Key Insights

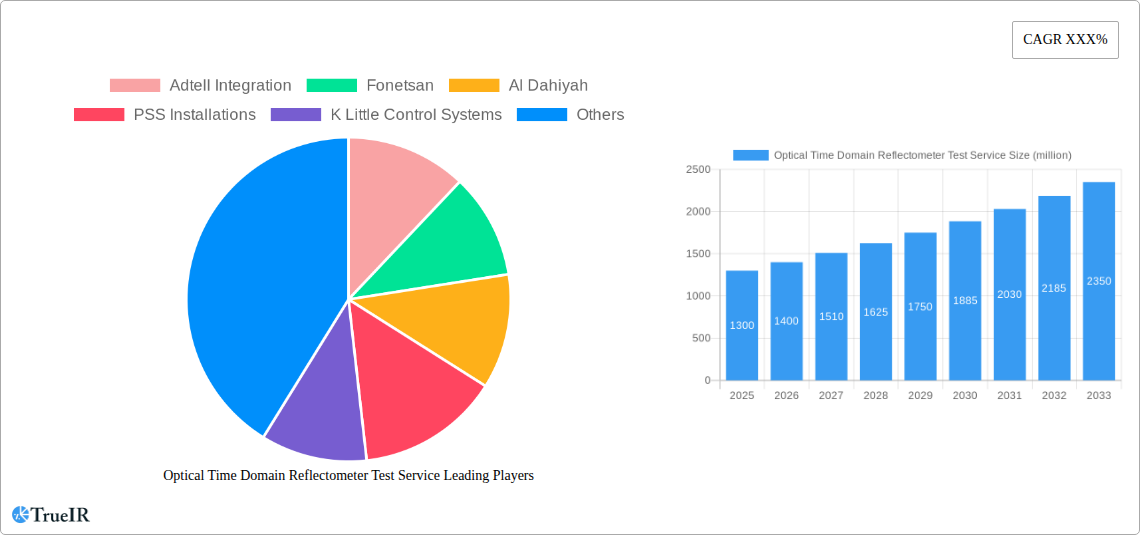

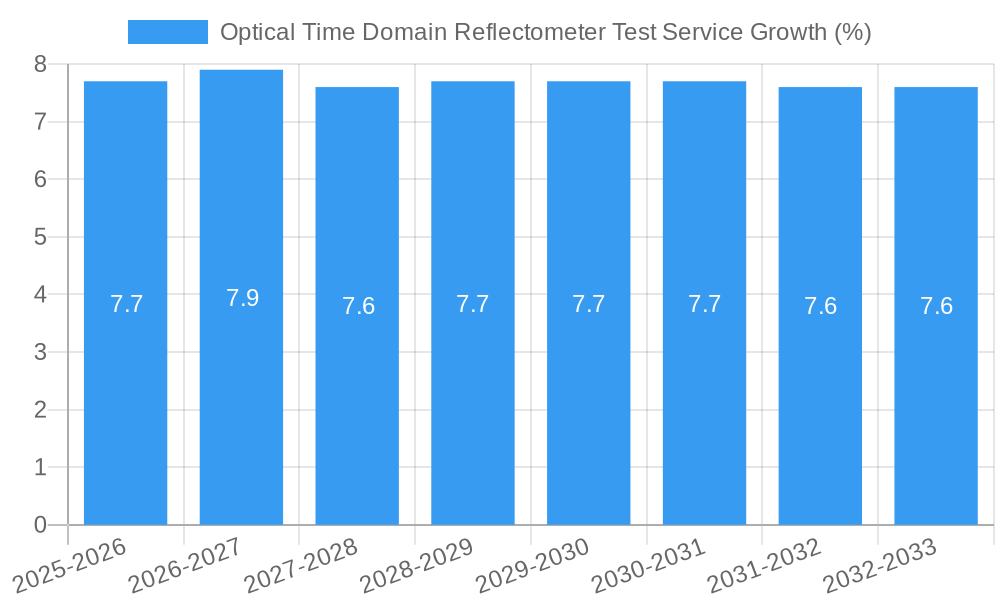

The global Optical Time Domain Reflectometer (OTDR) Test Service market is poised for significant expansion, projected to reach approximately $2.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 8.5% from its estimated 2025 valuation of $1.3 billion. This surge is primarily propelled by the escalating demand for reliable and efficient fiber optic network testing across diverse applications. The increasing deployment of 5G infrastructure, expansion of broadband internet services, and the continuous growth of data centers are key drivers fueling this market. Furthermore, the proliferation of smart cities initiatives and the growing adoption of IoT devices necessitate meticulous fiber network integrity, thereby amplifying the need for OTDR testing services. Both on-site and online service models are witnessing healthy growth, with on-site services catering to immediate diagnostic needs and complex installations, while online services offer scalability and remote monitoring capabilities, addressing the evolving preferences of service providers and end-users.

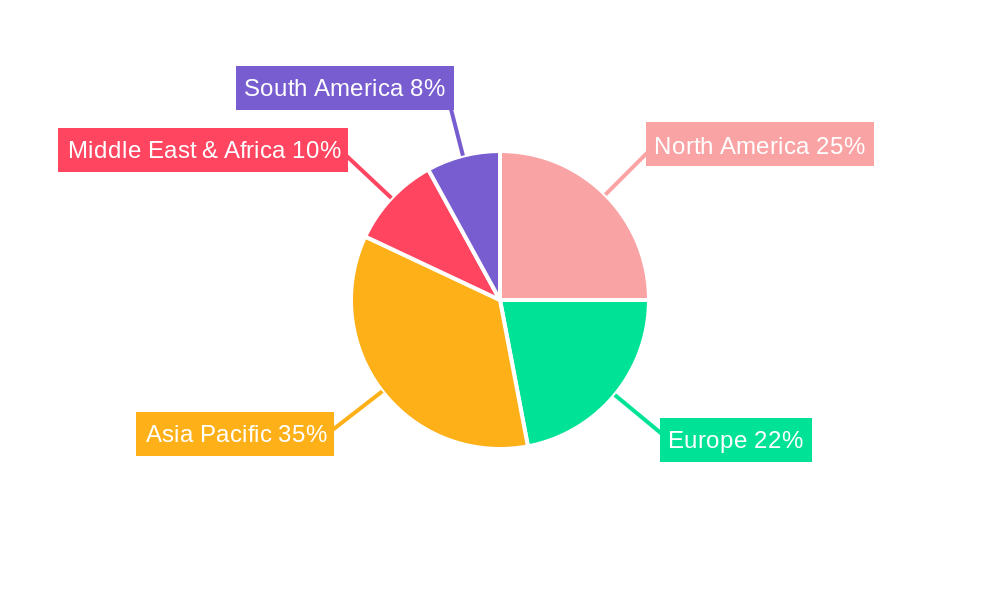

The market's trajectory is further shaped by emerging trends such as the integration of AI and machine learning for predictive maintenance of fiber networks, enhancing efficiency and reducing downtime. Advancements in OTDR technology, including higher resolution, faster testing times, and portability, are also contributing to market growth. However, challenges such as the initial high cost of advanced OTDR equipment and the shortage of skilled technicians in certain regions may present moderate restraints. The market is segmented across various applications, with Communication and Electronic sectors leading in adoption due to their inherent reliance on high-performance fiber optic networks. Energy sector applications are also showing promising growth, driven by the need for robust network infrastructure in utilities. Geographically, Asia Pacific is anticipated to lead market growth, driven by rapid digitalization and infrastructure development in countries like China and India, closely followed by North America and Europe, which continue to invest heavily in upgrading their existing fiber networks.

Here is a dynamic, SEO-optimized report description for Optical Time Domain Reflectometer Test Service, incorporating your specified details, keywords, and structure.

Report Title: Global Optical Time Domain Reflectometer Test Service Market: In-Depth Analysis and Forecast (2019-2033)

Report Description:

Uncover the intricate dynamics of the global Optical Time Domain Reflectometer (OTDR) Test Service market with this comprehensive report. Spanning from 2019 to 2033, this study offers deep insights into market structure, competitive landscape, emerging trends, and future opportunities. Leveraging high-volume keywords such as "fiber optic testing," "OTDR services," "telecom infrastructure," "network diagnostics," and "fiber optic maintenance," this report is engineered to enhance search rankings and capture the attention of professionals across communication, electronic, and energy sectors. Our analysis meticulously covers market size growth, technological advancements, regulatory impacts, and key player strategies, providing an indispensable resource for strategic decision-making.

Optical Time Domain Reflectometer Test Service Market Structure & Competitive Landscape

The Optical Time Domain Reflectometer (OTDR) Test Service market exhibits a moderately concentrated structure, with a significant presence of both established service providers and emerging specialized firms. Innovation drivers are primarily centered around the demand for higher bandwidth, increased network reliability, and the expansion of fiber optic deployments in telecommunication and data center infrastructure. Regulatory impacts are significant, particularly concerning network performance standards and safety protocols, often mandating stringent testing procedures. Product substitutes, while not direct replacements for OTDR's unique fault location capabilities, include fusion splicers and visual fault locators for less complex issues. End-user segmentation reveals a strong reliance on the Communication segment, followed by Energy and Electronic sectors, with a growing "Others" category encompassing industrial and transportation networks. Mergers and Acquisitions (M&A) trends are moderate, driven by companies seeking to expand their service portfolios and geographic reach. The market has witnessed several strategic acquisitions in the past five years, aiming to consolidate market share and enhance technological capabilities. Concentration ratios indicate that the top five players hold approximately 30-40% of the market share, with regional players contributing to market diversity. The competitive landscape is characterized by a blend of global and local service providers vying for contracts in large-scale infrastructure projects.

Optical Time Domain Reflectometer Test Service Market Trends & Opportunities

The global Optical Time Domain Reflectometer (OTDR) Test Service market is poised for substantial growth, projected to reach several billion dollars by 2033, driven by an aggressive Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). This expansion is fueled by the relentless demand for high-speed internet, the exponential growth of data traffic, and the ongoing deployment of 5G networks and broadband infrastructure worldwide. Technological shifts are paramount, with a noticeable trend towards automated OTDR testing, cloud-based data analysis, and the integration of Artificial Intelligence (AI) for predictive maintenance and fault identification. These advancements not only improve efficiency but also enhance the accuracy and speed of network diagnostics, reducing downtime and operational costs for service providers. Consumer preferences are increasingly gravitating towards reliable and seamless connectivity, making robust fiber optic network testing and maintenance services a critical component of service delivery. The competitive dynamics are intensifying, as companies differentiate themselves through specialized service offerings, advanced testing methodologies, and comprehensive reporting capabilities. The market penetration rate for OTDR test services is steadily increasing, particularly in developing economies where fiber optic infrastructure is rapidly being established to bridge the digital divide. Opportunities abound in emerging markets, renewable energy projects requiring resilient network connectivity, and the expansion of underwater fiber optic cables, all of which necessitate precise and reliable OTDR testing. The increasing adoption of fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) initiatives by telecommunication companies globally represents a significant growth catalyst. Furthermore, the evolution of the Internet of Things (IoT) and the proliferation of connected devices are creating a continuous need for high-capacity, low-latency networks, underscoring the importance of dependable fiber optic infrastructure and, consequently, OTDR testing services. The shift towards proactive network maintenance over reactive repairs is also a major trend, with OTDR services playing a pivotal role in early fault detection and prevention. The market is also observing a rise in demand for specialized OTDR testing for critical infrastructure, such as in the energy sector for smart grids and in transportation for intelligent traffic systems.

Dominant Markets & Segments in Optical Time Domain Reflectometer Test Service

The Communication segment stands as the dominant force in the global Optical Time Domain Reflectometer (OTDR) Test Service market, consistently driving demand and market value. This dominance is attributed to the continuous expansion of telecommunication networks, including the rollout of 5G infrastructure, the ubiquitous deployment of fiber-to-the-home (FTTH) services, and the burgeoning data center industry, all of which rely heavily on flawless fiber optic connectivity. Within this segment, On-Site Service constitutes the largest market share, as physical inspection and testing are crucial for new installations, troubleshooting complex faults, and routine maintenance of existing fiber optic networks.

Key Growth Drivers in the Dominant Segments:

Communication Segment:

- Infrastructure Expansion: Aggressive global investments in broadband and 5G network buildouts necessitate extensive fiber optic cable deployment and ongoing testing.

- Data Traffic Growth: The exponential increase in internet traffic from streaming, cloud computing, and IoT devices puts immense pressure on network performance, requiring reliable fiber.

- Network Upgrades: Legacy copper networks are being systematically replaced by fiber optics, creating sustained demand for testing services.

- Service Level Agreements (SLAs): Strict performance requirements in telecom SLAs mandate regular and accurate fiber optic testing.

On-Site Service Type:

- Real-time Diagnostics: On-site services allow for immediate identification and resolution of fiber optic faults, minimizing network downtime.

- New Deployments: Installation of new fiber optic cables and networks requires on-site testing to ensure integrity and performance from the outset.

- Complex Faults: In situations involving physical damage, difficult terrain, or buried cables, on-site expertise and equipment are indispensable.

- Preventative Maintenance: Regular on-site inspections and testing help in identifying potential issues before they escalate into major network failures.

The Energy segment is also a significant and growing market, particularly with the rise of smart grids, renewable energy infrastructure, and the need for reliable communication links for remote monitoring and control. The implementation of advanced metering infrastructure (AMI) and the integration of distributed energy resources are heavily reliant on robust fiber optic networks, where OTDR testing plays a vital role in ensuring uninterrupted operations. The Electronic segment, while smaller in comparison, encompasses testing for specialized electronic systems that utilize fiber optics, such as in industrial automation, avionics, and high-performance computing, where precision and reliability are paramount.

Geographically, North America and Europe currently lead the market due to mature telecommunication infrastructures and significant ongoing upgrades. However, the Asia-Pacific region is experiencing the most rapid growth, driven by massive investments in digital transformation, government initiatives to expand broadband access, and the rapid industrialization across countries like China and India.

Optical Time Domain Reflectometer Test Service Product Analysis

The OTDR test service market is characterized by a continuous stream of product innovations focused on enhancing accuracy, speed, and user-friendliness. Advanced OTDR devices now incorporate longer wavelengths, higher dynamic ranges, and shorter dead zones to meticulously analyze longer fiber spans and detect subtle flaws. Software solutions are increasingly sophisticated, offering automated trace analysis, cloud-based reporting platforms, and integration with network management systems for seamless data flow and predictive maintenance insights. Competitive advantages in this space are derived from the development of miniaturized, ruggedized portable units for field technicians, as well as integrated testing solutions that combine OTDR functionality with other optical test capabilities. The emphasis is on providing cost-effective, efficient, and highly reliable fiber optic testing solutions that meet the demanding requirements of modern communication networks.

Key Drivers, Barriers & Challenges in Optical Time Domain Reflectometer Test Service

The global Optical Time Domain Reflectometer (OTDR) Test Service market is propelled by several key drivers.

Key Growth Drivers:

- Explosive Data Growth: The relentless increase in data consumption from streaming, cloud services, and IoT devices necessitates robust and high-capacity fiber optic networks, driving demand for reliable testing.

- 5G Network Deployment: The widespread rollout of 5G infrastructure requires extensive fiber optic backhaul and fronthaul, creating significant opportunities for OTDR services.

- Broadband Expansion Initiatives: Government and private sector investments in extending high-speed internet access to underserved areas globally fuel the demand for fiber installation and testing.

- Technological Advancements: Innovations in OTDR equipment, such as increased accuracy, speed, and automation, enhance the efficiency and effectiveness of testing services.

- Increased Network Reliability Demands: Critical sectors like finance, healthcare, and energy depend on uninterrupted network operations, making proactive fiber optic testing essential.

The market also faces significant barriers and challenges that temper its growth.

Challenges Impacting Growth:

- High Initial Investment: The cost of advanced OTDR equipment and skilled personnel can be substantial, posing a barrier for smaller service providers.

- Skilled Workforce Shortage: A lack of adequately trained and experienced technicians capable of operating sophisticated OTDR equipment and interpreting complex results can limit service delivery.

- Complexity of Modern Networks: The intricate nature of advanced fiber optic networks, including dense wavelength division multiplexing (DWDM) and high-fiber-count cables, requires specialized expertise for accurate testing.

- Competition from In-house Testing: Some larger telecom operators may opt to build in-house testing capabilities, reducing reliance on external service providers.

- Standardization and Interoperability: Ensuring consistent testing results and interoperability across different equipment manufacturers and service providers can be a challenge.

Growth Drivers in the Optical Time Domain Reflectometer Test Service Market

The Optical Time Domain Reflectometer (OTDR) Test Service market is significantly propelled by the ongoing global expansion of fiber optic networks, particularly driven by the widespread deployment of 5G technology and the increasing adoption of fiber-to-the-home (FTTH) services. These fundamental infrastructure developments create a continuous need for precise cable testing, fault location, and performance verification, directly boosting the demand for OTDR services. Furthermore, government initiatives worldwide aimed at bridging the digital divide and enhancing broadband accessibility in both urban and rural areas are substantial growth catalysts. Technological advancements, including the development of more accurate, faster, and automated OTDR equipment, coupled with sophisticated data analytics platforms, are enhancing the efficiency and effectiveness of these services, making them more attractive to end-users.

Challenges Impacting Optical Time Domain Reflectometer Test Service Growth

Despite robust growth drivers, the Optical Time Domain Reflectometer (OTDR) Test Service market faces several key challenges. The significant initial investment required for high-end OTDR equipment and specialized software can act as a considerable barrier for smaller service providers or those in developing economies. Moreover, a persistent shortage of highly skilled and experienced technicians capable of operating complex OTDR devices and interpreting intricate test results can hinder service quality and availability. The increasing complexity of modern fiber optic networks, with higher fiber counts and advanced transmission technologies, necessitates continuous training and upskilling of personnel. Competitive pressures, including the potential for in-house testing capabilities within large telecommunication companies, also present a challenge to third-party service providers.

Key Players Shaping the Optical Time Domain Reflectometer Test Service Market

- Adtell Integration

- Fonetsan

- Al Dahiyah

- PSS Installations

- K Little Control Systems

- United Telecom Systems

- National Fiber Link Ltd.

- Mongo Optics

- Montakhab Sanat Pars

- Phoenix Fiber

Significant Optical Time Domain Reflectometer Test Service Industry Milestones

- 2020: Increased demand for remote diagnostic tools due to global health concerns, driving adoption of cloud-based OTDR analysis.

- 2021: Significant investment in fiber optic infrastructure for 5G network expansion globally.

- 2022: Launch of next-generation OTDR devices with enhanced dynamic range and reduced dead zones for testing longer fiber spans.

- 2023: Growing emphasis on predictive maintenance solutions powered by AI and machine learning for fiber optic networks.

- 2024: Expansion of OTDR services into new vertical markets, including renewable energy and smart city initiatives.

Future Outlook for Optical Time Domain Reflectometer Test Service Market

The future outlook for the Optical Time Domain Reflectometer (OTDR) Test Service market remains exceptionally positive, fueled by ongoing digital transformation and the relentless demand for high-speed connectivity. Strategic opportunities lie in the continued expansion of 5G networks, the proliferation of data centers, and the increasing adoption of fiber optics in traditionally underserved sectors like smart grids and autonomous transportation. As technology evolves, expect further integration of AI and machine learning for advanced network analytics, predictive maintenance, and automated fault resolution. The market will likely witness consolidation as larger players acquire specialized service providers to enhance their capabilities and geographic reach, ultimately leading to more comprehensive and efficient fiber optic infrastructure management solutions. The global push for enhanced digital infrastructure ensures a sustained and growing demand for reliable OTDR testing services.

Optical Time Domain Reflectometer Test Service Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Electronic

- 1.3. Energy

- 1.4. Others

-

2. Type

- 2.1. On Site Service

- 2.2. Online Services

Optical Time Domain Reflectometer Test Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Optical Time Domain Reflectometer Test Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Electronic

- 5.1.3. Energy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. On Site Service

- 5.2.2. Online Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Electronic

- 6.1.3. Energy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. On Site Service

- 6.2.2. Online Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Electronic

- 7.1.3. Energy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. On Site Service

- 7.2.2. Online Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Electronic

- 8.1.3. Energy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. On Site Service

- 8.2.2. Online Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Electronic

- 9.1.3. Energy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. On Site Service

- 9.2.2. Online Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Optical Time Domain Reflectometer Test Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Electronic

- 10.1.3. Energy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. On Site Service

- 10.2.2. Online Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adtell Integration

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fonetsan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Dahiyah

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PSS Installations

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 K Little Control Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 United Telecom Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National Fiber Link Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mongo Optics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Montakhab Sanat Pars

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Phoenix Fiber

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adtell Integration

List of Figures

- Figure 1: Global Optical Time Domain Reflectometer Test Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Optical Time Domain Reflectometer Test Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Optical Time Domain Reflectometer Test Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Optical Time Domain Reflectometer Test Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Optical Time Domain Reflectometer Test Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Optical Time Domain Reflectometer Test Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Optical Time Domain Reflectometer Test Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Optical Time Domain Reflectometer Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Optical Time Domain Reflectometer Test Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Optical Time Domain Reflectometer Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Optical Time Domain Reflectometer Test Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Optical Time Domain Reflectometer Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Optical Time Domain Reflectometer Test Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Optical Time Domain Reflectometer Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Optical Time Domain Reflectometer Test Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Optical Time Domain Reflectometer Test Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Optical Time Domain Reflectometer Test Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Time Domain Reflectometer Test Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Optical Time Domain Reflectometer Test Service?

Key companies in the market include Adtell Integration, Fonetsan, Al Dahiyah, PSS Installations, K Little Control Systems, United Telecom Systems, National Fiber Link Ltd., Mongo Optics, Montakhab Sanat Pars, Phoenix Fiber.

3. What are the main segments of the Optical Time Domain Reflectometer Test Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Time Domain Reflectometer Test Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Time Domain Reflectometer Test Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Time Domain Reflectometer Test Service?

To stay informed about further developments, trends, and reports in the Optical Time Domain Reflectometer Test Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence