Key Insights

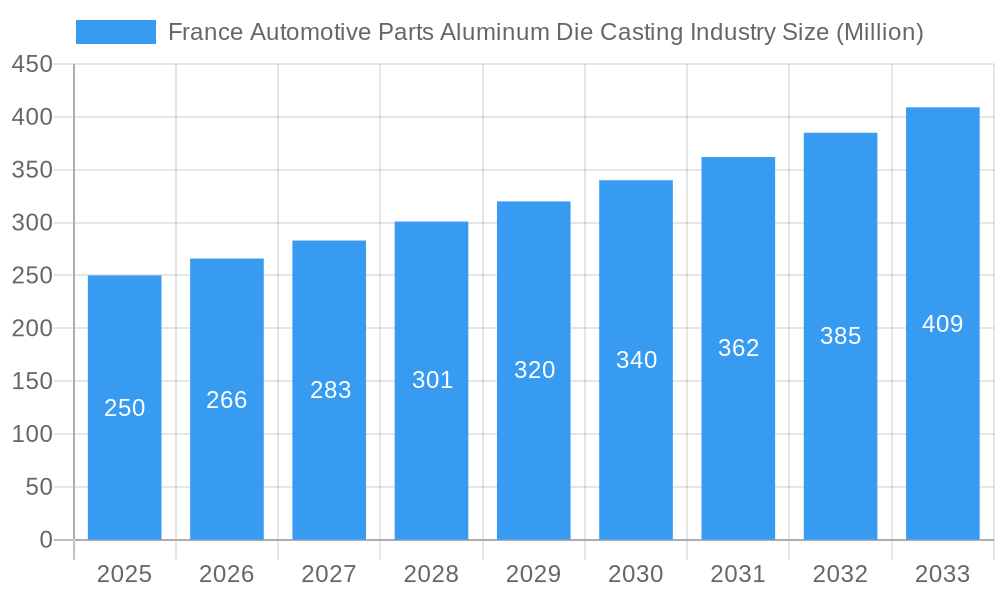

The France automotive parts aluminum die casting market is poised for significant expansion, driven by the imperative for lightweight vehicles and stringent fuel efficiency mandates. The market, valued at $12.02 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.28% between 2025 and 2033. This robust growth is underpinned by several key drivers. Foremost is the automotive industry's pervasive shift towards lightweighting to enhance fuel economy and reduce emissions, directly increasing the demand for aluminum die castings due to their superior strength-to-weight characteristics. Furthermore, technological advancements in die casting, particularly vacuum die casting, are elevating component quality and precision, fostering broader adoption in diverse automotive applications. The escalating popularity of electric vehicles (EVs) also fuels market growth, as aluminum die castings are integral to EV battery enclosures and other critical subsystems. Body assemblies and engine parts represent the dominant application segments, underscoring their widespread integration. While the market contends with challenges such as volatile raw material prices and rising labor expenses, these are anticipated to be mitigated by sustained demand and ongoing technological innovation.

France Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

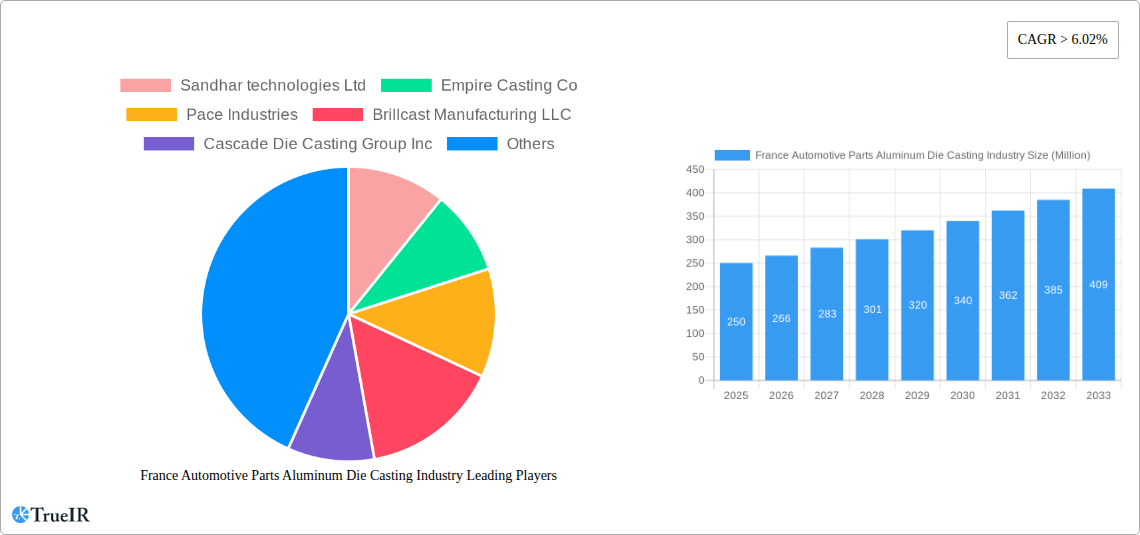

Leading players, including Sandhar Technologies Ltd and Empire Casting Co, are strategically advancing R&D and augmenting production capacity to leverage this burgeoning market. The prevalence of vacuum and pressure die casting processes highlights the industry's commitment to producing high-quality, intricate components. Geographic concentration aligns with established manufacturing centers and a strong automotive sector presence in France. The forecast period through 2033 anticipates sustained growth, propelled by both domestic automotive production and intra-EU export dynamics. The market's inherent resilience and growth trajectory present compelling long-term investment prospects within the automotive supply chain for both established and emerging entities.

France Automotive Parts Aluminum Die Casting Industry Company Market Share

France Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the France automotive parts aluminum die casting industry, offering invaluable insights for stakeholders seeking to navigate this evolving market. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to deliver a clear understanding of current market dynamics and future growth prospects. The report incorporates high-volume keywords to enhance search engine visibility and engage key industry audiences. Market values are expressed in Millions.

France Automotive Parts Aluminum Die Casting Industry Market Structure & Competitive Landscape

The French automotive parts aluminum die casting market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller firms. The market concentration ratio (CR4) is estimated at xx% in 2025, indicating a moderately consolidated landscape. Key innovation drivers include advancements in die casting technologies (like vacuum and pressure die casting), lightweighting initiatives in automotive manufacturing, and the increasing demand for high-precision components. Regulatory impacts, such as environmental regulations on emissions and material usage, significantly influence production processes and material choices. Product substitutes, primarily plastics and other metal casting techniques, pose moderate competitive pressure. End-user segmentation is primarily driven by the automotive sector, categorized by vehicle types (passenger cars, commercial vehicles) and original equipment manufacturers (OEMs) versus aftermarket suppliers. M&A activity in the sector has been moderate in recent years, with an estimated xx Million in transaction value between 2019 and 2024. This trend reflects strategic consolidation and efforts to expand geographic reach and product portfolios. Future M&A activity is expected to remain moderate but focused on enhancing technological capabilities and market access.

France Automotive Parts Aluminum Die Casting Industry Market Trends & Opportunities

The France automotive parts aluminum die casting market is poised for robust expansion, projecting a significant Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR here, e.g., 6.8%]** during the forecast period (2025-2033). This upward trajectory is underpinned by a confluence of compelling factors. The relentless pursuit of enhanced fuel efficiency and reduced environmental emissions is driving an escalating demand for lightweight vehicles, a key area where aluminum die castings excel. Continuous innovation in die casting technologies, including sophisticated high-pressure die casting techniques and the development of advanced aluminum alloys, is significantly elevating part quality and streamlining production efficiency. Furthermore, evolving consumer preferences for vehicles that offer superior performance, advanced safety features, and a more refined driving experience are necessitating the integration of intricate and high-performance die-cast components. The competitive landscape is characterized by a dynamic interplay of continuous innovation in both material science and manufacturing processes, coupled with an intensified focus on optimizing supply chains and achieving cost efficiencies. The inherent advantages of aluminum die castings – their exceptional lightweight properties, high strength-to-weight ratio, and inherent durability – are expected to drive increased market penetration across a diverse range of automotive applications. The accelerating global adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) represents a particularly potent growth catalyst, as these advanced powertrains inherently demand lightweight and energy-efficient components.

Dominant Markets & Segments in France Automotive Parts Aluminum Die Casting Industry

While a precise breakdown of regional dominance requires further granular data, the Ile-de-France region, owing to its high concentration of automotive manufacturing and supporting industries, is expected to be a leading market within France.

Production Process Type: Pressure die casting currently dominates the market due to its high production speed and cost-effectiveness. However, vacuum die casting is gaining traction due to its ability to produce high-quality, complex parts. Other production processes represent a smaller, but growing, market segment.

Application Type: Engine parts currently constitute the largest segment, driven by the substantial number of engine components requiring precise casting. Body assemblies and transmission parts also represent significant market segments, with substantial demand for lightweight and strong components. Other application types, such as chassis parts and interior components, are demonstrating steady growth.

Key growth drivers across segments include:

- Government incentives for lightweight vehicle manufacturing.

- Investments in advanced manufacturing technologies.

- Growing demand for high-performance and fuel-efficient vehicles.

France Automotive Parts Aluminum Die Casting Industry Product Analysis

Product development in the France automotive parts aluminum die casting sector is actively focused on enhancing the intrinsic mechanical properties of cast components. This is achieved through a two-pronged approach: pioneering new aluminum alloy formulations with superior strength and thermal resistance, and refining advanced casting processes to achieve greater precision and consistency. Key applications benefiting from these advancements include lightweight engine blocks designed for improved thermal management, intricate transmission casings that reduce overall vehicle weight, and critical structural body components that contribute to enhanced safety and chassis rigidity. Manufacturers are securing competitive advantages by leveraging their expertise in superior material characteristics, their capability for high-precision casting that minimizes post-processing, and their commitment to developing cost-effective and sustainable production methodologies.

Key Drivers, Barriers & Challenges in France Automotive Parts Aluminum Die Casting Industry

Key Drivers: The market is propelled forward by significant technological breakthroughs in die casting, the overarching industry-wide imperative for lighter vehicles, and stringent government regulations aimed at bolstering fuel efficiency and reducing emissions. The robust and evolving automotive manufacturing sector in France, coupled with favorable economic conditions, also serves as a substantial growth engine.

Barriers & Challenges: Persistent supply chain volatilities, particularly concerning the price fluctuations and availability of aluminum raw materials, present a significant hurdle. Increasingly stringent environmental regulations necessitate substantial investments in cleaner production technologies and sustainable manufacturing practices, thereby increasing operational costs. The intensely competitive global market, with pressure from manufacturers in lower-cost regions, impacts profit margins. These dynamic market conditions can lead to unpredictable shifts and demand a high degree of adaptability and strategic agility from industry participants.

Growth Drivers in the France Automotive Parts Aluminum Die Casting Industry Market

The burgeoning adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a pivotal growth driver, as these next-generation powertrains critically depend on lightweight, high-performance, and energy-efficient components. Continuous advancements in casting technology, enabling higher levels of precision and the utilization of cutting-edge aluminum alloys, are further accelerating market expansion. Supportive government policies that champion the use of lightweight materials in vehicle construction also play a crucial role in stimulating demand.

Challenges Impacting France Automotive Parts Aluminum Die Casting Industry Growth

Fluctuations in aluminum prices and supply chain disruptions create instability. Stringent environmental regulations increase production costs. Intense competition from global players pressures profit margins. These factors necessitate strategic management of resources and innovative approaches to sustain growth.

Key Players Shaping the France Automotive Parts Aluminum Die Casting Industry Market

- Sandhar technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Ashook Minda Grou

- Dynacast

- Kemlows Diecasting Products Ltd

Significant France Automotive Parts Aluminum Die Casting Industry Industry Milestones

- April 2023: Ryobi Die Casting (USA), Inc. achieved prestigious recognition as a 2022 General Motors Supplier of the Year, underscoring their consistent quality and unwavering reliability in supplying critical automotive casting parts.

- May 2022: Fondarex inaugurated a new European manufacturing facility, significantly expanding its specialized vacuum die-casting capabilities. This strategic expansion is designed to effectively address the escalating demand for high-quality, precision-engineered components across a spectrum of industries, with a particular emphasis on the automotive sector.

Future Outlook for France Automotive Parts Aluminum Die Casting Industry Market

The future outlook for the French automotive parts aluminum die casting industry is positive, driven by continued growth in the automotive sector and advancements in die casting technology. Strategic opportunities lie in developing lightweight and high-performance components for EVs and HEVs, along with exploring innovative alloys and production processes. The market holds substantial potential for expansion, especially with a focus on sustainable manufacturing practices and supply chain resilience.

France Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Vacuum Die Casting

- 1.2. Pressure Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

France Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. France

France Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of France Automotive Parts Aluminum Die Casting Industry

France Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight Vehicles

- 3.3. Market Restrains

- 3.3.1. Competition from Other Materials

- 3.4. Market Trends

- 3.4.1. Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Vacuum Die Casting

- 5.1.2. Pressure Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashook Minda Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: France Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the France Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the France Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight Vehicles.

6. What are the notable trends driving market growth?

Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

Competition from Other Materials.

8. Can you provide examples of recent developments in the market?

April 2023: Ryobi Die Casting, a leading company that supplies casting parts for most of the well-known automotive brands in the market, recently General Motors recognized Ryobi Die Casting (USA), Inc. as a 2022 supplier of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the France Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence