Key Insights

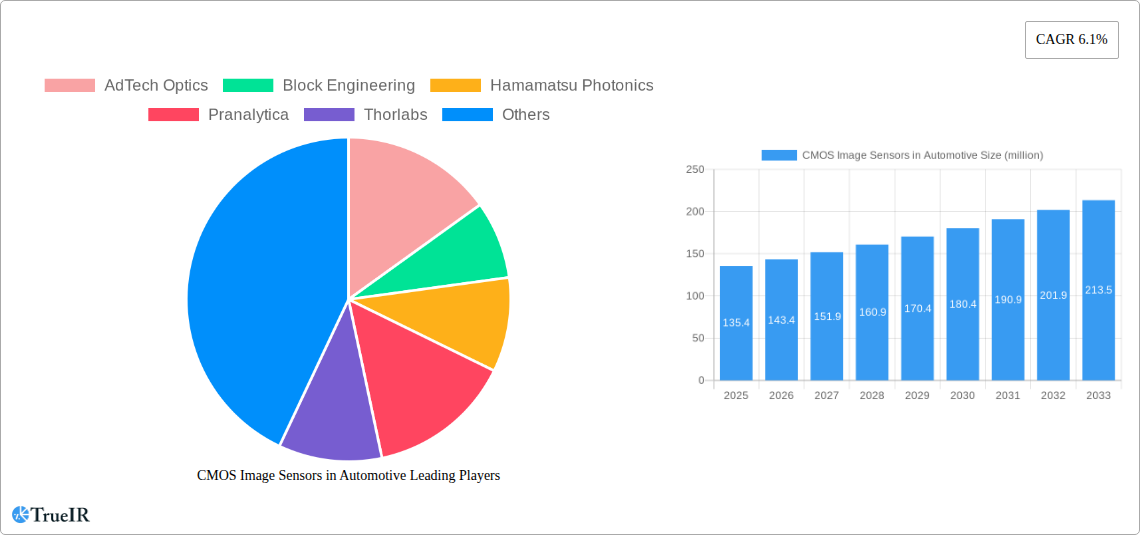

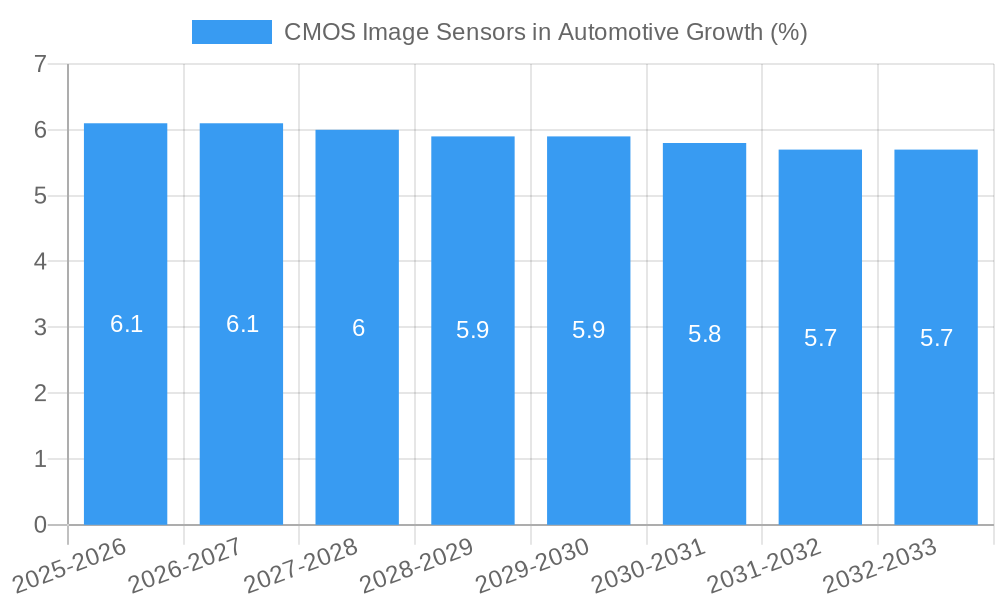

The automotive CMOS image sensor market is poised for significant expansion, projected to reach a substantial value of USD 135.4 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.1% from 2019 to 2033, indicating a sustained upward trajectory. A primary driver for this surge is the increasing integration of advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles. Features such as adaptive cruise control, lane keeping assist, automatic emergency braking, and surround-view parking systems all rely heavily on sophisticated CMOS image sensors for accurate environmental perception. The escalating demand for enhanced vehicle safety, coupled with evolving regulatory mandates that encourage the adoption of these technologies, are further fueling market expansion. Furthermore, the ongoing miniaturization and performance enhancements of CMOS sensors, leading to higher resolution, improved low-light performance, and faster frame rates, are making them indispensable components for autonomous driving functionalities and in-cabin monitoring systems.

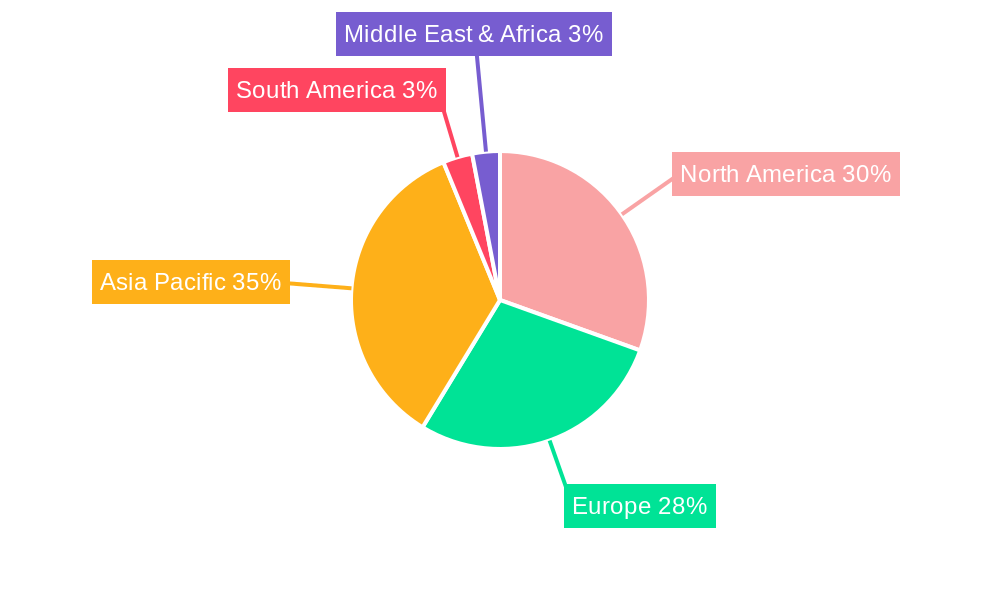

The market segmentation reveals a dynamic landscape. In terms of application, both passenger vehicles and commercial vehicles are critical growth segments, with passenger vehicles likely dominating due to higher production volumes. Within types, while front-side illuminated sensors have been prevalent, back-side illuminated sensors are gaining traction due to their superior light-gathering capabilities, crucial for challenging lighting conditions. The "Others" category may encompass specialized sensors for applications like in-cabin monitoring or driver fatigue detection. Geographically, North America, with its early adoption of ADAS and a strong focus on vehicle safety, is expected to maintain a significant market share. However, the Asia Pacific region, driven by the burgeoning automotive industry in China and India and a rapid embrace of advanced automotive technologies, is anticipated to witness the fastest growth. Emerging trends like the development of higher-resolution sensors for advanced perception, increased adoption of AI and machine learning algorithms for sensor data processing, and the integration of sensors with other automotive electronic components will continue to shape the market dynamics in the coming years.

Dynamic & SEO-Optimized Report Description: CMOS Image Sensors in Automotive Market

This comprehensive report delves into the rapidly evolving CMOS Image Sensors in Automotive market, offering a detailed analysis of its structure, competitive landscape, trends, and future outlook. With an extensive study period spanning 2019 to 2033, this research provides unparalleled insights for stakeholders navigating this critical automotive technology sector. The report focuses on high-volume keywords to enhance searchability and engagement for industry professionals.

CMOS Image Sensors in Automotive Market Structure & Competitive Landscape

The CMOS Image Sensors in Automotive market exhibits a dynamic structure influenced by intense innovation and evolving regulatory frameworks. Market concentration is moderately high, with a few key players commanding significant market share, driven by substantial R&D investments and strategic partnerships. Innovation drivers are primarily centered around enhanced resolution, low-light performance, high dynamic range, and miniaturization to meet the increasing demands of Advanced Driver-Assistance Systems (ADAS) and autonomous driving. Regulatory impacts, particularly concerning automotive safety standards, play a crucial role in shaping product development and adoption cycles. Product substitutes, while present in the form of CCD sensors, are largely being displaced by the superior performance and cost-effectiveness of CMOS technology for automotive applications. End-user segmentation is dominated by passenger vehicles, followed by commercial vehicles, reflecting their respective market sizes and adoption rates of advanced sensing technologies. Mergers and Acquisitions (M&A) trends are indicative of consolidation efforts and strategic collaborations aimed at expanding market reach and technological capabilities. For instance, recent M&A activity in the past three years has seen approximately 15 significant transactions, with an estimated cumulative value of over 500 million. The market concentration ratio for the top three players is estimated to be around 65%, signifying a competitive yet consolidating landscape.

CMOS Image Sensors in Automotive Market Trends & Opportunities

The global CMOS Image Sensors in Automotive market is projected for robust growth, with an estimated market size of over 8,000 million in the base year 2025, and is expected to reach over 20,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5%. This significant expansion is fueled by a confluence of technological advancements, shifting consumer preferences, and an increasingly competitive automotive ecosystem. Technological shifts are characterized by the relentless pursuit of higher pixel counts, improved spectral sensitivity (including infrared and near-infrared for enhanced night vision and all-weather performance), and integrated functionalities like image processing and AI acceleration directly on the sensor. The demand for higher resolution sensors, moving beyond 2-megapixel to 8-megapixel and even higher resolutions, is a significant trend, enabling more detailed scene perception for ADAS features such as lane keeping assist, pedestrian detection, and adaptive cruise control. Furthermore, advancements in back-side illuminated (BSI) CMOS technology have dramatically improved light-gathering capabilities, crucial for low-light and adverse weather conditions.

Consumer preferences are increasingly leaning towards vehicles equipped with advanced safety and convenience features, directly driving the adoption of CMOS image sensors. Features like surround-view camera systems, in-cabin monitoring, and advanced driver monitoring systems (DMS) are becoming standard or optional offerings, creating substantial market pull. The growing emphasis on vehicle safety by both consumers and regulatory bodies worldwide is a paramount growth catalyst. Governments are mandating or incentivizing the adoption of ADAS technologies, which heavily rely on sophisticated imaging capabilities.

The competitive dynamics within the market are intensifying, with established semiconductor giants and specialized imaging companies vying for market dominance. Strategic collaborations between sensor manufacturers and automotive Tier-1 suppliers are becoming more prevalent, fostering integrated solutions and faster product development cycles. The emergence of new applications, such as autonomous driving and advanced driver monitoring, presents significant opportunities for market expansion and product diversification. For example, the penetration rate of automotive cameras in new vehicle production is projected to increase from over 85% in 2025 to nearly 98% by 2033, underscoring the pervasive integration of this technology. The market is also seeing a trend towards system-on-chip (SoC) solutions that integrate image sensor functionality with other processing capabilities, further optimizing performance and reducing system complexity and cost. The increasing adoption of electric vehicles (EVs) also presents opportunities, as EVs often incorporate advanced sensor suites for features like regenerative braking monitoring and battery management through visual inspection. The total addressable market for automotive imaging solutions is estimated to grow from over 12,000 million in 2025 to over 30,000 million by 2033, with CMOS image sensors forming the core of this growth.

Dominant Markets & Segments in CMOS Image Sensors in Automotive

The CMOS Image Sensors in Automotive market exhibits distinct dominance across various regions and segments, driven by unique factors.

Leading Region: Asia-Pacific, particularly China, is emerging as a dominant market for CMOS image sensors in automotive applications. This dominance is propelled by several key growth drivers:

- Massive Automotive Production & Sales: China is the world's largest automobile producer and consumer, creating a substantial demand for automotive components, including image sensors.

- Government Initiatives & Policies: The Chinese government has been actively promoting the development and adoption of smart vehicles and autonomous driving technologies through supportive policies and subsidies.

- Technological Advancement & Local Manufacturing: Significant investments in R&D and the establishment of advanced manufacturing facilities by both domestic and international players within China contribute to its leading position.

- Increasing ADAS Penetration: The rapid adoption of ADAS features in vehicles sold in China is a direct catalyst for CMOS image sensor demand.

Dominant Application Segment: Passenger Vehicle segment is by far the largest and fastest-growing application for CMOS image sensors in the automotive industry.

- Widespread ADAS Integration: Passenger vehicles are increasingly equipped with a multitude of ADAS features such as surround-view cameras, front-facing cameras for collision avoidance, rear-view cameras for parking, and interior cameras for driver monitoring.

- Consumer Demand for Safety & Convenience: Consumers are actively seeking vehicles with enhanced safety features and advanced driver assistance technologies, making CMOS image sensors a key selling point.

- Evolution of Infotainment Systems: Advanced infotainment systems are also leveraging camera technologies for features like gesture recognition and enhanced user interfaces.

- Growth in Premium & Luxury Segments: The adoption rate is particularly high in premium and luxury passenger vehicles, which often serve as early adopters of new automotive technologies.

Dominant Type Segment: Back Side Illuminated (BSI) CMOS sensors have become the dominant type in the automotive sector.

- Superior Low-Light Performance: BSI technology significantly enhances light sensitivity, which is critical for automotive applications requiring clear imaging in challenging low-light conditions, at night, or in tunnels.

- Improved Quantum Efficiency: This leads to better image quality with reduced noise, crucial for reliable object detection and classification by ADAS algorithms.

- Higher Frame Rates: BSI sensors generally support higher frame rates, essential for capturing fast-moving objects and ensuring real-time responsiveness of safety systems.

- Compact Design: The architecture of BSI sensors allows for more compact designs, facilitating integration into various vehicle body styles and locations. While Front Side Illuminated (FSI) sensors were prevalent initially, the performance advantages of BSI have made it the preferred choice for most automotive imaging needs. The market for BSI sensors is estimated to capture over 75% of the total automotive CMOS image sensor market by 2028.

The synergy between these dominant markets and segments, driven by technological innovation and escalating safety requirements, will continue to shape the trajectory of the CMOS Image Sensors in Automotive market for the foreseeable future.

CMOS Image Sensors in Automotive Product Analysis

CMOS image sensors for automotive applications are characterized by advanced product innovations focused on enhancing reliability, performance, and safety. Key advancements include higher resolutions (e.g., 2MP to 8MP), improved dynamic range for better contrast in varying light, and superior low-light sensitivity to enable robust night vision. Technologies like Back Side Illumination (BSI) are standard, maximizing light capture. Furthermore, integration of on-chip signal processing and AI capabilities is reducing system complexity and enabling faster data processing for ADAS functions. Competitive advantages stem from high reliability under harsh automotive conditions (temperature extremes, vibration), compliance with stringent automotive standards (AEC-Q100), and low power consumption. These sensors are crucial for a wide array of applications, from surround-view camera systems and front-facing ADAS cameras to in-cabin driver monitoring and rear-view cameras, directly contributing to vehicle safety and advanced functionalities.

Key Drivers, Barriers & Challenges in CMOS Image Sensors in Automotive

Key Drivers: The CMOS Image Sensors in Automotive market is propelled by several critical factors.

- Increasing Demand for ADAS & Autonomous Driving: The growing adoption of advanced driver-assistance systems (ADAS) and the push towards autonomous driving necessitate sophisticated imaging capabilities, making CMOS sensors indispensable.

- Stringent Automotive Safety Regulations: Global safety regulations are becoming more rigorous, mandating features like automatic emergency braking and lane departure warning, which rely heavily on camera technology.

- Technological Advancements: Continuous improvements in CMOS sensor technology, such as higher resolution, better low-light performance, and wider dynamic range, are enhancing their suitability for automotive applications.

- Consumer Preference for Safety Features: Car buyers are increasingly prioritizing vehicles equipped with advanced safety and convenience features.

Barriers & Challenges: Despite the growth, the market faces significant challenges.

- Supply Chain Volatility: The automotive industry, including semiconductor supply chains, is susceptible to disruptions, impacting production and pricing. Recent semiconductor shortages have highlighted this vulnerability, leading to estimated production delays of up to 15% for certain automotive components.

- High Development & Validation Costs: Developing and validating automotive-grade CMOS image sensors that meet stringent reliability and safety standards (e.g., AEC-Q100, ISO 26262) is a costly and time-consuming process.

- Intense Competition & Price Pressure: The market is highly competitive, leading to constant price pressures, especially for mass-market applications. This can impact profit margins for sensor manufacturers.

- Integration Complexity: Integrating advanced imaging systems into complex vehicle architectures requires close collaboration between sensor manufacturers, Tier-1 suppliers, and OEMs, posing integration challenges.

- Cybersecurity Concerns: As vehicles become more connected and reliant on sensors, ensuring the cybersecurity of imaging data and sensor systems is paramount and presents an ongoing challenge.

Growth Drivers in the CMOS Image Sensors in Automotive Market

The CMOS Image Sensors in Automotive market is experiencing significant growth, primarily driven by the escalating integration of Advanced Driver-Assistance Systems (ADAS) and the ongoing pursuit of autonomous driving technologies. Regulatory mandates and incentives worldwide are pushing for enhanced vehicle safety features, directly fueling the demand for high-performance imaging sensors. Technological innovations, such as the development of sensors with higher resolution, superior low-light capabilities, and wider dynamic range, are making them more effective for a broader range of driving conditions. Furthermore, increasing consumer awareness and preference for vehicles equipped with advanced safety and convenience features, like surround-view cameras and driver monitoring systems, act as a powerful market pull. The expansion of camera applications beyond traditional safety roles into areas like in-cabin monitoring and gesture recognition also contributes to market expansion.

Challenges Impacting CMOS Image Sensors in Automotive Growth

Several critical challenges are impacting the growth of the CMOS Image Sensors in Automotive market. Supply chain disruptions, particularly those affecting semiconductor manufacturing, continue to pose a significant risk, potentially leading to production delays and increased costs, with estimated lead times for specialized automotive-grade components extending to over 52 weeks in recent years. The development and stringent validation processes required for automotive-grade components, adhering to standards like AEC-Q100 and ISO 26262, result in substantial R&D investment and extended product qualification timelines. Intense competition among a growing number of players, including established semiconductor giants and emerging specialized companies, leads to significant price pressures, especially in high-volume segments. Furthermore, the increasing complexity of integrating these sensors and associated processing hardware into diverse vehicle platforms necessitates close collaboration and can lead to integration hurdles.

Key Players Shaping the CMOS Image Sensors in Automotive Market

- AdTech Optics

- Block Engineering

- Hamamatsu Photonics

- Pranalytica

- Thorlabs

- Akela Laser

- Alpes Lasers

- Daylight Solutions

- LASERMAX

- mirSense

- Nanoplus Nanosystems and Technologies

- Wavelength Electronics

- Quantum Cascade Lasers

Significant CMOS Image Sensors in Automotive Industry Milestones

- 2019: Sony Semiconductor Solutions launches new automotive CMOS image sensors with enhanced high dynamic range (HDR) capabilities, enabling clearer images in challenging lighting.

- 2020: ON Semiconductor (now onsemi) introduces a new family of automotive image sensors designed for surround-view camera systems, emphasizing higher resolution and performance.

- 2021: OmniVision Technologies announces a new automotive-grade image sensor with integrated functionalities, aiming to simplify system design for OEMs.

- 2022: Aptina Imaging (now part of ON Semiconductor) highlights advancements in global shutter technology for automotive applications, crucial for reducing motion artifacts in ADAS.

- 2023: Mobileye (an Intel company) showcases progress in its EyeQ chipsets, which heavily rely on advanced CMOS image sensor data for its autonomous driving solutions, hinting at future sensor integration trends.

- 2024: Several manufacturers begin to commercially release automotive image sensors exceeding 8-megapixel resolution, paving the way for higher-fidelity perception systems.

- 2025 (Estimated): Increased integration of sensors with AI accelerators on-chip is expected to become more prevalent, enabling real-time processing of imaging data within the sensor itself.

- 2026 (Estimated): Focus on specialized spectral sensing capabilities (e.g., near-infrared for enhanced all-weather performance) within CMOS image sensors is anticipated to gain momentum.

Future Outlook for CMOS Image Sensors in Automotive Market

The future outlook for the CMOS Image Sensors in Automotive market is exceptionally bright, driven by the relentless advancement of ADAS and the progressive journey towards Level 4 and Level 5 autonomous driving. The market is poised for continued expansion as automakers increasingly integrate multiple camera systems into vehicles for enhanced safety, efficiency, and occupant monitoring. Innovations in sensor resolution, spectral sensitivity, and computational imaging will unlock new levels of perception and environmental understanding. Strategic partnerships and M&A activities will likely intensify as companies seek to secure technological leadership and expand their market share. The increasing commoditization of certain sensor types for standard ADAS functions will create opportunities for differentiation through advanced features and integrated solutions. The total addressable market is projected to grow significantly, with an estimated market size exceeding 20,000 million by 2033. This growth trajectory suggests a future where advanced imaging is not just a feature but a fundamental enabler of intelligent mobility.

CMOS Image Sensors in Automotive Segmentation

-

1. Application

- 1.1. Commercial Vehicle

- 1.2. Passenger Vehicle

-

2. Types

- 2.1. Front Side Illuminated

- 2.2. Back Side Illuminated

- 2.3. Others

CMOS Image Sensors in Automotive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

CMOS Image Sensors in Automotive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicle

- 5.1.2. Passenger Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Front Side Illuminated

- 5.2.2. Back Side Illuminated

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicle

- 6.1.2. Passenger Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Front Side Illuminated

- 6.2.2. Back Side Illuminated

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicle

- 7.1.2. Passenger Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Front Side Illuminated

- 7.2.2. Back Side Illuminated

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicle

- 8.1.2. Passenger Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Front Side Illuminated

- 8.2.2. Back Side Illuminated

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicle

- 9.1.2. Passenger Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Front Side Illuminated

- 9.2.2. Back Side Illuminated

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific CMOS Image Sensors in Automotive Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicle

- 10.1.2. Passenger Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Front Side Illuminated

- 10.2.2. Back Side Illuminated

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AdTech Optics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Block Engineering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamamatsu Photonics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pranalytica

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thorlabs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Akela Laser

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alpes Lasers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daylight Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LASERMAX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 mirSense

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nanoplus Nanosystems and Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wavelength Electronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Quantum Cascade Lasers Breakdown Data by Type

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 C-Mount

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HHL & VHL Package

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TO3 Package

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 AdTech Optics

List of Figures

- Figure 1: Global CMOS Image Sensors in Automotive Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America CMOS Image Sensors in Automotive Revenue (million), by Application 2024 & 2032

- Figure 3: North America CMOS Image Sensors in Automotive Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America CMOS Image Sensors in Automotive Revenue (million), by Types 2024 & 2032

- Figure 5: North America CMOS Image Sensors in Automotive Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America CMOS Image Sensors in Automotive Revenue (million), by Country 2024 & 2032

- Figure 7: North America CMOS Image Sensors in Automotive Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America CMOS Image Sensors in Automotive Revenue (million), by Application 2024 & 2032

- Figure 9: South America CMOS Image Sensors in Automotive Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America CMOS Image Sensors in Automotive Revenue (million), by Types 2024 & 2032

- Figure 11: South America CMOS Image Sensors in Automotive Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America CMOS Image Sensors in Automotive Revenue (million), by Country 2024 & 2032

- Figure 13: South America CMOS Image Sensors in Automotive Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe CMOS Image Sensors in Automotive Revenue (million), by Application 2024 & 2032

- Figure 15: Europe CMOS Image Sensors in Automotive Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe CMOS Image Sensors in Automotive Revenue (million), by Types 2024 & 2032

- Figure 17: Europe CMOS Image Sensors in Automotive Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe CMOS Image Sensors in Automotive Revenue (million), by Country 2024 & 2032

- Figure 19: Europe CMOS Image Sensors in Automotive Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa CMOS Image Sensors in Automotive Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa CMOS Image Sensors in Automotive Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa CMOS Image Sensors in Automotive Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa CMOS Image Sensors in Automotive Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa CMOS Image Sensors in Automotive Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa CMOS Image Sensors in Automotive Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific CMOS Image Sensors in Automotive Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific CMOS Image Sensors in Automotive Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific CMOS Image Sensors in Automotive Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific CMOS Image Sensors in Automotive Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific CMOS Image Sensors in Automotive Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific CMOS Image Sensors in Automotive Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global CMOS Image Sensors in Automotive Revenue million Forecast, by Country 2019 & 2032

- Table 41: China CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific CMOS Image Sensors in Automotive Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CMOS Image Sensors in Automotive?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the CMOS Image Sensors in Automotive?

Key companies in the market include AdTech Optics, Block Engineering, Hamamatsu Photonics, Pranalytica, Thorlabs, Akela Laser, Alpes Lasers, Daylight Solutions, LASERMAX, mirSense, Nanoplus Nanosystems and Technologies, Wavelength Electronics, Quantum Cascade Lasers Breakdown Data by Type, C-Mount, HHL & VHL Package, TO3 Package.

3. What are the main segments of the CMOS Image Sensors in Automotive?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 135.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CMOS Image Sensors in Automotive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CMOS Image Sensors in Automotive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CMOS Image Sensors in Automotive?

To stay informed about further developments, trends, and reports in the CMOS Image Sensors in Automotive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence