Key Insights

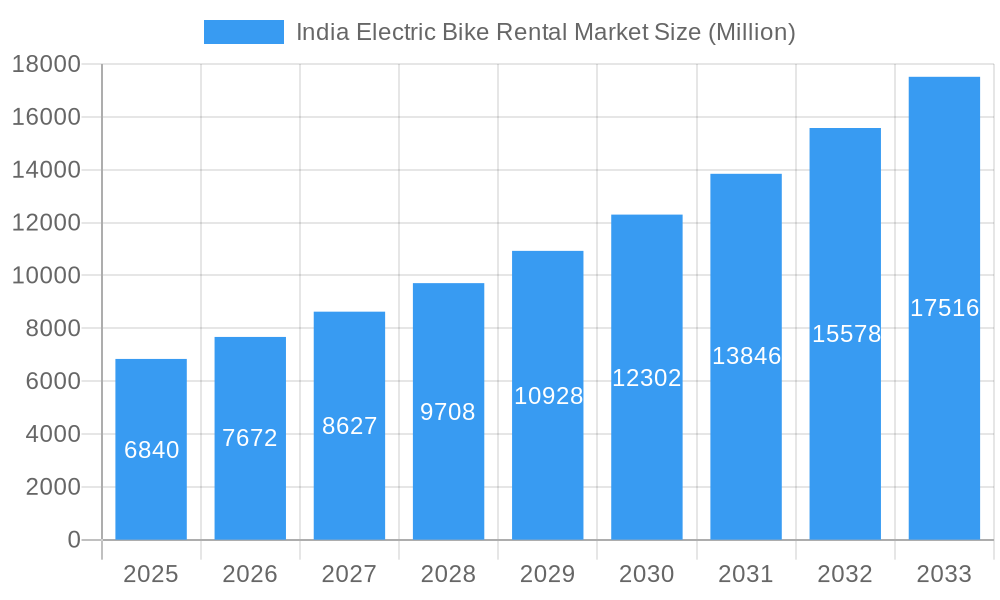

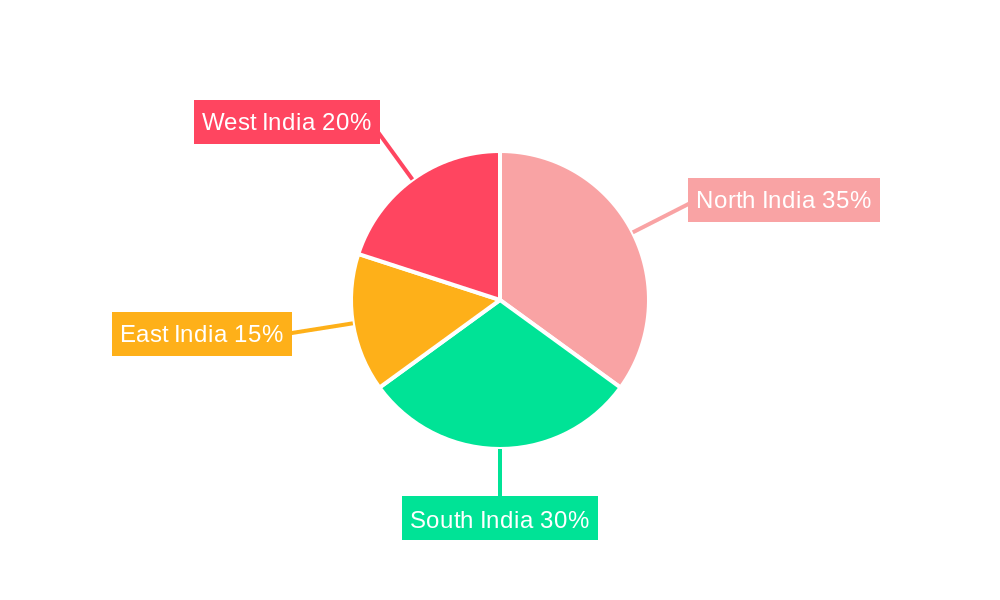

The India electric bike rental market is experiencing robust growth, projected to reach a market size of ₹6.84 billion (approximately US$820 million) in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 12.10% from 2025 to 2033. This surge is driven by several key factors. Increasing environmental concerns and government initiatives promoting sustainable transportation are significantly boosting demand for eco-friendly alternatives like electric bikes. Furthermore, the convenience and affordability of electric bike rentals compared to personal vehicle ownership, especially in congested urban areas, are compelling consumers to adopt this mode of transportation. The market is segmented by application type (urban/city, cargo) and vehicle type (pedal-assisted, throttle-assisted), with urban usage and pedal-assisted bikes currently dominating the market. The rising popularity of last-mile delivery services further fuels growth within the cargo segment. While challenges like initial investment costs for rental operators and the need for robust charging infrastructure exist, innovative business models and supportive government policies are actively mitigating these restraints. Major players like Rentrip Services, Yulu Bikes, Zypp, and Bounce are actively shaping the market landscape through technological advancements and strategic expansions. Regional variations exist, with metropolitan areas in North and South India demonstrating higher adoption rates than East and West India, reflecting varying levels of infrastructure development and consumer awareness. The forecast period (2025-2033) promises continued expansion, fueled by technological improvements, increasing disposable incomes, and growing urban populations.

India Electric Bike Rental Market Market Size (In Billion)

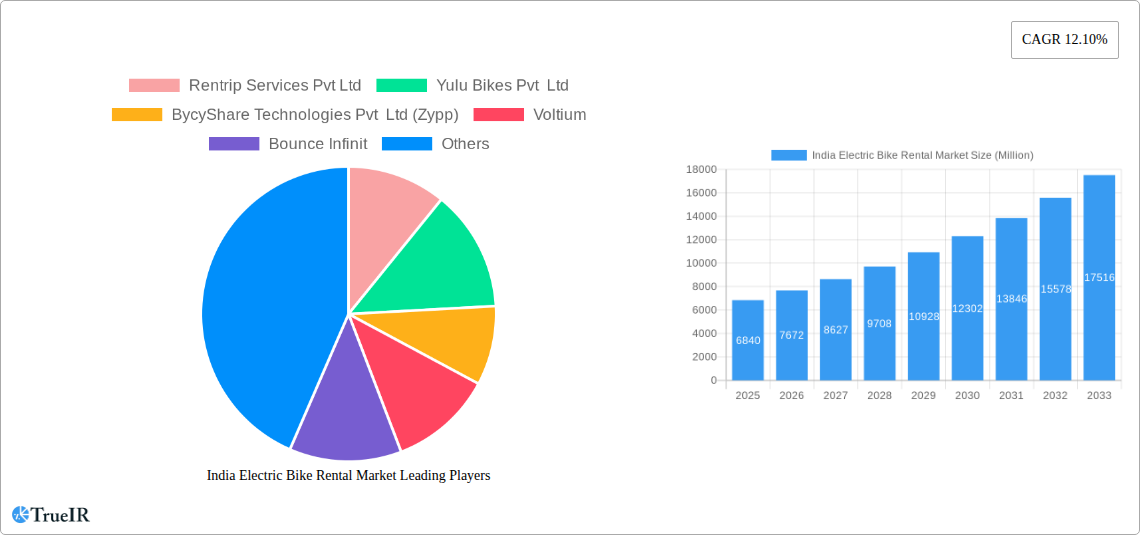

The competitive landscape features a mix of established players and emerging startups, each vying for market share through various strategies, such as expanding fleet size, optimizing rental platforms, and focusing on strategic partnerships. The market's future hinges on addressing existing challenges and capitalizing on opportunities presented by technological innovations like improved battery technology, smart charging solutions, and integrated mobile applications. Expansion into untapped regions, particularly in East and West India, presents significant growth opportunities. Continued government support in terms of subsidies, tax incentives, and infrastructure development is vital for ensuring sustained growth and wider adoption of electric bike rentals across the country. The overall market trajectory points towards a significant increase in market value over the next decade, establishing electric bike rentals as a prominent player in India's transportation sector.

India Electric Bike Rental Market Company Market Share

India Electric Bike Rental Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning India Electric Bike Rental Market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a comprehensive study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report leverages robust data and expert analysis to illuminate current market trends and predict future growth trajectories. The market is projected to reach xx Million by 2033, exhibiting a compelling CAGR of xx%.

India Electric Bike Rental Market Structure & Competitive Landscape

The India electric bike rental market exhibits a moderately fragmented structure, with several key players vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating the presence of both established players and emerging startups. Innovation is a key driver, with companies continually introducing new features, technologies (like improved battery life and smart connectivity), and business models (subscription services, etc.). Government regulations, particularly those related to safety standards and licensing, significantly influence market dynamics. Product substitutes, such as traditional bicycle rentals and ride-hailing services, represent a competitive threat. The market is segmented by application type (Urban/City, Cargo) and vehicle type (Pedal-Assisted, Throttle-Assisted). M&A activity has been relatively limited in recent years, with only xx transactions recorded between 2019-2024, suggesting potential for future consolidation.

- Key Market Players: Rentrip Services Pvt Ltd, Yulu Bikes Pvt Ltd, BycyShare Technologies Pvt Ltd (Zypp), Voltium, Bounce Infinit, EXA MOBILITY EXA RIDE, Giant Bikes, Zypp Electric, Motoride Scooter Rentals, Wheelbros, Vogo Rental, eBikeGo Pvt Ltd.

- Market Concentration: CR4 estimated at xx% (2024).

- M&A Activity: xx transactions recorded between 2019-2024.

India Electric Bike Rental Market Trends & Opportunities

The India electric bike rental market is experiencing robust growth, fueled by increasing urbanization, rising environmental awareness, and government initiatives promoting sustainable transportation. The market size, valued at xx Million in 2024, is projected to reach xx Million by 2033, driven by a CAGR of xx%. Technological advancements, such as improved battery technology and enhanced connectivity features, are transforming the user experience. Consumer preferences are shifting towards convenient, affordable, and eco-friendly transportation solutions, creating a fertile ground for growth. Intense competition among established players and new entrants is shaping the market landscape, leading to innovative pricing strategies, service enhancements, and geographic expansion. Market penetration rates are currently low but are expected to increase significantly in the coming years, driven by factors like increasing smartphone penetration and rising disposable incomes.

Dominant Markets & Segments in India Electric Bike Rental Market

The Urban/City segment dominates the India electric bike rental market, accounting for approximately xx% of the total market share in 2024. Bengaluru, Delhi, and Mumbai are key growth regions, driven by high population density, robust infrastructure, and favorable government policies. The Pedal-Assisted vehicle type holds a larger market share compared to Throttle-Assisted, due to its affordability and ease of use. The Cargo segment is expected to show significant growth in the coming years, fuelled by increasing e-commerce deliveries and last-mile connectivity needs.

Key Growth Drivers (Urban/City Segment):

- Expanding urban infrastructure (cycle lanes, charging stations).

- Government initiatives promoting electric mobility.

- Rising fuel prices and environmental concerns.

- Increasing smartphone penetration and digital literacy.

Key Growth Drivers (Cargo Segment):

- Growth of the e-commerce sector.

- Need for efficient and cost-effective last-mile delivery solutions.

- Government incentives for electric commercial vehicles.

India Electric Bike Rental Market Product Analysis

The market features a diverse range of electric bikes, catering to various user needs and preferences. Innovations focus on improving battery life, enhancing connectivity features (GPS tracking, mobile app integration), and incorporating safety features. Companies are competing on factors like price, range, and features, seeking to differentiate their offerings and capture market share. The market fit is strongly influenced by consumer demand for convenient, affordable, and environmentally friendly transportation options.

Key Drivers, Barriers & Challenges in India Electric Bike Rental Market

Key Drivers: Government policies promoting electric mobility, rising fuel costs, increasing environmental awareness, technological advancements leading to better battery life and performance, and the growing popularity of shared mobility services.

Challenges: High initial investment costs for establishing rental fleets, limited charging infrastructure in certain areas, regulatory uncertainties, and intense competition from other transportation modes (ride-hailing apps, public transport). The lack of standardized regulations across states also creates complexities. Supply chain disruptions impacting battery production and bike availability pose further hurdles.

Growth Drivers in the India Electric Bike Rental Market Market

The market's growth is propelled by technological advancements in battery technology, expanding urban infrastructure supporting electric vehicles, increasing environmental awareness among consumers, supportive government policies offering subsidies and incentives, and the rising adoption of shared mobility solutions.

Challenges Impacting India Electric Bike Rental Market Growth

Challenges include inadequate charging infrastructure, inconsistent regulatory frameworks across different states, intense competition from established players and new entrants, and high initial investment costs. Concerns about battery lifespan, safety standards, and maintenance costs also impede widespread adoption.

Key Players Shaping the India Electric Bike Rental Market Market

- Rentrip Services Pvt Ltd

- Yulu Bikes Pvt Ltd

- BycyShare Technologies Pvt Ltd (Zypp)

- Voltium

- Bounce Infinit

- EXA MOBILITY EXA RIDE

- Giant Bikes

- Zypp Electric

- Motoride Scooter Rentals

- Wheelbros

- Vogo Rental

- eBikeGo Pvt Ltd

Significant India Electric Bike Rental Market Industry Milestones

- June 2023: Yulu launches Yulu Wynn, a new low-speed e-bike model, expanding its presence in Bengaluru, Delhi, and Mumbai.

- February 2023: Yulu Bikes Pvt Ltd, in partnership with Bajaj Auto Ltd, launches two new electric two-wheelers, Miracle GR and DeX GR.

- December 2022: The Karnataka Transport Department licenses Bounce (Wicked Ride) to operate electric bike taxi services.

Future Outlook for India Electric Bike Rental Market Market

The India electric bike rental market is poised for substantial growth, driven by continued technological advancements, supportive government policies, and rising consumer preference for sustainable and convenient transportation. Strategic opportunities exist for companies to expand their service offerings, optimize operational efficiency, and tap into underserved markets. The market's future success hinges on addressing infrastructural limitations, streamlining regulatory processes, and fostering innovation to meet evolving consumer demands.

India Electric Bike Rental Market Segmentation

-

1. Application Type

- 1.1. Urban/City

- 1.2. Cargo

-

2. Vehicle Type

- 2.1. Pedal-Assisted

- 2.2. Throttle-Assisted

India Electric Bike Rental Market Segmentation By Geography

- 1. India

India Electric Bike Rental Market Regional Market Share

Geographic Coverage of India Electric Bike Rental Market

India Electric Bike Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Electric Vehicles is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Limited EV Charging Infrastructure May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. The Pedal-assisted Segment Holds the Highest Share by Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electric Bike Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Urban/City

- 5.1.2. Cargo

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Pedal-Assisted

- 5.2.2. Throttle-Assisted

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rentrip Services Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yulu Bikes Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BycyShare Technologies Pvt Ltd (Zypp)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Voltium

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bounce Infinit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EXA MOBILITY EXA RIDE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Giant Bikes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zypp Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Motoride Scooter Rentals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wheelbros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vogo Rental

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eBikeGo Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rentrip Services Pvt Ltd

List of Figures

- Figure 1: India Electric Bike Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Electric Bike Rental Market Share (%) by Company 2025

List of Tables

- Table 1: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: India Electric Bike Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: India Electric Bike Rental Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electric Bike Rental Market?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the India Electric Bike Rental Market?

Key companies in the market include Rentrip Services Pvt Ltd, Yulu Bikes Pvt Ltd, BycyShare Technologies Pvt Ltd (Zypp), Voltium, Bounce Infinit, EXA MOBILITY EXA RIDE, Giant Bikes, Zypp Electric, Motoride Scooter Rentals, Wheelbros, Vogo Rental, eBikeGo Pvt Ltd.

3. What are the main segments of the India Electric Bike Rental Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Electric Vehicles is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

The Pedal-assisted Segment Holds the Highest Share by Vehicle Type.

7. Are there any restraints impacting market growth?

Limited EV Charging Infrastructure May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Joining the burgeoning electric two-wheeler space, Bengaluru-headquartered electric mobility platform Yulu Bikes Pvt Ltd, in partnership with Bajaj Auto Ltd, launched two new electric 2-wheelers (e2Ws), namely Miracle GR and DeX GR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electric Bike Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electric Bike Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electric Bike Rental Market?

To stay informed about further developments, trends, and reports in the India Electric Bike Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence