Key Insights

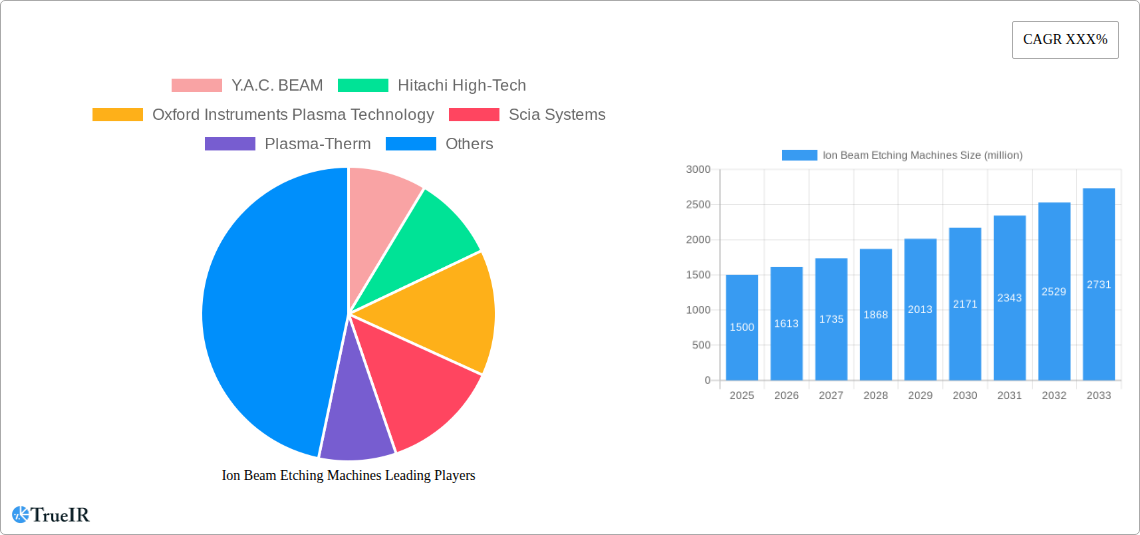

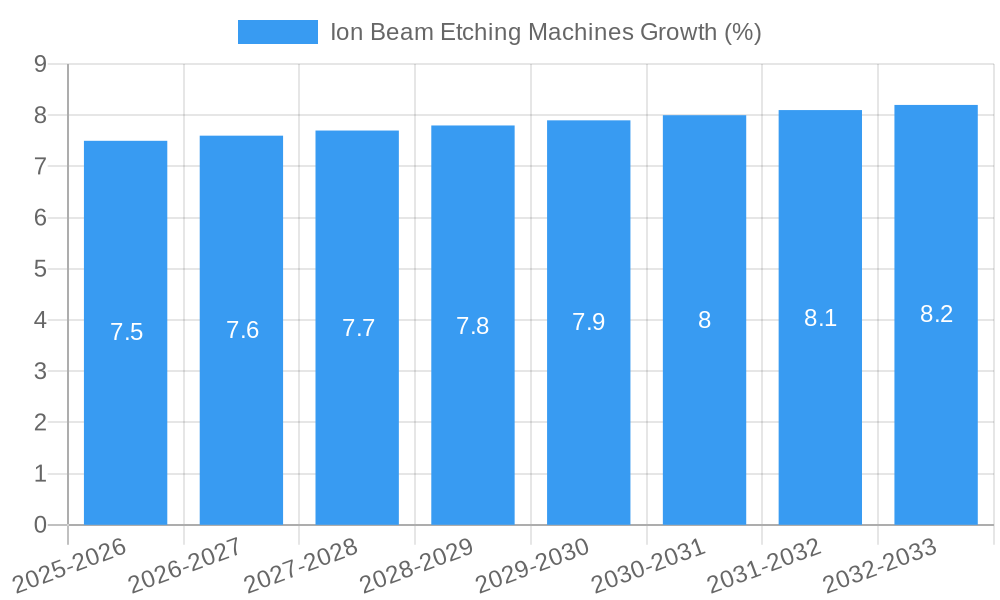

The global Ion Beam Etching Machines market is experiencing robust growth, projected to reach an estimated market size of $1,500 million in 2025. This expansion is driven by the escalating demand for advanced semiconductor manufacturing, particularly in the Microelectronics and Optoelectronics sectors, which are central to the development of next-generation devices. The increasing complexity of integrated circuits and the need for high precision in fabrication processes are fueling the adoption of ion beam etching technologies. Furthermore, the burgeoning IT & Communication industry, with its continuous drive for smaller, faster, and more efficient electronic components, acts as a significant catalyst for market expansion. Emerging applications beyond these core areas, though smaller in current share, are also poised for growth as technological frontiers push further. The market's trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of approximately 7.5%, indicating sustained and strong market performance expected to continue through 2033.

The market is segmented by substrate size, with a notable concentration in larger substrates (150 mm, 200 mm, and 300 mm) reflecting the industry's move towards larger wafer sizes for enhanced efficiency and cost-effectiveness in semiconductor production. While smaller substrates (<150 mm) still hold relevance for specialized applications, the trend clearly favors larger formats. Key market restraints include the high capital expenditure associated with advanced ion beam etching equipment and the need for specialized expertise in operation and maintenance. However, ongoing technological advancements, such as improved beam control, multi-chamber systems, and enhanced automation, are mitigating these challenges and driving innovation. The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, with a significant presence of companies in North America, Europe, and Asia Pacific, particularly China, Japan, and South Korea, which are hubs for semiconductor manufacturing.

This comprehensive report provides an in-depth analysis of the global Ion Beam Etching Machines market, offering invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. Spanning a study period from 2019 to 2033, with a base year of 2025, this report leverages advanced analytics and industry expertise to deliver actionable intelligence.

Ion Beam Etching Machines Market Structure & Competitive Landscape

The global Ion Beam Etching Machines market is characterized by a moderate to high concentration, with a few key players dominating market share. Innovation drivers are paramount, fueled by the relentless pursuit of higher precision, improved throughput, and enhanced cost-efficiency in semiconductor fabrication and advanced materials processing. Regulatory impacts, particularly concerning environmental standards and export controls, play a significant role in shaping market entry and operational strategies. The threat of product substitutes, while present in the form of other advanced etching technologies, is mitigated by the unique advantages offered by ion beam etching, such as its anisotropic etching capabilities and minimal undercutting. End-user segmentation reveals a strong demand from the microelectronics and optoelectronics sectors, driven by the miniaturization trends in consumer electronics and the burgeoning growth of advanced display technologies. Mergers and acquisitions (M&A) trends, though not always high in volume, have been strategic, often aimed at acquiring specialized technologies or expanding market reach. For instance, several key acquisitions have occurred within the historical period, consolidating technological expertise. The estimated M&A volume in recent years has been in the range of hundreds of million dollars, reflecting the strategic importance of these transactions. Concentration ratios indicate that the top 5 players command a significant majority of the market share, estimated to be over 70%.

Ion Beam Etching Machines Market Trends & Opportunities

The global Ion Beam Etching Machines market is poised for significant expansion, with projected market size growth expected to reach several million dollars by the end of the forecast period. This robust growth trajectory is underpinned by a confluence of evolving technological shifts and increasing consumer preferences for sophisticated electronic devices. The relentless miniaturization in microelectronics, demanding finer feature sizes and higher device densities, directly fuels the need for advanced etching solutions like ion beam etching. The expanding applications in optoelectronics, including the development of high-efficiency LEDs, advanced lasers, and next-generation photovoltaic cells, further contribute to market expansion. Consumer demand for faster, more powerful, and more compact electronic gadgets—ranging from smartphones and wearable devices to advanced computing systems and virtual reality hardware—creates a sustained demand for the cutting-edge semiconductor components that ion beam etching enables.

Technological advancements are a primary catalyst. Innovations in ion source design, beam control, and wafer handling systems are continuously improving etching uniformity, reducing process times, and enhancing overall yield. The development of multi-chamber systems and in-situ monitoring capabilities is also a significant trend, allowing for more efficient and controlled manufacturing processes. Furthermore, the increasing adoption of advanced materials, such as novel semiconductors and exotic alloys, in specialized applications necessitates the precision and controllability offered by ion beam etching techniques.

Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their offerings. This includes developing machines capable of handling larger substrate sizes and offering a wider range of etching chemistries and parameters. The market penetration rate for ion beam etching machines, while already substantial in high-end applications, is expected to increase as smaller players and emerging markets adopt these sophisticated technologies. The compound annual growth rate (CAGR) for the ion beam etching machines market is estimated to be in the double-digit percentage range over the forecast period, driven by these powerful trends and opportunities. The market size is expected to grow from an estimated million in the base year of 2025 to exceed million by 2033.

Dominant Markets & Segments in Ion Beam Etching Machines

The dominant markets and segments within the Ion Beam Etching Machines landscape are shaped by the pervasive demand for advanced microfabrication across various industries.

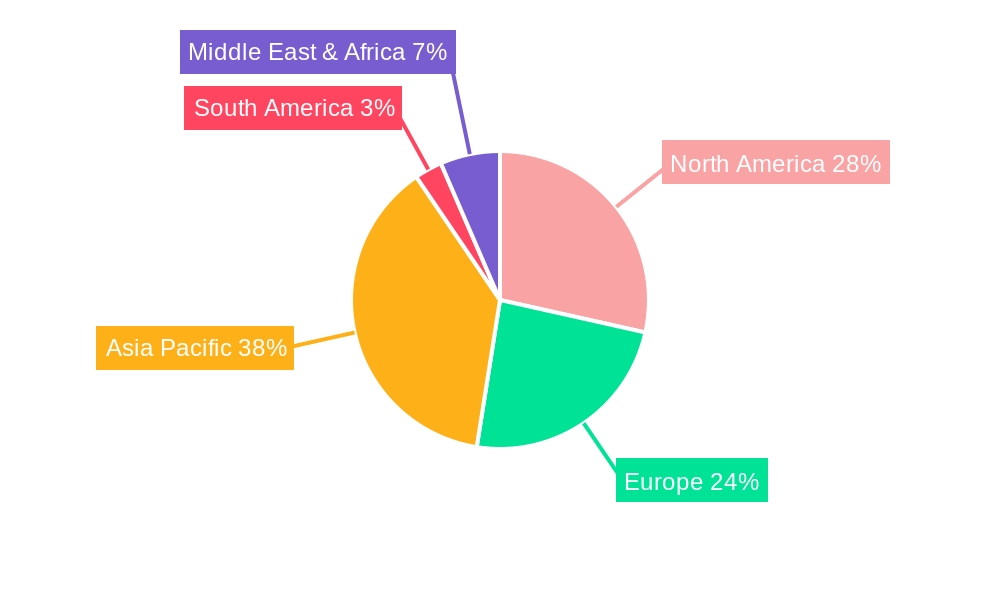

Leading Region: North America and Asia Pacific are identified as the leading regions for ion beam etching machines. This dominance is attributed to the significant presence of major semiconductor fabrication facilities, thriving optoelectronics industries, and substantial government investments in research and development. The concentration of R&D centers and advanced manufacturing hubs in these regions drives the adoption of state-of-the-art etching technologies.

Key Countries: Within these regions, countries such as the United States, South Korea, Japan, Taiwan, and China are at the forefront.

- United States: Home to a robust semiconductor industry and pioneering research institutions, driving demand for high-precision etching for cutting-edge chip development.

- South Korea & Taiwan: Giants in memory chip manufacturing, requiring high-volume, high-precision etching for advanced DRAM and NAND flash production.

- Japan: A leader in optoelectronics and advanced materials, utilizing ion beam etching for high-performance sensors and displays.

- China: Witnessing rapid growth in its domestic semiconductor industry, with substantial investments in advanced manufacturing equipment, including ion beam etching machines.

Dominant Application Segments:

- Microelectronics: This segment represents the largest and most critical application for ion beam etching machines. The relentless drive for smaller transistors, denser integrated circuits, and advanced packaging technologies in smartphones, high-performance computing, and artificial intelligence processors necessitates the sub-micron precision and anisotropic etching capabilities offered by ion beam systems. The market for microelectronics applications is estimated to contribute over million in revenue annually.

- Optoelectronics: This segment is experiencing rapid growth, driven by the demand for advanced LEDs, lasers for telecommunications and industrial applications, and sophisticated sensors. The precise etching of compound semiconductor materials is crucial for fabricating high-performance optoelectronic devices. The projected market size for optoelectronics applications is expected to reach million by 2033.

- IT & Communication: This segment encompasses the broader networking and communication infrastructure, including the manufacturing of components for 5G technology, fiber optics, and advanced data storage solutions. Ion beam etching plays a vital role in ensuring the reliability and performance of these critical components.

- Others: This category includes emerging applications in areas such as MEMS (Micro-Electro-Mechanical Systems) for sensors and actuators, advanced medical devices, and specialized scientific research equipment. While smaller in volume, these segments represent significant growth potential.

Dominant Type Segments (Substrate Size):

- Substrate 300 mm: The industry standard for high-volume semiconductor manufacturing, driving the demand for ion beam etching machines capable of handling 300 mm wafers. This segment is expected to continue its dominance, accounting for a substantial portion of the market revenue, estimated at million annually.

- Substrate 200 mm: Remains relevant for specialized applications and for manufacturers transitioning to larger wafer sizes, representing a significant segment with an estimated market size of million.

- Substrate 150 mm: Still utilized for certain niche applications and in research and development environments, contributing an estimated million to the market.

- Substrate <150 mm: Primarily found in laboratory settings and for prototyping, this segment has a smaller market share but is crucial for early-stage research and development.

The interplay between these regions, countries, applications, and substrate types creates a dynamic market landscape, with growth drivers including infrastructure development in emerging economies, favorable government policies supporting advanced manufacturing, and continuous technological innovation.

Ion Beam Etching Machines Product Analysis

Ion beam etching machines are at the forefront of precision manufacturing, offering unparalleled control over critical etch parameters. Product innovations are heavily focused on enhancing etch uniformity, reducing process variation across the wafer, and achieving higher etch rates without compromising resolution. Key competitive advantages lie in their anisotropic etching capabilities, enabling the fabrication of vertical sidewalls essential for high-density integrated circuits and advanced microstructures. Applications span from critical gate etching in advanced logic nodes to precise trench formation in memory devices and the patterning of complex optoelectronic structures. The continuous evolution of ion source technology, beam shaping optics, and advanced process control software allows manufacturers to achieve sub-nanometer precision, making these machines indispensable for cutting-edge semiconductor fabrication and the development of next-generation electronic and photonic devices. The market value of advanced product offerings in this space is estimated to be in the million dollar range.

Key Drivers, Barriers & Challenges in Ion Beam Etching Machines

Key Drivers: The ion beam etching machines market is propelled by several key drivers. Technologically, the relentless demand for miniaturization in microelectronics and the increasing complexity of semiconductor device architectures are paramount. Economic factors, such as the growth of the global electronics market and substantial investments in advanced manufacturing facilities, also play a crucial role. Policy-driven factors, including government initiatives to promote domestic semiconductor production and foster innovation in advanced materials, further fuel market expansion. For instance, national semiconductor strategies in various countries directly incentivize the adoption of advanced etching equipment.

Key Barriers & Challenges: Conversely, significant challenges exist. Supply chain issues, particularly the availability of specialized components and raw materials, can lead to production delays and increased costs. Regulatory hurdles, including stringent environmental regulations and export control measures for advanced technologies, can impact market access and global sales. Competitive pressures from established players and emerging technologies also pose a constant challenge. The high capital expenditure required for acquiring these sophisticated machines can also be a barrier for smaller companies or those in developing economies. For example, the cost of a single advanced ion beam etching system can range from several hundred thousand to million dollars, impacting market entry for some segments.

Growth Drivers in the Ion Beam Etching Machines Market

The ion beam etching machines market's growth is underpinned by a strong foundation of technological advancements, robust economic indicators, and supportive policy frameworks. Technologically, the increasing complexity and shrinking feature sizes in semiconductor manufacturing, particularly for advanced logic and memory devices, necessitate the sub-micron precision and anisotropic etch profiles achievable with ion beam technology. Economically, the burgeoning global demand for consumer electronics, data centers, and telecommunications infrastructure directly translates into a higher demand for advanced semiconductor components, thereby driving the need for ion beam etching solutions. Furthermore, government incentives and strategic investments in semiconductor manufacturing capabilities worldwide are creating fertile ground for market expansion. The ongoing development of new materials and applications in areas like advanced sensors and novel photonic devices also presents significant growth opportunities.

Challenges Impacting Ion Beam Etching Machines Growth

Despite its promising trajectory, the ion beam etching machines market faces several challenges that could impede growth. Regulatory complexities, including evolving environmental standards and trade restrictions on advanced technologies, can create market access hurdles and impact international sales volumes. Supply chain disruptions, exacerbated by geopolitical factors and global events, can lead to extended lead times for critical components and increased manufacturing costs, potentially affecting the overall cost-competitiveness of ion beam etching solutions. Intense competitive pressures from established global manufacturers and the emergence of alternative etching technologies also demand continuous innovation and cost optimization. The high initial capital investment required for ion beam etching equipment can also be a significant barrier for smaller players and emerging markets, limiting widespread adoption.

Key Players Shaping the Ion Beam Etching Machines Market

- Y.A.C. BEAM

- Hitachi High-Tech

- Oxford Instruments Plasma Technology

- Scia Systems

- Plasma-Therm

- NANO-MASTER

- Intlvac Thin Film

- Veeco

- Angstrom Engineering

- CANON ANELVA

- Denton Vacuum

- Nordiko

- Beijing Chuangshiweina Technology

- Beijing Jinshengweina Technology

- Beijing Advancedmems

- Tailong Elcetronics

- ACME POLE

Significant Ion Beam Etching Machines Industry Milestones

- 2019: Introduction of next-generation ion sources enabling higher current densities and improved etch selectivity, significantly impacting the Microelectronics segment.

- 2020: Development of advanced plasma diagnostics and real-time process control for enhanced wafer uniformity, a key milestone for Substrate 300 mm processing.

- 2021: Strategic M&A activity involving a major player acquiring a specialized technology provider, consolidating market expertise in Optoelectronics applications.

- 2022: Launch of new multi-chamber ion beam etching systems offering increased throughput for high-volume manufacturing in IT & Communication.

- 2023: Significant advancements in maskless ion beam etching for advanced research and development in novel materials.

- 2024: Expansion of manufacturing capacity by leading players to meet growing global demand, particularly from emerging markets.

Future Outlook for Ion Beam Etching Machines Market

- 2019: Introduction of next-generation ion sources enabling higher current densities and improved etch selectivity, significantly impacting the Microelectronics segment.

- 2020: Development of advanced plasma diagnostics and real-time process control for enhanced wafer uniformity, a key milestone for Substrate 300 mm processing.

- 2021: Strategic M&A activity involving a major player acquiring a specialized technology provider, consolidating market expertise in Optoelectronics applications.

- 2022: Launch of new multi-chamber ion beam etching systems offering increased throughput for high-volume manufacturing in IT & Communication.

- 2023: Significant advancements in maskless ion beam etching for advanced research and development in novel materials.

- 2024: Expansion of manufacturing capacity by leading players to meet growing global demand, particularly from emerging markets.

Future Outlook for Ion Beam Etching Machines Market

The future outlook for the Ion Beam Etching Machines market is exceptionally bright, driven by the unyielding demand for miniaturization, enhanced performance, and novel functionalities in the electronics and photonics industries. Strategic opportunities lie in catering to the burgeoning growth of AI, 5G infrastructure, and advanced display technologies, all of which require the precision etching capabilities that ion beam technology offers. The continuous innovation in machine design, including increased automation, reduced footprint, and expanded process flexibility, will further solidify its market position. As emerging economies continue to invest in advanced manufacturing capabilities, the adoption of ion beam etching machines is expected to accelerate, unlocking significant untapped market potential estimated in the million dollar range. The market is projected to see continued robust growth, driven by these key catalysts.

Ion Beam Etching Machines Segmentation

-

1. Application

- 1.1. Microelectronics

- 1.2. Optoelectronics

- 1.3. IT & Communication

- 1.4. Others

-

2. Type

- 2.1. Substrate <150 mm

- 2.2. Substrate 150 mm

- 2.3. Substrate 200 mm

- 2.4. Substrate 300 mm

Ion Beam Etching Machines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ion Beam Etching Machines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Microelectronics

- 5.1.2. Optoelectronics

- 5.1.3. IT & Communication

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Substrate <150 mm

- 5.2.2. Substrate 150 mm

- 5.2.3. Substrate 200 mm

- 5.2.4. Substrate 300 mm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Microelectronics

- 6.1.2. Optoelectronics

- 6.1.3. IT & Communication

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Substrate <150 mm

- 6.2.2. Substrate 150 mm

- 6.2.3. Substrate 200 mm

- 6.2.4. Substrate 300 mm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Microelectronics

- 7.1.2. Optoelectronics

- 7.1.3. IT & Communication

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Substrate <150 mm

- 7.2.2. Substrate 150 mm

- 7.2.3. Substrate 200 mm

- 7.2.4. Substrate 300 mm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Microelectronics

- 8.1.2. Optoelectronics

- 8.1.3. IT & Communication

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Substrate <150 mm

- 8.2.2. Substrate 150 mm

- 8.2.3. Substrate 200 mm

- 8.2.4. Substrate 300 mm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Microelectronics

- 9.1.2. Optoelectronics

- 9.1.3. IT & Communication

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Substrate <150 mm

- 9.2.2. Substrate 150 mm

- 9.2.3. Substrate 200 mm

- 9.2.4. Substrate 300 mm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ion Beam Etching Machines Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Microelectronics

- 10.1.2. Optoelectronics

- 10.1.3. IT & Communication

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Substrate <150 mm

- 10.2.2. Substrate 150 mm

- 10.2.3. Substrate 200 mm

- 10.2.4. Substrate 300 mm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Y.A.C. BEAM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi High-Tech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oxford Instruments Plasma Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Scia Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plasma-Therm

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NANO-MASTER

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intlvac Thin Film

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veeco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Angstrom Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CANON ANELVA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Denton Vacuum

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nordiko

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Beijing Chuangshiweina Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Beijing Jinshengweina Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Beijing Advancedmems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tailong Elcetronics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ACME POLE

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Y.A.C. BEAM

List of Figures

- Figure 1: Global Ion Beam Etching Machines Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ion Beam Etching Machines Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ion Beam Etching Machines Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ion Beam Etching Machines Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ion Beam Etching Machines Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ion Beam Etching Machines Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ion Beam Etching Machines Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ion Beam Etching Machines Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ion Beam Etching Machines Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ion Beam Etching Machines Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ion Beam Etching Machines Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ion Beam Etching Machines Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ion Beam Etching Machines Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ion Beam Etching Machines Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ion Beam Etching Machines Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ion Beam Etching Machines Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ion Beam Etching Machines Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ion Beam Etching Machines Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ion Beam Etching Machines Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ion Beam Etching Machines Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ion Beam Etching Machines Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ion Beam Etching Machines Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ion Beam Etching Machines Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ion Beam Etching Machines Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ion Beam Etching Machines Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ion Beam Etching Machines Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ion Beam Etching Machines Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ion Beam Etching Machines Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ion Beam Etching Machines Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ion Beam Etching Machines Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ion Beam Etching Machines Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ion Beam Etching Machines Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ion Beam Etching Machines Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ion Beam Etching Machines Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ion Beam Etching Machines Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ion Beam Etching Machines Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ion Beam Etching Machines Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ion Beam Etching Machines Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ion Beam Etching Machines Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ion Beam Etching Machines Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ion Beam Etching Machines Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ion Beam Etching Machines?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ion Beam Etching Machines?

Key companies in the market include Y.A.C. BEAM, Hitachi High-Tech, Oxford Instruments Plasma Technology, Scia Systems, Plasma-Therm, NANO-MASTER, Intlvac Thin Film, Veeco, Angstrom Engineering, CANON ANELVA, Denton Vacuum, Nordiko, Beijing Chuangshiweina Technology, Beijing Jinshengweina Technology, Beijing Advancedmems, Tailong Elcetronics, ACME POLE.

3. What are the main segments of the Ion Beam Etching Machines?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ion Beam Etching Machines," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ion Beam Etching Machines report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ion Beam Etching Machines?

To stay informed about further developments, trends, and reports in the Ion Beam Etching Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence