Key Insights

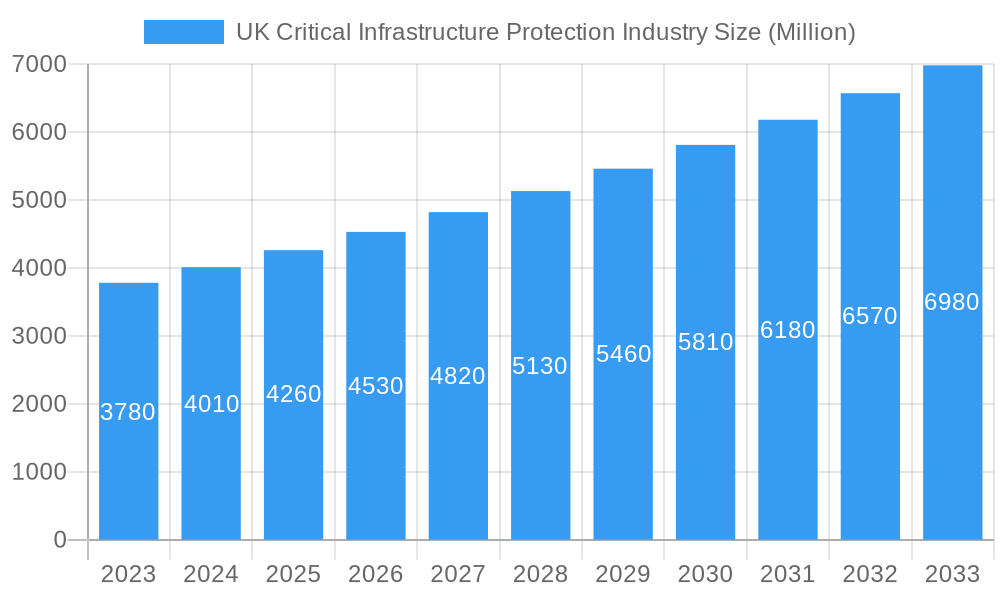

The UK Critical Infrastructure Protection (CIP) market is projected for significant growth, driven by the essential need to secure national assets against evolving cyber and physical threats. With an estimated market size of £152 billion in 2025, the sector is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 5% through 2033. This expansion is propelled by the escalating sophistication of threats targeting energy, transportation, and public service infrastructure. Digital transformation initiatives, while enhancing efficiency, also introduce new vulnerabilities, requiring robust protection strategies. Government mandates for national resilience and stringent security standards further accelerate market development.

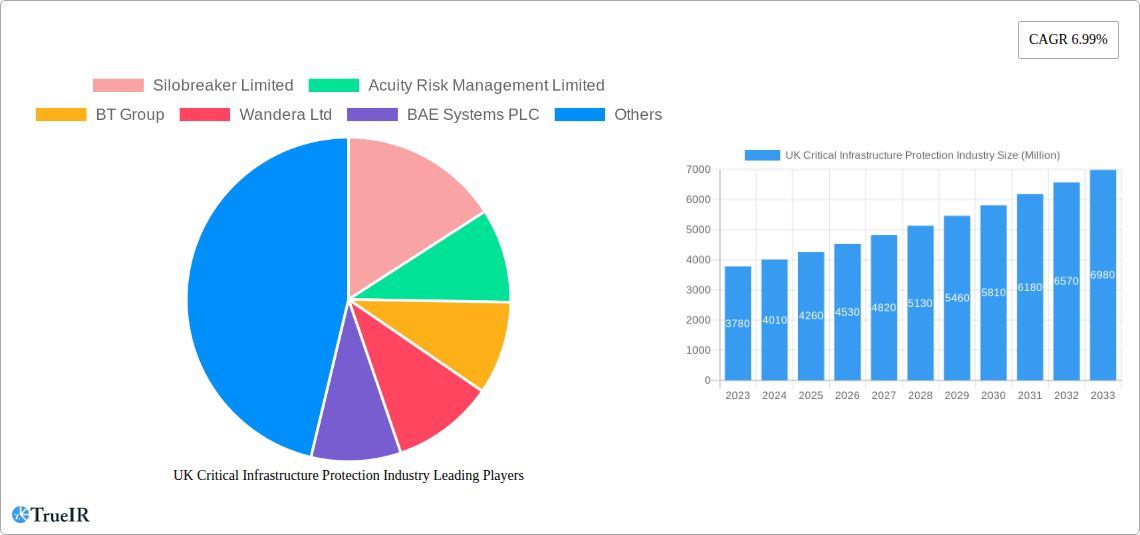

UK Critical Infrastructure Protection Industry Market Size (In Billion)

Key growth factors include the increasing frequency and complexity of cyber-attacks, the necessity for physical security of essential services, and the rising demand for integrated security management. The market encompasses advanced technologies such as network and physical security, vehicle identification, building management systems, and secure communications, alongside specialized areas like SCADA and CBRNE protection. Essential services include risk management, design and integration, managed security, and maintenance. Primary market adopters are the energy and power, transportation, and sensitive infrastructure and enterprise sectors.

UK Critical Infrastructure Protection Industry Company Market Share

UK Critical Infrastructure Protection Industry Market Structure & Competitive Landscape

The UK Critical Infrastructure Protection (CIP) industry is characterized by a dynamic and evolving market structure. Market concentration remains moderate, with a mix of large, established players and specialized SMEs contributing to innovation and service delivery. Key players like BT Group, BAE Systems PLC, and G4S PLC dominate certain segments, leveraging their scale and comprehensive offerings. However, niche providers such as Silobreaker Limited, Acuity Risk Management Limited, and Sophos Group PLC are carving out significant market share through specialized expertise in areas like cyber security and risk assessment. Innovation drivers are primarily fueled by the increasing sophistication of cyber threats, the imperative for enhanced physical security, and the growing adoption of advanced technologies like AI and IoT across critical sectors.

The regulatory impact is substantial, with government initiatives and legislation like the NIS Directive and upcoming frameworks driving demand for robust protection solutions. Product substitutes are limited in core protective functions, but convergence of technologies (e.g., integration of physical and cyber security) creates new competitive dynamics. End-user segmentation spans Energy and Power, Transportation, and Sensitive Infrastructure and Enterprises, each with unique protection requirements. Mergers and Acquisitions (M&A) trends are on the rise, as larger entities seek to acquire specialized capabilities and market access, consolidating market share and fostering strategic alliances. We anticipate an increase in M&A activity over the forecast period, reflecting the industry's drive for integrated solutions and expanded service portfolios.

Key M&A Activities (Estimated):

- 2021-2024: Approximately 15-20 significant M&A deals.

- 2025-2033: Projected to exceed 30 M&A transactions, with an estimated transaction value of over £500 million.

UK Critical Infrastructure Protection Industry Market Trends & Opportunities

The UK Critical Infrastructure Protection (CIP) industry is poised for significant expansion driven by a confluence of escalating threats, technological advancements, and increased government focus on national security. The market size is projected to grow substantially from approximately £10,000 million in the base year of 2025, reaching an estimated £25,000 million by 2033, signifying a robust Compound Annual Growth Rate (CAGR) of approximately 12%. This growth is underpinned by the continuous need to safeguard vital sectors such as Energy and Power, Transportation, and Sensitive Infrastructure and Enterprises from a widening array of physical and cyber-borne risks.

Technological shifts are a paramount trend, with the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) revolutionizing threat detection, response, and predictive analytics. For instance, AI-powered network security solutions are becoming indispensable for identifying sophisticated cyber intrusions in real-time, while IoT sensors are enhancing physical security by enabling comprehensive environmental monitoring and anomaly detection. Consumer preferences, or rather, end-user demand within critical sectors, are increasingly skewed towards proactive, intelligent, and integrated security solutions. Organizations are moving away from siloed security approaches towards holistic platforms that offer unified visibility and control across diverse protection domains, including network security, physical security, SCADA security, and CBRNE response.

The competitive landscape is intensifying, with established players like BT Group and BAE Systems PLC expanding their portfolios and investing heavily in R&D to maintain their market leadership. Simultaneously, specialized firms such as Sophos Group PLC and Silobreaker Limited are gaining traction by offering cutting-edge solutions in their respective domains, particularly in advanced threat intelligence and cybersecurity. The market penetration rate for advanced security technologies, while already significant, is set to accelerate, driven by the increasing realization that the cost of a major incident far outweighs the investment in robust protection measures. The demand for managed services, including risk management, design, integration, consultation, and ongoing maintenance and support, is also witnessing a steep upward trajectory. This trend reflects a strategic outsourcing decision by many critical infrastructure operators who seek to leverage expert capabilities and focus on their core operational functions, rather than managing complex security infrastructures internally. The ongoing digitalization of critical infrastructure, while bringing efficiency gains, also expands the attack surface, further fueling the demand for sophisticated and adaptable protection strategies. The industry is also witnessing a growing emphasis on resilience and business continuity planning, with a focus on not just preventing attacks but also ensuring rapid recovery and minimal disruption in the event of an incident. This holistic approach to security is becoming a standard expectation for all critical infrastructure operators.

Dominant Markets & Segments in UK Critical Infrastructure Protection Industry

The UK Critical Infrastructure Protection (CIP) industry exhibits distinct dominant markets and segments, driven by the specific vulnerabilities and operational requirements of each sector. Within the Security Technology landscape, Network Security stands out as a particularly dominant segment. The increasing digitalization and interconnectedness of critical systems, from smart grids in the Energy and Power sector to advanced traffic management in Transportation, have made robust network defense paramount. The proliferation of cyber threats, including ransomware, advanced persistent threats (APTs), and state-sponsored attacks, necessitates sophisticated solutions for threat detection, prevention, and incident response. The estimated market size for Network Security within UK CIP is projected to exceed £5,000 million by 2033, representing a significant portion of overall security technology spending. This dominance is fueled by continuous investment in next-generation firewalls, intrusion detection/prevention systems (IDPS), security information and event management (SIEM) platforms, and increasingly, AI-driven behavioral analytics.

Physical Security also commands a substantial share, driven by the need to protect tangible assets and operational sites from unauthorized access, sabotage, and terrorism. This segment encompasses surveillance systems, access control, perimeter security, and intelligent video analytics, particularly critical for the Energy and Power sector's power plants and substations, and Transportation's airports, rail networks, and ports. The market for Physical Security solutions is estimated to reach over £4,000 million by 2033.

In the Service domain, Managed Services and Designing, Integration, and Consultation are emerging as highly dominant. Critical infrastructure operators are increasingly outsourcing the complex tasks of designing, implementing, and managing their security systems to specialized providers. This trend allows them to leverage expert knowledge, reduce operational costs, and ensure compliance with evolving regulations. The demand for proactive risk management is also escalating, making Risk Management Services another key growth area, with an estimated market size of over £3,000 million for all services combined by 2033.

Considering the Verticals, the Energy and Power sector is a significant driver of CIP demand. The criticality of maintaining a stable energy supply makes this sector a prime target for malicious actors. Investments in safeguarding power grids, nuclear facilities, and renewable energy infrastructure are substantial. The Transportation sector, encompassing aviation, rail, and maritime, also represents a major market, given its interconnectedness and the potential for widespread disruption. Sensitive Infrastructure and Enterprises, including government facilities, financial institutions, and healthcare providers, are also major consumers of CIP solutions due to the high stakes involved.

Key Growth Drivers in Dominant Segments:

- Network Security: Increasing sophistication of cyber threats, adoption of cloud technologies, need for real-time threat intelligence.

- Physical Security: Rising geopolitical tensions, growing terrorism threats, need for integrated surveillance and access control.

- Managed Services: Complexity of modern security systems, shortage of skilled cybersecurity personnel, focus on core competencies.

- Energy and Power Vertical: Aging infrastructure requiring modernization, increased reliance on smart grid technologies, regulatory mandates for grid resilience.

- Transportation Vertical: Expanding air and rail networks, rise of autonomous vehicles, need for robust border security and passenger screening.

The dominance of these segments is further reinforced by substantial government investment and strategic initiatives aimed at bolstering the resilience of the UK's critical national infrastructure.

UK Critical Infrastructure Protection Industry Product Analysis

Product innovation in the UK Critical Infrastructure Protection (CIP) industry is heavily focused on integrated solutions and advanced analytics. Companies are increasingly developing platforms that converge network security, physical security, and SCADA security to provide a unified defense posture. For instance, the integration of AI-powered threat intelligence with advanced surveillance systems allows for proactive identification of potential threats, whether digital or physical. Innovations in secure communications are also crucial, with advancements in quantum-resistant encryption and resilient network architectures becoming more prevalent. CBRNE detection and response technologies are also seeing improvements in sensitivity and speed. These product advancements offer competitive advantages by providing enhanced situational awareness, faster response times, and more effective mitigation of complex threats, directly addressing the evolving needs of critical infrastructure operators.

Key Drivers, Barriers & Challenges in UK Critical Infrastructure Protection Industry

Key Drivers:

The UK Critical Infrastructure Protection (CIP) industry is propelled by several key drivers. Technological Advaves are at the forefront, with the proliferation of AI, IoT, and advanced analytics enabling more sophisticated threat detection and response. The increasing threat landscape, characterized by sophisticated cyber-attacks and the potential for physical sabotage, necessitates continuous investment in robust security solutions. Regulatory mandates and government initiatives, such as the NIS Directive, play a crucial role in driving compliance and investment across critical sectors. Economic considerations are also a factor, with the long-term cost of breaches and disruptions far outweighing the investment in proactive protection.

Barriers & Challenges:

Despite strong growth drivers, the industry faces significant challenges. Budgetary constraints for some smaller critical infrastructure operators can limit the adoption of advanced solutions. Regulatory complexities and evolving compliance requirements demand constant adaptation and expertise. Supply chain issues, particularly concerning specialized hardware and software components, can lead to delays and increased costs. A shortage of skilled cybersecurity and protection professionals presents a persistent barrier to effective implementation and management. Interoperability issues between legacy systems and new technologies can create security gaps. Furthermore, the sheer scale and complexity of critical infrastructure make comprehensive protection a monumental task.

Growth Drivers in the UK Critical Infrastructure Protection Industry Market

The UK Critical Infrastructure Protection (CIP) market is driven by a powerful synergy of technological innovation, evolving security threats, and proactive government policy. The increasing adoption of AI and machine learning for predictive threat detection and automated response is a significant catalyst. Furthermore, the growing interconnectedness of critical systems through the IoT expands the attack surface, compelling investment in advanced network security and SCADA protection. Economically, the escalating costs associated with major incidents, including financial losses, reputational damage, and service disruption, underscore the value proposition of robust CIP solutions. Regulatory frameworks, such as the upcoming NIS2 Directive, are imposing stricter security obligations, directly stimulating market growth. These factors collectively create a strong demand for comprehensive and adaptable protection strategies across all critical sectors.

Challenges Impacting UK Critical Infrastructure Protection Industry Growth

The growth of the UK Critical Infrastructure Protection (CIP) industry is hindered by several key challenges. Regulatory complexities, with constantly evolving compliance requirements, demand significant resources for adaptation. Supply chain vulnerabilities, particularly for specialized security hardware and software, can lead to project delays and increased costs. Competitive pressures among security providers, while fostering innovation, can also lead to price wars that strain margins. A persistent shortage of skilled cybersecurity professionals exacerbates the difficulty of implementing and maintaining sophisticated protection systems. Furthermore, the sheer scale and inherent interconnectedness of critical infrastructure present inherent vulnerabilities that are challenging and costly to fully mitigate.

Key Players Shaping the UK Critical Infrastructure Protection Industry Market

- Silobreaker Limited

- Acuity Risk Management Limited

- BT Group

- Wandera Ltd

- BAE Systems PLC

- Vision Security Group Ltd

- Sophos Group PLC

- Wilson James Ltd

- Advance Security (United Kingdom) Limited

- G4S PLC

Significant UK Critical Infrastructure Protection Industry Industry Milestones

- 2019: Launch of the National Cyber Security Centre's (NCSC) threat assessment reports, highlighting increasing cyber risks to critical infrastructure.

- 2020: Government announces significant investment in the modernization of the UK's energy grid, emphasizing cybersecurity.

- 2021: Implementation of enhanced security protocols for the UK transport sector following a series of high-profile security scares.

- 2022: Introduction of the Security of Critical Infrastructure Bill, proposing stricter regulations and penalties for infrastructure operators.

- 2023: Major cybersecurity drills conducted across the Energy and Power sector to test resilience against sophisticated attacks.

- 2024: Increased adoption of AI-driven physical security solutions for critical infrastructure sites.

- 2025: Anticipated finalization and implementation of key provisions from the Security of Critical Infrastructure Bill.

- 2026: Projected increase in M&A activity as companies seek to consolidate offerings and expand capabilities in response to evolving threats.

- 2028: Expected widespread adoption of quantum-resistant encryption technologies for secure communications in sensitive infrastructure.

- 2030: Growth in demand for integrated cyber-physical security platforms across all critical sectors.

- 2033: Maturation of the market towards fully autonomous and predictive security systems within critical infrastructure.

Future Outlook for the UK Critical Infrastructure Protection Industry Market

The future outlook for the UK Critical Infrastructure Protection (CIP) industry is exceptionally strong, driven by sustained and escalating threats and an ongoing commitment to national security. Strategic opportunities lie in the further integration of AI and ML for predictive analytics, enhancing proactive threat mitigation. The continuous expansion of 5G networks and IoT devices will necessitate more robust and adaptable security solutions, creating demand for advanced network and SCADA security. The increasing regulatory pressure for resilience and robust data protection will also fuel market growth. Furthermore, the projected increase in M&A activities signifies a consolidation trend, leading to more comprehensive service offerings and innovative solutions that will be crucial for safeguarding the UK's vital assets. The market is expected to evolve towards a more automated, intelligent, and integrated approach to critical infrastructure security.

UK Critical Infrastructure Protection Industry Segmentation

-

1. Security Technology

- 1.1. Network Security

- 1.2. Physical Security

- 1.3. Vehicle Identification Management

- 1.4. Building Management Systems

- 1.5. Secure Communications

- 1.6. Radars

- 1.7. Scada Security

- 1.8. CBRNE

-

2. Service

- 2.1. Risk Management Services

- 2.2. Designing, Integration, and Consultation

- 2.3. Managed Services

- 2.4. Maintenance and Support

-

3. Vertical

- 3.1. Energy and Power

- 3.2. Transportation

- 3.3. Sensitive Infrastructure and Enterprises

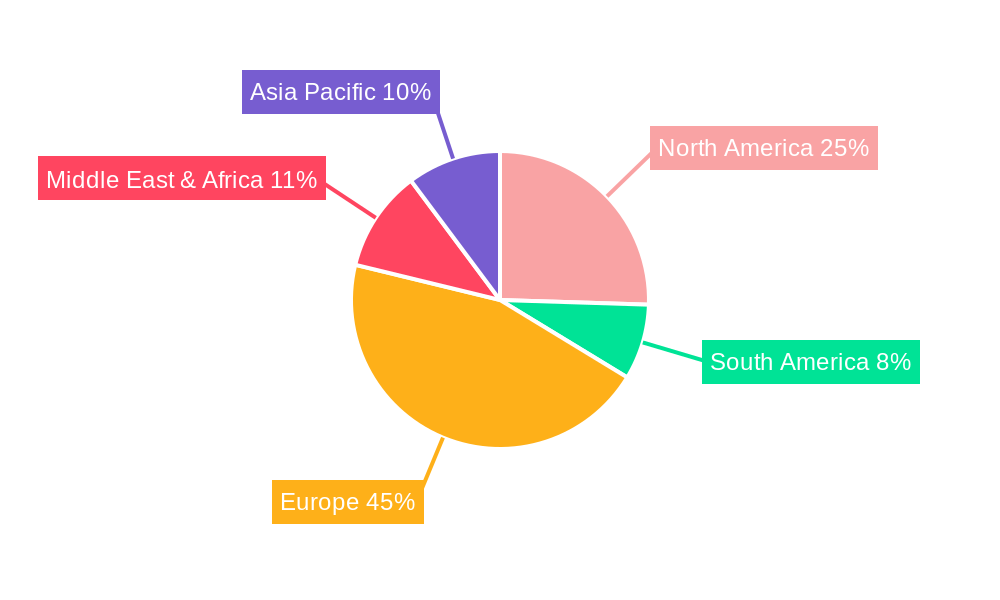

UK Critical Infrastructure Protection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Critical Infrastructure Protection Industry Regional Market Share

Geographic Coverage of UK Critical Infrastructure Protection Industry

UK Critical Infrastructure Protection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Joint Functioning of Cloud Computing and Critical Infrastructure Protection; Political Pressures for Better Regulations and Implementation

- 3.3. Market Restrains

- 3.3.1. Poor Understanding of Industrial Control Systems; Lack of Interoperability Between Products

- 3.4. Market Trends

- 3.4.1. Risk Management Accounts for Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Security Technology

- 5.1.1. Network Security

- 5.1.2. Physical Security

- 5.1.3. Vehicle Identification Management

- 5.1.4. Building Management Systems

- 5.1.5. Secure Communications

- 5.1.6. Radars

- 5.1.7. Scada Security

- 5.1.8. CBRNE

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Risk Management Services

- 5.2.2. Designing, Integration, and Consultation

- 5.2.3. Managed Services

- 5.2.4. Maintenance and Support

- 5.3. Market Analysis, Insights and Forecast - by Vertical

- 5.3.1. Energy and Power

- 5.3.2. Transportation

- 5.3.3. Sensitive Infrastructure and Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Security Technology

- 6. North America UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Security Technology

- 6.1.1. Network Security

- 6.1.2. Physical Security

- 6.1.3. Vehicle Identification Management

- 6.1.4. Building Management Systems

- 6.1.5. Secure Communications

- 6.1.6. Radars

- 6.1.7. Scada Security

- 6.1.8. CBRNE

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Risk Management Services

- 6.2.2. Designing, Integration, and Consultation

- 6.2.3. Managed Services

- 6.2.4. Maintenance and Support

- 6.3. Market Analysis, Insights and Forecast - by Vertical

- 6.3.1. Energy and Power

- 6.3.2. Transportation

- 6.3.3. Sensitive Infrastructure and Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Security Technology

- 7. South America UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Security Technology

- 7.1.1. Network Security

- 7.1.2. Physical Security

- 7.1.3. Vehicle Identification Management

- 7.1.4. Building Management Systems

- 7.1.5. Secure Communications

- 7.1.6. Radars

- 7.1.7. Scada Security

- 7.1.8. CBRNE

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Risk Management Services

- 7.2.2. Designing, Integration, and Consultation

- 7.2.3. Managed Services

- 7.2.4. Maintenance and Support

- 7.3. Market Analysis, Insights and Forecast - by Vertical

- 7.3.1. Energy and Power

- 7.3.2. Transportation

- 7.3.3. Sensitive Infrastructure and Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Security Technology

- 8. Europe UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Security Technology

- 8.1.1. Network Security

- 8.1.2. Physical Security

- 8.1.3. Vehicle Identification Management

- 8.1.4. Building Management Systems

- 8.1.5. Secure Communications

- 8.1.6. Radars

- 8.1.7. Scada Security

- 8.1.8. CBRNE

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Risk Management Services

- 8.2.2. Designing, Integration, and Consultation

- 8.2.3. Managed Services

- 8.2.4. Maintenance and Support

- 8.3. Market Analysis, Insights and Forecast - by Vertical

- 8.3.1. Energy and Power

- 8.3.2. Transportation

- 8.3.3. Sensitive Infrastructure and Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Security Technology

- 9. Middle East & Africa UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Security Technology

- 9.1.1. Network Security

- 9.1.2. Physical Security

- 9.1.3. Vehicle Identification Management

- 9.1.4. Building Management Systems

- 9.1.5. Secure Communications

- 9.1.6. Radars

- 9.1.7. Scada Security

- 9.1.8. CBRNE

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Risk Management Services

- 9.2.2. Designing, Integration, and Consultation

- 9.2.3. Managed Services

- 9.2.4. Maintenance and Support

- 9.3. Market Analysis, Insights and Forecast - by Vertical

- 9.3.1. Energy and Power

- 9.3.2. Transportation

- 9.3.3. Sensitive Infrastructure and Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Security Technology

- 10. Asia Pacific UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Security Technology

- 10.1.1. Network Security

- 10.1.2. Physical Security

- 10.1.3. Vehicle Identification Management

- 10.1.4. Building Management Systems

- 10.1.5. Secure Communications

- 10.1.6. Radars

- 10.1.7. Scada Security

- 10.1.8. CBRNE

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Risk Management Services

- 10.2.2. Designing, Integration, and Consultation

- 10.2.3. Managed Services

- 10.2.4. Maintenance and Support

- 10.3. Market Analysis, Insights and Forecast - by Vertical

- 10.3.1. Energy and Power

- 10.3.2. Transportation

- 10.3.3. Sensitive Infrastructure and Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Security Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silobreaker Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Acuity Risk Management Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BT Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wandera Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vision Security Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sophos Group PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wilson James Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Advance Security (United Kingdom) Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 G4S PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Silobreaker Limited

List of Figures

- Figure 1: Global UK Critical Infrastructure Protection Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 3: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 4: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 5: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 7: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 8: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 11: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 12: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 13: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 15: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 16: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 19: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 20: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 21: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 23: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 24: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 27: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 28: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 29: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 31: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 32: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 35: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 36: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 37: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 38: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 39: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 40: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 2: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 4: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 6: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 7: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 8: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 13: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 15: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 20: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 21: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 22: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 33: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 35: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 43: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 44: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 45: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Critical Infrastructure Protection Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the UK Critical Infrastructure Protection Industry?

Key companies in the market include Silobreaker Limited, Acuity Risk Management Limited, BT Group, Wandera Ltd, BAE Systems PLC, Vision Security Group Ltd, Sophos Group PLC, Wilson James Ltd, Advance Security (United Kingdom) Limited, G4S PLC.

3. What are the main segments of the UK Critical Infrastructure Protection Industry?

The market segments include Security Technology, Service, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 152 billion as of 2022.

5. What are some drivers contributing to market growth?

; Joint Functioning of Cloud Computing and Critical Infrastructure Protection; Political Pressures for Better Regulations and Implementation.

6. What are the notable trends driving market growth?

Risk Management Accounts for Significant Share.

7. Are there any restraints impacting market growth?

Poor Understanding of Industrial Control Systems; Lack of Interoperability Between Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Critical Infrastructure Protection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Critical Infrastructure Protection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Critical Infrastructure Protection Industry?

To stay informed about further developments, trends, and reports in the UK Critical Infrastructure Protection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence