Key Insights

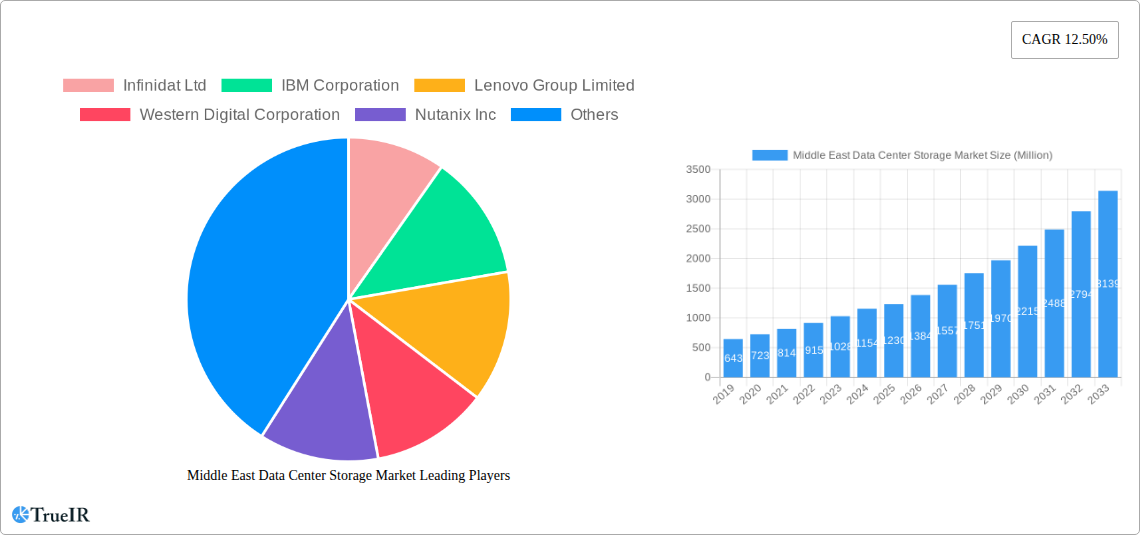

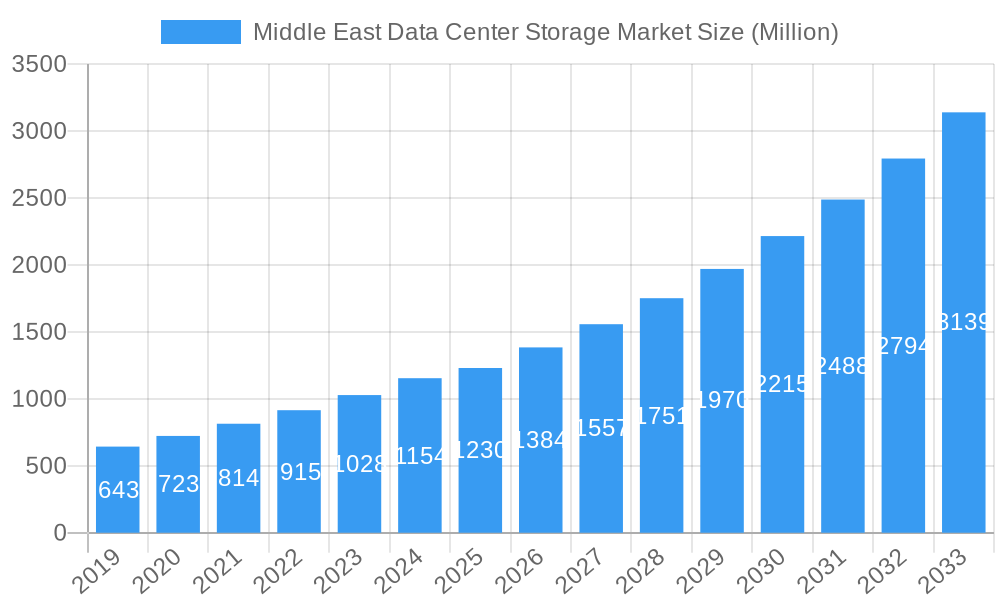

The Middle East Data Center Storage Market is poised for substantial growth, projected to reach an estimated market size of $1,230 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.50% expected to persist through 2033. This robust expansion is driven by the region's accelerating digital transformation initiatives, substantial investments in cloud infrastructure, and the increasing adoption of data-intensive technologies such as Artificial Intelligence (AI) and Big Data analytics. Key market drivers include the burgeoning demand for efficient and scalable storage solutions to manage vast datasets generated by smart city projects, e-commerce platforms, and the expanding IT and Telecommunication sector. Furthermore, government initiatives promoting digital governance and the growing need for secure data storage in sectors like BFSI and Media & Entertainment are fueling market demand. The Middle East's commitment to diversifying its economy and becoming a global hub for technology innovation directly translates into a heightened requirement for advanced data center storage capabilities.

Middle East Data Center Storage Market Market Size (In Million)

The market segmentation reveals a dynamic landscape, with Network Attached Storage (NAS) and Storage Area Network (SAN) technologies leading the charge due to their scalability and performance benefits for enterprise-level data management. The shift towards All-Flash Storage is a significant trend, offering superior speed and efficiency, thereby optimizing data center operations. Traditional storage solutions still hold a considerable share, but hybrid storage is gaining traction as organizations seek a balance between cost-effectiveness and performance. Key end-users like IT & Telecommunication, BFSI, and Government are at the forefront of adopting these advanced storage solutions. The competitive landscape features prominent global players such as IBM Corporation, Dell Inc., Hewlett Packard Enterprise, and Huawei Technologies, alongside regional specialists, all vying to capture market share through innovation and strategic partnerships. The focus on enhanced data security and compliance mandates within the region further amplifies the demand for sophisticated data center storage.

Middle East Data Center Storage Market Company Market Share

Middle East Data Center Storage Market: Comprehensive Analysis & Forecast (2019-2033)

Unlock deep insights into the burgeoning Middle East Data Center Storage Market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this analysis provides a granular view of market dynamics, competitive landscapes, and future opportunities. Leverage high-volume keywords such as "Middle East data center storage," "cloud storage," "enterprise storage solutions," "data infrastructure," and "digital transformation" to enhance searchability and reach key industry stakeholders.

Middle East Data Center Storage Market Market Structure & Competitive Landscape

The Middle East Data Center Storage Market exhibits a moderately concentrated structure, driven by significant investments in digital infrastructure and a growing demand for robust data management solutions. Innovation is a key differentiator, with leading players constantly introducing advanced storage technologies to cater to evolving enterprise needs. Regulatory frameworks surrounding data privacy and sovereignty are increasingly influencing market strategies, prompting organizations to adopt localized and secure storage solutions. Product substitution is moderate, with traditional storage systems gradually being augmented and replaced by all-flash and hybrid storage arrays, offering superior performance and efficiency. End-user segmentation is diverse, with IT & Telecommunication, BFSI, and Government sectors being the primary adopters. Mergers and acquisitions (M&A) activity, while not exceptionally high, is a strategic tool for market consolidation and the acquisition of specialized technologies. Anticipated M&A volumes are projected to increase by approximately 5-10% over the forecast period as larger entities seek to expand their market share and technological capabilities.

Middle East Data Center Storage Market Market Trends & Opportunities

The Middle East Data Center Storage Market is experiencing a transformative growth trajectory, propelled by an unprecedented surge in data generation and consumption across various industries. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated value of xx Million by the end of the forecast period. This expansion is underpinned by a significant technological shift towards all-flash storage and hybrid storage solutions, offering enhanced performance, scalability, and cost-efficiency compared to traditional storage systems. Consumer preferences are increasingly leaning towards software-defined storage and hyper-converged infrastructure, enabling greater flexibility and simplified management of data resources.

The burgeoning digital transformation initiatives across the region, coupled with government visions for economic diversification, are creating substantial demand for advanced data center storage. The proliferation of cloud computing services, the exponential growth of big data analytics, and the increasing adoption of Artificial Intelligence (AI) and the Internet of Things (IoT) are all contributing factors to this demand. For instance, the BFSI sector is heavily investing in secure and high-performance storage to manage vast amounts of transactional data, customer information, and regulatory compliance requirements. Similarly, the IT & Telecommunication sector is witnessing an explosion of data due to increased mobile usage, streaming services, and the rollout of 5G networks, necessitating robust and scalable storage infrastructure.

Emerging opportunities lie in the development and deployment of edge computing solutions that require distributed and intelligent storage capabilities. Furthermore, the growing emphasis on data analytics and business intelligence is driving the need for specialized storage solutions that can handle complex queries and provide real-time insights. The market is also witnessing a trend towards hybrid cloud storage models, allowing organizations to leverage the benefits of both on-premises and public cloud storage environments, thus optimizing costs and ensuring data flexibility. The competitive landscape is intensifying, with both established global players and emerging regional vendors vying for market dominance. Strategic partnerships and collaborations are becoming crucial for vendors to expand their reach and offer comprehensive solutions. The overall market penetration rate for advanced storage solutions is expected to reach xx% by 2033.

Dominant Markets & Segments in Middle East Data Center Storage Market

The Middle East Data Center Storage Market is characterized by distinct dominance across various segments, driven by specific industry needs and technological adoption patterns.

Leading End User: The IT & Telecommunication sector is currently the dominant end-user segment, owing to the rapid expansion of digital services, cloud infrastructure, and mobile data consumption. This segment is projected to contribute approximately 28% of the total market revenue in 2025.

- Growth Drivers: Increasing data traffic, the rollout of 5G networks, and the continuous development of cloud-native applications fuel demand for scalable and high-performance storage.

- Market Dominance Analysis: The sector's reliance on massive data storage for cloud services, content delivery networks, and network infrastructure makes it a consistent driver of storage technology advancements and investments.

Dominant Storage Technology: Network Attached Storage (NAS) holds a significant share, particularly for file sharing, collaboration, and unstructured data storage within enterprises. Its ease of deployment and management makes it a preferred choice for many organizations.

- Growth Drivers: Growing unstructured data volumes, increased collaboration needs, and the accessibility of NAS solutions for small and medium-sized businesses.

- Market Dominance Analysis: NAS solutions are integral to modern office environments and are increasingly being adopted for media storage and data archiving.

Dominant Storage Type: Hybrid Storage is emerging as the most dominant storage type, offering a balance between the performance of all-flash arrays and the cost-effectiveness of traditional disk-based storage.

- Growth Drivers: Cost optimization, flexibility to handle diverse workloads, and the ability to leverage SSDs for high-performance applications while utilizing HDDs for bulk storage.

- Market Dominance Analysis: Hybrid storage solutions provide a compelling value proposition for organizations seeking to improve performance without the high costs associated with fully flash-based systems, making them ideal for a wide range of enterprise workloads.

Leading Country: The United Arab Emirates (UAE) and Saudi Arabia are the leading countries in the Middle East Data Center Storage Market, driven by significant government investments in digital transformation, smart city initiatives, and the establishment of large-scale data centers.

- Growth Drivers: Visionary government strategies (e.g., UAE Vision 2030, Saudi Vision 2030), foreign direct investment, and the presence of major hyperscale cloud providers.

- Market Dominance Analysis: These nations are actively developing robust digital ecosystems, necessitating advanced data storage solutions to support their ambitions in AI, big data, and cloud computing.

Other significant end-user segments like BFSI and Government are also exhibiting strong growth, driven by regulatory compliance, cybersecurity concerns, and the need for efficient data management. The demand for All-Flash Storage is also on an upward trend, particularly in sectors requiring high transaction speeds and low latency, such as financial services and e-commerce.

Middle East Data Center Storage Market Product Analysis

The Middle East Data Center Storage Market is witnessing a wave of product innovations focused on enhancing performance, scalability, and data protection. All-flash arrays are offering unprecedented speeds for mission-critical applications, while hybrid solutions provide a cost-effective balance. Software-defined storage (SDS) is gaining traction, enabling greater flexibility and automation in storage management. Innovations also center on advanced data reduction technologies like deduplication and compression, as well as robust encryption and backup solutions to address growing cybersecurity concerns. Competitive advantages are derived from factors such as latency reduction, increased IOPS, unified management platforms, and seamless integration with cloud environments, catering to the evolving demands of digital transformation.

Key Drivers, Barriers & Challenges in Middle East Data Center Storage Market

Key Drivers: The Middle East Data Center Storage Market is propelled by several key drivers:

- Digital Transformation Initiatives: Governments and enterprises across the region are heavily investing in digital transformation, leading to an exponential increase in data generation and the need for advanced storage solutions.

- Cloud Adoption: The rapid growth of cloud computing services, both public and private, is a significant demand driver, requiring scalable and reliable storage infrastructure.

- Big Data Analytics & AI: The increasing adoption of big data analytics and artificial intelligence necessitates high-performance storage capable of processing vast datasets.

- Government Policies & Investments: Supportive government policies and substantial investments in ICT infrastructure are creating a conducive environment for market growth.

Barriers & Challenges: Despite robust growth, the market faces certain barriers and challenges:

- High Initial Investment Costs: Advanced storage solutions, particularly all-flash arrays, can involve substantial upfront capital expenditure.

- Skills Gap: A shortage of skilled IT professionals proficient in managing and maintaining complex storage systems can pose a challenge.

- Data Sovereignty & Regulations: Evolving data localization laws and privacy regulations in some countries can add complexity to storage deployments and require specialized solutions.

- Interoperability Issues: Ensuring seamless interoperability between different storage vendors and existing IT infrastructure can be a technical hurdle.

Growth Drivers in the Middle East Data Center Storage Market Market

The Middle East Data Center Storage Market is experiencing robust growth fueled by a confluence of technological, economic, and regulatory factors. Key technological drivers include the escalating adoption of cloud computing, leading to an insatiable demand for scalable and efficient storage solutions. The burgeoning field of big data analytics and the increasing integration of artificial intelligence (AI) and machine learning (ML) across industries necessitate high-performance storage capable of handling massive datasets and complex computations. Economically, aggressive government initiatives aimed at economic diversification and the development of digital economies, such as Saudi Vision 2030 and UAE Vision 2030, are creating a fertile ground for data center expansion and associated storage investments. Furthermore, the growing emphasis on digital services and e-commerce platforms is spurring demand for resilient and readily accessible data storage.

Challenges Impacting Middle East Data Center Storage Market Growth

Several challenges impact the growth trajectory of the Middle East Data Center Storage Market. Regulatory complexities surrounding data privacy, data residency, and cross-border data transfers can create operational hurdles and necessitate localized storage solutions, potentially increasing costs. Supply chain disruptions, as witnessed in recent global events, can affect the availability and lead times for critical storage hardware components, impacting project timelines. Fierce competitive pressures among both global and regional vendors drive down profit margins and necessitate continuous innovation and aggressive pricing strategies. The high initial capital expenditure required for advanced storage technologies, particularly for small and medium-sized enterprises (SMEs), can also act as a restraint. Furthermore, a persistent cybersecurity threat landscape demands constant vigilance and investment in robust data protection and recovery solutions, adding to the overall cost and complexity of data storage management.

Key Players Shaping the Middle East Data Center Storage Market Market

- Infinidat Ltd

- IBM Corporation

- Lenovo Group Limited

- Western Digital Corporation

- Nutanix Inc

- Hewlett Packard Enterprise

- Zadara Inc

- Dell Inc

- SMART Modular Technologies Inc

- NetApp Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Pure Storage Inc

Significant Middle East Data Center Storage Market Industry Milestones

- June 2023: Huawei Technologies Co. Ltd launched its innovative data center data infrastructure architecture F2F2X (flash-to-flash-to-anything) at the Financial Data Storage Session, a part of the Huawei Intelligent Finance Summit 2023 (HiFS 2023). This architecture forms a reliable data foundation to help financial institutions handle the challenges brought by new data, new apps, and new resilience.

- April 2023: Hewlett Packard Enterprise announced new file, block, disaster, and backup recovery data services designed to help customers eliminate data silos, reduce cost and complexity, and improve performance. The new file storage data services deliver scale-out, enterprise-grade performance for data-intensive workloads, and the expanded block services provide mission-critical storage with mid-range economics.

Future Outlook for Middle East Data Center Storage Market Market

The future outlook for the Middle East Data Center Storage Market is exceptionally promising, driven by continued digital transformation and increasing data volumes. Strategic opportunities lie in the expansion of cloud infrastructure, the adoption of AI and machine learning, and the development of edge computing solutions. The market is expected to witness a further surge in demand for all-flash and hybrid storage arrays, as well as a growing interest in software-defined storage and hyper-converged infrastructure. Government support for technological innovation and the establishment of regional tech hubs will continue to act as significant growth catalysts. As the region solidifies its position as a global digital hub, the demand for sophisticated, scalable, and secure data storage solutions will only intensify, offering substantial market potential for vendors and service providers.

Middle East Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Middle East Data Center Storage Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Storage Market Regional Market Share

Geographic Coverage of Middle East Data Center Storage Market

Middle East Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitalization and Emergence of Data-centric Applications; Rising Cloud Applications Among End Users

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. United Arab Emirates Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 7. Saudi Arabia Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 8. Qatar Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 9. Israel Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 10. Egypt Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 11. Oman Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Middle East Middle East Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Infinidat Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IBM Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lenovo Group Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Western Digital Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nutanix Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hewlett Packard Enterprise

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Zadara Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dell Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SMART Modular Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NetApp Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kingston Technology Company Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Huawei Technologies Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Pure Storage Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Infinidat Ltd

List of Figures

- Figure 1: Middle East Data Center Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Data Center Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Data Center Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 3: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 4: Middle East Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Middle East Data Center Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East Data Center Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Arab Emirates Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Saudi Arabia Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Qatar Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Israel Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Egypt Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Middle East Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 15: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 16: Middle East Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Middle East Data Center Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Saudi Arabia Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Israel Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Qatar Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Bahrain Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Jordan Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Lebanon Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Storage Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the Middle East Data Center Storage Market?

Key companies in the market include Infinidat Ltd, IBM Corporation, Lenovo Group Limited, Western Digital Corporation, Nutanix Inc, Hewlett Packard Enterprise, Zadara Inc, Dell Inc, SMART Modular Technologies Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Pure Storage Inc.

3. What are the main segments of the Middle East Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitalization and Emergence of Data-centric Applications; Rising Cloud Applications Among End Users.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

June 2023: Huawei Technologies Co. Ltd launched its innovative data center data infrastructure architecture F2F2X (flash-to-flash-to-anything) at the Financial Data Storage Session, a part of the Huawei Intelligent Finance Summit 2023 (HiFS 2023). This architecture forms a reliable data foundation to help financial institutions handle the challenges brought by new data, new apps, and new resilience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence