Key Insights

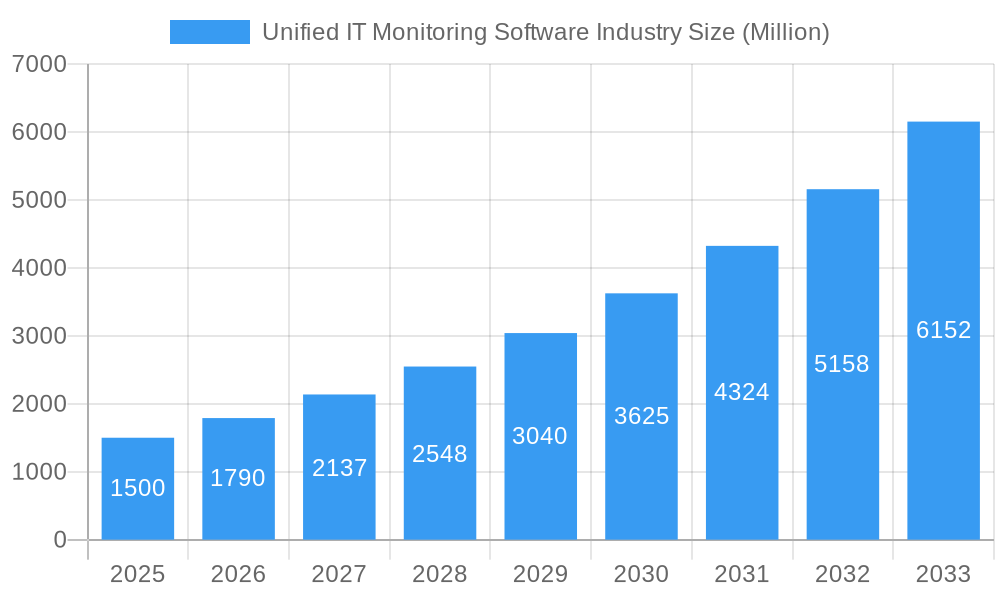

The Unified IT Monitoring Software industry is poised for significant expansion, projecting a substantial market size of approximately $1,500 million in 2025 and a remarkable Compound Annual Growth Rate (CAGR) of 19.56% through 2033. This robust growth is fueled by the increasing complexity of IT infrastructures and the critical need for comprehensive visibility and control across diverse environments. Organizations are heavily investing in solutions that can consolidate monitoring of networks, applications, servers, cloud services, and end-user experience, driven by the imperative to enhance performance, ensure uptime, and proactively address potential issues. The shift towards cloud adoption, hybrid environments, and the proliferation of IoT devices further amplifies the demand for unified monitoring capabilities that can seamlessly manage and analyze data from disparate sources.

Unified IT Monitoring Software Industry Market Size (In Billion)

Key growth drivers include the escalating volume of data generated by IT systems, the imperative for real-time performance analysis and anomaly detection, and the growing adoption of AI and machine learning for predictive insights. The BFSI, Healthcare and Life Sciences, and IT & Telecommunication sectors are leading this adoption due to stringent compliance requirements and the high stakes associated with system availability and data integrity. While the market benefits from the adoption of advanced solutions like AI-powered analytics and automation, potential restraints might emerge from budget constraints in smaller enterprises or the initial integration challenges associated with complex legacy systems. Leading companies such as Broadcom Inc., Dynatrace LLC, and AppDynamics Inc. are at the forefront, offering sophisticated solutions that address these evolving market demands.

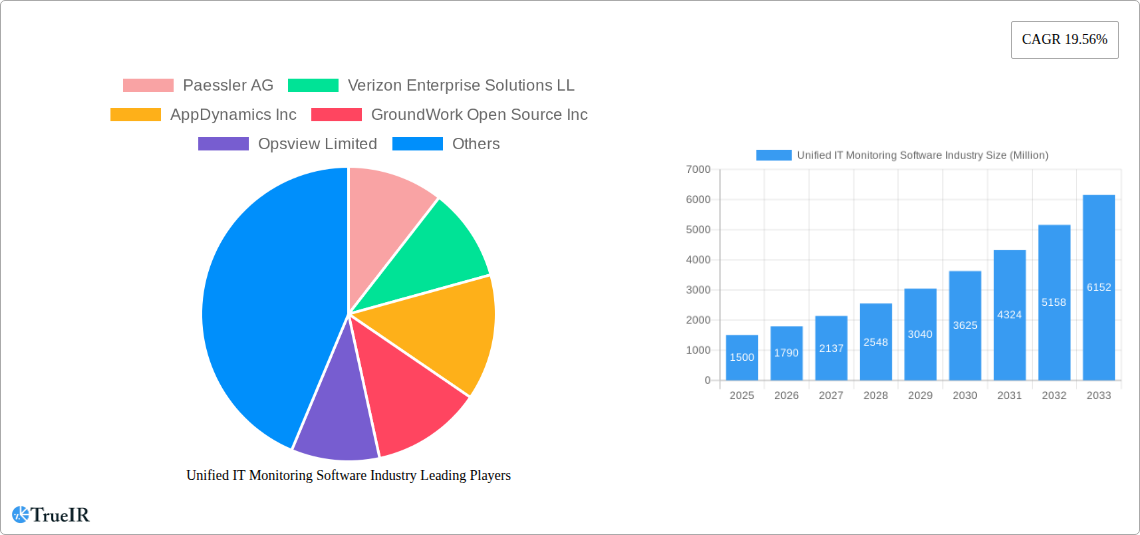

Unified IT Monitoring Software Industry Company Market Share

This comprehensive report delves into the Unified IT Monitoring Software industry, offering an in-depth analysis of market structure, key trends, dominant segments, and future outlook. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report leverages high-volume SEO keywords to provide actionable insights for industry stakeholders. We meticulously analyze critical aspects including market size, competitive landscape, technological advancements, and strategic opportunities, ensuring unparalleled clarity and depth.

Unified IT Monitoring Software Industry Market Structure & Competitive Landscape

The Unified IT Monitoring Software market exhibits a dynamic and evolving competitive landscape characterized by a moderate to high level of market concentration. Key innovation drivers include the escalating complexity of IT infrastructures, the pervasive adoption of cloud technologies, and the increasing demand for proactive issue resolution and enhanced performance observability. Regulatory impacts, while not overtly stringent, are subtly shaping the market by emphasizing data security and compliance mandates, particularly within sensitive verticals like BFSI and Healthcare. Product substitutes, though present in specialized monitoring tools, are increasingly being consolidated under unified platforms. End-user segmentation is robust, with IT & Telecommunication, BFSI, and Manufacturing emerging as significant adopters. Mergers and Acquisitions (M&A) trends are actively shaping the market, with larger players acquiring innovative startups to expand their feature sets and market reach. For instance, an estimated 50-70 M&A deals have been observed in the past five years, indicating a strong consolidation drive. Concentration ratios in the top 5 players are estimated to be around 65-75%, highlighting their significant market influence. Key players like Broadcom Inc. and Juniper Networks Inc. are at the forefront of this consolidation, driving innovation and expanding their portfolios to capture a larger market share. The ongoing digital transformation across all sectors fuels the demand for robust and integrated IT monitoring solutions, further intensifying competition and spurring innovation.

Unified IT Monitoring Software Industry Market Trends & Opportunities

The Unified IT Monitoring Software market is poised for substantial growth, projected to reach a market size of over $10 Billion by 2033. This expansion is driven by a confluence of factors, including the relentless digital transformation across industries, the increasing adoption of hybrid and multi-cloud environments, and the growing imperative for real-time performance insights and proactive issue resolution. The Compound Annual Growth Rate (CAGR) is estimated to be in the range of 15-20% during the forecast period. Technological shifts are fundamentally reshaping the market, with a pronounced move towards AI-driven analytics, machine learning for anomaly detection, and AIOps (Artificial Intelligence for IT Operations) becoming standard features. The demand for integrated observability platforms, capable of correlating data from disparate sources – encompassing networks, applications, and infrastructure – is surging. Consumer preferences are leaning towards simplified, user-friendly interfaces, robust automation capabilities, and seamless integration with existing IT ecosystems. Competitive dynamics are intensifying, with established players investing heavily in R&D to incorporate advanced analytics and machine learning, while agile startups are disrupting the market with niche, cloud-native solutions. The rise of remote work and the distributed workforce further amplifies the need for comprehensive network performance monitoring and application availability, creating significant opportunities for providers offering solutions that ensure seamless user experiences regardless of location. The market penetration rate for advanced unified IT monitoring solutions is currently estimated at around 40-50%, indicating substantial untapped potential. Emerging trends like edge computing and the Internet of Things (IoT) will also create new avenues for growth, demanding specialized monitoring capabilities that can handle massive data volumes and complex interdependencies. The increasing adoption of DevOps and agile methodologies necessitates continuous integration and delivery pipelines, which in turn require robust monitoring to ensure stability and performance, thus further fueling market expansion.

Dominant Markets & Segments in Unified IT Monitoring Software Industry

The IT & Telecommunication vertical stands as the dominant end-user segment within the Unified IT Monitoring Software industry, driven by the inherent complexity and constant evolution of their infrastructure. This segment alone accounts for an estimated 25-30% of the global market share. The BFSI sector follows closely, with a significant demand for robust security and compliance monitoring, contributing approximately 20-25% to the market.

Key Growth Drivers in IT & Telecommunication:

- The proliferation of 5G networks, cloud services, and the continuous expansion of data centers necessitate advanced monitoring capabilities for optimal performance and uptime.

- Increasingly complex network architectures and the growing reliance on software-defined networking (SDN) require sophisticated tools for visibility and management.

- The need to ensure high availability and low latency for critical communication services.

Key Growth Drivers in BFSI:

- Stringent regulatory compliance requirements (e.g., GDPR, PCI DSS) demand comprehensive audit trails and security monitoring.

- The increasing adoption of digital banking platforms and online financial services necessitates constant application performance monitoring.

- The imperative to prevent fraudulent activities and ensure the integrity of financial transactions.

Deployment Models: The Cloud deployment model is rapidly gaining traction, projected to capture over 60% of the market by 2033. This is largely attributed to the scalability, flexibility, and cost-effectiveness offered by cloud-based solutions. However, On-Premise deployments remain relevant, particularly for organizations with specific data sovereignty concerns or legacy infrastructure, holding an estimated 35-40% market share.

- Key Growth Drivers for Cloud Deployment:

- Reduced capital expenditure and predictable operational costs.

- Faster deployment times and easier scalability to meet fluctuating demands.

- Automatic updates and maintenance handled by the service provider.

Component Segmentation: The Solution component, encompassing the core monitoring software functionalities, is the largest segment, accounting for approximately 70-75% of the market. Services, including implementation, consulting, and managed services, represent the remaining 25-30%, highlighting the crucial role of expert support in maximizing the value of these complex platforms.

Unified IT Monitoring Software Industry Product Analysis

Unified IT Monitoring Software is revolutionizing IT operations by providing a consolidated view of application, network, and infrastructure performance. Product innovations are increasingly focused on leveraging Artificial Intelligence (AI) and Machine Learning (ML) for proactive anomaly detection, predictive analytics, and automated root cause analysis. Competitive advantages are being derived from seamless integration capabilities with diverse IT environments (cloud, on-premise, hybrid), user-friendly interfaces, and robust reporting dashboards. Key technological advancements include agentless monitoring solutions, enhanced observability for containerized environments (e.g., Kubernetes), and deeper insights into user experience. Market fit is increasingly defined by the ability of these solutions to reduce Mean Time To Resolution (MTTR) and improve overall IT service availability, thereby directly impacting business productivity and customer satisfaction.

Key Drivers, Barriers & Challenges in Unified IT Monitoring Software Industry

Key Drivers: The relentless surge in data volumes and the increasing complexity of modern IT infrastructures are paramount drivers for the Unified IT Monitoring Software industry. The accelerating adoption of cloud computing, microservices, and IoT devices necessitates sophisticated tools to maintain visibility and performance. Furthermore, the growing emphasis on digital transformation initiatives across all business sectors fuels the demand for robust IT monitoring to ensure seamless operations and optimal user experiences.

Barriers & Challenges: Significant challenges include the steep learning curve associated with advanced monitoring platforms and the high initial implementation costs, which can deter smaller organizations. Data security and privacy concerns, especially with cloud-based solutions, pose a considerable restraint. Furthermore, vendor lock-in and the interoperability issues between different monitoring tools can create integration complexities. Supply chain issues, while less direct, can impact hardware availability for on-premise deployments. The ongoing digital transformation, while a driver, also presents a challenge in keeping monitoring solutions up-to-date with rapidly evolving technologies. The competitive pressure to offer comprehensive features at competitive price points also creates a significant challenge for vendors.

Growth Drivers in the Unified IT Monitoring Software Industry Market

The accelerating adoption of cloud-native architectures and microservices is a primary growth catalyst, demanding advanced monitoring for dynamic and distributed environments. The increasing complexity of IT infrastructures, fueled by digital transformation initiatives, necessitates comprehensive visibility to ensure application performance and business continuity. The growing prevalence of remote work and hybrid work models further amplifies the need for real-time network and application performance monitoring to guarantee seamless user experiences. Government initiatives promoting digitalization and cybersecurity best practices also indirectly support market growth by emphasizing the importance of robust IT infrastructure management.

Challenges Impacting Unified IT Monitoring Software Industry Growth

The primary challenges impacting the Unified IT Monitoring Software industry growth include the complexity of integrating disparate monitoring tools and data sources, leading to potential data silos. The high cost of advanced solutions and the requirement for skilled IT professionals to manage them can be prohibitive for some organizations. Furthermore, evolving cybersecurity threats necessitate continuous updates and robust security features within monitoring platforms, adding to development costs and complexity. Regulatory compliance, while a driver, also presents challenges in ensuring that monitoring solutions meet the specific requirements of various industries and geographies. The constant pace of technological change requires vendors to continuously innovate, posing a significant R&D challenge.

Key Players Shaping the Unified IT Monitoring Software Industry Market

- Paessler AG

- Verizon Enterprise Solutions LL

- AppDynamics Inc

- GroundWork Open Source Inc

- Opsview Limited

- Broadcom Inc

- Juniper Networks Inc

- Zenoss Inc

- Zoho Corporation

- Acronis International GmbH

- Dynatrace LLC

Significant Unified IT Monitoring Software Industry Industry Milestones

- July 2022: New Relic Launches Agentless Monitoring for SAP® Solutions, the industry's first native observability solution delivered agentless for enterprises running critical business processes on SAP systems. The solution empowers IT teams to better support business operations by harnessing existing SAP data sources to access all necessary telemetry data. It also avoids installing intrusive monitoring agents in SAP production servers or relying on third-party connectors.

- September 2022: Riverbed Launches First Cloud Service As Part Of Unified Observability Push in Cloud-native SaaS service Alluvio IQ. It will inject more automation and visibility into the increasingly complex network, including remote and hybrid work environments, to help free up IT teams to work on more strategic IT initiatives when IT resources are being stretched thin.

Future Outlook for Unified IT Monitoring Software Industry Market

The future outlook for the Unified IT Monitoring Software industry is exceptionally promising, driven by the sustained digital transformation and the escalating demand for resilient and high-performing IT systems. The increasing integration of AI and machine learning will unlock predictive capabilities, enabling organizations to anticipate and resolve issues before they impact end-users. The expansion of cloud and hybrid cloud environments will continue to fuel the adoption of cloud-native monitoring solutions. Emerging technologies such as edge computing and the Internet of Things (IoT) will present new frontiers for market growth, requiring specialized and scalable monitoring solutions. Strategic opportunities lie in developing more integrated, automated, and user-centric platforms that can seamlessly adapt to the ever-evolving IT landscape. The market is projected to witness significant innovation in observability, aiming to provide end-to-end visibility across complex, distributed systems, thereby fostering greater operational efficiency and business agility.

Unified IT Monitoring Software Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Healthcare and Life Sciences

- 3.3. Manufacturing

- 3.4. IT & Telecommunication

- 3.5. Retail

- 3.6. Other End-user Vertical

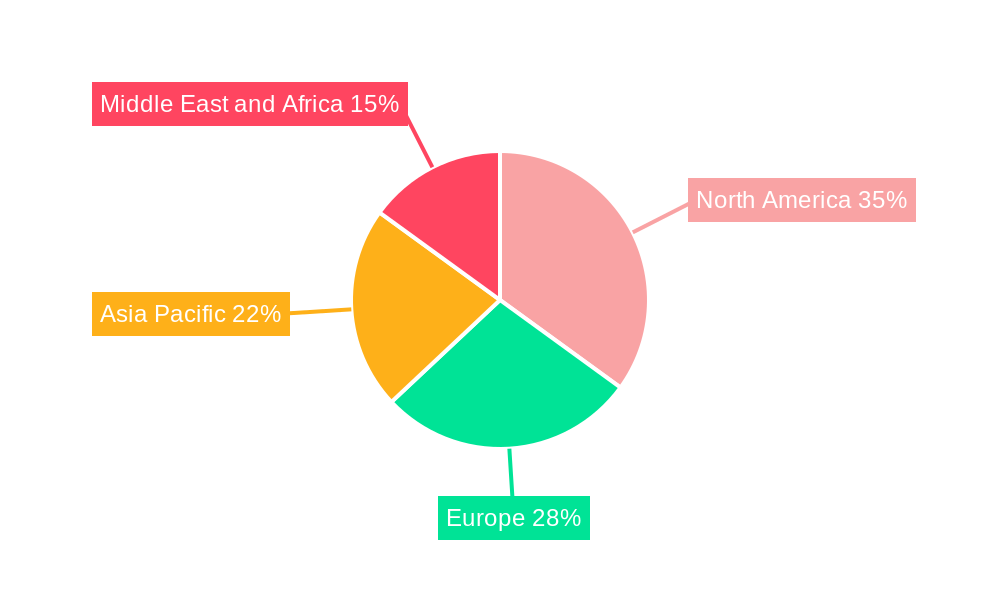

Unified IT Monitoring Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

Unified IT Monitoring Software Industry Regional Market Share

Geographic Coverage of Unified IT Monitoring Software Industry

Unified IT Monitoring Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. BFSI Sector Will Experience Significant Growth and Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Healthcare and Life Sciences

- 5.3.3. Manufacturing

- 5.3.4. IT & Telecommunication

- 5.3.5. Retail

- 5.3.6. Other End-user Vertical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Healthcare and Life Sciences

- 6.3.3. Manufacturing

- 6.3.4. IT & Telecommunication

- 6.3.5. Retail

- 6.3.6. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Healthcare and Life Sciences

- 7.3.3. Manufacturing

- 7.3.4. IT & Telecommunication

- 7.3.5. Retail

- 7.3.6. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Healthcare and Life Sciences

- 8.3.3. Manufacturing

- 8.3.4. IT & Telecommunication

- 8.3.5. Retail

- 8.3.6. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Healthcare and Life Sciences

- 9.3.3. Manufacturing

- 9.3.4. IT & Telecommunication

- 9.3.5. Retail

- 9.3.6. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Middle East and Africa Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Paessler AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Verizon Enterprise Solutions LL

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 AppDynamics Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 GroundWork Open Source Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Opsview Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Broadcom Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Juniper Networks Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Zenoss Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Zoho Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Acronis International GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Dynatrace LLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Paessler AG

List of Figures

- Figure 1: Global Unified IT Monitoring Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Unified IT Monitoring Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: North America Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: North America Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 13: North America Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: North America Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: North America Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: North America Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Unified IT Monitoring Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Europe Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Europe Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Europe Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Europe Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 16: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 23: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 24: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 25: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unified IT Monitoring Software Industry?

The projected CAGR is approximately 19.56%.

2. Which companies are prominent players in the Unified IT Monitoring Software Industry?

Key companies in the market include Paessler AG, Verizon Enterprise Solutions LL, AppDynamics Inc, GroundWork Open Source Inc, Opsview Limited, Broadcom Inc, Juniper Networks Inc, Zenoss Inc, Zoho Corporation, Acronis International GmbH, Dynatrace LLC.

3. What are the main segments of the Unified IT Monitoring Software Industry?

The market segments include Component, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations.

6. What are the notable trends driving market growth?

BFSI Sector Will Experience Significant Growth and Drive the Market.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

July 2022 - New Relic Launches Agentless Monitoring for SAP® Solutions, the industry's first native observability solution delivered agentless for enterprises running critical business processes on SAP systems. The solution empowers IT teams to better support business operations by harnessing existing SAP data sources to access all necessary telemetry data. It also avoids installing intrusive monitoring agents in SAP production servers or relying on third-party connectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unified IT Monitoring Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unified IT Monitoring Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unified IT Monitoring Software Industry?

To stay informed about further developments, trends, and reports in the Unified IT Monitoring Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence