Key Insights

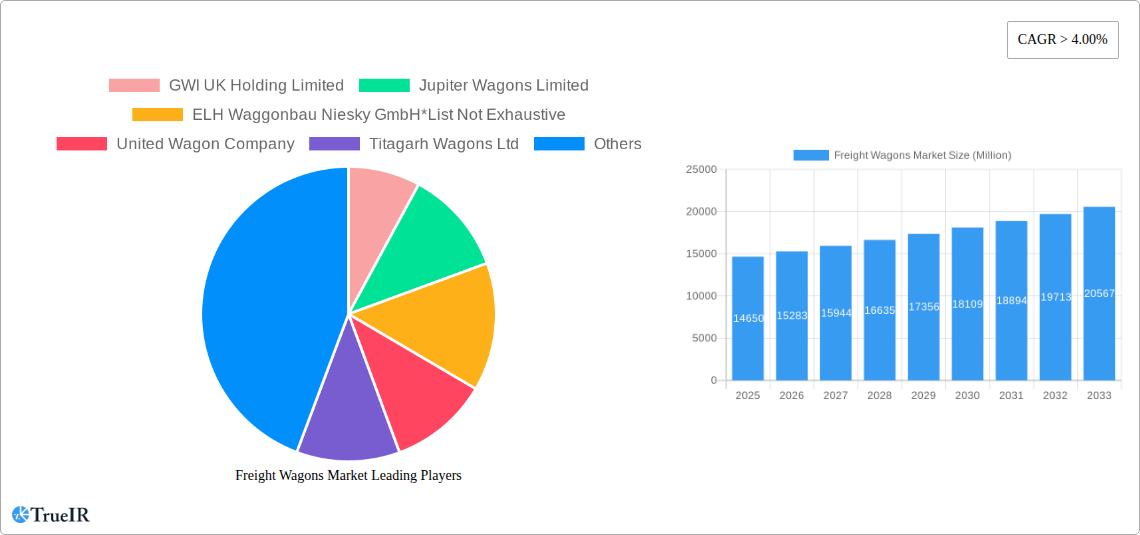

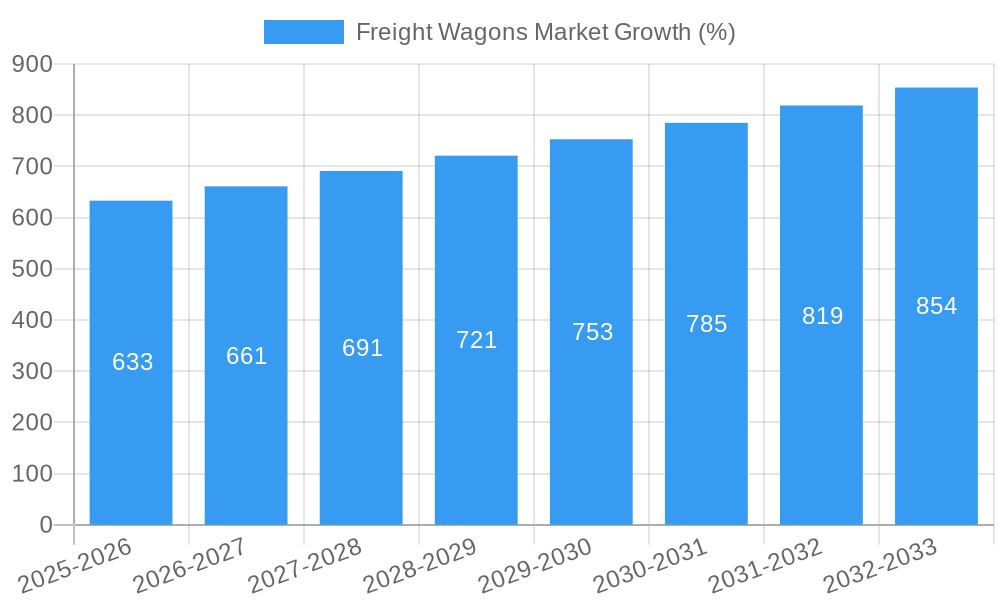

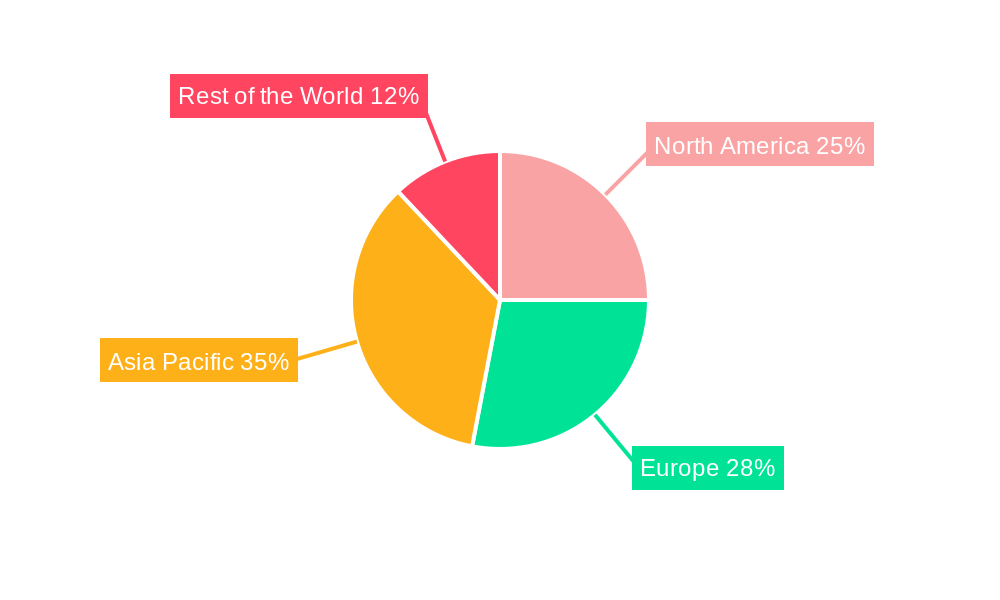

The global freight wagons market, valued at $14.65 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is driven primarily by the increasing demand for efficient and reliable freight transportation across diverse sectors, including manufacturing, construction, and agriculture. Growth in e-commerce and globalization further fuels the need for enhanced railway infrastructure and improved freight wagon capacity. Technological advancements, such as the integration of advanced sensors and telematics for real-time monitoring and predictive maintenance, are also contributing to market growth. The market is segmented by wagon type (closed, open, hopper, flat, tank, car, refrigerated, special purpose), payload capacity (up to 60 tons, above 60 tons), and axle configuration (2-axle, 2x2 axle, 4-axle, 6-axle). The Asia-Pacific region, particularly India and China, is anticipated to dominate the market due to significant investments in railway infrastructure development and expanding industrial activities. However, fluctuating raw material prices and potential regulatory hurdles pose challenges to market growth. Competition among established players like GWI UK Holding Limited, Jupiter Wagons Limited, and United Wagon Company, along with emerging players, is intense, leading to continuous innovation and improved product offerings.

The diverse range of wagon types caters to specific cargo needs, with closed wagons being particularly prevalent for transporting sensitive or easily damaged goods, while open and hopper wagons are favored for bulk materials. The demand for higher payload capacity wagons continues to rise, reflecting the increasing need for efficient freight movement. Regional variations in market growth are expected, with developed nations exhibiting steadier growth driven by infrastructure upgrades, while developing economies will experience a faster expansion fueled by industrialization and infrastructure development. The market will also see increasing focus on sustainable practices, such as the use of eco-friendly materials in wagon construction and the implementation of energy-efficient technologies. This focus is driven by growing environmental concerns and government regulations promoting sustainable transportation solutions.

Freight Wagons Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global freight wagons market, encompassing market size, segmentation, competitive landscape, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive market research and data analysis to offer invaluable insights for industry stakeholders, investors, and strategists. Discover key trends, opportunities, and challenges impacting this dynamic sector, and gain a competitive edge in this rapidly evolving market.

Freight Wagons Market Structure & Competitive Landscape

The freight wagons market exhibits a moderately concentrated structure, with several major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a relatively competitive yet consolidated market. Innovation is a crucial driver, with companies continuously developing advanced wagon technologies to improve efficiency, safety, and payload capacity. Stringent safety regulations and environmental standards significantly impact market dynamics. Product substitution is limited, with the primary alternatives being road and sea freight, which often lack the same cost-effectiveness and capacity for bulk transportation. The end-user segmentation is diverse, encompassing various industries such as mining, agriculture, manufacturing, and construction. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total of xx deals recorded between 2019 and 2024, indicating a relatively stable yet active consolidation phase.

- Market Concentration: HHI of xx in 2024.

- Innovation Drivers: Development of digital freight wagons (e.g., VTG iWagon), advanced materials, improved safety features.

- Regulatory Impacts: Stringent safety and environmental standards impacting design and production.

- Product Substitutes: Road and sea freight, with limitations in cost and capacity.

- End-User Segmentation: Mining, agriculture, manufacturing, construction, and others.

- M&A Trends: xx deals recorded between 2019 and 2024.

Freight Wagons Market Market Trends & Opportunities

The global freight wagons market is experiencing significant growth, driven by increasing global trade, expanding infrastructure projects, and the rising demand for efficient freight transportation. The market size is projected to reach USD xx million by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, particularly the adoption of digital technologies like the VTG iWagon, are revolutionizing the industry, enhancing operational efficiency and reducing maintenance costs. Consumer preferences are shifting towards more sustainable and technologically advanced wagons, creating opportunities for innovation. Competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and technological advancements. Market penetration rates vary across regions, with developed economies exhibiting higher penetration compared to developing nations.

Dominant Markets & Segments in Freight Wagons Market

The Asia-Pacific region is projected to dominate the freight wagons market throughout the forecast period, driven by substantial infrastructure development and a burgeoning manufacturing sector. Within this region, India and China are key contributors, fueled by consistent investment in railway expansion and modernization.

- Leading Region: Asia-Pacific

- Key Growth Drivers (Asia-Pacific):

- Massive infrastructure development projects.

- Expanding manufacturing and industrial sectors.

- Government initiatives promoting rail transportation.

- Increasing trade volumes.

Segment Analysis:

The open wagon segment currently holds a leading market share, driven by its versatility and adaptability for various freight types. However, the closed wagon and hopper wagon segments are expected to witness significant growth due to rising demand for secure and specialized cargo transportation. The "Above 60 Tons" payload capacity segment is experiencing robust growth, reflecting a trend towards enhanced efficiency and reduced transportation costs. Similarly, the 4-axle and 6-axle segments are growing rapidly due to their increased load-carrying capacity.

Freight Wagons Market Product Analysis

Recent innovations in freight wagon technology focus on enhanced safety, increased payload capacity, and improved operational efficiency. Advancements such as digital monitoring systems, advanced braking technologies (like the WFP system in the VTG iWagon), and lightweight materials improve overall performance. The market fit for these innovations is high, as they address critical industry needs for increased efficiency, reduced maintenance costs, and enhanced safety standards.

Key Drivers, Barriers & Challenges in Freight Wagons Market

Key Drivers:

- Increasing globalization and global trade volumes.

- Growing infrastructure development projects globally, particularly in developing economies.

- Technological advancements leading to enhanced efficiency and safety features.

- Government regulations promoting rail transportation as a sustainable alternative.

Challenges:

- Fluctuating raw material prices impacting manufacturing costs.

- Supply chain disruptions causing delays and cost increases.

- Intense competition amongst existing players.

- Stringent regulatory compliance requirements. Compliance costs are estimated to account for xx% of total production costs.

Growth Drivers in the Freight Wagons Market Market

The market's growth is fueled by a confluence of factors, including the expanding global trade volume requiring efficient freight transport solutions, substantial infrastructure development projects globally, advancements in wagon technology improving efficiency and safety, and governmental policies prioritizing rail transport to reduce carbon footprints.

Challenges Impacting Freight Wagons Market Growth

Challenges encompass fluctuating raw material costs impacting production expenses, unpredictable supply chain disruptions causing delays and cost escalation, intense competition among existing players, and adherence to stringent regulatory requirements.

Key Players Shaping the Freight Wagons Market Market

- GWI UK Holding Limited

- Jupiter Wagons Limited

- ELH Waggonbau Niesky GmbH

- United Wagon Company

- Titagarh Wagons Ltd

- Jindal Rail Infrastructure Limited

- AmstedMaxion

- WH Davis Group of Companies

- Texmaco Rail & Engineering Ltd

- FreightCar America

Significant Freight Wagons Market Industry Milestones

- December 2023: Jupiter Wagons Limited secured a INR 1,617 crores (~USD 195 million) contract from the Ministry of Railways for 4,000 BOXNS wagons, significantly boosting market demand.

- October 2023: Launch of the VTG iWagon, showcasing technological advancements in digital freight wagons and setting new industry standards.

Future Outlook for Freight Wagons Market Market

The freight wagons market is poised for sustained growth, driven by continued infrastructure investments, technological innovation, and the increasing preference for rail freight as a cost-effective and environmentally friendly mode of transport. Strategic opportunities exist for companies to focus on developing innovative and sustainable wagon solutions, catering to the evolving needs of various industries. The market's potential is substantial, promising substantial growth throughout the forecast period.

Freight Wagons Market Segmentation

-

1. Wagon Type

- 1.1. Closed Wagon

- 1.2. Open Wagon

- 1.3. Hopper Wagon

- 1.4. Flat Wagon

- 1.5. Tank Wagon

- 1.6. Car Wagon

- 1.7. Refrigerated Wagon

- 1.8. Special Purpose Wagon

-

2. Payload Capacity

- 2.1. Up To 60 Tons

- 2.2. Above 60 Tons

-

3. Axle

- 3.1. 2-Axle

- 3.2. 2x2 Axle

- 3.3. 4 Axle

- 3.4. 6 Axle

Freight Wagons Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. South Africa

- 4.3. Rest of the World

Freight Wagons Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Shift Toward Rail Freight Transport is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. Hopper Wagons are the Largest Segment Owing to Their Versatility

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Wagon Type

- 5.1.1. Closed Wagon

- 5.1.2. Open Wagon

- 5.1.3. Hopper Wagon

- 5.1.4. Flat Wagon

- 5.1.5. Tank Wagon

- 5.1.6. Car Wagon

- 5.1.7. Refrigerated Wagon

- 5.1.8. Special Purpose Wagon

- 5.2. Market Analysis, Insights and Forecast - by Payload Capacity

- 5.2.1. Up To 60 Tons

- 5.2.2. Above 60 Tons

- 5.3. Market Analysis, Insights and Forecast - by Axle

- 5.3.1. 2-Axle

- 5.3.2. 2x2 Axle

- 5.3.3. 4 Axle

- 5.3.4. 6 Axle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Wagon Type

- 6. North America Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Wagon Type

- 6.1.1. Closed Wagon

- 6.1.2. Open Wagon

- 6.1.3. Hopper Wagon

- 6.1.4. Flat Wagon

- 6.1.5. Tank Wagon

- 6.1.6. Car Wagon

- 6.1.7. Refrigerated Wagon

- 6.1.8. Special Purpose Wagon

- 6.2. Market Analysis, Insights and Forecast - by Payload Capacity

- 6.2.1. Up To 60 Tons

- 6.2.2. Above 60 Tons

- 6.3. Market Analysis, Insights and Forecast - by Axle

- 6.3.1. 2-Axle

- 6.3.2. 2x2 Axle

- 6.3.3. 4 Axle

- 6.3.4. 6 Axle

- 6.1. Market Analysis, Insights and Forecast - by Wagon Type

- 7. Europe Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Wagon Type

- 7.1.1. Closed Wagon

- 7.1.2. Open Wagon

- 7.1.3. Hopper Wagon

- 7.1.4. Flat Wagon

- 7.1.5. Tank Wagon

- 7.1.6. Car Wagon

- 7.1.7. Refrigerated Wagon

- 7.1.8. Special Purpose Wagon

- 7.2. Market Analysis, Insights and Forecast - by Payload Capacity

- 7.2.1. Up To 60 Tons

- 7.2.2. Above 60 Tons

- 7.3. Market Analysis, Insights and Forecast - by Axle

- 7.3.1. 2-Axle

- 7.3.2. 2x2 Axle

- 7.3.3. 4 Axle

- 7.3.4. 6 Axle

- 7.1. Market Analysis, Insights and Forecast - by Wagon Type

- 8. Asia Pacific Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Wagon Type

- 8.1.1. Closed Wagon

- 8.1.2. Open Wagon

- 8.1.3. Hopper Wagon

- 8.1.4. Flat Wagon

- 8.1.5. Tank Wagon

- 8.1.6. Car Wagon

- 8.1.7. Refrigerated Wagon

- 8.1.8. Special Purpose Wagon

- 8.2. Market Analysis, Insights and Forecast - by Payload Capacity

- 8.2.1. Up To 60 Tons

- 8.2.2. Above 60 Tons

- 8.3. Market Analysis, Insights and Forecast - by Axle

- 8.3.1. 2-Axle

- 8.3.2. 2x2 Axle

- 8.3.3. 4 Axle

- 8.3.4. 6 Axle

- 8.1. Market Analysis, Insights and Forecast - by Wagon Type

- 9. Rest of the World Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Wagon Type

- 9.1.1. Closed Wagon

- 9.1.2. Open Wagon

- 9.1.3. Hopper Wagon

- 9.1.4. Flat Wagon

- 9.1.5. Tank Wagon

- 9.1.6. Car Wagon

- 9.1.7. Refrigerated Wagon

- 9.1.8. Special Purpose Wagon

- 9.2. Market Analysis, Insights and Forecast - by Payload Capacity

- 9.2.1. Up To 60 Tons

- 9.2.2. Above 60 Tons

- 9.3. Market Analysis, Insights and Forecast - by Axle

- 9.3.1. 2-Axle

- 9.3.2. 2x2 Axle

- 9.3.3. 4 Axle

- 9.3.4. 6 Axle

- 9.1. Market Analysis, Insights and Forecast - by Wagon Type

- 10. North America Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Freight Wagons Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 South Africa

- 13.1.3 Rest of the World

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 GWI UK Holding Limited

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Jupiter Wagons Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 ELH Waggonbau Niesky GmbH*List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 United Wagon Company

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Titagarh Wagons Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Jindal Rail Infrastructure Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 AmstedMaxion

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 WH Davis Group of Companies

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Texmaco Rail & Engineering Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 FreightCar America

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 GWI UK Holding Limited

List of Figures

- Figure 1: Freight Wagons Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Freight Wagons Market Share (%) by Company 2024

List of Tables

- Table 1: Freight Wagons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Freight Wagons Market Revenue Million Forecast, by Wagon Type 2019 & 2032

- Table 3: Freight Wagons Market Revenue Million Forecast, by Payload Capacity 2019 & 2032

- Table 4: Freight Wagons Market Revenue Million Forecast, by Axle 2019 & 2032

- Table 5: Freight Wagons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Africa Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of the World Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Freight Wagons Market Revenue Million Forecast, by Wagon Type 2019 & 2032

- Table 26: Freight Wagons Market Revenue Million Forecast, by Payload Capacity 2019 & 2032

- Table 27: Freight Wagons Market Revenue Million Forecast, by Axle 2019 & 2032

- Table 28: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Freight Wagons Market Revenue Million Forecast, by Wagon Type 2019 & 2032

- Table 33: Freight Wagons Market Revenue Million Forecast, by Payload Capacity 2019 & 2032

- Table 34: Freight Wagons Market Revenue Million Forecast, by Axle 2019 & 2032

- Table 35: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Freight Wagons Market Revenue Million Forecast, by Wagon Type 2019 & 2032

- Table 41: Freight Wagons Market Revenue Million Forecast, by Payload Capacity 2019 & 2032

- Table 42: Freight Wagons Market Revenue Million Forecast, by Axle 2019 & 2032

- Table 43: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: India Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: China Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Freight Wagons Market Revenue Million Forecast, by Wagon Type 2019 & 2032

- Table 50: Freight Wagons Market Revenue Million Forecast, by Payload Capacity 2019 & 2032

- Table 51: Freight Wagons Market Revenue Million Forecast, by Axle 2019 & 2032

- Table 52: Freight Wagons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: South America Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of the World Freight Wagons Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight Wagons Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Freight Wagons Market?

Key companies in the market include GWI UK Holding Limited, Jupiter Wagons Limited, ELH Waggonbau Niesky GmbH*List Not Exhaustive, United Wagon Company, Titagarh Wagons Ltd, Jindal Rail Infrastructure Limited, AmstedMaxion, WH Davis Group of Companies, Texmaco Rail & Engineering Ltd, FreightCar America.

3. What are the main segments of the Freight Wagons Market?

The market segments include Wagon Type, Payload Capacity, Axle.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Shift Toward Rail Freight Transport is Driving the Market.

6. What are the notable trends driving market growth?

Hopper Wagons are the Largest Segment Owing to Their Versatility.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: Jupiter Wagons Limited secured a contract worth INR 1,617 crores (~USD 195 million) from the Ministry of Railways to manufacture and supply 4,000 BOXNS wagons.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight Wagons Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freight Wagons Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freight Wagons Market?

To stay informed about further developments, trends, and reports in the Freight Wagons Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence