Key Insights

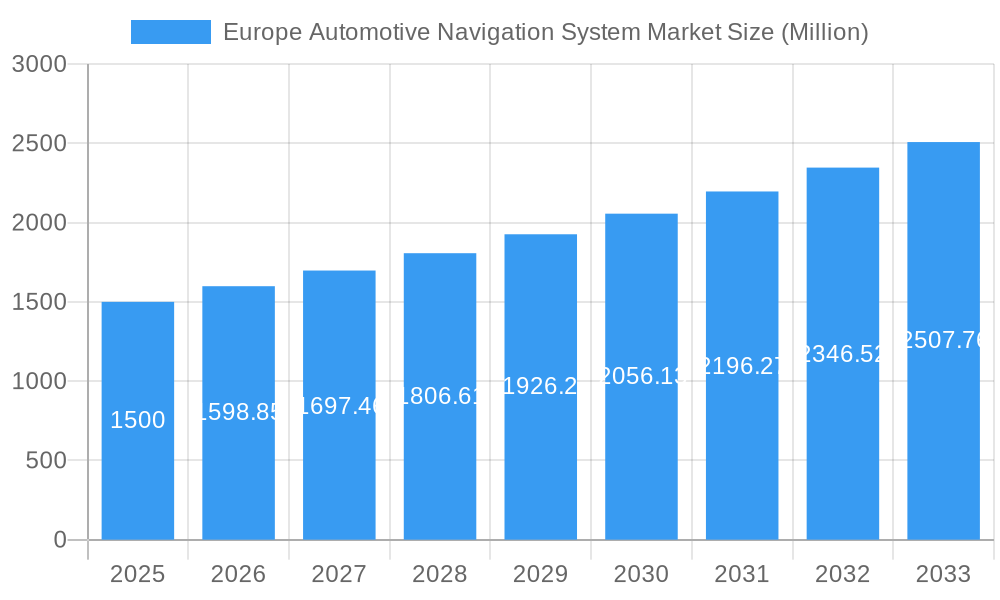

The European automotive navigation system market is poised for significant expansion, driven by increasing vehicle production, growing demand for advanced driver-assistance systems (ADAS), and seamless integration with infotainment. The market, valued at 11.4 million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.89% through 2033. Key growth drivers include the rising popularity of connected cars with integrated navigation and real-time traffic updates, alongside the increasing adoption of aftermarket navigation systems in older vehicles. While factory-fitted In-Vehicle Systems (IVS) are expected to retain market leadership due to OEM focus on premium features, the aftermarket segment will be propelled by consumer demand for upgrades and personalization. Technological advancements, such as enhanced mapping accuracy, advanced voice recognition, and smartphone integration, are further catalyzing market growth. The market is segmented by vehicle type (passenger and commercial), technology type (aftermarket IVS, factory-fitted IVS, PNDs, and smartphones/tablets), and sales channel (OEM and aftermarket). Germany, France, the UK, and Italy are identified as key European markets. Potential restraints include the proliferation of smartphone navigation alternatives and the rising cost of advanced navigation features.

Europe Automotive Navigation System Market Market Size (In Million)

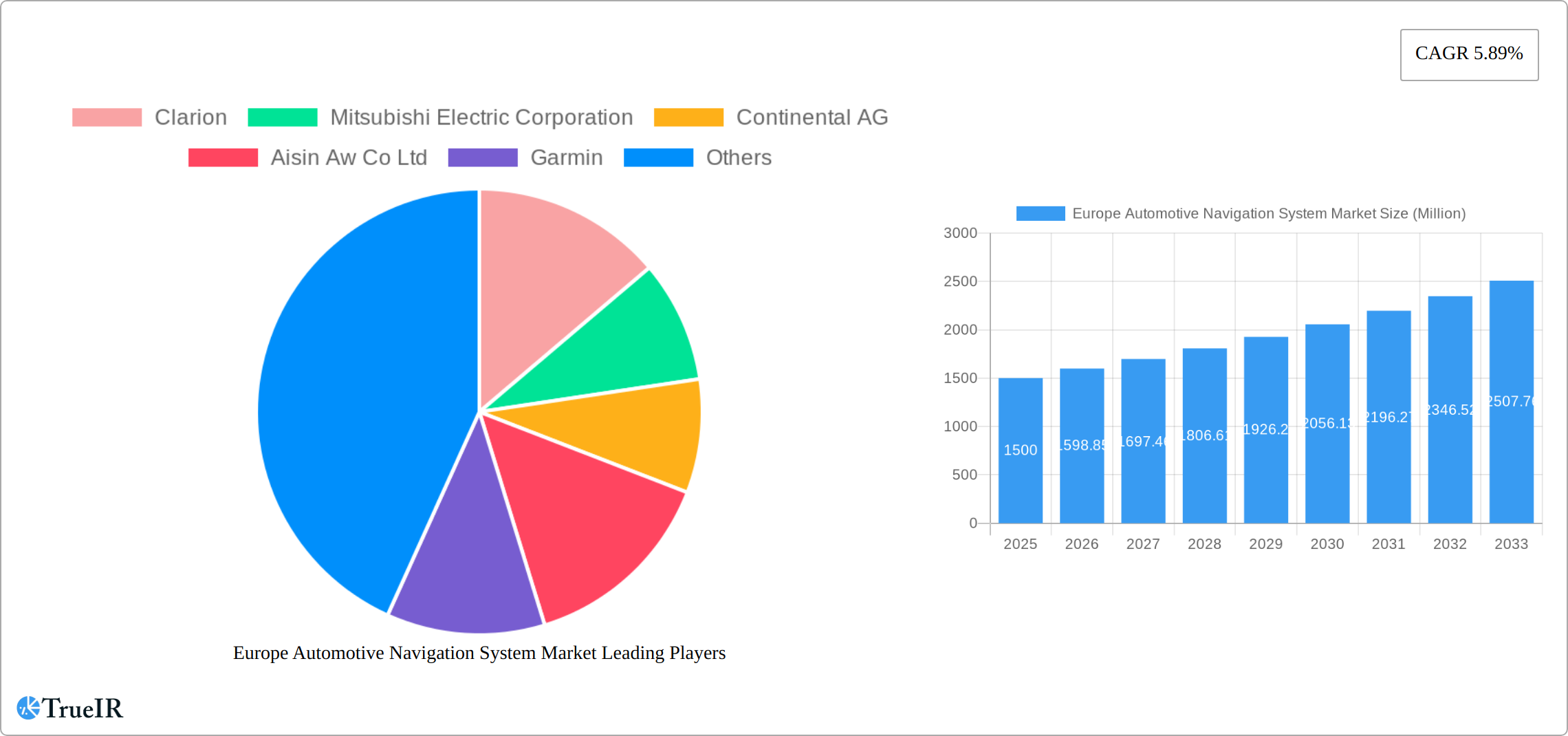

The competitive arena features established players such as Clarion, Mitsubishi Electric, Continental AG, Aisin AW, Garmin, Denso, Pioneer, and Alpine Electronics, alongside emerging technology firms. These entities are prioritizing innovation in augmented reality navigation, cloud-based mapping, and enhanced user interfaces to secure market share. The transition to electric and autonomous vehicles presents a dynamic landscape. Although autonomous driving might reduce long-term reliance on traditional navigation, the integration of navigation within ADAS and the critical need for precise location data for autonomous functions are anticipated to sustain market growth. Market participants are increasingly focused on delivering highly integrated and intuitive navigation solutions that enhance the overall in-car experience.

Europe Automotive Navigation System Market Company Market Share

Europe Automotive Navigation System Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Europe Automotive Navigation System Market, offering invaluable insights for industry stakeholders. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages high-impact keywords to ensure optimal search engine visibility. The report's detailed segmentation across vehicle types, technology types, and sales channels, coupled with analysis of key players and recent industry developments, provides a complete picture of this evolving market. The projected market value for 2025 is estimated at xx Million, showcasing significant growth opportunities.

Europe Automotive Navigation System Market Structure & Competitive Landscape

The European automotive navigation system market exhibits a moderately consolidated structure, with several key players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a competitive market with the potential for both consolidation and diversification. Innovation is a key driver, with continuous advancements in mapping technology, user interface design, and integration with connected car services. Regulatory pressures, particularly concerning data privacy and cybersecurity, play a significant role in shaping market dynamics. Product substitution is evident, with smartphones and tablet-based navigation systems increasingly challenging dedicated in-vehicle systems. The market comprises diverse end-users, including passenger car manufacturers, commercial vehicle fleets, and individual consumers. M&A activity in recent years has been moderate, with xx transactions recorded between 2019 and 2024, primarily focused on technology acquisition and strategic partnerships.

- Market Concentration: Moderately consolidated, with an HHI of xx in 2024.

- Innovation Drivers: Advancements in mapping, UI/UX, and connected car integration.

- Regulatory Impacts: Stringent data privacy and cybersecurity regulations.

- Product Substitutes: Smartphones, tablets, and alternative mapping apps.

- End-User Segmentation: Passenger cars, commercial vehicles, and individual consumers.

- M&A Trends: Moderate activity (xx transactions between 2019-2024), focusing on technology and strategic alliances.

Europe Automotive Navigation System Market Trends & Opportunities

The Europe Automotive Navigation System Market is projected to experience robust growth throughout the forecast period (2025-2033), driven by several key factors. Market size is anticipated to reach xx Million by 2033, exhibiting a CAGR of xx% from 2025. The increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for connected car features are propelling market expansion. The shift towards electric vehicles (EVs) and autonomous driving technologies also presents significant opportunities for innovative navigation solutions. Consumer preferences are evolving, with a greater emphasis on intuitive user interfaces, real-time traffic updates, and seamless integration with smartphones. Competitive dynamics are intense, with established players and new entrants vying for market share through technological innovation, strategic partnerships, and aggressive pricing strategies. Market penetration of factory-fitted IVS is steadily increasing, driven by OEM integration, while the Aftermarket IVS segment remains substantial.

Dominant Markets & Segments in Europe Automotive Navigation System Market

Germany, France, and the UK represent the leading markets within Europe, driven by strong automotive manufacturing bases and high consumer adoption rates. The passenger car segment holds the largest share, reflecting the widespread availability of factory-fitted and aftermarket navigation systems. Within technology types, factory-fitted IVS accounts for a significant portion of the market due to increasing OEM integration, while the PND segment is gradually declining due to smartphone penetration. The OEM sales channel dominates due to vehicle manufacturer integration, although the aftermarket channel offers significant opportunities for independent navigation system providers.

Key Growth Drivers:

- Germany, France, and UK: Strong automotive manufacturing and high consumer adoption.

- Passenger Cars: High demand for factory-fitted and aftermarket systems.

- Factory-Fitted IVS: Increasing OEM integration and bundled offerings.

- OEM Sales Channel: Vehicle manufacturer partnerships and wide distribution networks.

Market Dominance Analysis: Germany's robust automotive sector and high consumer spending on technology contribute to its market leadership. France and the UK follow closely, with their significant car markets and adoption of advanced navigation features.

Europe Automotive Navigation System Market Product Analysis

The European automotive navigation system market is a dynamic landscape encompassing a wide array of solutions, from basic GPS units to sophisticated, integrated infotainment systems. These advanced systems boast features like real-time traffic updates, lane guidance, augmented reality overlays, cloud-based services, and seamless integration with other vehicle functionalities. The competitive edge lies in delivering superior map data, intuitive user interfaces, and frictionless connectivity with connected car services. Key differentiators include advanced features such as voice recognition, personalized route recommendations, and increasingly popular subscription-based services providing continuous map updates and access to premium features. Innovation within the sector is heavily focused on enhancing accuracy, optimizing the user experience, and streamlining integration with the broader vehicle ecosystem. This includes a growing emphasis on sustainable features in line with the automotive industry's shift toward electric vehicles (EVs).

Key Drivers, Barriers & Challenges in Europe Automotive Navigation System Market

Key Drivers:

The market's robust growth is fueled by several key factors. The rising adoption of connected cars and the increasing demand for advanced driver-assistance systems (ADAS) are significant contributors. Government regulations mandating safety features, such as lane departure warnings, are creating lucrative opportunities for navigation systems incorporating these functionalities. Furthermore, continuous technological advancements are resulting in more accurate maps, real-time traffic updates, and increasingly user-friendly interfaces. The burgeoning electric vehicle market presents additional opportunities for navigation systems specifically optimized for EVs, incorporating features like range prediction and charging station location services.

Challenges & Restraints:

Despite the positive growth trajectory, the market faces several challenges. High initial investment costs and the ongoing need for map updates represent substantial barriers to entry and sustained profitability. Stringent data privacy and cybersecurity regulations add complexity and compliance costs. Intense competition from smartphone navigation apps and the trend towards integrating navigation into standard in-car infotainment systems are placing pressure on profit margins. Supply chain disruptions and volatile semiconductor prices continue to affect production costs and product availability, impacting market performance. The estimated cumulative negative revenue impact on the European Automotive Navigation System Market from these challenges is projected at xx million from 2022–2024.

Growth Drivers in the Europe Automotive Navigation System Market Market

Technological advancements in mapping, user interface design, and connected car technologies are key growth drivers. Increasing demand for enhanced safety features and driver assistance systems is pushing market expansion. Favorable government regulations promoting vehicle safety and autonomous driving are creating new opportunities. The growing popularity of electric vehicles and the need for route planning optimized for range and charging stations are additional growth factors.

Challenges Impacting Europe Automotive Navigation System Market Growth

The European automotive navigation system market faces considerable challenges that may impede its growth trajectory. High development and manufacturing costs, the constant need for map updates, and fierce competition are significant hurdles. Concerns surrounding data privacy and cybersecurity compliance add layers of complexity and expense. Supply chain vulnerabilities and fluctuating raw material prices impact both product availability and pricing strategies. The integration of navigation functionalities into increasingly standard infotainment systems intensifies the competitive pressure on specialized navigation system providers.

Key Players Shaping the Europe Automotive Navigation System Market Market

Significant Europe Automotive Navigation System Market Industry Milestones

- October 2022: Lotus and ECARX partnered with HERE Technologies to integrate advanced navigation services, featuring over-the-air updates, into the Lotus ELETRE, highlighting the growing importance of seamless software updates and service enhancements.

- September 2022: Renault's new Austral model showcased sophisticated integrated navigation and multimedia features, underscoring the ongoing trend towards fully integrated infotainment systems.

- August 2022: BMW Group collaborated with Linde Material Handling, leveraging SLAM technology to demonstrate advancements in autonomous navigation for commercial applications, showcasing the broader applications of related technologies beyond consumer vehicles.

Future Outlook for Europe Automotive Navigation System Market Market

The European Automotive Navigation System Market is poised for continued growth, driven by technological advancements and increasing demand for connected car features. Opportunities exist in developing highly accurate and personalized navigation solutions, integrating AI-powered features, and enhancing the user experience. Strategic partnerships between automakers, technology providers, and map data companies are expected to shape future market developments, unlocking increased efficiency and innovation. The market exhibits significant potential for expansion as autonomous driving technology matures.

Europe Automotive Navigation System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Technology Type

- 2.1. Aftermarket IVS

- 2.2. Factory fitted IVS

- 2.3. Personal navigation device (PND's)

- 2.4. Smartphones/Tablets

-

3. Sales Channel Type

- 3.1. OEM

- 3.2. Aftermarket

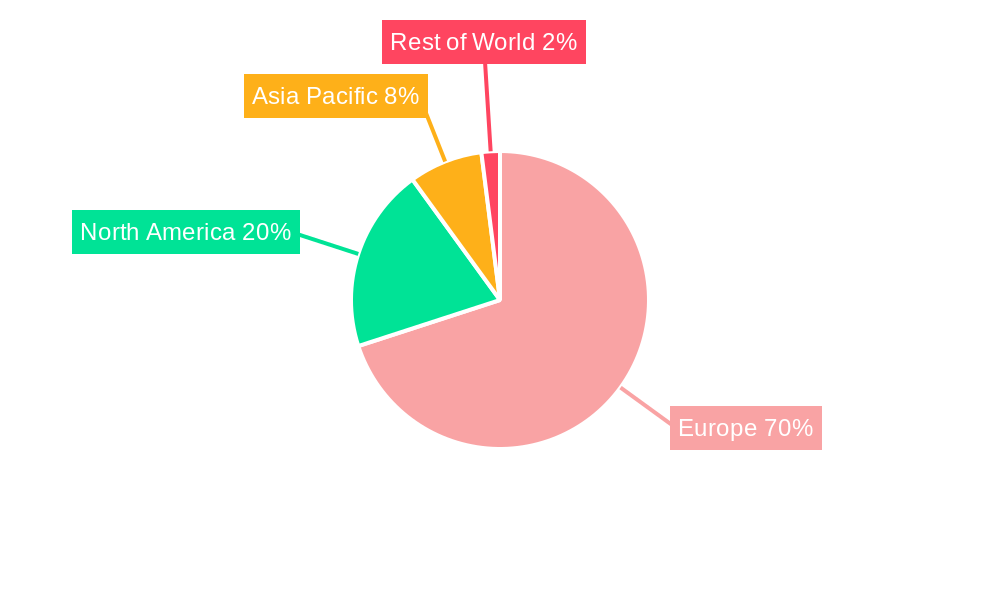

Europe Automotive Navigation System Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Europe Automotive Navigation System Market Regional Market Share

Geographic Coverage of Europe Automotive Navigation System Market

Europe Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Online Channel

- 3.3. Market Restrains

- 3.3.1. Increasing Traffic Problems And Reliability Issues

- 3.4. Market Trends

- 3.4.1. E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Aftermarket IVS

- 5.2.2. Factory fitted IVS

- 5.2.3. Personal navigation device (PND's)

- 5.2.4. Smartphones/Tablets

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clarion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Electric Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aisin Aw Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Garmin

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Denso Corporatio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pioneer

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alpine Electronics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Clarion

List of Figures

- Figure 1: Europe Automotive Navigation System Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Europe Automotive Navigation System Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 7: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Europe Automotive Navigation System Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Navigation System Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Europe Automotive Navigation System Market?

Key companies in the market include Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin Aw Co Ltd, Garmin, Denso Corporatio, Pioneer, Alpine Electronics.

3. What are the main segments of the Europe Automotive Navigation System Market?

The market segments include Vehicle Type, Technology Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Online Channel.

6. What are the notable trends driving market growth?

E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking.

7. Are there any restraints impacting market growth?

Increasing Traffic Problems And Reliability Issues.

8. Can you provide examples of recent developments in the market?

October 2022: Lotus and ECARX have chosen HERE Technologies to provide integrated navigation services for the recently launched Lotus ELETRE, the automaker's first pure electric hyper-SUV. The Lotus ELETRE's navigation experience can be updated over the air using HERE navigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence