Key Insights

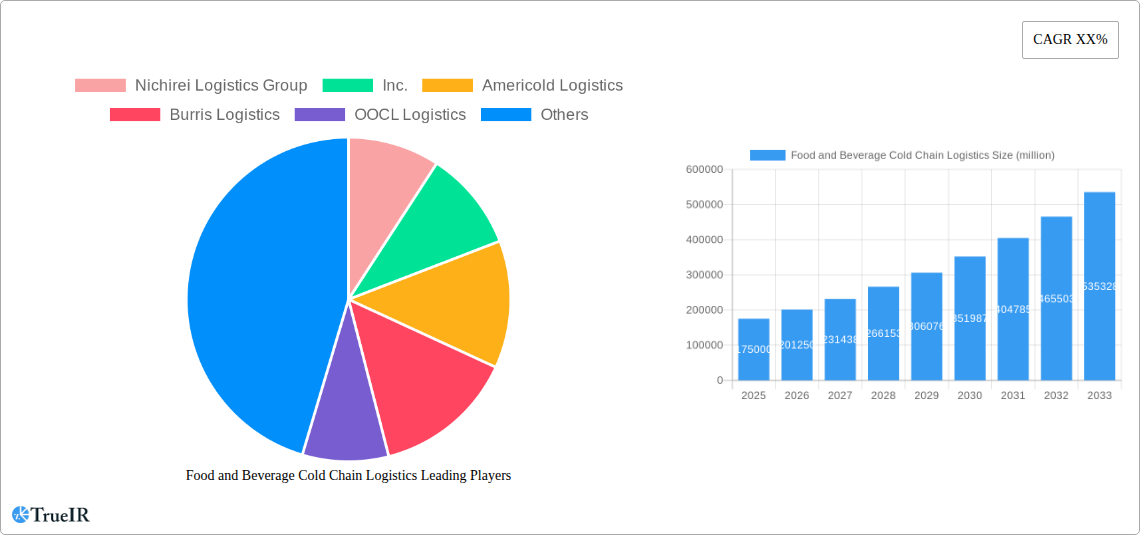

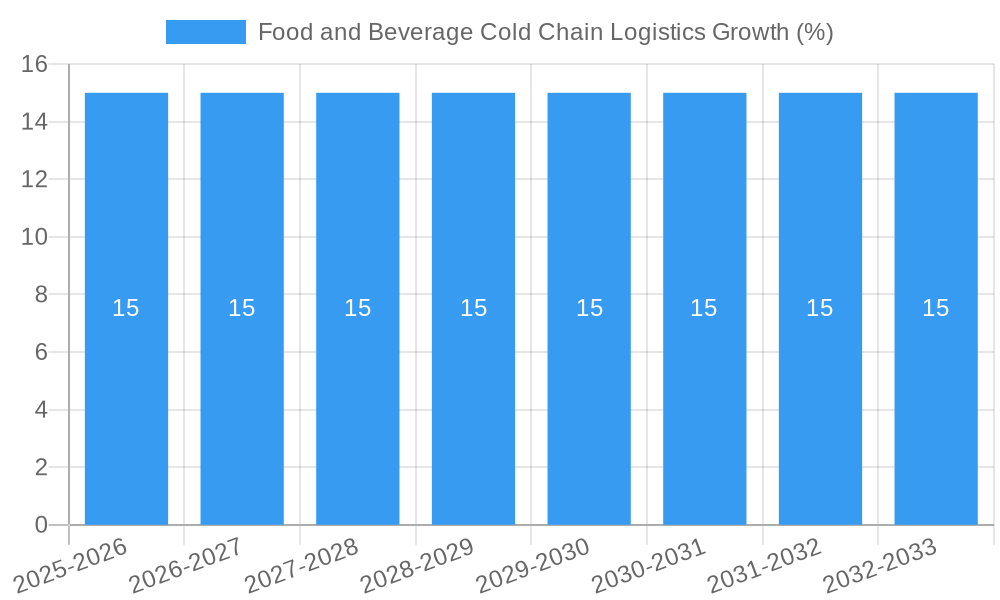

The global Food and Beverage Cold Chain Logistics market is poised for robust expansion, driven by an increasing demand for perishable goods, stringent food safety regulations, and the burgeoning e-commerce sector for groceries. With a current market size estimated to be around USD 175,000 million in 2025, and projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15% through 2033, this sector presents significant opportunities. Key market drivers include the growing consumer preference for fresh and high-quality produce, the expansion of international trade in food products, and the continuous innovation in cold chain technologies, such as advanced refrigeration systems, IoT-enabled monitoring, and specialized transport solutions. The need to minimize food spoilage and wastage throughout the supply chain further fuels the adoption of sophisticated cold chain solutions.

The market is segmented by application into the Food Industry and the Beverage Industry, with both experiencing sustained growth. Within transport types, Airways, Roadways, and Seaways all play crucial roles, with roadways expected to dominate due to its flexibility and reach for last-mile delivery, while airways and seaways are vital for global and long-haul transportation of temperature-sensitive products. Despite the promising outlook, the market faces restraints such as high operational costs associated with maintaining temperature integrity, the need for specialized infrastructure, and potential disruptions in the supply chain due to geopolitical events or climate change. However, the strategic investments by leading companies like Nichirei Logistics Group, Americold Logistics, and Lineage Logistics Holding LLC, alongside technological advancements and a growing focus on sustainability, are expected to mitigate these challenges and propel the market forward.

Food and Beverage Cold Chain Logistics Market Research Report: Global Insights and Forecasts (2019–2033)

This comprehensive report offers an in-depth analysis of the global Food and Beverage Cold Chain Logistics market, providing critical insights for industry stakeholders. Examining the market from 2019–2033, with a base year of 2025, this report delves into market structure, trends, opportunities, dominant segments, and key players. Leveraging high-volume keywords and detailed quantitative data, this report is designed for SEO optimization and maximum reader engagement.

Food and Beverage Cold Chain Logistics Market Structure & Competitive Landscape

The global Food and Beverage Cold Chain Logistics market exhibits a moderately fragmented structure, with several large multinational corporations and a significant number of regional players vying for market share. Leading entities like Americold Logistics, Lineage Logistics Holding LLC, and Nichirei Logistics Group, Inc. command substantial market presence, contributing to a concentration ratio estimated to be around 35-45% among the top five players. Innovation drivers are paramount, fueled by the demand for enhanced shelf-life extension, reduced spoilage, and improved traceability throughout the supply chain. Technological advancements in temperature-controlled warehousing, real-time monitoring systems, and specialized reefer containers are pivotal. Regulatory impacts, while varied across regions, generally emphasize food safety standards and emissions reduction, influencing operational strategies and investment. Product substitutes, though limited in direct cold chain services, can include localized distribution models or less temperature-sensitive packaging for specific goods. End-user segmentation is robust, with the Food Industry representing a dominant segment, followed closely by the Beverage Industry. Mergers and Acquisitions (M&A) trends are a significant feature, with an estimated volume of over 500 million USD in strategic acquisitions during the historical period (2019–2024) as companies seek to expand geographic reach and service portfolios. Key players are actively consolidating to achieve economies of scale and broader network coverage.

Food and Beverage Cold Chain Logistics Market Trends & Opportunities

The global Food and Beverage Cold Chain Logistics market is poised for substantial expansion, driven by a confluence of evolving consumer preferences, technological innovations, and increasing global trade of perishable goods. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, translating into a market size that is expected to surpass 200 million million USD by the end of the forecast period. This growth is underpinned by the escalating demand for fresh, frozen, and temperature-sensitive food and beverage products worldwide. Consumers are increasingly seeking healthier options, organic produce, and specialty items, all of which necessitate stringent cold chain management to maintain quality and safety. Furthermore, the burgeoning e-commerce sector for groceries and prepared meals is creating new avenues for cold chain logistics providers, demanding efficient last-mile delivery solutions and sophisticated inventory management. Technological shifts are profoundly influencing the market. The adoption of Internet of Things (IoT) devices for real-time temperature and humidity monitoring, predictive analytics for optimizing routes and inventory, and the development of energy-efficient refrigerated transport and warehousing solutions are becoming standard. Automation in warehouses, including robotics and advanced sorting systems, is enhancing operational efficiency and reducing labor costs. Competitive dynamics are intensifying, with established players investing heavily in expanding their cold storage capacities and enhancing their technological capabilities. The emergence of new market entrants with innovative business models, particularly in niche segments like last-mile delivery for frozen goods, is also shaping the landscape. Opportunities abound for companies that can offer integrated cold chain solutions, encompassing warehousing, transportation, and value-added services. Sustainability is emerging as a critical differentiator, with a growing emphasis on reducing carbon footprints in logistics operations, including the use of electric vehicles and optimized energy consumption in cold storage facilities. The increasing globalization of food supply chains further necessitates reliable and efficient cold chain infrastructure to connect producers with consumers across continents.

Dominant Markets & Segments in Food and Beverage Cold Chain Logistics

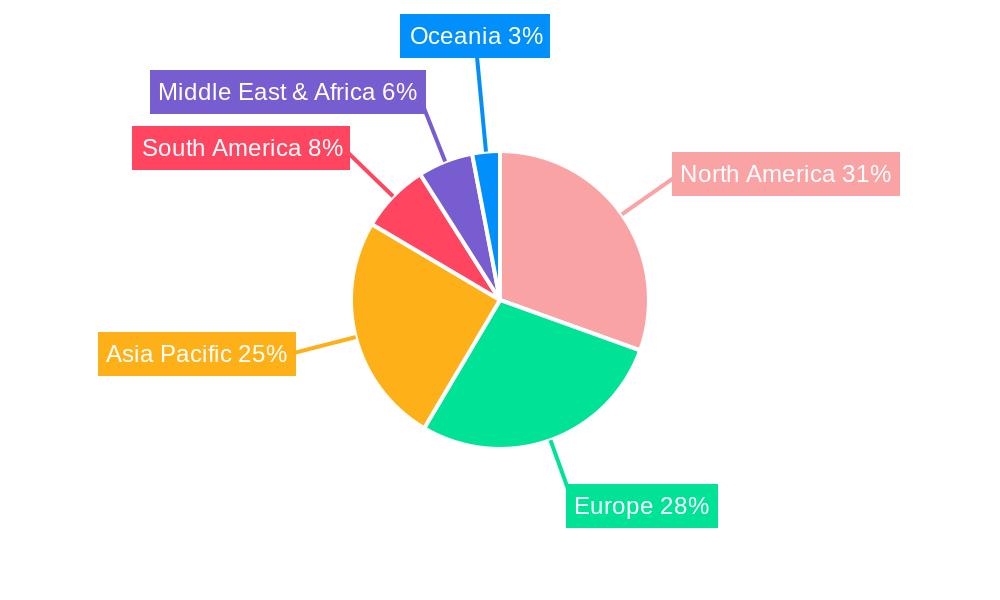

The Food Industry segment stands as the dominant force within the global Food and Beverage Cold Chain Logistics market, accounting for an estimated 70% of the overall market value. This dominance stems from the inherent perishability and diverse temperature requirements of a vast array of food products, ranging from fresh produce and dairy to frozen meats and ready-to-eat meals. The Beverage Industry represents a significant secondary segment, with a substantial portion of its products, such as juices, dairy beverages, and certain alcoholic drinks, requiring temperature-controlled logistics. Geographically, North America and Europe currently hold the largest market shares due to their well-established infrastructure, high consumer spending on food and beverages, and stringent food safety regulations that mandate robust cold chain practices. However, the Asia-Pacific region is emerging as the fastest-growing market, driven by rapid economic development, urbanization, a growing middle class with increased disposable income, and the subsequent rise in demand for a wider variety of perishable goods.

Within the transportation types, Roadways currently represent the most prevalent mode, facilitating efficient last-mile delivery and intra-regional distribution of chilled and frozen goods. The extensive road networks in developed economies and ongoing infrastructure development in emerging markets support this dominance. Seaways, particularly through refrigerated container ships (reefers), play a crucial role in global trade, enabling the long-haul transportation of bulk perishable commodities. The increasing volume of international trade in food and beverages continues to bolster the significance of this segment. Airways, while the most expensive, are critical for the rapid transport of high-value, extremely perishable, or time-sensitive products like certain seafood, exotic fruits, and pharmaceutical-grade food ingredients, ensuring minimal spoilage and maximum freshness upon arrival. Key growth drivers across these segments include government initiatives promoting food security and safety, increased investment in cold chain infrastructure by both public and private sectors, and the growing sophistication of supply chain management technologies. For instance, policies aimed at reducing food waste and enhancing agricultural exports directly stimulate demand for advanced cold chain solutions. The expansion of cold chain networks into rural and less developed areas is also a significant growth catalyst, improving market access for producers and ensuring product availability for consumers.

Food and Beverage Cold Chain Logistics Product Analysis

The Food and Beverage Cold Chain Logistics market is characterized by continuous product and service innovation aimed at enhancing efficiency, safety, and sustainability. Key advancements include the development of smart reefer containers equipped with advanced sensors for real-time monitoring of temperature, humidity, and ethylene levels, enabling proactive intervention to prevent spoilage. Furthermore, specialized packaging solutions designed for specific food and beverage categories, such as vacuum-sealed frozen meals or insulated boxes for chilled products, are crucial. The competitive advantage lies in providers who offer integrated solutions, combining advanced warehousing technologies like automated storage and retrieval systems (AS/RS) with optimized transportation networks, thereby ensuring end-to-end temperature integrity and minimizing product loss.

Key Drivers, Barriers & Challenges in Food and Beverage Cold Chain Logistics

Key Drivers:

- Growing Global Demand for Perishables: Increasing population, rising disposable incomes, and changing dietary habits worldwide fuel the demand for fresh, frozen, and temperature-sensitive food and beverages.

- E-commerce Expansion: The rapid growth of online grocery and food delivery services necessitates robust and efficient cold chain solutions for last-mile delivery.

- Technological Advancements: Innovations in IoT, AI, blockchain, and automation are enhancing transparency, efficiency, and reliability in cold chain operations.

- Food Safety Regulations: Stricter government regulations globally regarding food safety and quality standards compel companies to invest in reliable cold chain infrastructure.

Key Barriers & Challenges:

- High Capital Investment: Establishing and maintaining a sophisticated cold chain infrastructure, including specialized warehouses and refrigerated transport, requires significant capital outlay.

- Energy Consumption: Cold storage and transportation are energy-intensive, leading to substantial operational costs and environmental concerns, with an estimated energy cost impact of over 10 million USD annually per major facility.

- Supply Chain Complexity: Managing temperature-sensitive products across extended and complex global supply chains presents logistical challenges, with potential for spoilage estimated at over 5 million tons of food annually due to supply chain disruptions.

- Skilled Labor Shortage: The specialized nature of cold chain logistics requires skilled personnel for operations, maintenance, and management, leading to potential labor shortages.

- Regulatory Fragmentation: Navigating diverse and sometimes conflicting international and regional regulations adds complexity and cost.

Growth Drivers in the Food and Beverage Cold Chain Logistics Market

The primary growth drivers in the Food and Beverage Cold Chain Logistics market are multifaceted, encompassing technological advancements, economic shifts, and regulatory frameworks. Economically, the increasing disposable income in emerging economies directly translates into higher consumer demand for a wider variety of perishable goods, necessitating improved cold chain infrastructure. Technologically, the pervasive adoption of IoT devices for real-time monitoring of temperature and humidity, coupled with advancements in AI-powered route optimization and inventory management, significantly reduces spoilage and operational costs, estimated to save millions in potential losses annually. Regulatory drivers, such as stringent food safety standards and initiatives to reduce food waste, further compel investments in robust cold chain solutions. For example, government support for cold chain infrastructure development in countries like India, with an estimated investment exceeding 500 million USD, is a significant catalyst.

Challenges Impacting Food and Beverage Cold Chain Logistics Growth

Several significant challenges can impede the growth of the Food and Beverage Cold Chain Logistics market. The substantial capital expenditure required for building and maintaining state-of-the-art cold storage facilities and specialized transportation fleets remains a major barrier, with initial investments often running into tens of millions of USD per large-scale facility. Furthermore, the high energy consumption inherent in maintaining sub-zero temperatures contributes to significant operational costs and environmental concerns. Supply chain disruptions, whether due to geopolitical events, natural disasters, or labor disputes, can lead to critical temperature excursions, resulting in significant product loss, estimated in the hundreds of millions of USD annually. Competitive pressures from both established players seeking market dominance and new entrants with disruptive business models can also impact pricing and profitability. Navigating complex and often inconsistent international regulations for food safety and transportation adds another layer of operational and compliance challenges.

Key Players Shaping the Food and Beverage Cold Chain Logistics Market

- Nichirei Logistics Group, Inc.

- Americold Logistics

- Burris Logistics

- OOCL Logistics

- Lineage Logistics Holding LLC

- AGRO Merchants Group, LLC

- United States Cold Storage

- SSI SCHAEFER

- VersaCold Logistics Services

- DHL

- AIT

- Kloosterboer

- X2 Group

- NewCold Cooperatief U.A.

- Gruppo Marconi Logistica Integrata

- CWT Limited

- Congebec Logistics

- Crystal Logistic Cool Chain Ltd

- Frialsa Frigorificos

- BioStorage Technologies (Brooks Life Sciences)

- JWD Group

- Best Cold Chain Co.

- SCG Logistics

- ColdEX

Significant Food and Beverage Cold Chain Logistics Industry Milestones

- 2020: Increased investment in automated cold storage solutions to mitigate labor shortages and enhance efficiency.

- 2021: Emergence of advanced IoT-enabled temperature monitoring systems offering real-time data analytics and predictive maintenance.

- 2022: Major logistics providers expanded their e-commerce fulfillment capabilities for temperature-sensitive grocery items.

- 2023: Growing focus on sustainable cold chain practices, including the adoption of electric refrigerated trucks and renewable energy sources for warehouses.

- 2024: Strategic mergers and acquisitions aimed at consolidating market share and expanding global network coverage.

Future Outlook for Food and Beverage Cold Chain Logistics Market

The future outlook for the Food and Beverage Cold Chain Logistics market is exceptionally promising, driven by sustained global demand for perishable goods and the continuous evolution of technology. Growth catalysts include the increasing penetration of e-commerce for food and beverages, necessitating more sophisticated last-mile cold chain solutions, and the ongoing development of smart warehousing and transportation technologies that enhance efficiency and transparency. Strategic opportunities lie in expanding services to emerging markets, investing in sustainable logistics practices, and offering integrated end-to-end cold chain solutions. The market is expected to witness further consolidation and innovation as companies strive to meet the ever-increasing consumer expectations for fresh, safe, and readily available food and beverage products, with projected investments in infrastructure alone to exceed hundreds of millions annually.

Food and Beverage Cold Chain Logistics Segmentation

-

1. Application

- 1.1. Food Industry

- 1.2. Beverage Industry

-

2. Types

- 2.1. Airways

- 2.2. Roadways

- 2.3. Seaways

Food and Beverage Cold Chain Logistics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food and Beverage Cold Chain Logistics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Industry

- 5.1.2. Beverage Industry

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Airways

- 5.2.2. Roadways

- 5.2.3. Seaways

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Industry

- 6.1.2. Beverage Industry

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Airways

- 6.2.2. Roadways

- 6.2.3. Seaways

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Industry

- 7.1.2. Beverage Industry

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Airways

- 7.2.2. Roadways

- 7.2.3. Seaways

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Industry

- 8.1.2. Beverage Industry

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Airways

- 8.2.2. Roadways

- 8.2.3. Seaways

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Industry

- 9.1.2. Beverage Industry

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Airways

- 9.2.2. Roadways

- 9.2.3. Seaways

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Food and Beverage Cold Chain Logistics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Industry

- 10.1.2. Beverage Industry

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Airways

- 10.2.2. Roadways

- 10.2.3. Seaways

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nichirei Logistics Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Americold Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burris Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OOCL Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lineage Logistics Holding LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AGRO Merchants Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United States Cold Storage

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SSI SCHAEFER

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 VersaCold Logistics Services

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DHL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AIT

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kloosterboer

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 X2 Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 NewCold Cooperatief U.A.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Gruppo Marconi Logistica Integrata

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 CWT Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Congebec Logistics

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Crystal Logistic Cool Chain Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Frialsa Frigorificos

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 BioStorage Technologies (Brooks Life Sciences)

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 JWD Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Best Cold Chain Co.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 SCG Logistics

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 ColdEX

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 Nichirei Logistics Group

List of Figures

- Figure 1: Global Food and Beverage Cold Chain Logistics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Food and Beverage Cold Chain Logistics Revenue (million), by Application 2024 & 2032

- Figure 3: North America Food and Beverage Cold Chain Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Food and Beverage Cold Chain Logistics Revenue (million), by Types 2024 & 2032

- Figure 5: North America Food and Beverage Cold Chain Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Food and Beverage Cold Chain Logistics Revenue (million), by Country 2024 & 2032

- Figure 7: North America Food and Beverage Cold Chain Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food and Beverage Cold Chain Logistics Revenue (million), by Application 2024 & 2032

- Figure 9: South America Food and Beverage Cold Chain Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Food and Beverage Cold Chain Logistics Revenue (million), by Types 2024 & 2032

- Figure 11: South America Food and Beverage Cold Chain Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Food and Beverage Cold Chain Logistics Revenue (million), by Country 2024 & 2032

- Figure 13: South America Food and Beverage Cold Chain Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Food and Beverage Cold Chain Logistics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Food and Beverage Cold Chain Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Food and Beverage Cold Chain Logistics Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Food and Beverage Cold Chain Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Food and Beverage Cold Chain Logistics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Food and Beverage Cold Chain Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Food and Beverage Cold Chain Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Food and Beverage Cold Chain Logistics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Food and Beverage Cold Chain Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Food and Beverage Cold Chain Logistics Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Food and Beverage Cold Chain Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Food and Beverage Cold Chain Logistics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Food and Beverage Cold Chain Logistics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Food and Beverage Cold Chain Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Food and Beverage Cold Chain Logistics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food and Beverage Cold Chain Logistics?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Food and Beverage Cold Chain Logistics?

Key companies in the market include Nichirei Logistics Group, Inc., Americold Logistics, Burris Logistics, OOCL Logistics, Lineage Logistics Holding LLC, AGRO Merchants Group, LLC, United States Cold Storage, SSI SCHAEFER, VersaCold Logistics Services, DHL, AIT, Kloosterboer, X2 Group, NewCold Cooperatief U.A., Gruppo Marconi Logistica Integrata, CWT Limited, Congebec Logistics, Crystal Logistic Cool Chain Ltd, Frialsa Frigorificos, BioStorage Technologies (Brooks Life Sciences), JWD Group, Best Cold Chain Co., SCG Logistics, ColdEX.

3. What are the main segments of the Food and Beverage Cold Chain Logistics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food and Beverage Cold Chain Logistics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food and Beverage Cold Chain Logistics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food and Beverage Cold Chain Logistics?

To stay informed about further developments, trends, and reports in the Food and Beverage Cold Chain Logistics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence