Key Insights

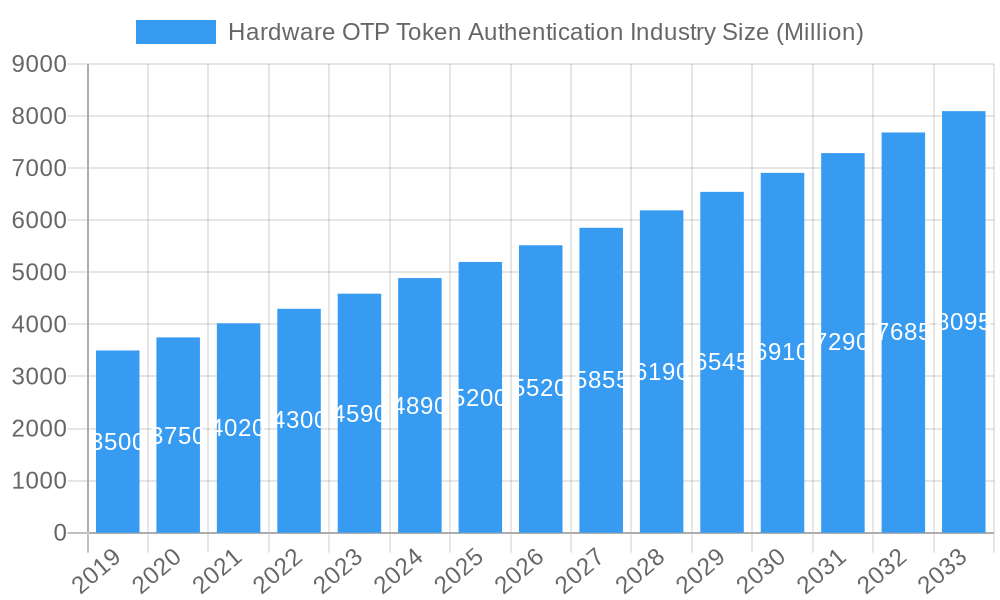

The Hardware OTP Token Authentication market is poised for robust expansion, projected to reach an estimated USD 5,875 Million in 2025 and grow at a compound annual growth rate (CAGR) of 7.50% through 2033. This significant market valuation is fueled by the escalating need for robust and secure identity verification solutions across a multitude of industries. The increasing sophistication of cyber threats and the constant drive for data protection are compelling organizations to adopt multi-factor authentication (MFA) methods, with hardware OTP tokens serving as a cornerstone for secure access. The drivers behind this growth include the pervasive adoption of digital transformation initiatives, the heightened regulatory compliance mandates (such as GDPR, HIPAA, and PCI DSS) necessitating strong authentication, and the growing trend of remote workforces demanding secure access to corporate networks from anywhere. Furthermore, the inherent reliability and resistance of hardware tokens to phishing attacks compared to software-based solutions position them favorably in the market.

Hardware OTP Token Authentication Industry Market Size (In Billion)

The market segmentation reveals diverse application landscapes. The Connected token segment is anticipated to witness substantial growth, driven by the integration of these devices with cloud-based platforms and IoT ecosystems, offering enhanced management and real-time verification capabilities. The Banking, Financial Services & Insurance (BFSI) sector remains a dominant end-user industry, leveraging hardware OTP tokens for secure online banking, transaction authorization, and fraud prevention. However, significant growth opportunities are also emerging in Government sectors for secure citizen identification and access to sensitive data, Enterprise Security for privileged access management and network security, and Healthcare for safeguarding patient records and enabling secure access for medical professionals. While the market is experiencing strong upward momentum, certain restraints such as the initial hardware procurement costs and the need for robust user training and management infrastructure could pose challenges. Nevertheless, the inherent security advantages and the expanding use cases continue to propel the hardware OTP token authentication market forward.

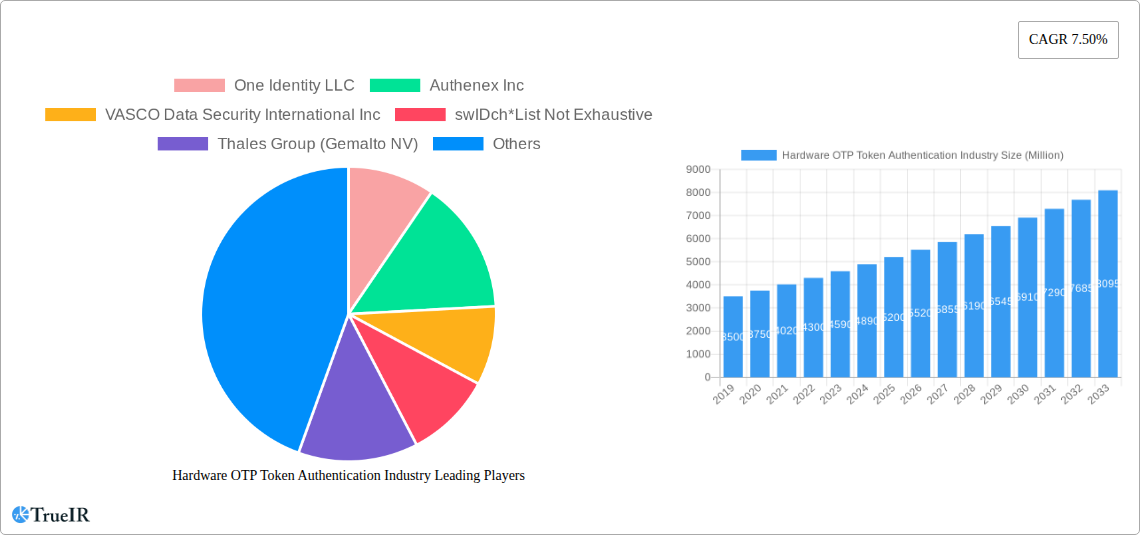

Hardware OTP Token Authentication Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the Hardware OTP Token Authentication Industry, designed for maximum impact and immediate use:

Report Title: Hardware OTP Token Authentication Industry Market Analysis: Size, Trends, Opportunities, and Forecast 2019–2033

Report Description:

Gain unparalleled insights into the Hardware OTP Token Authentication Industry, a critical sector for secure digital access. This comprehensive report delves into the market's intricate structure, competitive landscape, and future trajectory from 2019 to 2033, with a robust forecast period of 2025–2033. Leveraging high-volume keywords such as "hardware OTP token," "multi-factor authentication," "MFA solutions," "token authentication," "enterprise security," "BFSI security," and "government authentication," this analysis is meticulously crafted for industry professionals, cybersecurity experts, and strategic planners. Understand the driving forces, evolving trends, dominant market segments, and key players shaping the future of secure authentication. The report identifies significant industry developments, including swIDch's Tap-OTAC solution and Telesign's Silent Verification, highlighting innovations that are redefining user authentication and meeting stringent regulatory demands like PSD2 SCA and FTC's Safeguards Rule.

Key Deliverables:

- Market Size and Growth Projections: Detailed quantitative analysis of market value in millions, with base year 2025 and forecast to 2033.

- Segmentation Analysis: In-depth exploration of Type (Connected, Disconnected, Contactless) and End-user Industries (Banking, Financial Services & Insurance (BFSI), Government, Enterprise Security, Healthcare, Others).

- Competitive Intelligence: Comprehensive overview of key players, their strategies, and market concentration.

- Trend Identification: Analysis of evolving consumer preferences, technological advancements, and regulatory impacts.

- Opportunity Mapping: Identification of emerging market opportunities and strategic growth avenues.

Hardware OTP Token Authentication Industry Market Structure & Competitive Landscape

The Hardware OTP Token Authentication Industry exhibits a moderately concentrated market structure, driven by increasing demand for robust cybersecurity solutions across all sectors. Key innovation drivers include the continuous evolution of cyber threats, the need for seamless Multi-Factor Authentication (MFA), and the growing adoption of advanced encryption technologies. Regulatory impacts, such as PSD2 SCA in Europe and the FTC's Safeguards Rule in the United States, are profoundly shaping market dynamics by mandating stronger authentication protocols. Product substitutes, while present in the form of software-based OTPs and biometrics, are increasingly finding their niche against hardware tokens which offer unparalleled security against phishing and man-in-the-middle attacks. End-user segmentation reveals a strong preference for hardware OTPs in high-security environments. Mergers and Acquisitions (M&A) trends are notable as larger security firms aim to integrate comprehensive authentication portfolios, with an estimated 15-20 M&A deals occurring annually within the broader cybersecurity authentication space. Concentration ratios (CR4) are estimated to be around 50-60%, indicating the significant market share held by the top four players.

- Innovation Drivers:

- Rising sophisticated cyberattacks.

- Mandates for Strong Customer Authentication (SCA).

- Development of tamper-proof hardware.

- Integration with cloud-based security platforms.

- Regulatory Impacts:

- PSD2 SCA: Drives adoption in European financial institutions.

- FTC Safeguards Rule: Increases demand for secure authentication in the US.

- GDPR: Reinforces the need for data protection through robust authentication.

- M&A Trends:

- Consolidation of authentication portfolios.

- Acquisition of innovative technologies.

- Expansion into new geographic markets.

Hardware OTP Token Authentication Industry Market Trends & Opportunities

The Hardware OTP Token Authentication Industry is experiencing substantial growth, driven by the escalating global need for secure and reliable digital identity verification. The market size is projected to reach hundreds of millions of dollars, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period. Technological shifts are central to this expansion, with a significant trend towards integrating hardware OTP tokens with mobile devices and cloud-based identity management systems. This convergence enhances user convenience without compromising security, a key factor in addressing evolving consumer preferences for frictionless yet secure authentication experiences. Competitive dynamics are intensifying, with companies focusing on differentiating their offerings through advanced features, enhanced usability, and cost-effectiveness for large-scale deployments. The market penetration rate for hardware OTP tokens in enterprise and financial sectors is steadily increasing, projected to exceed 60% within the next decade. Opportunities abound in developing next-generation OTP tokens that offer enhanced biometric integration, longer battery life, and more sophisticated anti-tampering mechanisms. The rise of the Internet of Things (IoT) also presents a nascent but significant opportunity for secure device authentication using hardware OTPs. Furthermore, the increasing adoption of remote work models globally necessitates stronger endpoint security, directly benefiting the hardware OTP token market. The push for Zero Trust architectures across enterprises further solidifies the role of hardware-based authentication as a primary security control. The demand for compliance with evolving data privacy regulations worldwide will continue to fuel the adoption of robust authentication methods, making hardware OTP tokens an indispensable component of modern security strategies. The integration of hardware OTPs with blockchain technology for secure transaction signing and identity verification is another promising area for future growth.

Dominant Markets & Segments in Hardware OTP Token Authentication Industry

The Banking, Financial Services & Insurance (BFSI) sector emerges as the dominant end-user industry in the Hardware OTP Token Authentication Industry, driven by stringent regulatory requirements and the critical need to protect sensitive financial data from fraud and unauthorized access. The introduction of regulations like PSD2 Strong Customer Authentication (SCA) has been a significant catalyst, compelling financial institutions to implement robust MFA solutions, with hardware OTP tokens being a preferred choice for their high security. Following closely is the Government sector, which increasingly relies on hardware OTPs for secure access to critical infrastructure, classified information, and citizen services, particularly in defense, public administration, and law enforcement.

The Enterprise Security segment is also a major contributor, with businesses of all sizes adopting hardware OTPs to secure remote access, protect corporate networks, and comply with internal security policies and external data protection laws. The rise of cyber threats targeting corporate data and intellectual property makes hardware OTPs a crucial investment for maintaining business continuity and reputation. The Healthcare industry, dealing with sensitive patient data (PHI), is another significant segment that is increasingly adopting hardware OTPs to comply with regulations such as HIPAA and to prevent data breaches.

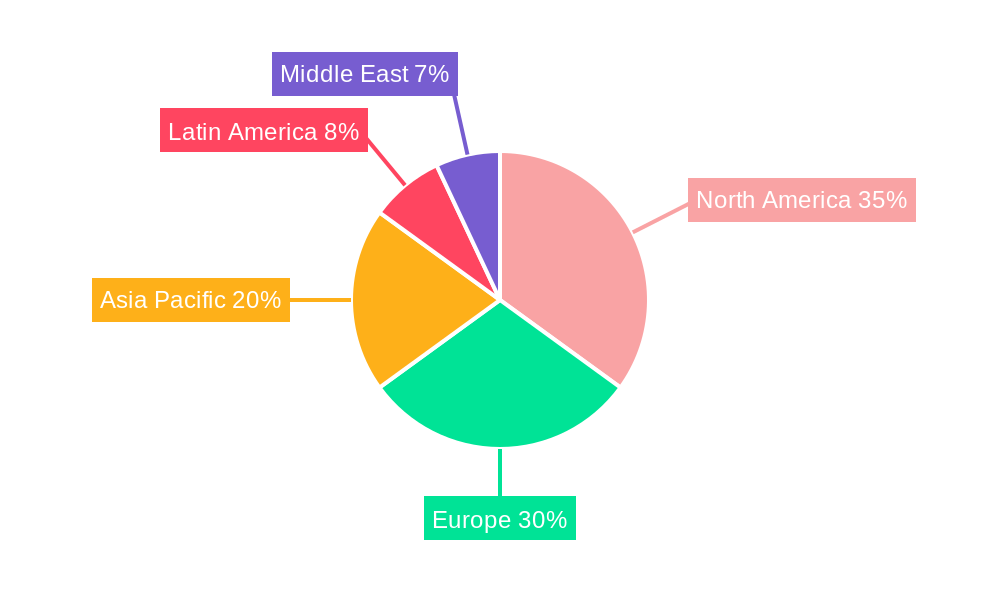

Geographically, North America and Europe currently dominate the market due to their mature regulatory frameworks, high cybersecurity spending, and established presence of key market players. However, the Asia-Pacific region is expected to witness the fastest growth due to rapid digital transformation, increasing internet penetration, and a growing awareness of cybersecurity threats among businesses and consumers. Within the Type segmentation, Connected hardware OTP tokens, which can communicate wirelessly with authentication servers, are gaining traction due to their convenience and real-time validation capabilities. However, Disconnected tokens, which generate OTPs independently, still hold a strong position in highly air-gapped or offline environments where network connectivity is a concern. Contactless OTP tokens, often integrated into smart cards or NFC-enabled devices, are emerging as a convenient option for physical access control and transaction authentication.

- Key Growth Drivers in Dominant Segments:

- BFSI: PSD2 SCA, PCI DSS compliance, fraud prevention mandates.

- Government: National security initiatives, e-governance adoption, citizen data protection.

- Enterprise Security: Remote work security needs, data breach prevention, compliance with industry standards.

- Healthcare: HIPAA compliance, safeguarding sensitive patient information, secure access to EMRs.

- Market Dominance Factors:

- Regulatory Compliance: Strict mandates requiring high levels of authentication.

- High Value of Data: Protection of financially sensitive and personal information.

- Cybersecurity Maturity: Advanced threat landscape necessitating robust solutions.

- Technological Adoption: Willingness to invest in cutting-edge security technologies.

Hardware OTP Token Authentication Industry Product Analysis

Hardware OTP token authentication solutions are characterized by their robust security and reliability. Products range from simple, single-button devices to advanced smart card-integrated tokens and USB security keys. Innovations are focused on enhancing user experience through features like simplified activation, longer battery life, and integration with mobile ecosystems. Competitive advantages lie in their resistance to sophisticated cyberattacks like phishing and man-in-the-middle attacks, offering a tangible security layer that software-based solutions may struggle to match. The application of these tokens spans across critical sectors, from securing banking transactions and enterprise network access to protecting government classified information and healthcare records.

Key Drivers, Barriers & Challenges in Hardware OTP Token Authentication Industry

The Hardware OTP Token Authentication Industry is propelled by several key drivers. Foremost is the escalating sophistication and frequency of cyber threats, necessitating stronger authentication mechanisms than simple passwords. Regulatory mandates globally, such as PSD2 SCA and FTC Safeguards Rule, are significant drivers, compelling organizations to adopt multi-factor authentication, with hardware OTPs offering a high assurance level. The increasing adoption of remote work and BYOD (Bring Your Own Device) policies further amplifies the need for secure remote access, where hardware tokens provide a reliable solution.

Conversely, the industry faces several barriers and challenges. The initial cost of hardware tokens and their deployment can be a significant barrier for small and medium-sized enterprises (SMEs). The perceived inconvenience of carrying and managing separate physical tokens by end-users can also hinder adoption, although this is being mitigated by integration with mobile devices. Supply chain disruptions, as experienced globally, can impact the availability and cost of manufacturing these devices. Competition from evolving software-based authentication methods, which often offer lower upfront costs, presents a constant challenge. Furthermore, the complexity of managing and provisioning large fleets of hardware tokens requires robust IT infrastructure and expertise, posing a challenge for some organizations.

Growth Drivers in the Hardware OTP Token Authentication Industry Market

The primary growth drivers for the Hardware OTP Token Authentication Industry are the escalating global cyber threat landscape, compelling organizations to adopt more secure authentication methods beyond passwords. Stringent regulatory compliance requirements, such as PSD2 SCA and the FTC's Safeguards Rule, are powerful mandates driving the adoption of multi-factor authentication, where hardware OTP tokens excel in providing high assurance. The persistent trend of remote work and the expanding attack surface it creates necessitate robust endpoint security, a role perfectly filled by hardware OTPs for secure remote access. Furthermore, the increasing value of digital assets and sensitive data across industries makes robust, hardware-based security an indispensable investment.

Challenges Impacting Hardware OTP Token Authentication Industry Growth

Several challenges impact the growth of the Hardware OTP Token Authentication Industry. The initial cost of purchasing and deploying hardware OTP tokens can be a significant deterrent, particularly for small and medium-sized enterprises (SMEs), making them a less accessible option compared to some software-based alternatives. End-user adoption can also be hampered by the perceived inconvenience of carrying and managing separate physical devices, despite ongoing efforts to integrate them with mobile technologies. Supply chain vulnerabilities and potential disruptions in the manufacturing and distribution of these hardware components can lead to availability issues and price volatility, impacting market stability. Competitive pressure from evolving software authentication methods that offer lower upfront costs and greater flexibility remains a constant challenge.

Key Players Shaping the Hardware OTP Token Authentication Industry Market

- One Identity LLC

- Authenex Inc

- VASCO Data Security International Inc

- swIDch

- Thales Group (Gemalto NV)

- Dell Technologies Inc

- Broadcom Inc (Symantec Corporation)

- RSA Security LLC

- SurepassID Corp

- Entrust Datacard Corporation

- Microcosm Ltd

Significant Hardware OTP Token Authentication Industry Industry Milestones

- October 2022: swIDch introduced an entirely new user authentication factor with the Tap-OTAC solution. Tap-OTAC serves as an empowering option to satisfy Multi-Factor Authentication (MFA) requirements, such as PSD2 Strong Customer Authentication (SCA) from Europe and FTC's Safeguards Rule from the United States. Moreover, the Tap-OTAC solution can be straightforwardly applied to a wide variety of smart cards, such as bank debit cards, credit cards, or even building access cards. Users benefit from both the enhanced security of hardware OTP (hardware token) and the convenience of mobile OTP.

- May 2022: Telesign, the customer identity and engagement solutions provider, released Silent Verification, a fast, frictionless, and secure mobile authentication solution to verify users. Silent Verification instantly matches the user's phone number with Mobile Network Operator data to verify the user has their device. Silent Verification delivers a safer, more seamless customer experience. Silent Verification works behind the scenes with no end-user interaction to authenticate end users.

Future Outlook for Hardware OTP Token Authentication Industry Market

The future outlook for the Hardware OTP Token Authentication Industry is exceptionally promising, fueled by an ever-intensifying global cybersecurity threat landscape and increasingly stringent regulatory mandates. Strategic opportunities lie in the deeper integration of hardware OTPs with emerging technologies such as blockchain for immutable transaction verification and with advanced biometric sensors for even more secure and convenient user authentication. The growing adoption of Zero Trust security architectures across enterprises will further solidify the essential role of hardware-based authentication. Market potential will expand as more industries, including critical infrastructure, IoT device management, and advanced manufacturing, recognize the unparalleled security and compliance benefits offered by hardware OTP solutions. Continued innovation in device form factors, power efficiency, and user experience will be critical for sustained growth and wider market penetration, ensuring hardware OTP tokens remain a cornerstone of robust digital security for years to come.

Hardware OTP Token Authentication Industry Segmentation

-

1. Type

- 1.1. Connected

- 1.2. Disconnected

- 1.3. Contactless

-

2. End-user Industry

- 2.1. Banking, Financial Services & Insurance

- 2.2. Government

- 2.3. Enterprise Security

- 2.4. Healthcare

- 2.5. Other End-user Industries

Hardware OTP Token Authentication Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Hardware OTP Token Authentication Industry Regional Market Share

Geographic Coverage of Hardware OTP Token Authentication Industry

Hardware OTP Token Authentication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Internet-based Transactions; Increasing Investments from Banking and Finance Industry

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Disconnected Hardware OTP Token Authentication to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Connected

- 5.1.2. Disconnected

- 5.1.3. Contactless

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Banking, Financial Services & Insurance

- 5.2.2. Government

- 5.2.3. Enterprise Security

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Connected

- 6.1.2. Disconnected

- 6.1.3. Contactless

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Banking, Financial Services & Insurance

- 6.2.2. Government

- 6.2.3. Enterprise Security

- 6.2.4. Healthcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Connected

- 7.1.2. Disconnected

- 7.1.3. Contactless

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Banking, Financial Services & Insurance

- 7.2.2. Government

- 7.2.3. Enterprise Security

- 7.2.4. Healthcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Connected

- 8.1.2. Disconnected

- 8.1.3. Contactless

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Banking, Financial Services & Insurance

- 8.2.2. Government

- 8.2.3. Enterprise Security

- 8.2.4. Healthcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Connected

- 9.1.2. Disconnected

- 9.1.3. Contactless

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Banking, Financial Services & Insurance

- 9.2.2. Government

- 9.2.3. Enterprise Security

- 9.2.4. Healthcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Hardware OTP Token Authentication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Connected

- 10.1.2. Disconnected

- 10.1.3. Contactless

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Banking, Financial Services & Insurance

- 10.2.2. Government

- 10.2.3. Enterprise Security

- 10.2.4. Healthcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 One Identity LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Authenex Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 VASCO Data Security International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 swIDch*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group (Gemalto NV)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dell Technologies Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Broadcom Inc (Symantec Corporation)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RSA Security LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SurepassID Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Entrust Datacard Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Microcosm Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 One Identity LLC

List of Figures

- Figure 1: Global Hardware OTP Token Authentication Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hardware OTP Token Authentication Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hardware OTP Token Authentication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hardware OTP Token Authentication Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Hardware OTP Token Authentication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Hardware OTP Token Authentication Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hardware OTP Token Authentication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hardware OTP Token Authentication Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Hardware OTP Token Authentication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Hardware OTP Token Authentication Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Hardware OTP Token Authentication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Hardware OTP Token Authentication Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hardware OTP Token Authentication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hardware OTP Token Authentication Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Hardware OTP Token Authentication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Hardware OTP Token Authentication Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Hardware OTP Token Authentication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Hardware OTP Token Authentication Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Hardware OTP Token Authentication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Hardware OTP Token Authentication Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Hardware OTP Token Authentication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Hardware OTP Token Authentication Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Hardware OTP Token Authentication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Hardware OTP Token Authentication Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Hardware OTP Token Authentication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Hardware OTP Token Authentication Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Hardware OTP Token Authentication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Hardware OTP Token Authentication Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East Hardware OTP Token Authentication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Hardware OTP Token Authentication Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Hardware OTP Token Authentication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Hardware OTP Token Authentication Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hardware OTP Token Authentication Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Hardware OTP Token Authentication Industry?

Key companies in the market include One Identity LLC, Authenex Inc, VASCO Data Security International Inc, swIDch*List Not Exhaustive, Thales Group (Gemalto NV), Dell Technologies Inc, Broadcom Inc (Symantec Corporation), RSA Security LLC, SurepassID Corp, Entrust Datacard Corporation, Microcosm Ltd.

3. What are the main segments of the Hardware OTP Token Authentication Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Internet-based Transactions; Increasing Investments from Banking and Finance Industry.

6. What are the notable trends driving market growth?

Disconnected Hardware OTP Token Authentication to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

October 2022 - swIDch introduced an entirely new user authentication factor with the Tap-OTAC solution. Tap-OTAC serves as an empowering option to satisfy Multi-Factor Authentication (MFA) requirements, such as PSD2 Strong Customer Authentication (SCA) from Europe and FTC's Safeguards Rule from the United States. Moreover, the Tap-OTAC solution can be straightforwardly applied to a wide variety of smart cards, such as bank debit cards, credit cards, or even building access cards. Users benefit from both the enhanced security of hardware OTP (hardware token) and the convenience of mobile OTP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hardware OTP Token Authentication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hardware OTP Token Authentication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hardware OTP Token Authentication Industry?

To stay informed about further developments, trends, and reports in the Hardware OTP Token Authentication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence