Key Insights

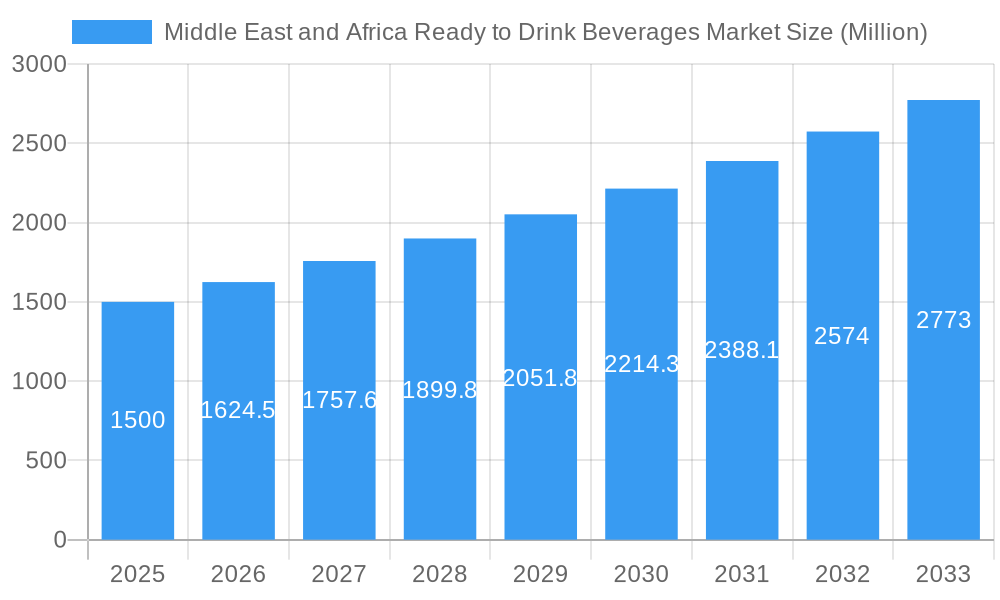

The Middle East and Africa Ready-to-Drink (RTD) Beverages market is projected to reach $804.87 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.22% from the base year 2025. This growth is propelled by a youthful demographic, increasing urbanization, and a growing demand for convenient, on-the-go beverage options. The rising health and wellness consciousness is also a significant driver, boosting demand for healthier RTD choices such as fruit and vegetable juices and dairy-based beverages. Key markets like the UAE and Saudi Arabia are experiencing particularly strong expansion due to higher disposable incomes and evolving consumer lifestyles. However, challenges include raw material price volatility, stringent regulations, and intense competition from global and local brands. The market is segmented by beverage type, with tea, coffee, and energy drinks performing robustly alongside healthier alternatives. Distribution channels are diversifying, with online retail complementing traditional supermarket and convenience store presence. The forecast period of 2025-2033 anticipates sustained expansion driven by economic growth and increased RTD penetration in untapped markets across the region.

Middle East and Africa Ready to Drink Beverages Market Market Size (In Billion)

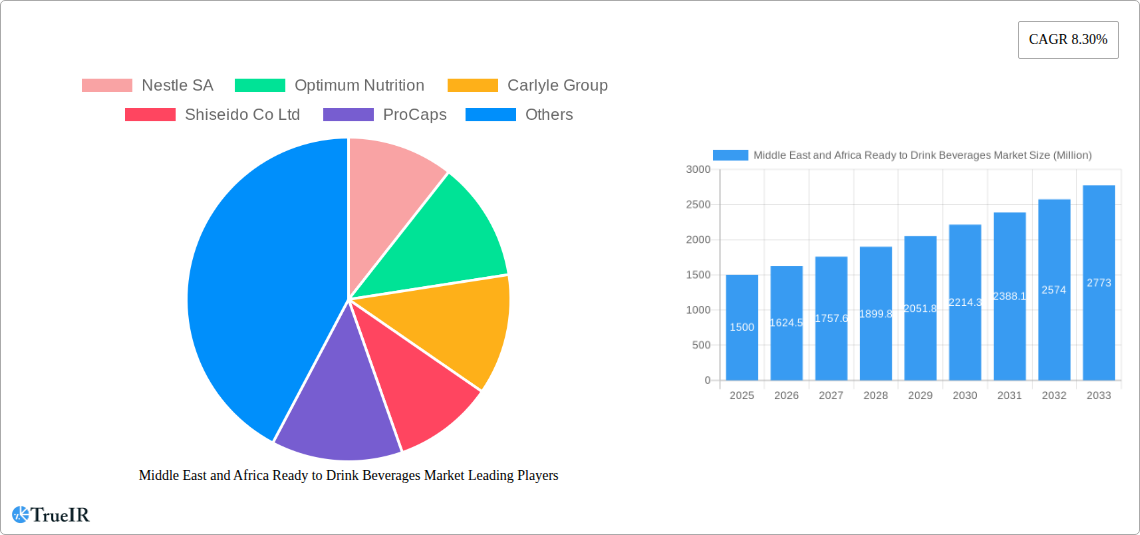

Intense competition characterizes this dynamic market, with major players like Nestle SA and agile local brands employing strategic partnerships, product innovation, and targeted marketing to secure market share. Premiumization and the introduction of functional, health-enhancing beverages are key emerging trends. Improved retail infrastructure and cold chain logistics are vital for the widespread distribution of temperature-sensitive RTD products. Companies are increasingly tailoring product offerings and marketing strategies to cater to specific regional tastes, cultural sensitivities, and consumer needs, fostering brand loyalty and ensuring successful market navigation.

Middle East and Africa Ready to Drink Beverages Market Company Market Share

Middle East and Africa Ready to Drink Beverages Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Middle East and Africa Ready-to-Drink (RTD) Beverages market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, competitive landscapes, and future growth potential. The study incorporates detailed segmentation by product type (Tea, Coffee, Energy Drinks, Fruit and Vegetable Juice, Dairy-based Beverages, Other Product Types) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels), providing a granular understanding of this rapidly evolving market.

Middle East and Africa Ready to Drink Beverages Market Market Structure & Competitive Landscape

The Middle East and Africa RTD beverage market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is witnessing increased competition from both established multinational corporations and emerging regional brands. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies constantly introducing new flavors, functional beverages, and sustainable packaging options to cater to evolving consumer preferences. Regulatory changes, particularly those related to sugar content and labeling, significantly impact market dynamics. Product substitutes, such as bottled water and fresh juices, also pose a competitive challenge. The market is segmented by various end-users, including individual consumers, food service establishments, and retailers. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: HHI (2024): xx

- Innovation Drivers: New flavors, functional beverages, sustainable packaging.

- Regulatory Impacts: Sugar content regulations, labeling requirements.

- Product Substitutes: Bottled water, fresh juices.

- End-User Segmentation: Individual consumers, food service, retailers.

- M&A Trends: xx deals (2019-2024), focused on portfolio expansion and geographic reach.

Middle East and Africa Ready to Drink Beverages Market Market Trends & Opportunities

The Middle East and Africa RTD beverage market is experiencing robust growth, driven by rising disposable incomes, urbanization, and changing consumer lifestyles. The market size reached USD xx Million in 2024 and is projected to reach USD xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as improved packaging and distribution systems, are enhancing market efficiency. Consumer preferences are shifting towards healthier options, including low-sugar and functional beverages, presenting significant opportunities for innovative product development. The increasing penetration of online retail channels also presents new avenues for growth. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of niche brands catering to specific consumer segments. Market penetration rates for various product segments vary significantly, with xx% for energy drinks and xx% for dairy-based beverages in 2024.

Dominant Markets & Segments in Middle East and Africa Ready to Drink Beverages Market

The Middle East and Africa RTD beverage market shows significant variation across regions and product types. While exact market share data needs further research, initial estimations suggest the following:

- Leading Region: [Region Name - Requires Further Research to Determine]

- Leading Country: [Country Name - Requires Further Research to Determine]

- Leading Product Type: Fruit and Vegetable Juices (due to rising health consciousness)

- Leading Distribution Channel: Supermarkets/Hypermarkets (due to established infrastructure)

Key Growth Drivers:

- Infrastructure Development: Improved cold chain logistics and retail infrastructure enhance product availability.

- Favorable Government Policies: Initiatives promoting local manufacturing and food security boost market expansion.

- Rising Disposable Incomes: Increased purchasing power fuels consumer demand for RTD beverages.

- Changing Consumer Preferences: Healthier beverage options like functional drinks fuel segment growth.

Middle East and Africa Ready to Drink Beverages Market Product Analysis

Product innovation within the RTD beverage sector is focused on enhancing taste, providing functional benefits (e.g., added vitamins, probiotics), and adopting sustainable packaging. Companies are developing beverages tailored to specific dietary requirements and lifestyle choices. The success of new products hinges on factors such as appealing flavor profiles, convenient packaging, and effective marketing strategies. Technological advancements in preservation techniques extend shelf life and enhance product quality.

Key Drivers, Barriers & Challenges in Middle East and Africa Ready to Drink Beverages Market

Key Drivers:

Rising disposable incomes, urbanization, changing lifestyles, and the increasing popularity of convenience foods fuel RTD beverage consumption in the MEA region. The growing preference for on-the-go consumption also contributes to the market growth.

Key Challenges and Restraints:

Stringent regulations regarding sugar content and labeling create compliance costs and limit product innovation. Supply chain inefficiencies, particularly in remote areas, increase distribution costs. Intense competition from both established and emerging players leads to price wars, impacting profitability. The fluctuating prices of raw materials also pose a challenge.

Growth Drivers in the Middle East and Africa Ready to Drink Beverages Market Market

Technological advancements in packaging (e.g., aseptic packaging) extending shelf life and improved distribution networks are driving market expansion. Economic growth and rising disposable incomes fuel consumer demand, while supportive government policies promoting local manufacturing provide further impetus.

Challenges Impacting Middle East and Africa Ready to Drink Beverages Market Growth

Regulatory complexities related to food safety and labeling standards present hurdles. Supply chain inefficiencies and infrastructure gaps hinder efficient distribution, particularly in rural areas. Intense competition from both international and regional players exerts pressure on pricing and profit margins.

Key Players Shaping the Middle East and Africa Ready to Drink Beverages Market Market

- Nestle SA

- Optimum Nutrition

- Carlyle Group

- Shiseido Co Ltd

- ProCaps

- Laboratories LLC

- Rejuvenated Ltd

- Holland & Barrett

- Nutraformis Limited

- Naturals LLC

- Revive

Significant Middle East and Africa Ready to Drink Beverages Market Industry Milestones

- July 2022: Arla Foods invested USD 43 Million to expand its RTD product line in the Middle East, Asia, and Europe. This signifies a significant investment in the RTD market and indicates future growth.

- May 2022: Emirates Food Industries launched Hayatna ready-to-consume dairy products in the UAE, expanding the dairy-based beverage segment. This strengthens the local dairy industry and increases product diversity.

- April 2021: Honest Tea (Coca-Cola subsidiary) launched Honest Yebra Mate RTD tea in Saudi Arabia, showcasing expansion into niche beverage categories. This reflects the growing demand for specialized and premium beverages.

Future Outlook for Middle East and Africa Ready to Drink Beverages Market Market

The Middle East and Africa RTD beverage market is poised for continued growth, driven by sustained economic expansion, urbanization, and evolving consumer preferences. Strategic opportunities exist in developing innovative, healthier products and leveraging e-commerce platforms to reach wider consumer segments. The market's future growth is also linked to the effective management of challenges such as supply chain issues and regulatory hurdles. The market's potential is vast given the region’s population growth and rising middle class.

Middle East and Africa Ready to Drink Beverages Market Segmentation

-

1. Product Type

- 1.1. Tea

- 1.2. Coffee

- 1.3. Energy Drinks

- 1.4. Fruit and Vegetable Juice

- 1.5. Dairy-based Beverages

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

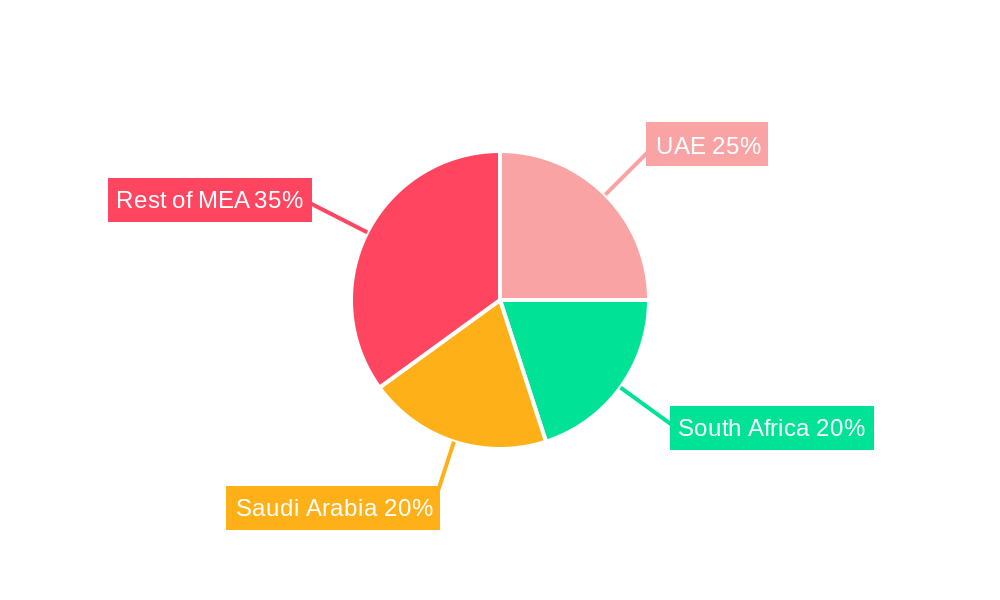

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

Middle East and Africa Ready to Drink Beverages Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Ready to Drink Beverages Market Regional Market Share

Geographic Coverage of Middle East and Africa Ready to Drink Beverages Market

Middle East and Africa Ready to Drink Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Inclination Toward Healthy and Convenience Drinking Habits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tea

- 5.1.2. Coffee

- 5.1.3. Energy Drinks

- 5.1.4. Fruit and Vegetable Juice

- 5.1.5. Dairy-based Beverages

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tea

- 6.1.2. Coffee

- 6.1.3. Energy Drinks

- 6.1.4. Fruit and Vegetable Juice

- 6.1.5. Dairy-based Beverages

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tea

- 7.1.2. Coffee

- 7.1.3. Energy Drinks

- 7.1.4. Fruit and Vegetable Juice

- 7.1.5. Dairy-based Beverages

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tea

- 8.1.2. Coffee

- 8.1.3. Energy Drinks

- 8.1.4. Fruit and Vegetable Juice

- 8.1.5. Dairy-based Beverages

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tea

- 9.1.2. Coffee

- 9.1.3. Energy Drinks

- 9.1.4. Fruit and Vegetable Juice

- 9.1.5. Dairy-based Beverages

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. UAE Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 11. South Africa Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 12. Saudi Arabia Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 13. Rest of MEA Middle East and Africa Ready to Drink Beverages Market Analysis, Insights and Forecast, 2020-2032

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Optimum Nutrition

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Carlyle Group

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Shiseido Co Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 ProCaps

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Laboratories LLC

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Rejuvenated Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Holland & Barrett

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Nutraformis Limited

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Naturals LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Revive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Middle East and Africa Ready to Drink Beverages Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Ready to Drink Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: UAE Middle East and Africa Ready to Drink Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Africa Middle East and Africa Ready to Drink Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Ready to Drink Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of MEA Middle East and Africa Ready to Drink Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 16: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 26: Middle East and Africa Ready to Drink Beverages Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Ready to Drink Beverages Market?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the Middle East and Africa Ready to Drink Beverages Market?

Key companies in the market include Nestle SA , Optimum Nutrition , Carlyle Group , Shiseido Co Ltd , ProCaps , Laboratories LLC , Rejuvenated Ltd , Holland & Barrett , Nutraformis Limited , Naturals LLC, Revive .

3. What are the main segments of the Middle East and Africa Ready to Drink Beverages Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 804.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

Increasing Inclination Toward Healthy and Convenience Drinking Habits.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

July 2022: Arla Foods declared an investment of USD 43 million for expanding its ready to drink product line in the Middle East, Asia, and Europe regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Ready to Drink Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Ready to Drink Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Ready to Drink Beverages Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Ready to Drink Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence