Key Insights

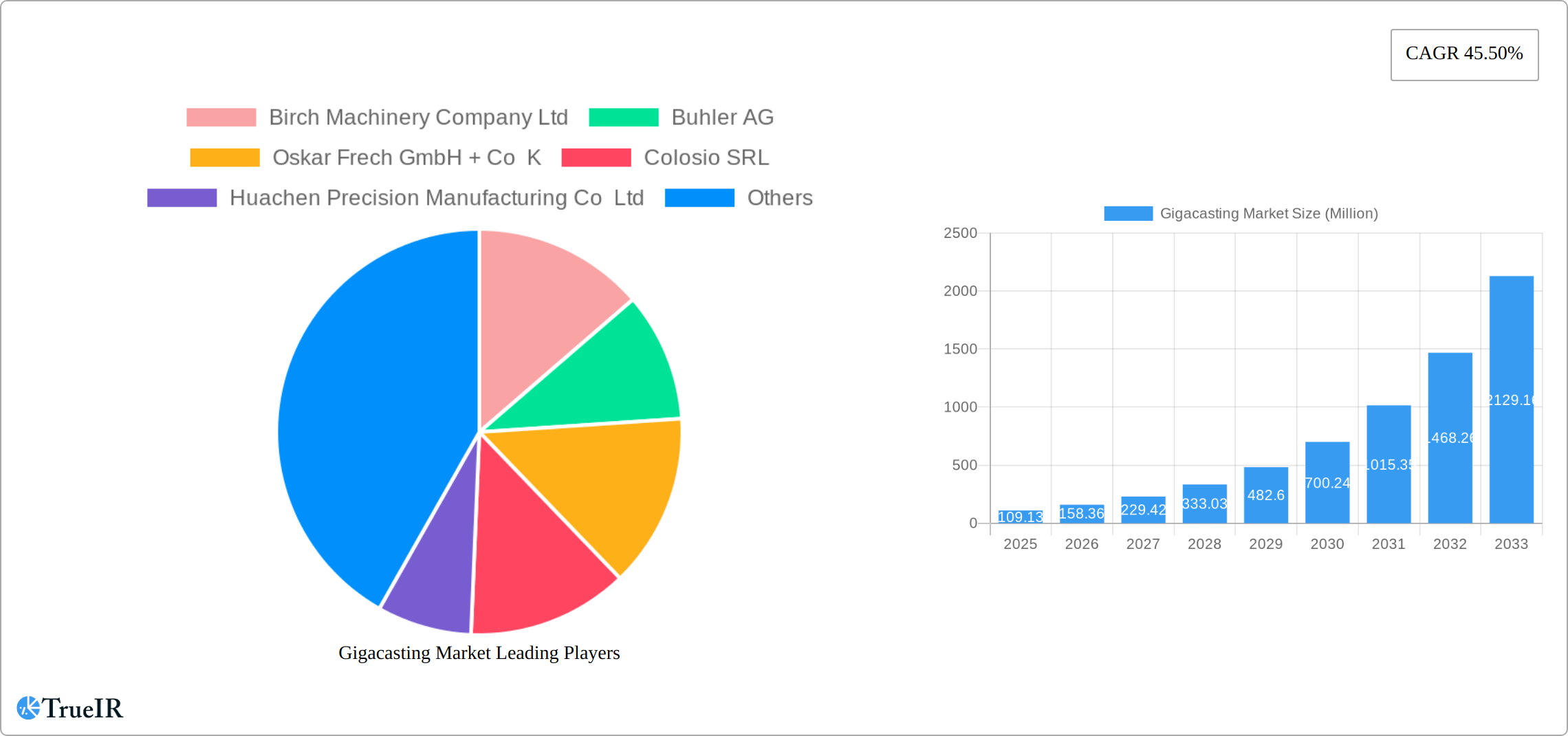

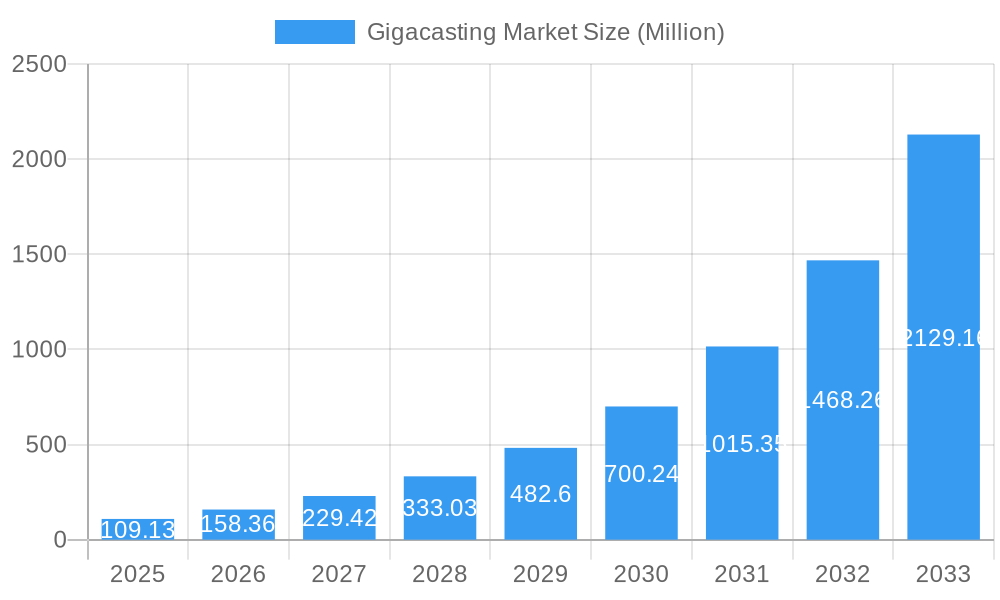

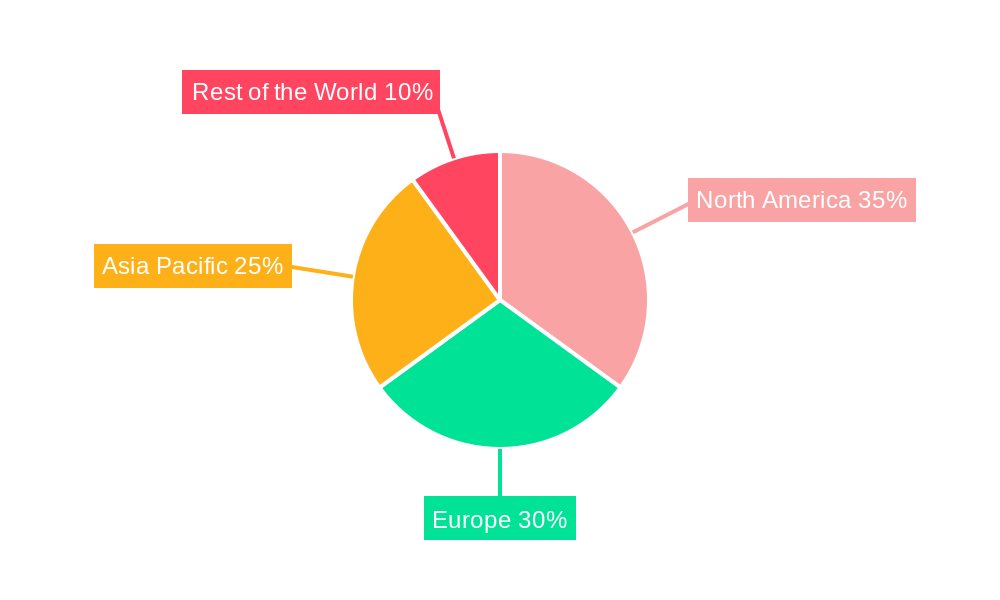

The global gigacasting market is experiencing explosive growth, projected to reach a valuation of $109.13 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 45.50%. This surge is primarily driven by the increasing demand for lightweight yet high-strength components in the automotive industry, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs). The automotive sector's shift towards fuel efficiency and reduced emissions is a key catalyst, with gigacasting offering a significant advantage in reducing vehicle weight and improving fuel economy. Furthermore, advancements in casting technologies, such as improved die design and materials, are contributing to enhanced production efficiency and quality, thereby fueling market expansion. The adoption of gigacasting is also expanding into other sectors, including aerospace and industrial machinery, where the need for robust and lightweight parts is paramount. The market is segmented by application, with body assemblies, engine parts, and transmission parts currently dominating, yet the "others" segment holds considerable future potential as the technology finds new applications. Key players like Birch Machinery Company Ltd, Buhler AG, and others are actively investing in research and development to refine gigacasting processes and broaden their market presence. Geographic growth is robust, with North America and Europe currently leading, followed by rapidly expanding markets in Asia Pacific, particularly China and India, reflecting the region's burgeoning automotive and industrial sectors.

Gigacasting Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued market expansion, fueled by sustained technological advancements, increasing adoption across diverse industries, and the ongoing shift towards lighter and more fuel-efficient vehicles. However, potential restraints include the high initial investment costs associated with gigacasting equipment and the complexities involved in mastering the process. Nevertheless, the long-term benefits, including improved component performance and reduced manufacturing costs, are expected to outweigh these challenges, ensuring the continued and substantial growth of the gigacasting market throughout the forecast period. The market's expansion will likely be characterized by increased competition, strategic partnerships, and continuous innovation within the manufacturing technology itself.

Gigacasting Market Company Market Share

This dynamic report provides a comprehensive analysis of the Gigacasting Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive market research and data analysis spanning the period 2019-2033 (Study Period), with a focus on 2025 (Base Year and Estimated Year), this report projects market trends through 2033 (Forecast Period), encompassing the historical period of 2019-2024. The report delves into market structure, competitive landscape, technological advancements, key players, and future growth prospects. It identifies significant opportunities and challenges, providing a clear roadmap for navigating the evolving Gigacasting Market. Expect detailed analysis, quantitative data, and actionable strategic recommendations. The market is expected to reach xx Million by 2033, growing at a CAGR of xx%.

Gigacasting Market Market Structure & Competitive Landscape

The Gigacasting market demonstrates a moderately concentrated structure, with the top five players commanding an estimated [Insert Updated Percentage]% market share in 2025. This concentration is driven by significant capital investment requirements and technological expertise needed for gigapress production. Key innovation drivers include the burgeoning demand for lighter, stronger automotive components, particularly within the burgeoning electric vehicle (EV) sector, coupled with advancements in die-casting technology and the increasing integration of automation in manufacturing processes. Furthermore, the industry is significantly influenced by regulatory impacts, encompassing environmental regulations, safety standards, and potentially future mandates regarding carbon emissions and material sourcing. Traditional manufacturing processes, such as forging and machining, continue to present competitive pressure; however, the advantages of gigacasting in terms of cost-effectiveness, reduced lead times, and enhanced component integration are steadily eroding their market share.

End-user segmentation is heavily weighted towards the automotive industry, with leading applications in body assemblies, engine parts, and transmission components. However, growth is also evident in other sectors including aerospace, heavy machinery, and consumer electronics, as the benefits of high-volume, complex part production become increasingly clear. Mergers and acquisitions (M&A) activity has shown moderate but steady growth in recent years, with approximately [Insert Updated Number] transactions recorded between 2019 and 2024. This signifies ongoing consolidation, strategic positioning by key players seeking to expand capacity and technological capabilities, and a drive for vertical integration within the supply chain.

- Market Concentration: Top 5 players hold approximately [Insert Updated Percentage]% market share (2025).

- Innovation Drivers: Lightweight automotive parts (especially for EVs), advanced die casting, automation, and material science advancements.

- Regulatory Impacts: Environmental and safety regulations, carbon footprint reduction targets, and supply chain transparency significantly influence operations.

- Product Substitutes: Traditional forging and machining processes offer competition, but their market share is declining.

- End-User Segmentation: Automotive (body assemblies, engine parts, transmission parts) remains dominant, with growing adoption in aerospace, heavy machinery, and consumer electronics.

- M&A Activity: Approximately [Insert Updated Number] transactions between 2019 and 2024, indicating market consolidation.

Gigacasting Market Market Trends & Opportunities

The Gigacasting Market is experiencing robust growth, driven by several factors. The global automotive industry's increasing demand for lightweight yet high-strength components is a major catalyst. The transition towards electric vehicles (EVs) is further fueling this demand as gigacasting offers significant advantages in EV production, such as reduced manufacturing costs and enhanced production efficiency. Technological advancements, such as the development of larger and more efficient giga presses, are continuously expanding the capabilities and applications of gigacasting.

Consumer preferences for fuel-efficient and environmentally friendly vehicles are indirectly boosting market growth by pushing manufacturers to adopt lighter materials and optimized designs. Competitive dynamics are characterized by ongoing innovation, capacity expansions, and strategic partnerships aimed at securing market share. The market is expected to witness a significant expansion, reaching xx Million by 2033, driven by a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates in key segments such as automotive body parts are projected to increase to xx% by 2033.

Dominant Markets & Segments in Gigacasting Market

The automotive industry, specifically within the body assemblies segment, is the dominant market for gigacasting. Significant growth drivers within this segment include:

- Increased demand for lightweight vehicles: Regulations mandating improved fuel efficiency and lower emissions are driving the adoption of lightweight materials.

- Expansion of the electric vehicle market: Gigacasting is particularly advantageous in EV manufacturing, enabling the creation of complex parts in a single piece, reducing assembly time and costs.

- Government support and incentives: Many governments provide financial support and incentives for the development and adoption of advanced manufacturing technologies.

While the Asian region demonstrates strong overall growth, specific countries within Europe and North America are seeing significant adoption rates in the automotive sector due to a high concentration of automotive manufacturers. The Body Assemblies segment is significantly outpacing growth in Engine Parts and Transmission Parts due to the complexity and scale of components involved in vehicle bodies. Other applications are showing incremental growth, though they lag behind automotive in market size.

Gigacasting Market Product Analysis

Gigacasting technology continues to evolve, with advancements in machine design, die materials, and casting processes leading to improved part quality, dimensional accuracy, and production efficiency. The primary applications remain in the automotive sector, addressing the need for complex, lightweight, and high-strength components for vehicles. Competitive advantages are derived from higher production rates, reduced material waste, and the ability to produce larger and more intricate parts compared to traditional methods. This leads to cost savings and faster production cycles, making gigacasting a highly attractive option for manufacturers.

Key Drivers, Barriers & Challenges in Gigacasting Market

Key Drivers:

The accelerating demand for lightweight vehicles, driven by fuel efficiency standards and the expansion of the electric vehicle market, is a primary driver. Technological advancements in gigacasting machinery, including increased press tonnage and improved die design, are continuously improving efficiency and part complexity. Government support and incentives aimed at promoting advanced manufacturing technologies and reducing carbon emissions further bolster market growth.

Key Challenges and Restraints:

High capital investment costs associated with purchasing and installing gigapresses remain a significant barrier to entry for new players. Supply chain vulnerabilities, particularly concerning specialized materials and skilled labor, can lead to disruptions. Intense competition amongst established players, particularly those with existing large-scale manufacturing capabilities, poses a challenge. The technology's inherent complexity necessitates highly skilled labor, specialized expertise in die design and manufacturing, and sophisticated quality control processes.

Growth Drivers in the Gigacasting Market Market

The growth of the Gigacasting Market is driven by the increasing demand for lightweight vehicles, particularly electric vehicles. Technological advancements such as larger giga presses with improved casting capabilities are key enablers. Government incentives and regulations supporting advanced manufacturing further contribute to market expansion.

Challenges Impacting Gigacasting Market Growth

Significant challenges include the substantial initial investment costs for gigapresses, the need for specialized skilled labor, and potential supply chain disruptions affecting both raw materials and specialized components. Furthermore, intense competition from established players and the complexities inherent in integrating this technology into existing manufacturing processes present substantial obstacles to market penetration for new entrants.

Key Players Shaping the Gigacasting Market Market

- Birch Machinery Company Ltd

- Buhler AG

- Oskar Frech GmbH + Co K

- Colosio SRL

- Huachen Precision Manufacturing Co Ltd

- Handtmann Holding GmbH & Co KG

- LK Technology Holdings Limited

- UBE Machinery Inc

- Idra SRL

- Yizumi Holdings Co Ltd

Significant Gigacasting Market Industry Milestones

- September 2023: Toyota Motor Corporation unveils gigacasting machinery for enhanced EV production, aiming for 3.5 Million EV sales annually by 2030, highlighting the technology's crucial role in automotive electrification.

- November 2023: Idra SRL secures a contract with Volvo Cars to install two 9,000-ton giga press machines in Košice, Slovakia, signifying a major commitment to gigacasting in high-volume automotive manufacturing and reinforcing the technology's increasing adoption rate.

- [Add other relevant milestones here with dates and descriptions]

Future Outlook for Gigacasting Market Market

The Gigacasting market is poised for robust and sustained growth, propelled by the unwavering demand from the automotive sector, especially within electric vehicle manufacturing. Strategic partnerships, focusing on technological innovation and supply chain optimization, will play a crucial role in shaping the market's future trajectory. Continuous investments in capacity expansion and the development of more efficient gigapresses will be key to meeting the increasing demand. The increasing adoption of lightweight materials and the persistent need for cost-effective manufacturing processes present significant opportunities for growth and innovation. The market is expected to witness continued consolidation, further technological advancements, and a broadening of applications beyond the automotive sector into diverse industries.

Gigacasting Market Segmentation

-

1. Application

- 1.1. Body Assemblies

- 1.2. Engine Parts

- 1.3. Transmission Parts

- 1.4. Others

Gigacasting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Gigacasting Market Regional Market Share

Geographic Coverage of Gigacasting Market

Gigacasting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Lightweight Vehicle Parts

- 3.3. Market Restrains

- 3.3.1. High Intial Investment

- 3.4. Market Trends

- 3.4.1. Body Assemblies Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gigacasting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Body Assemblies

- 5.1.2. Engine Parts

- 5.1.3. Transmission Parts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gigacasting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Body Assemblies

- 6.1.2. Engine Parts

- 6.1.3. Transmission Parts

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Gigacasting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Body Assemblies

- 7.1.2. Engine Parts

- 7.1.3. Transmission Parts

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Gigacasting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Body Assemblies

- 8.1.2. Engine Parts

- 8.1.3. Transmission Parts

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Gigacasting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Body Assemblies

- 9.1.2. Engine Parts

- 9.1.3. Transmission Parts

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Birch Machinery Company Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Buhler AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Oskar Frech GmbH + Co K

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Colosio SRL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Huachen Precision Manufacturing Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Handtmann Holding GmbH & Co KG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LK Technology Holdings Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 UBE Machinery Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Idra SRL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yizumi Holdings Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Birch Machinery Company Ltd

List of Figures

- Figure 1: Global Gigacasting Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gigacasting Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Gigacasting Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Gigacasting Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Gigacasting Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Gigacasting Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Gigacasting Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Gigacasting Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Gigacasting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Gigacasting Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Gigacasting Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Gigacasting Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Gigacasting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Gigacasting Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World Gigacasting Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Gigacasting Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Gigacasting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gigacasting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Gigacasting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Gigacasting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Gigacasting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Gigacasting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Gigacasting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Gigacasting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Gigacasting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Gigacasting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Gigacasting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: South America Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Gigacasting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gigacasting Market?

The projected CAGR is approximately 45.50%.

2. Which companies are prominent players in the Gigacasting Market?

Key companies in the market include Birch Machinery Company Ltd, Buhler AG, Oskar Frech GmbH + Co K, Colosio SRL, Huachen Precision Manufacturing Co Ltd, Handtmann Holding GmbH & Co KG, LK Technology Holdings Limited, UBE Machinery Inc, Idra SRL, Yizumi Holdings Co Ltd.

3. What are the main segments of the Gigacasting Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Lightweight Vehicle Parts.

6. What are the notable trends driving market growth?

Body Assemblies Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Intial Investment.

8. Can you provide examples of recent developments in the market?

November 2023: Idra SRL signed a contract with Volvo Cars to install two 9,000-ton giga press machines at a new site located in Košice, Slovakia. This installation of advanced machinery is set to revolutionize the automotive manufacturing sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gigacasting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gigacasting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gigacasting Market?

To stay informed about further developments, trends, and reports in the Gigacasting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence