Key Insights

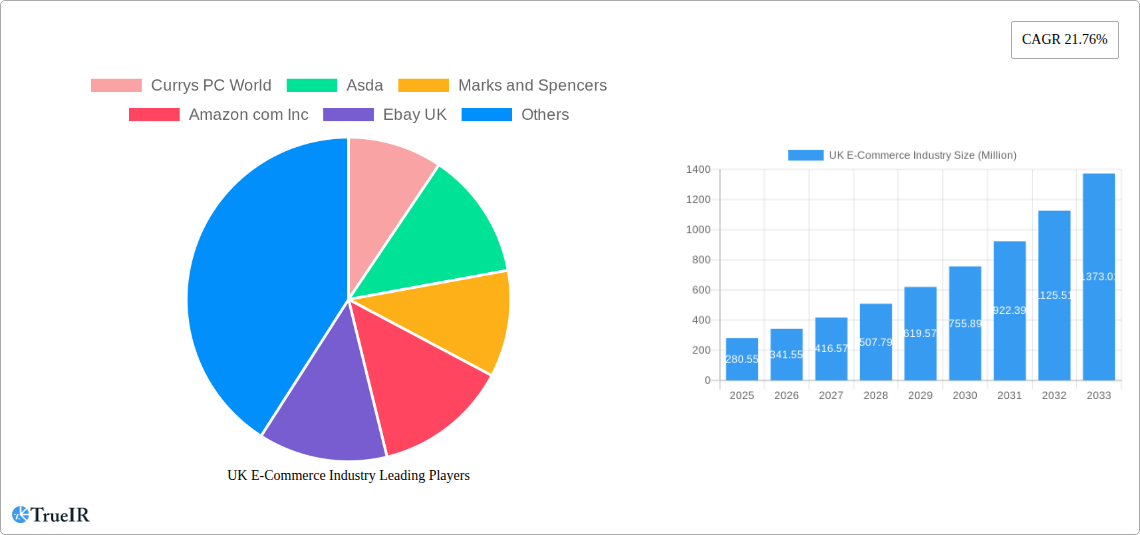

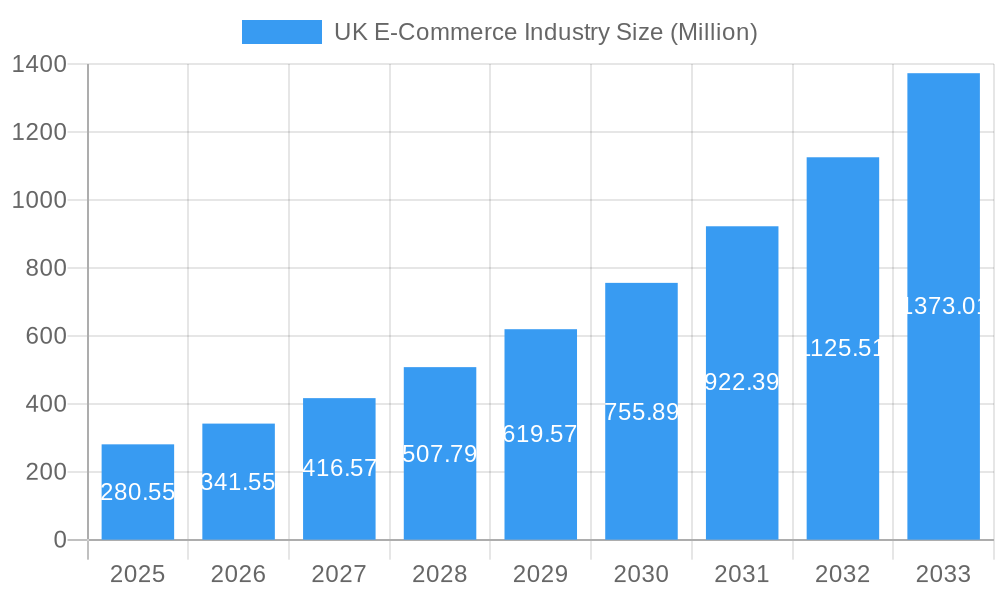

The UK E-Commerce industry is poised for remarkable expansion, driven by a confluence of robust consumer adoption and evolving technological landscapes. Valued at an estimated 280.55 million, the market is projected to witness an impressive Compound Annual Growth Rate (CAGR) of 21.76% over the forecast period from 2025 to 2033. This surge is largely fueled by the increasing prevalence of online shopping for everyday necessities and discretionary items alike. The B2C segment, encompassing categories such as Fashion and Apparel, Beauty and Personal Care, and Consumer Electronics, will continue to dominate consumer spending. Furthermore, the expanding reach of online platforms is democratizing access to goods, with more businesses, from established retailers like Amazon UK and Currys PC World to niche providers, leveraging digital channels to connect with a wider customer base. The seamless integration of online and offline experiences, coupled with personalized customer journeys, are emerging as critical success factors.

UK E-Commerce Industry Market Size (In Million)

The growth trajectory of the UK E-Commerce market is further supported by ongoing advancements in logistics and payment technologies, which are enhancing convenience and security for shoppers. The burgeoning B2B E-Commerce sector also presents significant untapped potential, as businesses increasingly adopt digital procurement solutions to streamline operations and reduce costs. While the market benefits from strong consumer demand, it also faces certain challenges. These include intensifying competition among established players and new entrants, the need for continuous adaptation to evolving consumer preferences, and the imperative to maintain robust cybersecurity measures. However, the inherent resilience of the online retail model, combined with strategic investments in innovation and customer engagement, positions the UK E-Commerce market for sustained and substantial growth throughout the study period.

UK E-Commerce Industry Company Market Share

This comprehensive report delves into the dynamic UK E-Commerce industry, providing in-depth analysis of market structure, competitive landscape, key trends, dominant segments, and future outlook. Leveraging high-volume keywords like "UK e-commerce," "online retail UK," "digital commerce UK," and "e-commerce growth UK," this report is meticulously crafted for maximum SEO impact and to offer actionable insights for industry stakeholders.

UK E-Commerce Industry Market Structure & Competitive Landscape

The UK e-commerce market exhibits a moderately concentrated structure, driven by fierce competition among major players and a continuous influx of innovative online retailers. Key innovation drivers include the adoption of artificial intelligence for personalized shopping experiences, the expansion of same-day and next-day delivery services, and the growing popularity of social commerce. Regulatory impacts are significant, with evolving data privacy laws (GDPR) and consumer protection legislation shaping operational strategies. Product substitutes are abundant, with a wide array of online marketplaces and direct-to-consumer (DTC) brands offering alternatives to traditional retail. End-user segmentation is predominantly B2C, though B2B e-commerce is experiencing robust growth. Mergers and acquisitions (M&A) activity is consistent, with larger entities acquiring smaller, agile startups to expand their market reach and technological capabilities. For instance, the acquisition of niche fashion platforms by established online retailers is a recurring trend. Concentration ratios are influenced by the dominance of a few large players, with the top 5 companies holding an estimated 65% of the market share. M&A volumes have averaged around 50 transactions annually over the historical period, indicating a healthy but consolidating market.

UK E-Commerce Industry Market Trends & Opportunities

The UK e-commerce market is projected for substantial growth, fueled by evolving consumer behaviors and technological advancements. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated market size of over 200 billion pounds by 2033. Market penetration rates are already high, with over 85% of UK consumers having made an online purchase in the past year, a figure poised to increase. Technological shifts are profoundly reshaping the landscape, with advancements in artificial intelligence (AI) powering hyper-personalized recommendations and dynamic pricing. Augmented reality (AR) and virtual reality (VR) are increasingly being integrated to offer immersive shopping experiences, particularly in the fashion and furniture segments. The rise of voice commerce, driven by smart speakers, is creating new avenues for product discovery and purchase.

Consumer preferences are shifting towards sustainability and ethical sourcing, creating opportunities for brands that can demonstrably meet these demands. The demand for faster, more flexible delivery options, including click-and-collect and locker services, continues to grow. Personalization remains a key differentiator, with consumers expecting tailored product suggestions and marketing communications. Competitive dynamics are characterized by intense price competition, a focus on customer loyalty programs, and the strategic use of social media for marketing and community building. The increasing adoption of mobile commerce (m-commerce) necessitates optimized mobile interfaces and seamless payment processes. Opportunities also lie in serving underserved market segments, such as the elderly population or individuals with specific accessibility needs, through tailored online platforms and services. The growing influence of influencer marketing and live shopping events are further testament to the evolving nature of online retail engagement. The increasing adoption of cloud-based e-commerce solutions and headless commerce architectures offers agility and scalability for businesses.

Dominant Markets & Segments in UK E-Commerce Industry

Within the UK e-commerce industry, the B2C E-Commerce segment overwhelmingly dominates, with specific applications showing significant traction. Among these, Fashion and Apparel consistently emerges as a leading segment, driven by accessible online stores, rapid trend cycles, and a strong presence of major brands like ASOS. The Consumer Electronics segment also holds substantial market share, with retailers such as Currys PC World and Amazon UK consistently driving sales. Beauty and Personal Care is another rapidly expanding application, benefiting from online subscription models and the ability to offer a wider product range than physical stores.

The Food and Beverage segment is experiencing a surge in growth, accelerated by the pandemic and the convenience of grocery delivery services from giants like Tesco, Asda, and Amazon Fresh. Furniture and Home goods are also seeing increased online sales, as consumers gain confidence in purchasing larger items online, facilitated by detailed product descriptions, customer reviews, and improved logistics. The Others category, encompassing Toys, DIY, and Media, collectively represents a significant portion of the market, with platforms like Amazon and eBay offering a vast selection.

Key growth drivers for these dominant segments include robust digital infrastructure across the UK, supportive government policies aimed at fostering digital adoption, and a high level of internet and smartphone penetration. The widespread availability of various payment options, including buy-now-pay-later services, further fuels consumer spending. For example, advancements in supply chain management and last-mile delivery solutions have significantly improved the customer experience in the Food and Beverage segment, enabling faster and more reliable deliveries. In Fashion and Apparel, the integration of virtual try-on technologies and sophisticated recommendation engines enhance the online shopping journey. The increasing reliance on mobile devices for shopping across all categories underscores the need for mobile-first strategies.

UK E-Commerce Industry Product Analysis

Product innovation in the UK e-commerce industry is characterized by a focus on enhancing customer experience and operational efficiency. Advancements in AI are powering personalized product recommendations and intelligent search functionalities, directly improving market fit. The integration of Augmented Reality (AR) for virtual try-ons in fashion and furniture categories provides a significant competitive advantage, bridging the gap between online and offline shopping. Technological advancements in packaging and sustainable delivery solutions are also gaining prominence, aligning with consumer demand for eco-friendly options. The competitive advantage lies in offering seamless user journeys, from intuitive product discovery to effortless checkout and reliable delivery.

Key Drivers, Barriers & Challenges in UK E-Commerce Industry

The UK e-commerce industry is propelled by several key drivers, including the pervasive adoption of smartphones, leading to an estimated 60% of online sales occurring via mobile devices. Evolving consumer preferences for convenience and personalized shopping experiences are paramount. Technological advancements like AI and AR are enhancing product discovery and engagement. Furthermore, supportive government initiatives promoting digital trade and investment in e-commerce infrastructure contribute to market growth.

However, significant barriers and challenges exist. Supply chain disruptions, exacerbated by global events and labor shortages, can impact delivery times and costs, affecting an estimated 15% of online orders. Regulatory complexities, particularly around data privacy and consumer rights, require continuous adaptation. Intense competitive pressures from both domestic and international players, including Amazon and eBay UK, can lead to price wars and necessitate significant marketing investment. The increasing cost of customer acquisition, estimated at over 50 pounds per customer for some sectors, presents another formidable challenge.

Growth Drivers in the UK E-Commerce Industry Market

Key growth drivers in the UK e-commerce market are multifaceted. Technological innovation, such as the widespread adoption of AI for personalization and the increasing use of augmented reality (AR) for product visualization, significantly enhances the customer experience. Economic factors, including a rise in disposable income and the continued shift towards online spending habits, provide a fertile ground for expansion. Supportive government policies aimed at fostering digital trade and investment in infrastructure, such as improved broadband connectivity across the nation, further catalyze growth. The burgeoning influencer marketing ecosystem also plays a crucial role in driving product discovery and consumer engagement.

Challenges Impacting UK E-Commerce Industry Growth

Challenges impacting UK e-commerce growth are diverse. Intensifying competitive pressures from established players like Amazon.com Inc. and eBay UK, alongside an influx of agile DTC brands, necessitates significant investment in customer acquisition and retention. Regulatory complexities, particularly concerning data privacy (GDPR) and evolving consumer protection laws, demand constant vigilance and adaptation from businesses, potentially increasing compliance costs. Supply chain issues, including port congestion and a shortage of logistics workers, continue to create bottlenecks, impacting delivery timelines and increasing operational expenses. Furthermore, the rising cost of digital advertising and marketing campaigns is making it more expensive for businesses to reach their target audiences effectively.

Key Players Shaping the UK E-Commerce Industry Market

- Amazon com Inc

- Ebay UK

- Currys PC World

- Asda

- Marks and Spencers

- John Lewis and Partners

- Argos

- Asos

- Tesco

- Gumtree

Significant UK E-Commerce Industry Industry Milestones

- July 2023: Amazon announced an investment exceeding 4.2 billion pounds (USD 5.4 billion) in the UK's creative industries since 2010, contributing an estimated 4.8 billion pounds (USD 6.1 billion) to gross value. This investment included support for over 100 new apprenticeships.

- 2022: The UK government launched new initiatives to support small and medium-sized enterprises (SMEs) in adopting e-commerce solutions, aiming to boost digital exports.

- 2021: The COVID-19 pandemic accelerated the adoption of online grocery shopping, with major supermarkets like Tesco and Asda significantly expanding their delivery and click-and-collect services, demonstrating over a 25% increase in online grocery sales.

- 2020: A surge in demand for home improvement and DIY products led to record online sales for retailers like Argos and John Lewis and Partners, driven by increased time spent at home.

- 2019: The introduction of more sophisticated AI-powered recommendation engines by major online retailers significantly improved product discovery and personalization for consumers, leading to higher conversion rates.

Future Outlook for UK E-Commerce Industry Market

The future outlook for the UK e-commerce industry remains exceptionally bright, with a sustained trajectory of robust growth anticipated. Strategic opportunities lie in further leveraging AI and machine learning for hyper-personalization, predictive analytics, and optimized inventory management. The expansion of sustainable e-commerce practices, from eco-friendly packaging to carbon-neutral delivery options, will become a key differentiator and a significant market driver. The continued integration of immersive technologies like AR and VR will further enhance the online shopping experience, reducing returns and increasing customer satisfaction. The growth of social commerce and live shopping events presents innovative avenues for direct consumer engagement and sales. The market potential for niche and specialized e-commerce platforms catering to specific consumer needs is also significant.

UK E-Commerce Industry Segmentation

-

1. B2C E-Commerce

-

1.1. Application

- 1.1.1. Beauty and Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion and Apparel

- 1.1.4. Food and Beverage

- 1.1.5. Furniture and Home

- 1.1.6. Others (Toys, DIY, Media, etc.)

-

1.1. Application

- 2. B2B E-Commerce

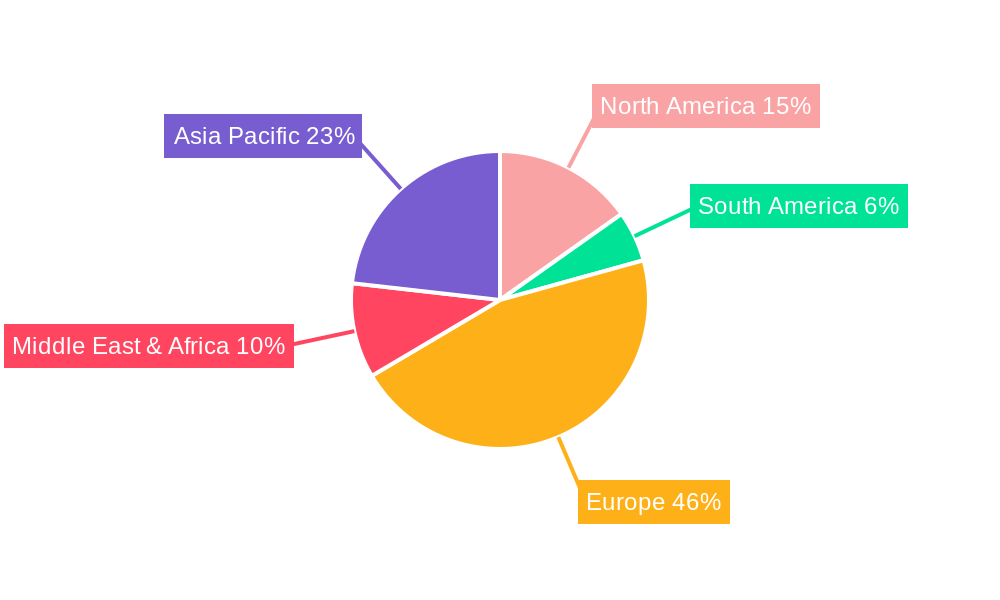

UK E-Commerce Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK E-Commerce Industry Regional Market Share

Geographic Coverage of UK E-Commerce Industry

UK E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase developments of 5G Technology; Increased Adoption of Online Payments

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. The increasing ease of using alternative payment methods will propel the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Application

- 5.1.1.1. Beauty and Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion and Apparel

- 5.1.1.4. Food and Beverage

- 5.1.1.5. Furniture and Home

- 5.1.1.6. Others (Toys, DIY, Media, etc.)

- 5.1.1. Application

- 5.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. North America UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6.1.1. Application

- 6.1.1.1. Beauty and Personal Care

- 6.1.1.2. Consumer Electronics

- 6.1.1.3. Fashion and Apparel

- 6.1.1.4. Food and Beverage

- 6.1.1.5. Furniture and Home

- 6.1.1.6. Others (Toys, DIY, Media, etc.)

- 6.1.1. Application

- 6.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7. South America UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7.1.1. Application

- 7.1.1.1. Beauty and Personal Care

- 7.1.1.2. Consumer Electronics

- 7.1.1.3. Fashion and Apparel

- 7.1.1.4. Food and Beverage

- 7.1.1.5. Furniture and Home

- 7.1.1.6. Others (Toys, DIY, Media, etc.)

- 7.1.1. Application

- 7.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8. Europe UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8.1.1. Application

- 8.1.1.1. Beauty and Personal Care

- 8.1.1.2. Consumer Electronics

- 8.1.1.3. Fashion and Apparel

- 8.1.1.4. Food and Beverage

- 8.1.1.5. Furniture and Home

- 8.1.1.6. Others (Toys, DIY, Media, etc.)

- 8.1.1. Application

- 8.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9. Middle East & Africa UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9.1.1. Application

- 9.1.1.1. Beauty and Personal Care

- 9.1.1.2. Consumer Electronics

- 9.1.1.3. Fashion and Apparel

- 9.1.1.4. Food and Beverage

- 9.1.1.5. Furniture and Home

- 9.1.1.6. Others (Toys, DIY, Media, etc.)

- 9.1.1. Application

- 9.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 10. Asia Pacific UK E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 10.1.1. Application

- 10.1.1.1. Beauty and Personal Care

- 10.1.1.2. Consumer Electronics

- 10.1.1.3. Fashion and Apparel

- 10.1.1.4. Food and Beverage

- 10.1.1.5. Furniture and Home

- 10.1.1.6. Others (Toys, DIY, Media, etc.)

- 10.1.1. Application

- 10.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 10.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Currys PC World

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Asda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Marks and Spencers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amazon com Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ebay UK

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 John Lewis and Partners

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Argos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Asos

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gumtree

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tesco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Currys PC World

List of Figures

- Figure 1: Global UK E-Commerce Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK E-Commerce Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America UK E-Commerce Industry Revenue (Million), by B2C E-Commerce 2025 & 2033

- Figure 4: North America UK E-Commerce Industry Volume (K Unit), by B2C E-Commerce 2025 & 2033

- Figure 5: North America UK E-Commerce Industry Revenue Share (%), by B2C E-Commerce 2025 & 2033

- Figure 6: North America UK E-Commerce Industry Volume Share (%), by B2C E-Commerce 2025 & 2033

- Figure 7: North America UK E-Commerce Industry Revenue (Million), by B2B E-Commerce 2025 & 2033

- Figure 8: North America UK E-Commerce Industry Volume (K Unit), by B2B E-Commerce 2025 & 2033

- Figure 9: North America UK E-Commerce Industry Revenue Share (%), by B2B E-Commerce 2025 & 2033

- Figure 10: North America UK E-Commerce Industry Volume Share (%), by B2B E-Commerce 2025 & 2033

- Figure 11: North America UK E-Commerce Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America UK E-Commerce Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America UK E-Commerce Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UK E-Commerce Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UK E-Commerce Industry Revenue (Million), by B2C E-Commerce 2025 & 2033

- Figure 16: South America UK E-Commerce Industry Volume (K Unit), by B2C E-Commerce 2025 & 2033

- Figure 17: South America UK E-Commerce Industry Revenue Share (%), by B2C E-Commerce 2025 & 2033

- Figure 18: South America UK E-Commerce Industry Volume Share (%), by B2C E-Commerce 2025 & 2033

- Figure 19: South America UK E-Commerce Industry Revenue (Million), by B2B E-Commerce 2025 & 2033

- Figure 20: South America UK E-Commerce Industry Volume (K Unit), by B2B E-Commerce 2025 & 2033

- Figure 21: South America UK E-Commerce Industry Revenue Share (%), by B2B E-Commerce 2025 & 2033

- Figure 22: South America UK E-Commerce Industry Volume Share (%), by B2B E-Commerce 2025 & 2033

- Figure 23: South America UK E-Commerce Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America UK E-Commerce Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: South America UK E-Commerce Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America UK E-Commerce Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe UK E-Commerce Industry Revenue (Million), by B2C E-Commerce 2025 & 2033

- Figure 28: Europe UK E-Commerce Industry Volume (K Unit), by B2C E-Commerce 2025 & 2033

- Figure 29: Europe UK E-Commerce Industry Revenue Share (%), by B2C E-Commerce 2025 & 2033

- Figure 30: Europe UK E-Commerce Industry Volume Share (%), by B2C E-Commerce 2025 & 2033

- Figure 31: Europe UK E-Commerce Industry Revenue (Million), by B2B E-Commerce 2025 & 2033

- Figure 32: Europe UK E-Commerce Industry Volume (K Unit), by B2B E-Commerce 2025 & 2033

- Figure 33: Europe UK E-Commerce Industry Revenue Share (%), by B2B E-Commerce 2025 & 2033

- Figure 34: Europe UK E-Commerce Industry Volume Share (%), by B2B E-Commerce 2025 & 2033

- Figure 35: Europe UK E-Commerce Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe UK E-Commerce Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Europe UK E-Commerce Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe UK E-Commerce Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa UK E-Commerce Industry Revenue (Million), by B2C E-Commerce 2025 & 2033

- Figure 40: Middle East & Africa UK E-Commerce Industry Volume (K Unit), by B2C E-Commerce 2025 & 2033

- Figure 41: Middle East & Africa UK E-Commerce Industry Revenue Share (%), by B2C E-Commerce 2025 & 2033

- Figure 42: Middle East & Africa UK E-Commerce Industry Volume Share (%), by B2C E-Commerce 2025 & 2033

- Figure 43: Middle East & Africa UK E-Commerce Industry Revenue (Million), by B2B E-Commerce 2025 & 2033

- Figure 44: Middle East & Africa UK E-Commerce Industry Volume (K Unit), by B2B E-Commerce 2025 & 2033

- Figure 45: Middle East & Africa UK E-Commerce Industry Revenue Share (%), by B2B E-Commerce 2025 & 2033

- Figure 46: Middle East & Africa UK E-Commerce Industry Volume Share (%), by B2B E-Commerce 2025 & 2033

- Figure 47: Middle East & Africa UK E-Commerce Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa UK E-Commerce Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East & Africa UK E-Commerce Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa UK E-Commerce Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific UK E-Commerce Industry Revenue (Million), by B2C E-Commerce 2025 & 2033

- Figure 52: Asia Pacific UK E-Commerce Industry Volume (K Unit), by B2C E-Commerce 2025 & 2033

- Figure 53: Asia Pacific UK E-Commerce Industry Revenue Share (%), by B2C E-Commerce 2025 & 2033

- Figure 54: Asia Pacific UK E-Commerce Industry Volume Share (%), by B2C E-Commerce 2025 & 2033

- Figure 55: Asia Pacific UK E-Commerce Industry Revenue (Million), by B2B E-Commerce 2025 & 2033

- Figure 56: Asia Pacific UK E-Commerce Industry Volume (K Unit), by B2B E-Commerce 2025 & 2033

- Figure 57: Asia Pacific UK E-Commerce Industry Revenue Share (%), by B2B E-Commerce 2025 & 2033

- Figure 58: Asia Pacific UK E-Commerce Industry Volume Share (%), by B2B E-Commerce 2025 & 2033

- Figure 59: Asia Pacific UK E-Commerce Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific UK E-Commerce Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific UK E-Commerce Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific UK E-Commerce Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 2: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 3: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 4: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 5: Global UK E-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UK E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 8: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 9: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 10: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 11: Global UK E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UK E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 20: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 21: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 22: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 23: Global UK E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UK E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Brazil UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Argentina UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 32: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 33: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 34: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 35: Global UK E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global UK E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: United Kingdom UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Germany UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Russia UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Benelux UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Nordics UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 56: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 57: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 58: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 59: Global UK E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global UK E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Turkey UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Israel UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: GCC UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: North Africa UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Global UK E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 74: Global UK E-Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 75: Global UK E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 76: Global UK E-Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 77: Global UK E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global UK E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 79: China UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: India UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Japan UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: South Korea UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: ASEAN UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oceania UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific UK E-Commerce Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific UK E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK E-Commerce Industry?

The projected CAGR is approximately 21.76%.

2. Which companies are prominent players in the UK E-Commerce Industry?

Key companies in the market include Currys PC World, Asda, Marks and Spencers, Amazon com Inc, Ebay UK, John Lewis and Partners, Argos, Asos, Gumtree, Tesco.

3. What are the main segments of the UK E-Commerce Industry?

The market segments include B2C E-Commerce , B2B E-Commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 280.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase developments of 5G Technology; Increased Adoption of Online Payments.

6. What are the notable trends driving market growth?

The increasing ease of using alternative payment methods will propel the market.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

July 2023 - Amazon has said that it invested more than 4.2 billion pounds (USD 5.4 billion) in the U.K. creative industries since 2010, spending that it claims has contributed some 4.8 billion pounds (USD 6.1 billion) of gross value. As part of its ongoing investment, the company has also announced support for more than 100 new apprenticeships in organizations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK E-Commerce Industry?

To stay informed about further developments, trends, and reports in the UK E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence