

- IoT Integration: The proliferation of the Internet of Things (IoT) is creating demand for connected sensors that can provide real-time data for remote monitoring and control.

Asia Pacific Chemical Sensors Industry Product Analysis

Product innovation in the Asia Pacific chemical sensors market is characterized by a strong emphasis on miniaturization, enhanced selectivity, and increased sensitivity. Electrochemical sensors continue to evolve with improved electrode materials and sophisticated algorithms for precise gas detection in industrial and environmental applications. Optical sensors are seeing advancements through the integration of novel optical fibers, photonic crystals, and fluorescence-based detection methods, enabling the identification of complex analytes in medical and environmental settings. Pellistor/Catalytic Bead sensors remain relevant for combustible gas detection, with ongoing improvements in longevity and resistance to poisoning. Competitive advantages are increasingly derived from sensor integration with IoT platforms, enabling cloud-based data analytics, remote monitoring, and predictive maintenance, thereby offering end-users greater value beyond mere detection.

Key Drivers, Barriers & Challenges in Asia Pacific Chemical Sensors Industry

Key Drivers:

- Stringent Environmental Regulations: Growing government focus on air and water quality monitoring mandates the use of advanced chemical sensors.

- Industrial Automation & Safety: The need for enhanced process control, efficiency, and worker safety in expanding industrial sectors.

- Technological Advancements: Innovations in miniaturization, sensitivity, selectivity, and IoT integration are expanding sensor applications.

- Healthcare Sector Growth: Increasing demand for diagnostic and monitoring sensors in an aging population and for personalized medicine.

Barriers & Challenges:

- High Development Costs: Significant R&D investment is required for cutting-edge sensor technologies, impacting pricing and market accessibility for smaller players.

- Supply Chain Disruptions: Geopolitical factors and the reliance on specific raw material suppliers can lead to price volatility and lead time issues, affecting production volumes and delivery schedules, with potential cost escalations of 5-10% during disruptions.

- Regulatory Harmonization: Differing standards and certification requirements across Asia Pacific countries can create complexities for market entry and product compliance.

- Skilled Workforce Shortage: A lack of trained professionals for developing, deploying, and maintaining advanced sensor systems can hinder market growth.

Growth Drivers in the Asia Pacific Chemical Sensors Industry Market

The Asia Pacific chemical sensors market is propelled by a confluence of robust growth drivers. The relentless pursuit of industrial automation and enhanced safety protocols across manufacturing powerhouses like China and India fuels demand for process control and occupational hazard monitoring sensors. Furthermore, the escalating global concern over environmental degradation and climate change is driving significant investment in air and water quality monitoring systems, creating substantial opportunities for environmental sensors. Technological innovation, particularly in the areas of miniaturization, increased sensitivity, and wireless connectivity, is expanding the application scope of chemical sensors into new frontiers, including the Internet of Medical Things (IoMT) and smart agriculture. Government initiatives promoting technological adoption and digitalization also play a pivotal role in accelerating market penetration.

Challenges Impacting Asia Pacific Chemical Sensors Industry Growth

Despite the positive growth trajectory, the Asia Pacific chemical sensors industry faces several challenges. The complex and often fragmented regulatory landscape across different countries presents a significant hurdle for manufacturers aiming for regional expansion. Ensuring compliance with diverse standards for product safety, emissions, and data privacy requires substantial resources and can lead to prolonged market entry timelines. Supply chain vulnerabilities, particularly concerning the sourcing of critical raw materials and electronic components, can lead to production delays and cost fluctuations, potentially impacting profit margins. For instance, disruptions in semiconductor supply chains have led to an average cost increase of 7-12% for certain sensor components. Moreover, intense competition, coupled with the need for continuous R&D to stay ahead of technological advancements, exerts downward pressure on pricing and margins.

Key Players Shaping the Asia Pacific Chemical Sensors Industry Market

- Honeywell International Inc.

- Smiths Detection Inc.

- Siemens AG

- Compur Monitors GmbH & Co KG

- Sick AG

- Ocean Insight (Halma PLC)

- General Electric Company

- Pepperl+Fuchs Group

- AirTest Technologies Inc.

- SenseAir AB

Significant Asia Pacific Chemical Sensors Industry Industry Milestones

- 2021/06: Launch of advanced miniaturized optical sensors with enhanced detection capabilities for environmental monitoring applications.

- 2022/03: Major telecommunications company announces strategic investment in IoT-enabled industrial sensor solutions for smart factory initiatives.

- 2022/11: Regulatory body in a key Asian nation introduces stricter emission standards for industrial facilities, boosting demand for compliance-driven sensors.

- 2023/07: A leading player in medical diagnostics unveils a novel electrochemical biosensor for rapid disease detection, expanding its healthcare portfolio.

- 2024/01: Significant M&A activity observed with a strategic acquisition of a specialized gas sensor manufacturer by a multinational conglomerate, consolidating market presence.

Future Outlook for Asia Pacific Chemical Sensors Industry Market

The future outlook for the Asia Pacific chemical sensors industry is exceptionally promising, fueled by sustained technological innovation and expanding application horizons. The increasing integration of AI and machine learning with sensor data will unlock unprecedented capabilities in predictive analytics and autonomous systems, further embedding chemical sensors into the fabric of industrial operations and smart infrastructure. The growing emphasis on sustainability and climate action will continue to drive demand for advanced environmental monitoring solutions. Furthermore, the burgeoning IoMT sector presents a significant growth catalyst, with a projected increase in demand for sophisticated, connected sensors in personalized healthcare and remote patient monitoring. Strategic investments in R&D, focus on interoperability, and adaptation to evolving regulatory frameworks will be crucial for stakeholders to capitalize on the vast market potential in the coming years, with an estimated market valuation to reach over xx Million by 2033.

Asia Pacific Chemical Sensors Industry Segmentation

-

1. Product Type

- 1.1. Electrochemical

- 1.2. Optical

- 1.3. Pellistor/Catalytic Bead

- 1.4. Other Product Types

-

2. Application

- 2.1. Industrial

- 2.2. Medical

- 2.3. Environmental Monitoring

- 2.4. Defense and Homeland Security

- 2.5. Other Applications

Asia Pacific Chemical Sensors Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Chemical Sensors Industry Regional Market Share

Geographic Coverage of Asia Pacific Chemical Sensors Industry

Asia Pacific Chemical Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Investments in New Plants in Oil and Gas

- 3.3. Market Restrains

- 3.3.1. Lower Awareness of Facility Management Services

- 3.4. Market Trends

- 3.4.1. Defense Security to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Chemical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electrochemical

- 5.1.2. Optical

- 5.1.3. Pellistor/Catalytic Bead

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Medical

- 5.2.3. Environmental Monitoring

- 5.2.4. Defense and Homeland Security

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smiths Detection Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Compur Monitors GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sick AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ocean Insight (Halma PLC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pepperl+Fuchs Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AirTest Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SenseAir AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Chemical Sensors Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Chemical Sensors Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Asia Pacific Chemical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Chemical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Chemical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Chemical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Chemical Sensors Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Asia Pacific Chemical Sensors Industry?

Key companies in the market include Honeywell International Inc, Smiths Detection Inc, Siemens AG, Compur Monitors GmbH & Co KG, Sick AG, Ocean Insight (Halma PLC), General Electric Company, Pepperl+Fuchs Group, AirTest Technologies Inc, SenseAir AB.

3. What are the main segments of the Asia Pacific Chemical Sensors Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.63 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Investments in New Plants in Oil and Gas.

6. What are the notable trends driving market growth?

Defense Security to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

Lower Awareness of Facility Management Services.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Chemical Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Chemical Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Chemical Sensors Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Chemical Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence